Non GMO Lecithin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436029 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Non GMO Lecithin Market Size

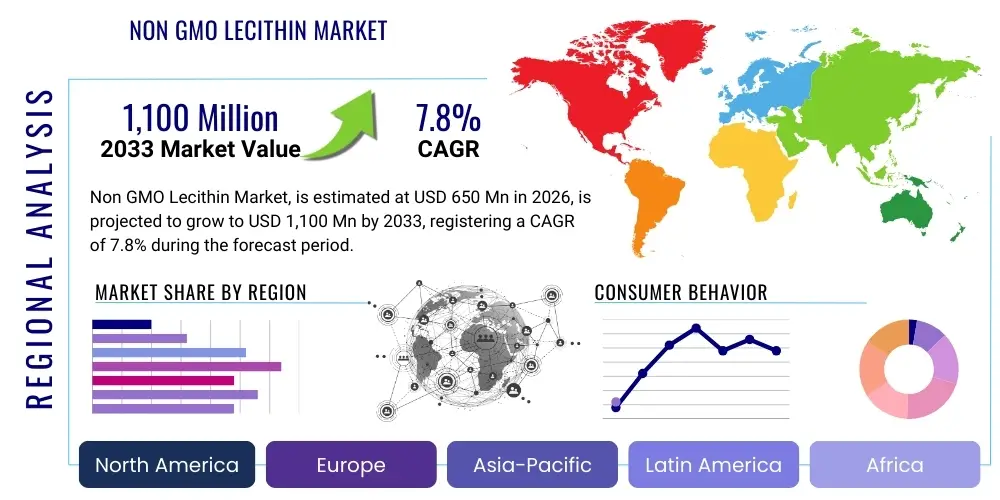

The Non GMO Lecithin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $650 million in 2026 and is projected to reach $1,100 million by the end of the forecast period in 2033.

Non GMO Lecithin Market introduction

Non-GMO Lecithin is a critical natural emulsifier and surfactant derived primarily from plant sources such as soy, sunflower, and rapeseed, ensuring the source crop has not been genetically modified. This ingredient is extensively utilized across the food and beverage, pharmaceutical, cosmetics, and animal feed industries due to its multifaceted functional properties, including stabilizing emulsions, reducing viscosity, and extending shelf life. Its rising adoption is fundamentally driven by the global consumer shift toward clean label ingredients, transparency in sourcing, and avoidance of genetically modified organisms (GMOs) in edible products, making it a preferred additive over conventional, often GMO-sourced lecithin.

The product description of non-GMO lecithin centers on its designation as a complex mixture of phospholipids, including phosphatidylcholine, phosphatidylethanolamine, and phosphatidylinositol, which are vital components for cellular function. In industrial applications, particularly in confectioneries, baked goods, and instant foods, non-GMO lecithin acts as an effective anti-spattering agent, wetting agent, and release agent, simultaneously improving texture and consistency without compromising natural ingredient integrity. Major applications span from enhancing the mixability of powdered drinks and nutritional supplements to stabilizing the fat content in chocolate and improving dough handling in bakery products, demonstrating its versatile technological utility across various manufacturing processes.

Key benefits driving the market expansion include its natural origin, strong consumer perception of health and safety, and versatility in formulation. Non-GMO lecithin provides superior functionality compared to synthetic alternatives while aligning with stringent regulatory requirements in key regions like the European Union and North America. The market is also propelled by robust growth in the pharmaceutical industry, where high-purity non-GMO lecithin is essential for liposomal drug delivery systems and injectable emulsions, requiring the highest standards of natural sourcing and ingredient quality assurance.

Non GMO Lecithin Market Executive Summary

The Non-GMO Lecithin Market is experiencing dynamic growth, characterized by strong business trends centered on supply chain diversification and capacity expansion, particularly in sunflower and rapeseed lecithin, driven by concerns over soy sourcing and allergenicity. Regional trends indicate that Europe and North America remain the dominant consumption centers due to stringent non-GMO labeling regulations and high consumer awareness, while the Asia Pacific region is emerging as the fastest-growing market, bolstered by urbanization, increasing disposable incomes, and the modernization of food processing industries seeking premium ingredients. Manufacturers are heavily investing in advanced extraction techniques, such as solvent-free and organic processing, to meet the demand for higher-quality and sustainably sourced products, enhancing market differentiation.

Segment trends reveal that the sunflower-based non-GMO lecithin segment is rapidly gaining market share, primarily due to its non-allergenic status and excellent functional properties, positioning it as a preferred substitute for traditional soy lecithin in allergen-sensitive formulations. The Food & Beverages segment continues to dominate the application landscape, with significant traction observed in the nutritional supplements and functional foods categories, where lecithin acts as a bioavailability enhancer and stability agent for sensitive active ingredients. Geographically, while established markets focus on premiumization and high-purity grades, developing economies are seeing increased adoption of non-GMO lecithin in mass-market applications like processed baked goods and fortified animal feed, indicating market penetration across diverse economic strata.

Strategic movements within the competitive landscape highlight mergers, acquisitions, and strategic partnerships aimed at securing consistent raw material supply and expanding global distribution networks. Key players are prioritizing vertical integration to maintain quality control from seed to final product, responding directly to consumer demand for traceability. The overall market outlook is highly positive, underpinned by supportive regulatory frameworks that favor natural and non-GMO ingredients, alongside persistent consumer willingness to pay a premium for certified clean-label products across the globe, ensuring sustained long-term market valuation growth.

AI Impact Analysis on Non GMO Lecithin Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Non-GMO Lecithin market typically focus on optimizing raw material sourcing, enhancing efficiency in extraction and purification processes, and improving supply chain transparency crucial for non-GMO verification. Users are keenly interested in how predictive analytics can forecast fluctuations in crop yield and quality (especially for sunflower and rapeseed), thereby stabilizing pricing and ensuring consistent non-GMO compliance. There is significant concern about leveraging machine learning models to analyze complex phospholipid profiles during processing, aiming to achieve consistent functional characteristics (like emulsification strength) necessary for specific high-value applications in the pharmaceutical and cosmetics sectors. Additionally, consumers and manufacturers frequently query the role of AI in auditing and maintaining the stringent separation protocols required throughout the non-GMO supply chain to prevent cross-contamination, a primary operational challenge in this specialized market.

- AI optimizes agricultural practices for non-GMO crop yields through predictive modeling, reducing reliance on conventional farm management techniques.

- Machine learning algorithms enhance extraction efficiency by analyzing real-time processing data (temperature, pressure, solvent ratio), minimizing energy consumption and waste.

- Predictive supply chain analytics improve inventory management and buffer stock planning, mitigating risks associated with volatile non-GMO crop harvest volumes and regional sourcing restrictions.

- AI-driven quality control systems, utilizing computer vision and sensor data, rapidly verify the integrity and purity of lecithin batches, specifically checking for solvent residues or contamination.

- Automation facilitated by AI streamlines compliance documentation and traceability logs, essential for maintaining non-GMO certifications (e.g., Non-GMO Project Verified, EU Organic).

- Advanced data analysis supports R&D by simulating new lecithin formulations (e.g., fractional purification, enzyme modification) to achieve specific functional requirements for complex food or pharmaceutical systems.

DRO & Impact Forces Of Non GMO Lecithin Market

The dynamics of the Non-GMO Lecithin Market are shaped by a confluence of influential factors categorized as Drivers, Restraints, and Opportunities, which collectively determine the market trajectory and competitive intensity. The primary driver is the pervasive global consumer trend demanding clean-label, natural, and transparently sourced ingredients, forcing food manufacturers to reformulate products away from synthetic additives and conventionally sourced GMO ingredients. This is supported by stringent labeling regulations in major economies that mandate disclosure of GMO content, effectively incentivizing the switch to non-GMO alternatives. However, the market faces significant restraints, chiefly the higher cost of production associated with non-GMO crops, necessitating strict segregation, specialized infrastructure, and verifiable documentation throughout the supply chain, which translates into a higher final product price relative to conventional lecithin.

Opportunities for growth are abundant, particularly in leveraging the expanding applications within the clinical nutrition and pharmaceutical sectors, where high-purity, standardized non-GMO phospholipids are required for advanced drug delivery systems, parenteral nutrition, and specialized dietary supplements. Furthermore, there is a clear opportunity for market expansion in emerging economies, where rising health consciousness and increasing regulatory oversight are gradually shifting demand toward premium, non-GMO ingredients. The impact forces acting upon this market are substantial; the power of buyers is high, driven by the availability of substitutes (though often less functionally effective or lacking the non-GMO status), and intense regulatory scrutiny imposes high barriers to entry regarding compliance and certification, favoring established players with robust quality systems.

The market faces the constant threat of substitution, mainly from alternative emulsifiers such as mono- and diglycerides, polysorbates, and specialized proteins, although these often fail to match the multifunctional properties and natural appeal of lecithin. Competitive rivalry remains high, particularly within the sunflower lecithin segment, where players compete aggressively on pricing, quality consistency, and certification scope. Successful navigation of these impact forces requires manufacturers to focus intensely on vertical integration to control raw material quality, invest in efficient, solvent-free processing technologies, and continuously innovate to unlock new functional benefits across diverse applications, thereby justifying the premium pricing structure inherent to the non-GMO distinction.

Segmentation Analysis

The Non-GMO Lecithin Market is structurally segmented based on Source, Application, and Form, allowing for granular analysis of demand patterns and strategic market positioning. The Source segment is critical, as it directly addresses allergen concerns and determines functional properties, encompassing Soy, Sunflower, Rapeseed (Canola), and Other sources like egg or corn. The Application segment defines the end-use industries, with Food & Beverages dominating, followed by substantial consumption in Animal Feed, Cosmetics, and Pharmaceuticals. Analyzing these segmentations is essential for stakeholders to target specialized manufacturing needs, such as the preference for sunflower lecithin in infant formula due to its non-allergenic properties and the high-purity requirements for pharmaceutical-grade phospholipids.

- Source

- Non-GMO Soy Lecithin: Traditional, cost-effective, but faces allergen concerns.

- Non-GMO Sunflower Lecithin: Fastest growing, non-allergenic, clean processing methods.

- Non-GMO Rapeseed (Canola) Lecithin: Offers unique functional properties, often used in specialized industrial applications.

- Others (e.g., Corn, Egg Yolk): Niche applications requiring highly specialized compositions.

- Application

- Food & Beverages: Bakery, Confectionery, Convenience Foods, Dairy Alternatives, Functional Foods, Infant Nutrition.

- Animal Feed: Pet food, Aquaculture feed, Livestock feed (improving nutrient absorption).

- Cosmetics & Personal Care: Emollients, stabilizing agents in creams and lotions.

- Pharmaceuticals & Healthcare: Drug delivery systems (liposomes), Nutritional supplements, Injectable emulsions.

- Industrial Use: Paints, Coatings, Textiles, Release agents.

- Form

- Liquid: Most common form, suitable for bulk industrial processes requiring easy dispersion.

- Powder: Used primarily in dry mixes, nutritional supplements, and standardized baking ingredients, offering enhanced shelf stability.

- Granules: Preferred for direct consumption or specific applications requiring low dust and excellent flowability.

- Type

- Standard Lecithin

- Fractionated Lecithin

- De-oiled Lecithin

- Hydrolyzed Lecithin

Value Chain Analysis For Non GMO Lecithin Market

The value chain for Non-GMO Lecithin is complex, commencing with the upstream sourcing of specific non-GMO seeds, demanding rigorous separation protocols throughout cultivation and harvesting to maintain certification integrity. Upstream analysis focuses heavily on certified non-GMO seed suppliers, specialized farmers adhering to strict planting and segregation guidelines, and initial oil extraction facilities that must prevent cross-contamination with conventional crops. This initial stage dictates the purity and quality of the raw material, setting a premium price benchmark compared to standard commodity lecithin. Key challenges upstream include yield variability of certified seeds and the high cost associated with dedicated storage and transportation infrastructure necessary for identity preservation.

The midstream processing involves the complex operations of degumming, drying, and eventual modification (e.g., fractionation, hydrolysis) to produce the various lecithin grades (liquid, powder, de-oiled). Distribution channels are critical; direct channels often involve large lecithin manufacturers supplying major multinational food, pharmaceutical, and feed companies that require tailored specifications and large volumes under long-term contracts. Indirect distribution utilizes specialized food ingredient distributors and brokers who cater to smaller manufacturers, providing a broader range of product forms and smaller batch sizes, thus ensuring market reach across the SME sector.

Downstream analysis centers on the diverse end-user applications across the food processing, pharmaceutical, and cosmetic industries. Factors influencing downstream demand include regulatory approval, consumer willingness to pay for non-GMO attributes, and formulation requirements. The market demands efficient logistics to handle both liquid bulk shipments and specialized packaging for high-value powder and granular forms destined for pharmaceutical use. Effective management of this integrated value chain, from verifiable non-GMO seed to compliant end-use application, is essential for maximizing profitability and maintaining brand trust in a highly label-sensitive market environment.

Non GMO Lecithin Market Potential Customers

Potential customers for Non-GMO Lecithin span multiple specialized sectors, primarily consisting of large-scale food and beverage manufacturers focused on clean-label and natural ingredient portfolios, and pharmaceutical companies requiring high-purity phospholipids for advanced drug delivery systems. The food sector includes major players in the bakery industry seeking improved dough conditioning and anti-staling properties, confectionery giants utilizing lecithin as a viscosity reducer in chocolate manufacturing, and producers of infant nutrition and specialized dietary supplements prioritizing non-allergenic, traceable ingredients like non-GMO sunflower lecithin. These customers value consistency, verifiable non-GMO certification, and stability of supply.

The animal nutrition industry represents another significant buyer segment, utilizing lecithin in feed formulations, particularly in aquaculture and pet food, to enhance fat emulsification, improve nutrient bioavailability, and boost overall feed efficiency, meeting the growing consumer demand for premium pet nutrition. Furthermore, the cosmetics industry, encompassing personal care and high-end beauty product manufacturers, purchases non-GMO lecithin for its natural emulsifying and moisturizing properties, aligning with the clean beauty trend. Buyers in these sectors are generally sophisticated, demanding specific quality parameters (e.g., acetone insoluble levels, color, and viscosity) and often sourcing through direct contracts with major lecithin producers to ensure tailored technical support and cost effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 million |

| Market Forecast in 2033 | $1,100 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bunge Limited, Archer Daniels Midland Company (ADM), Cargill Incorporated, Stern-Wywiol Gruppe, Lipoid GmbH, Lasenor Emul, Solae LLC (now part of IFF/Dupont), VAV Life Sciences Pvt. Ltd., Avanti Polar Lipids Inc., Clarkson Specialty Foods, Lecico GmbH, Ruchi Soya Industries Ltd., Wilmar International Ltd., Lucas Meyer Cosmetics, Dow Chemical Company, Global Specialty Ingredients (GSI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non GMO Lecithin Market Key Technology Landscape

The technology landscape in the Non-GMO Lecithin market is primarily focused on enhancing extraction purity, ensuring non-GMO traceability, and modifying the molecular structure to improve functional performance. A major technological advancement involves solvent-free extraction methods, such as water degumming and mechanical pressing, particularly crucial for sunflower lecithin. This methodology addresses consumer aversion to chemical solvents like hexane, aligns with clean-label initiatives, and often allows manufacturers to achieve higher certification standards (e.g., organic non-GMO). Continuous investment is being made in sophisticated chromatography and filtration systems to refine lecithin, enabling the isolation and concentration of specific phospholipids (like phosphatidylserine or phosphatidylcholine) vital for high-value nutraceutical and pharmaceutical applications, resulting in highly specialized, premium-priced ingredients.

Another crucial area of technological innovation is enzymatic modification, including hydrolysis, which alters the lecithin structure to produce lysolecithin. Lysolecithin exhibits superior emulsifying properties and thermal stability compared to standard lecithin, making it highly desirable in applications such as baked goods and dairy alternatives where robust performance under challenging processing conditions is required. Furthermore, technology plays an indispensable role in traceability and verification; advanced blockchain technology and specialized ERP systems are being implemented across the supply chain to provide immutable records of seed origin, segregation status, and processing pathways, which is paramount for substantiating non-GMO claims and meeting complex regulatory auditing requirements globally.

Process engineering focuses on continuous improvement in drying and de-oiling processes to produce stable, low-moisture powder and granular forms of non-GMO lecithin, which are easier to handle, store, and incorporate into dry mix formulations. Vacuum drying and supercritical fluid extraction (SFE) are also explored for sensitive phospholipids to maintain their bioactivity and functional integrity, minimizing thermal degradation. These technological efforts underscore the industry's shift toward high-purity, application-specific ingredients that offer superior functional outcomes while strictly adhering to the fundamental promise of non-GMO origin.

Regional Highlights

- North America: This region is a major consumer and technological leader, characterized by strong demand driven by the Non-GMO Project Verified certification and proactive consumer avoidance of GMOs. The US market dominates due to widespread adoption of non-GMO ingredients in the massive functional foods, dietary supplements, and infant formula sectors. Regulatory clarity, alongside substantial retail penetration of clean-label brands, ensures sustained high growth.

- Europe: Europe holds a dominant position, largely due to extremely strict EU regulations regarding GMO labeling and a deeply ingrained consumer preference for natural, traceable ingredients. Germany, France, and the UK are primary markets, with a high consumption rate of non-GMO sunflower and rapeseed lecithin, driven by the strong emphasis on organic and allergen-free food manufacturing. European companies often lead in sustainable and solvent-free extraction technologies.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by rapidly modernizing food processing sectors in China, India, and Southeast Asian nations. Increasing affluence, urbanization, and a growing awareness of food safety and ingredients quality are fueling the shift from conventional to non-GMO inputs. While soy lecithin remains strong, the growth of the regional aquaculture and nutritional supplement industries specifically drives demand for high-grade non-GMO varieties.

- Latin America: This region, particularly Brazil and Argentina (major soy producers), plays a crucial role as a raw material source, though domestic consumption of non-GMO derivatives is growing steadily. The market is developing, with increased focus on adopting international food safety standards and non-GMO certification, driven by export requirements and a gradual rise in local consumer demand for premium products.

- Middle East and Africa (MEA): The MEA market is niche but emerging, with demand concentrated in affluent GCC countries and South Africa. Growth is tied to rising imports of processed foods and increasing pharmaceutical manufacturing capacity. Halal certification requirements often align closely with non-GMO standards, providing a synergistic demand factor for traceable, high-quality ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non GMO Lecithin Market.- Bunge Limited

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Stern-Wywiol Gruppe (including Berg+Schmidt)

- Lipoid GmbH

- Lasenor Emul, S.A.

- International Flavors & Fragrances Inc. (IFF - post acquisition of Solae)

- VAV Life Sciences Pvt. Ltd.

- Avanti Polar Lipids Inc.

- Clarkson Specialty Foods Inc.

- Lecico GmbH

- Ruchi Soya Industries Ltd. (now Patanjali Foods)

- Wilmar International Ltd.

- Lucas Meyer Cosmetics (Ingredient division)

- Sime Darby Plantation Berhad

- Advanced Organic Materials S.A. (AOM)

- Cenac Holding S.A.

- The Lecithin Company

- Global Specialty Ingredients (GSI)

- Dow Chemical Company (related specialty applications)

Frequently Asked Questions

Analyze common user questions about the Non GMO Lecithin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Non-GMO Soy Lecithin and Non-GMO Sunflower Lecithin?

The primary difference is allergenicity; sunflower lecithin is non-allergenic and widely preferred in infant formula and products sensitive to the eight major allergens, whereas soy lecithin, while functional and cost-effective, must be labeled as a major allergen.

How is non-GMO status verified and maintained across the supply chain?

Non-GMO status is verified through rigorous identity preservation programs, third-party certifications (like Non-GMO Project Verified), and documentation ensuring segregation from planting through processing, utilizing PCR testing at critical control points to detect genetic modification presence.

Which application segment drives the highest demand for Non-GMO Lecithin?

The Food and Beverages segment drives the highest demand, specifically within baked goods, confectioneries (e.g., chocolate), and functional foods, due to lecithin's effectiveness as a natural emulsifier, viscosity modifier, and ingredient stabilizer.

Why is Non-GMO Lecithin generally more expensive than conventional lecithin?

The higher cost is attributed to the complex upstream requirements, including specialized planting of non-GMO seeds, dedicated infrastructure for segregation during harvesting, storage, and processing, and the expenses associated with mandatory third-party certification and quality testing.

What technological advancements are shaping the future of Non-GMO Lecithin processing?

Key advancements include solvent-free extraction (e.g., water degumming) to meet clean-label demands, enzymatic modification (hydrolysis) for improved functionality, and advanced chromatographic purification necessary to isolate high-purity phospholipids for pharmaceutical use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager