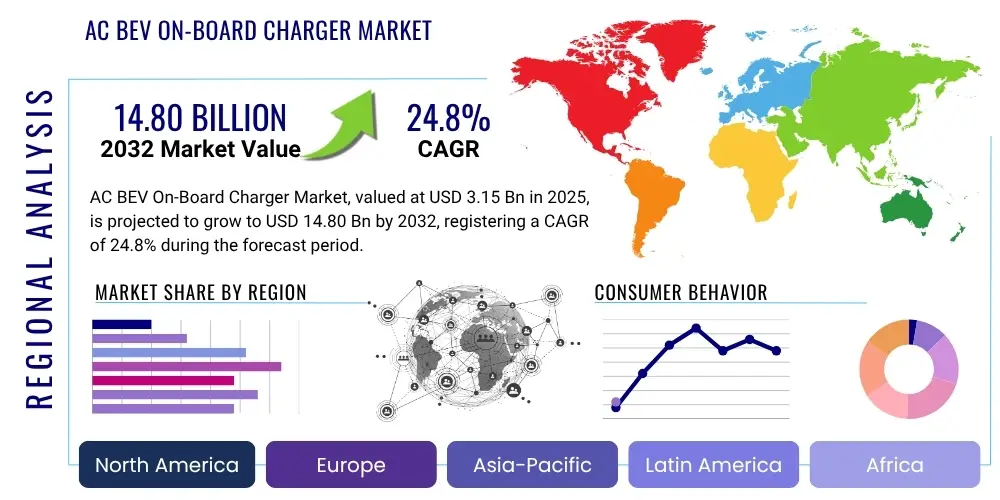

AC BEV On-Board Charger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430112 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

AC BEV On-Board Charger Market Size

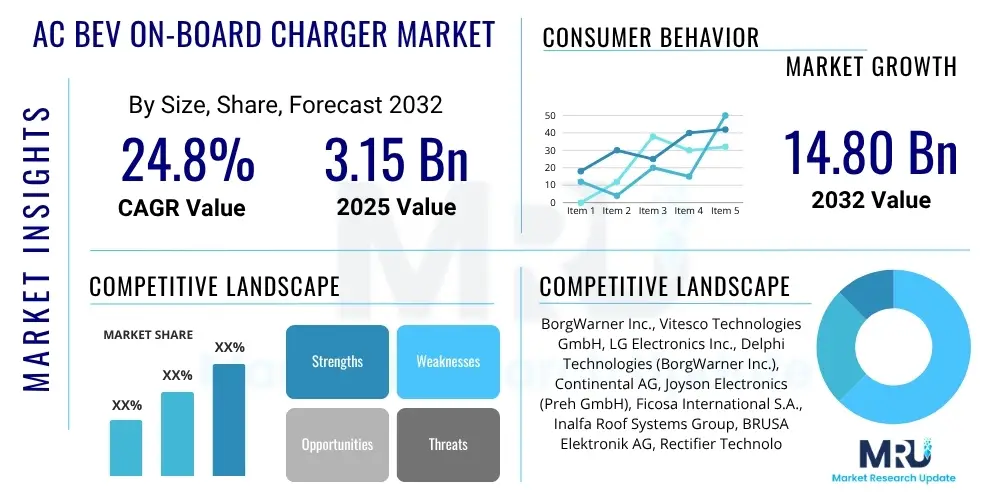

The AC BEV On-Board Charger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.8% between 2025 and 2032. The market is estimated at USD 3.15 Billion in 2025 and is projected to reach USD 14.80 Billion by the end of the forecast period in 2032.

AC BEV On-Board Charger Market introduction

The AC Battery Electric Vehicle (BEV) On-Board Charger (OBC) market is a critical component within the rapidly expanding electric vehicle ecosystem, forming the essential link between the conventional AC grid and a vehicle's high-voltage DC battery pack. An on-board charger is an electronic device integrated into an electric vehicle that converts alternating current (AC) supplied from a standard wall outlet or charging station into direct current (DC) that can be stored in the vehicle's battery. This conversion process is fundamental for the widespread adoption of BEVs, allowing users to conveniently charge their vehicles at home, workplaces, or public AC charging points, thus significantly enhancing the vehicle's utility and range without relying solely on specialized DC fast charging infrastructure.

The product, an AC BEV On-Board Charger, is characterized by its power conversion efficiency, compact design, thermal management capabilities, and adherence to various international charging standards such as SAE J1772, Type 2 (Mennekes), and GB/T. Its major applications span across all categories of battery electric vehicles, including passenger cars, light commercial vehicles, and increasingly, heavy-duty electric trucks and buses. These chargers are instrumental in enabling overnight charging, opportunity charging, and providing flexibility for drivers who may not have immediate access to high-power DC fast charging stations. The primary benefits include ubiquitous charging accessibility, reduced reliance on dedicated DC charging infrastructure, enhanced grid stability through smart charging capabilities, and the potential for Vehicle-to-Grid (V2G) or Vehicle-to-Load (V2L) functionalities, transforming EVs into mobile power units.

Several significant factors are currently driving the robust growth of the AC BEV On-Board Charger market. Foremost among these is the accelerating global adoption of electric vehicles, fueled by stringent emission regulations, increasing consumer awareness regarding environmental sustainability, and substantial government incentives in the form of subsidies, tax credits, and infrastructure investments. Additionally, advancements in battery technology, which enable greater energy density and faster charging acceptance, are spurring demand for more powerful and efficient OBCs. The expansion of AC charging infrastructure worldwide, coupled with the rising consumer expectation for convenient and versatile charging options, further solidifies the market's upward trajectory, making OBCs indispensable for the practical operation of BEVs.

AC BEV On-Board Charger Market Executive Summary

The AC BEV On-Board Charger market is experiencing dynamic growth driven by the global surge in electric vehicle adoption and the strategic emphasis on robust charging infrastructure. Business trends indicate a strong focus on enhancing power density, improving thermal management, and integrating advanced semiconductor technologies like Silicon Carbide (SiC) and Gallium Nitride (GaN) to achieve higher efficiency and more compact designs. Manufacturers are increasingly prioritizing modular and scalable OBC architectures to cater to diverse vehicle platforms and power requirements, while also incorporating smart charging capabilities to optimize grid interaction and support Vehicle-to-Grid (V2G) functionalities. Consolidation within the market, through strategic partnerships and mergers, is also a notable trend as companies aim to leverage economies of scale and expand technological expertise to offer comprehensive charging solutions.

Regional trends highlight Asia Pacific as the dominant market, primarily propelled by China's aggressive EV mandates, extensive manufacturing capabilities, and rapid deployment of charging infrastructure. European countries are witnessing substantial growth, driven by ambitious decarbonization goals, attractive consumer incentives, and a robust regulatory environment that encourages EV adoption and smart charging solutions. North America is also exhibiting significant expansion, bolstered by policy support, investments in charging networks, and increasing consumer interest in electric vehicles. Emerging markets in Latin America and the Middle East and Africa are beginning to show promise, albeit at an earlier stage of development, with nascent EV markets and growing awareness creating future growth opportunities for OBC manufacturers as charging infrastructure develops.

Segmentation trends reveal that higher power level OBCs, particularly those above 11 kW and 22 kW, are gaining significant traction due to increasing demand for faster AC charging capabilities in premium and long-range BEVs. By vehicle type, passenger BEVs continue to hold the largest market share, but the commercial BEV segment, encompassing electric buses, trucks, and delivery vans, is projected to exhibit the highest growth rate as fleet electrification efforts intensify globally. Technologically, the shift towards SiC and GaN based chargers is a critical development, offering superior performance over traditional silicon-based alternatives. Furthermore, the market is seeing increased adoption of bi-directional OBCs, underscoring the future potential for EVs to act as energy storage assets, which is a key area of innovation and investment across various segments.

AI Impact Analysis on AC BEV On-Board Charger Market

User inquiries regarding the impact of Artificial Intelligence on the AC BEV On-Board Charger market frequently revolve around how AI can enhance charging efficiency, optimize battery longevity, integrate with smart grids, improve predictive maintenance, and ensure cybersecurity for charging systems. The central themes emerging from these questions highlight user expectations for AI to deliver more intelligent, efficient, and reliable charging experiences. Consumers and industry stakeholders are keen to understand how AI algorithms can predict charging behavior, dynamically adjust power delivery, monitor battery health in real-time, and facilitate seamless communication between the EV, the charger, and the wider energy infrastructure. There is a strong anticipation that AI will transform OBCs from simple power converters into sophisticated, adaptive energy management units, addressing concerns about grid strain, charging costs, and the overall lifespan of expensive EV batteries, ultimately making electric vehicle ownership more attractive and sustainable.

- Smart Charging Algorithms: AI enables OBCs to learn user charging patterns, optimize charging schedules based on electricity tariffs, grid demand, and renewable energy availability, thereby reducing costs and minimizing grid impact.

- Predictive Battery Health Monitoring: AI algorithms analyze battery charging and discharging cycles, temperature, and voltage data to predict potential issues, recommend optimal charging strategies, and extend battery lifespan, directly managed by the OBC.

- Grid Integration and Optimization: AI facilitates intelligent communication between the OBC and the smart grid, allowing for dynamic load balancing, peak shaving, and active participation in Vehicle-to-Grid (V2G) services, turning EVs into grid assets.

- Enhanced Thermal Management: AI-driven control systems can precisely manage the thermal performance of OBC components, preventing overheating, improving efficiency, and ensuring the longevity and safety of the charger, even during high-power operations.

- Cybersecurity and Authentication: AI plays a crucial role in detecting unusual charging patterns or potential cyber threats, enhancing the security of charging sessions and protecting both the vehicle and the grid infrastructure from malicious attacks or unauthorized access.

- Personalized User Experience: AI can tailor charging recommendations and settings based on individual driver preferences, typical routes, and real-time energy requirements, offering a more intuitive and convenient charging experience.

DRO & Impact Forces Of AC BEV On-Board Charger Market

The AC BEV On-Board Charger market is profoundly influenced by a complex interplay of driving forces, inherent restraints, promising opportunities, and overarching impact forces that shape its growth trajectory. Key drivers include the exponential increase in global electric vehicle sales, fueled by growing environmental consciousness and supportive government policies aimed at reducing carbon emissions and transitioning to cleaner transportation. The continuous advancements in battery technology, enabling longer ranges and faster charging capabilities, inherently boost demand for sophisticated OBCs. Furthermore, the expanding global network of AC charging infrastructure, including public charging stations, workplace chargers, and home charging solutions, directly necessitates the integration of high-performance and reliable on-board charging systems in every BEV. Regulatory mandates for vehicle electrification and energy efficiency also play a pivotal role, compelling automotive manufacturers to incorporate advanced OBC technologies into their designs.

Despite the strong growth drivers, the market faces several significant restraints. The relatively high manufacturing cost of advanced OBCs, particularly those utilizing newer SiC and GaN technologies, can contribute to the overall cost of electric vehicles, potentially hindering broader consumer adoption in price-sensitive segments. Effective thermal management in compact, high-power density OBC designs presents a continuous engineering challenge, impacting performance and reliability if not adequately addressed. Moreover, the lack of universal standardization across different regions and vehicle types for charging protocols and connectors can create interoperability issues and slow down market penetration. Lastly, the increasing strain on existing electrical grids, particularly in regions with high EV adoption, poses a restraint, as the simultaneous charging of numerous vehicles can necessitate significant grid upgrades, indirectly affecting OBC deployment strategies and capacities.

Opportunities for growth in the AC BEV On-Board Charger market are abundant and diverse. The burgeoning potential of Vehicle-to-Grid (V2G) and Vehicle-to-Load (V2L) technologies represents a substantial opportunity, as OBCs are central to enabling EVs to act as distributed energy resources, feeding power back to the grid or powering external appliances. The integration of wireless charging technology with on-board chargers offers unparalleled convenience and opens up new avenues for charging infrastructure development. Furthermore, the expansion into emerging markets, where EV adoption is still in its nascent stages but poised for rapid growth, presents a fertile ground for OBC manufacturers. The ongoing technological evolution in power electronics, materials science, and software intelligence provides continuous opportunities for innovation, leading to more efficient, compact, and feature-rich OBC solutions that can cater to future demands and market niches.

Segmentation Analysis

The AC BEV On-Board Charger market is broadly segmented across several critical dimensions to provide a detailed understanding of its dynamics and growth prospects. These segmentation categories encompass various technical specifications, vehicle applications, and geographical regions, reflecting the diverse needs and technological advancements within the electric vehicle industry. Analyzing the market through these segments allows for a granular assessment of current trends, identifies specific growth drivers and challenges, and offers strategic insights for stakeholders, including manufacturers, suppliers, and policymakers. This comprehensive approach ensures that product development, market penetration strategies, and investment decisions are aligned with the evolving landscape of electric vehicle charging requirements globally.

- By Power Level:

Low Power (Up to 3.7 kW): Primarily used for Level 1 charging, offering basic, slow charging suitable for overnight domestic use or auxiliary charging where time is not critical. Often found in smaller urban BEVs or PHEVs.

Medium Power (3.7 kW to 11 kW): The most common segment for Level 2 AC charging, enabling faster charging suitable for homes, workplaces, and public charging stations, balancing speed and infrastructure requirements. Widely adopted across mainstream passenger BEVs.

High Power (Above 11 kW, including 22 kW): Gaining traction for premium and long-range BEVs, offering significantly reduced charging times at compatible AC charging stations, often supporting three-phase power, enhancing user convenience and fleet operational efficiency.

- By Vehicle Type:

Passenger BEVs: The largest segment, encompassing a wide range of electric cars, SUVs, and sedans. This segment drives innovation in compact, efficient, and cost-effective OBCs due to high production volumes and diverse consumer demands for charging convenience.

Commercial BEVs: Includes electric buses, trucks, vans, and other utility vehicles. This segment requires robust, high-power, and often rugged OBCs designed for demanding operational cycles, faster turnaround times, and fleet management integration, experiencing rapid growth.

- By Technology:

Silicon (Si) Based Chargers: Traditional technology, widely adopted due to its maturity and cost-effectiveness. Continues to be prevalent in lower and medium power OBCs, offering reliable performance with established manufacturing processes.

Silicon Carbide (SiC) Based Chargers: Advanced wide-bandgap semiconductor technology offering significantly higher efficiency, power density, and thermal performance compared to silicon. This segment is rapidly growing, especially in high-power OBCs for premium and performance BEVs, enabling smaller, lighter, and more efficient designs.

Gallium Nitride (GaN) Based Chargers: Emerging wide-bandgap technology, promising even higher switching frequencies and smaller form factors than SiC. Still in earlier stages of commercialization for OBCs but holds immense potential for ultra-compact and highly efficient next-generation charging solutions.

- By Charging Type:

Uni-directional Chargers: Standard OBCs that allow power to flow only from the AC grid to the vehicle battery. This is the predominant type currently, fulfilling the fundamental need for charging electric vehicles.

Bi-directional Chargers: Advanced OBCs that enable power flow in both directions, allowing the vehicle to charge its battery from the grid and discharge power back to the grid (V2G) or to external loads (V2L). This segment is a key growth area, leveraging EVs for grid stabilization and mobile power applications.

- By Region:

North America: Significant market with growing EV sales and infrastructure investments.

Europe: Strong regulatory push for EVs and advanced charging solutions, leading to rapid market expansion.

Asia Pacific (APAC): Dominant market, driven by China's extensive EV adoption and manufacturing base, along with growth in Japan, South Korea, and India.

Latin America: Emerging market with increasing interest in EVs and developing charging infrastructure.

Middle East & Africa (MEA): Nascent market with future growth potential as EV awareness and policies evolve.

Value Chain Analysis For AC BEV On-Board Charger Market

The value chain for the AC BEV On-Board Charger market is a complex ecosystem, beginning with upstream raw material and component suppliers, extending through manufacturing and assembly, and culminating in distribution and end-user integration. The upstream segment primarily involves the provision of critical raw materials such as copper for windings, aluminum for heatsinks, and various rare earth elements for magnetics, alongside sophisticated electronic components like semiconductors (Si, SiC, GaN diodes and MOSFETs), capacitors, inductors, transformers, microcontrollers, and communication chips. These specialized components are sourced from a global network of technology providers, forming the foundational layer of the OBC’s performance and efficiency. The quality and availability of these components directly impact the cost, reliability, and technical specifications of the final OBC product.

Midstream activities involve the design, development, and manufacturing of the OBC modules. This stage sees significant R&D investment in power electronics, thermal management solutions, and software integration for smart charging functionalities. Leading OBC manufacturers then assemble these components, integrating them into compact and robust units that meet stringent automotive standards for safety, electromagnetic compatibility (EMC), and environmental resilience. The downstream segment of the value chain focuses on the distribution and integration of these completed OBCs. Primarily, this involves direct sales and long-term supply agreements with electric vehicle manufacturers (OEMs), where OBCs are designed as an integral part of the vehicle's electrical architecture during the production phase. These OEM relationships are critical, often involving co-development to ensure seamless integration and optimal performance tailored to specific vehicle models.

Distribution channels for AC BEV On-Board Chargers are predominantly direct-to-OEM, constituting the major pathway for sales. This direct relationship ensures technical alignment, bulk purchasing, and streamlined logistics. However, indirect channels also exist, especially for aftermarket solutions, replacement parts, or specialized applications, where distributors and third-party integrators play a role. These indirect channels cater to fleet operators, independent repair shops, and potentially individual EV owners seeking upgrades or replacements, though this segment is comparatively smaller than the OEM market. The effectiveness of the distribution network is crucial for ensuring that OBCs reach the manufacturing lines efficiently and cost-effectively, supporting the rapid production demands of the expanding electric vehicle industry and facilitating widespread availability of charging solutions.

AC BEV On-Board Charger Market Potential Customers

The primary potential customers for AC BEV On-Board Chargers are multifaceted, reflecting the diverse applications and integration points within the electric vehicle ecosystem. At the forefront are electric vehicle manufacturers, commonly referred to as OEMs, who integrate OBCs as a fundamental component during the vehicle's design and assembly phase. These OEMs, ranging from established automotive giants to innovative EV startups, require high-performance, compact, and cost-effective OBCs that meet their specific vehicle architectures, power requirements, and brand standards. Their purchasing decisions are heavily influenced by factors such as efficiency, reliability, thermal management capabilities, compliance with international standards, and the supplier's ability to offer advanced features like bi-directional charging and smart grid integration. Long-term partnerships and co-development initiatives are common in this critical customer segment.

Beyond the direct OEM market, fleet operators represent another significant customer segment. Companies managing large fleets of electric vehicles, such as logistics companies, public transportation authorities, ride-sharing services, and corporate fleets, require durable and efficient OBCs that can withstand continuous heavy usage and integrate seamlessly with their fleet management and charging infrastructure. For these customers, factors like reliability, ease of maintenance, and the ability to optimize charging schedules to minimize operational costs are paramount. As fleet electrification accelerates globally, the demand from this segment for robust and intelligent OBC solutions is projected to grow substantially, driving further innovation in charger design and system integration capabilities to support high utilization rates.

Additionally, while not purchasing OBCs directly, public and private charging station developers, as well as energy management solution providers, indirectly influence the demand for OBCs. These entities build and operate the charging infrastructure that EVs utilize, thereby creating the environment where OBCs perform their function. Individual electric vehicle owners also represent a potential customer base, primarily through the aftermarket for replacement parts or upgrades, though the integrated nature of OBCs means direct purchases are less frequent than through OEMs. Ultimately, any entity involved in the production, deployment, or operation of Battery Electric Vehicles and their associated charging infrastructure is, directly or indirectly, a key stakeholder and potential customer within the AC BEV On-Board Charger market, necessitating a broad market approach for suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.15 Billion |

| Market Forecast in 2032 | USD 14.80 Billion |

| Growth Rate | 24.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BorgWarner Inc., Vitesco Technologies GmbH, LG Electronics Inc., Delphi Technologies (BorgWarner Inc.), Continental AG, Joyson Electronics (Preh GmbH), Ficosa International S.A., Inalfa Roof Systems Group, BRUSA Elektronik AG, Rectifier Technologies Ltd., Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Inc., STMicroelectronics N.V., ABB Ltd., Siemens AG, ChargePoint Inc., EVBox Group (ENGIE SA), Webasto Group, Eaton Corporation plc, Denso Corporation, Toyota Industries Corporation, Kemet Corporation, Vishay Intertechnology, Inc., Littelfuse, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AC BEV On-Board Charger Market Key Technology Landscape

The AC BEV On-Board Charger market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of higher efficiency, increased power density, reduced size and weight, and enhanced intelligence. At the core of this evolution are advancements in power semiconductor technologies. The transition from traditional silicon-based devices to wide-bandgap materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) is a pivotal development. SiC and GaN allow for significantly higher switching frequencies, leading to smaller magnetics (inductors and transformers), reduced energy losses, and ultimately more compact and lighter OBC designs with superior thermal performance. This shift is critical for meeting the space and weight constraints in modern electric vehicles while delivering higher power output.

Beyond semiconductor materials, other crucial technological innovations include sophisticated power converter topologies. Resonant converter designs, such as LLC resonant converters, are increasingly being adopted due to their ability to achieve high efficiency across a wide load range and reduce switching losses. Active Power Factor Correction (PFC) circuits are essential for drawing clean sinusoidal current from the grid, improving energy quality, and complying with stringent harmonic regulations. Advanced thermal management systems, incorporating liquid cooling or highly efficient heat sinks, are also paramount for handling the significant heat generated by high-power OBCs, ensuring reliability and longevity under various operating conditions and preventing performance degradation.

Furthermore, the integration of advanced control algorithms and communication protocols is transforming OBCs into smart, connected devices. Microcontrollers and digital signal processors (DSPs) with high processing power enable complex control strategies for optimal charging, battery management, and grid interaction. Communication interfaces such as CAN (Controller Area Network), Ethernet, and Power Line Communication (PLC) facilitate seamless data exchange between the OBC, the vehicle's Battery Management System (BMS), and external charging infrastructure, supporting features like smart charging, V2G functionality, and remote diagnostics. The ongoing development in these areas promises to deliver more intelligent, adaptable, and efficient AC BEV On-Board Chargers that are integral to the future of electric mobility and smart energy grids.

Regional Highlights

Asia Pacific (APAC): Dominates the global market, primarily driven by China's colossal EV market and ambitious government policies promoting electric vehicle adoption and extensive charging infrastructure development. Countries like South Korea and Japan also contribute significantly with robust automotive manufacturing and technological advancements in power electronics. India is emerging as a strong growth market with increasing focus on localized EV production and charging solutions, making it a key region for future market expansion.

Europe: Exhibits rapid growth fueled by stringent emission regulations, substantial government incentives, and a strong consumer preference for electric vehicles, particularly in countries like Germany, Norway, France, and the UK. The region is a leader in adopting advanced OBC technologies, including 22 kW three-phase chargers and bi-directional capabilities, supporting its ambitious decarbonization goals and smart grid initiatives.

North America: A significant and growing market, propelled by increasing EV sales in the United States and Canada, supportive federal and state-level policies, and considerable investments in building out a comprehensive charging infrastructure. The region is characterized by a strong demand for powerful and reliable OBCs, adapting to various grid standards and vehicle requirements, particularly for longer-range passenger BEVs and emerging commercial fleets.

Latin America: An emerging market for AC BEV On-Board Chargers, with nascent but accelerating EV adoption rates in countries such as Brazil and Mexico. Government initiatives to promote electric mobility are gradually taking shape, alongside increasing awareness among consumers and businesses. The region presents long-term growth opportunities as charging infrastructure develops and EV prices become more competitive, driving demand for fundamental charging solutions.

Middle East and Africa (MEA): Currently represents a smaller market share but holds considerable future potential, particularly in countries like UAE and Saudi Arabia that are investing in diversifying their economies and embracing sustainable technologies. Growth is expected to be gradual, influenced by government commitment to EV infrastructure development, supportive policies, and the expansion of smart city initiatives, gradually increasing demand for integrated OBC solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AC BEV On-Board Charger Market.- BorgWarner Inc.

- Vitesco Technologies GmbH

- LG Electronics Inc.

- Delphi Technologies (BorgWarner Inc.)

- Continental AG

- Joyson Electronics (Preh GmbH)

- Ficosa International S.A.

- Inalfa Roof Systems Group

- BRUSA Elektronik AG

- Rectifier Technologies Ltd.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments Inc.

- STMicroelectronics N.V.

- ABB Ltd.

- Siemens AG

- ChargePoint Inc.

- EVBox Group (ENGIE SA)

- Webasto Group

- Eaton Corporation plc

- Denso Corporation

- Toyota Industries Corporation

Frequently Asked Questions

What is an AC BEV On-Board Charger and how does it function?

An AC BEV On-Board Charger (OBC) is an electronic device integrated within an electric vehicle that converts alternating current (AC) electricity from the grid into direct current (DC) electricity to safely and efficiently charge the vehicle's high-voltage battery pack. It enables an EV to plug into standard AC outlets or public AC charging stations, making it a crucial component for widespread EV adoption by providing convenient and accessible charging options for various scenarios, including home and workplace charging.

How does an On-Board Charger differ from DC fast charging?

The key difference lies in the location of the AC-to-DC conversion. An On-Board Charger performs this conversion inside the vehicle using AC power input from the grid, typically at lower power levels (up to 22 kW) resulting in slower charging times. DC fast charging, conversely, converts AC to DC power within an external charging station, then delivers high-power DC directly to the vehicle's battery, bypassing the OBC entirely for significantly faster charging. OBCs are for Level 1 and Level 2 AC charging, while DC fast chargers are for Level 3 charging.

What are the primary factors driving the growth of the AC BEV On-Board Charger market?

The market is primarily driven by the escalating global sales of battery electric vehicles, stringent government regulations promoting vehicle electrification and carbon emission reduction, continuous technological advancements in battery energy density and charging acceptance, and the rapid expansion of AC charging infrastructure worldwide. Additionally, rising consumer demand for convenient and versatile charging solutions at home and in public spaces further fuels the market's robust growth trajectory, making OBCs indispensable for daily EV operation.

What role do Silicon Carbide (SiC) and Gallium Nitride (GaN) technologies play in modern OBCs?

SiC and GaN are wide-bandgap semiconductor materials that significantly improve OBC performance compared to traditional silicon. They enable higher switching frequencies, leading to smaller, lighter, and more compact charger designs, which are critical for limited space in EVs. These technologies also offer superior efficiency, reduced power losses, and enhanced thermal management capabilities, allowing for higher power density and faster charging without compromising reliability. Their adoption is vital for the next generation of high-performance and efficient on-board chargers.

What is the significance of bi-directional On-Board Chargers and their future impact?

Bi-directional On-Board Chargers represent a pivotal advancement, allowing power to flow both from the grid to the vehicle (charging) and from the vehicle back to the grid (Vehicle-to-Grid or V2G) or to power external devices (Vehicle-to-Load or V2L). This functionality transforms EVs into mobile energy storage units that can support grid stability, enable home energy backup, and generate revenue for owners. The future impact is profound, positioning EVs as integral components of smart grids and distributed energy systems, enhancing energy resilience and promoting renewable energy integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager