5G Automotive Grade Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429182 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

5G Automotive Grade Product Market Size

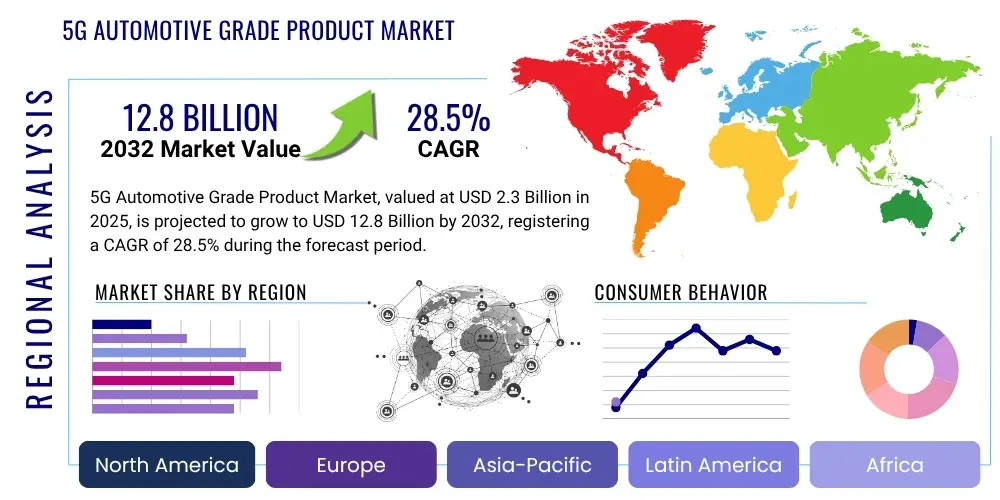

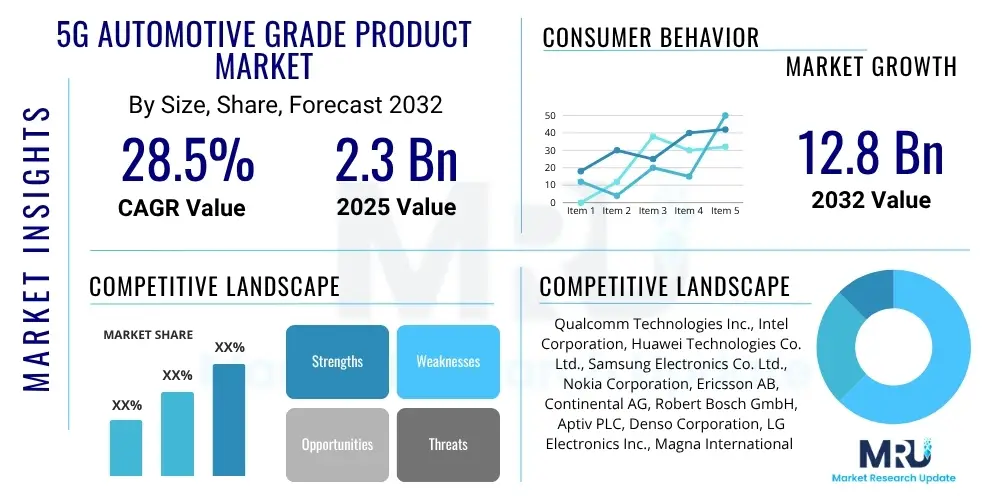

The 5G Automotive Grade Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at USD 2.3 Billion in 2025 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2032.

5G Automotive Grade Product Market introduction

The 5G Automotive Grade Product Market encompasses specialized hardware, software, and services designed to enable high-speed, low-latency, and ultra-reliable connectivity for vehicles. These products are crucial for advancing connected car features, autonomous driving capabilities, and enhanced in-car experiences. The core functionality revolves around providing robust communication links for Vehicle-to-Everything (V2X) interactions, including Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N), and Vehicle-to-Pedestrian (V2P) communications, alongside enabling complex data processing and real-time decision-making required by modern automotive systems.

Product descriptions typically include 5G cellular modules, advanced antenna systems, secure communication platforms, edge computing units, and sophisticated software stacks for telematics, infotainment, and critical safety applications. Major applications span from basic telematics and emergency call systems to highly advanced autonomous driving platforms that rely on continuous, high-bandwidth data exchange. The benefits derived from these products are substantial, including significantly improved road safety through real-time hazard warnings, optimized traffic flow, reduced emissions through intelligent routing, and the delivery of rich, personalized in-car infotainment and productivity services.

Key driving factors for market expansion include the escalating demand for connected vehicles globally, stringent government regulations promoting vehicular safety and efficiency, the rapid progression of autonomous driving technologies, and substantial investments in 5G infrastructure development by telecommunication providers. These elements collectively foster an environment conducive to the widespread adoption and integration of 5G automotive grade products into both passenger and commercial vehicles, positioning 5G as an indispensable foundation for the future of mobility.

5G Automotive Grade Product Market Executive Summary

The 5G Automotive Grade Product Market is experiencing dynamic growth, propelled by the relentless pursuit of enhanced vehicle connectivity and autonomy. Business trends indicate a strong move towards strategic collaborations between automotive OEMs, Tier 1 suppliers, and telecommunication companies, fostering an ecosystem essential for developing integrated 5G solutions. There is also a notable shift towards software-defined vehicles, where 5G connectivity is foundational for over-the-air (OTA) updates, new feature deployments, and enabling subscription-based services. Consolidation efforts and vertical integration are becoming prevalent as companies seek to gain a competitive edge and optimize their value chains.

Regional trends reveal Asia Pacific as a dominant market, primarily driven by large automotive manufacturing bases in countries like China, Japan, and South Korea, coupled with aggressive 5G rollout strategies. North America and Europe are also demonstrating robust growth, fueled by significant investments in autonomous vehicle research and development, stringent safety regulations, and a high consumer demand for advanced connected car features. Latin America, the Middle East, and Africa are emerging markets, with increasing urbanization and infrastructure development gradually paving the way for 5G automotive adoption, albeit at a slower pace compared to more developed regions.

Segment trends highlight telematics and infotainment as primary growth drivers, benefiting from increased consumer expectation for seamless digital experiences inside vehicles. The autonomous driving segment, while still nascent in widespread commercial deployment, represents the most significant long-term growth opportunity, with 5G playing a critical role in enabling its advanced sensing, decision-making, and communication capabilities. Vehicle-to-Everything (V2X) communication, particularly C-V2X based on 5G New Radio, is gaining traction as a crucial technology for improving road safety and traffic efficiency, with early deployments focused on specific smart city initiatives and dedicated highway corridors.

AI Impact Analysis on 5G Automotive Grade Product Market

User inquiries regarding AI's influence on the 5G Automotive Grade Product Market frequently center on how AI can augment autonomous driving systems, the implications for cybersecurity, methods for optimizing 5G network performance for automotive applications, and the potential for new, AI-driven in-car services. Key themes emerging from these questions include the expectation that AI will unlock higher levels of autonomy and improve predictive capabilities, while simultaneously raising concerns about the security vulnerabilities introduced by increasingly complex, interconnected systems. Users also seek clarity on how AI can ensure efficient and reliable 5G network slicing and quality of service for critical automotive functions, and envision a future where AI personalizes vehicle experiences and offers proactive support.

The integration of AI into 5G automotive products is transformative, enabling vehicles to process vast amounts of sensor data in real-time for improved perception, decision-making, and prediction in complex driving scenarios. AI algorithms enhance the capabilities of 5G connectivity by optimizing data flow, prioritizing critical safety communications, and managing network resources more efficiently, ensuring ultra-low latency and high reliability for autonomous functions. This synergy allows for more sophisticated V2X applications, where vehicles can intelligently communicate and coordinate with their surroundings to prevent accidents and improve traffic efficiency. Furthermore, AI contributes significantly to the development of proactive cybersecurity measures, identifying and mitigating threats in the highly dynamic and distributed automotive network environment.

Beyond safety and operational efficiency, AI powered by 5G facilitates the creation of highly personalized and intelligent in-car experiences. From adaptive infotainment systems that learn driver preferences to predictive maintenance alerts that anticipate component failures, AI enriches the user interaction with the vehicle. It also plays a crucial role in edge computing, processing data closer to the source to reduce latency and bandwidth strain, which is vital for time-sensitive autonomous driving tasks. The combined power of AI and 5G is not merely an incremental improvement but a foundational shift, paving the way for a new era of intelligent, connected, and truly autonomous mobility solutions that redefine safety, efficiency, and user experience.

- AI enhances autonomous driving through advanced sensor fusion and real-time decision-making.

- AI optimizes 5G network resource allocation for critical automotive applications like V2X.

- Predictive maintenance and personalized in-car experiences are driven by AI algorithms.

- AI supports cybersecurity by detecting and responding to anomalies in connected vehicle systems.

- Edge AI processes data locally, reducing latency for time-sensitive autonomous functions.

DRO & Impact Forces Of 5G Automotive Grade Product Market

The 5G Automotive Grade Product Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the impact forces shaping its trajectory. A primary driver is the accelerating demand for connected and autonomous vehicles, fueled by consumer desires for advanced safety features, enhanced infotainment, and increased convenience. Governments worldwide are also pushing for smart transportation initiatives and mandating advanced driver-assistance systems (ADAS), which necessitate robust 5G connectivity. Furthermore, growing concerns over road safety and the potential of 5G to enable real-time hazard detection and collision avoidance systems are significant market accelerators.

Despite these strong tailwinds, several restraints temper the market's growth. The high initial cost associated with deploying 5G infrastructure and integrating complex 5G modules into vehicles presents a substantial barrier for both manufacturers and consumers. Cybersecurity risks inherent in highly connected vehicles, where vulnerabilities could lead to severe consequences, demand continuous innovation and investment in robust security solutions. Regulatory complexities, differing standards across regions, and data privacy concerns create hurdles for global harmonization and widespread adoption. Additionally, the limited 5G coverage in many rural areas and some urban locales restricts the full potential and deployment of 5G-dependent automotive applications.

Opportunities for growth are abundant within this evolving landscape. The development of new business models, such as subscription-based services for connectivity, advanced features, and personalized experiences, presents new revenue streams for OEMs and service providers. Expanding into emerging markets, particularly in regions where automotive sales are growing rapidly and infrastructure is developing, offers significant untapped potential. Integration with smart city initiatives, where vehicles communicate seamlessly with urban infrastructure to optimize traffic flow, parking, and public safety, further broadens the scope for 5G automotive products. Moreover, continuous advancements in edge computing and artificial intelligence are enabling more powerful and efficient in-vehicle processing, reducing reliance on constant cloud connectivity for critical functions.

Segmentation Analysis

The 5G Automotive Grade Product Market is intricately segmented based on various factors including components, applications, vehicle types, and connectivity types, reflecting the diverse needs and technological nuances of the automotive industry. This segmentation provides a granular view of the market, allowing stakeholders to identify specific growth areas, understand competitive dynamics, and tailor their product development and market strategies. Each segment addresses distinct requirements, from the foundational hardware that enables connectivity to the sophisticated software platforms that manage vehicle functions and user experiences, demonstrating the comprehensive nature of the 5G automotive ecosystem.

Analyzing these segments helps to highlight the varying rates of adoption and technological maturity across different facets of the automotive market. For instance, while hardware components form the bedrock, the increasing complexity and reliance on software for features and updates underscore the growing importance of the software segment. Similarly, the diverse applications, from established telematics to rapidly evolving autonomous driving, illustrate the market's progression and future potential. Understanding these segmentations is critical for market participants to strategically position their offerings and capitalize on emerging trends within the connected and autonomous vehicle landscape.

- By Component

- Hardware (5G Modems, Antennas, RF Components, GNSS Modules)

- Software (Operating Systems, Communication Protocols, Application Software, Cybersecurity Software)

- Services (Connectivity Services, OTA Updates, Cloud Services, Telematics Services)

- By Application

- Telematics (eCall, Breakdown Call, Stolen Vehicle Tracking, Remote Diagnostics)

- Infotainment (Navigation, Streaming Media, In-car Wi-Fi, App Integration)

- Autonomous Driving (Sensor Data Transmission, Real-time Mapping, V2X for ADAS)

- V2X Communication (V2V, V2I, V2N, V2P)

- Others (Fleet Management, Predictive Maintenance)

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses, Vans)

- By Connectivity Type

- Dedicated Short Range Communications (DSRC)

- Cellular Vehicle-to-Everything (C-V2X) (4G LTE-V2X, 5G NR-V2X)

Value Chain Analysis For 5G Automotive Grade Product Market

The value chain for the 5G Automotive Grade Product Market is a complex network involving multiple tiers of suppliers, manufacturers, integrators, and service providers, all contributing to the final connected vehicle solution. The upstream segment primarily consists of semiconductor manufacturers and component suppliers who develop and produce the foundational technologies. This includes companies specializing in 5G chipsets, modems, RF components, advanced antennas, GNSS modules, and various sensors critical for automotive applications. These suppliers are pivotal, as their innovations in performance, efficiency, and miniaturization directly impact the capabilities and cost-effectiveness of the downstream products. Intellectual property and R&D prowess are key differentiators in this initial phase.

Moving downstream, the value chain progresses to Tier 1 automotive suppliers who integrate these components into larger, more complex systems and modules, such as telematics control units (TCUs), infotainment systems, and advanced driver-assistance systems (ADAS) platforms. These Tier 1 suppliers then deliver these integrated solutions to automotive original equipment manufacturers (OEMs). The OEMs assemble these components into their vehicles, often customizing software and user interfaces. Beyond the manufacturing aspect, telecommunication operators play a crucial role by providing the network infrastructure and connectivity services essential for the functioning of 5G-enabled vehicles, while software developers create the applications and platforms that leverage this connectivity.

Distribution channels for 5G automotive grade products are primarily direct, with component and module manufacturers selling directly to Tier 1 suppliers and OEMs through established supply agreements. Finished vehicles with integrated 5G capabilities are then sold to end-consumers through dealership networks. Indirect channels also exist, particularly in the aftermarket for upgrades or specific fleet management solutions, where specialized integrators or service providers might offer 5G connectivity solutions. Partnerships and collaborations across the value chain, from semiconductor companies to telecom providers and automotive OEMs, are increasingly common to ensure seamless integration, interoperability, and the delivery of comprehensive connected mobility solutions to the market.

5G Automotive Grade Product Market Potential Customers

The potential customers for 5G Automotive Grade Products span a wide array of stakeholders within the mobility ecosystem, representing both direct buyers and end-users who benefit from the integrated technologies. At the forefront are Automotive Original Equipment Manufacturers (OEMs), who are the primary integrators of these products into their new vehicle designs. These manufacturers demand robust, reliable, and scalable 5G solutions to power their next-generation connected and autonomous vehicles, differentiating their brands through advanced features, enhanced safety, and superior in-car experiences. Their purchasing decisions are heavily influenced by performance, cost-efficiency, regulatory compliance, and the ability to seamlessly integrate with their vehicle architectures.

Tier 1 automotive suppliers also represent a significant customer base. These companies purchase 5G components and modules from semiconductor and technology providers to develop and supply integrated systems, such as telematics control units, infotainment systems, and ADAS platforms, to OEMs. Fleet management companies and logistics operators are emerging as key customers, seeking 5G solutions to enhance operational efficiency, track assets in real-time, optimize routes, improve driver safety, and facilitate predictive maintenance across their commercial vehicle fleets. The reliability and low latency of 5G are crucial for these business-critical applications, enabling better resource utilization and cost savings.

Beyond traditional automotive players, public transport operators and smart city initiatives are increasingly exploring 5G automotive grade products to improve urban mobility, manage traffic congestion, and enhance public safety. Ride-sharing and mobility-as-a-service (MaaS) providers also stand to benefit significantly, leveraging 5G connectivity for real-time vehicle dispatch, dynamic routing, and personalized passenger services. Government agencies, particularly those involved in intelligent transportation systems and emergency services, are also potential buyers, deploying 5G-enabled vehicles and infrastructure to improve emergency response times, enforce traffic laws, and manage public safety incidents more effectively. These diverse customer segments underscore the broad applicability and transformative potential of 5G in shaping the future of transportation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.3 Billion |

| Market Forecast in 2032 | USD 12.8 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies Inc., Intel Corporation, Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Nokia Corporation, Ericsson AB, Continental AG, Robert Bosch GmbH, Aptiv PLC, Denso Corporation, LG Electronics Inc., Magna International Inc., Valeo SA, Harman International (Samsung subsidiary), NXP Semiconductors N.V., MediaTek Inc., Sierra Wireless Inc., Thales Group, Verizon Communications Inc., AT&T Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

5G Automotive Grade Product Market Key Technology Landscape

The 5G Automotive Grade Product Market is underpinned by a rapidly evolving technological landscape, where several innovations converge to enable advanced vehicle connectivity and intelligence. At its core is 5G New Radio (NR) technology, specifically designed to meet the ultra-low latency, high bandwidth, and massive connectivity requirements of automotive applications. 5G NR provides the foundation for enhanced Mobile Broadband (eMBB), Ultra-Reliable Low-Latency Communication (URLLC), and Massive Machine Type Communication (mMTC), all critical for different aspects of connected and autonomous driving. This includes support for direct communication between vehicles (sidelink), which is crucial for V2V and V2P safety applications, without relying solely on cellular infrastructure.

Another pivotal technology is Cellular Vehicle-to-Everything (C-V2X), which leverages cellular network technology for various V2X communication scenarios. While earlier iterations used 4G LTE-V2X, the advent of 5G NR-V2X significantly enhances its capabilities, supporting advanced safety features, efficient traffic management, and coordination among autonomous vehicles. Complementing this, edge computing plays a crucial role by bringing computational power and data storage closer to the vehicle. This reduces data transmission latency to the cloud, enabling real-time processing for critical autonomous driving functions, sensor fusion, and immediate decision-making, thereby improving both responsiveness and data privacy.

Artificial intelligence and machine learning (AI/ML) are deeply integrated across the automotive technology stack, from optimizing 5G network performance through intelligent resource allocation to powering advanced perception systems in autonomous vehicles. AI algorithms process vast amounts of sensor data, enabling vehicles to understand their environment, predict events, and make complex driving decisions. High-precision Global Navigation Satellite Systems (GNSS) are also vital, providing centimeter-level positioning accuracy essential for autonomous navigation and lane-keeping. Furthermore, robust cybersecurity solutions and Over-The-Air (OTA) update capabilities are indispensable for protecting sensitive vehicle data, ensuring system integrity, and enabling continuous feature enhancements and bug fixes throughout a vehicle's lifecycle, securing the long-term viability and trustworthiness of 5G automotive products.

Regional Highlights

- North America: This region is a significant market driven by strong research and development in autonomous driving technologies and a high adoption rate of connected cars. The United States and Canada are witnessing substantial investments in 5G infrastructure and smart city initiatives. Regulatory support for autonomous vehicle testing and deployment, coupled with a tech-savvy consumer base, propels market growth. Major automotive OEMs and technology companies are headquartered here, fostering innovation.

- Europe: Europe represents a mature market with stringent safety regulations and a strong emphasis on reducing road fatalities and emissions. Countries like Germany, France, and the UK are at the forefront of C-V2X deployments and vehicle electrification, which often go hand-in-hand with enhanced connectivity. The European Union's initiatives for connected and automated mobility significantly influence market development and standardization efforts.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for 5G automotive grade products, primarily due to the vast automotive manufacturing bases in China, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and aggressive 5G network rollouts are key drivers. China, in particular, leads in 5G deployments and has ambitious plans for autonomous mobility and smart transportation systems, making it a pivotal market.

- Latin America: This region is an emerging market, with growth driven by increasing vehicle production, particularly in Brazil and Mexico, and a rising demand for vehicle safety and security features. While 5G infrastructure is still developing, investments are increasing, paving the way for future adoption of connected car technologies. Government support for smart mobility solutions is crucial for market expansion.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, with countries in the GCC (Gulf Cooperation Council) actively investing in smart city projects and advanced infrastructure, including 5G. The demand for premium and technologically advanced vehicles, especially in urban centers, contributes to the market. Africa's market is nascent but holds long-term potential as connectivity and economic development improve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 5G Automotive Grade Product Market.- Qualcomm Technologies Inc.

- Intel Corporation

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Nokia Corporation

- Ericsson AB

- Continental AG

- Robert Bosch GmbH

- Aptiv PLC

- Denso Corporation

- LG Electronics Inc.

- Magna International Inc.

- Valeo SA

- Harman International (Samsung subsidiary)

- NXP Semiconductors N.V.

- MediaTek Inc.

- Sierra Wireless Inc.

- Thales Group

- Verizon Communications Inc.

- AT&T Inc.

Frequently Asked Questions

What are 5G automotive grade products?

5G automotive grade products are specialized hardware, software, and services designed to provide high-speed, ultra-low latency, and reliable 5G connectivity for vehicles, enabling advanced features like autonomous driving, V2X communication, and enhanced infotainment.

How does 5G impact autonomous driving?

5G is crucial for autonomous driving by providing the high bandwidth and low latency necessary for real-time sensor data exchange, V2X communication, cloud connectivity for AI processing, and over-the-air updates, enabling higher levels of vehicle autonomy and safety.

What are the main applications of 5G in vehicles?

The main applications include telematics for safety and diagnostics, advanced infotainment systems, enabling various levels of autonomous driving, and V2X communication for improved road safety and traffic efficiency.

What are the biggest challenges facing the 5G automotive market?

Key challenges include high deployment costs, cybersecurity risks for connected systems, fragmented regulatory landscapes, and ensuring ubiquitous 5G network coverage, which can hinder widespread adoption and full functionality.

Which regions are leading the adoption of 5G automotive technology?

Asia Pacific, particularly China, is leading in adoption and deployment due to significant investments in 5G infrastructure and automotive manufacturing. North America and Europe are also strong markets, driven by R&D in autonomous vehicles and stringent safety regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager