Nonstick Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435163 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Nonstick Coating Market Size

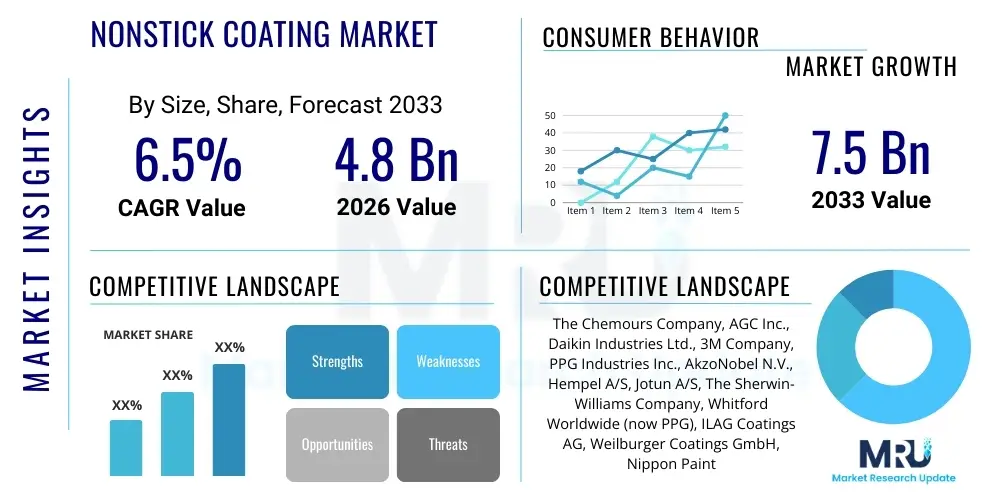

The Nonstick Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

The consistent growth observed in the nonstick coating sector is fundamentally driven by the escalating demand from the consumer goods industry, particularly cookware and bakeware. Nonstick properties, traditionally associated with PTFE, are now expanding into advanced ceramic and sol-gel technologies, addressing increasing consumer concerns regarding health and environmental safety. This transition is not only reshaping product formulations but is also broadening the market's application scope into specialized industrial uses, such as aerospace components and medical devices, where low friction and high temperature resistance are critical performance indicators.

Geographically, market expansion is heavily concentrated in the Asia Pacific region, fueled by rapid urbanization, rising disposable incomes, and the modernization of manufacturing infrastructure, especially in emerging economies like China and India. Furthermore, stringent regulatory frameworks in North America and Europe concerning Per- and Polyfluorofluoroalkyl Substances (PFAS) are compelling manufacturers to invest heavily in sustainable and PFAS-free alternatives, ensuring that innovation remains a core pillar of market growth throughout the projected timeline. The convergence of technological advancements and consumer preference for durable, easy-to-clean products solidifies the market's robust trajectory.

Nonstick Coating Market introduction

The Nonstick Coating Market encompasses specialized surface treatments applied primarily to metals to impart low surface energy, enabling easy release of materials, crucial heat resistance, and enhanced durability. The core products include fluoropolymers such as Polytetrafluoroethylene (PTFE), Perfluoroalkoxy Alkane (PFA), and Fluorinated Ethylene Propylene (FEP), alongside newer non-fluoropolymer alternatives like ceramics and silicones. These coatings significantly reduce friction, prevent adhesion, and offer superior resistance to corrosion and high temperatures. Major applications span residential cookware and bakeware, food processing equipment, automotive components (e.g., piston skirts, gaskets), industrial tools, and specialized aerospace parts. The primary benefits derived from these coatings include improved cooking efficiency, reduced cleaning time, energy conservation, enhanced product lifespan, and crucial safety features in industrial settings. Key driving factors fueling market expansion are the rising consumer demand for convenience in kitchen appliances, stringent quality requirements in the food and beverage industry, and continuous technological innovation focusing on developing environmentally sustainable and health-conscious coating solutions, particularly those offering alternatives to traditional PTFE formulations.

Nonstick Coating Market Executive Summary

The Nonstick Coating Market is experiencing dynamic shifts, characterized by a strong pivot towards high-performance, PFAS-free formulations, largely dictated by evolving global regulatory landscapes and increasing consumer health awareness. Current business trends indicate significant investment in research and development aimed at improving the thermal stability, scratch resistance, and overall longevity of ceramic and silicone-based coatings, thereby positioning these alternatives as viable high-growth segments. Strategically, market participants are engaging in targeted mergers and acquisitions to consolidate technological capabilities and expand their geographic footprint, ensuring they can efficiently cater to diverse regional demands, especially within the rapidly industrializing APAC region. This consolidation often focuses on securing proprietary expertise in advanced application techniques, such as powder coating and liquid dispersion methods.

Regional trends highlight the Asia Pacific as the undeniable growth engine, propelled by its massive manufacturing capacity for kitchenware and the burgeoning middle-class population driving consumer expenditure on home goods. Conversely, North America and Europe are mature markets defined by premium pricing, stringent compliance standards, and a high rate of adoption for sustainable, premium-grade coatings. Segment trends underscore the continued dominance of the Cookware Application segment, although the Industrial segment, specifically in automotive and chemical processing, is poised for accelerated growth due driven by the requirement for coatings that withstand extreme operating conditions and reduce component wear. The Type segment is witnessing a gradual shift away from conventional PTFE towards advanced, multi-layer ceramic coatings which promise higher durability and appeal to the "green chemistry" ethos.

AI Impact Analysis on Nonstick Coating Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Nonstick Coating Market primarily revolve around optimizing formulation chemistry, improving quality control during application, and forecasting material performance under varied operational stress. Common themes include how AI can accelerate the discovery of novel, environmentally friendly coating materials (especially PFAS alternatives), the application of machine learning for defect detection in high-volume coating lines, and the use of predictive analytics to model coating degradation and lifespan. Users are highly interested in AI’s capability to minimize material waste, fine-tune curing parameters (temperature, time), and enhance process efficiency, ultimately driving down manufacturing costs while simultaneously increasing product reliability. The consensus expectation is that AI will transform the traditionally empirical process of coating development into a data-driven, systematic engineering discipline, leading to faster market introduction of superior, compliant coating products.

The implementation of AI and machine learning models in the nonstick coating sector facilitates predictive quality assurance by analyzing real-time sensor data from coating application equipment. This enables manufacturers to identify minute variances in film thickness, porosity, or adhesion profiles instantaneously, minimizing batch failures and ensuring uniform coating quality across massive production runs. Furthermore, computational chemistry, powered by AI, significantly reduces the duration and cost associated with synthesizing new chemical structures. Instead of extensive laboratory experimentation, AI models simulate the molecular interactions and predict the nonstick properties, durability, and toxicity profiles of thousands of potential compounds, rapidly filtering candidates for further empirical testing, particularly crucial in the race for next-generation PFAS-free coatings.

AI's role extends beyond production to supply chain resilience and demand forecasting. Machine learning algorithms analyze global raw material price fluctuations, logistics constraints, and end-user market sentiment to optimize inventory management of critical components like fluoropolymers, pigments, and solvents. This enhanced predictive capability allows coating suppliers to maintain competitive pricing and stable supply, particularly important given the complex regulatory environment surrounding certain raw materials. The integration of AI also aids in designing smart coating formulations tailored precisely for specific end-use environments, such as coatings optimized for extremely high thermal cycling in aerospace or enhanced corrosion resistance in marine applications, moving the industry towards highly specialized, performance-driven products.

- AI optimizes chemical formulation design, accelerating the discovery of sustainable, PFAS-free alternatives.

- Machine learning improves quality control (QC) by detecting microscopic defects during the coating process in real-time.

- Predictive maintenance driven by AI ensures optimal performance and longevity of complex coating application machinery.

- AI-powered simulation models accurately forecast coating performance, durability, and thermal stability under stress conditions.

- Algorithms enhance supply chain efficiency, optimizing inventory levels for specialized raw materials.

DRO & Impact Forces Of Nonstick Coating Market

The Nonstick Coating Market is fundamentally influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the exponential growth in global cookware production, increasing consumer preference for convenient, easy-to-clean kitchenware, and robust expansion in specialized industrial applications requiring reduced friction and high chemical inertness. However, this growth is significantly restrained by stringent governmental regulations, notably concerning the phasing out of PFOA and related PFAS chemicals, which necessitates costly reformulations and compliance efforts. Furthermore, the higher cost associated with advanced ceramic and multi-layer coating systems acts as a barrier to mass adoption in price-sensitive markets. Major opportunities lie in the commercialization of novel, ultra-durable ceramic and sol-gel coatings that offer superior performance without environmental liabilities, coupled with expansion into niche high-value industrial sectors such as electric vehicle components and renewable energy infrastructure. The primary impact forces shaping the market are evolving consumer preferences favoring sustainable and non-toxic materials, technological breakthroughs in non-fluorinated chemistries, and the constant pressure from regulatory bodies to ensure product safety and environmental compliance.

A crucial restraint impacting the market trajectory is the limited scratch resistance and relatively shorter lifespan of some traditional nonstick coatings, particularly standard PTFE versions, which leads to frequent replacement and consumer frustration regarding perceived durability. This challenge is driving intense R&D efforts to develop hybrid polymer-ceramic matrix coatings that significantly enhance surface hardness and abrasion resistance, thereby addressing one of the core consumer pain points. The volatility in the prices of key raw materials, particularly fluoropolymer precursors and specialty ceramic fillers, presents a continuous challenge for manufacturers' profit margins and supply chain stability. Mitigating this volatility requires long-term sourcing contracts and strategic backward integration in some large manufacturing entities.

The most compelling opportunity resides in the expanding industrial segment, especially sectors undergoing rapid technological transformation. For instance, the transition to electric vehicles (EVs) creates new demands for lightweight, thermally stable coatings for battery components and internal motor parts that require electrical insulation and superior heat dissipation. Similarly, the medical device industry increasingly seeks nonstick, biocompatible coatings for surgical instruments and implants, ensuring reduced friction and ease of sterilization. Capitalizing on these high-specification markets demands advanced material science expertise and strict adherence to industry-specific certifications, offering significant revenue potential for specialized coating providers capable of meeting extremely high performance thresholds.

- Drivers: Growing demand for convenient cookware; increased adoption in specialized automotive and aerospace applications; rising consumer expenditure on durable home goods.

- Restraints: Strict global regulations regarding PFAS compounds; relatively higher cost of advanced non-fluorinated coatings; issues related to coating durability and scratch resistance.

- Opportunity: Development and commercialization of advanced ceramic and sol-gel technologies; untapped potential in high-specification industrial applications (EVs, medical devices); expansion into emerging economies with growing middle-class populations.

- Impact Forces: Technological innovation in PFOA/PFAS-free alternatives; evolving consumer health and environmental consciousness; governmental regulation and mandatory phase-outs of traditional chemistries.

Segmentation Analysis

The Nonstick Coating Market is systematically segmented based on Type, Application, and End-Use, offering granular insights into specific market dynamics and growth potential across various product categories and user groups. The segmentation by Type focuses on the chemical composition, differentiating between dominant fluoropolymers (PTFE, PFA, FEP) and burgeoning non-fluoropolymer materials (Ceramic, Silicone, Sol-Gel). This distinction is critical as regulatory pressure accelerates the substitution of fluoropolymer types with ceramic and sol-gel alternatives, reflecting a major shift in material science priorities. The Application segment delineates the market based on where the coating is applied, with Cookware and Industrial components forming the largest segments, each presenting unique performance requirements—consumer safety and aesthetics for the former, and high thermal/chemical resilience for the latter.

Analyzing the Application segment further reveals that cookware remains the backbone of the market, driven by high volume and replacement cycles. However, the fastest growth is projected within the Industrial application sector, specifically in areas demanding extreme reliability, such as chemical processing reactors, mold releases, and machine parts subject to constant friction. The End-Use segmentation classifies buyers into Residential, Commercial, and Industrial categories. Residential use accounts for the vast majority of demand due to kitchenware, but Commercial use (restaurants, catering services) demands coatings with superior robustness and abrasion resistance to withstand heavy, continuous use. Understanding these segment-specific requirements allows manufacturers to tailor their product offerings, marketing strategies, and pricing structures effectively to maximize market penetration across diverse industries globally.

- By Type:

- Polytetrafluoroethylene (PTFE)

- Perfluoroalkoxy Alkane (PFA)

- Fluorinated Ethylene Propylene (FEP)

- Ceramic and Sol-Gel Coatings

- Silicone Coatings

- Other Fluoropolymers

- By Application:

- Cookware (Pots, Pans, Griddles)

- Bakeware

- Food Processing Equipment

- Industrial (Chemical, Automotive, Aerospace, Textiles)

- Medical Devices

- By End-Use:

- Residential

- Commercial

- Industrial

Value Chain Analysis For Nonstick Coating Market

The Value Chain of the Nonstick Coating Market begins with upstream activities involving the sourcing and production of fundamental raw materials, including fluoropolymer resins (TFE, HFP, VDF), specialty pigments, solvents, and ceramic precursors (e.g., silica, titania). This stage is highly consolidated and dominated by large chemical companies, where intellectual property and process efficiency are critical competitive factors. Following raw material synthesis, midstream activities involve the specialized formulation and compounding of these materials into liquid dispersions or powder coatings suitable for industrial application. This formulation process, often proprietary, determines the final performance characteristics like heat resistance, adhesion, and nonstick properties.

The downstream segment encompasses the actual coating application process, typically performed by independent specialized coating service providers or in-house by large Original Equipment Manufacturers (OEMs), particularly in the cookware sector. This stage requires high-capital investment in specialized equipment, such as spray guns, electrostatic applicators, and high-temperature curing ovens. Quality control and adherence to precise film thickness specifications are paramount here. The distribution channel involves both direct and indirect routes. Large coating manufacturers often supply directly to major industrial end-users (e.g., aerospace manufacturers), while indirect distribution leverages specialized distributors and wholesalers to reach smaller applicators and regional retailers, particularly for consumer-grade products. The efficiency of this downstream segment relies heavily on maintaining rigorous standards of application to ensure product longevity and consumer satisfaction, effectively bridging the material science with the final consumer product.

Nonstick Coating Market Potential Customers

Potential customers for nonstick coatings span a highly diverse range of industries, driven by the universal need to reduce friction, prevent sticking, and enhance the lifespan of components. The largest and most immediate customer base consists of manufacturers of residential cookware and small kitchen appliances, who rely on nonstick coatings to drive consumer appeal and product functionality. These buyers prioritize cost-effectiveness, consumer safety certifications (e.g., FDA compliance), and aesthetic variety. Beyond the residential sector, high-volume industrial manufacturers form a critical customer group.

Specifically, the automotive industry requires nonstick coatings for engine parts (piston skirts to reduce friction), gaskets, and internal components where high thermal stability is mandatory. The aerospace industry uses these coatings on specialized components, such as valves, actuators, and structural parts, benefiting from their low friction and resistance to extreme temperatures and corrosive environments. Furthermore, the food and beverage processing sector is a consistent buyer, needing durable, cleanable coatings for conveyor belts, molds, and mixing equipment to maintain hygiene standards and efficiency. Lastly, the medical device sector utilizes these coatings on surgical instruments and laboratory equipment, demanding superior non-toxicity and sterilization resilience, representing a high-value, high-specification customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chemours Company, AGC Inc., Daikin Industries Ltd., 3M Company, PPG Industries Inc., AkzoNobel N.V., Hempel A/S, Jotun A/S, The Sherwin-Williams Company, Whitford Worldwide (now PPG), ILAG Coatings AG, Weilburger Coatings GmbH, Nippon Paint Holdings Co. Ltd., KCC Corporation, Beckers Group, Axalta Coating Systems, BASF SE, Kansai Paint Co. Ltd., RPM International Inc., Sika AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonstick Coating Market Key Technology Landscape

The technological landscape of the Nonstick Coating Market is undergoing a rapid evolution, primarily driven by the imperative to replace PFOA and minimize the use of all per- and polyfluoroalkyl substances (PFAS). Historically, the market was dominated by traditional solvent-based PTFE liquid dispersions, applied through spraying and cured at high temperatures. However, recent technological advancements emphasize water-based formulations to reduce Volatile Organic Compound (VOC) emissions, aligning with stringent environmental mandates. A key area of innovation is in multi-layer coating systems, where different layers (primer, mid-coat, top-coat) are engineered to provide enhanced adhesion, scratch resistance, and prolonged nonstick performance, often involving ceramic reinforcement in the intermediate layers.

The most significant disruptive technology is the widespread adoption of ceramic and sol-gel coatings. These materials are typically derived from inorganic compounds (silica, silicates) and applied via a sol-gel process, offering high hardness, superior heat resistance (up to 450°C or higher), and, crucially, a fully PFAS-free composition. While traditionally less flexible than PTFE, ongoing research is focused on improving their nonstick release properties and flexibility through the incorporation of specialized silicone additives or nano-scale materials. Furthermore, plasma enhanced chemical vapor deposition (PECVD) and powder coating techniques are gaining traction in industrial applications, offering excellent uniform coverage and durability for complex geometries, moving beyond traditional liquid application methods for performance-critical components.

Advancements also include the development of hybrid coating systems that combine the benefits of fluoropolymers with the durability of ceramic materials. These hybrid systems utilize advanced binders and primer chemistry to ensure maximum substrate adhesion, crucial for preventing flaking and maximizing the lifespan of the coated product under thermal stress. Nanotechnology plays an increasingly vital role, particularly the integration of carbon nanotubes, graphene, or specialized inorganic nanoparticles into the coating matrix to enhance mechanical strength, thermal conductivity, and reduce porosity, ultimately delivering next-generation nonstick surfaces that can withstand aggressive cleaning and extreme use environments far better than their predecessors.

Regional Highlights

Regional analysis of the Nonstick Coating Market reveals disparate growth rates and technological adoption patterns influenced by local manufacturing capacities, regulatory environments, and consumer spending power. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market. This dominance is primarily attributed to the high concentration of manufacturing hubs, particularly in China and India, which produce vast quantities of cookware and industrial goods for both domestic consumption and global export. Rapid urbanization and the expansion of the middle class in countries like Vietnam and Indonesia further fuel residential demand for modern, convenient kitchen appliances, driving high-volume sales of both standard and premium nonstick coatings. Investment in industrial infrastructure, particularly in automotive and electronics manufacturing, also strongly contributes to the regional market expansion, focusing on cost-effective and high-throughput coating solutions.

North America and Europe represent mature markets characterized by high market penetration, strict regulatory oversight, and a strong preference for premium, sustainable products. In these regions, growth is less volume-driven and more value-driven, centered on high-performance ceramic, PFOA-free, and PFAS-free formulations. European regulations, particularly REACH mandates, have significantly accelerated the shift away from older fluoropolymer chemistries, fostering innovation in environmentally compliant coatings. Consumers here are willing to pay a premium for certified non-toxic and highly durable products. Key industrial sectors, such as aerospace in the US and Germany, drive demand for highly specialized, certified coatings that meet rigorous performance standards, ensuring sustained, albeit slower, high-value growth.

The Latin America (LATAM) and Middle East & Africa (MEA) regions offer significant long-term growth potential, though currently representing smaller market shares. In LATAM, market growth is closely tied to economic stability and increasing industrial investment, especially in Brazil and Mexico, which possess established automotive manufacturing bases. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing growth driven by infrastructure development, tourism, and increased domestic consumption. These regions often act as recipients of global technological trends, showing increasing adoption of advanced nonstick systems as consumer awareness and quality standards rise. Challenges include localized supply chain limitations and price sensitivity, which favor basic coating chemistries over expensive, specialized formulations in many sectors.

- Asia Pacific (APAC): Dominant market size and fastest growth; driven by massive cookware manufacturing capacity (China, India) and rising middle-class consumer demand. Focus on cost-effective, high-volume production and industrial expansion.

- North America: Mature market; characterized by strict environmental regulations (PFAS reduction) and high demand for premium, PFOA-free, ceramic and specialized industrial coatings (aerospace, medical).

- Europe: High-value market focused on sustainability and compliance (REACH); rapid transition to non-fluorinated chemistries; strong industrial application in high-end automotive and engineering sectors.

- Latin America (LATAM): Emerging market; growth tied to industrialization, particularly in the automotive and food processing sectors in Brazil and Mexico.

- Middle East & Africa (MEA): Growth driven by infrastructure projects, urbanization, and increasing consumer awareness of modern kitchenware; high potential for new market entry and technological transfer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonstick Coating Market.- The Chemours Company

- AGC Inc.

- Daikin Industries Ltd.

- 3M Company

- PPG Industries Inc.

- AkzoNobel N.V.

- Hempel A/S

- Jotun A/S

- The Sherwin-Williams Company

- Whitford Worldwide (now PPG)

- ILAG Coatings AG

- Weilburger Coatings GmbH

- Nippon Paint Holdings Co. Ltd.

- KCC Corporation

- Beckers Group

- Axalta Coating Systems

- BASF SE

- Kansai Paint Co. Ltd.

- RPM International Inc.

- Sika AG

Frequently Asked Questions

Analyze common user questions about the Nonstick Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between PTFE and ceramic nonstick coatings?

PTFE (Polytetrafluoroethylene) is a traditional fluoropolymer known for excellent nonstick properties and low friction, but concerns exist regarding its use at extremely high temperatures. Ceramic coatings (sol-gel derived) are typically inorganic, PFAS-free, offer superior heat resistance, and are harder, providing better scratch resistance, though they may have a shorter life or slightly less slick release than high-grade PTFE.

How are global regulations, such as those concerning PFAS, influencing the Nonstick Coating Market?

Stringent global regulations, particularly the phasing out of PFOA and scrutiny of related PFAS chemicals, are the single largest driver of innovation. This forces manufacturers to rapidly invest in and transition towards non-fluorinated alternatives, primarily ceramic and advanced silicone formulations, leading to higher product development costs but opening up significant opportunities for sustainable coating technologies.

Which application segment holds the largest market share for nonstick coatings?

The Cookware application segment (including frying pans, pots, and bakeware) currently holds the largest market share globally due to high-volume manufacturing, frequent product replacement cycles, and widespread consumer adoption driven by convenience and ease of cleaning.

What is the Compound Annual Growth Rate (CAGR) projected for the Nonstick Coating Market?

The Nonstick Coating Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by industrial adoption and the continuous launch of high-performance, environmentally compliant products.

What role does nanotechnology play in the future development of nonstick coatings?

Nanotechnology is crucial for enhancing coating performance by incorporating materials like graphene or specialized nanoparticles into the coating matrix. This integration significantly improves mechanical durability, scratch resistance, adhesion to the substrate, and thermal stability, allowing for the creation of ultra-hard and long-lasting nonstick surfaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager