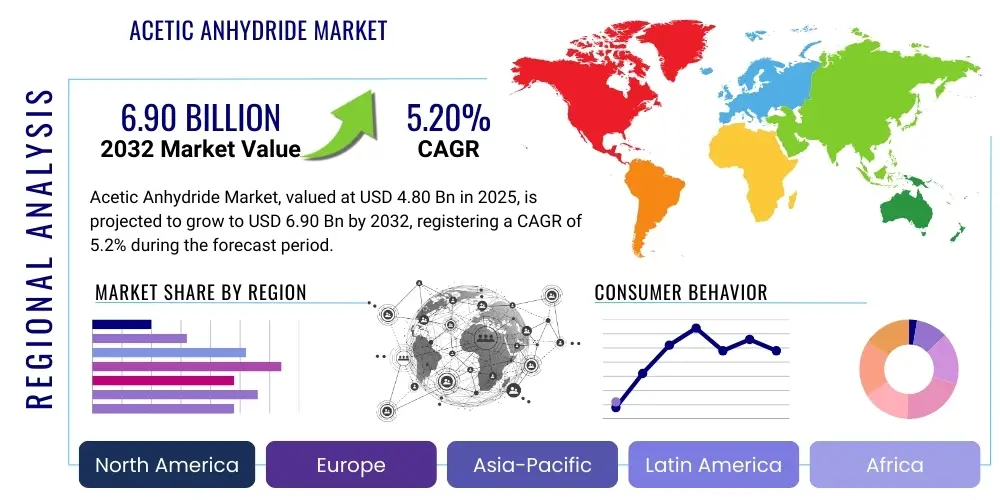

Acetic Anhydride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427350 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Acetic Anhydride Market Size

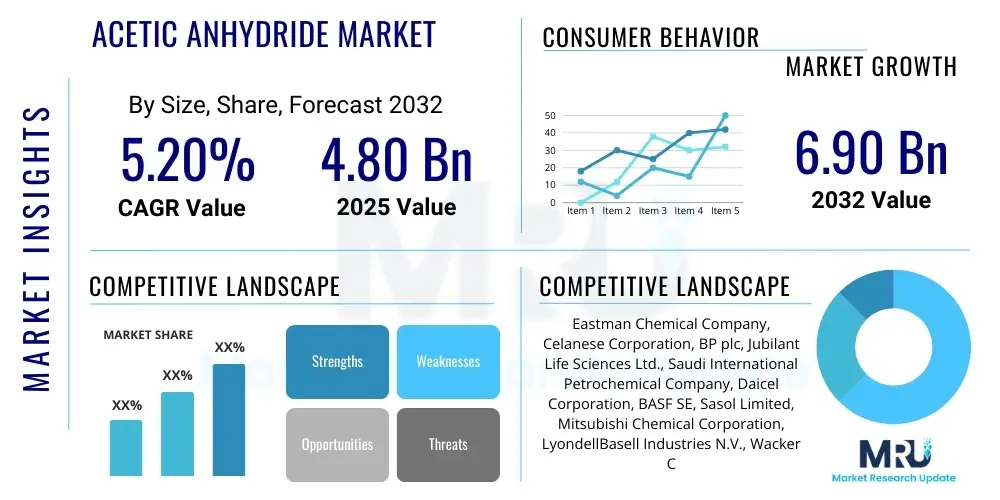

The Acetic Anhydride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2025 and 2032. The market is estimated at USD 4.80 billion in 2025 and is projected to reach USD 6.90 billion by the end of the forecast period in 2032.

Acetic Anhydride Market introduction

The Acetic Anhydride market is defined by the production, distribution, and consumption of acetic anhydride, a crucial chemical intermediate. Acetic anhydride is a colorless liquid with a strong acetic odor, primarily recognized for its high reactivity as an acetylating agent. Its chemical structure, an acid anhydride derived from acetic acid, grants it unique properties that are indispensable across various industrial applications. The manufacturing process typically involves the dehydration of acetic acid or the carbonylation of methanol, ensuring high purity and consistent quality essential for its diverse end-uses.

The major applications of acetic anhydride span multiple sectors, including pharmaceuticals, where it is a key precursor for acetylsalicylic acid (aspirin) and various other drug compounds. In the textile and plastics industry, it is vital for the production of cellulose acetate, which is used in cigarette filters, photographic films, and lacquers. Furthermore, acetic anhydride finds significant utility in the agrochemical sector for synthesizing herbicides and pesticides, as well as in the dye and pigment industry for creating vibrant colorants. Its benefits include its versatility as a powerful acetylating and dehydrating agent, facilitating the synthesis of complex organic compounds and enabling the creation of high-performance materials.

Key driving factors for the acetic anhydride market include the sustained demand from the pharmaceutical sector due to ongoing healthcare advancements and rising global populations. The expanding textile and apparel industries, particularly in emerging economies, also contribute significantly to its consumption for cellulose acetate production. Additionally, the growing agricultural output worldwide necessitates increased use of agrochemicals, further boosting demand for acetic anhydride as a critical raw material. Industrial growth and ongoing innovation in chemical synthesis continue to underscore its importance as a fundamental building block in the chemical industry.

Acetic Anhydride Market Executive Summary

The Acetic Anhydride market is experiencing dynamic shifts influenced by evolving business strategies, regional industrialization patterns, and specific segmental demands. Business trends indicate a strong focus on enhancing production efficiency through technological advancements and expanding manufacturing capacities, particularly in Asia-Pacific, to meet burgeoning demand. Companies are also investing in research and development to explore sustainable production methods and new application areas, aiming to reduce environmental impact and diversify their product portfolios. Strategic collaborations and mergers are observed as key players seek to consolidate market share and leverage synergistic opportunities in raw material sourcing and distribution networks, optimizing the overall supply chain efficiency and strengthening market presence.

Regionally, the market exhibits robust growth in developing economies, notably in Asia-Pacific, driven by rapid industrialization, increasing pharmaceutical production, and expanding textile manufacturing bases. Countries such as China and India are emerging as major consumption hubs, benefiting from favorable government policies and significant investments in their chemical and manufacturing sectors. Conversely, mature markets in North America and Europe demonstrate stable demand, with a focus on high-value applications, regulatory compliance, and the adoption of more sustainable production practices. These regions are also witnessing a trend towards bio-based derivatives and advanced chemical processes to align with stringent environmental standards and consumer preferences for eco-friendly products.

Segmentation trends highlight the enduring dominance of cellulose acetate production as the largest application segment, primarily due to its extensive use in cigarette filters and specialized plastics. However, the pharmaceutical sector is projected to register significant growth, fueled by the continuous development of new drugs and the rising global demand for generic medications. The agrochemicals segment also presents substantial opportunities, driven by the need for increased food production and advancements in crop protection solutions. Innovation in production technologies, such as improved catalysts and energy-efficient processes, is shaping the market landscape, allowing for enhanced product purity and cost-effectiveness across all major application areas, thereby influencing competitive dynamics and market penetration strategies.

AI Impact Analysis on Acetic Anhydride Market

Users frequently inquire about the transformative potential of Artificial Intelligence in optimizing chemical manufacturing, particularly for an essential intermediate like acetic anhydride. Key themes revolve around how AI can enhance process efficiency, improve product quality, manage complex supply chains, and mitigate environmental impacts. Concerns also surface regarding the initial investment required for AI integration and the need for specialized skills to manage AI-driven systems. Expectations are high for AI to revolutionize predictive maintenance, yield optimization, and real-time process control, ultimately leading to significant operational cost reductions and more sustainable production cycles within the acetic anhydride market.

- AI-powered predictive analytics optimizes raw material procurement and inventory management, reducing waste and associated costs.

- Machine learning algorithms enhance process control, leading to improved reaction yields, reduced energy consumption, and consistent product quality in acetic anhydride synthesis.

- AI models facilitate real-time monitoring of production parameters, enabling early detection of anomalies and proactive maintenance, thereby minimizing downtime.

- Generative AI assists in accelerated research and development of novel catalysts or more sustainable production routes for acetic anhydride, shortening innovation cycles.

- AI-driven supply chain optimization tools improve logistics, demand forecasting, and distribution efficiency, ensuring timely delivery and responsiveness to market fluctuations.

- Enhanced data analysis through AI provides deeper market insights, aiding strategic decision-making regarding capacity expansion, pricing, and market entry.

DRO & Impact Forces Of Acetic Anhydride Market

The Acetic Anhydride market is significantly influenced by a confluence of driving forces, inherent restraints, and emerging opportunities, all contributing to its overall impact dynamics. Primary drivers include the robust and expanding demand from key end-use industries such as pharmaceuticals, where acetic anhydride is critical for synthesizing various drugs including aspirin and paracetamol derivatives. The enduring requirement for cellulose acetate in cigarette filters, photographic films, and textile fibers also provides a stable foundation for market growth. Furthermore, the increasing global population and advancements in healthcare infrastructure, particularly in developing regions, continue to fuel the need for pharmaceutical intermediaries, directly impacting acetic anhydride consumption. The ongoing industrialization in emerging economies also translates into higher demand for various chemical products, including those that utilize acetic anhydride as a precursor.

However, the market faces several notable restraints. The volatility of raw material prices, primarily acetic acid, poses a significant challenge, impacting production costs and profit margins for manufacturers. Stricter environmental regulations governing the production and handling of chemical intermediates, coupled with increasing concerns over health hazards associated with acetic anhydride exposure, necessitate costly compliance measures and process modifications. These regulatory pressures often lead to higher operational expenses and can restrict market expansion in certain regions. Additionally, the availability and adoption of alternative chemicals or processes in some applications, though limited, represent a potential long-term restraint that could influence demand patterns and market share.

Despite these challenges, substantial opportunities exist for market players. The development and commercialization of bio-based acetic anhydride derived from renewable sources present a promising avenue for sustainable growth, aligning with global environmental objectives and consumer preferences for greener products. Continuous innovation in production technologies, focusing on improved catalysts and energy-efficient processes, can lead to enhanced cost-effectiveness and reduced ecological footprints. Furthermore, exploring new and niche applications for acetic anhydride in advanced materials, specialty chemicals, and fine chemical synthesis offers avenues for market diversification and value creation. The strategic expansion into high-growth regional markets, particularly those with burgeoning pharmaceutical and textile industries, provides significant potential for market penetration and revenue generation, shaping the competitive landscape and fostering long-term market resilience.

Segmentation Analysis

The Acetic Anhydride market is comprehensively segmented based on various criteria, including application, end-use industry, and manufacturing process, providing a detailed view of its diverse landscape and growth drivers. This segmentation allows for a nuanced understanding of market dynamics, identifying key consumption patterns and strategic opportunities across different sectors. Each segment exhibits distinct growth trajectories and demand characteristics, influenced by specific industrial requirements, technological advancements, and regional economic factors. Analyzing these segments is crucial for market participants to tailor their strategies, optimize product offerings, and capitalize on the most promising areas of growth within the global acetic anhydride market.

- By Application:

- Cellulose Acetate (Fibers, Films, Plastics)

- Pharmaceuticals (Aspirin, Paracetamol, other drug compounds)

- Agrochemicals (Herbicides, Insecticides)

- Dyes and Pigments

- Perfumes and Flavors

- Chemical Reagents

- Others (e.g., in resins, coatings, and various organic syntheses)

- By End-Use Industry:

- Pharmaceutical Industry

- Textile Industry

- Chemical Industry

- Food & Beverage Industry

- Agriculture Industry

- Automotive Industry

- Others

- By Manufacturing Process:

- Ketene Process

- Acetic Acid Carbonylation

- Others (e.g., oxidation of acetaldehyde)

Acetic Anhydride Market Value Chain Analysis

The value chain for the Acetic Anhydride market begins with upstream activities, primarily involving the sourcing of raw materials. The most critical raw material is acetic acid, which can be produced via various methods, including methanol carbonylation and oxidation of petrochemical feedstocks. Other less common raw materials or intermediates may also be utilized depending on the specific manufacturing process employed. Key suppliers in the upstream segment include major petrochemical companies and chemical producers that specialize in acetic acid synthesis. The efficiency of raw material procurement, including cost-effectiveness, supply chain reliability, and quality control, significantly impacts the overall production cost and competitive positioning of acetic anhydride manufacturers. Strategic long-term contracts and vertical integration can provide stability in this crucial initial stage.

Moving downstream, the value chain encompasses the manufacturing processes for acetic anhydride, followed by its distribution and subsequent utilization by end-use industries. Manufacturers employ sophisticated chemical processes, such as the ketene process or the carbonylation of methanol (via acetic acid), requiring specialized equipment, catalysts, and stringent safety protocols. After production, the acetic anhydride is stored, transported, and distributed through a combination of direct sales and indirect channels. Direct sales often involve large-volume contracts with major industrial consumers, facilitating tailored delivery and technical support. Indirect distribution utilizes a network of distributors, traders, and agents who manage smaller orders, regional logistics, and reach a broader customer base, particularly small and medium-sized enterprises (SMEs).

The distribution channel plays a pivotal role in ensuring the efficient and safe delivery of acetic anhydride to its diverse end-users. Direct distribution provides manufacturers with greater control over pricing, customer relationships, and market feedback, fostering closer ties with key clients. Indirect distribution, on the other hand, leverages the established networks and logistical capabilities of third-party partners, enabling wider market penetration and reduced operational complexities for the manufacturer. The end-users of acetic anhydride are primarily players in the pharmaceutical, textile, agrochemical, and other specialty chemical industries. These industries then convert acetic anhydride into various finished products like aspirin, cellulose acetate, herbicides, and dyes, thereby adding further value and completing the markets comprehensive value chain, highlighting the interconnectedness of each stage from raw material to final product application.

Acetic Anhydride Market Potential Customers

The potential customers for acetic anhydride are predominantly large industrial entities that rely on its unique properties as an acetylating and dehydrating agent in their manufacturing processes. These end-users span a broad spectrum of industries, each utilizing acetic anhydride for specific applications critical to their product formulations. Pharmaceutical companies constitute a major customer base, as acetic anhydride is an indispensable precursor in the synthesis of numerous active pharmaceutical ingredients (APIs), most notably acetylsalicylic acid (aspirin) and paracetamol derivatives. The stringent quality and purity requirements of the pharmaceutical sector mean these customers often seek high-grade acetic anhydride from reputable suppliers, emphasizing reliability and consistency.

Another significant segment of potential customers includes textile and plastics manufacturers. Within these industries, acetic anhydride is crucial for the production of cellulose acetate, a versatile polymer used in a wide array of applications such as cigarette filters, photographic films, spectacle frames, and certain textile fibers. These customers require bulk quantities of acetic anhydride to sustain their large-scale production lines, and their demand is often influenced by fashion trends, consumer preferences for specific materials, and regulatory shifts concerning plastics and filters. The efficiency and cost-effectiveness of their acetic anhydride supply directly impact their competitive standing in the global market for cellulose-based products and specialty plastics.

Furthermore, agrochemical companies represent a substantial customer segment, utilizing acetic anhydride for the synthesis of various herbicides, insecticides, and fungicides that are vital for crop protection and yield enhancement. The agricultural sectors ongoing need for effective and innovative crop protection solutions drives consistent demand for acetic anhydride. Other notable potential customers include manufacturers of dyes and pigments, where acetic anhydride facilitates the acetylation process for colorants, as well as the flavors and fragrances industry for synthesizing specific esters. Specialty chemical producers and research institutions also form a customer base, albeit typically for smaller volumes, employing acetic anhydride as a versatile chemical reagent for various organic syntheses and R&D activities across diverse industrial and academic settings.

Acetic Anhydride Market Key Technology Landscape

The technological landscape of the Acetic Anhydride market is characterized by several established and evolving production methods, each offering distinct advantages in terms of raw material utilization, energy efficiency, and product purity. The ketene process, historically a predominant method, involves the thermal decomposition of acetic acid to produce ketene, which then reacts with acetic acid to form acetic anhydride. This technology has been refined over decades to optimize reaction conditions, catalyst efficiency, and minimize side-product formation, ensuring high yields and purity. Continuous research focuses on improving catalyst lifespans and reducing the energy intensity of the ketene formation step, which is highly endothermic. The process requires careful temperature control and quick quenching of ketene to prevent its polymerization, making process control a critical technological aspect.

Another significant technological approach is the acetic acid carbonylation method, often involving the reaction of acetic acid with carbon monoxide in the presence of a catalyst, typically a rhodium or iridium-based system. This method is generally known for its high selectivity and milder operating conditions compared to the ketene process, offering potential advantages in terms of energy consumption and environmental impact. Advancements in this area focus on developing more robust and cost-effective catalysts that can operate at lower pressures and temperatures, enhancing overall process economics and reducing the need for expensive high-pressure equipment. Innovations also target improving the catalyst recovery and recycling processes, which are crucial for both economic viability and environmental sustainability, minimizing the generation of hazardous waste streams.

Beyond these primary methods, ongoing technological advancements in the acetic anhydride market are exploring more sustainable and efficient production routes. This includes research into bio-based acetic anhydride derived from renewable feedstocks, which involves the fermentation of biomass to produce acetic acid, subsequently converted to acetic anhydride. Furthermore, process intensification techniques, such as reactive distillation and microreactors, are being investigated to reduce equipment size, increase reaction efficiency, and lower operational costs. Digitalization and automation, including the integration of advanced sensors and control systems, are also becoming integral, enabling real-time monitoring, predictive maintenance, and optimized process parameters, leading to enhanced safety, reliability, and overall productivity in acetic anhydride manufacturing facilities globally. These technological shifts are vital for meeting evolving market demands and increasingly stringent environmental regulations.

Regional Highlights

- Asia-Pacific: This region dominates the global acetic anhydride market, driven by rapid industrialization, burgeoning pharmaceutical manufacturing, and the expanding textile industry, particularly in countries like China and India. Favorable government policies and substantial investments in chemical infrastructure further propel market growth.

- North America: Characterized by a mature market, North America exhibits stable demand for acetic anhydride, primarily from the pharmaceutical and specialized chemical sectors. The region emphasizes advanced manufacturing processes, regulatory compliance, and a shift towards sustainable production methods.

- Europe: The European market maintains a steady demand, supported by a strong pharmaceutical industry and innovation in specialty chemicals. Strict environmental regulations encourage the adoption of greener technologies and bio-based alternatives in countries such as Germany and the UK.

- Latin America: This region shows moderate growth, influenced by the expansion of its agricultural sector, leading to increased demand for agrochemicals. Economic development and industrial investment are gradually boosting consumption across various end-use industries.

- Middle East & Africa: The market in MEA is developing, with growing investments in industrialization and the petrochemical sector. Demand is primarily driven by the expansion of local manufacturing capabilities and the need for chemical intermediates in various applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acetic Anhydride Market.- Eastman Chemical Company

- Celanese Corporation

- BP plc

- Jubilant Life Sciences Ltd.

- Saudi International Petrochemical Company (Sipchem)

- Daicel Corporation

- BASF SE

- Sasol Limited

- Mitsubishi Chemical Corporation

- LyondellBasell Industries N.V.

- Wacker Chemie AG

- Chemplast Sanmar Ltd.

- Nantong Acetic Acid Chemical Co., Ltd.

- Yangtze River Acetyls Co., Ltd. (YRA)

- GNFC Limited (Gujarat Narmada Valley Fertilizers & Chemicals Limited)

Frequently Asked Questions

What is the primary use of acetic anhydride in the industry?

The primary use of acetic anhydride is as an acetylating agent, crucially employed in the production of cellulose acetate for textiles and cigarette filters, and in the pharmaceutical industry for synthesizing drugs like aspirin.

Which factors are driving the growth of the acetic anhydride market?

The market growth for acetic anhydride is significantly driven by robust demand from the pharmaceutical, textile, and agrochemical industries, alongside increasing industrialization and healthcare advancements globally.

What are the main challenges faced by the acetic anhydride market?

Key challenges include the volatility of raw material prices, stringent environmental regulations affecting production, and health concerns associated with chemical exposure, leading to increased operational costs and compliance needs.

How is acetic anhydride typically produced on an industrial scale?

Industrially, acetic anhydride is primarily produced via the ketene process, which involves the thermal decomposition of acetic acid, or through the carbonylation of methanol (via acetic acid), using specialized catalysts.

What is the future outlook for sustainable production of acetic anhydride?

The future outlook for sustainable production of acetic anhydride is promising, with increasing research and investment in bio-based methods derived from renewable feedstocks and the adoption of more energy-efficient, environmentally friendly processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bismaleimide Market Size Report By Type (Acetic anhydride dehydration method, Closed-loop thermal dehydration method, Azeotropic distillation dehydration method), By Application (Electrical insulation materials and high temperature resistance paints, Advanced compound material resin, aviation and space flight materials, Project plastic PMMA strength enhanced modifier agent., Wear resistant material, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bismaleimide Market Statistics 2025 Analysis By Application (Electrical insulation materials and high temperature resistance paints, Advanced compound material resin, aviation and space flight materials, Project plastic PMMA strength enhanced modifier agent., Wear resistant material), By Type (Acetic anhydride dehydration method, Closed-loop thermal dehydration method, Azeotropic distillation dehydration method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager