3D Printed Satellite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430111 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

3D Printed Satellite Market Size

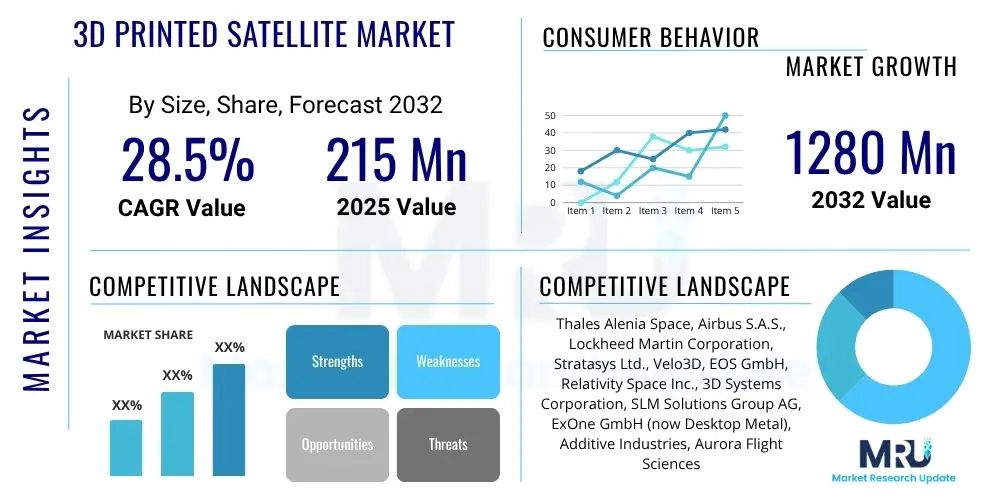

The 3D Printed Satellite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 215 Million in 2025 and is projected to reach USD 1280 Million by the end of the forecast period in 2032.

3D Printed Satellite Market introduction

The 3D Printed Satellite Market encompasses the design, manufacturing, and deployment of satellite components and entire small satellites using additive manufacturing technologies. This innovative approach revolutionizes traditional space manufacturing by offering unparalleled design flexibility, rapid prototyping capabilities, and significant cost reductions. Products range from structural components, propulsion system parts, and antenna arrays to complete CubeSats and micro-satellites, benefiting from complex geometries and optimized material usage not achievable with conventional methods. Major applications span Earth observation, telecommunications, scientific research, and defense, enabling more frequent and specialized missions for various stakeholders.

The primary benefits of integrating 3D printing into satellite production include a substantial reduction in manufacturing lead times, lower material waste, and the ability to produce highly customized and integrated structures. This allows for lighter satellites with enhanced performance and reduced launch costs, making space access more affordable and democratized. The driving factors behind this market expansion are the increasing demand for small satellites, the ongoing miniaturization of electronic components, advancements in additive manufacturing materials and processes, and the escalating need for rapid deployment of satellite constellations for diverse commercial and governmental applications.

3D Printed Satellite Market Executive Summary

The 3D Printed Satellite Market is experiencing robust growth, driven by technological advancements and the increasing demand for cost-effective and rapidly deployable space solutions. Business trends indicate a shift towards agile space manufacturing, with significant investments from both established aerospace giants and innovative startups. Companies are focusing on vertical integration, acquiring additive manufacturing capabilities, and forging partnerships to optimize the entire satellite production lifecycle. This includes the development of advanced materials specifically qualified for space environments and the standardization of 3D printing processes to meet rigorous aerospace certifications.

Regional trends show North America and Europe leading in terms of R&D investment and market adoption, fueled by robust space programs and a strong private space industry presence. Asia Pacific is emerging as a critical growth region, with countries like China, India, and Japan heavily investing in their domestic space capabilities and leveraging 3D printing for satellite development. This geographical expansion is further supported by government initiatives promoting space exploration and the establishment of new spaceports, which reduce launch complexities and costs. Latin America, the Middle East, and Africa are also showing nascent interest, particularly in leveraging small satellites for remote sensing and communication infrastructure development.

Segment trends highlight the dominance of metallic 3D printing for high-performance structural and propulsion components, while polymer-based additive manufacturing is gaining traction for less critical, lightweight elements and prototyping. The market is witnessing increased innovation in propulsion systems, optical components, and integrated electronic housings enabled by additive manufacturing. End-user segments, including commercial enterprises, government agencies, and defense organizations, are increasingly adopting 3D printed solutions to achieve shorter mission timelines, enhanced mission flexibility, and improved cost efficiencies across a wide spectrum of satellite applications.

AI Impact Analysis on 3D Printed Satellite Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally transform the design, manufacturing, and operational aspects of 3D printed satellites. Key themes revolve around the potential for AI to optimize design parameters for weight and performance, enhance manufacturing efficiency and quality control, and enable greater autonomy and intelligence in satellite operations. There is significant interest in AI's role in predictive maintenance, mission planning, and real-time data analysis, alongside concerns about data security, algorithmic bias in design, and the need for robust validation frameworks for AI-generated designs in critical space applications. Users expect AI to accelerate development cycles and improve reliability while seeking reassurance on the safety and regulatory implications of increasingly autonomous systems.

- AI driven generative design optimizes satellite structures for minimal weight and maximum strength, reducing material usage and improving performance.

- Predictive maintenance algorithms analyze sensor data from 3D printed components to forecast potential failures, enhancing satellite longevity and reliability.

- AI enabled quality control systems monitor the 3D printing process in real time, detecting anomalies and ensuring superior part integrity and consistency.

- Autonomous manufacturing cells leverage AI for adaptive process control, allowing for on demand, customizable production of satellite parts.

- Machine learning enhances material science research, accelerating the discovery and qualification of new additive manufacturing materials suitable for extreme space environments.

- AI assists in complex mission planning and orbital optimization for satellite constellations incorporating 3D printed components, improving efficiency and coverage.

- Advanced data analytics powered by AI processes telemetry from 3D printed satellites, providing deeper insights into in orbit performance and health.

DRO & Impact Forces Of 3D Printed Satellite Market

The 3D Printed Satellite Market is significantly influenced by a confluence of driving forces, inherent restraints, and emerging opportunities, all shaped by broader impact forces. Key drivers include the ever-growing demand for small satellites, enabling more frequent and cost-effective launches, coupled with the inherent advantages of additive manufacturing such as reduced lead times, design complexity, and lower component weight. The ability to rapidly iterate designs and produce customized parts for specific mission requirements provides a substantial competitive edge. Furthermore, the decreasing costs associated with 3D printing technologies and materials are making it an increasingly viable option for satellite manufacturers and operators alike, fostering innovation and market entry.

Despite the considerable advantages, the market faces several restraints. The qualification of 3D printed materials and components for the harsh space environment remains a significant challenge, requiring extensive testing and validation processes to ensure reliability and longevity. Regulatory hurdles and the lack of standardized certification protocols for additive manufactured space parts can slow down adoption. Furthermore, the limited availability of high-performance, space-grade materials suitable for 3D printing, combined with the specialized expertise required for operating advanced additive manufacturing equipment, present barriers to entry for some potential players. Intellectual property concerns surrounding digital designs also pose a complex restraint.

Opportunities in this market are abundant, particularly in the realm of in-orbit manufacturing and repair, which promises to revolutionize future space missions by reducing launch mass and enabling on-demand component fabrication. The market also presents significant potential for the development of highly integrated satellite systems with reduced parts count, leading to improved reliability and performance. Partnerships between traditional aerospace companies and additive manufacturing specialists, along with investments in research and development for new materials and processes, will unlock further growth. The development of next-generation satellite constellations and the expansion of commercial space exploration initiatives also represent major avenues for market expansion. Impact forces such as governmental space policies, increasing private sector investment in space, and rapid technological advancements in both additive manufacturing and miniaturized electronics will continue to shape the market trajectory.

Segmentation Analysis

The 3D Printed Satellite Market can be comprehensively segmented based on various critical attributes, including platform type, application, material, technology, and end-user. This multi-faceted segmentation provides a granular view of market dynamics, revealing specific growth pockets and demand patterns across different industry verticals. Understanding these segments is crucial for stakeholders to tailor their product offerings and strategic investments effectively within this evolving domain. Each segment reflects unique requirements and opportunities, driving specialized innovations in design, manufacturing processes, and material science to meet the specific needs of diverse space missions.

- By Platform Type

- CubeSat

- Micro-satellite

- Mini-satellite

- Small-satellite Constellations

- Others (e.g., components for larger satellites)

- By Application

- Earth Observation and Remote Sensing

- Telecommunication and Navigation

- Technology Development and Prototyping

- Scientific Research and Exploration

- Defense and Intelligence

- Commercial Communication

- By Material

- Metals (e.g., Titanium Alloys, Aluminum Alloys, Nickel Alloys)

- Polymers (e.g., PEEK, Ultem, ABS)

- Ceramics

- Composites

- By Technology

- Selective Laser Melting (SLM)

- Electron Beam Melting (EBM)

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- Binder Jetting

- Material Jetting

- By End-User

- Commercial Satellite Operators

- Government and Defense Organizations

- Academic and Research Institutions

- New Space Startups

Value Chain Analysis For 3D Printed Satellite Market

The value chain for the 3D Printed Satellite Market begins with robust upstream activities focused on research, design, and material development. This segment involves specialized software providers for generative design and simulation, material scientists developing advanced space-qualified alloys and polymers, and manufacturers of high-precision additive manufacturing equipment. Upstream players are critical in establishing the foundational capabilities for creating innovative and reliable satellite components, ensuring that raw materials and technologies meet stringent aerospace standards. Collaborations between material suppliers and 3D printing technology developers are vital for pushing the boundaries of what is possible in terms of performance and weight reduction.

Midstream activities primarily encompass the actual 3D printing and post-processing of satellite components or entire small satellite structures. This phase involves dedicated additive manufacturing service providers, in-house capabilities of aerospace prime contractors, and specialized component manufacturers. Quality control, testing, and certification for space flight are paramount at this stage, requiring sophisticated inspection techniques and adherence to rigorous industry standards. Downstream activities extend to the integration of 3D printed components into functional satellite systems, assembly, testing, and ultimately, launch services. Satellite integrators work closely with launch providers to ensure successful deployment and operation of the spacecraft.

Distribution channels in the 3D Printed Satellite Market are predominantly direct, characterized by close relationships between satellite manufacturers, service providers, and end-users such as government space agencies or commercial satellite operators. Original Equipment Manufacturers (OEMs) often leverage in-house additive manufacturing capabilities or partner directly with specialized 3D printing bureaus to produce custom components. Indirect channels may involve specialized distributors for certain 3D printing materials or equipment, but for complex, mission-critical satellite parts, direct engagement ensures stringent quality control and seamless integration. Strategic partnerships and long-term contracts are common, emphasizing the highly specialized and trust-dependent nature of this market.

3D Printed Satellite Market Potential Customers

The 3D Printed Satellite Market serves a diverse range of end-users and buyers, each with unique requirements and strategic objectives. Government space agencies, such as NASA, ESA, JAXA, and national defense departments, are significant customers, seeking to leverage 3D printing for scientific missions, reconnaissance, and rapid deployment of secure communication assets. Their demand is driven by the need for advanced capabilities, reduced costs for public-funded projects, and accelerated timelines for critical national security initiatives. These agencies often require high reliability, stringent qualification processes, and long operational lifetimes for their satellite systems, making the material science and certification aspects of 3D printing particularly important.

Commercial satellite operators form another substantial customer base, particularly those involved in developing large constellations for global broadband internet, Earth observation, and IoT connectivity. Companies like SpaceX (Starlink), OneWeb, and Planet Labs are constantly seeking ways to reduce the cost and manufacturing time per satellite, making 3D printing an attractive solution for mass production of standardized yet customizable components. Their focus is on scalability, cost-efficiency, and rapid iteration of designs to maintain a competitive edge and deploy services quickly. The ability of 3D printing to create lightweight, high-performance parts directly contributes to lower launch costs and improved operational economics for these commercial ventures.

Furthermore, academic and research institutions worldwide represent a growing segment of potential customers. These entities utilize 3D printed satellites, especially CubeSats, for educational purposes, technology demonstration missions, and cutting-edge scientific experiments in space. The lower cost and faster turnaround of 3D printed components enable more universities and research labs to participate in space exploration, fostering innovation and talent development. Finally, new space startups, characterized by agile development cycles and innovative business models, are significant adopters of 3D printing, leveraging it to rapidly prototype and launch novel satellite services with reduced initial capital investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 215 Million |

| Market Forecast in 2032 | USD 1280 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thales Alenia Space, Airbus S.A.S., Lockheed Martin Corporation, Stratasys Ltd., Velo3D, EOS GmbH, Relativity Space Inc., 3D Systems Corporation, SLM Solutions Group AG, ExOne GmbH (now Desktop Metal), Additive Industries, Aurora Flight Sciences (a Boeing Company), Materialise NV, Aerojet Rocketdyne (L3Harris Technologies), Launcher Inc., Space Systems Loral (SSL) (a Maxar company), NanoAvionics (a Konguchi Company), GomSpace A/S, OHB SE, Surrey Satellite Technology Ltd (SSTL) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printed Satellite Market Key Technology Landscape

The 3D Printed Satellite Market is fundamentally shaped by a dynamic and evolving technological landscape, driven by continuous innovation in additive manufacturing processes and materials science. Key technologies predominantly include various metal additive manufacturing techniques such as Selective Laser Melting (SLM) and Electron Beam Melting (EBM), which are crucial for producing high-strength, lightweight metallic components for structural elements, thrusters, and heat exchangers. These processes offer superior mechanical properties and the ability to create complex internal geometries that significantly reduce part count and enhance performance. Polymer-based additive manufacturing, particularly Fused Deposition Modeling (FDM) and Stereolithography (SLA), also plays a vital role for prototyping, non-critical components, and insulation, benefiting from lower costs and faster production cycles.

Beyond the core printing methods, advancements in materials are central to the market's growth. High-performance polymers like PEEK and Ultem are increasingly being qualified for space applications due to their high strength-to-weight ratio, chemical resistance, and thermal stability. For metallic components, new alloys of titanium, aluminum, and nickel are being developed specifically for additive manufacturing, optimized to withstand the extreme temperatures, vacuum, and radiation prevalent in space. These materials often undergo extensive post-processing, including heat treatments and surface finishing, to achieve the required aerospace-grade quality and performance. The integration of composite materials through advanced additive techniques is also an emerging area, promising even lighter and stronger components.

Furthermore, sophisticated software for design optimization, simulation, and process control is indispensable. Generative design tools powered by artificial intelligence enable engineers to automatically create optimized geometries for minimum weight and maximum efficiency. Advanced simulation software accurately predicts the behavior of 3D printed parts under space conditions, reducing the need for extensive physical prototyping. Real-time monitoring and feedback systems integrated into 3D printers enhance process reliability and ensure consistent quality, which is paramount for mission-critical satellite components. Post-processing technologies, including advanced machining, surface treatments, and non-destructive testing, further contribute to the robustness and reliability of 3D printed satellite parts, ensuring they meet the demanding specifications of the space environment.

Regional Highlights

- North America: Leads the global market in terms of investment, research and development, and adoption of 3D printed satellite technologies. The presence of major aerospace and defense contractors, a thriving new space economy, and significant government funding (e.g., NASA, DoD) drives innovation and market growth. The region benefits from a robust ecosystem of material suppliers, additive manufacturing equipment providers, and specialized service bureaus.

- Europe: A strong contender in the market, supported by initiatives from the European Space Agency (ESA) and national space programs. Countries like France, Germany, and the UK are actively investing in additive manufacturing for space applications, focusing on both research and industrial implementation. Academic institutions and leading aerospace companies are collaborating to advance material qualification and process standardization for 3D printed satellite components.

- Asia Pacific (APAC): Represents a rapidly expanding market, propelled by ambitious space programs in China, India, and Japan. These nations are heavily investing in indigenous satellite manufacturing capabilities and are keen to leverage 3D printing to reduce costs and accelerate their space exploration timelines. The region is witnessing a surge in government-backed projects and an increasing number of startups entering the space sector, creating substantial demand for additive manufactured satellite solutions.

- Latin America: An emerging market with growing interest in small satellite development for earth observation, communication, and climate monitoring. Countries like Brazil and Argentina are exploring 3D printing to develop cost-effective satellite components, often in collaboration with international partners and academic institutions. While nascent, the region presents opportunities for technology transfer and capacity building.

- Middle East and Africa (MEA): This region is gradually entering the space sector, with countries like the UAE and Saudi Arabia making significant investments in space infrastructure and satellite technology. The adoption of 3D printed satellite components is in its early stages but is expected to grow as these nations seek to develop independent space capabilities and diversify their economies, leveraging additive manufacturing for faster and more affordable satellite production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printed Satellite Market.- Thales Alenia Space

- Airbus S.A.S.

- Lockheed Martin Corporation

- Stratasys Ltd.

- Velo3D

- EOS GmbH

- Relativity Space Inc.

- 3D Systems Corporation

- SLM Solutions Group AG

- ExOne GmbH (now Desktop Metal)

- Additive Industries

- Aurora Flight Sciences (a Boeing Company)

- Materialise NV

- Aerojet Rocketdyne (L3Harris Technologies)

- Launcher Inc.

- Space Systems Loral (SSL) (a Maxar company)

- NanoAvionics (a Konguchi Company)

- GomSpace A/S

- OHB SE

- Surrey Satellite Technology Ltd (SSTL)

Frequently Asked Questions

What are the primary benefits of 3D printing for satellite manufacturing?

The primary benefits include significant cost reduction, accelerated production timelines, unparalleled design flexibility for complex geometries, reduced weight, and the ability to produce highly customized components tailored to specific mission requirements. This leads to more efficient and affordable access to space.

What materials are commonly used in 3D printed satellite components?

Commonly used materials include high-performance metallic alloys such as titanium, aluminum, and nickel for structural and propulsion parts, as well as advanced polymers like PEEK and Ultem for lightweight components, insulation, and prototyping. Research into ceramics and composites is also ongoing.

What challenges does the 3D Printed Satellite Market face?

Key challenges include the rigorous qualification and certification of 3D printed materials and components for the harsh space environment, the high cost of specialized additive manufacturing equipment, a lack of standardized testing protocols, and intellectual property concerns related to digital designs and production data.

How does 3D printing impact satellite launch costs?

3D printing significantly impacts launch costs by enabling the creation of lighter satellite structures and components. Reduced satellite mass directly translates to lower fuel consumption for launch vehicles or the ability to carry more payload per launch, thereby reducing the overall cost of placing satellites into orbit.

What is the future outlook for in-orbit manufacturing of 3D printed satellites?

In-orbit manufacturing represents a transformative future outlook. It promises to enable on-demand production, assembly, and repair of satellites directly in space, drastically reducing reliance on ground launches for replacements or upgrades, optimizing material transport, and facilitating sustained human presence in space.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager