Nonmetallic Gasket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434060 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nonmetallic Gasket Market Size

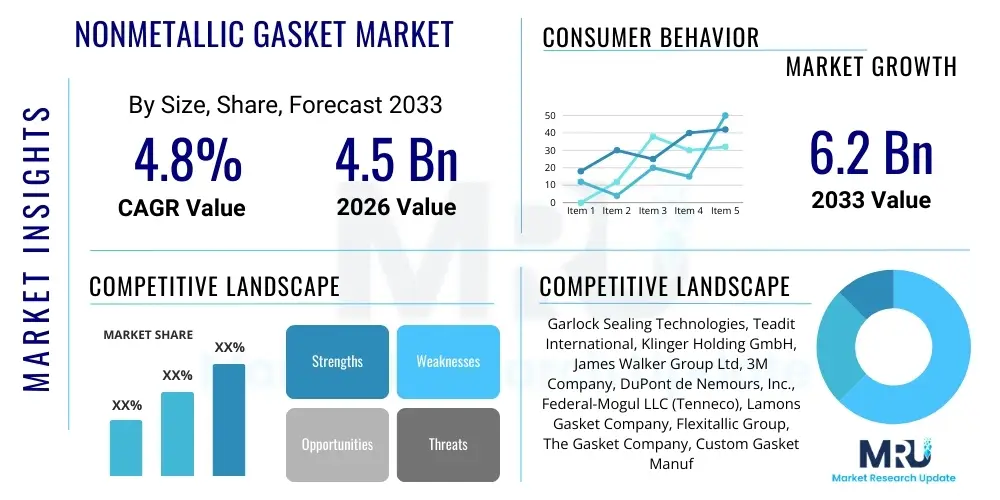

The Nonmetallic Gasket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Nonmetallic Gasket Market introduction

Nonmetallic gaskets are critical sealing components manufactured from pliable materials such as compressed non-asbestos fiber (CNAF), PTFE (Polytetrafluoroethylene), flexible graphite, rubber, and various polymer composites. These components are indispensable across diverse industrial sectors, primarily functioning to prevent leakage of fluids or gases between two mating surfaces under compression. They are favored in applications requiring excellent chemical resistance, dielectric strength, or accommodation for minor flange irregularities, distinguishing them from their metallic counterparts which typically handle extreme pressure and temperature conditions. The intrinsic flexibility and superior resistance to corrosive media make nonmetallic gaskets the preferred choice in medium-pressure fluid handling systems, contributing significantly to operational safety and efficiency across the global industrial landscape.

The primary applications of nonmetallic gaskets span critical infrastructure in chemical processing, petrochemical refining, power generation, and the robust automotive manufacturing sector. In chemical plants, materials like PTFE are essential for sealing aggressive acids and solvents, ensuring process integrity and minimizing environmental contamination risks. For the automotive industry, rubber and synthetic polymer gaskets are utilized extensively in engines, transmissions, and exhaust systems to ensure reliable fluid containment and thermal management. The widespread adoption is driven by the consistent need for maintenance, repair, and overhaul (MRO) activities in aging industrial assets, coupled with the installation of new industrial capacity globally, particularly in emerging economies focusing on manufacturing and infrastructure development.

Key driving factors supporting the market's trajectory include stringent environmental and safety regulations necessitating zero-leakage performance, prompting industries to upgrade their sealing solutions. Furthermore, continuous advancements in material science are producing nonmetallic composites capable of withstanding higher temperatures and pressures, thereby expanding their application envelope previously reserved for metallic seals. The benefits of using nonmetallic materials include cost-effectiveness compared to specialized metals, ease of installation, and superior compatibility with a broad range of operational fluids. The ongoing transition towards high-performance, environmentally conscious sealing materials, such as bio-degradable or low-VOC (Volatile Organic Compound) emitting elastomers, further solidifies the market’s growth foundation.

Nonmetallic Gasket Market Executive Summary

The Nonmetallic Gasket Market is characterized by robust growth anchored in the resurgence of capital expenditure in the oil and gas sector and sustained expansion in chemical processing infrastructure, particularly across Asia Pacific. Business trends indicate a strong move toward specialization, where manufacturers are focusing on developing proprietary composite materials offering enhanced thermal stability and resistance to new generation aggressive chemical agents. Merger and acquisition activities remain steady as large multinational players seek to consolidate regional manufacturing capabilities and acquire niche technological expertise, especially in advanced PTFE and graphite processing. Furthermore, supply chain resilience has become a focal strategic imperative following global disruptions, leading companies to prioritize dual sourcing and localized production hubs, shifting the competitive focus from sheer volume to reliable, high-quality, and traceable supply chains.

Regional dynamics highlight the Asia Pacific (APAC) region as the primary growth engine, driven by massive infrastructure investments in China, India, and Southeast Asia, covering power generation, water treatment, and rapidly expanding automotive production bases. North America and Europe, while mature, exhibit steady demand fueled primarily by strict regulatory mandates requiring the replacement of older, less compliant sealing systems (MRO demand) and the ongoing transition toward sustainable manufacturing practices. Segments analysis shows that flexible graphite and PTFE materials are registering the fastest growth rates, owing to their superior performance attributes in high-corrosion and high-temperature environments, specifically within hydrogen applications and high-purity systems in the pharmaceutical industry. Conversely, conventional rubber-based and cork gaskets, while maintaining volume share, face slower value growth due to material standardization and increasing price competition.

In summary, the market's resilience is intrinsically linked to global industrial output and environmental compliance pressures. The future competitive landscape will be defined by innovation in material composites—specifically those that offer better long-term creep resistance and reduced fugitive emissions. Key strategic imperatives for market participants include securing stable raw material procurement for specialized polymers and focusing research and development efforts on advanced manufacturing techniques, such as precision cutting and additive manufacturing, to meet the increasingly tight tolerances required by modern processing equipment. The market outlook remains positive, driven by the non-negotiable requirement for leak prevention and operational safety across all process industries globally.

AI Impact Analysis on Nonmetallic Gasket Market

Common user questions regarding AI's impact on the Nonmetallic Gasket Market often revolve around predictive failure analysis, optimization of manufacturing processes, and how AI can aid in quality control of complex material geometries. Users are highly interested in leveraging AI algorithms to predict the end-of-life for gaskets installed in critical infrastructure, minimizing unscheduled downtime, and transitioning from reactive to proactive maintenance schedules. Key concerns include the investment required for sensor implementation (Industrial IoT or IIoT) necessary to feed the AI models, data security, and the integration complexity of machine learning models into traditional industrial environments. The overarching expectation is that AI will enhance product reliability, streamline supply chain logistics for MRO components, and ultimately drive down the total cost of ownership (TCO) for end-users by preventing catastrophic sealing failures. This synthesis of inquiries confirms that the primary value proposition of AI is centered on reliability engineering and operational excellence within the manufacturing and end-user maintenance domains.

Within manufacturing, AI is revolutionizing the efficiency and consistency of nonmetallic gasket production. Machine learning algorithms are applied to optimize the mixing and curing processes of polymer and composite sheets, ensuring uniformity in material properties such as tensile strength, compression set, and density, which are vital for sealing integrity. Furthermore, AI-driven visual inspection systems utilizing high-resolution cameras and pattern recognition software are replacing manual quality checks. These systems can instantaneously detect minute defects, such as surface scratches, micro-fissures, or inconsistent dimensions, far beyond the capability of human operators. This implementation significantly reduces scrap rates, improves yield, and guarantees that gaskets meet the precise, often highly sensitive, specifications required by industries like aerospace and semiconductor manufacturing, where tolerance for failure is near zero.

For the supply chain and end-user maintenance, AI and predictive analytics are proving transformational. AI models analyze operational data—including temperature fluctuations, pressure cycles, vibration readings, and historical failure data—to develop highly accurate predictive maintenance schedules. This predictive capability allows maintenance teams to replace gaskets just before they are expected to fail, avoiding costly unplanned shutdowns. Furthermore, in logistics, AI optimizes inventory management for MRO providers by forecasting regional and industrial demand shifts, minimizing stockouts of critical sealing components while reducing excessive inventory holding costs. This smart inventory management ensures that high-demand, specialized nonmetallic gaskets, especially those made from proprietary materials, are readily available when and where they are needed, enhancing overall service delivery to industrial customers globally.

- AI optimizes raw material blending and curing cycles for superior material uniformity.

- Machine Vision systems powered by AI conduct real-time, high-precision quality inspection, reducing dimensional inconsistencies and surface defects.

- Predictive maintenance algorithms analyze IIoT sensor data (temperature, pressure, vibration) to forecast gasket failure and schedule proactive replacement.

- AI-driven demand forecasting improves MRO supply chain efficiency, reducing inventory holding costs and minimizing stockouts of critical spares.

- Generative Design tools aid in optimizing gasket geometry for specific flange loading conditions and temperature gradients.

- AI assists in correlating process deviations with material performance, leading to accelerated failure analysis and material improvement cycles.

DRO & Impact Forces Of Nonmetallic Gasket Market

The Nonmetallic Gasket Market is powerfully driven by the non-negotiable requirement for operational safety and the concurrent implementation of rigorous environmental regulations worldwide, notably those targeting the reduction of fugitive emissions (such as EPA mandates in North America and REACH in Europe). These regulations mandate superior sealing performance, favoring advanced materials like high-density graphite and premium PTFE compounds that offer exceptional leak-tightness over extended periods. A concurrent driver is the global industrialization wave, particularly the heavy investment in chemical, petrochemical, and power generation infrastructure in emerging economies, which creates substantial demand for large volumes of durable sealing components. These drivers create a sustained high-impact force, ensuring consistent demand for replacement and new installations, overriding short-term cyclical downturns in specific end-user sectors.

Significant restraints challenging market expansion include the inherent volatility in the prices of key raw materials, such as synthetic rubbers, fluoropolymers (PTFE), and specialty fillers (e.g., carbon fibers). Price unpredictability complicates procurement and forces manufacturers to maintain higher safety stocks or frequently adjust product pricing, impacting overall competitiveness, particularly for mass-produced standard gaskets. Additionally, competition from higher-performance metallic and semi-metallic gaskets (like spiral wound seals) poses a constraint, especially in applications pushing the thermal and pressure boundaries where nonmetallic materials traditionally struggle. The lack of universal standardization across regional material testing protocols also presents a friction point, requiring manufacturers to maintain multiple product lines to satisfy differing localized compliance requirements, increasing complexity and cost.

Opportunities for exponential growth lie in the development and commercialization of next-generation composite gaskets featuring enhanced resistance to aggressive new media, such as high-purity oxygen, hydrogen in fuel cell applications, and high-temperature steam in advanced power cycles. The transition toward sustainable and green manufacturing practices creates a specific niche opportunity for bio-based or recyclable nonmetallic materials, appealing to environmentally conscious industries. Furthermore, the burgeoning MRO sector, fueled by the massive installed base of industrial equipment requiring scheduled maintenance and component replacement, offers a sustained revenue stream. The impact forces indicate that technological innovation (Opportunity) centered on regulatory compliance (Driver) will increasingly overcome material cost volatility (Restraint), steering the market towards high-value, high-performance sealing solutions.

Segmentation Analysis

The Nonmetallic Gasket Market is fundamentally segmented based on Material Type, Product Type, Application, and End-User Industry, reflecting the diversity of operational environments they serve. The Material Type segmentation is crucial as performance characteristics—such as chemical inertness, temperature rating, and mechanical strength—are directly dependent on the base material (e.g., PTFE for chemical purity, Graphite for thermal resistance, and Elastomers for vibration dampening). Segmentation allows suppliers to tailor their offerings precisely to the demanding specifications of industries like petrochemicals, where material compatibility is paramount, or pharmaceuticals, which require non-contaminating, high-purity seals.

Within the Product Type category, sheets and pre-cut gaskets dominate the volume, but molded and extruded seals offer higher growth potential driven by specialized OEM requirements in sectors like aerospace and heavy machinery. The application segmentation, spanning static seals, fluid handling, and heat exchangers, helps define the required sealing properties. End-user analysis reveals that the Chemical and Petrochemical sectors remain the largest consumers due to the aggressive nature of their processes, demanding frequent replacement of specialized seals. However, sectors such as Pulp & Paper and Water Treatment are exhibiting steady, resilient growth, underpinned by infrastructure expansion and ongoing MRO requirements, ensuring a stable, diversified demand profile across the global industrial economy.

- By Material Type:

- PTFE (Polytetrafluoroethylene)

- Flexible Graphite

- Compressed Non-Asbestos Fiber (CNAF)

- Elastomers (Rubber, Silicone, Nitrile, EPDM)

- Cork

- Ceramic/Fiberglass Composites

- By Product Type:

- Gasket Sheets

- Pre-cut/Die-cut Gaskets

- Molded Gaskets

- Gasket Tapes and Packing

- By Application:

- Heat Exchangers

- Piping and Flanges

- Valves and Pumps

- Compressors

- Engines and Transmissions

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear, Renewables)

- Automotive and Transportation

- Water and Wastewater Treatment

- Marine and Shipbuilding

- Pharmaceutical and Food & Beverage

Value Chain Analysis For Nonmetallic Gasket Market

The value chain for the Nonmetallic Gasket Market begins with the upstream procurement and processing of specialized raw materials, which is highly fragmented and characterized by dependence on global commodity markets. Upstream analysis involves sourcing critical components such as natural and synthetic rubber latex, virgin PTFE powder, natural graphite flakes, and high-performance aramid or carbon fibers. Specialized chemical manufacturers process these raw materials into sheet stock, compounds, or billets. Price fluctuations in crude oil directly impact synthetic rubber and PTFE costs, necessitating sophisticated hedging and long-term procurement strategies by primary gasket sheet manufacturers. The quality of the raw material significantly determines the final product's performance rating, placing strong emphasis on supplier accreditation and traceability within the foundational stage of the value chain.

The midstream segment involves the transformation of raw sheets or compounds into finished gaskets via processes like compression molding, die-cutting, waterjet cutting, and CNC machining. This phase is capital-intensive, requiring high precision machinery to meet stringent dimensional tolerances. Direct distribution typically involves Original Equipment Manufacturers (OEMs) who integrate the gaskets into new equipment (e.g., pumps, engines, heat exchangers). Indirect distribution relies heavily on global and regional industrial distributors and MRO suppliers, who manage vast inventories of standard and customized gaskets to serve immediate maintenance requirements across all industrial sectors. The efficiency of this distribution network is crucial for capturing the high-volume, rapid-turnaround MRO market, which often accounts for the majority of revenue for standard product lines.

Downstream analysis focuses on the end-user application and post-sale support. The direct sales channel involves providing highly customized or engineered gaskets directly to large-scale projects or specialized industries (e.g., nuclear power). The greatest value is often captured through providing technical expertise, installation guidance, and failure analysis services, transforming the supplier into a strategic sealing partner rather than just a component vendor. Profitability in the downstream hinges on establishing long-term service contracts, especially with critical process industries where operational reliability is paramount. The shift toward digital inventories and rapid prototyping for small-volume, highly complex seals is optimizing the downstream fulfillment process, offering significant competitive advantages to technologically advanced firms.

Nonmetallic Gasket Market Potential Customers

The potential customers for nonmetallic gaskets are defined broadly as any industrial entity operating fluid or gas handling systems, particularly those that involve aggressive chemical media or require seals for medium-pressure, medium-temperature applications. These customers are predominantly categorized within the process manufacturing industries, including oil and gas, chemical refining, and bulk pharmaceutical production, where the integrity of piping, valves, and pressurized vessels is non-negotiable for safety and regulatory compliance. These end-users prioritize materials that offer excellent chemical compatibility, creep resistance, and low emission performance, making specialized materials like expanded PTFE (ePTFE) and chemically treated flexible graphite highly sought after for critical seals in flanges and static joints.

A second major segment of potential customers comprises the high-volume Original Equipment Manufacturers (OEMs) in the automotive, heavy machinery, and industrial pump and valve manufacturing sectors. These customers integrate gaskets as foundational components into their final products, requiring highly standardized, cost-effective, and dimensionally consistent seals, often procured in massive quantities under long-term supply agreements. For these customers, factors such as material consistency, ease of assembly, and specific thermal or vibration dampening properties (typically achieved with rubber or cork compounds) are the primary determinants in supplier selection, rather than extreme chemical resistance. The purchasing decisions in this segment are characterized by rigorous qualification processes and a strong emphasis on supply chain reliability and cost optimization.

Furthermore, the Maintenance, Repair, and Overhaul (MRO) segment, facilitated by industrial distributors and third-party maintenance contractors, represents a perpetually stable customer base. These customers often require rapid access to a vast array of standardized and semi-custom nonmetallic gaskets to respond to scheduled maintenance or emergency breakdowns across aging industrial facilities. Their purchasing behavior is driven by immediate availability, speed of delivery, and material certification traceability. Industries like utility power generation (coal, gas, nuclear) and water/wastewater treatment, which operate continuously and undergo rigorous regulatory inspections, are core MRO consumers, relying heavily on distributors who can provide reliable, certified nonmetallic sealing components quickly to ensure minimal operational downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garlock Sealing Technologies, Teadit International, Klinger Holding GmbH, James Walker Group Ltd, 3M Company, DuPont de Nemours, Inc., Federal-Mogul LLC (Tenneco), Lamons Gasket Company, Flexitallic Group, The Gasket Company, Custom Gasket Manufacturing, W. L. Gore & Associates, Inc., Sealing Devices Inc., Victor Reinz (Dana Incorporated), Mehra Gasket P. Ltd, Nichias Corporation, SKF Group, Armstrong Industrial Specialties, Inc., Spetech Gaskets, Leader Gasket Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonmetallic Gasket Market Key Technology Landscape

The technological landscape of the nonmetallic gasket market is increasingly focused on two primary areas: enhancing material performance through specialized composites and improving manufacturing precision to meet complex geometric demands. In material science, the focus is on developing advanced PTFE compounds incorporating specialized fillers (such as silica, glass microspheres, or barium sulfate) to drastically reduce cold flow and creep relaxation—the main weaknesses of virgin PTFE—thereby extending the service life in high-pressure flange applications. Similarly, innovations in flexible graphite are centered on oxidation inhibitors and multilayer foil constructions to improve thermal cycling stability and sealing reliability in ultra-high-temperature environments. These material breakthroughs are crucial for expanding the use of nonmetallic solutions into higher-spec industries like aerospace and high-efficiency power generation, maintaining relevance against metallic seal alternatives.

Manufacturing technology has shifted towards high-precision, automated cutting techniques that ensure zero material waste and achieve extremely tight dimensional tolerances. Advanced waterjet and CNC cutting machines, often integrated with sophisticated CAD/CAM systems, allow for the rapid production of complex gasket geometries from specialty sheet materials without compromising the material structure through heat or mechanical stress. This technological advancement supports the trend toward mass customization, enabling manufacturers to quickly prototype and produce small batches of application-specific seals with demanding precision. Furthermore, the integration of Industry 4.0 principles, including sensor technology and real-time data monitoring on the factory floor, facilitates preventative maintenance for machinery and optimizes tool life, ensuring consistent, high-quality output and minimizing production variance.

A burgeoning technological area is the integration of sealing components with smart functionalities, although still nascent in the nonmetallic sector. This involves incorporating micro-sensors or embedded conductive fibers into the gasket material itself. These smart seals can monitor crucial operational parameters, such as compression load, thermal degradation, and early signs of leakage, providing real-time diagnostic feedback to a central monitoring system. This technology is highly valued in remote or critical industrial installations, allowing for predictive failure analysis and reducing the need for manual inspection. While additive manufacturing (3D printing) is not yet widely used for large-scale production due to material limitations, rapid prototyping of complex polymer and composite gaskets using selective laser sintering (SLS) is gaining traction for specialized, low-volume applications, speeding up the product development cycle and bringing custom solutions to market faster than traditional methods.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market both in terms of production capacity and consumption volume, driven by unprecedented growth in industrial output, infrastructure development, and a booming manufacturing base across China, India, Japan, and South Korea. This region is characterized by high demand for standard, cost-effective gaskets for automotive and basic manufacturing, but also exhibits rapid uptake of high-performance seals (PTFE, Graphite) to support new chemical and liquefied natural gas (LNG) projects. Government initiatives promoting domestic manufacturing and significant foreign direct investment into petrochemical complexes continue to fuel demand. The strong push for reliable utility scale power generation and subsequent MRO needs solidify APAC's position as the primary growth engine for the forecast period.

- North America: North America represents a mature, high-value market defined by stringent safety and environmental regulations, particularly those imposed by the EPA regarding fugitive emissions. Demand here is less volume-driven and more value-driven, emphasizing high-integrity sealing solutions, especially in the massive domestic oil and gas (shale extraction, refining) and chemical processing industries. The market is primarily driven by MRO activities, as aging infrastructure requires constant maintenance and upgrades to meet current regulatory standards. Innovation adoption is high, with end-users actively seeking advanced materials that offer certified low-emission performance, driving premiums for specialized graphite and ePTFE products.

- Europe: The European market is heavily influenced by strict adherence to regulatory frameworks like REACH and various EU environmental directives, necessitating continuous innovation in asbestos-free and environmentally benign sealing materials. While industrial growth rates are moderate compared to APAC, the demand for sophisticated, high-performance, and sustainable nonmetallic gaskets is exceptionally strong, especially within the chemical, pharmaceutical, and high-tech automotive sectors (EV manufacturing). Germany, the UK, and France are key consumers, focused on efficiency and material traceability. The region shows a specific trend towards high-reliability seals for renewable energy infrastructure, such as seals designed for hydrogen storage and processing systems.

- Latin America (LATAM): LATAM presents significant potential, though growth can be erratic due to economic volatility. Key drivers include investment in oil and gas exploration and processing (Brazil, Mexico), and mineral mining operations. The demand profile is mixed, requiring both cost-effective standard gaskets for general industry and specialized seals for large-scale energy projects. Infrastructure upgrades and ongoing industrial expansion, coupled with regional trade agreements, are gradually stabilizing demand and improving prospects for long-term supply agreements.

- Middle East and Africa (MEA): The MEA region is dominated by massive capital expenditure projects in the petrochemical and downstream oil and gas sectors, particularly in Saudi Arabia, UAE, and Qatar. This region demands gaskets capable of withstanding extreme temperatures and corrosive environments associated with hydrocarbon processing and desalination plants. Demand is characterized by large, multi-year construction projects followed by sustained MRO requirements. The increasing focus on diversifying economies beyond crude oil, including investment in power infrastructure and manufacturing, is expected to broaden the nonmetallic gasket application base in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonmetallic Gasket Market.- Garlock Sealing Technologies

- Teadit International

- Klinger Holding GmbH

- James Walker Group Ltd

- 3M Company

- DuPont de Nemours, Inc.

- Federal-Mogul LLC (Tenneco)

- Lamons Gasket Company

- Flexitallic Group

- The Gasket Company

- Custom Gasket Manufacturing

- W. L. Gore & Associates, Inc.

- Sealing Devices Inc.

- Victor Reinz (Dana Incorporated)

- Mehra Gasket P. Ltd

- Nichias Corporation

- SKF Group

- Armstrong Industrial Specialties, Inc.

- Spetech Gaskets

- Leader Gasket Technologies

Frequently Asked Questions

Analyze common user questions about the Nonmetallic Gasket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for high-performance PTFE and Graphite gaskets?

Demand is driven by stringent global environmental regulations, specifically those requiring certified low-fugitive-emission sealing (e.g., ISO 15848-1 standards). PTFE and Flexible Graphite offer superior chemical inertness and thermal stability, making them essential for critical, zero-leakage applications in chemical processing and high-temperature power generation.

How is the volatility of raw material costs impacting the overall profitability of nonmetallic gasket manufacturers?

Volatility, particularly in oil-derived synthetic polymers and graphite, directly affects manufacturing costs and margins, especially for standardized, high-volume products. Manufacturers mitigate this through long-term supplier agreements, strategic inventory management, and focusing on high-value, proprietary composite products where price sensitivity is lower.

Which end-user industry segment is anticipated to exhibit the fastest growth rate for nonmetallic gaskets during the forecast period?

The Chemical and Petrochemical Processing sector, particularly in the Asia Pacific region, is anticipated to show the fastest growth rate due to continuous capacity expansion, modernization of existing facilities, and the necessity for highly specialized, chemically resistant nonmetallic sealing solutions for new process streams.

What role does Industry 4.0 technology play in the manufacturing and performance monitoring of nonmetallic gaskets?

Industry 4.0, including IIoT and AI-driven analytics, optimizes manufacturing precision through automated CNC cutting and visual inspection systems. For end-users, these technologies enable predictive maintenance by monitoring gasket compression and temperature, thus extending equipment uptime and preventing unscheduled shutdowns.

What is the key technological challenge nonmetallic gasket materials must overcome to compete with metallic seals?

The primary challenge is enhancing resistance to creep relaxation (the tendency to deform under continuous stress) and increasing thermal and pressure thresholds. Manufacturers are addressing this by integrating advanced fillers and reinforcement fibers into base materials like PTFE and CNAF to improve dimensional stability under extreme operating conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager