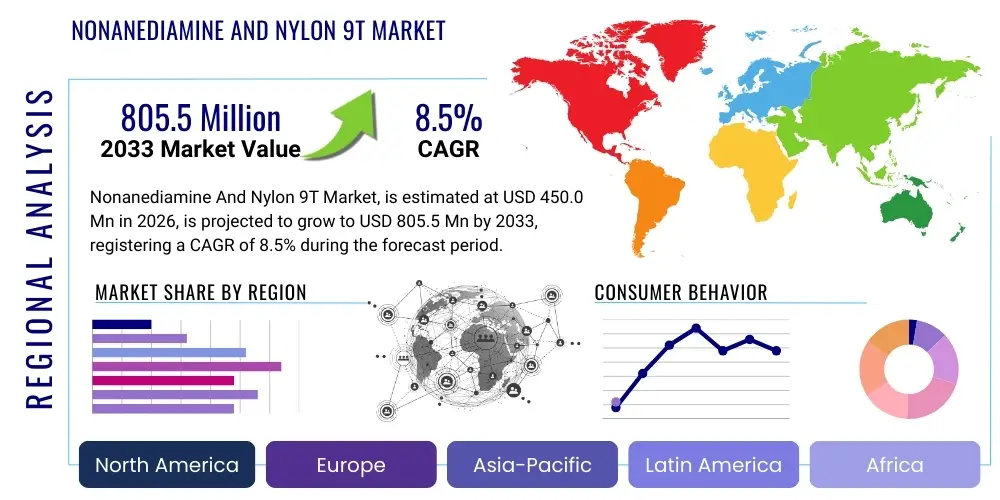

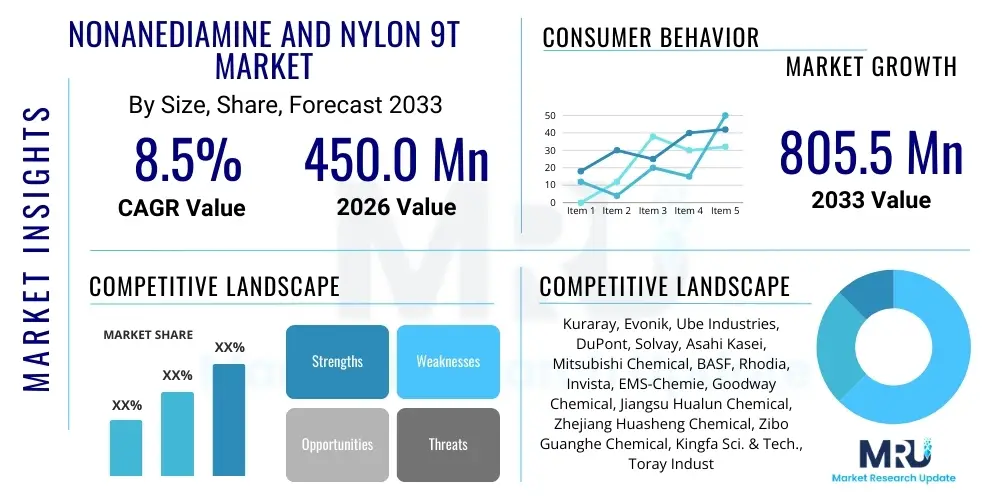

Nonanediamine And Nylon 9T Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435703 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Nonanediamine And Nylon 9T Market Size

The Nonanediamine And Nylon 9T Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $450.0 Million in 2026 and is projected to reach $805.5 Million by the end of the forecast period in 2033.

Nonanediamine And Nylon 9T Market introduction

The Nonanediamine (NDA) and Nylon 9T (PA9T) market encompasses high-performance polyamides and their essential monomer components, primarily driven by increasing demand in sophisticated engineering applications. Nonanediamine is a crucial long-chain aliphatic diamine monomer used in the synthesis of specialized polyamides, most notably Nylon 9T. Its unique chain length provides superior properties to the resulting polymer compared to traditional nylons like PA6 or PA66, including enhanced chemical resistance, low water absorption, and high thermal stability. The chemical structure of NDA, typically derived from petrochemical or increasingly bio-based sources (such as oleochemicals), makes it indispensable for developing engineering plastics capable of performing in demanding environments, particularly within automotive electrification and miniaturized electronics.

Nylon 9T, a polyphthalamide (PPA) derived from NDA and terephthalic acid (TPA), is categorized as an advanced engineering plastic known for its exceptional mechanical strength and heat deflection temperature (HDT). These characteristics position PA9T as an ideal material for replacing metals and thermoset plastics in applications requiring dimensional stability under extreme temperatures, such as engine components, structural parts in electric vehicles (EVs), and surface mount technology (SMT) connectors. The market's growth is fundamentally linked to global trends in lightweighting and miniaturization across the transportation, consumer goods, and electrical industries, where traditional materials fail to meet stringent performance benchmarks. Furthermore, the rising regulatory pressure concerning fuel efficiency and emissions reduction favors the adoption of high-performance, lighter polymer solutions like PA9T.

Major applications for Nonanediamine and Nylon 9T include automotive components (e.g., cooling systems, sensors, fuel lines), electrical and electronics (E&E) connectors, circuit breakers, mobile device structural parts, and specialized industrial films and fibers. The driving factors accelerating market expansion include significant investment in EV manufacturing globally, the relentless miniaturization of electronic devices necessitating high-flow, high-heat resistant polymers, and the ongoing shift toward sustainable, bio-based sources for NDA production, which offers manufacturers a competitive advantage and improved environmental profiles.

Nonanediamine And Nylon 9T Market Executive Summary

The Nonanediamine and Nylon 9T market is currently experiencing robust expansion, propelled by significant shifts in global business trends focused on high-temperature resistance and sustainability in engineered materials. Key business trends include the vertical integration strategies adopted by major chemical manufacturers to secure NDA supply chains, minimizing reliance on volatile raw material markets, and substantial R&D investments aimed at expanding the application scope of PA9T into structural composites. Furthermore, the market is characterized by increasing patent activity surrounding bio-based NDA synthesis routes, signaling a pivotal move away from purely petrochemical derivatives, driven by corporate sustainability mandates and consumer preference for green materials. This technological focus ensures that PA9T remains a forefront material for the high-end segments of the automotive and electronics sectors, particularly where continuous high-heat performance is essential.

Regionally, the Asia Pacific (APAC) dominates the consumption and production landscape, primarily due to the concentration of global electronics manufacturing hubs and rapid expansion of the automotive sector, especially in China, Japan, and South Korea, which are leading EV producers. North America and Europe demonstrate mature market characteristics, focusing intensely on regulatory compliance, material substitution in aerospace and medical devices, and the adoption of bio-based NDA to meet stringent EU environmental directives. Segment-wise, the Nylon 9T segment, particularly injection molding grade PA9T for E&E applications, is showing the highest growth rates. The monomer segment (Nonanediamine) is experiencing stability but with increasing cost pressures related to the transition toward more complex, higher-purity bio-based production methods necessary for high-specification polymer manufacturing.

The overall market trajectory is highly positive, underpinned by macroeconomic drivers such as global digitalization and the energy transition. Key risks involve raw material price volatility, specifically for petroleum-derived NDA precursors, and the competitive threat posed by alternative high-performance polyamides (e.g., PA4T, PA6T/6I). However, PA9T’s superior balance of mechanical properties, hydrolysis resistance, and thermal performance ensures its competitive edge, driving its premium positioning. Strategic imperatives for market players include expanding production capacity in APAC, focusing on joint ventures for bio-NDA scaling, and developing application-specific, compounded grades of Nylon 9T tailored for specific harsh environments.

AI Impact Analysis on Nonanediamine And Nylon 9T Market

User queries regarding AI’s influence in the Nonanediamine and Nylon 9T market primarily revolve around optimizing chemical synthesis processes, enhancing quality control, and accelerating material discovery. Users frequently ask: "How can AI optimize the yield of bio-based Nonanediamine production?" and "Is AI used to predict the long-term performance and degradation of Nylon 9T components in extreme automotive conditions?" The core themes identified are centered on efficiency gains in manufacturing, predictive maintenance for large-scale reactors, and leveraging machine learning (ML) for novel material formulation. Stakeholders anticipate AI to dramatically reduce R&D cycle times by simulating polymerization conditions and predicting final polymer properties (such as crystallinity and melt flow index) before laboratory synthesis, thereby streamlining product development and customization for specific end-user requirements, particularly in complex compounding operations.

- AI-driven optimization of Nonanediamine synthesis process parameters (temperature, pressure, catalyst concentration) to maximize yield and purity, especially in complex bio-fermentation pathways.

- Predictive quality control mechanisms using machine learning models to analyze spectral data and detect impurities in NDA monomers instantly, ensuring feedstock consistency for high-end PA9T manufacturing.

- Accelerated material informatics used to simulate the structure-property relationships of Nylon 9T, reducing the time required to develop new compounded grades with enhanced thermal or electrical characteristics.

- Optimization of compounding and extrusion processes for Nylon 9T resins, employing AI to adjust extruder settings in real-time based on material inputs and desired output specifications (e.g., fiber orientation in reinforced composites).

- Demand forecasting and supply chain optimization for NDA, utilizing AI to predict fluctuations in raw material costs and end-user demand (e.g., automotive production cycles), minimizing inventory holding costs and risk.

- Development of smart sensor technologies embedded in PA9T components, utilizing AI algorithms to monitor structural integrity and predict failure points in critical applications like EV battery casings or high-voltage connectors.

- Enhanced cybersecurity for proprietary chemical synthesis intellectual property (IP), using AI-based threat detection systems to safeguard sensitive process parameters and novel catalyst formulations.

DRO & Impact Forces Of Nonanediamine And Nylon 9T Market

The Nonanediamine and Nylon 9T market dynamics are characterized by a strong interplay between the superior performance attributes of PA9T (Driver) and the persistent challenges of raw material sourcing and cost volatility (Restraint). The most significant driver is the unparalleled thermal and dimensional stability of Nylon 9T, making it indispensable for high-heat automotive applications, especially within the rapidly growing electric vehicle sector where high-voltage components require reliable insulation and structural support under continuous thermal stress. Simultaneously, the market is restrained by the limited availability and high cost of Nonanediamine compared to commodity diamines like hexamethylenediamine, which limits PA9T adoption in non-critical applications. Opportunities lie predominantly in leveraging advancements in industrial biotechnology to scale up bio-based Nonanediamine production, offering a sustainable, cost-competitive alternative that addresses both environmental concerns and supply chain risks, opening up new potential for PA9T in sustainable consumer goods and textiles.

The immediate impact forces shaping this market are substantial. Force A, the global shift towards high-voltage electrification, demands materials like Nylon 9T that can withstand temperatures exceeding 200°C for extended periods, providing strong momentum. Force B, stringent environmental regulations globally, pressures manufacturers to invest in bio-NDA, forcing capital expenditure but simultaneously offering a clear path for market differentiation and premium pricing. The five competitive forces are also active: Buyer power is moderate to high, as large automotive Tier 1 suppliers demand specific, consistent material specifications, driving quality standards but providing volume guarantees. Supplier power is high, especially for patented bio-NDA technology providers, granting them significant pricing leverage. Threat of new entrants is low due to the high capital intensity and complex synthesis IP required. Threat of substitutes is moderate, primarily from competing PPAs (e.g., PA6T/6I) and high-end PPS or PEEK, though PA9T often offers a superior cost-to-performance ratio. Finally, competitive rivalry is intense among the few dominant producers (e.g., Kuraray, Evonik) focusing on application development and regional capacity expansion.

Ultimately, the successful navigation of this market hinges on overcoming the structural cost barriers associated with Nonanediamine production. Companies that effectively integrate bio-based technology, ensuring high yield and purity, will capture significant market share. The enduring impact force remains the demand for miniaturization in electronics and lightweighting in vehicles; as components shrink and temperatures rise, the niche performance of Nylon 9T becomes a necessity rather than a luxury, ensuring continued market resilience despite cost pressures.

Segmentation Analysis

The Nonanediamine and Nylon 9T market is strategically segmented based on product type, manufacturing technology, application, and end-user industry, reflecting the diverse requirements of high-performance engineering applications. Nonanediamine segmentation focuses heavily on purity levels and origin (bio-based versus petrochemical), where bio-based NDA is rapidly gaining prominence due to sustainability mandates and reduced dependence on fossil fuel volatility. Conversely, the Nylon 9T segmentation is dominated by the type of resin grade (injection molding, extrusion, film), with injection molding grades for E&E and automotive parts constituting the largest volume segment, owing to the complexity and precision required for these components. These materials are tailored to provide superior flow characteristics during molding while maintaining crystalline structures necessary for thermal stability.

The application segmentation is crucial for understanding demand elasticity. The Electrical and Electronics sector, particularly connectors and circuit protection devices, is a primary driver, capitalizing on PA9T's excellent electrical insulation properties and ability to withstand reflow soldering temperatures. The Automotive sector is rapidly increasing its share, driven by the shift towards high-voltage battery enclosures, power control units, and engine bay components where extreme chemical and thermal resistance are non-negotiable. Furthermore, specialized end-user segmentation includes industrial equipment (e.g., bearings, gears), aerospace, and medical devices, all demanding the stringent performance profile of PA9T, often in highly reinforced or filled composite forms to maximize mechanical strength.

Strategic positioning within these segments requires manufacturers to focus on tailored solutions. For instance, producers targeting the consumer electronics market must prioritize high-flow, low-warpage grades suitable for thin-wall components, while those serving the automotive sector must ensure material compliance with relevant specifications (e.g., high RTI - Relative Thermal Index) and long-term hydrolysis resistance. The differentiation provided by bio-based NDA is increasingly defining the competitive landscape, serving as a critical differentiator for customers seeking to reduce their Scope 3 emissions footprints.

- By Product Type:

- Nonanediamine (NDA)

- Nylon 9T (PA9T) Resin

- By Manufacturing Route (for NDA):

- Petrochemical-Based

- Bio-Based (Fermentation/Oleochemical Conversion)

- By Grade (for PA9T):

- Injection Molding Grade

- Extrusion Grade

- Film and Fiber Grade

- Reinforced (Glass Fiber/Carbon Fiber Filled)

- By Application:

- Automotive (Under-the-hood components, Fluid handling, Sensors, EV Battery components)

- Electrical and Electronics (Connectors, Circuit Breakers, SMT components, Switches)

- Industrial Machinery (Bearings, Gears, Casings)

- Consumer Goods (Mobile device parts, Structural components)

- Other Specialized Applications (Medical devices, Aerospace)

Value Chain Analysis For Nonanediamine And Nylon 9T Market

The value chain for Nonanediamine and Nylon 9T is highly integrated and complex, starting with the sourcing of specialized precursors and culminating in the highly technical compounding and assembly of end-use components. The upstream segment involves the synthesis of Nonanediamine, traditionally derived from petrochemical feedstocks (e.g., cyclododecanone, butadiene) or, increasingly, from bio-based sources such as castor oil or microbial fermentation processes. Control over these upstream technologies is concentrated among a few global chemical giants, resulting in high entry barriers and significant proprietary intellectual property surrounding catalyst systems and purification techniques necessary to achieve the high purity required for polymerization. The cost and purity of the NDA monomer are the primary determinants of downstream PA9T resin pricing and quality, making upstream control a crucial competitive advantage.

Midstream activities involve the polycondensation of Nonanediamine with terephthalic acid (TPA) to produce the Nylon 9T base resin. This stage requires sophisticated high-pressure, high-temperature polymerization reactors and subsequent solid-state polymerization (SSP) to achieve the necessary high molecular weight for engineering applications. Resin manufacturers then engage in compounding, where the base polymer is blended with fillers (e.g., glass fiber, mineral fillers), stabilizers, and colorants to create application-specific grades. The distribution channel for these advanced materials typically follows a dual approach: Direct sales and technical support are crucial for large volume automotive and Tier 1 electronics suppliers, facilitating co-development and customization. Indirect channels involve specialized distributors or agents who manage smaller volumes and provide regional logistics support, particularly vital in fragmented markets like smaller industrial equipment manufacturers.

The downstream segment is dominated by processors (injection molders, extruders) who convert the PA9T resins into finished components. Their success relies heavily on detailed technical knowledge of PA9T’s processing parameters, including high melt temperatures and specific mold designs necessary to handle the material's crystallization speed and minimal shrinkage. End-users (OEMs in automotive and E&E) dictate the final specifications, driving continuous innovation and specialization in the compounding phase. The strong reliance on direct sales and high technical service levels throughout the distribution channel underscores the material's premium, technical nature, where material failure can lead to catastrophic system failure in critical applications.

Nonanediamine And Nylon 9T Market Potential Customers

The core potential customers for Nonanediamine and Nylon 9T are highly technical engineering procurement teams within industries demanding materials with exceptional thermal, chemical, and dimensional stability. The largest group of buyers is the Automotive Tier 1 and Original Equipment Manufacturers (OEMs). These customers procure Nylon 9T for critical under-the-hood components, structural parts for electric vehicle battery systems, advanced sensor housings, and high-pressure fuel or cooling system connectors. Their procurement decisions are driven by strict regulatory standards (e.g., USCAR specifications, thermal cycling requirements) and the necessity for lightweighting without compromising safety or lifespan.

A second significant customer base resides in the Electrical and Electronics (E&E) sector, specifically manufacturers of connectors, surface mount devices (SMD), and circuit protection components. These buyers require materials that can withstand the intense heat of reflow soldering processes (typically >260°C) and provide excellent dielectric strength in miniaturized form factors. Major integrated device manufacturers (IDMs) and contract electronics manufacturers (CEMs) are prime targets, focusing on high-flow PA9T grades for precision injection molding. Furthermore, high-performance PA9T is sought after by manufacturers of specialized industrial equipment, including high-load gears, bearings, and fluid handling components, where resistance to aggressive industrial chemicals and high operational temperatures is paramount for equipment longevity and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.0 Million |

| Market Forecast in 2033 | $805.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray, Evonik, Ube Industries, DuPont, Solvay, Asahi Kasei, Mitsubishi Chemical, BASF, Rhodia, Invista, EMS-Chemie, Goodway Chemical, Jiangsu Hualun Chemical, Zhejiang Huasheng Chemical, Zibo Guanghe Chemical, Kingfa Sci. & Tech., Toray Industries, DSM Engineering Materials, LANXESS, Kaneka Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonanediamine And Nylon 9T Market Key Technology Landscape

The Nonanediamine and Nylon 9T market is defined by several critical, proprietary technologies spanning monomer synthesis and polymerization. In the production of Nonanediamine, the technology landscape is bifurcated. The conventional route involves complex multi-step chemical synthesis, often starting from petrochemical precursors like butadiene or cyclododecanone, requiring high-pressure hydrogenation and specialized catalyst systems (e.g., Raney Nickel or cobalt-based catalysts) to ensure high purity and yield of the C9 diamine. However, the rapidly emerging key technology is the bio-based production of NDA, primarily through the fermentation of renewable feedstocks (like sugars or biomass) to produce precursors (e.g., aminononanoic acid) which are then chemically converted or directly produced via engineered microbial pathways. Companies with advanced fermentation and subsequent purification technologies hold a significant competitive edge, enabling them to meet growing demand for sustainable polymers while potentially mitigating petrochemical price volatility.

In the synthesis of Nylon 9T (PA9T), the core technology revolves around controlled polycondensation. PA9T, being a semi-crystalline polymer with a high melting point (around 305°C), requires specialized melt polymerization and subsequent solid-state polymerization (SSP) processes. The high melt temperature and relatively quick crystallization rate necessitate carefully designed polymerization reactors and precise temperature control to achieve the desired high molecular weight and narrow molecular weight distribution, which directly translates to superior mechanical and thermal performance in the final part. Technological innovation here focuses on catalyst systems that enhance reaction speed and prevent discoloration, as well as compounding technologies (twin-screw extrusion) used to homogeneously incorporate high levels of reinforcement (up to 60% glass fiber) without significant fiber breakage.

A third crucial technological domain involves processing and simulation tools. Because PA9T is a high-cost material often used in thin-wall, precision components (like fine-pitch connectors), manufacturers rely heavily on advanced Moldflow and Finite Element Analysis (FEA) simulations to optimize part design and molding parameters. Technologies that allow accurate prediction of warpage, weld-line strength, and flow characteristics under high shear conditions are vital for reducing development costs and ensuring component reliability. The integration of advanced diagnostics and inline sensing during both polymerization and compounding further enhances consistency, solidifying the market's reliance on highly advanced, patented chemical and process engineering expertise.

Regional Highlights

- Asia Pacific (APAC): Market Dominance and Manufacturing Hub

The Asia Pacific region stands as the dominant market for Nonanediamine and Nylon 9T, both in terms of consumption and production capacity. This supremacy is directly attributable to the region's position as the global manufacturing hub for electronics, automotive components, and consumer goods. Countries like China, Japan, and South Korea host the world's largest consumer electronics manufacturers and are leading the charge in electric vehicle production, creating exponential demand for high-performance polymers like PA9T in battery management systems, power electronics, and structural connectors. Furthermore, the supportive governmental policies and significant investments in localized chemical production, particularly in advanced materials, solidify APAC's leading role. The market dynamics in this region are characterized by intense local competition, rapid technological adoption, and a strong focus on high-volume production efficiency, driving down unit costs.

Japan, home to pioneering PA9T manufacturers like Kuraray, remains a critical innovation center, focusing on ultra-high-grade polymers for precision engineering and medical applications. Meanwhile, China represents the largest growth engine, with rapid expansion in domestic EV manufacturing fueling demand for locally sourced high-temperature plastics. The key challenge in APAC is managing the complexity of global supply chains for NDA precursors, though investment in bio-based NDA facilities is starting to address this, positioning the region not only as a consumer but also as a future leader in sustainable high-performance material sourcing. The sheer scale of industrial output here ensures that APAC's influence on global pricing and technological standards remains paramount throughout the forecast period.

The increasing disposable income across emerging economies in Southeast Asia is also contributing to the growing demand for durable consumer electronics and appliances, further bolstering the need for PA9T. Localization of production facilities by multinational companies seeking proximity to key end-users continues to drive capital expenditure in the chemical and polymer sectors across the region. This centralized production capacity is highly leveraged to serve global export markets, cementing APAC's status as the global epicenter for the Nonanediamine and Nylon 9T value chain.

- North America: Technological Adoption and EV Focus

North America holds a substantial share of the PA9T market, primarily driven by the stringent quality requirements of the domestic automotive industry and a strong focus on technological innovation, particularly within the nascent electric vehicle and aerospace sectors. The United States is witnessing significant investment in large-scale gigafactories and EV manufacturing hubs, creating a concentrated demand source for PA9T in thermal management systems, high-voltage charging components, and lightweight structural parts. The requirement for materials that meet exacting safety and durability standards in crash tests and extended operational lifetimes favors the adoption of premium engineering plastics.

Moreover, the North American electronics industry, though smaller than APAC's in volume, focuses on high-reliability, mission-critical applications (e.g., defense, medical diagnostics), where PA9T's stability is crucial. Environmental regulations and corporate sustainability pledges are strongly pushing regional manufacturers toward the adoption of bio-based Nonanediamine. This demand for 'green' PA9T creates unique commercial opportunities for manufacturers who can ensure verifiable sourcing and reduced carbon footprint, aligning with stricter US and Canadian environmental standards. The high cost of labor and energy necessitates an intense focus on process efficiency and high-value applications, rather than competing on volume alone.

The region’s market is characterized by strong collaboration between polymer suppliers and Tier 1 automotive engineers, fostering co-development of application-specific grades. The presence of significant R&D centers ensures continuous innovation in specialized compounding formulations, particularly for high glass fiber content grades tailored for structural reinforcement. This emphasis on high-performance customization, coupled with the ongoing push for vehicle lightweighting and efficiency, ensures sustained, albeit specialized, growth for the Nonanediamine and Nylon 9T market in North America.

- Europe: Sustainability and Regulatory Compliance

Europe represents a mature yet high-growth market for Nonanediamine and Nylon 9T, heavily influenced by the European Union’s ambitious regulatory framework focusing on sustainability, circular economy principles, and stringent automotive emissions standards. The European automotive industry, renowned for its premium and luxury vehicle production, is rapidly transitioning to electrification, demanding high-performance polymers for new thermal and electrical architectures. PA9T is strategically utilized in advanced cooling circuits, electrical insulation components, and sophisticated sensor enclosures where durability under high heat is mandatory.

A key distinguishing factor in the European market is the overwhelming demand for bio-based and sustainable sourcing. EU chemical regulations, coupled with strong consumer and corporate pressure, mandate verifiable reduction in reliance on fossil fuels. This accelerates the adoption of bio-based Nonanediamine, placing European manufacturers at the forefront of sustainable PA9T development. Investment is heavily focused on optimizing bio-conversion pathways and securing partnerships with specialty chemical producers capable of providing certified sustainable monomers, often commanding a premium price.

Furthermore, the region's strong industrial machinery and medical device sectors are significant consumers of Nylon 9T, leveraging its excellent dimensional stability and hydrolysis resistance. The high regulatory barriers (e.g., REACH compliance) create a protected market environment, favoring established material suppliers who can ensure long-term regulatory compliance and provide extensive technical data. The combination of intense regulatory pressure, high technological standards in automotive engineering, and a pervasive commitment to sustainability positions Europe as a highly valuable, albeit challenging, market for Nonanediamine and Nylon 9T.

- Latin America (LATAM): Emerging Industrialization

The Latin American market for Nonanediamine and Nylon 9T is currently smaller compared to global leaders but exhibits steady potential, driven primarily by localized automotive assembly and growing infrastructure projects. Brazil and Mexico are the principal consumers, serving as regional automotive manufacturing centers that require engineering plastics for vehicles produced for both domestic use and export. Demand for PA9T in this region is largely correlated with the adoption rate of advanced vehicle technologies and the general pace of industrial modernization, particularly in replacing traditional commodity plastics with high-performance alternatives.

The market faces challenges related to economic volatility and reliance on imported materials, as specialized NDA and PA9T production capacity is limited domestically. However, the increasing presence of multinational automotive and electronics manufacturers is introducing higher performance standards, gradually increasing the uptake of PA9T. Opportunities exist in infrastructure projects and the expansion of the regional electronics assembly sector, which requires durable and heat-resistant components. Investment focuses on securing reliable, cost-effective import channels and providing localized technical support to processing industries.

Long-term growth in LATAM will be supported by improved economic stability and regulatory mandates promoting fuel efficiency, which inherently require lightweight, high-performance materials. While price sensitivity remains higher than in developed markets, the demand for quality and performance in critical industrial and transport applications ensures a stable, gradually expanding market segment for Nylon 9T.

- Middle East and Africa (MEA): Industrial Diversification and Energy Focus

The Middle East and Africa market is characterized by specialized demand, heavily concentrated in infrastructure development, oil and gas processing, and emerging industrial diversification efforts. In the Middle East, the petrochemical industry itself drives demand for high-performance polymers in piping, valves, and corrosive environment applications, where Nylon 9T’s chemical resistance and high thermal stability are indispensable. Investments in renewable energy projects (solar power) also create niche demand for PA9T in durable connector and enclosure systems exposed to extreme desert heat and UV radiation.

In Africa, growth is fragmented but primarily linked to urbanization and investment in local electronics assembly and telecommunications infrastructure. The demand for PA9T in this region is relatively low in volume but focuses on high-reliability applications where material failure is unacceptable, often involving imported, specialized engineering plastic grades. The overall market is heavily dependent on imports of both NDA and PA9T resin, leading to higher material costs compared to global benchmarks.

Future growth hinges on successful economic diversification strategies away from pure oil dependence in the Gulf Cooperation Council (GCC) countries, focusing on manufacturing and technology. The development of robust, localized processing capabilities and the establishment of local technical service centers are necessary steps to unlock the full potential of PA9T within the MEA region. This market segment emphasizes durability and chemical resistance over sheer volume consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonanediamine And Nylon 9T Market.- Kuraray Co., Ltd. (Major producer of PA9T under the GENESTAR brand)

- Evonik Industries AG (Key developer of Nonanediamine and specialty polyamides)

- Ube Industries, Ltd.

- DuPont de Nemours, Inc.

- Solvay S.A.

- Asahi Kasei Corporation

- Mitsubishi Chemical Corporation

- BASF SE

- Rhodia (now part of Solvay)

- Invista (A subsidiary of Koch Industries)

- EMS-Chemie Holding AG (EMS-Grivory)

- Goodway Chemical Co., Ltd.

- Jiangsu Hualun Chemical Co., Ltd.

- Zhejiang Huasheng Chemical Co., Ltd.

- Zibo Guanghe Chemical Co., Ltd.

- Kingfa Sci. & Tech. Co., Ltd.

- Toray Industries, Inc.

- DSM Engineering Materials (now part of LANXESS)

- LANXESS AG

- Kaneka Corporation

Frequently Asked Questions

Analyze common user questions about the Nonanediamine And Nylon 9T market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific performance advantages does Nylon 9T (PA9T) offer over traditional nylons like PA66 in high-temperature applications?

Nylon 9T offers significantly superior thermal stability and dimensional retention compared to PA66, primarily due to its longer Nonanediamine (C9) chain structure and the inclusion of aromatic rings from terephthalic acid (TPA), classifying it as a Polyphthalamide (PPA). PA9T exhibits a much higher melting point (around 305°C), reduced water absorption, and excellent chemical resistance, enabling it to maintain structural integrity and electrical insulation under continuous operating temperatures often exceeding 200°C, critical for reflow soldering and under-the-hood automotive environments.

How is the growth of the electric vehicle (EV) sector impacting the demand for Nylon 9T?

The rapid growth of the EV sector is a primary demand driver for Nylon 9T. EVs require lightweight, high-temperature resistant materials for power electronics, high-voltage connectors, battery management system casings, and motor components. PA9T’s superior dielectric properties, flame retardancy, and ability to withstand thermal cycling and high power loads position it as an essential material for ensuring the safety, reliability, and extended range of modern electric vehicles, replacing heavier metal or less stable plastic alternatives.

What are the key differences between petrochemical-based and bio-based Nonanediamine (NDA) and which trend is dominant?

Petrochemical-based NDA is derived from fossil fuels (e.g., butadiene or cyclododecanone) via complex synthesis, whereas bio-based NDA is produced through the fermentation of renewable feedstocks like sugars or vegetable oils, offering a reduced carbon footprint. While petrochemical NDA currently accounts for the majority of historical supply, the dominant market trend is a swift transition toward bio-based NDA. This shift is driven by stringent sustainability regulations in Europe and North America and corporate commitments to reduce Scope 3 emissions, making bio-NDA the preferred, high-growth segment for premium PA9T manufacturers.

Which regions are leading the consumption of Nylon 9T, and what factors drive their market dominance?

Asia Pacific (APAC), particularly China, Japan, and South Korea, leads global consumption of Nylon 9T. This dominance stems from the region's status as the world's largest manufacturing hub for electronics (connectors, switches, SMT components) and its robust, rapidly expanding automotive sector, especially in EV manufacturing. High volume production, advanced technological integration, and localized supply chains are the key factors solidifying APAC’s market leadership and influence on global demand.

What strategic restraints limit the wider adoption of Nonanediamine and Nylon 9T in mass-market applications?

The primary strategic restraint is the high cost of the Nonanediamine monomer and, consequently, the Nylon 9T resin compared to commodity polyamides like Nylon 66. NDA production involves complex, proprietary synthesis routes, leading to limited sourcing options and high material input costs. This price sensitivity restricts PA9T adoption exclusively to high-performance, mission-critical applications where its superior properties justify the premium pricing, limiting its use in general consumer or non-critical industrial segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager