Accelerometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428056 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Accelerometer Market Size

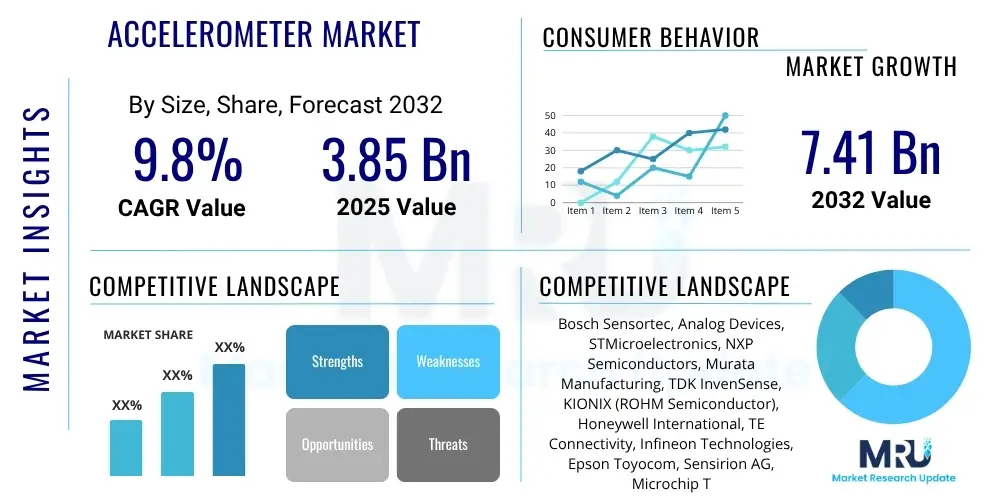

The Accelerometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at USD 3.85 Billion in 2025 and is projected to reach USD 7.41 Billion by the end of the forecast period in 2032.

Accelerometer Market introduction

The accelerometer market encompasses a broad range of sensor technologies designed to measure proper acceleration, which is the acceleration of a body in its own instantaneously comoving rest frame. These devices detect changes in velocity, vibration, tilt, and shock, making them indispensable components across numerous industries. Originally developed for navigation and industrial applications, modern accelerometers have evolved significantly, particularly with the advent of Micro-Electro-Mechanical Systems (MEMS) technology, leading to smaller, more cost-effective, and highly integrated solutions. Their core function involves sensing inertial forces, which are then converted into electrical signals for processing and interpretation, enabling a multitude of functionalities from orientation detection to impact sensing.

Major applications for accelerometers span diverse sectors. In consumer electronics, they are crucial for screen rotation, gaming controls, pedometers, and image stabilization in smartphones, tablets, and wearable devices. The automotive industry relies heavily on accelerometers for critical safety features such as airbag deployment systems, electronic stability control (ESC), anti-lock braking systems (ABS), and increasingly, for autonomous driving systems and in-vehicle infotainment. Industrial applications include machine health monitoring, structural health monitoring, robotics, and navigation systems for drones and industrial vehicles. The benefits of integrating accelerometers are extensive, offering enhanced safety, improved user experience, precise motion control, and sophisticated data collection capabilities that drive efficiency and innovation.

Several driving factors are propelling the growth of the accelerometer market. The ubiquitous penetration of smartphones and wearables, coupled with the escalating demand for advanced automotive safety features and the rapid adoption of IoT devices, are key contributors. Furthermore, the expansion of industrial automation, smart manufacturing initiatives, and the increasing complexity of aerospace and defense systems necessitate highly accurate and reliable acceleration sensing. Miniaturization, cost-effectiveness, and advancements in sensor fusion technologies also play a pivotal role, allowing accelerometers to be integrated into an ever-wider array of products and solutions, thereby expanding their market reach and application scope.

Accelerometer Market Executive Summary

The accelerometer market is experiencing robust growth, primarily driven by rapid advancements in MEMS technology and the proliferation of smart, connected devices across various end-use industries. Key business trends include an intensified focus on miniaturization, enhanced power efficiency, and the development of multi-axis sensing capabilities that can be easily integrated into complex systems. Companies are investing heavily in research and development to improve sensor accuracy, expand measurement ranges, and incorporate advanced features such as on-chip processing and sensor fusion algorithms. Strategic collaborations and partnerships between sensor manufacturers and system integrators are also becoming common, aiming to provide comprehensive solutions that address specific application needs, particularly in high-growth segments like autonomous vehicles and industrial IoT.

Regional trends indicate that Asia Pacific holds a dominant position in the accelerometer market, largely due to its strong manufacturing base for consumer electronics and automotive components, particularly in countries like China, Japan, and South Korea. This region also benefits from a burgeoning middle class and increasing disposable incomes, which fuel the demand for smart devices. North America and Europe are significant markets driven by innovation in automotive safety, aerospace & defense, and advanced industrial automation sectors. These regions are characterized by stringent regulatory standards and a strong emphasis on technological adoption, leading to continuous demand for high-performance and reliable accelerometer solutions. Emerging economies in Latin America, the Middle East, and Africa are showing promising growth, spurred by increasing urbanization, industrialization, and digital transformation initiatives.

Segmentation trends highlight distinct growth patterns across different product types, technologies, and end-use industries. MEMS accelerometers continue to dominate the market due to their small size, low cost, and high performance, making them ideal for consumer electronics and automotive applications. The automotive segment remains a primary revenue generator, with increasing demand for accelerometers in airbag systems, stability control, and advanced driver-assistance systems (ADAS). The industrial sector is also witnessing significant uptake, driven by predictive maintenance, robotics, and smart factory applications. Furthermore, the shift towards intelligent edge computing and the integration of AI-enabled sensor processing are poised to redefine market dynamics, leading to the development of more sophisticated and application-specific accelerometer solutions.

AI Impact Analysis on Accelerometer Market

Common user inquiries about AI's influence on the Accelerometer Market frequently revolve around how artificial intelligence can enhance sensor performance, enable smarter data interpretation, and unlock new application possibilities. Users are particularly interested in AI's role in improving the accuracy and reliability of accelerometer data by filtering noise, compensating for environmental factors, and performing predictive analytics. There is also a strong curiosity about how AI can facilitate advanced sensor fusion, allowing accelerometers to work more effectively with other sensors (e.g., gyroscopes, magnetometers) to provide more comprehensive environmental awareness. Expectations are high for AI to drive the development of truly autonomous systems that can make real-time decisions based on motion data, from self-driving cars to intelligent industrial robots, and to enable more personalized and predictive health monitoring in wearable devices, demonstrating a shift from raw data collection to actionable insights.

- Enhanced Data Processing: AI algorithms enable advanced filtering, noise reduction, and signal processing, leading to more accurate and reliable accelerometer data.

- Predictive Maintenance: Machine learning models analyze accelerometer vibration data to predict equipment failures, optimize maintenance schedules, and reduce downtime in industrial applications.

- Improved Sensor Fusion: AI facilitates seamless integration and interpretation of data from multiple sensors (including accelerometers), providing a more holistic understanding of motion and environment for applications like autonomous navigation.

- Autonomous System Decision-Making: AI allows systems (e.g., self-driving cars, drones, robots) to interpret complex motion patterns from accelerometers in real-time, enabling intelligent decision-making and precise control.

- Personalized Health Monitoring: AI analyzes accelerometer data from wearables to provide personalized insights into activity levels, sleep patterns, fall detection, and early detection of medical conditions.

- Contextual Awareness: AI helps accelerometers understand the context of motion, differentiating between various activities (walking, running, falling, sitting) with higher precision for smart homes and context-aware computing.

- Energy Efficiency: AI-driven algorithms can optimize accelerometer sampling rates and processing, reducing power consumption in battery-powered devices by only activating full functionality when relevant motion is detected.

DRO & Impact Forces Of Accelerometer Market

The Accelerometer Market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. Key drivers include the pervasive integration of accelerometers into consumer electronics such as smartphones, tablets, and smartwatches, where they enable critical functions like screen orientation, gesture recognition, and activity tracking. The automotive sector stands as another major catalyst, with accelerometers being fundamental to airbag deployment, electronic stability control, and emerging ADAS (Advanced Driver-Assistance Systems) and autonomous driving technologies. Furthermore, the rapid expansion of the Internet of Things (IoT) and industrial automation initiatives, which rely on precise motion sensing for predictive maintenance, robotics, and asset tracking, continues to fuel demand for these sensors. Miniaturization, coupled with continuous advancements in MEMS technology, has made accelerometers more compact, cost-effective, and suitable for a wider range of applications, further boosting market expansion.

However, the market also faces notable restraints. High initial investment costs associated with research, development, and advanced manufacturing processes for cutting-edge accelerometer technologies can be a barrier for smaller players. The complexity involved in integrating accelerometers into intricate electronic systems, especially in applications requiring high precision and reliability, poses technical challenges for designers and engineers. Moreover, the sensitivity of these devices to environmental factors such as temperature fluctuations, vibration noise, and electromagnetic interference necessitates sophisticated calibration and shielding, adding to the overall system cost and complexity. Data security and privacy concerns, particularly in applications collecting sensitive user motion data, also represent a growing challenge that manufacturers must address through robust security protocols and ethical data handling practices.

Despite these challenges, numerous opportunities are poised to drive future growth. The development of advanced sensor fusion techniques, leveraging AI and machine learning, allows accelerometers to combine data with other sensors for more accurate and comprehensive environmental perception, opening doors for enhanced navigation and autonomous capabilities. The ongoing exploration of new application areas, such as smart agriculture for precision farming, augmented and virtual reality (AR/VR) for immersive experiences, and sophisticated medical devices for patient monitoring and rehabilitation, presents significant untapped market potential. Innovations in energy harvesting solutions for accelerometers could also lead to self-powered or ultra-low-power devices, extending their utility in remote or long-term monitoring applications. The continuous evolution of semiconductor manufacturing processes, promising even greater miniaturization and integration, is expected to unlock further opportunities across diverse industries.

Segmentation Analysis

The accelerometer market is comprehensively segmented based on various critical parameters, including the type of accelerometer, the underlying technology, the end-use industry, the measurement range, and the number of axes. This granular segmentation helps in understanding the diverse applications and specific market dynamics relevant to each category. The dominance of MEMS technology, driven by its cost-effectiveness and compact size, contrasts with the high precision and ruggedness offered by piezoelectric and piezoresistive types for specialized applications. End-use industries such as automotive and consumer electronics account for the largest shares, while emerging sectors like healthcare and industrial IoT are demonstrating significant growth potential. Analyzing these segments provides a clear roadmap of where innovation and demand are concentrated across the global market landscape.

- By Type

- MEMS Accelerometer

- Piezoelectric Accelerometer

- Piezoresistive Accelerometer

- Capacitive Accelerometer

- Others (e.g., Thermal, Hall Effect)

- By Technology

- Closed-Loop Accelerometer

- Open-Loop Accelerometer

- By End-Use Industry

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Aerospace & Defense

- Oil & Gas

- Others (e.g., Marine, Agriculture)

- By Range

- Low-G Accelerometer (<100g)

- High-G Accelerometer (>100g)

- By Axis

- 1-Axis Accelerometer

- 2-Axis Accelerometer

- 3-Axis Accelerometer

Value Chain Analysis For Accelerometer Market

The value chain for the accelerometer market begins with upstream analysis, involving the raw material suppliers and component manufacturers. This segment includes suppliers of silicon wafers, specialized metals, polymers, and other semiconductor materials crucial for fabricating MEMS structures or piezoelectric elements. Foundries and fabrication plants that specialize in micro-fabrication processes, such as photolithography, etching, and deposition, are also key upstream players. These entities provide the foundational components and manufacturing capabilities that determine the quality, performance, and cost-effectiveness of the core accelerometer sensor. Innovation in material science and micro-manufacturing techniques at this stage directly impacts the downstream product development and market competitiveness, focusing on miniaturization, enhanced sensitivity, and power efficiency.

Moving downstream, the value chain encompasses sensor manufacturers who integrate these raw materials and components into functional accelerometer devices. These manufacturers are responsible for design, packaging, testing, and calibration of the sensors. They often develop proprietary algorithms and firmware to optimize sensor performance and integrate additional features like digital interfaces and signal conditioning. Further down the chain are module integrators and original equipment manufacturers (OEMs). These companies incorporate accelerometers into larger systems or end products, such as smartphones, automotive control units, industrial machinery, or medical devices. Their role involves selecting appropriate sensors, integrating them into complex electronic systems, and ensuring compatibility and performance within the final application, often requiring extensive software development and system-level validation.

The distribution channel for accelerometers is multifaceted, involving both direct and indirect sales approaches. Direct sales are common for large-volume OEM customers, particularly in the automotive and industrial sectors, where manufacturers establish direct relationships to provide technical support, customization, and long-term supply agreements. Indirect channels involve a network of distributors, value-added resellers (VARs), and online marketplaces. These channels cater to smaller businesses, academic institutions, and prototype developers, offering a wide range of standard products, technical documentation, and logistical support. The choice of distribution channel often depends on the customer's size, technical requirements, geographical location, and the volume of purchase, with a growing emphasis on efficient supply chain management and global reach to serve diverse customer bases effectively.

Accelerometer Market Potential Customers

The Accelerometer Market serves a diverse range of potential customers, primarily classified by their end-use industry. In the consumer electronics sector, key buyers include smartphone manufacturers, wearable device companies, gaming console developers, and tablet producers. These customers seek compact, low-power, and cost-effective accelerometers for features like screen rotation, gesture recognition, activity tracking, and immersive gaming experiences. Their demand is often driven by evolving consumer preferences for advanced functionalities and sleek designs, pushing accelerometer manufacturers to innovate in terms of size, accuracy, and integration capabilities for mass-market applications.

Another significant customer base resides within the automotive industry, encompassing major car manufacturers, Tier 1 suppliers of automotive components, and developers of autonomous driving systems. For these customers, accelerometers are critical for safety applications such as airbag deployment systems, electronic stability control (ESC), anti-lock braking systems (ABS), and advanced driver-assistance systems (ADAS) like adaptive cruise control and lane keeping assist. Reliability, robustness, and compliance with stringent automotive industry standards (e.g., AEC-Q100) are paramount, as sensor failures can have severe consequences, driving demand for high-performance and resilient sensor solutions.

Beyond consumer and automotive, industrial customers form a substantial segment. This includes manufacturers of industrial machinery, robotics companies, drone producers, and smart factory solution providers. Accelerometers are utilized here for machine health monitoring, structural integrity assessments, precise motion control in robotics, and navigation for unmanned aerial and ground vehicles. In the healthcare sector, potential customers include medical device manufacturers developing remote patient monitoring systems, fall detection devices for the elderly, and rehabilitation equipment. The aerospace & defense sector also represents a high-value customer group, requiring accelerometers for inertial navigation systems, missile guidance, flight control, and satellite stabilization, where extreme precision, reliability, and performance in harsh environments are critical considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.85 Billion |

| Market Forecast in 2032 | USD 7.41 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Sensortec, Analog Devices, STMicroelectronics, NXP Semiconductors, Murata Manufacturing, TDK InvenSense, KIONIX (ROHM Semiconductor), Honeywell International, TE Connectivity, Infineon Technologies, Epson Toyocom, Sensirion AG, Microchip Technology, Texas Instruments, Maxim Integrated, Memsic Inc., VTI Technologies (Murata), PCB Piezotronics, Colibrys SA, Imec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accelerometer Market Key Technology Landscape

The accelerometer market is dominated by Micro-Electro-Mechanical Systems (MEMS) technology, which revolutionized the sensor industry by enabling the creation of extremely small, highly integrated, and cost-effective sensors. MEMS accelerometers leverage micro-fabrication techniques to create microscopic mechanical structures, such as cantilever beams or proof masses, that deflect under acceleration. This deflection is then converted into an electrical signal, typically through capacitive, piezoresistive, or piezoelectric sensing mechanisms. The inherent advantages of MEMS, including low power consumption, high shock resistance, and the ability to integrate multiple axes on a single chip, make them ideal for mass-market applications like consumer electronics and automotive safety systems. Continuous innovation in MEMS manufacturing processes focuses on further miniaturization, improved noise performance, and enhanced long-term stability.

Beyond MEMS, other significant technologies include piezoelectric accelerometers and piezoresistive accelerometers, each catering to specific niche applications. Piezoelectric accelerometers utilize crystals that generate an electrical charge when subjected to mechanical stress from acceleration. These are often favored for high-frequency vibration measurement and industrial condition monitoring due to their wide frequency response and excellent linearity, especially in harsh environments. Piezoresistive accelerometers, on the other hand, measure acceleration by detecting changes in electrical resistance within a semiconductor material or strain gauge when mechanical stress is applied. They are known for their robust performance in high-shock applications and their ability to measure static acceleration, making them suitable for crash testing and industrial machinery monitoring where durability is key.

The technological landscape is also rapidly evolving with advancements in sensor fusion and integrated smart features. Modern accelerometers are increasingly being bundled with gyroscopes and magnetometers into multi-sensor modules, enabling sophisticated 9-axis or 6-axis motion tracking capabilities. This integration, often coupled with on-chip processing and advanced algorithms, allows for more accurate orientation detection, dead reckoning, and environmental awareness, critical for applications in robotics, drones, and virtual reality. Furthermore, the incorporation of artificial intelligence and machine learning at the edge is enhancing accelerometer capabilities by enabling smarter data interpretation, predictive analytics, and contextual awareness directly within the sensor, reducing data latency and improving system efficiency. These technological shifts are driving the development of more intelligent, autonomous, and versatile accelerometer solutions.

Regional Highlights

- North America: A mature market driven by high adoption of advanced automotive safety systems, aerospace and defense applications, and a strong presence of R&D for industrial automation and IoT. The U.S. leads in innovation and technology adoption.

- Europe: Characterized by stringent automotive safety regulations and significant investments in industrial IoT and Industry 4.0 initiatives. Germany, France, and the UK are key contributors, focusing on high-precision and robust sensor solutions.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by massive manufacturing bases for consumer electronics (China, South Korea, Japan) and rapid expansion of the automotive industry. Increasing disposable income and urbanization further fuel demand for smart devices.

- Latin America: An emerging market with growing industrialization and increasing adoption of smartphones and connected devices. Brazil and Mexico are leading the regional growth, particularly in automotive manufacturing and electronics assembly.

- Middle East and Africa (MEA): Demonstrating steady growth, primarily driven by investments in smart city projects, industrial infrastructure development, and increasing penetration of consumer electronics. UAE and Saudi Arabia are key markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accelerometer Market.- Bosch Sensortec

- Analog Devices

- STMicroelectronics

- NXP Semiconductors

- Murata Manufacturing

- TDK InvenSense

- KIONIX (ROHM Semiconductor)

- Honeywell International

- TE Connectivity

- Infineon Technologies

- Epson Toyocom

- Sensirion AG

- Microchip Technology

- Texas Instruments

- Maxim Integrated

- Memsic Inc.

- VTI Technologies (Murata)

- PCB Piezotronics

- Colibrys SA

- Imec

Frequently Asked Questions

Analyze common user questions about the Accelerometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an accelerometer and how does it work?

An accelerometer is a device that measures proper acceleration, which is the acceleration it experiences relative to freefall. It works by sensing inertial forces on a proof mass. When the device accelerates, the proof mass moves relative to a reference frame, and this displacement is converted into an electrical signal, typically through capacitive, piezoresistive, or piezoelectric means. This signal is then processed to provide data on motion, vibration, tilt, or shock.

What are the primary applications of accelerometers?

Accelerometers are extensively used across various sectors. In consumer electronics, they enable screen rotation, gesture control, and activity tracking in smartphones, wearables, and gaming. In automotive, they are crucial for airbag deployment, electronic stability control, and ADAS. Industrially, they support machine health monitoring, robotics, and navigation. Other key applications include aerospace & defense for guidance systems, and healthcare for patient monitoring and fall detection.

What types of accelerometers are most common in the market?

The most common type is the MEMS (Micro-Electro-Mechanical Systems) accelerometer due to its small size, low cost, and high integration capabilities, making it ideal for consumer and automotive applications. Other types include piezoelectric accelerometers, known for high-frequency vibration measurements in industrial settings, and piezoresistive accelerometers, valued for their robustness in high-shock environments like crash testing.

How is AI impacting the accelerometer market?

AI significantly enhances accelerometer performance by enabling advanced data processing for noise reduction and predictive analytics. It facilitates improved sensor fusion, combining accelerometer data with other sensors for more comprehensive environmental awareness. AI also drives decision-making in autonomous systems and allows for personalized health monitoring by interpreting complex motion patterns from wearables, transforming raw data into actionable insights.

What factors are driving the growth of the accelerometer market?

Key growth drivers include the widespread adoption of accelerometers in consumer electronics like smartphones and wearables, increasing demand for advanced safety features in the automotive sector (e.g., ADAS and autonomous driving), and the rapid expansion of IoT and industrial automation initiatives requiring precise motion sensing. Miniaturization, cost-effectiveness, and continuous technological advancements in MEMS also play a crucial role in market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Accelerometer Based Digital Pen Market Size Report By Type (Handwriting, Scanning), By Application (Billing and Back Office, Clinical Documentation, Communication, Education, Media and Entertainment, Retail, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- VR Sensor Market Statistics 2025 Analysis By Application (VR Headsets, VR Playstation, Others), By Type (Accelerometer Sensor, Gyroscope Sensor, Magnetometer Sensor, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Capacitive Accelerometer Market Statistics 2025 Analysis By Application (Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Others), By Type (1-Axis, 2-Axis, 3-Axis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Piezoresistive Accelerometer Market Statistics 2025 Analysis By Application (Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Others), By Type (1-Axis, 2-Axis, 3-Axis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- AC Response Accelerometer Market Statistics 2025 Analysis By Application (Consumer Electronics, Automotive, Health Care, Aerospace and Defense), By Type (1-Axis, 2-Axis, 3-Axis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager