Normal Paraffin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438426 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Normal Paraffin Market Size

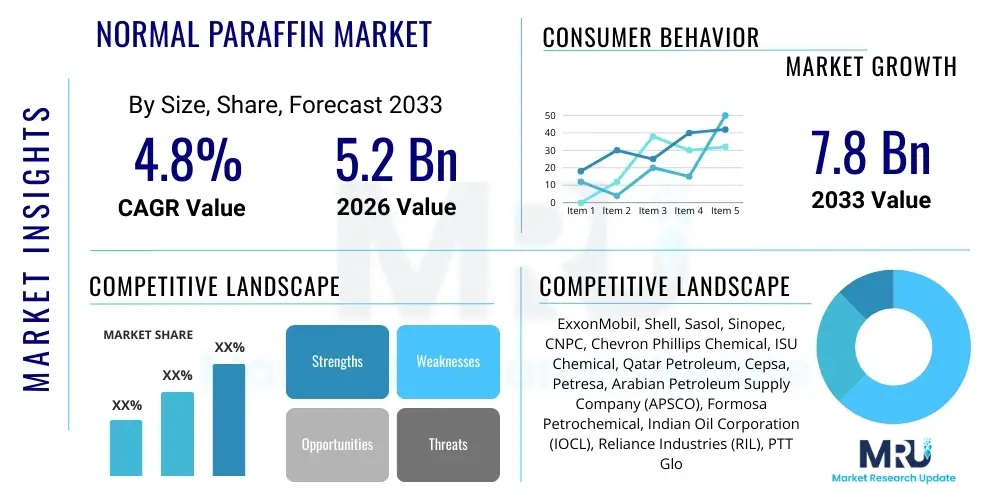

The Normal Paraffin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% CAGR between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033.

Normal Paraffin Market introduction

Normal paraffin, also known as n-paraffin, comprises saturated, straight-chain hydrocarbon molecules typically extracted from kerosene or gas oil feedstock through highly specialized refining processes, primarily molecular sieve separation. These colorless, odorless compounds are crucial intermediate chemicals characterized by their high purity and predictable chemical structure. They are distinguished from isoparaffins and cycloparaffins by the lack of branching in their molecular chain, which grants them specific desirable properties essential for downstream synthesis.

The primary application of normal paraffins, particularly those in the C10-C13 range, is the manufacturing of Linear Alkyl Benzene (LAB), which is the principal raw material utilized in the production of Linear Alkyl Benzene Sulfonate (LABS), a widely used biodegradable surfactant in laundry detergents and household cleaners. Beyond surfactants, normal paraffins serve as high-purity solvents in various industrial processes, feedstocks for manufacturing chlorinated paraffins used as flame retardants and plasticizers, and integral components in synthetic wax production. The chemical stability and low toxicity associated with highly refined normal paraffins drive their widespread adoption across diverse industrial sectors globally.

The market expansion for normal paraffins is fundamentally driven by the escalating global demand for biodegradable surfactants, especially in rapidly developing economies characterized by increasing urbanization and improved sanitation standards. Furthermore, the persistent need for effective and versatile solvents in industries like agriculture, paints, and coatings contributes significantly to market growth. However, this growth trajectory is closely linked to the volatility of crude oil prices, the primary source feedstock, and is increasingly influenced by environmental regulations promoting sustainable sourcing and production methods.

Normal Paraffin Market Executive Summary

The Normal Paraffin Market exhibits robust growth, primarily propelled by the exponential expansion of the detergent industry across Asia Pacific and Latin America, where population growth and rising disposable incomes fuel demand for Linear Alkyl Benzene (LAB) and subsequent Linear Alkyl Benzene Sulfonate (LABS). Business trends indicate a strategic focus on expanding integrated petrochemical facilities capable of optimizing the separation and purification of specific n-paraffin fractions, particularly C10-C13, to secure supply chains for detergent manufacturers. Key market participants are increasingly investing in proprietary molecular sieve technology and hydrocracking processes to enhance product purity and energy efficiency, positioning themselves competitively in a commodity-driven market.

Regionally, Asia Pacific maintains its dominance, driven by massive manufacturing output in China and India, coupled with new refinery capacity additions across Southeast Asia focusing on petrochemical integration. North America and Europe demonstrate mature market conditions but are characterized by high regulatory scrutiny, spurring innovation toward bio-based or renewable normal paraffin alternatives, though these segments remain nascent. Middle East and Africa (MEA) are emerging as critical production hubs, capitalizing on abundant, low-cost crude oil feedstock and strategic geographic locations facilitating exports to high-demand Asian markets, thereby shifting the global supply equilibrium.

Segment-wise, the Linear Alkyl Benzene (LAB) application segment holds the dominant market share due to its indispensable role in surfactant production. Within the grade segmentation, the C10-C13 segment is the most crucial, reflecting the direct reliance of the LAB manufacturing process on these specific molecular chain lengths. Future growth is anticipated in the solvent and chlorinated paraffin application areas, particularly where high-purity, environmentally compliant solvents are mandated. Sustainable manufacturing practices and efficient energy utilization throughout the value chain are becoming non-negotiable segment trends influencing long-term procurement decisions by major downstream players.

AI Impact Analysis on Normal Paraffin Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Normal Paraffin Market primarily revolve around operational efficiency, predictive maintenance, and optimizing refining margins. Common questions address how AI can enhance the performance and lifespan of molecular sieve units, minimize energy consumption during separation, and predict feedstock quality fluctuations (kerosene/gas oil) to adjust processing parameters dynamically. Users also express interest in AI's role in optimizing the logistics and supply chain of this commodity, particularly in dynamic pricing models and inventory management across global storage facilities. The consensus highlights that AI is not a direct product replacement threat but rather a transformative tool for refining operations, aiming for higher yield, lower waste, and improved safety compliance.

AI's initial impact is focused on improving the reliability and efficiency of capital-intensive petrochemical processes. By utilizing machine learning algorithms, operators can now analyze vast streams of sensor data from fractional distillation columns and separation units, detecting subtle anomalies that indicate impending equipment failure long before conventional monitoring systems. This shift towards predictive maintenance significantly reduces unplanned downtime, a critical factor given the high throughput and low margin nature of paraffin production. Furthermore, AI models are proving instrumental in feedstock optimization, enabling refiners to precisely tailor the hydrotreating and separation steps based on real-time analysis of crude oil characteristics, thereby maximizing the yield of high-purity normal paraffins and minimizing utility costs.

The long-term influence of AI extends into research and development, particularly in modeling new catalyst systems and optimizing reaction conditions for downstream processes like LAB synthesis, ensuring higher conversion rates and reduced by-product formation. Supply chain management benefits from AI-driven forecasting tools that process global demand signals, geopolitical risk factors, and transportation constraints to optimize shipping routes and inventory placement, enhancing market responsiveness. As digital twins of refining units become standard, AI will manage complex operational parameters simultaneously, ensuring stringent quality control (e.g., controlling the narrow boiling point range requirements) crucial for end-user applications like high-performance solvents and specialized plasticizers.

- AI drives predictive maintenance in molecular sieve units, reducing costly unplanned shutdowns.

- Machine learning algorithms optimize energy consumption during separation and purification processes, improving operational expenditure.

- Advanced analytics enhance feedstock characterization, allowing refiners to maximize the yield of desired n-paraffin fractions (e.g., C10-C13).

- AI-powered simulation tools accelerate the development and testing of new catalysts for downstream LAB production.

- Digital supply chain models use AI for dynamic pricing, optimal inventory management, and mitigating logistics bottlenecks.

- Process automation enhanced by AI ensures tighter quality control and consistency in normal paraffin specifications.

DRO & Impact Forces Of Normal Paraffin Market

The Normal Paraffin Market is influenced by a dynamic interplay of factors encompassing strong demand drivers, significant constraints tied to feedstock sourcing, pervasive market opportunities focused on sustainability, and high-impact forces such as geopolitical stability and technological shifts in competitive material synthesis. The market’s resilience is rooted in the essential nature of its primary derivative, LABS, indispensable for the rapidly expanding global cleaning industry. However, the energy-intensive nature of separation processes and the dependency on petroleum resources introduce structural limitations and susceptibility to external economic fluctuations. Strategic opportunities lie prominently in emerging solvent applications requiring specific purity levels and the gradual adoption of bio-based feedstocks that offer long-term stability and environmental advantages.

Key drivers include the relentless industrialization and urbanization across Asian and African countries, dramatically increasing the consumption of household and industrial detergents, thereby sustaining demand for LAB precursors. Concurrently, technological advancements in petrochemical refining, specifically improvements in zeolitic molecular sieve technology, are enabling producers to achieve higher purity levels and greater processing efficiencies, lowering the effective cost of production. The increasing global focus on biodegradability further supports the market, as LABS remains a preferred environmentally compliant surfactant compared to older alternatives. These drivers ensure a consistent upward trajectory for production capacity utilization worldwide.

Restraints primarily center around the price volatility of crude oil and its derivatives, kerosene and gas oil, which directly impacts the raw material cost for normal paraffin manufacturers and introduces unpredictability in margins. Moreover, the high capital expenditure required for setting up or expanding advanced molecular sieve separation plants acts as a barrier to entry for smaller players. Impact forces include stringent global chemical regulations, especially in developed economies, concerning solvent toxicity and production emissions, pushing manufacturers towards higher purity standards and safer processing techniques. Competitive threats, though minor currently, arise from the potential development of cost-effective, non-petroleum-derived synthetic alternatives for detergents or specialized solvents that could substitute normal paraffins in niche applications.

Opportunity areas are vast and include the burgeoning demand for specialized low-aromatic solvents in high-end applications like electronics cleaning, precision engineering, and specialized polymerization reactions, where high-purity n-paraffins are essential. Additionally, the development and commercial scaling of technologies to produce normal paraffins from renewable sources, such as biomass or natural gas conversion (GTL technology), present a long-term strategic opportunity to decouple production economics from crude oil cycles and meet sustainability targets set by multinational end-users. Geographical expansion into untapped emerging markets, particularly in Sub-Saharan Africa and Central Asia, also provides significant scope for growth, particularly for regional players capable of managing complex logistics.

Segmentation Analysis

The Normal Paraffin Market is extensively segmented based on application, grade, and manufacturing process, reflecting the diversity of end-user requirements and the technical complexity of the production landscape. The segmentation based on application is critical, as it directly correlates with the ultimate market value and volume demanded, with the production of Linear Alkyl Benzene (LAB) consuming the vast majority of the global output. Grade segmentation, defined by carbon chain length (C10-C13, C14-C17, etc.), is essential because different end-use sectors require very specific boiling ranges and molecular weights, directly influencing the utility and market price of the paraffin fraction. The manufacturing process segmentation highlights the reliance on advanced refining technologies necessary to achieve the high purity standards expected by the chemical industry.

The dominance of the LAB segment dictates the operational focus of major producers, emphasizing the efficient and cost-effective isolation of the C10 to C13 fractions. This requires significant investment in highly selective separation techniques like molecular sieves, optimized for recovering specific n-paraffin ranges from kerosene streams. The solvent application segment, while smaller in volume, often commands premium pricing due to the stringent purity requirements needed for specific industrial, cosmetic, or food-grade uses. Growth in this segment is tied to the expansion of industrial activities requiring low-aromatic, odorless, and chemically stable carrier solvents, particularly in pharmaceutical synthesis and specialized agricultural chemical formulation.

The remaining applications, including chlorinated paraffins and plasticizers, exhibit steady growth, driven by construction and infrastructure development which utilize these derivatives in PVC stabilization and flame-retardant coatings. Chlorinated paraffins (CPs), derived from normal paraffins, are widely used as secondary plasticizers and fire-retardants, though their market presence is increasingly scrutinized by environmental regulations concerning persistence and bioaccumulation, pushing producers towards specific, less toxic grades. The market dynamic is therefore characterized by volume-driven demand from the detergent industry and margin-driven opportunities in high-specification solvent markets and specialized chemical intermediaries, necessitating flexible production capabilities across the value chain.

- By Application:

- Linear Alkyl Benzene (LAB): Dominant segment driven by global surfactant demand for detergents and household cleaning products.

- Solvents: Includes high-purity, low-aromatic solvents used in industrial cleaning, paints, coatings, specialized extraction, and chemical reactions.

- Chlorinated Paraffins (CPs): Used as secondary plasticizers, flame retardants, and lubricants, essential in PVC products and metalworking fluids.

- Plasticizers: Direct use as plasticizer components, often blended with CPs, enhancing flexibility and durability of polymers.

- Others: Including applications in drilling fluids, aviation turbine fuels, synthetic waxes, and specialized chemical intermediates.

- By Grade (Carbon Chain Length):

- C10-C13: Primary feedstock for LAB production; highest volume and most critical segment.

- C14-C17: Used predominantly in specialized solvents, synthetic lubricant bases, and heavy-duty chlorinated paraffins.

- C18-C20: Utilized in microcrystalline waxes, high-melting-point blends, and specialized heavy solvents.

- Others (C20+ and specific narrow cuts): Niche applications requiring extremely high boiling points or specific crystalline structures.

- By Manufacturing Process:

- Kerosene Hydrotreating and Fractionation: Initial process step to remove impurities and obtain the suitable kerosene cut.

- Molecular Sieve Separation (Adsorption): The crucial technology for selective extraction of normal paraffins from iso-paraffins and aromatics; includes techniques like UOP Molex process.

Value Chain Analysis For Normal Paraffin Market

The value chain for the Normal Paraffin Market commences with the upstream segment, highly reliant on the exploration, drilling, and refining of crude oil. Normal paraffins are derived primarily from the middle distillate fraction, specifically kerosene or gas oil. Therefore, the upstream cost structure and availability are heavily influenced by global crude oil market dynamics and the output specifications of integrated refineries. Major international oil companies (IOCs) and national oil companies (NOCs) that operate large-scale, complex refineries capable of producing specific kerosene cuts suitable for paraffin extraction constitute the foundation of the supply chain. Efficiency in this stage is paramount, focusing on maximizing the desired middle distillate yield through optimized crude distillation and hydrotreating processes.

The midstream segment involves the specialized chemical processing where the actual isolation of normal paraffins occurs. This phase, dominated by proprietary technologies such as UOP's Molex process or similar molecular sieve adsorption systems, is highly capital intensive and technically sophisticated. Producers must ensure ultra-high purity (>99%) to meet the strict requirements of downstream chemical synthesis, particularly for LAB production. The distribution channel in this phase is predominantly bulk liquid logistics, involving specialized storage tanks, pipelines, and dedicated maritime tankers for inter-regional trade, given that production often occurs in oil-rich regions (MEA) while consumption is concentrated in manufacturing hubs (APAC).

The downstream segment includes the conversion of normal paraffins into derivative products. Direct distribution (B2B) involves large-volume sales to manufacturers of LAB, who further process it into LABS. Indirect distribution channels cater to smaller end-users, such as specialized solvent blenders, cosmetic manufacturers, and producers of chlorinated paraffins, often utilizing global chemical distributors and regional agents who handle smaller bulk quantities and specialized packaging. The profitability of the downstream market is driven by the sustained, non-cyclical demand for consumer cleaning products, securing a relatively stable end-market for the normal paraffin commodity. Upstream volatility, however, remains the primary risk transmitted through the entire chain.

Normal Paraffin Market Potential Customers

Potential customers for normal paraffins are predominantly large-scale chemical intermediate manufacturers that rely on high-purity feedstocks for synthesizing specialized commercial chemicals. The largest single group of buyers comprises producers of Linear Alkyl Benzene (LAB), who are vertically integrated chemical companies focused on detergent raw materials. These customers require continuous, high-volume supply of C10-C13 n-paraffins, and their purchasing decisions are centered on supply security, consistent quality specifications, and long-term contract pricing stability. Their global operations mean normal paraffin suppliers must meet diverse regulatory standards across multiple jurisdictions.

Another significant customer base includes specialty chemical manufacturers focusing on chlorinated paraffins (CPs). These customers convert n-paraffins into plasticizers and flame retardants primarily for the construction, automotive, and coatings industries. Their demand is generally tied to global infrastructure spending and polymer manufacturing output. Additionally, industrial users of specialized solvents—including companies in the aerospace, electronics, metalworking, and agricultural sectors—purchase normal paraffins directly for use as low-odor, low-aromatic cleaning, carrier, or diluent solvents. These customers emphasize high purity (low aromatics) and compliance with strict health and safety standards.

Furthermore, wax and lubricant manufacturers constitute a smaller but significant customer segment, utilizing heavier normal paraffin cuts (C18+) for producing synthetic waxes, base oils, and specific lubricant additives. The buying patterns in this segment prioritize technical specifications related to melting point, viscosity, and chemical stability. Overall, the market is characterized by a few extremely large, high-volume buyers (LAB producers) dictating market prices and a broader base of specialized customers requiring customized grades and reliable technical support from their normal paraffin suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, Sasol, Sinopec, CNPC, Chevron Phillips Chemical, ISU Chemical, Qatar Petroleum, Cepsa, Petresa, Arabian Petroleum Supply Company (APSCO), Formosa Petrochemical, Indian Oil Corporation (IOCL), Reliance Industries (RIL), PTT Global Chemical, Hindustan Petroleum Corporation Ltd. (HPCL), Nippon Oil (ENEOS), TotalEnergies, Petrobras, SIBUR |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Normal Paraffin Market Key Technology Landscape

The technological landscape of the Normal Paraffin Market is centered almost entirely around highly efficient and selective separation processes designed to isolate straight-chain hydrocarbons from complex refinery streams. The cornerstone technology remains Molecular Sieve Adsorption. Processes such as UOP’s Molex process and similar proprietary technologies employ specialized synthetic zeolites (molecular sieves) that selectively adsorb n-paraffin molecules based on their linear structure, allowing branched and cyclic hydrocarbons (iso-paraffins and aromatics) to pass through. This selectivity is crucial because downstream processes, particularly LAB synthesis, are highly sensitive to impurities, which can poison catalysts or degrade product quality. Continuous optimization of zeolite materials, focusing on pore size uniformity and regeneration efficiency, is a primary area of ongoing technological refinement.

Beyond separation, advancements in feedstock preparation are also critical. Modern refining techniques utilize sophisticated hydrotreating and fractionation methods (part of the Kerosene Hydrotreating process) to ensure the kerosene feedstock stream is clean, low in sulfur, and contains the optimal concentration of the desired carbon chain lengths (C10-C13 or C14-C17) before it enters the molecular sieve unit. Integrated refinery-petrochemical complexes leverage advanced process control systems, often utilizing digital twins and AI analytics, to fine-tune distillation curves and optimize the initial cut, maximizing the input efficiency for the subsequent paraffin separation stage. This integration minimizes utility consumption and waste generation, enhancing overall process economics.

A burgeoning technological development involves the exploration of alternative, non-petroleum feedstocks. Gas-to-Liquids (GTL) technology, which converts natural gas (methane) into liquid hydrocarbons, produces high-quality, ultra-pure synthetic paraffins with virtually no sulfur or aromatics, offering an alternative supply route decoupled from crude oil prices. While GTL requires substantial capital investment, the resulting n-paraffins are premium grade, suitable for high-specification solvent and lubricant applications. Furthermore, research into biomass-to-liquids (BTL) routes aims to provide a sustainable, bio-based normal paraffin substitute, addressing increasing regulatory and consumer pressure for renewable chemical feedstocks, although commercial scaling remains a significant technical and economic challenge.

Regional Highlights

The global Normal Paraffin Market exhibits significant regional disparities in both production capacity and consumption demand, heavily influenced by regional petrochemical investments, refining complexity, and urbanization rates, particularly in relation to detergent consumption. Asia Pacific dominates the market, acting as the global consumption engine, while the Middle East holds the strategic advantage in production capacity due to abundant, low-cost feedstock availability. These two regions collectively shape global trade flows and pricing mechanisms for normal paraffins, leading to intense competition among global suppliers to secure long-term contracts with major Asian chemical converters. North America and Europe, while representing mature markets, focus on specialized applications and compliance with rigorous environmental standards, driving demand for premium, high-purity grades.

The Middle East and Africa (MEA) region is critically important, largely due to Saudi Arabia, Qatar, and the UAE housing some of the world's largest, most technologically advanced integrated refineries and petrochemical complexes. These facilities are designed for large-scale, cost-efficient production of bulk chemicals, including high-purity normal paraffins, often exported to Asian markets. The strategic location of MEA facilitates efficient shipping lanes, positioning it as the central global production hub. Regional market growth is further supported by governmental initiatives aiming for economic diversification away from simple crude oil exports towards value-added chemical production. This investment ensures MEA remains the price setter for globally traded normal paraffin commodities.

Asia Pacific (APAC) accounts for the largest share of consumption globally, driven by the massive and expanding detergent industries in China, India, and Southeast Asia. The rapid urbanization and increasing per capita consumption of household goods in these nations translate directly into sustained, high demand for Linear Alkyl Benzene (LAB) and subsequent n-paraffin feedstock. While APAC has considerable indigenous production capacity, the region remains a net importer, supplementing local supply with cost-competitive imports from the MEA. Market dynamics in APAC are characterized by high price sensitivity and fierce competition among regional suppliers (like Sinopec, RIL, and IOCL) focused on volume and securing domestic market share against international giants.

- Asia Pacific (APAC): Dominates global consumption, fueled by explosive growth in detergent manufacturing driven by population and income expansion in China and India. APAC drives demand for C10-C13 grade paraffins.

- Middle East and Africa (MEA): A major net exporter and global production hub, capitalizing on low feedstock costs and large-scale, integrated petrochemical operations in countries like Saudi Arabia and Qatar. MEA dictates global supply trends.

- North America: Mature market characterized by stable, high-specification demand. Focuses heavily on solvent applications (low-aromatic grades) and specialized chemical intermediates, emphasizing regulatory compliance and supply security.

- Europe: Highly regulated market with a strong emphasis on sustainability and REACH compliance. Demand is stable, centered on premium, high-purity solvents and feedstocks for specialized chemical synthesis. Innovation is often geared toward bio-based paraffins.

- Latin America: Emerging market with increasing industrial activity and growing detergent consumption, particularly in Brazil and Mexico. Relies heavily on imports from MEA and North America, with localized production capacity focused mainly on meeting domestic LAB demand.

The North American market, though mature, showcases resilience driven by robust industrial sectors such as oil and gas (using specialized drilling fluid additives) and advanced manufacturing (requiring high-purity solvents for electronics and precision parts). Environmental regulations, particularly those enforced by the EPA, heavily influence the types of solvents used, favoring highly refined, low-aromatic normal paraffins over traditional organic solvents. This focus on environmental compatibility ensures continuous demand for premium grades, often procured via local production or specialized imports that guarantee specific quality certifications. Furthermore, the region is a leader in technological innovation in refining, seeking ways to improve energy efficiency within existing molecular sieve infrastructure to maintain cost competitiveness.

In Europe, the chemical industry’s stringent adherence to regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) mandates exceptionally high standards for purity and environmental safety. This regulatory landscape has encouraged European producers and importers to prioritize normal paraffins that minimize hazardous components. While overall consumption growth is slower compared to APAC, the stability of the industrial base—covering pharmaceuticals, automotive coatings, and advanced materials—ensures sustained demand for specific, narrow-cut paraffin grades used in specialized formulations and as reaction media. European companies are often at the forefront of research into sustainable sourcing, actively exploring and piloting bio-based alternatives to reduce dependence on fossil fuel feedstocks.

Latin America presents a mixed landscape. Brazil, Mexico, and Argentina are key consumers, driven by domestic detergent production and expanding industrial bases. However, refining complexity varies significantly, leading to a reliance on imported normal paraffins, particularly from the U.S. and MEA, to meet domestic LAB production needs. Investment in new, integrated refining facilities is underway in several countries to boost self-sufficiency, but logistical challenges and volatile economic conditions often impede rapid market expansion. The demand in this region is primarily volume-driven, concentrating on the basic C10-C13 grade, essential for foundational consumer goods manufacturing.

The MEA region, capitalizing on its vast, cost-advantageous crude reserves, continues to strategically expand its petrochemical footprint. Companies like SABIC, ADNOC, and Qatar Petroleum are building massive, world-class facilities designed for export, leveraging their low production costs to undercut competition globally. The focus here is on maximizing throughput and maintaining efficient global logistics networks. The growth strategy in MEA is not just about volume but also securing long-term supply agreements with multinational corporations operating globally, thereby institutionalizing the region's central role in the normal paraffin supply chain. The proximity to high-growth Asian markets further solidifies its dominant position in global trade patterns.

The interplay between these regions creates a complex global market structure: MEA provides the volume, APAC provides the demand pull, and North America/Europe provide the high-specification, premium market stability. Future growth is predicted to be disproportionately driven by Asian consumption, meaning global suppliers must continue to align their operational strategies—including capacity expansion and logistical deployments—to meet the specific needs and price sensitivities of the high-volume buyers in this continent. Furthermore, the global shift towards sustainability will increasingly challenge producers to implement cleaner manufacturing processes, even in high-volume production hubs.

Specifically within APAC, the South Korean and Japanese markets, though relatively mature, focus on high-quality chemical derivatives and advanced materials. Here, normal paraffins are often used in highly specialized applications, such as feedstocks for alpha olefins or synthetic lubricants, demanding purity levels exceeding basic detergent requirements. This differentiation in technical requirements means that suppliers targeting these mature Asian economies must provide highly consistent product quality and detailed technical support, rather than focusing solely on price competition, which is typical in bulk Chinese and Indian markets.

Furthermore, infrastructural investments across Southeast Asian nations (Vietnam, Indonesia, Thailand) are fostering decentralized manufacturing hubs, driving up local demand for LAB and solvents. These regional manufacturers seek localized or short-distance supply solutions to minimize transportation costs and regulatory hurdles associated with international shipping. This trend creates niche opportunities for smaller, regional refining and separation operations to serve localized markets effectively, mitigating the dominance of large global exporters. Consequently, the APAC market is fragmenting slightly into high-volume commodity segments and specialized high-ppurity niche applications.

The African continent, outside of the major oil-producing nations in the MEA sphere, is largely an emerging consumer market. As economies stabilize and urbanization accelerates, the demand for cleaning products and basic chemicals is forecast to rise sharply. While capacity building is slow, the long-term potential for market entry in consumer goods manufacturing is significant, presenting a future growth vector for exporters capable of navigating complex regional logistics and regulatory environments. This growth will initially be concentrated in countries with established ports and trade routes, such as South Africa, Nigeria, and Egypt, gradually expanding into inland markets.

In summary, while the market remains a global commodity sensitive to crude oil prices, its regional execution is highly differentiated. Production optimization remains the focus in MEA, volume sales and securing market share dominate APAC strategies, and technological refinement and compliance define the competitive landscape in Europe and North America. Successful market players must maintain flexible production facilities capable of meeting both high-volume commodity requirements and specialized high-purity niche demands, while simultaneously managing the geopolitical risks associated with international crude oil sourcing and transportation logistics across continents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Normal Paraffin Market.- ExxonMobil

- Shell

- Sasol

- Sinopec

- CNPC

- Chevron Phillips Chemical

- ISU Chemical

- Qatar Petroleum

- Cepsa

- Petresa

- Arabian Petroleum Supply Company (APSCO)

- Formosa Petrochemical

- Indian Oil Corporation (IOCL)

- Reliance Industries (RIL)

- PTT Global Chemical

- Hindustan Petroleum Corporation Ltd. (HPCL)

- Nippon Oil (ENEOS)

- TotalEnergies

- Petrobras

- SIBUR

Frequently Asked Questions

Analyze common user questions about the Normal Paraffin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of Normal Paraffin market growth?

The primary driver is the massive and sustained global demand for Linear Alkyl Benzene (LAB), which uses normal paraffin (C10-C13) as its key feedstock. LAB is essential for producing biodegradable surfactants (LABS) used extensively in the burgeoning household and industrial detergent industries, particularly across Asia Pacific.

How does the volatility of crude oil prices affect Normal Paraffin profitability?

Normal paraffins are derived from middle distillates (kerosene/gas oil), making the cost structure highly sensitive to crude oil price fluctuations. High volatility directly impacts raw material costs, leading to margin pressure for manufacturers, despite steady downstream demand for derivatives like LABS.

Which geographical region dominates the global production capacity of Normal Paraffin?

The Middle East and Africa (MEA) region, particularly countries like Saudi Arabia and Qatar, dominates global production capacity. This dominance is due to access to abundant, low-cost crude oil feedstock and large-scale, technologically advanced integrated petrochemical complexes optimized for high-volume export.

What are the key technological advancements influencing the Normal Paraffin industry?

Key advancements include continuous optimization of Molecular Sieve Adsorption technology (e.g., UOP Molex process) for achieving ultra-high purity (>99% n-paraffins), and the exploration of non-petroleum feedstocks through Gas-to-Liquids (GTL) synthesis to produce premium, low-aromatic grades.

Beyond detergents, what are the high-value applications for high-purity Normal Paraffins?

High-purity normal paraffins are critical in specialized applications such as low-aromatic solvents for industrial cleaning, electronics manufacturing, and precision engineering. They are also used as high-quality feedstocks for synthetic waxes, specialized lubricants, and chemical reaction media where low toxicity and chemical stability are required.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager