Noninverting Buffer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431507 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Noninverting Buffer Market Size

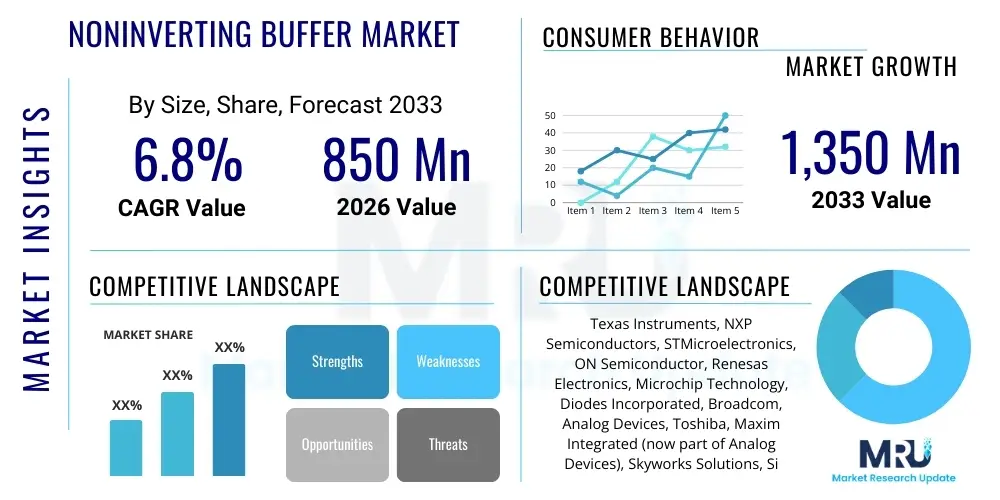

The Noninverting Buffer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Noninverting Buffer Market introduction

The Noninverting Buffer Market encompasses integrated circuits (ICs) designed to provide signal isolation, drive capability, and impedance matching without altering the phase or logic state of the input signal. These essential components, often implemented using high-speed CMOS or specialized bipolar technologies, are fundamental building blocks in digital logic systems and analog signal processing where precise signal integrity and fan-out capability are critical. Noninverting buffers prevent excessive loading on a source circuit, ensuring that the original signal characteristics, such as rise and fall times, are maintained across multiple subsequent stages.

Noninverting buffers find major applications across a broad spectrum of industries, predominantly in computing, telecommunications, and industrial control systems. In computing infrastructure, they are essential for clock distribution networks, memory interfacing, and peripheral connectivity where timing accuracy is paramount. Benefits derived from their utilization include enhanced system stability, improved noise immunity, and the capability to interface between circuits operating at different voltage levels or current requirements. They effectively manage signal reflection issues in high-speed transmission lines, which is increasingly vital in advanced electronics requiring multi-gigabit data rates.

Key driving factors accelerating the adoption of Noninverting Buffers include the relentless demand for faster data processing, the proliferation of complex electronic devices (such as IoT endpoints and sophisticated automotive systems), and the continuous miniaturization of semiconductor fabrication processes. Furthermore, the expansion of high-performance computing (HPC) and data centers, which necessitate robust and scalable clock and data synchronization mechanisms, acts as a primary market catalyst. The stringent requirements for electromagnetic compatibility (EMC) and low power consumption in battery-operated devices also push manufacturers toward integrating highly efficient buffer solutions.

Noninverting Buffer Market Executive Summary

The Noninverting Buffer Market exhibits robust expansion driven by significant business trends centered around digital transformation and infrastructure upgrades globally. A major business trend involves the shift towards smaller, lower-power buffers fabricated using advanced FinFET and FD-SOI processes, enabling integration into dense, power-sensitive applications like mobile computing and edge AI devices. Strategic partnerships between chip manufacturers and large-scale electronics integrators are accelerating the adoption of customized buffering solutions tailored for specific industrial bus protocols and high-speed memory interfaces, consequently streamlining the supply chain and reducing time-to-market for complex systems.

Regionally, Asia Pacific (APAC) continues to dominate the market, fueled by its status as the global manufacturing hub for consumer electronics, automotive components, and IT hardware. China, South Korea, and Taiwan are critical centers for both demand and production, characterized by intensive investment in 5G infrastructure and advanced semiconductor fabrication plants. North America and Europe, while mature, demonstrate steady growth rooted in high-value applications such as aerospace, defense, and specialized data center technology, emphasizing resilience and high reliability in demanding operational environments, thereby supporting premium-priced product segments.

Segment trends reveal that the CMOS segment maintains the largest market share due to its low power consumption and easy integration capabilities, though the BiCMOS segment is anticipated to witness the highest growth rate, offering superior drive strength and speed necessary for next-generation interfaces. Application-wise, the Data Center and Telecommunications segments are experiencing exponential growth, driven by massive data traffic increases necessitating reliable signal propagation across vast networks. The increasing complexity of ADAS (Advanced Driver Assistance Systems) and infotainment systems is simultaneously positioning the Automotive segment as a crucial high-growth area for specialized, high-temperature tolerant buffers.

AI Impact Analysis on Noninverting Buffer Market

Users frequently inquire about how the exponential growth of Artificial Intelligence (AI) and Machine Learning (ML) workloads affects the demand and specifications for Noninverting Buffers. Common concerns center on whether AI accelerators require specialized buffers for ultra-low latency memory access, and how the inherent unpredictability of AI data streams impacts clock jitter and signal integrity requirements. The consensus derived from user analysis indicates a strong expectation that AI will dramatically increase the demand for high-speed, multi-channel buffers capable of managing massive parallelism and minimizing propagation delay in densely packed GPU and ASIC arrays, thereby pushing the limits of current semiconductor design.

The primary influence of AI lies in its fundamental requirement for specialized hardware designed for massive parallel processing, such as custom AI chips and high-bandwidth memory (HBM) stacks. These architectures necessitate extremely precise and stable clock and data buffering to ensure synchronization across thousands of processing cores and memory lanes. Noninverting buffers serve a crucial role in distributing synchronized signals with minimal skew, which is essential for maintaining computational integrity during complex deep learning operations. Consequently, AI infrastructure acts as a forcing function, driving the industry to develop buffers with enhanced thermal management and superior noise suppression characteristics to operate reliably under continuous high-load conditions.

Furthermore, the edge AI movement, which involves deploying ML inference capabilities directly onto smaller devices (IoT, robotics, autonomous vehicles), dictates a need for highly integrated, ultra-low power buffering solutions. These edge devices operate under strict power budgets and often harsh environmental constraints. This shift not only increases unit volume demand but also requires buffers optimized for integration alongside complex SoCs, supporting mixed-signal environments and varying supply voltages. The optimization targets for buffer design are shifting from just speed to a critical balance of speed, power efficiency, and compact form factor, directly influenced by the pervasive deployment of AI at all layers of computing infrastructure.

- Increased demand for buffers optimized for HBM (High Bandwidth Memory) interfaces.

- Requirement for ultra-low jitter buffers to synchronize highly parallel AI processing units (GPUs, TPUs).

- Growth in the specialized low-power buffer segment driven by edge AI and IoT devices.

- Adoption of buffers supporting multi-voltage domains for interfacing disparate AI components (e.g., analog sensors to digital accelerators).

- Focus on buffers with high drive strength to manage capacitance loading in densely populated AI server racks.

- Integration of buffer functionality directly into sophisticated AI SoC designs to minimize latency.

- Development of thermal-tolerant buffers for sustained high-performance operation in AI data centers.

DRO & Impact Forces Of Noninverting Buffer Market

The Noninverting Buffer Market is significantly shaped by a confluence of driving factors, structural restraints, and emerging opportunities, collectively defining the market trajectory. The core drivers stem from the pervasive digitalization across all sectors and the continuous push for higher data transmission speeds, directly impacting the demand for components that ensure signal integrity. However, this growth is tempered by critical restraints, primarily revolving around the complexity of achieving ultra-low jitter specifications in mass production and the cyclical nature of the broader semiconductor industry. Opportunities lie predominantly in technological leaps, such as the adoption of 5G and 6G technologies, and the rise of niche high-reliability applications like space electronics and medical imaging, offering pathways for differentiated product development.

Drivers include the rapid expansion of hyperscale data centers requiring precise clocking mechanisms, the ongoing global rollout of 5G networks which mandates robust signal conditioning, and the increasing electronic content in vehicles driven by autonomous driving features and enhanced safety systems. The necessity to minimize power consumption in portable electronics also fuels demand for energy-efficient CMOS buffers. These forces create a consistently strong underlying demand, ensuring market resilience against minor economic fluctuations, as signal integrity remains non-negotiable for system functionality.

Conversely, the primary restraints include intense price competition, particularly in the standard logic buffer segments, leading to margin pressure for manufacturers. Technical limitations related to managing signal reflection and crosstalk at increasingly higher frequencies pose significant design challenges that increase R&D costs. Furthermore, the reliance on advanced lithography for high-performance buffers exposes the market to supply chain risks and geopolitical factors affecting the semiconductor foundry capacity. Successfully navigating these impact forces requires manufacturers to focus on proprietary intellectual property, vertical integration, and diversification across end-user applications.

Segmentation Analysis

The Noninverting Buffer Market is systematically segmented based on Type, Technology, Number of Channels, Application, and Operating Voltage, providing granular insights into demand patterns and growth hotspots. This segmentation helps stakeholders understand which specific component characteristics are most valued by different end-user industries, such as the preference for TTL technology in legacy industrial control systems versus the dominance of high-speed CMOS in modern server architectures. The detailed analysis across these segments informs strategic resource allocation and targeted product development efforts for maximum market penetration.

Segmentation by Type broadly separates the market into standard logic gates used as simple buffers and specialized buffers offering integrated features like Schmitt triggers or level translation capabilities. Technology classification differentiates between CMOS (low power), TTL (legacy compatibility), and BiCMOS (high speed/high drive), with BiCMOS increasingly gaining traction in advanced networking equipment. The Number of Channels (e.g., Single, Dual, Quad, Octal) dictates complexity and integration density, correlating directly with the physical constraints of the application board. Each segment operates under distinct economic forces and competitive landscapes.

Application segmentation is crucial as it links product function to macroeconomic trends, identifying data centers, automotive, and telecommunications as key revenue generators. Operating voltage segmentation, encompassing 1.8V, 3.3V, 5V, and variable voltage translation types, reflects the power efficiency requirements and the need for interoperability between older and newer electronic systems. Analyzing these dimensions reveals that while the volume market is driven by basic, high-channel count buffers for consumer electronics, the highest revenue growth often originates from specialized, low-voltage, high-reliability buffers tailored for mission-critical industrial and medical applications.

- By Type:

- Standard Noninverting Buffers

- Noninverting Buffers with Open-Drain Output

- Noninverting Buffers with Schmitt Trigger Input

- Level Translating Buffers

- By Technology:

- CMOS Technology

- TTL Technology

- BiCMOS Technology

- Low-Voltage Differential Signaling (LVDS) Buffers

- By Number of Channels:

- Single Channel

- Dual Channel

- Quad Channel

- Octal Channel

- 16-Channel and Above

- By Operating Voltage:

- Low Voltage (1.8V and below)

- Standard Voltage (3.3V to 5V)

- Mixed Voltage (Translating)

- By Application:

- Data Centers and Cloud Infrastructure

- Telecommunications (5G/4G Base Stations)

- Consumer Electronics (Smartphones, Laptops)

- Automotive (ADAS, Infotainment)

- Industrial Automation and Control Systems

- Aerospace and Defense

- Medical Devices

Value Chain Analysis For Noninverting Buffer Market

The value chain for the Noninverting Buffer Market begins with Upstream Analysis, which focuses primarily on raw material suppliers and specialized intellectual property (IP) providers. Key upstream inputs include silicon wafers, critical fabrication chemicals, and specialized photolithography equipment necessary for semiconductor manufacturing. Access to reliable and high-quality silicon feedstock, coupled with cutting-edge process technology IP (such as advanced interconnect and device structure designs), dictates the potential performance and cost base of the finished buffer ICs. Strategic control over proprietary transistor architectures or specialized packaging materials provides a competitive advantage at this initial stage.

The middle segment of the chain involves IC design houses, wafer fabrication (foundries), and assembly, testing, and packaging (ATP) operations. Design houses translate market requirements into specific buffer architectures, focusing on minimizing jitter, power consumption, and footprint. Fabrication, often outsourced to major foundries (like TSMC or Samsung), is highly capital-intensive. The efficiency and quality of ATP processes—especially advanced wafer-level packaging (WLP) and flip-chip techniques—are crucial for high-speed buffers, directly influencing signal integrity and thermal performance. This manufacturing segment is characterized by intense automation and stringent quality control protocols required for high-reliability applications.

Downstream analysis covers distribution channels and end-user integration. Noninverting Buffers are distributed through both Direct and Indirect channels. Direct sales are common for large-volume OEM contracts in the automotive and data center sectors, allowing for customized inventory management and technical support. Indirect channels, primarily encompassing global semiconductor distributors (e.g., Arrow Electronics, Avnet), serve the vast majority of smaller enterprises, maintenance, repair, and operations (MRO) needs, and the prototyping market. Successful downstream deployment relies heavily on the distributor’s technical expertise in recommending appropriate components and managing complex international logistics to meet just-in-time manufacturing requirements across diverse geographical locations.

Noninverting Buffer Market Potential Customers

The primary End-Users/Buyers of Noninverting Buffers span several high-technology sectors, including large-scale Original Equipment Manufacturers (OEMs) specializing in computing and networking hardware, industrial system integrators, and consumer electronics brands. Companies operating hyperscale data centers are major consumers, utilizing high-channel, low-skew buffers extensively for reliable clock distribution in server motherboards and networking switches, where milliseconds of latency reduction translate directly into economic performance advantages. Furthermore, telecommunications equipment manufacturers heavily rely on these components for signal conditioning in high-frequency base stations and optical network terminals.

The Automotive industry represents a rapidly expanding customer segment, driven by the increasing deployment of complex electronic control units (ECUs) and sensor fusion platforms necessary for Advanced Driver Assistance Systems (ADAS) and eventual fully autonomous vehicles. These systems require buffers qualified to operate reliably across extreme temperature ranges and meet stringent automotive quality standards (AEC-Q100). Buyers in this space prioritize components that offer exceptional electromagnetic compatibility (EMC) and fault tolerance, often leading to procurement of specialized, high-reliability buffers.

Industrial Automation and Medical Device manufacturers constitute another crucial customer base. Industrial customers, ranging from robotics firms to process control system providers, demand robust, long-lifecycle buffers capable of interfacing disparate voltage levels and maintaining signal integrity in electrically noisy environments. Medical device OEMs, particularly those building imaging equipment (MRI, CT scanners) and patient monitoring systems, prioritize buffers with guaranteed long-term availability and extremely high levels of reliability and accuracy, reflecting the mission-critical nature of their applications where component failure is unacceptable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texas Instruments, NXP Semiconductors, STMicroelectronics, ON Semiconductor, Renesas Electronics, Microchip Technology, Diodes Incorporated, Broadcom, Analog Devices, Toshiba, Maxim Integrated (now part of Analog Devices), Skyworks Solutions, Silicon Labs, ROHM Semiconductor, Infineon Technologies, Integrated Device Technology (IDT, now Renesas), Vishay Intertechnology, Cypress Semiconductor (now Infineon), Lattice Semiconductor, Semtech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Noninverting Buffer Market Key Technology Landscape

The technological landscape of the Noninverting Buffer Market is constantly evolving, driven by the imperative to achieve higher operating speeds, lower power consumption, and greater integration density. Core technology relies heavily on advanced semiconductor fabrication nodes, with many new-generation buffers utilizing 28nm and 14nm FinFET processes to reduce leakage current and improve transistor switching speed. The primary focus is on minimizing propagation delay and clock jitter (timing instability), which are critical metrics, particularly in synchronous digital systems like complex processors and memory controllers. Specialized circuit design techniques, such as balanced impedance outputs and slew-rate control, are essential to maintain signal integrity over long PCB traces and managed transmission lines.

An emerging technology trend involves the sophisticated integration of multiple functions alongside the basic buffering capability. This includes incorporating features like precision timing control, programmable voltage translation, and built-in self-test (BIST) capabilities directly into the buffer IC. For high-reliability applications, especially in the automotive and aerospace sectors, silicon-on-insulator (SOI) technology is gaining prominence due to its inherent resistance to single-event upsets (radiation hardening) and improved isolation, reducing parasitic effects. Furthermore, the push towards standardized high-speed interfaces like PCIe Gen 5/6 and DDR5/6 mandates buffers that are electrically compliant with these rigorous specifications, driving innovation in input/output (I/O) driver design.

Packaging technology also plays a crucial role in the performance envelope of Noninverting Buffers, particularly in managing thermal characteristics and physical footprint. The transition from older, large plastic packages to highly compact, leadless formats such as Quad Flat No-leads (QFN) and wafer-level chip-scale packages (WLCSP) is widespread, facilitating integration into densely populated printed circuit boards. Advanced packaging solutions are engineered to minimize parasitic inductance and capacitance, which can degrade signal quality at gigahertz frequencies. The ongoing development of heterogeneous integration and 3D stacking technologies (e.g., combining buffers with termination resistors or level shifters) promises further reductions in size and improvements in signal fidelity for future high-density electronic systems.

Regional Highlights

Regional dynamics are critical to understanding the distribution of demand and manufacturing capabilities within the Noninverting Buffer Market. Asia Pacific (APAC) stands as the undisputed leader, commanding the largest market share due to its massive electronic manufacturing base encompassing major global OEMs for consumer devices, industrial machinery, and automotive components. Countries like China, Taiwan, South Korea, and Japan drive volume demand, fueled by massive investments in 5G infrastructure deployment and continuous expansion of semiconductor fabrication capacity. The sheer scale of production and assembly operations ensures APAC's dominance in both consumption and supply.

North America and Europe represent mature markets characterized by high technological sophistication and stringent quality requirements, particularly focusing on high-reliability and low-power segments. North America's growth is primarily driven by hyperscale data center construction, defense applications, and cutting-edge research in AI and specialized computing, necessitating premium-priced, high-performance buffers with ultra-low jitter specifications. European demand is robust in the automotive sector (driven by stringent emissions and safety standards), precision industrial automation, and advanced medical electronics, prioritizing quality and long-term supply assurance over cost minimization.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth trajectories, largely correlated with infrastructural investment. In LATAM, increasing consumer electronics penetration and nascent industrial automation projects fuel moderate demand. The MEA region’s growth is predominantly linked to smart city initiatives, IT infrastructure upgrades, and telecommunication expansions, particularly in the Gulf Cooperation Council (GCC) countries. These regions present opportunities for standardized, cost-effective buffer solutions necessary for general networking and utility applications, although technical demands are generally lower compared to APAC or North America.

- Asia Pacific (APAC): Dominates the market share due to high-volume manufacturing of consumer electronics, automotive components, and extensive 5G network rollout in China, South Korea, and Southeast Asia. Focus on high integration and cost-effective solutions.

- North America: Strong demand driven by massive investments in hyperscale data centers, aerospace and defense sectors, and specialized high-performance computing (HPC). Emphasis on ultra-low jitter and high reliability.

- Europe: Steady growth propelled by the automotive industry (e.g., German auto manufacturing), precision industrial automation, and adherence to stringent quality standards. Significant adoption of BiCMOS technology for high drive capability.

- Latin America (LATAM): Emerging market driven by telecommunications infrastructure expansion and increasing adoption of industrial IoT devices. Focus remains on standard and mid-range components.

- Middle East and Africa (MEA): Growth tied to government digital transformation initiatives (e.g., smart cities in the UAE and Saudi Arabia) and modernization of telecommunications networks. Demand is project-specific.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Noninverting Buffer Market.- Texas Instruments

- NXP Semiconductors

- STMicroelectronics

- ON Semiconductor

- Renesas Electronics

- Microchip Technology

- Diodes Incorporated

- Broadcom

- Analog Devices

- Toshiba

- Maxim Integrated (now part of Analog Devices)

- Skyworks Solutions

- Silicon Labs

- ROHM Semiconductor

- Infineon Technologies

- Integrated Device Technology (IDT, now Renesas)

- Vishay Intertechnology

- Cypress Semiconductor (now Infineon)

- Lattice Semiconductor

- Semtech

Frequently Asked Questions

Analyze common user questions about the Noninverting Buffer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Noninverting Buffer in a digital circuit?

The primary function of a Noninverting Buffer is to strengthen or restore a digital signal, increase its current drive capability (fan-out), and provide impedance matching without altering the phase or logic state (i.e., output equals input). This ensures reliable signal integrity across longer traces or when driving multiple loads.

Which application segment drives the largest demand for high-speed Noninverting Buffers?

The Data Centers and Telecommunications segments drive the largest demand for high-speed Noninverting Buffers. These applications require components capable of ultra-low jitter and minimal skew to manage synchronous clock distribution and high-frequency data transmission within complex server and 5G network architectures.

How does the choice between CMOS and BiCMOS technology impact buffer selection?

CMOS technology is preferred for applications prioritizing low static power consumption, such as battery-operated consumer electronics. BiCMOS technology, combining the benefits of Bipolar and CMOS transistors, is selected when very high switching speed, superior drive strength, and better noise immunity are critical, typically in high-performance networking equipment.

What role does signal integrity play in the Noninverting Buffer Market growth?

Signal integrity is a major driver, as increasing clock frequencies and miniaturization make signals more susceptible to noise, reflection, and crosstalk. Noninverting Buffers are essential tools used to condition, isolate, and ensure that the digital signal waveform remains clean and undistorted at the receiver end, thereby enabling reliable system operation at higher speeds.

Which geographical region is projected to experience the fastest growth in the buffer market?

While the Asia Pacific (APAC) region currently holds the largest market share, it is projected to maintain strong growth, particularly fueled by investments in high-speed rail, smart infrastructure, and the massive deployment of 5G infrastructure, making it the fastest-growing region in terms of volume and new technology adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager