Abrasives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428295 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Abrasives Market Size

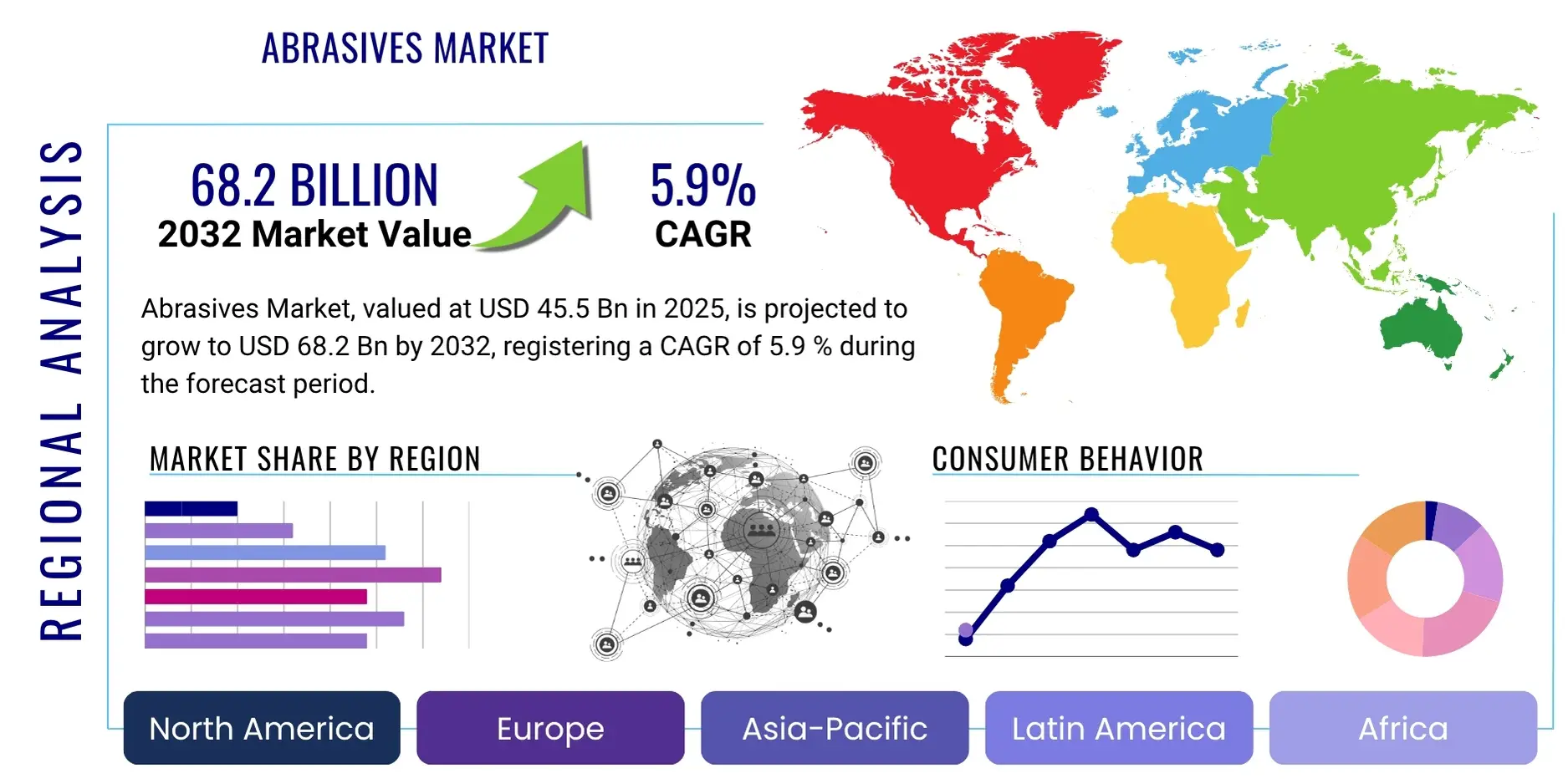

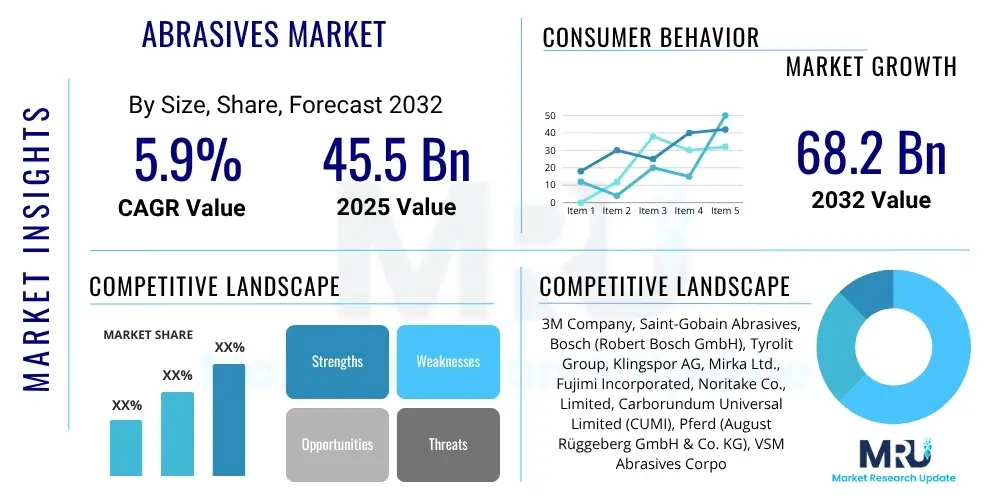

The Abrasives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% between 2025 and 2032. The market is estimated at USD 45.5 Billion in 2025 and is projected to reach USD 68.2 Billion by the end of the forecast period in 2032.

Abrasives Market introduction

The global abrasives market encompasses a diverse range of materials essential for shaping, grinding, polishing, and finishing operations across various industries. These materials, characterized by their hardness and sharp edges, facilitate the removal of unwanted material from workpieces, enabling precision and desired surface finishes. The market is broadly categorized into natural abrasives, such as garnet, emery, and corundum, and synthetic abrasives, including aluminum oxide, silicon carbide, boron carbide, industrial diamonds, and cubic boron nitride (CBN). The functional forms of abrasives range from bonded abrasives like grinding wheels and cutting discs, to coated abrasives such as sandpaper and abrasive belts, and loose abrasives used in lapping and polishing compounds. These products are indispensable in manufacturing processes, contributing significantly to product quality, operational efficiency, and material precision across a multitude of applications.

Major applications for abrasives span critical sectors including automotive, aerospace and defense, construction, electronics, medical devices, and metal fabrication. In the automotive industry, abrasives are vital for engine component manufacturing, body finishing, and brake system production. The aerospace sector relies on high-performance abrasives for turbine blade machining, structural component finishing, and surface preparation for coatings, ensuring the integrity and performance of critical parts. Construction activities utilize abrasives for cutting, grinding, and polishing concrete, stone, and various building materials. The electronics industry employs fine abrasives for wafer slicing, polishing semiconductor substrates, and micro-finishing of components, where micron-level precision is paramount. Medical device manufacturing leverages specialized abrasives for creating precise surgical instruments and implants, adhering to stringent surface finish requirements and biocompatibility standards.

The inherent benefits of abrasives include enhanced surface quality, improved dimensional accuracy, and significant operational efficiency in material removal processes. These advantages are crucial for modern manufacturing, which increasingly demands tight tolerances and superior finishes. The market's growth is primarily driven by accelerating industrialization across developing economies, sustained demand from the automotive and construction sectors, and the continuous evolution of advanced manufacturing techniques that require highly specialized abrasive solutions. Furthermore, the increasing adoption of automated and robotic grinding and polishing systems, which necessitate consistent and high-quality abrasives, is further propelling market expansion. Innovation in abrasive materials, particularly in superabrasives and engineered coatings, also plays a pivotal role in meeting the evolving performance demands of high-tech industries, ensuring the abrasives market remains a cornerstone of global industrial output.

Abrasives Market Executive Summary

The global abrasives market is currently experiencing robust growth, primarily fueled by prevailing business trends emphasizing automation, precision manufacturing, and sustainability. Manufacturers are increasingly investing in robotic abrasive systems and advanced machining centers to enhance efficiency, reduce labor costs, and achieve superior surface finishes, leading to a surge in demand for high-performance and specialized abrasives. Concurrently, there is a strong drive towards developing and utilizing environmentally friendly abrasive materials and production processes, including recyclable abrasives and energy-efficient manufacturing, in response to stricter environmental regulations and growing corporate social responsibility initiatives. The e-commerce channel is also gaining traction, particularly for smaller volumes and specialized products, offering greater accessibility and a wider product range to end-users globally. These business trends underscore a shift towards more intelligent, efficient, and responsible abrasive solutions.

Regional trends significantly influence the dynamics of the abrasives market. Asia-Pacific stands as the dominant region, driven by rapid industrialization, burgeoning automotive production, and massive infrastructure development projects, especially in countries like China and India. This region benefits from lower manufacturing costs and a large, expanding industrial base, making it a key hub for both production and consumption of abrasives. North America and Europe, while representing more mature markets, are characterized by a focus on innovation, high-performance abrasives for specialized applications in aerospace, medical, and advanced manufacturing sectors, and a strong emphasis on automation and sustainable practices. Latin America and the Middle East & Africa regions are experiencing steady growth, propelled by investments in construction, mining, oil & gas, and emerging manufacturing industries, creating new demand pockets for various abrasive products.

Segmentation trends within the abrasives market highlight distinct growth trajectories across different product types and materials. Superabrasives, including industrial diamonds and cubic boron nitride (CBN), are witnessing significant expansion due to their superior hardness, wear resistance, and efficiency in machining hard and advanced materials, making them indispensable in aerospace, automotive, and electronics. Coated abrasives are benefiting from their versatility and adaptability to a wide range of applications, from woodworking to metal finishing, driven by continuous innovation in backing materials and grain coatings. Bonded abrasives, traditionally used for heavy-duty grinding and cutting, continue to see demand from construction and general fabrication, with ongoing advancements focused on improved safety, durability, and cutting efficiency. The overall market is observing a trend towards application-specific solutions, with manufacturers developing customized abrasive products tailored to unique industry requirements and process optimization needs.

AI Impact Analysis on Abrasives Market

The integration of Artificial Intelligence (AI) is set to revolutionize various facets of the abrasives market, fundamentally transforming how abrasive products are designed, manufactured, applied, and optimized. Common user questions related to AI's impact often revolve around improvements in manufacturing efficiency, precision, quality control, predictive maintenance, and the development of novel abrasive materials. Users are keen to understand how AI can lead to more consistent product performance, reduce operational costs, and enable greater customization. The consensus among industry stakeholders is that AI will usher in an era of intelligent abrasive solutions, moving beyond traditional manual processes to data-driven, optimized, and highly responsive systems. This shift is expected to significantly enhance the value proposition of abrasive products and services throughout their lifecycle.

One of the most significant impacts of AI will be in enhancing manufacturing processes for abrasives. AI-powered systems can analyze vast datasets from production lines to optimize parameters such as sintering temperatures, bonding agent compositions, and grain size distribution, leading to more consistent and higher-performing abrasive tools. Furthermore, AI algorithms can be deployed for predictive maintenance of abrasive machinery, anticipating failures before they occur and minimizing costly downtime. This not only improves operational efficiency but also extends the lifespan of production equipment. By leveraging machine learning, manufacturers can fine-tune their processes to reduce material waste, improve energy efficiency, and produce abrasives with tighter specifications, thereby meeting the escalating demands for precision from end-user industries like aerospace and electronics.

Beyond manufacturing, AI's influence extends to quality control, product development, and supply chain management. AI-driven vision systems can perform real-time, high-speed inspection of abrasive products, identifying microscopic defects that might be missed by human operators, thus ensuring unparalleled quality and consistency. In research and development, AI can accelerate the discovery and formulation of new abrasive materials by simulating material properties and predicting performance characteristics, drastically shortening development cycles. For end-users, AI can offer personalized abrasive product recommendations based on specific application requirements, material types, and desired surface finishes, optimizing process outcomes and reducing trial-and-error. Moreover, AI's capability in demand forecasting and supply chain optimization will enable more efficient inventory management and timely delivery of abrasives, mitigating supply chain disruptions and enhancing overall market responsiveness.

- Predictive maintenance of abrasive tooling and machinery, reducing downtime.

- Optimized material formulation and manufacturing processes through data analytics.

- Automated, real-time quality control and defect detection systems.

- Personalized abrasive product recommendations based on application data.

- Enhanced supply chain management and demand forecasting for better inventory.

- Integration with robotics for automated grinding, polishing, and deburring.

- Accelerated R&D for novel abrasive materials and binders.

DRO & Impact Forces Of Abrasives Market

The abrasives market is shaped by a confluence of intricate drivers, formidable restraints, and promising opportunities, all subjected to various impactful forces. Key drivers propelling market expansion include the consistent growth of industrial sectors globally, particularly automotive production, which relies heavily on abrasives for manufacturing engine components, body parts, and brake systems. Escalating demand from the construction industry for cutting, grinding, and polishing a diverse array of building materials, alongside significant investments in infrastructure development, also acts as a primary growth catalyst. Furthermore, the burgeoning aerospace and defense sector, requiring high-performance and precision abrasives for critical component manufacturing, and the relentless evolution of advanced manufacturing techniques across industries are continuously generating new demand for sophisticated abrasive solutions. These factors collectively underpin the robust trajectory of the abrasives market.

However, the market also faces several significant restraints. Volatility in the prices of raw materials, such as bauxite for aluminum oxide and silicon carbide, directly impacts production costs and can lead to price instability for end products, affecting profitability. Stringent environmental regulations concerning waste disposal, dust emissions, and the use of certain chemicals in abrasive manufacturing processes impose compliance burdens and necessitate investment in greener technologies, which can increase operational expenses. Additionally, the emergence of alternative material removal technologies, such as laser cutting, waterjet cutting, and electro-chemical machining, presents competitive pressure, potentially limiting the growth of traditional abrasive applications. Health and safety concerns related to airborne particles and ergonomic risks associated with manual abrasive operations also compel industries to invest in protective measures and automation, adding to overall costs.

Despite these challenges, substantial opportunities exist for market players. Emerging economies in Asia-Pacific, Latin America, and Africa present vast untapped potential due to ongoing industrialization and urbanization, leading to increased demand for manufacturing and construction activities. The growing trend towards customization and specialized abrasive solutions, where manufacturers can develop tailored products for niche applications, offers lucrative avenues for market differentiation and premium pricing. The continuous advancements in superabrasives, offering superior performance for machining extremely hard and advanced materials, represent a high-growth segment. Moreover, the increasing integration of automation and robotics in industrial processes creates demand for abrasives optimized for automated systems, driving innovation in abrasive design and composition. Sustainable product development, including recyclable abrasives and eco-friendly manufacturing, also opens doors for market leadership and compliance with evolving global standards.

Segmentation Analysis

The abrasives market is comprehensively segmented to provide a granular understanding of its diverse landscape and facilitate targeted strategic planning. This segmentation typically involves categorizing the market based on several key attributes, including product type, material composition, application area, and the end-use industry. This multi-dimensional approach allows for a detailed analysis of market dynamics, growth drivers, and competitive landscapes within specific sub-markets, enabling manufacturers, distributors, and investors to identify high-potential segments and tailor their offerings accordingly. Understanding these segments is crucial for navigating the complexities of industrial demand, technological advancements, and regional specificities that characterize the global abrasives industry. The intricate interplay between these segments often dictates the pace of innovation and market penetration for both established players and new entrants.

By breaking down the market into its constituent segments, it becomes possible to observe varying growth rates, technological preferences, and purchasing behaviors across different industrial verticals. For instance, the demand for superabrasives in the automotive sector might differ significantly from the demand for coated abrasives in the woodworking industry. Similarly, the material choice for an abrasive application is often dictated by the workpiece material, desired finish, and operational efficiency requirements. This detailed segmentation not only helps in sizing and forecasting specific market niches but also aids in identifying unmet needs and emerging opportunities for product development and market expansion. Moreover, it assists in formulating effective marketing strategies, optimizing supply chains, and positioning products competitively within a highly diversified market.

- Type:

- Bonded Abrasives

- Coated Abrasives

- Superabrasives

- Loose Abrasives

- Material:

- Natural Abrasives (Garnet, Emery, Corundum, Quartz, Pumice, Diamond)

- Synthetic Abrasives (Aluminum Oxide, Silicon Carbide, Boron Carbide, Cubic Boron Nitride (CBN), Synthetic Diamond)

- Application:

- Grinding

- Polishing

- Cutting

- Blasting

- Honing

- Lapping

- Deburring

- Sanding

- End-Use Industry:

- Automotive

- Aerospace & Defense

- Construction

- Electronics & Semiconductor

- Medical Devices

- Metal Fabrication

- Woodworking

- Optics

- Energy

- Others

Value Chain Analysis For Abrasives Market

A comprehensive value chain analysis for the abrasives market typically begins with the upstream segment, which involves the sourcing and processing of various raw materials critical for abrasive manufacturing. This stage includes mining and refining bauxite for aluminum oxide, processing petroleum coke and silica for silicon carbide, extracting natural diamonds or synthesizing industrial diamonds, and sourcing other minerals like garnet, emery, and corundum. Key activities at this stage involve raw material extraction, purification, crushing, and initial grading to ensure the quality and consistency required for abrasive production. The efficiency and cost-effectiveness of this upstream segment significantly influence the overall production cost and quality of the final abrasive products. Disruptions in raw material supply chains, geopolitical factors, or fluctuations in commodity prices can directly impact the profitability and stability of abrasive manufacturers.

Moving downstream, the value chain encompasses the manufacturing processes where these raw materials are transformed into various abrasive products, followed by their distribution to end-users. Manufacturing involves complex processes such as fusion for synthetic abrasives, specialized bonding techniques for bonded wheels, coating technologies for abrasive belts and discs, and precision shaping for superabrasive tools. Post-manufacturing, products undergo rigorous quality control, packaging, and logistics planning. The distribution channel then plays a crucial role in delivering these products to a diverse customer base. This can involve direct sales channels, where manufacturers engage directly with large industrial clients, particularly for highly specialized or customized abrasive solutions. This direct approach allows for closer customer relationships, technical support, and tailored service offerings, which are vital for complex applications.

Alternatively, indirect distribution channels involve leveraging a network of distributors, wholesalers, and retailers to reach a broader market, including small and medium-sized enterprises (SMEs) and individual users. These intermediaries provide essential services such as warehousing, inventory management, regional market penetration, and local customer support. The choice between direct and indirect channels often depends on factors such as market size, customer segment, product complexity, and geographic reach. E-commerce platforms are also increasingly becoming a significant indirect channel, offering convenience and accessibility, especially for standardized or commodity abrasive products. The effectiveness of the entire value chain, from raw material sourcing to final product delivery and post-sales support, is paramount for competitive advantage, customer satisfaction, and sustainable growth within the dynamic abrasives market.

Abrasives Market Potential Customers

The abrasives market serves an incredibly broad and diverse base of potential customers, spanning nearly every manufacturing and construction sector globally. Essentially, any industry requiring precision material removal, surface conditioning, finishing, or shaping of materials is a potential buyer. Leading among these are sectors like automotive manufacturing, where abrasives are indispensable for machining engine blocks, camshafts, crankshafts, gears, and for painting preparation and polishing car bodies. The aerospace and defense industry represents another critical customer segment, demanding high-performance and superabrasives for turbine blade grinding, structural component finishing, and precision machining of high-strength alloys where component integrity and reliability are paramount.

Beyond these heavy industries, the construction sector is a major consumer, utilizing abrasives for cutting concrete, asphalt, stone, and tiles, as well as for grinding and polishing various surfaces in infrastructure projects and building construction. The electronics and semiconductor industry relies on ultra-fine and specialized abrasives for wafer slicing, lapping, and polishing, which are crucial steps in manufacturing microchips, circuit boards, and other electronic components with micron-level precision. Medical device manufacturers also form a significant customer base, requiring highly specialized abrasives for producing surgical instruments, implants, and prosthetics, where surface finish and biocompatibility are non-negotiable standards. Metal fabrication shops, from large-scale foundries to small workshops, continually purchase abrasives for cutting, deburring, grinding welds, and surface preparation of various metals.

Furthermore, woodworking industries use a wide array of coated abrasives for sanding, shaping, and finishing furniture, flooring, and other wood products. The optics industry employs precision abrasives for shaping and polishing lenses and mirrors. Even the energy sector, particularly in oil and gas for pipeline maintenance and in renewable energy for manufacturing components like wind turbine blades, relies on abrasive solutions. The diversity of these end-user industries underscores the fundamental and pervasive role that abrasives play in modern industrial processes, ensuring a sustained and evolving demand for innovative abrasive products tailored to specific application needs and performance requirements. The ongoing technological advancements in each of these sectors continually drive the need for more efficient, precise, and specialized abrasive solutions, solidifying the market's long-term growth potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 45.5 Billion |

| Market Forecast in 2032 | USD 68.2 Billion |

| Growth Rate | 5.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Saint-Gobain Abrasives, Bosch (Robert Bosch GmbH), Tyrolit Group, Klingspor AG, Mirka Ltd., Fujimi Incorporated, Noritake Co., Limited, Carborundum Universal Limited (CUMI), Pferd (August Rüggeberg GmbH & Co. KG), VSM Abrasives Corporation, Flexovit (Saint-Gobain Abrasives), Radiac Abrasives (Tyrolit Group), Deerfos Co., Ltd., Hermes Abrasives, Osborn International, SwatyComet (Tyrolit Group), Arc Abrasives Inc., Precision Grinding Wheel Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Abrasives Market Key Technology Landscape

The abrasives market is continuously evolving, driven by significant advancements in material science, manufacturing processes, and application techniques. A pivotal area of innovation lies in binder technology, which focuses on developing more robust, temperature-resistant, and application-specific bonding agents for bonded and coated abrasives. Researchers are exploring novel resin systems, ceramic matrices, and metallic binders that can withstand extreme grinding conditions, improve grain retention, and enhance cutting efficiency and tool life. These advancements are crucial for applications involving high-performance materials like superalloys, composites, and ceramics, where conventional abrasives may fall short. Furthermore, the optimization of grain morphology and crystal structure of abrasive grits, through advanced synthesis techniques and surface treatments, is enabling the creation of sharper, more durable, and self-sharpening abrasive particles that maintain cutting ability over extended periods.

Another critical technological frontier involves advanced coating processes and surface engineering of abrasive grains. Innovations in this area aim to modify the surface chemistry and physical properties of abrasive particles to reduce friction, prevent loading (clogging of the abrasive surface with workpiece material), and improve heat dissipation during grinding. Techniques such as PVD (Physical Vapor Deposition), CVD (Chemical Vapor Deposition), and electroplating are being employed to apply thin, hard, and lubricious coatings (e.g., titanium nitride, diamond-like carbon, or ceramic layers) to individual abrasive grains, significantly enhancing their performance in demanding applications. The integration of nanotechnology is also gaining traction, with nanomaterials being incorporated into abrasive formulations to improve strength, wear resistance, and cutting precision, particularly for ultra-fine finishing and polishing applications in the electronics and medical device industries.

Beyond material and grain technologies, automation and digital integration are reshaping the application landscape of abrasives. The development of intelligent abrasive systems, including robotic grinding and polishing cells equipped with force feedback sensors and vision systems, is allowing for unprecedented levels of precision, consistency, and efficiency. These automated systems require abrasives with highly consistent properties and predictable wear characteristics. Moreover, the adoption of 3D printing technologies for manufacturing specialized or custom-shaped abrasive tools is opening up new possibilities for complex geometries and application-specific designs that were previously unachievable with traditional manufacturing methods. Data analytics and simulation tools are also being increasingly used to optimize abrasive tool design, predict performance, and improve process parameters, leading to more efficient material removal and superior surface finishes across a wide range of industrial applications.

Regional Highlights

- North America: This region is characterized by a mature industrial base with a strong emphasis on advanced manufacturing, aerospace, automotive, and medical device sectors. The demand for high-performance and specialized abrasives, including superabrasives, is significant, driven by the need for precision engineering and automation. Research and development activities are robust, focusing on innovative abrasive materials and sustainable manufacturing practices. The market here benefits from substantial investments in R&D and a highly skilled workforce, leading to the adoption of sophisticated abrasive solutions.

- Europe: Similar to North America, Europe possesses a highly developed industrial landscape, particularly in precision engineering, automotive, machinery, and medical technology. The region is known for its stringent environmental regulations, which drive the demand for eco-friendly and sustainable abrasive products and processes. European manufacturers are leaders in developing advanced bonded and coated abrasives, with a focus on improving efficiency, tool life, and reducing energy consumption. Countries like Germany, Italy, and France are key contributors to market innovation and consumption.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market for abrasives, propelled by rapid industrialization, burgeoning automotive production, massive infrastructure development, and a booming electronics manufacturing sector. Countries like China, India, Japan, and South Korea are major consumers and producers of abrasives. The region benefits from lower manufacturing costs, a large consumer base, and significant government investments in industrial growth. The demand here spans across all types of abrasives, from commodity products to high-performance superabrasives for advanced applications.

- Latin America: This region is experiencing steady growth in its industrial sectors, including automotive, construction, mining, and metal fabrication. Increasing foreign investments and improving economic conditions are driving demand for abrasives. Brazil and Mexico are the leading markets, with significant automotive production and a growing manufacturing base. The market often seeks cost-effective and reliable abrasive solutions for general industrial applications, alongside increasing demand for more specialized products.

- Middle East and Africa (MEA): The MEA region is witnessing growth driven by substantial investments in infrastructure projects, oil & gas exploration and processing, mining, and diversification of its industrial base. The demand for abrasives primarily comes from construction, metal fabrication, and energy sectors. While still an emerging market for advanced abrasives, there is a growing trend towards adopting modern manufacturing techniques, which is expected to fuel future demand for higher-performance abrasive solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Abrasives Market.- 3M Company

- Saint-Gobain Abrasives

- Bosch (Robert Bosch GmbH)

- Tyrolit Group

- Klingspor AG

- Mirka Ltd.

- Fujimi Incorporated

- Noritake Co., Limited

- Carborundum Universal Limited (CUMI)

- Pferd (August Rüggeberg GmbH & Co. KG)

- VSM Abrasives Corporation

- Flexovit (Saint-Gobain Abrasives)

- Radiac Abrasives (Tyrolit Group)

- Deerfos Co., Ltd.

- Hermes Abrasives

- Osborn International

- SwatyComet (Tyrolit Group)

- Arc Abrasives Inc.

- Precision Grinding Wheel Co.

- Norton Abrasives (Saint-Gobain subsidiary)

Frequently Asked Questions

What are the main types of abrasives?

The main types of abrasives include bonded abrasives (like grinding wheels and cut-off discs), coated abrasives (such as sandpaper and belts), superabrasives (industrial diamonds and CBN), and loose abrasives (powders and slurries used for lapping and polishing).

Which industries are the primary consumers of abrasives?

Primary consumers of abrasives include the automotive, aerospace and defense, construction, electronics, medical devices, and metal fabrication industries. These sectors rely on abrasives for critical processes like shaping, grinding, polishing, and finishing.

How does sustainability impact the abrasives market?

Sustainability significantly impacts the abrasives market by driving demand for environmentally friendly materials, recyclable products, and energy-efficient manufacturing processes. This includes developing longer-lasting abrasives to reduce waste and utilizing eco-conscious bonding agents and production methods.

What is the role of superabrasives in modern manufacturing?

Superabrasives, such as industrial diamonds and cubic boron nitride (CBN), play a crucial role in modern manufacturing due to their extreme hardness and wear resistance. They are indispensable for precision machining of hard and advanced materials like ceramics, composites, and superalloys, delivering superior efficiency and surface finish.

How is technology shaping the future of abrasives?

Technology is shaping the future of abrasives through advancements in material science, AI integration, and automation. This involves developing improved binder systems, optimizing grain morphology, incorporating nanotechnology, and deploying AI-powered systems for process optimization, quality control, and robotic grinding, leading to higher precision and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Diamond Tools Market Size Report By Type (Abrasives Type, Diamond Sawing Tools, Diamond Drilling Tools, Diamond Cutting Tools, Others), By Application (Stone Processing Industry, Transportation Industry, Geological Prospecting Industry, Machining, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Abrasives Market Size Report By Type (Bonded Abrasives, Coated Abrasives, Super Abrasives), By Application (Automotive, Machinery, Metal Fabrication, Electrical & Electronics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Superhard Materials Market Size Report By Type (Synthetic Diamond, Cubic Boron Nitride), By Application (Stone and Construction, Abrasives Category, Composite Polycrystalline Tool, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Superabrasives Market Statistics 2025 Analysis By Application (Automotive, Aerospace and Defense, Building and Construction, Oil and Gas), By Type (Diamond Material, Cubic Boron Nitride Material, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sol-gel Alumina Abrasives Market Statistics 2025 Analysis By Application (Automotive, Machinery, Metal Fabrication, Electronics, Other), By Type (White SG Alumina Abrasives, Blue SG Alumina Abrasives), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager