Nitrogen and Zero Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432446 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Nitrogen and Zero Generator Market Size

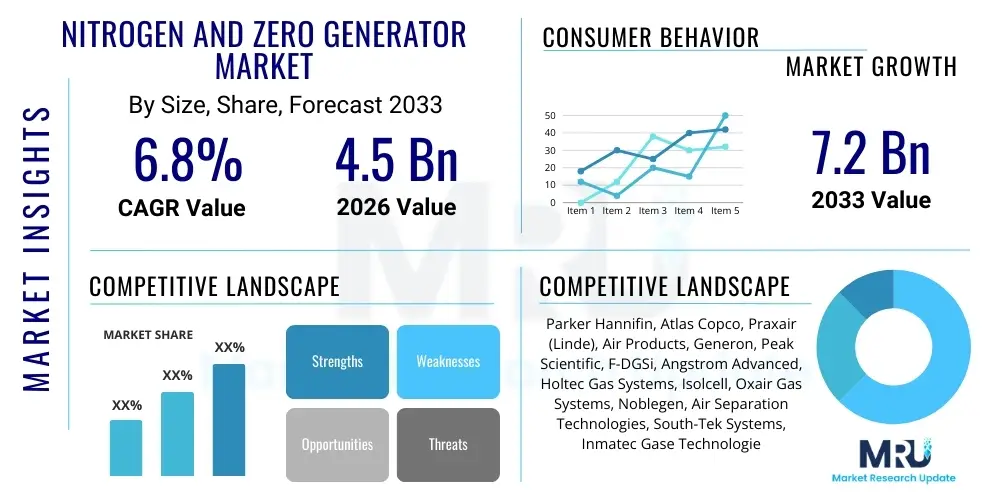

The Nitrogen and Zero Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global demand across critical industrial sectors, including food and beverage, pharmaceuticals, and electronics manufacturing, where the need for reliable, on-demand, high-purity inert gas supply is paramount. The shift away from traditional bulk gas delivery systems toward modular, on-site generation solutions provides substantial operational cost savings and enhances supply chain security, thus bolstering market expansion.

The core valuation of the market reflects the heightened investment in infrastructure development and technological advancements, particularly in developing economies, coupled with stricter regulatory compliance requirements regarding gas purity and emissions. The zero air generator segment, while smaller, maintains stable growth, primarily catering to sophisticated laboratory applications such as gas chromatography and spectroscopy, where consistent, contaminant-free oxidant air is critical for accurate analysis. Furthermore, the market benefits significantly from the focus on sustainability, as on-site generation reduces the carbon footprint associated with cryogenic production and transportation of nitrogen gas, aligning with global environmental, social, and governance (ESG) mandates.

Nitrogen and Zero Generator Market introduction

The Nitrogen and Zero Generator Market encompasses advanced industrial systems designed to produce high-purity nitrogen (N2) and contaminant-free zero air (O2/N2 mix) directly at the point of use. Nitrogen generators typically utilize Pressure Swing Adsorption (PSA) or membrane separation technologies to extract N2 from ambient air, delivering purities ranging from 95% to 99.9999% depending on the application requirement. Zero generators, conversely, employ purification methods like catalytic conversion and moisture removal to strip ambient air of hydrocarbons, carbon monoxide, sulfur dioxide, and particulates, providing clean, dry air essential for calibration, analytical instrumentation, and specific industrial processes. These generators serve as indispensable components across diverse sectors, including inerting and blanketing in chemical processing, Modified Atmosphere Packaging (MAP) in food and beverage, laser cutting, tire inflation, and as carrier and combustion gases in high-precision laboratory environments like Gas Chromatography (GC) and Liquid Chromatography-Mass Spectrometry (LC-MS).

Key benefits driving the adoption of these generator systems include substantial reductions in the total cost of ownership (TCO) compared to reliance on rented cylinders or liquid nitrogen bulk tanks, elimination of logistical complexities associated with gas delivery, and significant improvements in workplace safety by removing high-pressure cylinder handling risks. The operational efficiency provided by on-demand production ensures a continuous and stable supply, which is critical for continuous manufacturing processes and sensitive analytical operations. Market driving factors include rapid industrial automation, stringent quality control standards in the pharmaceutical and semiconductor industries demanding ultra-high purity gas, and the accelerating transition toward environmentally sustainable and energy-efficient generation technologies that minimize waste and maximize resource utilization.

Nitrogen and Zero Generator Market Executive Summary

The Nitrogen and Zero Generator Market is characterized by robust commercial trends, driven primarily by industrial automation and the push for operational efficiencies across manufacturing and laboratory sectors. Business trends show a distinct preference for modular, skid-mounted, and containerized generation systems, facilitating easier deployment and scalability. The market is consolidating around key technological advances, including smart connectivity and remote monitoring capabilities, which reduce maintenance downtime and optimize energy consumption. Furthermore, the increasing demand for ultra-high purity nitrogen (99.999% and above) from the semiconductor and specialty chemical industries is driving innovation in multi-stage PSA systems and hybrid generator models that combine different separation techniques to achieve stringent purity specifications.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by massive investments in electronics manufacturing, pharmaceutical production, and the burgeoning food processing industry, particularly in China, South Korea, and India. North America and Europe maintain mature market status, characterized by high adoption rates in laboratories and aerospace/defense sectors, focusing on replacing older, less efficient generation fleets with modern, sustainable units. Segment trends highlight that the Pressure Swing Adsorption (PSA) technology segment holds the largest market share due to its cost-effectiveness and ability to deliver mid-to-high purity nitrogen suitable for most industrial applications. Conversely, the laboratory application segment is seeing rapid growth, especially for high-purity zero air generators required for advanced analytical instrumentation to ensure baseline stability and measurement accuracy.

AI Impact Analysis on Nitrogen and Zero Generator Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Nitrogen and Zero Generator Market predominantly center on how AI can enhance operational reliability, optimize energy consumption, and ensure consistent gas purity levels in real-time. Key themes include the implementation of predictive maintenance schedules to minimize unexpected downtime, the use of machine learning algorithms to fine-tune PSA cycle times based on ambient atmospheric conditions (temperature, humidity) and dynamic demand, and the integration of AI-powered diagnostics for immediate fault detection. Users are seeking solutions that move beyond simple automation to truly intelligent generation systems capable of self-optimization, resulting in lower Total Cost of Ownership (TCO) and improved sustainable operations, particularly concerning the substantial energy input required for air compression.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast component failure (e.g., valve wear, filter saturation) before it occurs, ensuring continuous uptime.

- Energy Consumption Optimization: Real-time adjustment of compressor speed, air intake, and PSA cycle parameters based on demand fluctuations and external environmental variables, significantly reducing electricity usage.

- Enhanced Purity Control: AI algorithms monitoring gas quality sensors to automatically adjust flow rates and purge cycles, maintaining required purity levels with minimal waste.

- Remote Diagnostics and System Self-Correction: Enabling smart generators to identify anomalies, diagnose root causes, and initiate minor operational adjustments without human intervention.

- Inventory and Supply Chain Integration: Optimizing buffer tank levels and scheduling raw material (air) compression based on forecasted demand patterns derived from connected plant operations data.

DRO & Impact Forces Of Nitrogen and Zero Generator Market

The Nitrogen and Zero Generator market dynamics are shaped by a complex interplay of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces. The primary drivers include the stringent regulatory requirements in highly sensitive industries like pharmaceuticals and semiconductors, where gas purity is non-negotiable for product quality, compelling manufacturers to invest in dedicated, controlled generation sources. Additionally, the inherent economic advantage of on-site generation—offering significant long-term cost savings compared to costly and logistically intensive cylinder or bulk liquid nitrogen procurement—serves as a powerful incentive for industrial users. Growing environmental concerns also drive adoption, as generators reduce the reliance on energy-intensive cryogenic separation and eliminate transportation emissions associated with traditional gas delivery.

Conversely, significant restraints limit faster market penetration. The high initial capital expenditure (CAPEX) required for sophisticated PSA and cryogenic systems poses a barrier for small and medium-sized enterprises (SMEs). Furthermore, these generators require specialized maintenance and technical expertise for optimal performance and troubleshooting, which can be challenging to source in all geographical locations. However, these restraints are balanced by substantial opportunities. The emergence of modular, compact, and IoT-enabled generators is overcoming the CAPEX barrier by offering scalable solutions. The integration of nitrogen generation into the growing green hydrogen economy, where nitrogen is used for purging and blanketing equipment, presents a significant future market avenue. Moreover, the increasing prevalence of advanced analytical laboratories worldwide fuels demand for specialized, high-accuracy zero air generators.

The collective impact forces favor market expansion. Economic pressures for cost reduction combined with regulatory mandates for high-quality processes push organizations toward self-sufficiency in gas supply. Technological advancements, particularly in membrane materials and energy recovery systems, are continuously improving the efficiency and reducing the footprint of these units, making them more appealing across a wider range of industrial applications, including newer fields like additive manufacturing (3D printing) where inert environments are essential. This dynamic ensures sustained growth, focusing heavily on technology innovation and expanding application scope.

Segmentation Analysis

The Nitrogen and Zero Generator market is extensively segmented based on technology, application, and end-user industry, reflecting the diverse purity requirements and operational scales demanded by modern industry. Technology segmentation distinguishes between methods like Pressure Swing Adsorption (PSA), which dominates industrial nitrogen production due to its efficiency and purity range, and Membrane Separation, favored for lower purity, high-flow applications and smaller, decentralized installations due to its simplicity and robust nature. Cryogenic distillation, though requiring massive infrastructure, remains crucial for ultra-high purity, high-volume requirements. Application segmentation covers areas from blanket gas and inerting, which requires high volumes of industrial grade nitrogen, to precise carrier gas applications in analytical chemistry, which demand absolute zero air and ultra-high purity nitrogen. End-user segmentation captures the market revenue flow through major verticals such as food and beverage (dominated by MAP), pharmaceutical and biotechnology (requiring GMP compliance), and electronics (demanding ppm-level purity for semiconductor fabrication).

- Technology

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Cryogenic Distillation (Separation)

- Catalytic Oxidation (Zero Air)

- Electrochemical Separation

- Application

- Industrial Inerting and Blanketing

- Chemical Processing

- Food & Beverage Packaging (MAP)

- Tire Inflation

- Laser Cutting

- Analytical & Laboratory Applications (GC, LC-MS)

- Pharmaceutical Manufacturing

- Electronics and Semiconductor Fabrication

- End-User Industry

- Automotive

- Healthcare and Pharmaceutical

- Food and Beverage

- Chemical and Petrochemical

- Electronics and Semiconductor

- Oil & Gas

- Aerospace and Defense

- Research and Development Laboratories

Value Chain Analysis For Nitrogen and Zero Generator Market

The Value Chain for the Nitrogen and Zero Generator Market begins with the upstream suppliers of raw materials and specialized components. This includes manufacturers of high-performance air compressors, essential for generating the feed air; producers of specialized adsorbents like Carbon Molecular Sieves (CMS) used in PSA technology; and suppliers of advanced polymer membranes and filtering media crucial for effective gas separation and purification. Strong relationships with reliable component suppliers are vital, as the efficiency and longevity of the generator unit are directly dependent on the quality of the compressor and the molecular sieve material. Upstream innovation focuses on developing more energy-efficient compressors and longer-lasting adsorbent materials that reduce regeneration time and extend service intervals, thereby reducing the unit's operating costs and enhancing its competitive advantage in the market.

Midstream activities involve the core manufacturing, assembly, and integration of the generator systems, where key players focus heavily on engineering design, system optimization, and quality control. This stage includes designing the complex piping, incorporating sophisticated control systems (PLCs), and integrating humidity and oxygen sensors to monitor and ensure gas purity according to industry standards. Distribution channels vary, encompassing direct sales models for large industrial clients requiring highly customized, high-capacity installations, and indirect channels relying on specialized distributors and systems integrators who offer installation, commissioning, and localized maintenance services. These indirect channels are crucial for reaching SMEs and remote geographical locations, ensuring widespread market penetration and localized technical support.

The downstream segment centers on end-user integration, post-sale service, and ongoing operational support. This includes installation, system commissioning, staff training, and critical preventive maintenance services. Given the technical nature of these generators, post-sale service contracts, including remote monitoring and prompt parts replacement, represent a significant revenue stream for manufacturers. Direct customers often prefer comprehensive service agreements to guarantee continuous, compliant gas supply. The value chain emphasizes efficiency throughout, with strong focus on reducing energy consumption at the point of compression and separation, aligning the entire process with the end-users' objective of achieving the lowest possible Total Cost of Ownership (TCO) for their on-site gas generation capability.

Nitrogen and Zero Generator Market Potential Customers

Potential customers for Nitrogen and Zero Generators are widely diversified, primarily comprising industries that require a continuous, high-purity supply of inert gas for safety, quality assurance, or process control. The pharmaceutical and biotechnology sectors are critical buyers, utilizing generators for bioreactor blanketing, transferring sensitive powders, and purging sterilization equipment, demanding validation and strict compliance with Good Manufacturing Practices (GMP). Similarly, the electronics industry, specifically semiconductor foundries and PCB manufacturers, represents a high-value customer base, as they require ultra-high purity nitrogen (up to 99.9999%) for purging cleanrooms, soldering processes, and protecting sensitive silicon wafers from oxidation. These customers prioritize reliability and extreme purity control above all other factors, often opting for multi-stage PSA or cryogenic systems.

The food and beverage industry constitutes another substantial segment, utilizing generators predominantly for Modified Atmosphere Packaging (MAP) to extend the shelf life of perishable goods, and for inerting storage tanks to prevent oxidation of oils, wines, and beverages. These applications require high flow rates and mid-to-high purity levels (95% to 99.9%). Furthermore, analytical laboratories and research institutions worldwide are key buyers, particularly for zero air generators, which are essential for running sensitive equipment like Gas Chromatographs (GC) and FTIR spectrometers by providing hydrocarbon-free combustion and carrier air. These lab customers prioritize small footprint, silent operation, and verifiable output purity, often opting for compact, dedicated benchtop units that integrate seamlessly into existing lab infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Atlas Copco, Praxair (Linde), Air Products, Generon, Peak Scientific, F-DGSi, Angstrom Advanced, Holtec Gas Systems, Isolcell, Oxair Gas Systems, Noblegen, Air Separation Technologies, South-Tek Systems, Inmatec Gase Technologie, Gardner Denver, Vairex Air Systems, CLA-VAL, Nano Purification Solutions, PCI Gas Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nitrogen and Zero Generator Market Key Technology Landscape

The technology landscape of the Nitrogen and Zero Generator Market is dominated by separation techniques, with continuous innovation focusing on energy efficiency and achieving higher purity thresholds. Pressure Swing Adsorption (PSA) remains the market workhorse for nitrogen generation, utilizing two vessels filled with Carbon Molecular Sieve (CMS) material. The technological focus in PSA is on optimizing cycle timing, improving valve durability, and developing advanced CMS materials that exhibit higher selectivity for oxygen adsorption, thereby boosting N2 output purity while minimizing energy use. Newer PSA systems incorporate variable speed drive (VSD) compressors and sophisticated PLC controls to match generation output precisely to real-time demand, significantly reducing the energy waste inherent in traditional fixed-speed systems. This ongoing refinement of PSA technology secures its position as the most commercially viable solution for medium to high-purity industrial needs.

Membrane separation technology, utilizing bundles of hollow fiber membranes, is gaining traction due to its robust design, minimal maintenance requirements, and simplicity, making it ideal for mobile applications, corrosive environments, and lower-purity bulk nitrogen needs (typically below 99.5%). Advances in polymer science are leading to the development of new, highly selective membrane materials that improve separation efficiency, allowing for higher flow rates and reducing the required compressor size. For Zero Air Generators, the key technology involves catalytic oxidation, where ambient air is passed over a heated catalyst (often palladium) to convert trace hydrocarbons into carbon dioxide and water, followed by sophisticated drying and particle filtration stages. The technological forefront here involves developing non-consumable, long-life catalyst beds and improving heat exchanger efficiency to reduce the operational power required for the catalytic reaction, ensuring the delivery of genuinely hydrocarbon-free air essential for sensitive analytical equipment.

A crucial cross-cutting technological trend is the pervasive integration of IoT and Industry 4.0 principles. Modern generators are equipped with embedded sensors and network connectivity, enabling seamless remote monitoring, data logging, and integration into plant-wide control systems. This connectivity is essential for implementing AI-driven predictive maintenance and for providing verifiable audit trails of gas purity and flow rates, which is vital for regulated industries like pharmaceuticals. The drive towards modularity and plug-and-play installation is also shaping the technology landscape, reducing commissioning time and allowing end-users to scale their generation capacity easily as their demand fluctuates, ensuring future-proofing of the gas supply infrastructure.

Regional Highlights

Regional dynamics heavily influence the Nitrogen and Zero Generator market, reflecting varied levels of industrialization, regulatory stringency, and technological adoption rates across the globe. Each region presents unique demand drivers and segmentation preferences.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by massive foreign direct investment in electronics, semiconductor manufacturing (especially Taiwan, South Korea, and China), and the rapid expansion of the pharmaceutical and biotechnology sectors in India and Southeast Asia. The region exhibits high demand for both ultra-high purity nitrogen for cleanroom applications and bulk nitrogen for large-scale industrial inerting. Government initiatives promoting domestic manufacturing and rising health safety standards are accelerating the shift from delivered gas to reliable, on-site generation.

- North America: Characterized by high technological maturity, North America displays strong demand from specialized sectors like aerospace, defense, and research laboratories. The focus here is heavily on efficiency, reliability, and regulatory compliance, particularly for zero air generators required by the vast network of analytical testing facilities and environmental monitoring agencies. The market growth is stable, primarily driven by fleet replacement cycles and the adoption of advanced, energy-efficient PSA systems.

- Europe: The European market is mature and highly regulated, with significant emphasis on sustainability and energy efficiency (driven by EU mandates). Key adoption sectors include the pharmaceutical industry (Germany, Switzerland) and advanced manufacturing (automobile component production). European demand often centers on high-quality, certified systems that adhere to strict safety and environmental standards, favoring vendors offering comprehensive service and maintenance agreements and certified TUV/PED systems.

- Latin America (LATAM): Growth in LATAM is concentrated in key industrialized economies like Brazil and Mexico, fueled by expanding food and beverage processing sectors (Modified Atmosphere Packaging) and growing automotive manufacturing. The market is price-sensitive, often favoring robust membrane technology for mid-purity bulk applications, but is increasingly exploring PSA solutions as operational cost savings become clearer.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the oil and gas and petrochemical industries, requiring massive amounts of nitrogen for pipeline purging, tank blanketing, and safety flare systems. While demand is significant, adoption can be cyclical, tied to major capital projects. Renewable energy projects and localized pharmaceutical manufacturing initiatives are emerging as secondary growth drivers, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nitrogen and Zero Generator Market.- Parker Hannifin Corporation

- Atlas Copco AB

- Linde plc (formerly Praxair)

- Air Products and Chemicals, Inc.

- Generon Systems

- Peak Scientific Instruments Ltd.

- F-DGSi

- Angstrom Advanced Inc.

- Holtec Gas Systems, LLC

- Isolcell S.p.A.

- Oxair Gas Systems Pty Ltd

- Noblegen Inc.

- Air Separation Technologies (AST)

- South-Tek Systems

- Inmatec Gase Technologie GmbH

- Gardner Denver Holdings, Inc.

- Vairex Air Systems

- CLA-VAL

- Nano Purification Solutions

- PCI Gas Technology

Frequently Asked Questions

Analyze common user questions about the Nitrogen and Zero Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary cost-saving benefit of using an on-site nitrogen generator?

The primary benefit is the reduction in Total Cost of Ownership (TCO), achieved by eliminating recurring costs associated with gas delivery, cylinder rental fees, evaporation losses inherent in liquid tanks, and reduced dependence on fluctuating supplier pricing and logistics.

How does Pressure Swing Adsorption (PSA) technology compare to Membrane Separation in terms of purity?

PSA technology generally achieves higher purity levels, often up to 99.999% or better, suitable for sensitive electronics and pharmaceutical applications. Membrane systems are typically more cost-effective for lower purity (95% to 99%) and high-flow industrial applications, offering simpler operation and less maintenance.

What role does Zero Air generation play in analytical laboratories?

Zero Air generators are essential in analytical labs, providing ultra-clean, dry, and hydrocarbon-free air required as an oxidant or combustion gas for highly sensitive instruments like Gas Chromatographs (GC) and mass spectrometers (LC-MS) to ensure accurate baseline stability and reliable detection limits.

Are nitrogen generators compliant with environmental sustainability goals?

Yes, on-site nitrogen generators significantly enhance sustainability by eliminating the high energy consumption and substantial carbon emissions associated with cryogenic gas production, liquefaction, and road transportation of bulk liquid nitrogen or cylinders.

How is Industry 4.0 impacting the maintenance and operation of gas generators?

Industry 4.0 integration, utilizing IoT sensors and cloud connectivity, enables advanced predictive maintenance, allowing operators to monitor equipment health remotely, optimize operational parameters in real-time for peak efficiency, and prevent unplanned downtime through data-driven insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager