Nonalcoholic Steatohepatitis Diagnostic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435689 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nonalcoholic Steatohepatitis Diagnostic Market Size

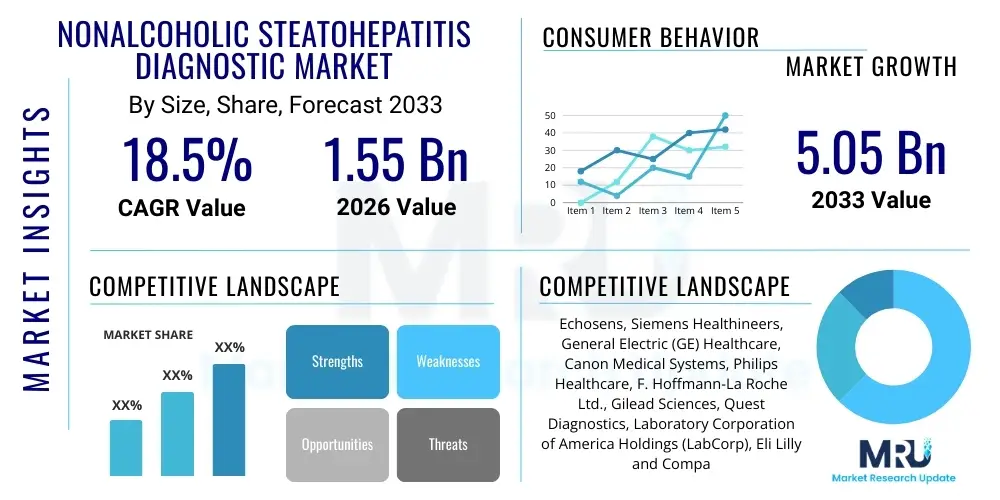

The Nonalcoholic Steatohepatitis Diagnostic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 5.05 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global prevalence of associated metabolic disorders, including type 2 diabetes and obesity, coupled with the critical unmet need for accurate, non-invasive diagnostic tools that can differentiate simple steatosis from advanced fibrosis (NASH). The existing gold standard, liver biopsy, is invasive, prone to sampling error, and carries risks, accelerating the industry's investment into imaging modalities and sophisticated liquid biopsy solutions. Regulatory approvals for novel diagnostic algorithms, particularly those leveraging multi-parametric data inputs, are expected to significantly contribute to the rapid market penetration throughout the forecast horizon.

Nonalcoholic Steatohepatitis Diagnostic Market introduction

The Nonalcoholic Steatohepatitis (NASH) Diagnostic Market encompasses technologies and services dedicated to identifying, characterizing, and staging liver damage caused by NASH, a severe form of nonalcoholic fatty liver disease (NAFLD) characterized by inflammation and hepatocyte injury, which can progress to cirrhosis and hepatocellular carcinoma. NASH diagnosis is complex, requiring precise assessment of steatosis, lobular inflammation, and fibrosis staging. Traditional diagnostic pathways relied almost exclusively on invasive liver biopsy, a method constrained by patient reluctance, high cost, and the subjectivity inherent in pathological interpretation. The fundamental product offering within this market is shifting towards non-invasive modalities designed for mass screening and monitoring, including advanced imaging techniques like Magnetic Resonance Elastography (MRE) and Vibration Controlled Transient Elastography (VCTE), alongside highly specific serum-based biomarker panels. These diagnostic innovations aim to facilitate earlier intervention and better patient management, especially crucial as pharmaceutical treatments for NASH advance through clinical trials.

Major applications for NASH diagnostics span several critical areas, primarily revolving around patient screening, disease monitoring, and clinical trial stratification. Screening applications are becoming paramount in high-risk populations, specifically those diagnosed with metabolic syndrome, severe obesity, or type 2 diabetes, where the prevalence of underlying NASH is remarkably high. Accurate and reliable non-invasive tools enable primary care physicians and endocrinologists to refer appropriate patients to specialists (hepatologists) for further confirmation and treatment. Furthermore, the pharmaceutical industry relies heavily on precise diagnostic tools to select suitable candidates for NASH drug trials and to quantitatively measure treatment efficacy, accelerating the adoption of quantitative measures such as Magnetic Resonance Imaging-Proton Density Fat Fraction (MRI-PDFF) for measuring liver fat content and MRE for assessing stiffness (fibrosis). The shift toward non-invasive methods is a significant benefit, improving patient compliance and allowing for longitudinal monitoring necessary for chronic disease management.

Driving factors in the NASH diagnostic market include the exponential growth in the global prevalence of metabolic risk factors, increased public health awareness campaigns targeting liver health, and supportive regulatory environments, particularly in the US and Europe, which are encouraging the development of non-invasive tools. The benefits of modern diagnostics are manifold: reduced healthcare costs associated with invasive procedures, enhanced patient comfort, improved standardization of diagnostic results compared to variable biopsy interpretation, and the potential for population-level screening initiatives that can catch the disease before irreversible damage occurs. The intense research activity in drug development for NASH simultaneously fuels the demand for companion diagnostics and specific biomarkers that can predict treatment response, creating a symbiotic relationship between therapeutic advancements and diagnostic innovation, ensuring sustained market momentum over the coming decade.

Nonalcoholic Steatohepatitis Diagnostic Market Executive Summary

The Nonalcoholic Steatohepatitis Diagnostic Market is experiencing a pivotal transformation characterized by a strong shift from invasive procedures to advanced, scalable, non-invasive technologies, a trend largely dictated by improved regulatory clarity and the pressing needs of pharmaceutical companies conducting late-stage clinical trials. Business trends indicate significant mergers, acquisitions, and strategic partnerships focusing on combining biomarker expertise with imaging technology platforms to offer integrated diagnostic solutions. Key players are aggressively investing in AI and machine learning algorithms to enhance the predictive power of existing non-invasive tests, particularly those relying on complex imaging data analysis or multi-marker blood panel interpretation. The primary segment driving revenue growth remains the imaging segment, specifically modalities providing quantitative measurements of fat and fibrosis, though the blood-based biomarker segment is expected to exhibit the highest CAGR due to its low cost, accessibility, and potential for widespread adoption in primary care settings. These commercial strategies are tailored to capture the massive, underserved population requiring initial screening and ongoing monitoring, transitioning diagnostics from specialty care tools to population health management solutions.

Regional trends highlight North America as the dominant market, attributable to the high prevalence of obesity and diabetes, sophisticated healthcare infrastructure, established reimbursement pathways for advanced imaging (like MRE), and the presence of major biopharmaceutical companies heavily engaged in NASH drug development, requiring constant diagnostic support. Europe follows closely, driven by national health services prioritizing non-invasive screening protocols to manage rising healthcare expenditure related to liver disease complications. Meanwhile, the Asia Pacific (APAC) region is poised for explosive growth, fueled by rapidly increasing rates of metabolic syndrome in countries like China and India, coupled with expanding investment in modern diagnostic infrastructure and growing awareness among clinical professionals regarding NASH detection. This region presents a critical opportunity for low-cost, high-throughput blood-based diagnostic solutions designed for large-scale application, influencing global market expansion strategies toward accessibility and affordability.

Segment trends underscore the segmentation by diagnostic method, where imaging techniques, despite their higher cost, maintain dominance in confirmation and staging due to their reproducibility and accuracy in assessing fibrosis severity. However, the future trajectory points towards the widespread utility of biomarker tests, including proprietary panels like the Enhanced Liver Fibrosis (ELF) test or FIB-4 scores, which serve as crucial gatekeepers, filtering out low-risk patients and reserving expensive imaging or biopsy for those with high suspicion of advanced disease. The end-user segmentation shows that Hospitals and Specialty Clinics remain the largest consumers of advanced imaging equipment, while independent diagnostic laboratories are becoming the primary users for automated biomarker analysis and high-volume testing required for large-scale epidemiological studies and drug trials. The integration of these segments—using biomarkers for screening and advanced imaging for confirmation—is the cornerstone of optimized clinical pathways emerging globally, dictating future investment priorities across the diagnostic value chain.

AI Impact Analysis on Nonalcoholic Steatohepatitis Diagnostic Market

The convergence of artificial intelligence and machine learning (AI/ML) with diagnostic procedures is a major theme driving user inquiries, centered around how AI can resolve the current bottlenecks of accuracy, subjectivity, and scale inherent in NASH diagnosis. Users frequently question AI’s capacity to standardize the interpretation of complex imaging data, such as MRE and ultrasound, asking whether algorithms can outperform human readers in grading subtle fibrosis stages or quantifying liver fat (steatosis) reliably across diverse patient populations. There is significant interest in AI's role in biomarker discovery, specifically the ability of neural networks to process vast multi-omic data sets (genomics, proteomics, metabolomics) to identify novel, highly sensitive non-invasive biomarkers that are predictive of disease progression or treatment response, a function crucial for developing effective companion diagnostics. Furthermore, a core expectation is that AI systems will integrate clinical, imaging, and lab data to create comprehensive risk stratification models, moving away from single-parameter assessments toward holistic, predictive diagnostics that enable primary care screening and vastly improve patient selection for high-stakes clinical trials.

The immediate impact of AI is most visible in enhancing the reliability and throughput of imaging diagnostics. AI algorithms are being developed and deployed to automate the segmentation and quantification of liver tissue features in MRI, CT, and ultrasound scans. This automation drastically reduces the inter-observer variability that traditionally plagues subjective radiological review, leading to more consistent and reproducible fibrosis scores, which is vital for longitudinal monitoring of chronic conditions like NASH. By efficiently analyzing large batches of imaging data, AI accelerates the diagnostic process, enabling high-volume screening programs that were previously impractical due to the time and specialist expertise required for manual image review. This technological leap addresses the scalability challenge, making advanced diagnostics accessible in lower-resource settings where specialist hepatology radiologists might be scarce, democratizing high-quality diagnostic accuracy.

Beyond imaging, AI is revolutionizing the utility of blood-based diagnostics. Current biomarker panels, while useful for screening, often lack the specificity required for definitive staging (F2, F3, F4 fibrosis). AI/ML models are adept at analyzing complex non-linear relationships between dozens of circulating biomarkers, clinical parameters (age, BMI, diabetes status), and genetic factors to generate highly accurate, composite diagnostic scores. These sophisticated algorithms move beyond simple cutoff points, providing precise probabilities of advanced fibrosis. For pharmaceutical companies, AI models are critical tools for patient recruitment, ensuring only those patients who meet precise histological criteria (without requiring upfront biopsy) are enrolled in trials, thereby streamlining the drug development pipeline and reducing the substantial costs associated with screening failures, solidifying AI as a necessary component for the future efficacy of NASH therapeutic development.

- AI standardizes quantitative assessment of fibrosis and steatosis using MRE and MRI-PDFF data, minimizing inter-reader variability.

- Machine learning accelerates the discovery and validation of novel, predictive circulating biomarkers for early-stage NASH detection.

- AI integrates multi-modal patient data (clinical, imaging, lab results) to generate precise risk stratification scores and disease progression probabilities.

- Algorithms improve efficiency in clinical trials by identifying and stratifying suitable patients non-invasively, reducing reliance on biopsy screening.

- AI facilitates the development of automated, point-of-care ultrasound applications for rapid, non-specialist screening in primary care settings.

DRO & Impact Forces Of Nonalcoholic Steatohepatitis Diagnostic Market

The NASH diagnostic market is characterized by powerful drivers and significant constraints, all influenced by converging impact forces across regulatory and technological landscapes. The primary driver is the epidemic rise in global NAFLD/NASH prevalence, intrinsically linked to the parallel growth in type 2 diabetes and obesity worldwide, creating an ever-expanding pool of patients requiring sophisticated diagnostic management. Coupled with this is the substantial unmet clinical need stemming from the recognized limitations and patient aversion to liver biopsy, which has catalyzed intense research and investment into non-invasive alternatives. These positive forces are countered by restraints, chiefly the high capital cost associated with advanced imaging technologies like MRE, leading to limited accessibility and variability in reimbursement policies across different geographies. Additionally, the lack of a single, universally accepted, highly accurate non-invasive biomarker that perfectly correlates with histological staging continues to pose a challenge, leading to fragmented diagnostic pathways and slower clinical adoption in some regions. Opportunities abound in the development of point-of-care (POC) testing devices utilizing microfluidics and biosensors, aimed at bringing high-sensitivity diagnostics closer to the primary care physician, thereby enabling widespread screening and early diagnosis, essential steps for mitigating the long-term societal burden of liver failure.

Impact forces acting on this market include the pervasive influence of regulatory bodies, such as the FDA and EMA, which are increasingly emphasizing the need for diagnostic tests to be validated against standardized endpoints and demonstrate utility in clinical decision-making, particularly concerning drug efficacy monitoring. The pharmaceutical industry acts as a major external force; as dozens of novel NASH drugs enter Phase 2 and Phase 3 trials, the demand for repeatable, quantitative diagnostics (often stipulated as companion diagnostics or integral endpoints) skyrockets, ensuring continuous R&D funding flows into the diagnostic sector. Furthermore, technological advancements in material science and bioinformatics are drastically lowering the cost and increasing the throughput of molecular diagnostics, making sophisticated genomic and metabolomic profiling economically feasible for broader clinical use. These synergistic factors are pushing the market toward integrated diagnostic panels that combine functional imaging data with precise molecular signatures, offering highly nuanced pathological insights without the invasiveness of traditional methods.

The overarching dynamics suggest a continuous market restructuring where non-invasive methods transition from supplementary tools to front-line diagnostic standards, leveraging the dual opportunities provided by mass screening needs and specific requirements for drug development. Successful market participants will be those who can navigate the complex reimbursement environment by providing diagnostics that not only offer superior clinical performance (high specificity for advanced fibrosis) but also demonstrate clear health economic value compared to traditional pathways. The ability to integrate AI into existing diagnostic hardware, turning conventional equipment into powerful, highly accurate diagnostic engines, represents the critical competitive differentiator. The convergence of these technological, clinical, and economic forces ensures that while high costs and biomarker standardization remain restraints, the enormous clinical and commercial opportunity drives aggressive innovation and market expansion throughout the forecast period.

Segmentation Analysis

The Nonalcoholic Steatohepatitis Diagnostic Market is comprehensively segmented based on the type of diagnostic methodology employed, the specific disease stage being targeted, and the end-user setting where the diagnostic tests are primarily utilized. This segmentation reflects the varied needs of the clinical workflow, ranging from initial non-invasive screening in primary care to advanced staging in specialized hepatology clinics. The primary segments are defined by the technology used, predominantly differentiating between imaging technologies and blood-based biomarker tests. Imaging technologies, while typically more expensive, offer direct visualization and highly quantitative measurements of both fat content and liver stiffness, making them essential for disease confirmation and staging (F2-F4). Conversely, blood-based tests offer high throughput, lower cost, and ease of use, positioning them as the preferred choice for large-scale population screening and risk stratification. The market’s evolution is driven by the synergistic use of these segments, where low-cost biomarkers act as effective filters for the application of high-precision imaging modalities, streamlining the patient journey and maximizing resource allocation efficiency across the healthcare system.

Further granular segmentation includes distinctions based on the stage of diagnosis, encompassing early screening (detection of steatosis/NAFLD) versus late-stage staging (assessment of advanced fibrosis/NASH). Products targeting early screening focus on sensitivity and affordability, often utilizing basic lipid panels and composite scoring algorithms, whereas products for staging demand high specificity and robust quantitative metrics, dominated by advanced imaging like MRE and specialized proprietary biomarker panels. End-user segmentation reveals that hospitals and specialty liver clinics represent the largest market share due to their immediate need for advanced, capital-intensive imaging equipment and specialized expertise for complex staging procedures. However, the fastest-growing end-user segment is independent diagnostic laboratories and Contract Research Organizations (CROs), which process the majority of blood samples for biomarker analysis and play a critical role in supporting the massive demand generated by global NASH clinical trials, requiring rapid, standardized, and high-volume testing capabilities.

Understanding these segments is crucial for strategic planning, as market dynamics vary significantly between them. For instance, the hardware-focused imaging segment is governed by long purchasing cycles, capital expenditure budgets, and regulatory approvals for device manufacturing, whereas the biomarker segment is characterized by rapid innovation cycles, intellectual property protection over assay panels, and highly competitive pricing pressures to achieve widespread adoption. The future competitive landscape will likely favor companies that offer comprehensive, vertically integrated solutions—combining proprietary biomarker assays with AI-enhanced reading capabilities for imaging devices—allowing for seamless transition across the diagnostic workflow. Geographic market potential also varies significantly; while developed regions quickly adopt high-end imaging, emerging markets often prioritize affordable, scalable biomarker solutions, requiring differentiated product strategies tailored to local infrastructure and reimbursement structures.

- Diagnostic Technology:

- Imaging Modalities (MRI-PDFF, MRE, VCTE/FibroScan, Ultrasound)

- Blood-Based Biomarkers (Proprietary Panels, Serological Scores like FIB-4, ELF Test)

- Disease Stage:

- Screening and Risk Assessment (NAFLD/Steatosis Detection)

- Staging and Confirmation (NASH and Advanced Fibrosis F2-F4)

- End-User:

- Hospitals and Specialty Liver Clinics

- Diagnostic Laboratories and Reference Labs

- Academic and Research Institutes

- Pharmaceutical and Contract Research Organizations (CROs)

Value Chain Analysis For Nonalcoholic Steatohepatitis Diagnostic Market

The value chain for the NASH Diagnostic Market is characterized by a complex interplay between technology innovators, specialized manufacturers, and diverse healthcare delivery channels, reflecting the technical complexity inherent in both imaging and biomarker development. Upstream activities are dominated by research and development organizations, particularly academic institutions and biotech startups, focused on identifying novel targets—whether new genetic markers, metabolomic signatures, or computational algorithms for image processing. Key upstream suppliers include providers of highly specific reagents and antibodies necessary for biomarker assays, specialized software developers creating AI tools for image analysis, and manufacturers of high-precision magnetic resonance and ultrasound components. The success of the downstream market relies heavily on the quality and specificity of these foundational components, necessitating robust intellectual property protection and strict quality control standards for raw materials and software code. This initial stage defines the clinical utility and cost structure of the final diagnostic product.

Midstream activities involve the core manufacturing and regulatory processes. For imaging diagnostics, this includes the assembly, calibration, and rigorous testing of complex medical devices (e.g., MRE-enabled scanners, VCTE devices). For biomarker diagnostics, this involves the standardization, mass production, and FDA/CE Mark clearance of assay kits and automated laboratory analyzers. Direct distribution often involves large medical device corporations selling capital equipment directly to large hospital systems and specialized clinics, requiring sophisticated technical support and long-term service contracts. Indirect channels are more common for consumable blood-based diagnostics, leveraging established networks of diagnostic laboratories and distributors that provide wide-reaching logistics capabilities, especially important for time-sensitive reagent delivery and test processing across national and international boundaries. Efficiency in the midstream segment is crucial for reducing the final cost per test and ensuring global scalability.

Downstream analysis focuses on the end-users and the patient journey. Direct end-users include hepatology clinics, endocrinologists, primary care physicians initiating screening, and increasingly, pharmaceutical companies utilizing diagnostics for patient enrollment and monitoring. The final consumption is driven by payer policies and reimbursement coverage, which heavily influence the adoption rates of both expensive imaging and novel biomarker tests. The final part of the chain, the provision of diagnostic results, relies on efficient IT infrastructure for secure data transmission and integration into Electronic Health Records (EHRs). Patient acquisition and utilization are directly linked to physician awareness and regulatory endorsements that integrate specific non-invasive tests into standard clinical guidelines, thereby creating sustained market demand and closing the loop from research innovation to patient benefit.

Nonalcoholic Steatohepatitis Diagnostic Market Potential Customers

The primary customer base for Nonalcoholic Steatohepatitis diagnostics is diverse, reflecting the chronic nature and multi-specialty management required for the disease, but is fundamentally centered around institutions and clinicians managing patients with metabolic risk factors. Leading the customer segment are large Hospital Systems and Academic Medical Centers, which require high-capital expenditure imaging equipment (MRI, MRE, advanced ultrasound) necessary for confirmatory staging and managing complex, late-stage patients. These institutions prioritize diagnostic accuracy, throughput, and the integration of results into existing research and clinical workflows, often being early adopters of the most sophisticated, yet expensive, diagnostic platforms. The decision-makers here are typically hospital procurement officers, heads of radiology departments, and leading hepatologists who influence purchasing based on clinical efficacy and potential revenue generation from advanced diagnostic procedures.

A rapidly expanding and highly strategic customer segment includes Independent Diagnostic Laboratories and Reference Labs. These entities are the primary consumers of high-volume, automated blood-based biomarker assays. Their importance stems from their ability to process samples efficiently for large populations and, critically, their partnership with pharmaceutical and Contract Research Organizations (CROs). CROs and pharmaceutical companies utilize these laboratories to manage the substantial diagnostic workload required for Phase 2 and Phase 3 NASH clinical trials, where thousands of potential participants need non-invasive screening and monitoring. This segment prioritizes scalability, standardization across different sites, and reliability, driving high demand for proprietary and robust biomarker panels that minimize variability in trial endpoints. The financial decisions here are often driven by centralized procurement teams focused on cost-per-test efficiency and global logistical capabilities.

The third major customer group involves the vast network of Primary Care Physicians (PCPs) and Endocrinologists, especially those managing large cohorts of diabetic and obese patients. While they may not purchase high-end imaging equipment, they are the key gatekeepers for initial screening using simple, affordable blood-based scoring systems (like FIB-4) or point-of-care (POC) elastography devices. The demand from this segment is volume-driven and favors diagnostics that are user-friendly, require minimal training, and offer low per-unit cost, allowing for widespread population health screening initiatives. Successfully marketing to this segment requires generating sufficient clinical evidence and securing clinical guideline endorsements that emphasize non-invasive screening protocols, thereby funneling high-risk patients into the specialized diagnostic pathways offered by the larger hospital and lab systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 5.05 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Echosens, Siemens Healthineers, General Electric (GE) Healthcare, Canon Medical Systems, Philips Healthcare, F. Hoffmann-La Roche Ltd., Gilead Sciences, Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), Eli Lilly and Company, Medtronic PLC, Perspectum Diagnostics, HealthTronics, Inc., Biomerica, Inc., Owlstone Medical, Resoundant, Inc., Exalenz Bioscience, Metabolon, Inc., Trivitron Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonalcoholic Steatohepatitis Diagnostic Market Key Technology Landscape

The technological landscape of the Nonalcoholic Steatohepatitis Diagnostic Market is defined by intense innovation across two primary pillars: advanced non-invasive imaging and sophisticated molecular diagnostics. The leading imaging technology is Magnetic Resonance Elastography (MRE), considered one of the most accurate non-invasive methods for quantifying liver stiffness, which correlates directly with fibrosis stage. MRE utilizes modified MRI sequences to measure tissue elasticity, offering high reproducibility and low operator dependence. Complementing MRE is Magnetic Resonance Imaging-Proton Density Fat Fraction (MRI-PDFF), which provides highly precise, quantitative measurement of liver fat content (steatosis). These high-end MRI-based techniques are capital-intensive but offer the necessary quantitative rigor demanded by clinical trials and complex patient management. Furthermore, Vibration Controlled Transient Elastography (VCTE), commercially known as FibroScan, remains crucial due to its portability, lower cost, and ability to be used at the point-of-care, making it an essential tool for high-volume screening in specialty clinics, despite being less accurate than MRE for very early fibrosis stages. The technological trajectory in imaging focuses on enhancing resolution, reducing scan times, and integrating AI for automated post-processing and reporting.

The second pillar, molecular diagnostics, focuses on identifying and quantifying circulating biomarkers in blood samples. This area encompasses standard serological markers (e.g., ALT, AST) used in composite scores like FIB-4 and non-proprietary NAFLD Fibrosis Score, as well as proprietary multi-analyte panels. Key proprietary technologies include the Enhanced Liver Fibrosis (ELF) test, which measures three markers of fibrosis turnover, and various panels incorporating novel markers of inflammation, apoptosis, and extracellular matrix remodeling (such as circulating microRNAs or specialized lipid metabolites). Advances in proteomics and metabolomics, particularly through high-throughput liquid chromatography-mass spectrometry (LC-MS) and advanced immunoassay techniques, are enabling the identification of highly specific biomarkers that can not only detect the presence of NASH but also predict the likelihood of progression to cirrhosis. The technological challenge here lies in ensuring that these multi-analyte assays are standardized, affordable, and readily automated for high-volume diagnostic laboratory use globally, necessitating robust intellectual property and manufacturing scale.

Emerging technologies include advanced ultrasound techniques integrating quantitative methods, providing low-cost alternatives to MRI, and breath testing technologies (such as those detecting volatile organic compounds) that offer highly accessible, non-invasive screening options, though these are still undergoing substantial clinical validation. Crucially, the integration of computational tools, particularly AI and deep learning, forms the technology glue binding these diverse modalities together. AI algorithms enhance the diagnostic power of both imaging and molecular data by identifying subtle, non-linear correlations predictive of histological NASH—a feat beyond human capacity or simple linear models. The future key technology will not be a single test, but rather a seamless diagnostic platform that utilizes AI to integrate data from cheap screening biomarkers (blood, ultrasound) with confirmatory advanced imaging data (MRE/MRI-PDFF) to provide a precise, personalized staging profile for every patient, thereby maximizing clinical efficiency and diagnostic confidence.

Regional Highlights

- North America: North America, comprising the United States and Canada, currently holds the largest share of the Nonalcoholic Steatohepatitis Diagnostic Market, a dominance driven by several factors including the extremely high prevalence of underlying risk factors (Type 2 diabetes and obesity), which fuels the massive patient pool requiring diagnosis and monitoring. The region benefits from a highly advanced healthcare infrastructure, robust reimbursement coverage for specialized diagnostic procedures such as MRE and VCTE, and the highest concentration of leading diagnostic technology developers and major pharmaceutical companies engaged in late-stage NASH therapeutic trials. The U.S. market, in particular, is highly competitive and characterized by rapid adoption of FDA-approved novel diagnostic algorithms, often leveraging AI integration into existing imaging modalities. Furthermore, high healthcare expenditure per capita and a strong emphasis on preventative health and chronic disease management contribute significantly to sustained demand for high-value, accurate diagnostic tools. Regulatory bodies here often serve as the benchmark for global approval of new NASH diagnostics.

- Europe: The European market represents the second largest regional segment, exhibiting steady growth propelled by increasing standardization of diagnostic protocols and strong clinical guidelines promoting non-invasive screening, particularly within national health services (NHS). Countries such as Germany, the UK, and France are leaders in adopting elastography devices (VCTE) for primary screening due to cost-effectiveness and accessibility. The European market benefits from a strong foundation in biotech research, leading to faster uptake of proprietary blood-based biomarker panels, especially the Enhanced Liver Fibrosis (ELF) test, which has seen strong adoption in several national guidelines for risk stratification. Government initiatives aimed at reducing the long-term economic burden of chronic liver disease, coupled with concerted efforts to improve early diagnosis rates in high-risk populations, ensure continuous market growth. However, reimbursement policies remain fragmented across individual member states, presenting a varied landscape for market entry compared to the unified approach often seen in the US.

- Asia Pacific (APAC): The Asia Pacific region is forecast to be the fastest-growing market during the forecast period, driven by the massive patient base resulting from rapid urbanization, dietary changes, and escalating rates of obesity and metabolic syndrome across populous nations like China, India, and Japan. While the current diagnostic infrastructure is still developing compared to Western nations, significant public and private investment is being poured into modernizing hospital facilities and expanding access to advanced medical devices. The primary opportunity in APAC lies in scalable, affordable diagnostic solutions; therefore, demand is surging for low-cost VCTE devices and highly automatable, cost-effective blood-based diagnostic assays designed for high-throughput screening in large, densely populated areas. Regulatory streamlining, increased healthcare awareness, and growing physician education regarding NASH diagnosis are critical accelerators for maximizing the enormous untapped market potential in this region over the next decade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonalcoholic Steatohepatitis Diagnostic Market.- Echosens

- Siemens Healthineers

- General Electric (GE) Healthcare

- Canon Medical Systems

- Philips Healthcare

- F. Hoffmann-La Roche Ltd. (Diagnostics Division)

- Gilead Sciences

- Quest Diagnostics

- Laboratory Corporation of America Holdings (LabCorp)

- Medtronic PLC

- Perspectum Diagnostics

- HealthTronics, Inc.

- Biomerica, Inc.

- Owlstone Medical

- Resoundant, Inc.

- Metabolon, Inc.

- Trivitron Healthcare

- Exalenz Bioscience

- Bristol-Myers Squibb (focused on companion diagnostics)

- AbbVie Inc. (in drug development diagnostics)

Frequently Asked Questions

Analyze common user questions about the Nonalcoholic Steatohepatitis Diagnostic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver accelerating the growth of the NASH Diagnostic Market?

The primary driver is the accelerating global epidemic of associated metabolic diseases, notably type 2 diabetes and obesity, which significantly increases the patient population requiring monitoring and diagnosis for Nonalcoholic Steatohepatitis (NASH). This demographic trend mandates the urgent shift from invasive biopsy procedures to accessible, scalable non-invasive testing methods, propelling technological investment.

How do non-invasive methods like MRE and VCTE compare in clinical use for NASH diagnosis?

Magnetic Resonance Elastography (MRE) is generally considered the most accurate non-invasive tool for quantifying advanced fibrosis (F3-F4 stage) and is preferred for confirmatory staging and clinical trials due to its precision. Vibration Controlled Transient Elastography (VCTE), or FibroScan, is more portable and cost-effective, making it the preferred method for large-scale screening and assessment in primary care or specialty clinics.

What role does Artificial Intelligence (AI) play in the future of NASH diagnostics?

AI's role is critical in enhancing diagnostic accuracy and efficiency. AI algorithms are used to automate the precise quantification of fat (steatosis) and stiffness (fibrosis) in imaging scans, reducing subjectivity. Furthermore, AI models integrate complex multi-biomarker data and clinical factors to provide highly accurate, predictive risk scores, optimizing patient selection for drug treatment and clinical trials.

Which diagnostic segment is anticipated to experience the highest growth rate during the forecast period?

The Blood-Based Biomarkers segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR). This is due to the inherent benefits of biomarkers, including low cost, high throughput, and ease of use, positioning them as the ideal initial screening tool for large populations in primary care settings, thereby maximizing the total addressable market.

What are the main restraints hindering the wider adoption of advanced NASH diagnostics?

The primary restraints include the high capital expenditure required for advanced diagnostic imaging devices (e.g., MRE equipment), which limits accessibility in lower-resource settings. Additionally, the market faces challenges related to the lack of a single, highly sensitive non-invasive biomarker that is universally accepted as a perfect surrogate for histological staging across all regulatory bodies.

How does the pharmaceutical industry influence the NASH diagnostic market?

The pharmaceutical industry exerts massive influence by fueling demand for highly precise and quantitative diagnostic tools, essential for patient stratification, measuring therapeutic efficacy (endpoints), and monitoring safety in drug clinical trials. The success of novel NASH drugs is directly reliant on the accuracy and reliability of companion diagnostics.

What distinguishes NASH from simple NAFLD in terms of diagnostic requirements?

Nonalcoholic Fatty Liver Disease (NAFLD) is characterized by simple fat accumulation (steatosis), which can often be detected by basic imaging. NASH (Steatohepatitis) requires confirmation of inflammation and hepatocyte injury, critically necessitating advanced diagnostics (like MRE or specific biomarkers) that can accurately assess fibrosis stage (F2 and above) to identify patients at high risk of progression to cirrhosis.

Which region currently dominates the NASH Diagnostic Market in terms of revenue?

North America currently dominates the market in terms of revenue share. This is attributed to the high prevalence of metabolic syndrome, superior healthcare expenditure, early adoption of expensive advanced diagnostic technologies, and robust research activities supporting both drug and diagnostic development within the region.

What is the significance of the shift toward point-of-care (POC) testing in this market?

The shift toward POC testing, particularly using portable VCTE and microfluidic biomarker analysis, is significant because it allows non-specialist primary care physicians to screen high-risk patients efficiently and affordably. This expansion drastically increases the reach of diagnostics beyond specialized clinics, facilitating earlier detection and intervention at the community level.

Are regulatory frameworks keeping pace with the rapid technological innovations in NASH diagnostics?

Regulatory bodies, particularly the FDA and EMA, are actively developing specialized pathways to assess and approve non-invasive NASH diagnostics, recognizing the clinical urgency. While traditionally slow, the focus on surrogate endpoints and standardized validation methods is accelerating the market entry of novel, non-invasive tools, demonstrating a supportive trend in regulatory responsiveness.

What is the technical basis for the high accuracy of MRI-PDFF in NASH assessment?

MRI-Proton Density Fat Fraction (MRI-PDFF) provides high accuracy by utilizing specific quantitative MRI sequences that suppress the water signal, allowing for the precise and uniform quantification of liver fat percentage throughout the entire organ. This volumetric assessment offers greater reliability and reproducibility compared to ultrasound or localized biopsy samples, making it essential for drug trials.

Why are large diagnostic laboratories critical customers in the NASH diagnostic value chain?

Large diagnostic laboratories and reference labs are critical customers because they possess the automation and scalability required to process high volumes of biomarker tests necessary for population screening and large-scale, multi-site pharmaceutical clinical trials. Their centralized testing capabilities ensure standardization and efficiency across the global diagnostic landscape.

What kind of strategic partnerships are common in the NASH diagnostic market?

Common strategic partnerships involve collaborations between imaging device manufacturers and biomarker developers to create integrated diagnostic platforms. Furthermore, partnerships between diagnostic companies and pharmaceutical firms are crucial for developing companion diagnostics required to monitor drug response and enroll patients accurately in pivotal trials.

How does reimbursement coverage affect the adoption of NASH diagnostics?

Reimbursement coverage significantly impacts adoption, especially for expensive capital equipment like MRE. Favorable coverage policies for advanced non-invasive tests encourage hospitals and clinics to invest, while limited or variable coverage—especially for novel biomarkers—can impede market penetration and limit diagnostics primarily to self-pay or research settings.

Beyond fat and fibrosis, what other pathological aspects are new diagnostics aiming to measure?

New diagnostics are increasingly aiming to measure markers of inflammation and ballooning (hepatocyte injury), which are key defining features of NASH beyond simple fat accumulation (steatosis) and scarring (fibrosis). These molecular markers, often utilizing metabolomic or proteomic analysis, are crucial for differentiating active NASH from benign NAFLD and predicting disease progression risk.

What is the primary challenge related to standardizing blood-based biomarker tests globally?

The primary challenge in standardizing blood-based biomarker tests globally is the variability inherent in laboratory methodologies, equipment calibration, and regional reference ranges. Achieving universal clinical acceptance requires extensive multi-site validation studies and harmonization of assays to ensure reproducible results regardless of where the test is performed.

How is the market addressing the need for improved patient compliance?

The market addresses the need for improved patient compliance by focusing intensely on non-invasive diagnostic solutions. The shift away from painful and risky liver biopsies to simple blood draws, portable external scans (VCTE), or routine MRI scans drastically reduces patient discomfort, encouraging greater participation in screening and longitudinal monitoring programs.

What drives the high demand for diagnostic solutions from Contract Research Organizations (CROs)?

CROs require high-volume diagnostic solutions to efficiently manage patient screening and monitoring for large-scale NASH drug trials. They need tests that are highly accurate, standardized across multiple global sites, and can provide quantitative, repeatable data suitable for regulatory submission regarding drug efficacy endpoints.

In the Value Chain, where is the most significant intellectual property concentrated?

The most significant intellectual property is concentrated upstream in the research and development phase, specifically around proprietary blood-based biomarker panels (patented combinations of analytes), unique pulse sequences utilized in Magnetic Resonance Elastography (MRE) technology, and the sophisticated AI algorithms used for complex data interpretation and risk modeling.

How do advancements in genomics and metabolomics influence NASH diagnosis?

Advancements in genomics and metabolomics are paving the way for highly personalized NASH diagnosis. These fields help identify genetic predispositions to the disease and specific metabolic signatures associated with active inflammation or advanced fibrosis, offering potential new targets for non-invasive molecular diagnostics with higher predictive power than current standard panels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager