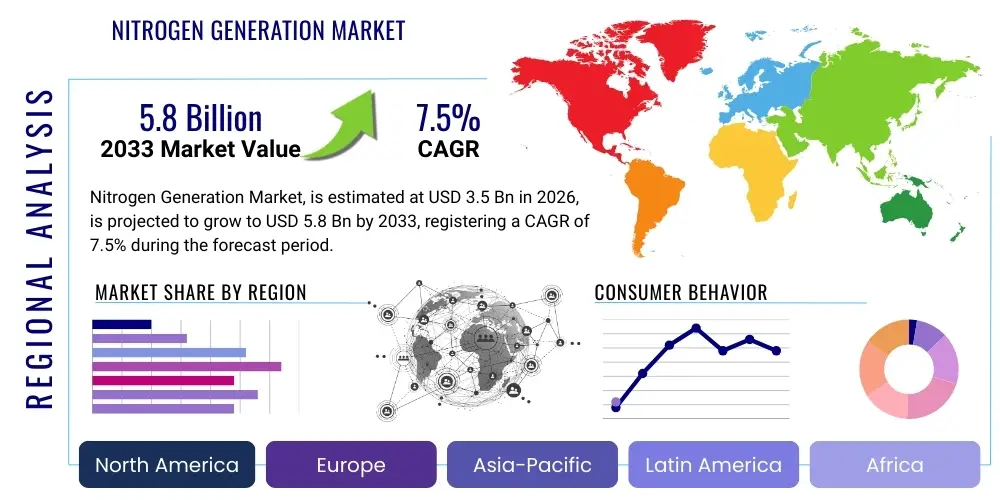

Nitrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436124 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Nitrogen Generation Market Size

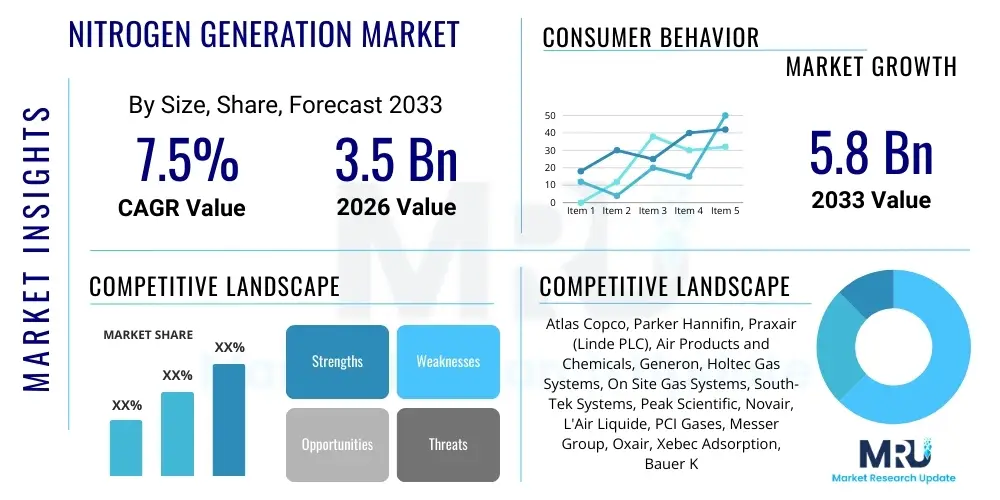

The Nitrogen Generation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.8 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing industrial demand for high-purity nitrogen across critical sectors such as pharmaceuticals, food and beverage, and electronics manufacturing, where nitrogen serves essential roles in ensuring product integrity and operational safety.

The valuation reflects the increasing shift from conventional bulk nitrogen supply, such as cylinders and liquid tanks, toward decentralized, on-site nitrogen generation systems. These on-site systems offer substantial long-term cost savings, improved logistical independence, and enhanced control over nitrogen purity and flow rates. The capital expenditure required for installing these advanced systems is rapidly being justified by operational efficiency gains, particularly in regions with volatile energy costs or complex supply chain logistics.

Market growth is also significantly influenced by stringent safety and quality regulations worldwide. Industries like oil and gas utilize nitrogen extensively for inerting and purging to prevent hazardous explosions, while the semiconductor industry requires ultra-high purity nitrogen to maintain cleanroom environments and prevent oxidation during production processes. These non-negotiable quality requirements ensure continuous investment in reliable and advanced nitrogen generation technologies, solidifying the market’s steady upward trajectory through the forecast period.

Nitrogen Generation Market introduction

The Nitrogen Generation Market encompasses the design, manufacture, installation, and servicing of equipment used to produce nitrogen gas directly at the point of use, bypassing the need for continuous external supply via cryogenic methods or high-pressure cylinders. Nitrogen, an inert gas, is crucial for processes requiring an oxygen-free environment, acting as a blanket, purge agent, carrier, or coolant. Key technologies driving this market include Pressure Swing Adsorption (PSA), Membrane Separation, and smaller-scale Cryogenic Distillation units. The shift toward on-site generation addresses logistical complexities, reduces dependency on third-party suppliers, and offers significant operational expenditure savings compared to traditional bulk supply methods.

Major applications for generated nitrogen span a diverse range of high-value industrial sectors. In the food and beverage industry, nitrogen is vital for packaging (MAP) to extend shelf life and prevent spoilage. The pharmaceutical and biotechnology sectors rely on high-purity nitrogen for inerting reactors, purging sterile areas, and material transfer. Furthermore, the electronics and semiconductor manufacturing industry requires specialized nitrogen purity levels for critical processes like soldering and cleanroom maintenance. The versatility and necessity of nitrogen across these regulated environments underscore the foundational importance of reliable generation systems.

The primary benefits driving market adoption include enhanced cost predictability, guaranteed supply independence, and improved safety profiles by minimizing the handling of high-pressure liquid nitrogen containers. Key driving factors involve escalating energy efficiency improvements in PSA and membrane technologies, the rapid growth of the global pharmaceutical manufacturing base, and stringent regulatory mandates in oil and gas demanding effective inerting solutions. These factors collectively push industries towards adopting customized, scalable, and environmentally conscious on-site generation solutions, contributing substantially to market expansion.

Nitrogen Generation Market Executive Summary

The Nitrogen Generation Market is characterized by a strong global pivot toward decentralized production methods, driven by the desire for operational resilience and cost optimization. Current business trends indicate heavy investment in system miniaturization, enhanced IoT integration for remote monitoring, and the development of energy-efficient adsorption materials and membranes. Manufacturers are focusing on offering modular solutions that can be easily scaled to match fluctuating industrial demand, making on-site generation feasible even for medium-sized enterprises. Furthermore, strategic mergers and acquisitions among key technology providers are shaping a more consolidated market landscape capable of delivering global, standardized service and support, which is critical for multinational corporations.

Regional dynamics highlight Asia Pacific (APAC) as the fastest-growing market segment, primarily propelled by massive investments in infrastructure development, rapid industrialization, and the exponential expansion of the electronics and semiconductor industries in countries like China, South Korea, and Taiwan. North America and Europe, while mature, demonstrate sustained growth through the robust pharmaceutical and oil & gas sectors, emphasizing high-purity requirements and environmental compliance. Latin America and MEA are emerging as lucrative markets due to expanding oil and gas exploration activities requiring inerting processes, signaling diversification away from traditional suppliers and toward self-sufficiency.

Segmentation trends reveal that the Pressure Swing Adsorption (PSA) technology segment maintains the largest market share due to its proven reliability and ability to produce medium-to-high purity nitrogen economically. However, the Membrane Separation segment is projected to register the highest CAGR, favored particularly by industries needing lower to medium purity nitrogen for bulk blanketing applications, due to its low maintenance needs and operational simplicity. Among end-users, the Pharmaceuticals & Biotechnology segment is expected to show superior growth, mandated by extremely high purity standards (USP grade) and the continuous global surge in drug manufacturing and sterile processing requirements, necessitating ultra-reliable nitrogen supply.

AI Impact Analysis on Nitrogen Generation Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Nitrogen Generation Market reveals a focus on three core areas: predictive maintenance, optimization of energy consumption, and autonomous control systems. Users are keenly interested in how AI algorithms can move beyond simple diagnostics to forecast component failure in PSA and membrane systems, thereby maximizing uptime and minimizing expensive emergency repairs. A second major theme centers around utilizing AI and machine learning (ML) to dynamically adjust operational parameters—such as adsorption cycle times, valve sequencing, and feed air pressure—in real-time, matching nitrogen output purity and flow precisely to variable demand, ultimately aiming to drastically reduce the energy footprint, which is the primary operational cost. Lastly, there is expectation regarding the development of fully autonomous, self-correcting generation units that can optimize themselves based on environmental variables and historical performance data, fundamentally changing how these mission-critical systems are managed.

- AI-driven Predictive Maintenance: Utilizing machine learning models to analyze sensor data from compressors, valves, and adsorbent beds, forecasting component failure before it occurs, ensuring near-zero unplanned downtime.

- Energy Consumption Optimization: Implementing algorithms to dynamically adjust PSA cycle times and membrane operational pressure settings in real-time, minimizing energy input while maintaining required purity and flow rates, leading to substantial cost savings.

- Automated Purity Control: Deploying AI to manage gas mixing and purification stages, instantly correcting deviations in nitrogen purity based on stringent industry standards (e.g., USP grade or semiconductor grade) without human intervention.

- Supply Chain and Inventory Management: Using AI tools to predict required maintenance parts and consumables (like adsorbent material or membranes) based on usage patterns and system health, optimizing inventory levels for service providers and end-users.

- Remote Monitoring and Diagnostics: Enhancing Industrial Internet of Things (IIoT) frameworks with AI capabilities to provide comprehensive remote diagnostic assessments, improving response times for service technicians and facilitating proactive system upgrades.

DRO & Impact Forces Of Nitrogen Generation Market

The dynamics of the Nitrogen Generation Market are shaped by powerful Drivers, crucial Restraints, and significant Opportunities, which together form the Impact Forces propelling its trajectory. A primary driver is the pervasive and non-negotiable need for inert atmospheres across hazardous and sensitive manufacturing environments, particularly within the oil and gas sector for inerting storage tanks and pipelines, and in electronics for semiconductor fabrication, demanding extremely high and consistent nitrogen purity. Coupled with this, the economic imperative to reduce long-term operational costs motivates large-volume users to transition from expensive, logistically complex external bulk supply to economically superior on-site generation solutions, offering a fast return on investment.

Despite strong drivers, the market faces notable restraints, primarily centered around the initial substantial capital investment required for high-capacity PSA or cryogenic units. This high barrier to entry can deter smaller and medium enterprises (SMEs) from adopting the technology, limiting market penetration in segments sensitive to upfront costs. Furthermore, the operational performance of non-cryogenic systems (PSA and membrane) is critically dependent on the purity and quality of the feed air supply, necessitating robust pre-treatment systems (compressors, filters, dryers), which adds complexity and additional maintenance overhead, presenting a continuous technical challenge for end-users.

Significant opportunities exist through rapid technological advancements focused on efficiency and purity, notably the development of advanced carbon molecular sieves (CMS) that enhance the performance of PSA systems and the creation of highly selective hollow-fiber membranes. Additionally, the exponential growth of the global pharmaceutical and biotechnology sectors, driven by pandemic preparedness and expanding R&D, creates a vast, untapped market for ultra-high purity nitrogen generators compliant with stringent Good Manufacturing Practices (GMP). These opportunities, combined with increasing environmental scrutiny pushing manufacturers toward energy-efficient, low-carbon footprint generation methods, ensure sustained investment and innovation.

Segmentation Analysis

The Nitrogen Generation Market is comprehensively segmented based on technology, capacity, and end-user application, providing a granular view of market dynamics and adoption patterns across diverse industrial landscapes. Technology segmentation is pivotal, defining the process used for separation, with Pressure Swing Adsorption (PSA) dominating due to its efficiency and cost-effectiveness for medium-to-high purity requirements, while Membrane Separation caters efficiently to applications needing bulk, lower-purity nitrogen where simplicity and low maintenance are prioritized. The capacity dimension segregates the market based on flow rate, allowing manufacturers to tailor systems precisely to end-user volume requirements, ranging from small lab-scale units to massive centralized industrial generators.

The end-user segmentation highlights the strategic importance of nitrogen across core global industries. The Food & Beverage sector remains a consistent consumer for packaging and storage, but the highest growth trajectory is observed in high-tech fields. The Electronics industry demands ultra-high purity nitrogen for cleanroom blanketing and soldering processes, while the Pharmaceuticals & Biotechnology segment requires certified, sterile nitrogen supply for critical process steps and storage. Understanding these distinct segment needs is crucial for market participants in developing specialized products, such as mobile nitrogen units for oil and gas operations or highly certified generators for medical use.

This detailed segmentation structure not only aids in market forecasting but also informs strategic resource allocation for key players, allowing them to focus R&D efforts on areas promising the highest returns, such as improving the energy consumption profile of PSA systems or extending the lifespan and selectivity of polymer membranes. Furthermore, the segmentation by application capacity ensures that pricing and service models are optimized, facilitating market entry for providers offering tailored solutions that meet specific volume and purity thresholds required by specific vertical markets, thereby maximizing market penetration.

- By Technology:

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Cryogenic Distillation

- By Capacity:

- Low Capacity (Up to 500 SCFH)

- Medium Capacity (500 to 2,000 SCFH)

- High Capacity (Above 2,000 SCFH)

- By End-User Industry:

- Food & Beverage (e.g., Modified Atmosphere Packaging, Wine Production)

- Oil & Gas (e.g., Inerting, Purging, Pipeline Pigging)

- Chemical and Petrochemicals (e.g., Reactor Blanketing, Solvent Transfer)

- Pharmaceuticals & Biotechnology (e.g., Sterile Processing, Freeze Drying)

- Electronics & Semiconductors (e.g., Cleanroom Environments, Reflow Soldering)

- Automotive & Transportation

- Healthcare (e.g., Medical Grade Nitrogen)

- Mining & Metallurgy

Value Chain Analysis For Nitrogen Generation Market

The value chain for the Nitrogen Generation Market begins with robust upstream activities focused primarily on the sourcing and manufacturing of critical components, including specialized compressors, advanced filtration systems, durable pressure vessels, high-performance valves, and, most crucially, the proprietary separation media—carbon molecular sieves (CMS) for PSA and hollow-fiber polymer materials for membrane systems. Upstream suppliers dedicated to manufacturing these highly technical and often proprietary components hold significant leverage, as the efficiency and longevity of the final nitrogen generator are directly dependent on the quality and selectivity of these raw materials. Investment in R&D at this stage focuses on enhancing adsorbent material lifespan and improving membrane selectivity to boost overall system energy efficiency.

Midstream activities involve the design, assembly, and testing of the complete nitrogen generation units. Key Original Equipment Manufacturers (OEMs) integrate the upstream components into standardized or customized skid-mounted systems. This phase requires specialized engineering expertise to optimize gas separation processes, ensuring compliance with strict purity standards (e.g., 99.999% purity for electronics applications) and safety regulations. OEMs manage the entire system integration, ensuring seamless interaction between the air compression stage, pre-treatment, separation technology, and final buffering/storage tanks. The competitive advantage in the midstream often rests on the reliability, compactness, and operational longevity of the integrated system.

The downstream component involves distribution, installation, service, and maintenance. Distribution channels are typically a mix of direct sales teams catering to large industrial users (oil & gas, major chemical plants) and established networks of authorized regional distributors or integrators who handle sales and installation for SMEs and specialized applications. Post-sales service is a critical value differentiator, encompassing routine preventative maintenance, supply of spare parts (especially replacement CMS and membrane modules), and 24/7 technical support. The shift toward IIoT and remote diagnostics is transforming the downstream, allowing for more efficient, predictive maintenance contracts and enhancing the overall customer experience, securing long-term service revenue for system providers.

Nitrogen Generation Market Potential Customers

Potential customers for nitrogen generation systems are concentrated in large-scale industrial operations and high-tech sectors where the continuous, reliable, and high-purity supply of inert gas is mandatory for core operations, safety, and product quality. The largest volume consumers often originate from the petrochemical and chemical manufacturing industries, utilizing nitrogen extensively for blanket inerting of storage tanks, purging pipelines to remove flammable substances, and pressurized transfer of liquids. These customers demand high flow rates and robust systems capable of operating reliably in often harsh or remote industrial environments, emphasizing durability and compliance with strict safety protocols.

A rapidly growing segment of potential customers includes the global Pharmaceuticals and Biotechnology community, encompassing manufacturers of active pharmaceutical ingredients (APIs), sterile injectable drugs, and specialized research laboratories. This customer base is unique in its demand for ultra-high purity nitrogen, often requiring USP (United States Pharmacopeia) grade certification, free from moisture and trace contaminants, which is essential for protecting sensitive compounds during synthesis, handling, and cryogenic storage. Their purchasing decisions are heavily influenced not just by cost, but by validation documentation, system compliance with GMP (Good Manufacturing Practices), and traceability, creating a need for highly specialized generation solutions.

Furthermore, the electronics, semiconductor, and specialized manufacturing sectors represent a significant customer base due to the critical nature of oxidation prevention during fabrication. In these environments, even trace amounts of oxygen or moisture can compromise microchip performance or sophisticated laser welding processes. Customers in this domain require high-capacity generators capable of delivering nitrogen with purity levels often exceeding 99.999%, necessitating advanced PSA or cryogenic technologies, along with comprehensive air purification stages. The increasing global investment in new fabrication plants (fabs) assures sustained demand from this high-value customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Parker Hannifin, Praxair (Linde PLC), Air Products and Chemicals, Generon, Holtec Gas Systems, On Site Gas Systems, South-Tek Systems, Peak Scientific, Novair, L'Air Liquide, PCI Gases, Messer Group, Oxair, Xebec Adsorption, Bauer Kompressoren, Airgenics, Ingersoll Rand. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nitrogen Generation Market Key Technology Landscape

The technological landscape of the Nitrogen Generation Market is dominated by two non-cryogenic methods, Pressure Swing Adsorption (PSA) and Membrane Separation, alongside traditional Cryogenic Distillation, which still holds relevance for ultra-high purity, large-scale demand. PSA technology leverages carbon molecular sieves (CMS) to selectively adsorb oxygen and other trace gases from compressed air under high pressure, releasing the purified nitrogen. This method is highly favored for applications requiring purity levels typically ranging from 99.5% up to 99.999%, offering a good balance between capital cost, operational expenditure, and purity output. Recent innovations in PSA focus on optimizing cycle times and developing more durable, efficient CMS materials to reduce the overall energy intensity per unit of nitrogen produced.

Membrane Separation offers a simpler, lower-maintenance alternative, particularly effective for lower purity requirements (typically 95% to 99%) and high-volume blanketing applications. This technology uses hollow-fiber polymeric membranes that selectively permeate fast gases (like oxygen and water vapor) while slowing down the passage of nitrogen. The primary advantage of membrane systems lies in their compact footprint, quick startup time, and lack of moving parts within the separation module, leading to significantly lower maintenance costs compared to PSA. Technological evolution in membrane systems is concentrated on developing next-generation polymer materials that offer higher selectivity and permeability, reducing the system’s footprint and improving its overall energy efficiency, making it increasingly competitive against PSA in the medium-purity range.

While the market is shifting toward on-site non-cryogenic generation, Cryogenic Distillation remains indispensable for industries requiring extremely large volumes and ultra-high purity (99.9999% or higher), such as specialized semiconductor fabrication or large industrial gas suppliers. Cryogenic plants cool and liquefy air, separating components based on their boiling points. Although highly efficient at massive scale and capable of unparalleled purity, cryogenic units involve massive capital expenditure and complex infrastructure. The technological future of nitrogen generation is trending toward hybrid systems that combine the efficiencies of PSA and membrane technologies to offer customized purity and flow flexibility, allowing end-users to optimize supply based on real-time process requirements.

Regional Highlights

Regional dynamics heavily influence the Nitrogen Generation Market, primarily driven by industrial output and regulatory environments. Asia Pacific (APAC) stands out as the global leader in growth rate, fueled by unprecedented expansion in its manufacturing base, particularly in electronics, automotive, and chemicals across China, India, South Korea, and Southeast Asian nations. The massive proliferation of new semiconductor fabrication facilities (fabs) in this region, which necessitate millions of cubic feet of ultra-high purity nitrogen annually, is the single greatest driver. Governments in APAC are increasingly prioritizing local industrial self-sufficiency, favoring on-site generation over complex import logistics.

North America and Europe represent mature markets characterized by sustained, stable demand, especially from highly regulated industries such as pharmaceuticals, biotechnology, and deep-water oil and gas exploration. In North America, the market is driven by strict pipeline and storage tank inerting regulations, pushing operators toward reliable, high-capacity PSA and membrane systems. European growth is underpinned by stringent environmental standards and robust demand from the advanced manufacturing and medical sectors. These regions emphasize reliability, system certification, and energy efficiency, leading to higher adoption rates for premium, technologically sophisticated generation equipment with robust service contracts.

Latin America and the Middle East & Africa (MEA) are emerging markets with significant potential, predominantly linked to the growth of oil, gas, and mining industries. MEA, rich in hydrocarbon reserves, utilizes generated nitrogen extensively for enhanced oil recovery (EOR), drilling, and purging applications. Market growth in these areas is often tied to large capital projects and relies heavily on mobile and ruggedized nitrogen generators suitable for remote, challenging operational sites. As these regions continue to diversify their industrial bases, investment in food processing and localized chemical manufacturing is expected to further boost the demand for reliable on-site nitrogen supply systems.

- Asia Pacific (APAC): Highest growth market, driven by massive investments in semiconductor manufacturing (China, Taiwan, South Korea), rapid industrialization, and expansion of the pharmaceutical sector. Key demand for ultra-high purity systems.

- North America: Mature market characterized by stringent safety regulations in the oil & gas and chemical sectors. Strong adoption of advanced, energy-efficient PSA systems and high demand from biotechnology R&D hubs.

- Europe: Steady growth market focusing on environmental compliance and high-quality manufacturing standards (Automotive and Pharma). Emphasis on optimizing the energy consumption profile of installed systems.

- Middle East & Africa (MEA): Emerging market primarily driven by petrochemical and oil & gas upstream activities (inerting and purging). Demand concentrated on rugged, high-capacity, and mobile generation units.

- Latin America: Growth fueled by expanding mining operations and increasing investment in the regional food and beverage processing industry, necessitating reliable gas blanketing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nitrogen Generation Market.- Atlas Copco

- Parker Hannifin

- Linde PLC (formerly Praxair)

- Air Products and Chemicals, Inc.

- Generon

- Holtec Gas Systems

- On Site Gas Systems

- South-Tek Systems

- Peak Scientific

- Novair

- L'Air Liquide S.A.

- PCI Gases

- Messer Group GmbH

- Oxair Gas Systems

- Xebec Adsorption Inc.

- Inmatec Gase Technologie GmbH

- Ingersoll Rand Inc.

- Domnick Hunter (Parker Hannifin Division)

- Donaldson Company, Inc.

- Bauer Kompressoren GmbH

Frequently Asked Questions

Analyze common user questions about the Nitrogen Generation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of on-site nitrogen generators over traditional bulk supply?

The primary driver is the significant reduction in long-term operational costs and the achievement of supply independence. On-site generation eliminates recurring rental fees, transportation charges, and price volatility associated with outsourced liquid nitrogen supply, providing better cost control and resilience against supply chain disruptions.

Which nitrogen generation technology holds the largest market share based on current adoption trends?

Pressure Swing Adsorption (PSA) technology currently holds the largest market share. PSA is favored due to its robust capacity to produce medium-to-high purity nitrogen (up to 99.999%) efficiently and cost-effectively, making it suitable for high-demand applications across chemical, pharmaceutical, and electronic sectors.

How does the Nitrogen Generation Market address the specialized purity requirements of the semiconductor industry?

The semiconductor industry requires ultra-high purity nitrogen (typically 99.999% to 99.9999%). This requirement is met through advanced, multi-stage PSA systems or specialized small-scale cryogenic units, often incorporating catalytic purification or specialized filtration stages to remove trace contaminants like oxygen, hydrogen, and moisture essential for cleanroom and lithography processes.

What is the typical return on investment (ROI) period for installing a medium-capacity on-site nitrogen generator?

The typical ROI period for a medium-capacity on-site nitrogen generator ranges generally between 18 months and 36 months, depending heavily on the previous cost structure of bulk gas supply, the system’s utilization rate, local electricity costs, and the specific purity level required for the application.

What role does Artificial Intelligence (AI) play in improving the efficiency of modern nitrogen generation systems?

AI is increasingly used for predictive maintenance and energy optimization. AI algorithms analyze operational data in real-time to adjust PSA cycle timings and feed air parameters, ensuring precise output purity with minimal energy consumption, thereby maximizing uptime and reducing the overall operational footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager