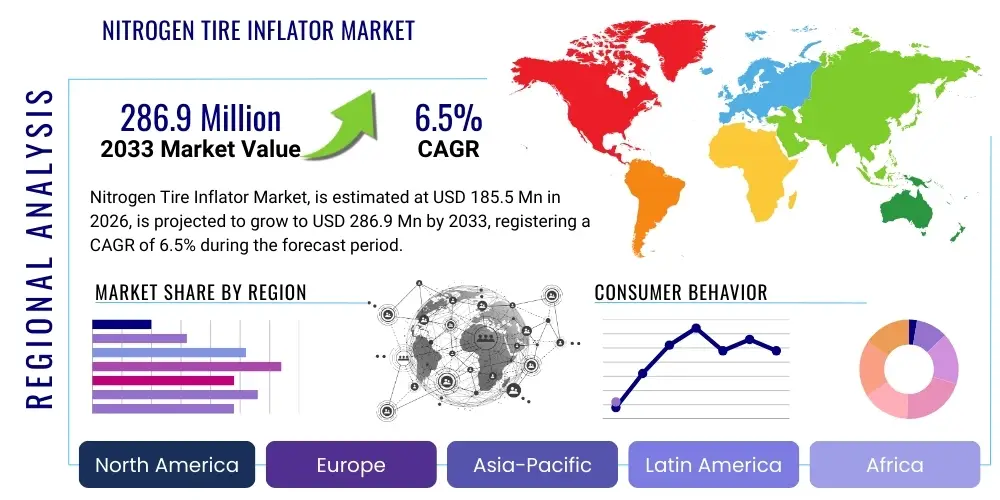

Nitrogen Tire Inflator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435207 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nitrogen Tire Inflator Market Size

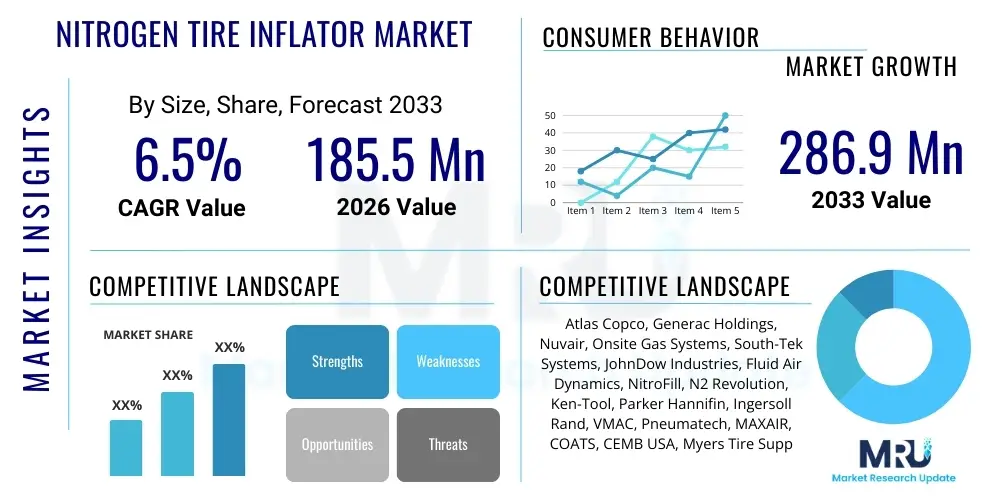

The Nitrogen Tire Inflator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 286.9 million by the end of the forecast period in 2033.

Nitrogen Tire Inflator Market introduction

The Nitrogen Tire Inflator Market encompasses specialized equipment designed to fill vehicle tires with high-purity nitrogen gas, rather than standard compressed air. This equipment, which includes stationary units for large service centers and portable units for mobile applications, primarily utilizes Pressure Swing Adsorption (PSA) or membrane separation technologies to extract nitrogen from ambient air. The core benefit stems from nitrogen’s properties: it is an inert, dry gas, which significantly reduces oxidation within the tire cavity, prevents corrosion of rim components, and maintains stable tire pressure over longer periods, translating to improved fuel economy and extended tire lifespan. Major applications span the automotive aftermarket, commercial fleet operations, aircraft maintenance, and heavy-duty vehicles, where precise tire maintenance is critical for operational safety and cost efficiency.

The market's expansion is driven by increasing awareness among consumers and fleet managers regarding the long-term benefits of nitrogen inflation, especially in performance and commercial vehicle segments. Regulatory mandates emphasizing vehicular safety and fuel efficiency also contribute significantly to the adoption rate. Furthermore, the rising proliferation of vehicle dealerships and independent service garages offering premium tire services has bolstered demand for reliable, high-pcapacity nitrogen generation systems. While initially a premium offering, the declining cost of PSA and membrane technologies is making nitrogen inflation more accessible to the mass market, positioning it as a standard feature in high-end automotive maintenance protocols.

Driving factors center on the verifiable performance advantages, including better heat dissipation under stress—crucial for racing and heavy-duty transport—and the elimination of moisture, which is the primary cause of internal tire and wheel degradation when using compressed air. The professional service sector, encompassing large automotive repair chains, tire retailers, and specialized motorsports teams, represents the strongest consumer base, demanding continuous innovation in portability, purity levels, and automation features within the inflator units. This sustained demand is cementing the nitrogen tire inflator as a crucial piece of equipment in modern vehicular upkeep.

Nitrogen Tire Inflator Market Executive Summary

The Nitrogen Tire Inflator Market is characterized by robust growth, propelled by stringent vehicle safety regulations and a heightened focus on minimizing operational costs within commercial fleets. Business trends indicate a strong shift towards integration, where manufacturers are developing systems compatible with existing garage infrastructure and incorporating smart features for enhanced user experience and maintenance diagnostics. This technological push is particularly visible in the development of highly efficient, smaller footprint PSA generators suitable for space-constrained service environments. Geographically, Asia Pacific is emerging as a critical growth engine, driven by massive automotive production output and rapid expansion of the organized aftermarket service industry, while North America and Europe maintain market maturity through high adoption rates in premium and performance segments.

Segment trends reveal that stationary nitrogen generators, offering high flow rates and continuous operation, dominate the revenue share, catering primarily to large dealerships and fleet depots. However, the portable segment is exhibiting the fastest growth trajectory, largely due to increased demand from mobile service vans and small-to-medium enterprises (SMEs) seeking flexibility. Furthermore, application segmentation highlights the commercial vehicle and aviation sectors as key profit centers, given their zero-tolerance policy for tire failure and the substantial fuel efficiency gains realized through precise pressure management. Investment activity is focusing on refining membrane technology to achieve higher nitrogen purity with less energy consumption, addressing the historical trade-off between speed and purity in generation.

The competitive landscape remains moderately fragmented, with specialized equipment manufacturers vying against large industrial gas suppliers entering the equipment distribution space. Strategic alliances focusing on bundled services—combining equipment installation, training, and long-term maintenance contracts—are becoming commonplace. Overall, the market outlook is positive, underpinned by the fundamental value proposition of nitrogen inflation, which directly addresses the critical industry needs for safety, longevity, and operational efficiency across diverse transportation modalities.

AI Impact Analysis on Nitrogen Tire Inflator Market

Analysis of common user questions regarding AI's influence on the Nitrogen Tire Inflator Market reveals key themes revolving around predictive maintenance capabilities, optimization of inventory, and integration into overall smart garage systems. Users frequently inquire whether AI can anticipate equipment failure, optimize nitrogen generation cycles based on real-time service demand, or automate purity testing and calibration processes. There is a strong expectation that AI algorithms, leveraging data from connected inflators, could transition tire service from reactive repair to proactive maintenance scheduling, predicting when specific fleets require nitrogen top-offs based on telemetry data (such as road conditions, load weight, and ambient temperature fluctuations). Furthermore, users anticipate AI-driven recommendations for optimal tire pressure settings tailored to specific vehicle characteristics and operating conditions, moving beyond generic pressure recommendations to highly personalized safety protocols.

- AI-driven predictive maintenance forecasts equipment component failures, minimizing inflator downtime.

- Real-time demand forecasting allows AI systems to adjust nitrogen generation speed and storage, optimizing energy use.

- Integration of AI into garage management software enables automated tracking of nitrogen service intervals per vehicle.

- AI algorithms analyze vehicle telemetry data to recommend dynamic, optimized tire pressure levels for improved performance and safety.

- Enhanced quality control using machine learning to monitor gas purity and automate calibration verification processes.

- Optimization of spare parts inventory management for maintenance companies servicing a large installed base of inflators.

DRO & Impact Forces Of Nitrogen Tire Inflator Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, Opportunities, and external Impact Forces. The primary drivers stem from tangible performance and safety benefits, specifically the documented reduction in tire oxidation and consistent pressure stability, which are highly valued by professional fleet operators aiming for optimal Total Cost of Ownership (TCO). This is strongly coupled with increasing global mandates concerning vehicle safety and emissions standards, indirectly promoting any technology that enhances tire health and fuel efficiency. Simultaneously, the market faces restraints, chiefly the initial capital expenditure associated with high-purity nitrogen generation equipment and, crucially, persistent misconceptions or lack of education among general consumers regarding the value proposition of nitrogen over standard air.

Significant opportunities lie in expanding market penetration into emerging economies with rapidly growing vehicle parc and developing cost-effective, highly portable units suitable for non-traditional service locations, such as remote mining sites or agricultural operations. Technological advancements, particularly in modular membrane separation systems, offer a pathway to lower manufacturing costs and increase accessibility. The impact forces acting upon this market include fluctuating energy costs—critical for the operation of PSA units—and evolving material science in tire construction that might necessitate different internal inflation parameters. Furthermore, the competitive pressure from advanced air-drying and filtration systems, which offer near-dry air, poses a subtle but persistent external challenge to the nitrogen inflator dominance.

Ultimately, the market trajectory will be defined by the industry's success in mitigating perceived cost barriers through robust TCO analyses and expanding customer education initiatives. While performance advantages provide a solid foundation for growth, overcoming the entrenched habit of using free compressed air requires persuasive evidence of long-term savings and tangible safety improvements. Strategic pricing, enhanced distribution networks, and the integration of these devices into comprehensive tire management solutions will be essential for sustained market acceleration against competing technologies and user inertia.

Segmentation Analysis

The Nitrogen Tire Inflator Market is structurally segmented based on crucial dimensions, including the type of equipment (determining mobility and capacity), the technology used for generation (impacting purity and efficiency), the application sector (defining use case criticality), and the end-user base (reflecting purchase behavior and volume requirements). This granular segmentation is vital for manufacturers to tailor their product offerings, sales strategies, and service models to specific market needs. The segmentation by technology, particularly between Pressure Swing Adsorption (PSA) and Membrane Separation, remains a focal point, as it dictates the required footprint, operational costs, and the maximum achievable nitrogen purity level.

From an end-user perspective, the segmentation reveals distinct purchasing patterns. High-volume end-users, such as major automotive dealerships and large commercial fleet service centers, predominantly invest in stationary, high-capacity PSA systems. Conversely, smaller independent repair garages and mobile tire service providers favor the lower initial investment and greater flexibility offered by portable units or mid-range membrane separation devices. This differentiation highlights the need for a diversified product portfolio that addresses both the high-throughput, capital-intensive environment and the lower-volume, cost-sensitive operational settings prevalent across the automotive aftermarket ecosystem. Successful market penetration hinges on accurately matching technology and capacity to the operational constraints of the target end-user.

- By Type:

- Portable Nitrogen Tire Inflators

- Stationary Nitrogen Tire Inflators

- By Technology:

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- By Application:

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses)

- Aviation

- Mining and Construction Equipment

- By End-User:

- Tire Dealerships and Retailers

- Independent Repair Garages

- Automotive Original Equipment Manufacturers (OEMs)

- Commercial Fleet Operators

- Government and Military Installations

Value Chain Analysis For Nitrogen Tire Inflator Market

The value chain for the Nitrogen Tire Inflator Market begins with the sourcing of specialized components, primarily high-grade molecular sieve carbons (for PSA systems) and sophisticated polymer membranes (for membrane separation units). Upstream analysis is critical, as the quality and cost volatility of these raw materials directly impact the final equipment cost and nitrogen purity achievable. Key upstream activities involve R&D into enhanced material science to improve separation efficiency and reduce energy consumption during the generation process. Manufacturers often forge long-term agreements with specialized chemical suppliers to ensure a consistent supply of these proprietary components, mitigating supply chain risks associated with complex filtration media.

The midstream segment involves the design, manufacturing, and assembly of the inflator units, including compressors, storage tanks, control systems (PLCs), and the nitrogen generation core. Manufacturers prioritize modular design to facilitate maintenance and scalability. Distribution channels are highly varied; they include direct sales to large fleet operators and OEM dealerships seeking integrated shop solutions, and indirect sales through specialized industrial equipment distributors and automotive aftermarket wholesalers. The choice of channel often depends on the scale of the customer and the required level of technical support, with indirect channels dominating the distribution to smaller, independent garages due to their wide reach and existing service infrastructure.

Downstream analysis focuses on installation, after-sales service, maintenance contracts, and consumable replacement (filters, membranes). Given the technical nature of these high-pressure systems, robust after-market support is a significant competitive differentiator. Direct channels excel here by offering specialized training and rapid on-site maintenance. End-users, who include major commercial airlines, heavy equipment operators, and vehicle dealerships, focus on long-term reliability and guaranteed nitrogen purity. The value chain concludes with the consumer benefiting from the enhanced longevity and safety afforded by nitrogen inflation, closing the loop by reinforcing the demand for high-quality service equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 286.9 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Generac Holdings, Nuvair, Onsite Gas Systems, South-Tek Systems, JohnDow Industries, Fluid Air Dynamics, NitroFill, N2 Revolution, Ken-Tool, Parker Hannifin, Ingersoll Rand, VMAC, Pneumatech, MAXAIR, COATS, CEMB USA, Myers Tire Supply, TECH Tire Repairs, Chicago Pneumatic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nitrogen Tire Inflator Market Potential Customers

The core customer base for Nitrogen Tire Inflator systems consists of entities requiring precise, reliable, and high-volume tire inflation services, where the cost of tire failure or sub-optimal pressure significantly outweighs the equipment investment. Primary buyers are commercial fleet operators, including large logistics companies, bus lines, and trucking fleets, for whom consistent tire pressure directly translates into fuel cost savings and reduced maintenance downtime. These customers seek high-capacity stationary PSA systems that can handle hundreds of tires monthly while maintaining regulatory compliance and detailed service logs. The measurable return on investment (ROI) derived from reduced tire replacement cycles makes this segment highly receptive to premium nitrogen solutions.

Another crucial customer group includes new and used vehicle dealerships, particularly those associated with luxury, performance, or large truck brands. These dealerships leverage nitrogen inflation as a value-added service to enhance customer satisfaction and differentiate their maintenance offerings. They typically purchase integrated systems that fit seamlessly into their service bays and often utilize branding associated with nitrogen inflation technology. Furthermore, the aviation sector represents a high-value, niche customer base, demanding the highest purity nitrogen generation equipment for aircraft landing gear tires, where safety standards are non-negotiable and compressed air moisture content poses a critical risk. Military and defense sectors also fall into this category, focusing on rugged, highly mobile units for field operations.

The fastest-growing segment of potential customers encompasses independent tire retailers and small-to-mid-sized repair garages. Although they operate with tighter budgets, the desire to compete with larger service chains and offer enhanced tire warranties is driving adoption of more affordable, often membrane-based, portable units. These customers prioritize ease of use, minimal required maintenance, and reliable technical support from their distributors. Successful market penetration strategies must address this diverse customer landscape by offering scalability across equipment size, purity levels, and corresponding price points.

Nitrogen Tire Inflator Market Key Technology Landscape

The Nitrogen Tire Inflator market is dominated by two primary generation technologies: Pressure Swing Adsorption (PSA) and Membrane Separation. PSA technology, recognized for its ability to produce extremely high-purity nitrogen (up to 99.999%) and high flow rates, is the incumbent technology preferred by high-volume users such as industrial facilities and large commercial tire service centers. PSA systems work by utilizing two pressurized vessels filled with Carbon Molecular Sieve (CMS) that selectively adsorb oxygen and other trace gases from compressed air, leaving high-purity nitrogen. Recent technological advancements in PSA focus on optimizing the valve switching cycles and improving the regeneration efficiency of the CMS material to reduce energy consumption per unit of nitrogen produced.

Membrane separation technology offers a more compact, silent, and maintenance-friendly alternative, often favored in portable units and smaller garages. This system uses hollow fiber membranes made of specialized polymers. Compressed air is pushed through these fibers, and oxygen, water vapor, and other fast gases permeate the membrane walls, while nitrogen molecules travel slowly and are collected at the end of the fibers. While membrane systems generally achieve slightly lower purity levels (typically 95%-98%) compared to industrial PSA, improvements in polymer chemistry are steadily closing this gap, offering a compelling blend of compactness, lower operating pressure requirements, and reduced upfront cost, making them ideal for mobile applications.

A crucial technological trend across the entire market is the integration of Internet of Things (IoT) capabilities. Modern inflators are increasingly equipped with embedded sensors and communication modules that allow for real-time monitoring of nitrogen purity, flow rate, pressure, and operational status. This connectivity facilitates predictive maintenance alerts, remote diagnostics, and seamless integration with existing garage management systems. Furthermore, advanced microprocessor control systems are now standard, enabling automated purging cycles and sophisticated diagnostic self-checks, ensuring that the delivered nitrogen consistently meets safety and performance thresholds without constant manual oversight.

Regional Highlights

- North America: North America represents a mature and high-value market segment, characterized by stringent safety regulations, a high concentration of sophisticated commercial fleets, and strong consumer demand for premium automotive services. The region exhibits high adoption rates, driven particularly by tire dealerships, racing organizations, and the aviation sector. Technological adoption here is rapid, with a high focus on IoT integration and energy efficiency. The United States, in particular, leads in research and development and accounts for a substantial portion of the regional revenue, emphasizing stationary, high-purity PSA systems tailored for large-scale operations.

- Europe: The European market demonstrates consistent, steady growth, fueled by strict European Union regulations pertaining to vehicle emissions and safety, which necessitate optimal tire performance. Western European countries, including Germany, the UK, and France, are key consumers, where nitrogen inflation is often integrated into standardized fleet maintenance contracts. The region shows a strong preference for durable, certified equipment with minimal environmental impact. The trend leans towards modular systems that can be easily scaled and integrated into existing, often older, service infrastructure across diverse national markets.

- Asia Pacific (APAC): APAC is poised for the most significant expansion in the forecast period, primarily due to the rapid urbanization, massive growth in vehicle manufacturing (especially in China and India), and the subsequent expansion of the automotive aftermarket service industry. While price sensitivity remains a factor, the emergence of large-scale logistics and e-commerce fleet operations is creating massive demand for reliable nitrogen solutions to manage operating costs. Key opportunities exist in providing cost-effective membrane separation units and localized service support to meet the diverse operational needs across this vast geographical region.

- Latin America: This region presents a market in nascent stages, but with high potential, driven by infrastructure development and increasing commercial activity. Adoption is currently focused in industrial centers and major capital cities where standardized fleet management practices are being implemented. Challenges include fragmented distribution networks and the need for robust, simple-to-operate equipment that can withstand inconsistent power supply and varying climatic conditions.

- Middle East and Africa (MEA): The MEA market growth is predominantly led by the Gulf Cooperation Council (GCC) countries, particularly due to the extreme heat conditions which necessitate superior tire pressure stability, making nitrogen highly advantageous. The presence of large international oil and gas fleets and high-end automotive dealerships contributes significantly to market consumption. Demand centers on heavy-duty, robust units designed to operate efficiently in harsh, dusty environments, often requiring higher levels of filtration prior to the nitrogen generation process.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nitrogen Tire Inflator Market.- Atlas Copco

- Generac Holdings

- Nuvair

- Onsite Gas Systems

- South-Tek Systems

- JohnDow Industries

- Fluid Air Dynamics

- NitroFill

- N2 Revolution

- Ken-Tool

- Parker Hannifin

- Ingersoll Rand

- VMAC

- Pneumatech

- MAXAIR

- COATS

- CEMB USA

- Myers Tire Supply

- TECH Tire Repairs

- Chicago Pneumatic

Frequently Asked Questions

Analyze common user questions about the Nitrogen Tire Inflator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between PSA and Membrane Nitrogen Tire Inflators?

Pressure Swing Adsorption (PSA) technology uses Carbon Molecular Sieve material to chemically separate oxygen, yielding higher nitrogen purity (often 99%+), making it suitable for high-volume, stationary applications. Membrane Separation uses specialized polymer fibers to physically filter gases, offering better portability, less maintenance, and generally 95%-98% purity, ideal for mobile or small garage use.

How does nitrogen inflation contribute to improved fuel efficiency in vehicles?

Nitrogen is significantly less prone to permeation through tire rubber than oxygen, ensuring tire pressure remains stable for much longer periods. Maintaining optimal tire pressure minimizes rolling resistance, which directly reduces the required engine power and subsequent fuel consumption, offering measurable cost savings for fleet operators.

What is the typical ROI period for investing in a high-capacity nitrogen tire inflator system?

The Return on Investment (ROI) period varies significantly based on fleet size and fuel prices, but for commercial fleet operations, ROI is generally achieved within 18 to 36 months. This is primarily realized through extended tire lifespan, reduced tire-related maintenance costs, and quantifiable fuel savings derived from consistent tire pressure.

Are nitrogen tire inflators mandatory for specific vehicle types or industries?

While nitrogen inflation is not universally mandated for passenger vehicles, it is often required or strongly recommended by regulatory bodies and manufacturers in high-stakes environments, notably the commercial aviation sector, specialized military vehicles, and professional motorsports, due to the critical need for tire thermal stability and moisture elimination.

What maintenance requirements are associated with nitrogen generation equipment?

Maintenance largely involves routine checks and replacement of pre-filtration elements (to protect the core generation media from moisture and oil) and periodic testing of nitrogen purity levels. PSA systems require occasional replacement of the Carbon Molecular Sieve, while membrane systems require membrane replacement after a specified operational lifespan, usually measured in years or operational hours.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager