Non-Dairy Creamer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437199 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Non-Dairy Creamer Market Size

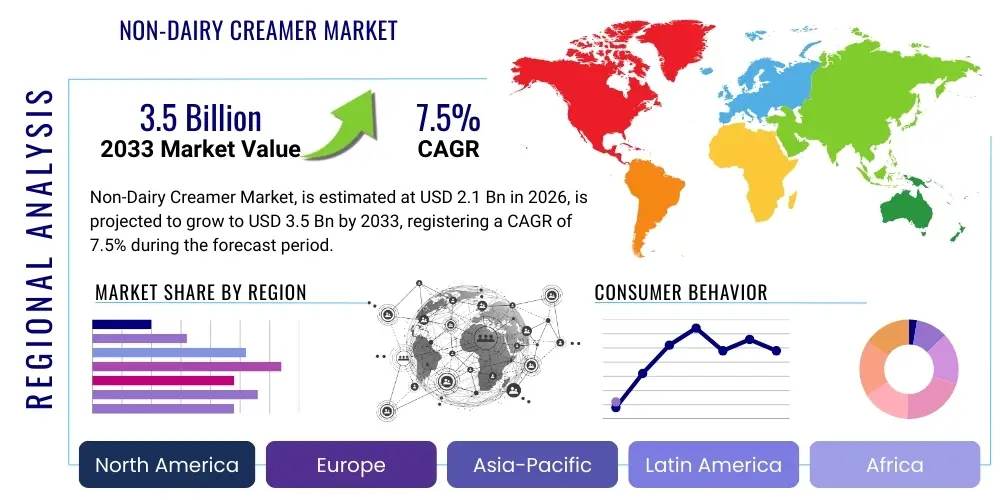

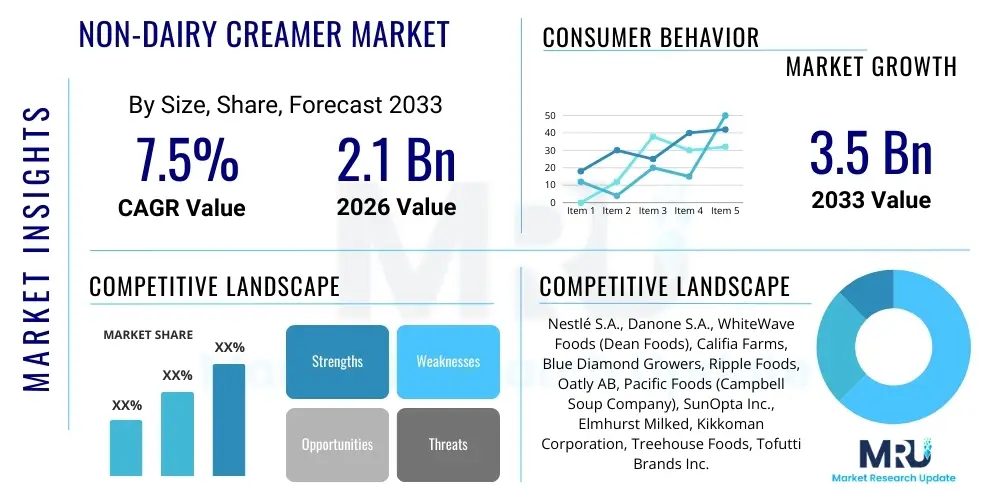

The Non-Dairy Creamer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Non-Dairy Creamer Market introduction

The Non-Dairy Creamer Market encompasses products designed to replace traditional dairy creamers, primarily used in coffee, tea, and cooking applications, catering to a growing consumer base with dietary restrictions, ethical preferences, and health consciousness. These creamers are typically formulated using plant-based milk alternatives such as oat, almond, coconut, soy, and rice. The rapid expansion of vegan and flexitarian diets globally serves as the fundamental catalyst for market growth, driving innovation in flavor profiles, texture, and nutritional value to closely mimic the sensory experience of dairy products while offering significant functional benefits, including cholesterol reduction and suitability for lactose-intolerant individuals. Manufacturers are focusing heavily on clean-label ingredients and sustainable sourcing practices to meet modern consumer demands for transparency and environmental responsibility, thereby transforming a niche market into a staple segment of the food and beverage industry.

Major applications of non-dairy creamers extend beyond simple beverage enhancement to include specialized formulations for professional food service industries and home baking. In commercial settings, baristas increasingly utilize oat and almond creamers for their superior frothing capabilities, facilitating the creation of high-quality lattes and cappuccinos. The benefits associated with these products are multi-faceted: they provide digestive comfort for those with lactose sensitivity, adhere to vegan and kosher dietary laws, and often contain fewer saturated fats than conventional dairy options. This broad appeal ensures market penetration across diverse demographic and socioeconomic groups, solidifying non-dairy creamers as a versatile ingredient across multiple culinary landscapes.

Driving factors for the market include elevated awareness regarding animal welfare, increasing prevalence of lactose intolerance and milk allergies worldwide, and proactive marketing by major food corporations emphasizing the health halos surrounding plant-based products. Furthermore, advancements in food technology, particularly in stabilizers and emulsifiers, have significantly improved the shelf life and sensory attributes of non-dairy creamers, overcoming previous consumer reservations regarding taste and texture. The competitive landscape is characterized by continuous product diversification, including flavored, sweetened, unsweetened, and functional variants fortified with vitamins or probiotics, ensuring sustained momentum and innovation throughout the forecast period.

Non-Dairy Creamer Market Executive Summary

The Non-Dairy Creamer Market is experiencing robust acceleration driven by shifting consumer preferences towards plant-based diets and escalating concerns over sustainability and health. Current business trends indicate a strong focus on oat-based creamers, which have gained substantial market share due to their superior texture, neutral flavor profile, and environmental benefits compared to historical market leaders like soy and almond. Key industry players are aggressively engaging in strategic acquisitions and partnerships with specialized plant-based ingredient suppliers to secure sustainable raw material supply chains and enhance product development capabilities. Furthermore, there is a pronounced trend toward premiumization, where niche segments like organic, non-GMO, and ethically sourced creamers command higher price points, signifying consumer willingness to invest in quality and provenance.

Regionally, North America and Europe remain the dominant markets, characterized by high disposable income, strong vegan population density, and established retail infrastructure facilitating easy access to diverse non-dairy options. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, increasing middle-class populations, and a growing Western influence on dietary habits, particularly in emerging economies like China and India. Local manufacturers in APAC are adapting traditional beverage concepts to incorporate non-dairy creamers, expanding the product’s relevance beyond coffee culture. Regulatory harmonization concerning food safety and plant-based labeling across various countries is further supporting global expansion and cross-border trade.

Segmentation trends highlight the increasing dominance of the liquid creamer segment over powdered formats, largely due to consumer demand for convenience and superior dissolution properties in cold and hot beverages. Within the source segment, oat milk is rapidly displacing almond milk as the preferred base in several key consumer demographics, primarily for its creamy mouthfeel and lower water usage footprint, appealing to environmentally conscious buyers. The retail segment (supermarkets, hypermarkets) continues to be the primary distribution channel, though e-commerce is gaining traction rapidly, offering direct-to-consumer opportunities and facilitating access to niche and artisanal brands, thereby transforming how consumers discover and purchase non-dairy creamer products.

AI Impact Analysis on Non-Dairy Creamer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Non-Dairy Creamer Market predominantly focus on optimizing production efficiency, enhancing personalized flavor development, and predicting ingredient sourcing stability. Consumers and industry stakeholders are keen to understand how AI-driven analytics can improve the texture and performance of plant bases (e.g., using machine learning to balance protein and fat ratios in oat milk fermentation), reduce waste in manufacturing, and refine supply chain logistics, especially concerning volatile ingredients like coconuts or almonds affected by climate change. A core concern is the ethical implementation of AI in personalized nutrition, ensuring that tailored creamer recommendations meet individual health goals without compromising privacy. Expectations center around AI streamlining the R&D cycle, allowing companies to launch highly customized, next-generation clean-label products faster, thereby accelerating market responsiveness.

The implementation of AI is revolutionizing the formulation process within the non-dairy sector. Machine learning algorithms analyze vast datasets comprising sensory profiles, ingredient interactions, and consumer taste preferences to design new creamer prototypes with unprecedented accuracy, minimizing the need for extensive physical testing. This capability drastically shortens the time-to-market for innovative flavors and textures, ensuring that products are launched with maximized consumer appeal. Furthermore, AI tools are critical in predictive maintenance across manufacturing lines, identifying potential equipment failures before they occur, thus ensuring consistent product quality, reducing downtime, and optimizing operational costs across global production facilities.

- AI-driven Predictive Analytics: Optimizing raw material procurement (e.g., predicting almond yield fluctuations) to ensure supply stability and cost efficiency.

- Automated Quality Control: Implementing computer vision systems for real-time monitoring of consistency, texture, and color during emulsion stabilization.

- Personalized Product Formulation: Using machine learning to develop customized creamer blends based on user nutritional data and dietary profiles (e.g., ketogenic, low-sugar).

- Supply Chain Optimization: AI algorithms enhancing cold chain logistics, route planning, and inventory management to reduce spoilage of perishable liquid products.

- Accelerated R&D: Utilizing generative AI to simulate ingredient combinations, reducing the experimental phase for new plant-base development (e.g., fava bean or hemp creamers).

DRO & Impact Forces Of Non-Dairy Creamer Market

The Non-Dairy Creamer Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include the escalating global awareness and acceptance of plant-based diets, coupled with the rising incidence of lactose intolerance and dairy allergies, necessitating viable alternatives for daily consumption. Opportunities manifest prominently through innovation in ingredient technology, particularly focusing on sustainable and novel plant sources (such as potato, chickpea, or specialized fermented oats) to deliver superior functional attributes like enhanced solubility, foaming capacity, and shelf stability, thereby attracting new user demographics, especially in the premium coffee segment. These forces combine to create a highly dynamic environment characterized by rapid product cycles and intense competitive innovation, pushing the market forward rapidly.

Conversely, significant restraints temper the market’s exponential growth trajectory. The most critical restraint involves the perceived higher cost of non-dairy creamers compared to traditional dairy or standard powdered coffee whiteners, which can deter price-sensitive consumers, particularly in developing economies. Furthermore, the inherent challenges in formulating plant-based products to achieve the desired mouthfeel and rich flavor profile of dairy cream remain a technical barrier. Some non-dairy bases, such as almond, face substantial scrutiny related to water usage and environmental sustainability, requiring constant innovation in sourcing and processing to mitigate negative public perception and maintain their health halo advantage over traditional dairy products.

Impact forces such as competitive rivalry and technological changes exert substantial pressure. Intense rivalry among established dairy giants and agile plant-based startups drives down prices and necessitates constant product differentiation through flavor and nutritional fortification. Regulatory changes, especially concerning labeling standards (e.g., the debate on using "milk" terminology for plant-based products), dictate marketing strategies and consumer communication. The overall impact of these forces is overwhelmingly positive for market expansion, ensuring continuous advancement in ingredient sourcing, processing efficiency, and the commercial viability of innovative, sustainable, and functional non-dairy creamer formulations globally.

Segmentation Analysis

The segmentation of the Non-Dairy Creamer Market provides a critical understanding of consumer demand dynamics across various dimensions, allowing manufacturers to tailor their product lines strategically. The market is primarily segmented by Source (Almond, Soy, Coconut, Oat, Others), Formulation (Liquid, Powdered), Flavor (Original/Unsweetened, Vanilla, Hazelnut, Others), Application (Food Service, Retail/Household), and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail). The versatility inherent in these segments underscores the market's adaptability to global culinary traditions and evolving dietary trends. Liquid creamers, favored for their convenience and textural similarity to dairy, currently dominate the market, while powdered alternatives maintain a strong presence in regions prioritizing longer shelf life and lower cost logistics.

Analysis by Source reveals a definitive shift towards oat-based creamers, which currently exhibit the highest growth potential due to their sustainable profile and superior emulsification properties crucial for hot beverages. While almond remains a staple, the focus on sustainable sourcing is compelling producers to invest heavily in alternatives. Flavor segmentation indicates that traditional flavors like vanilla and hazelnut retain strong popularity, but there is an increasing demand for functional, unsweetened, or clean-label options, aligning with broader health and wellness movements. Manufacturers are increasingly utilizing natural sweeteners and innovative flavor extraction techniques to appeal to health-conscious consumers seeking indulgence without excessive sugar content.

From an application perspective, the food service segment is crucial for driving premiumization and consumer adoption, as specialized coffee chains often introduce consumers to new creamer bases and flavors, influencing subsequent retail purchasing decisions. The retail segment, however, accounts for the largest volume sales, demonstrating robust household acceptance of non-dairy alternatives for daily use. This comprehensive segmentation framework allows market players to identify under-served geographical areas or demographic groups, such as fitness enthusiasts requiring protein-fortified creamers or pediatric populations needing allergen-free formulations, thus optimizing product portfolios for maximum market penetration.

- By Source: Almond, Soy, Coconut, Oat, Rice, Hemp, Others (e.g., Chickpea, Potato).

- By Formulation: Liquid (Refrigerated, Shelf-stable), Powdered.

- By Flavor: Original/Unsweetened, Vanilla, Hazelnut, Caramel, Seasonal Flavors, Others.

- By Application: Food Service (Cafes, Restaurants, Hotels), Retail/Household.

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores.

Value Chain Analysis For Non-Dairy Creamer Market

The value chain for the Non-Dairy Creamer Market begins with extensive upstream activities centered around the sourcing and processing of core raw materials—plant bases such as oats, almonds, soybeans, and coconuts. This stage is characterized by significant agricultural risks, price volatility, and increasing emphasis on certified sustainable and non-GMO sourcing practices. Key players invest heavily in backward integration or long-term contracts with specialized farming cooperatives to ensure consistent quality and supply chain transparency. Processing involves complex extraction, filtration, and homogenization techniques to create the base liquid or powder, demanding advanced food processing technology to maximize yield and achieve optimal sensory characteristics required for consumer acceptance.

Midstream activities involve sophisticated formulation, manufacturing, and packaging. This stage is critical for adding value through the incorporation of functional ingredients, including stabilizers (e.g., carrageenan, gellan gum), emulsifiers, natural flavors, and sweeteners. Quality control and regulatory compliance are paramount, particularly concerning allergen management, pasteurization protocols, and shelf-stability enhancements (aseptic processing for shelf-stable liquid creamers). Manufacturing facilities must meet stringent hygiene standards to prevent contamination, especially given the perishable nature of liquid formulations. Efficient packaging design, focusing on sustainability (recyclable or biodegradable materials) and extended freshness, further dictates the marketability of the final product.

Downstream analysis highlights the complexity of distribution, encompassing both direct and indirect channels. Indirect distribution, primarily through large supermarkets, hypermarkets, and convenience stores, accounts for the majority of sales volume, requiring robust cold chain logistics management for refrigerated products. Direct channels, including e-commerce platforms and direct partnerships with food service giants (e.g., major coffee shop chains), facilitate market reach for specialized or high-end products. Effective marketing and branding strategies, often leveraging social media and influencer partnerships, are essential to differentiate products in a crowded marketplace, ensuring high visibility and consumer pull at the point of sale and strengthening the brand’s positioning against both dairy and competitor non-dairy products.

Non-Dairy Creamer Market Potential Customers

The primary segment of potential customers for the Non-Dairy Creamer Market consists of individuals with diagnosed or self-perceived lactose intolerance and dairy allergies, seeking functional and safe alternatives to enrich their daily beverages without adverse health effects. This segment values reliable ingredient lists, clear allergen information, and formulations that minimize digestive discomfort while delivering acceptable taste and texture. Manufacturers target this group by prominently displaying "lactose-free" and "dairy-free" labels, and often fortifying products with calcium or Vitamin D to match the nutritional profile of dairy, addressing common concerns regarding potential dietary deficiencies arising from dairy avoidance.

A rapidly expanding segment includes consumers adhering to plant-based diets, such as vegans, vegetarians, and flexitarians, who prioritize ethical and environmental considerations alongside health benefits. These consumers are highly motivated by sustainability credentials, favoring brands that offer organic, non-GMO, and responsibly sourced ingredients, particularly plant bases with lower carbon or water footprints like oat or pea milk. For this demographic, the purchasing decision is heavily influenced by corporate ethics, supply chain transparency, and product certifications, driving the market toward clean-label and minimally processed formulations that align with their ethical consumption values.

The third significant group comprises mainstream consumers and coffee enthusiasts who seek variety, convenience, and functional benefits beyond basic substitution. This segment includes individuals pursuing low-sugar or ketogenic diets, driving demand for unsweetened, low-carbohydrate creamers based on coconut or MCT oil. Furthermore, the professional food service sector (cafés, restaurants) acts as a crucial business-to-business customer, requiring specialized, high-performance liquid creamers that provide superior foaming and latte art capabilities, ensuring consistency and quality across high-volume beverage preparation, thus requiring bulk and commercial-grade packaging solutions tailored for professional use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., WhiteWave Foods (Dean Foods), Califia Farms, Blue Diamond Growers, Ripple Foods, Oatly AB, Pacific Foods (Campbell Soup Company), SunOpta Inc., Elmhurst Milked, Kikkoman Corporation, Treehouse Foods, Tofutti Brands Inc., Rich Products Corporation, Hain Celestial Group, Miyoko's Kitchen, Chobani Global Holdings, Green Grass Foods, Silk, International Delight. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Dairy Creamer Market Key Technology Landscape

The technological landscape of the Non-Dairy Creamer Market is defined by continuous advancements aimed at solving the inherent challenges of creating stable, palatable, and functional plant-based emulsions that mimic dairy. A critical technology is High-Pressure Processing (HPP) and Ultra-High Temperature (UHT) sterilization. UHT processing ensures microbial safety and significantly extends the shelf life of liquid creamers, enabling shelf-stable products that simplify distribution and inventory management for both manufacturers and retailers. However, the application of HPP is increasingly favored as it reduces the thermal degradation of nutrients and minimizes the formation of off-flavors associated with high heat, helping maintain the 'freshness' and nutritional integrity of the plant bases.

Emulsification and stabilization technologies represent the cornerstone of product quality. Manufacturers employ specialized homogenizers and colloidal mills to achieve fine, uniform particle size distribution, which prevents phase separation (the common issue of fat solids separating from the water base) and ensures a creamy, smooth mouthfeel. Furthermore, the selection and combination of hydrocolloids (gums) and natural emulsifiers (like sunflower lecithin or pea protein) are constantly refined to enhance the creamer’s performance, specifically its stability under high heat (preventing curdling in hot coffee) and its ability to foam effectively for baristas, a non-negotiable requirement for premium coffee applications.

Biotechnology and fermentation are emerging as transformative technologies, especially within the oat creamer segment. Controlled fermentation processes using specific microbial cultures can enhance the flavor profile, improve digestibility, and naturally increase the sweetness of the plant base, reducing the need for added sugars and artificial flavors. Micro-encapsulation technology is also gaining traction; this technique is used to shield sensitive functional ingredients, such as vitamins, probiotics, or MCT oils, ensuring their stability during processing and extending their efficacy through the product’s shelf life. These technological leaps are crucial for closing the sensory gap between non-dairy and traditional dairy creamers, driving increased consumer acceptance and repeat purchase rates.

Regional Highlights

The Non-Dairy Creamer Market exhibits significant regional variations in consumption patterns, flavor preferences, and market maturity, with North America leading the global landscape. North America, particularly the United States and Canada, acts as the epicenter of innovation and demand, driven by high consumer awareness regarding health and environmental issues, robust retail infrastructure, and the early adoption of diverse plant-based options. The region is characterized by intense competition and a strong preference for flavored liquid creamers, primarily utilizing almond and, increasingly, oat bases. Regulatory standards in this region are well-established, though labeling debates concerning plant milk remain an ongoing point of focus, influencing marketing strategies.

Europe represents the second largest market, characterized by stringent sustainability standards and a strong emphasis on clean labels and organic certification, particularly in Western European countries like Germany, the UK, and Sweden. European consumers tend to favor unsweetened or naturally flavored creamers, aligning with the region’s broader dietary trend toward lower sugar consumption. Oat-based products, largely due to successful local marketing campaigns by Scandinavian brands, hold a dominant position here. Market growth is spurred by the widespread integration of non-dairy options into mainstream coffee culture and institutional food services, necessitating bulk commercial packaging solutions.

The Asia Pacific (APAC) region is poised for explosive growth, despite currently holding a smaller overall market share. This growth is predominantly fueled by rapid economic development, increasing Western influence, and a demographic shift toward higher consumption of processed and convenient food items in countries such as China, Japan, and Australia. While soy remains a historically familiar base in many Asian cultures, coconut and rice creamers are also popular. The key challenge in APAC involves developing localized flavors that appeal to regional tastes and overcoming complex cold chain logistics in emerging economies. Manufacturers are focusing on localized sourcing and smaller packaging formats to penetrate traditional retail outlets effectively.

- North America: Dominance in liquid and flavored formats; strong consumer base in the U.S. and Canada driving oat and almond adoption; high investment in R&D for functional creamers.

- Europe: High adoption of organic and clean-label products; regulatory focus on sustainability; strong preference for oat-based creamers across retail and food service.

- Asia Pacific (APAC): Fastest growing region; increasing urbanization and Westernization driving demand; soy and coconut bases popular; focus on shelf-stable powdered options in developing countries.

- Latin America (LATAM): Emerging market with potential, primarily driven by middle-class expansion; price sensitivity remains a constraint; increasing interest in health-focused alternatives.

- Middle East and Africa (MEA): Growth driven by expanding expatriate populations and high disposable income regions (GCC countries); focus on imported, premium, shelf-stable products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Dairy Creamer Market.- Nestlé S.A.

- Danone S.A.

- WhiteWave Foods (Dean Foods)

- Califia Farms

- Blue Diamond Growers

- Ripple Foods

- Oatly AB

- Pacific Foods (Campbell Soup Company)

- SunOpta Inc.

- Elmhurst Milked

- Kikkoman Corporation

- Treehouse Foods

- Tofutti Brands Inc.

- Rich Products Corporation

- Hain Celestial Group

- Miyoko's Kitchen

- Chobani Global Holdings

- Green Grass Foods

- Silk

- International Delight

Frequently Asked Questions

Analyze common user questions about the Non-Dairy Creamer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Non-Dairy Creamer Market?

The primary factor is the increasing prevalence of lactose intolerance globally, coupled with a significant consumer shift towards adopting vegan, vegetarian, and flexitarian diets, which necessitates viable, functional, and ethically sourced alternatives to traditional dairy creamers, especially for daily coffee consumption.

Which non-dairy creamer source is currently experiencing the highest growth rate?

Oat-based creamers are experiencing the highest growth rate. This surge is attributed to their superior functional qualities, such as excellent frothing and emulsification stability, creamy texture, and the perceived environmental benefit related to their lower water usage compared to almond or coconut bases.

What are the main technical challenges in manufacturing high-quality non-dairy creamers?

The main technical challenges involve achieving high emulsion stability to prevent product separation or curdling in hot beverages (thermostability), ensuring a desirable mouthfeel and texture that mimics dairy fat, and masking the inherent ‘beany’ or plant-specific off-flavors present in some raw materials without relying on excessive sugar or artificial additives.

How is the adoption of AI impacting the Non-Dairy Creamer production cycle?

AI adoption is significantly streamlining the R&D and manufacturing phases by utilizing machine learning to predict optimal ingredient ratios for stability and texture, reducing waste through predictive maintenance, and accelerating the development of novel, customized flavor profiles based on large-scale consumer preference data, thereby enhancing overall efficiency and product consistency.

What is the forecast for the liquid versus powdered non-dairy creamer segments?

The liquid segment is forecast to maintain market dominance, driven by consumer demand for convenience and better sensory properties in coffee shops and households. However, the powdered segment will retain importance, particularly in emerging markets and institutional sectors, due to its longer shelf life, lower shipping costs, and easier storage logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Low-Fat Non-Dairy Creamer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Low-protein, Medium protein, High-protein), By Application (Coffee, Milk Tea, Baking,Cold Drinks and Candy, Solid Beverage, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Non-dairy Creamer (Non Dairy Creamer) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Low-fat NDC, Medium-fat NDC, High-fat NDC), By Application (NDC for Coffee, NDC for Milk Tea, NDC for Baking, Cold, Drinks and Candy, NDC Solid Beverage), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager