Acoustic Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428098 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Acoustic Camera Market Size

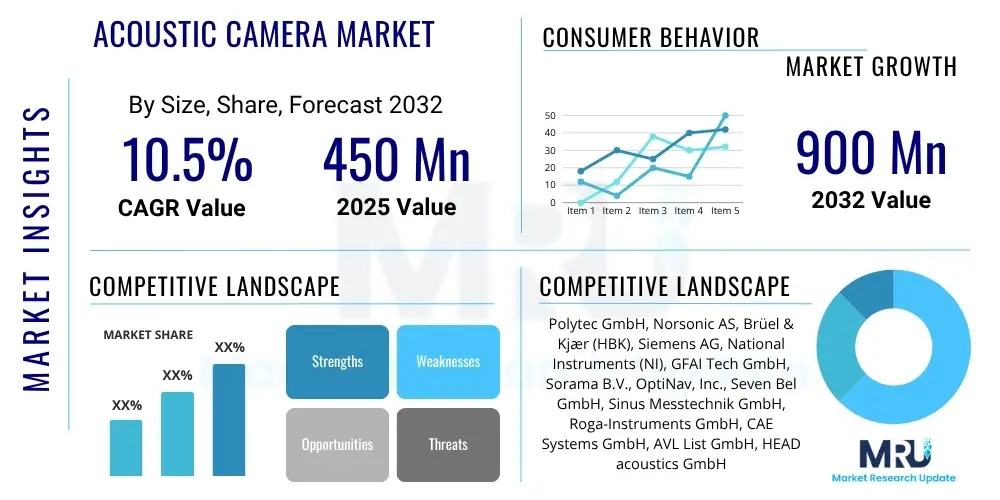

The Acoustic Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 450 Million in 2025 and is projected to reach USD 900 Million by the end of the forecast period in 2032.

Acoustic Camera Market introduction

The Acoustic Camera Market is experiencing unprecedented expansion, fueled by the escalating global demand for precise sound source localization, efficient leak detection, and advanced predictive maintenance solutions across a multitude of industrial and environmental applications. An acoustic camera is a sophisticated diagnostic instrument that visually represents sound, translating complex sound waves into intuitive, color-coded maps overlaid onto real-time optical images. This innovative capability allows engineers, technicians, and researchers to instantly identify, pinpoint, and analyze noise sources or acoustic anomalies even within cluttered and acoustically challenging environments. Its non-invasive operational characteristics, coupled with its ability to function effectively in various industrial settings, underscore its growing importance as an indispensable tool for enhancing operational efficiency, ensuring product quality, and mitigating environmental impact.

At its technological core, an acoustic camera integrates an array of high-precision microphones with a robust data acquisition system and specialized software. The operational principle relies heavily on advanced digital signal processing techniques, primarily beamforming algorithms. These algorithms process the phase and amplitude differences of sound signals received by multiple microphones, enabling the system to accurately determine the direction, distance, and intensity of sound originating from distinct points. The generated visual representation, often displayed as a "heat map" of sound, provides immediate and actionable insights that would be challenging or impossible to obtain with traditional sound level meters or human auditory inspection alone. This transformation of abstract acoustic data into tangible visual information is what truly distinguishes acoustic cameras in the realm of acoustic diagnostics and analysis.

The applications for acoustic cameras are remarkably diverse and continue to expand. In the automotive industry, they are crucial for Noise, Vibration, and Harshness (NVH) testing, helping manufacturers reduce cabin noise and improve vehicle acoustics. Within manufacturing, they are vital for quality control, identifying anomalies in machinery operation, detecting electrical discharges, and locating pneumatic or vacuum leaks. For energy efficiency, these cameras excel at identifying costly air or gas leaks in industrial facilities, leading to significant savings. Benefits encompass substantial reductions in troubleshooting time and labor costs, enhanced safety by minimizing human exposure to hazardous environments, facilitation of proactive maintenance strategies to prevent equipment failures, and compliance with increasingly stringent environmental noise regulations. These multifaceted advantages, combined with the ongoing drive towards Industry 4.0 and smart manufacturing paradigms, are the primary driving factors propelling the Acoustic Camera Market forward, positioning it as a pivotal technology for future industrial and environmental intelligence.

Acoustic Camera Market Executive Summary

The Acoustic Camera Market is characterized by dynamic shifts driven by accelerating technological innovation, the broadening spectrum of applications, and the increasing integration of advanced analytical capabilities. Current business trends indicate a strong emphasis on comprehensive solution offerings, where manufacturers combine high-performance hardware with intuitive, AI-powered software platforms, often including cloud-based data management and reporting services. This integrated approach aims to provide end-users with not just diagnostic tools but complete acoustic intelligence systems. Furthermore, market players are increasingly engaging in strategic partnerships and collaborations with software developers, IoT platform providers, and specialized industry consultants to develop niche solutions and expand their market penetration, particularly in high-growth areas like predictive maintenance and environmental monitoring. The competitive landscape is evolving, with innovation in portability, real-time processing, and user interface design becoming key differentiators as the market matures and diversifies.

Regionally, the market exhibits a clear bifurcation in terms of maturity and growth drivers. North America and Europe continue to represent the largest and most mature markets, primarily due to the early adoption of advanced industrial technologies, well-established manufacturing bases, and stringent regulatory frameworks concerning industrial safety and environmental noise. These regions are characterized by a strong demand for high-end, precision acoustic cameras used in aerospace, automotive R&D, and critical infrastructure. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid industrialization, massive investments in manufacturing and infrastructure development, and a burgeoning awareness of the benefits of proactive maintenance and energy efficiency. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, driven by their expanding industrial sectors and a strong governmental push towards smart factory initiatives. Latin America, the Middle East, and Africa are showing incremental growth, primarily in sectors like mining, oil & gas, and construction, albeit with varying rates influenced by economic stability and technological adoption.

Analysis of market segments reveals distinct trends in product preferences and application demands. The demand for 3D acoustic cameras, which offer more comprehensive spatial analysis and depth perception, is on an upward trajectory, indicating a shift towards more sophisticated diagnostic needs. In terms of components, the software segment is gaining significant traction, with a focus on advanced analytics, AI integration for automated interpretation, and seamless connectivity. End-user industries such as automotive and aerospace & defense remain dominant, but there is a notable surge in adoption within the electronics & manufacturing, power & energy, and environmental sectors, driven by the imperative for zero-defect production, asset integrity management, and regulatory compliance. The market is also witnessing a growing preference for portable and handheld acoustic cameras, reflecting a need for greater flexibility and on-site diagnostic capabilities, which is broadening the accessibility of this technology to a wider user base and expanding its deployment scenarios.

AI Impact Analysis on Acoustic Camera Market

The integration of Artificial Intelligence (AI) into acoustic camera technology is poised to fundamentally revolutionize how sound is analyzed and interpreted, addressing common user questions about automation, diagnostic precision, and data complexity. Users frequently inquire about AI's potential to transcend manual data interpretation, asking how AI can automate the identification of specific anomalies, improve the accuracy of noise source localization in intricate environments, and transform raw acoustic data into actionable insights for predictive maintenance. There is a palpable expectation that AI will convert acoustic cameras from mere detection devices into highly intelligent, proactive diagnostic systems, significantly reducing the requirement for extensive human expertise and accelerating decision-making processes. Concerns also exist regarding the robustness of AI algorithms across diverse industrial noises, data privacy, and the ethical implications of autonomous analysis, yet the overarching sentiment is one of eagerness for AI to unlock unprecedented capabilities and broaden the applicability of acoustic cameras, making them more powerful and user-friendly for a wider array of industrial and environmental challenges.

AI's influence extends across multiple facets of acoustic camera functionality, from enhancing data acquisition to optimizing reporting. Machine learning algorithms, for instance, can be trained on vast datasets of acoustic signatures to automatically recognize and classify specific machinery faults, electrical discharges, or leak patterns with remarkable speed and accuracy, far exceeding human cognitive abilities. This automation not only accelerates diagnostic procedures but also standardizes the analysis, reducing subjectivity. Furthermore, AI-driven noise filtering techniques can intelligently isolate target sounds from complex background noise, dramatically improving the signal-to-noise ratio and enabling precise localization even in extremely noisy industrial settings. This capability addresses a critical pain point for users operating in challenging environments, ensuring that relevant acoustic information is extracted efficiently and reliably for critical operational decisions and maintenance scheduling.

- AI-powered algorithms enhance the precision of noise source localization by intelligently filtering ambient noise and pinpointing specific acoustic signatures, even in complex soundscapes.

- Automated sound pattern recognition enables the identification and classification of distinct machinery faults, electrical discharges, or leak types, significantly reducing manual analysis time.

- Predictive maintenance capabilities are augmented through continuous acoustic monitoring coupled with AI-driven trend analysis, forecasting potential equipment failures before they occur.

- Real-time data processing and interpretation are accelerated by AI, providing immediate, actionable insights that facilitate rapid decision-making and operational adjustments.

- Improved classification accuracy of sound events allows for more nuanced differentiation between various types of acoustic anomalies, leading to more targeted intervention strategies.

- Development of self-learning systems enables acoustic cameras to adapt to new operational environments and identify novel fault signatures, evolving their diagnostic capabilities over time.

- The integration of AI reduces the dependency on highly specialized operators, making advanced acoustic camera technology more accessible and user-friendly for a broader industrial workforce.

- Seamless integration with broader Industrial IoT (IIoT) platforms allows for comprehensive data aggregation and analysis, optimizing overall plant performance and asset management.

- AI assists in optimizing measurement parameters and camera settings autonomously, ensuring optimal data quality and consistency across various diagnostic scenarios.

- Automated generation of detailed, highly precise reports with integrated anomaly detection and severity assessments streamlines documentation and compliance efforts.

DRO & Impact Forces Of Acoustic Camera Market

The Acoustic Camera Market is experiencing significant momentum driven by several potent factors. A primary driver is the surging global demand for advanced predictive maintenance (PdM) solutions across nearly all industrial sectors. Companies are increasingly recognizing that preventing equipment failures through continuous monitoring and early fault detection is far more cost-effective than reactive repairs, leading to reduced downtime and increased operational longevity. Concurrently, increasingly stringent governmental and environmental regulations concerning industrial noise pollution, coupled with a heightened focus on workplace safety, compel industries to adopt sophisticated monitoring technologies like acoustic cameras to ensure compliance and protect workers. Furthermore, rapid technological advancements in sensor design, digital signal processing, and integrated software platforms continue to enhance the capabilities, accuracy, and ease of use of acoustic cameras, making them more attractive and indispensable. The widespread adoption of Industry 4.0 paradigms and the proliferation of smart manufacturing initiatives are also significant catalysts, as they necessitate real-time data acquisition and intelligent diagnostic tools for optimizing complex production processes and maintaining asset integrity, placing acoustic cameras at the forefront of industrial intelligence.

Despite these powerful growth drivers, the Acoustic Camera Market encounters several restraining factors that temper its expansion. The most prominent restraint is the relatively high initial capital expenditure associated with purchasing and deploying advanced acoustic camera systems. This cost barrier can be particularly prohibitive for small and medium-sized enterprises (SMEs) with limited budgets, slowing broader market penetration. Another significant challenge is the inherent technical complexity involved in operating these sophisticated devices and accurately interpreting the generated acoustic data. While software is becoming more intuitive, extracting meaningful insights often requires a level of specialized training and acoustic expertise, which can be a bottleneck in regions with a less skilled workforce. Moreover, a lack of comprehensive awareness about the full spectrum of capabilities and the tangible return on investment (ROI) that acoustic cameras offer still persists in certain emerging markets and traditional industries, hindering faster adoption rates and necessitating increased educational efforts by manufacturers and distributors to demonstrate their value proposition.

Opportunities for substantial growth and market diversification within the Acoustic Camera Market are abundant and strategically compelling. The most transformative opportunity lies in the continued integration of artificial intelligence (AI) and machine learning (ML) algorithms, which promise to revolutionize data analysis, automate fault identification, and elevate predictive capabilities to unprecedented levels, extending the utility of acoustic cameras beyond current diagnostic functions. The ongoing miniaturization of components and advancements in battery technology are paving the way for the widespread development of highly portable, handheld, and even drone-mounted acoustic cameras, opening vast new avenues for flexible, remote, and autonomous monitoring, particularly in hazardous or difficult-to-reach environments. Furthermore, emerging markets across the Asia Pacific, Latin America, and African regions represent substantial untapped potential, driven by burgeoning industrialization, infrastructure development, and growing environmental consciousness. The expansion of acoustic camera applications into novel domains such as smart city initiatives for urban noise mapping, advanced environmental impact assessments, and potentially even specialized medical diagnostics could unlock entirely new revenue streams, significantly diversifying and expanding the overall market landscape.

The Acoustic Camera Market is profoundly shaped by a dynamic interplay of impact forces. Technological advancements represent a relentless force, continuously driving innovation in sensor materials, microphone array designs, digital signal processing capabilities, and advanced software analytics, leading to the creation of more accurate, faster, and versatile devices. Regulatory changes, particularly the increasing stringency of industrial noise limits, occupational safety standards, and environmental protection mandates, directly influence and often mandate the adoption of effective acoustic monitoring solutions across various industries. Global economic conditions exert a significant influence, with periods of economic prosperity stimulating capital expenditures on new diagnostic equipment, while downturns can lead to delayed investments. The competitive landscape, characterized by a mix of established global players and innovative niche entrants, fosters continuous product improvement and puts pressure on pricing strategies and differentiation. Lastly, escalating environmental concerns worldwide are compelling industries to pursue more sustainable and energy-efficient operational practices, positioning acoustic cameras as a key tool in detecting energy losses through leaks, optimizing machinery performance, and reducing overall carbon footprints.

Segmentation Analysis

The Acoustic Camera Market is comprehensively segmented across several crucial parameters, providing an intricate and granular view of its multifaceted landscape. This detailed segmentation is instrumental for market participants to identify distinct growth pockets, understand varying demand drivers, and formulate highly targeted product development and marketing strategies. By dissecting the market based on criteria such as camera type, constituent components, specific application areas, and diverse end-user industries, stakeholders can gain profound insights into the underlying market dynamics, technological adoption patterns, and regional variances. This analytical framework enables a more nuanced understanding of where demand is originating, how it is evolving, and which specific solutions are gaining traction in different contexts, laying the groundwork for strategic decision-making and competitive positioning.

A deeper dive into these segments reveals compelling insights into the market's evolutionary trajectory. For instance, the differentiation between 2D and 3D acoustic cameras highlights a progression towards more sophisticated spatial analysis requirements, reflecting an increasing need for volumetric sound data in complex diagnostic scenarios. Similarly, the breakdown by component — distinguishing between hardware elements like microphone arrays and software solutions for analysis and visualization — underscores the growing importance of advanced algorithms, intuitive user interfaces, and integrated data analytics in delivering comprehensive acoustic intelligence. Furthermore, the application-based segmentation, which spans from traditional noise source localization to highly specialized predictive maintenance and electrical discharge detection, illustrates the broad and expanding utility of acoustic cameras in addressing a wide array of operational challenges across the industrial spectrum. This detailed segmentation not only clarifies current market structures but also provides foresight into future growth avenues and potential areas for innovation, ensuring that market offerings remain aligned with evolving customer needs and technological advancements.

- By Type

- 2D Acoustic Cameras: Primarily used for planar noise source localization, providing a two-dimensional map of sound intensity over an optical image. They are typically more cost-effective and suitable for applications where depth information is not critical.

- 3D Acoustic Cameras: Advanced systems capable of generating a three-dimensional representation of sound sources, offering depth perception and volumetric analysis. These are vital for complex environments or when precise source location in space is required, especially in large industrial settings or intricate machinery.

- By Component

- Hardware: Encompasses the physical elements of the acoustic camera system.

- Microphone Arrays: The core component consisting of multiple, high-sensitivity microphones (often MEMS-based) arranged in specific patterns (e.g., spiral, uniform circular) to enable beamforming.

- Data Acquisition Systems: Electronic systems responsible for converting analog microphone signals into digital data at high sampling rates.

- Processing Units: Embedded processors or external computing units that execute complex algorithms for signal processing, beamforming, and image generation.

- Software: The intelligence behind the hardware, transforming raw data into actionable insights.

- Analysis Software: Provides tools for advanced acoustic analysis, including frequency analysis, transient analysis, and sound intensity mapping.

- Visualization Software: Overlays acoustic data onto optical images or 3D models, creating intuitive sound maps and visual representations.

- Reporting Tools: Features for generating comprehensive reports, documenting findings, and integrating with enterprise asset management (EAM) systems.

- Hardware: Encompasses the physical elements of the acoustic camera system.

- By Application

- Noise Source Localization: Identifying the exact origin of unwanted noise in products, machinery, or environments for noise reduction and compliance.

- Leak Detection (Air, Gas, Vacuum): Pinpointing costly and potentially dangerous leaks in compressed air systems, gas pipelines, vacuum lines, and industrial equipment, improving energy efficiency and safety.

- Predictive Maintenance: Monitoring machinery for abnormal acoustic signatures indicating impending failure, enabling proactive intervention and preventing unplanned downtime.

- Quality Control: Ensuring product quality in manufacturing by detecting defects or anomalies through acoustic analysis during production lines or final inspection.

- NVH (Noise, Vibration, Harshness) Testing: Critical in automotive and aerospace industries for optimizing acoustic comfort and identifying sources of undesirable noise and vibration.

- Electrical Discharge Detection: Identifying partial discharges, corona, and arcing in high-voltage electrical equipment, preventing failures and ensuring grid reliability.

- Environmental Noise Monitoring: Assessing and monitoring urban noise levels, construction site noise, or industrial facility sound emissions for regulatory compliance and community impact studies.

- Acoustic Research & Development: Used in academic and industrial research for studying sound propagation, material acoustics, and developing new acoustic products or solutions.

- By End-User Industry

- Automotive: For NVH testing, vehicle interior noise reduction, electric vehicle component testing, and quality control on assembly lines.

- Aerospace & Defense: Identifying noise sources in aircraft engines, cabin acoustics, structural integrity checks, and detecting potential system malfunctions in critical defense equipment.

- Power & Energy: Leak detection in power plants (steam, gas), electrical discharge detection in substations and transmission lines, and condition monitoring of turbines and generators.

- Electronics & Manufacturing: Quality control of electronic components, leak detection in pneumatic systems, machinery health monitoring, and defect analysis in production processes.

- Building & Construction: Identifying sound insulation deficiencies, structural integrity checks, and urban noise mapping for new developments.

- Research & Development: Across various scientific and engineering disciplines for fundamental acoustic studies, product prototyping, and material characterization.

- Oil & Gas: Leak detection in pipelines, valves, and storage tanks; monitoring of compressors and pumps in refineries and drilling operations.

- Mining: Equipment condition monitoring, identifying operational inefficiencies, and ensuring safety in harsh mining environments.

- Marine: Underwater noise mapping, propeller cavitation analysis, and vessel acoustic signature management.

- Others: Includes medical diagnostics (e.g., stethoscope applications), smart cities (urban noise mapping), and environmental agencies.

Value Chain Analysis For Acoustic Camera Market

The value chain for the Acoustic Camera Market is a complex ecosystem beginning with sophisticated upstream activities focused on component sourcing and advanced manufacturing. This foundational stage involves key suppliers specializing in micro-electro-mechanical systems (MEMS) microphones, high-speed analog-to-digital converters (ADCs), powerful digital signal processors (DSPs), and high-resolution optical camera sensors. These components demand precision engineering, miniaturization capabilities, and robust performance characteristics to meet the stringent technical requirements of acoustic arrays. Extensive research and development (R&D) investments at this stage are crucial, driving innovations in sensor sensitivity, noise reduction, and energy efficiency. Manufacturers of these specialized components, often global leaders in semiconductor and sensor technology, form the critical bedrock of the value chain, supplying the highly specialized inputs required by acoustic camera integrators and developers, with the quality and reliability of these components directly impacting the performance and competitive advantage of the final product.

Proceeding downstream, the value chain encompasses the intricate processes of acoustic camera assembly, comprehensive software development, strategic marketing, effective sales, and essential post-sales support services. This stage involves the meticulous integration of diverse hardware elements—microphone arrays, optical cameras, and data acquisition units—into a cohesive, functional system. Simultaneously, the development of highly sophisticated software is paramount, providing the intelligence for advanced data processing, real-time visualization, and in-depth acoustic analysis. This software, which includes proprietary beamforming algorithms, intelligent noise filtering techniques, and intuitive graphical user interfaces, is increasingly serving as a key differentiator, enhancing the camera's analytical power, operational efficiency, and overall user experience. Strategic marketing efforts are vital for educating potential customers about the profound benefits and diverse applications of this complex technology, often necessitating technically adept sales teams capable of conducting detailed product demonstrations and offering consultative guidance. Post-sales activities, such as comprehensive customer training, regular system calibration, preventative maintenance, and continuous software updates, are critical for ensuring sustained customer satisfaction, fostering long-term client relationships, and maintaining the system's peak performance and accuracy throughout its lifecycle.

The distribution channels for acoustic cameras typically leverage a hybrid approach, strategically combining direct sales with a robust network of indirect partners to maximize market penetration and customer reach. Direct sales channels are frequently employed for engaging with large industrial clients, governmental agencies, or specialized research institutions, where manufacturers interact directly with end-users to provide highly customized solutions, in-depth technical consultations, and comprehensive, personalized support. This direct engagement fosters stronger client relationships, facilitates invaluable direct feedback for product improvement, and ensures precise alignment with specific customer requirements. Conversely, indirect channels involve collaborating with a meticulously selected network of authorized distributors, specialized system integrators, and value-added resellers (VARs). These partners often possess established regional footprints, in-depth industry-specific knowledge, and the capability to offer integrated solutions that bundle acoustic cameras with complementary diagnostic tools or existing monitoring infrastructure. Such collaborations are instrumental in expanding market reach into diverse geographical areas and niche industrial segments, providing localized technical support, and offering tailored solutions that address specific client pain points. Furthermore, the increasing prominence of e-commerce platforms is opening new avenues for the distribution of more standardized or portable acoustic camera models, enabling broader market accessibility, particularly for smaller businesses, and streamlining transactional efficiencies, thus optimizing the overall supply chain and delivery mechanisms for acoustic camera products globally.

Acoustic Camera Market Potential Customers

The potential customer base for acoustic camera technology is exceptionally broad and continually expanding, driven by a universal industrial imperative to enhance operational reliability, ensure stringent quality control, mitigate environmental impact, and improve workplace safety. Primary end-users dominantly include large-scale manufacturing conglomerates, leading automotive original equipment manufacturers (OEMs), global aerospace and defense contractors, and major power and energy utility providers. These formidable sectors consistently require highly precise identification of noise sources for critical applications such as meticulous product development (e.g., advanced NVH testing in vehicle design), swift and accurate leak detection within complex, pressurized systems (e.g., power plant steam lines, extensive oil and gas pipelines), and proactive, condition-based maintenance of mission-critical machinery. The unparalleled ability of acoustic cameras to deliver immediate, highly intuitive visual insights into complex sound problems positions them as indispensable tools for senior engineers, shrewd maintenance managers, and meticulous quality assurance teams, empowering them to diagnose issues with unparalleled speed and accuracy, thereby drastically minimizing costly unplanned downtime, optimizing operational uptime, and significantly enhancing overall performance metrics.

Beyond these traditional and established industrial applications, the Acoustic Camera Market is actively diversifying its customer portfolio to encompass a wide array of emerging and specialized sectors. This includes discerning building and construction firms focused on infrastructure integrity, influential environmental consulting agencies involved in ecological assessments, forward-thinking smart city initiatives aiming for urban acoustic mapping, and pioneering academic and industrial research institutions pushing the boundaries of acoustic science. In the construction domain, acoustic cameras are pivotal for identifying structural weaknesses through anomaly detection and assessing sound insulation efficacy. Environmental agencies deploy them for granular urban noise mapping, ensuring compliance with evolving regulations, and evaluating the acoustic footprint of industrial operations on surrounding communities. Research and development departments across various scientific and engineering disciplines leverage acoustic cameras for fundamental studies into sound propagation, advanced material acoustics, and the iterative development of innovative, next-generation acoustic products. This extensive and growing diversity in adoption profoundly underscores the technology's remarkable versatility and its increasing strategic relevance in effectively addressing a vast spectrum of complex, sound-related challenges, firmly establishing acoustic cameras as a critical diagnostic and preventative instrument across an ever-widening array of professional, industrial, and societal applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 450 Million |

| Market Forecast in 2032 | USD 900 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polytec GmbH, Norsonic AS, Brüel & Kjær (HBK), Siemens AG, National Instruments (NI), GFAI Tech GmbH, Sorama B.V., OptiNav, Inc., Seven Bel GmbH, Sinus Messtechnik GmbH, Roga-Instruments GmbH, CAE Systems GmbH, AVL List GmbH, HEAD acoustics GmbH, Hottinger Brüel & Kjær (HBK), Teledyne FLIR LLC, Ono Sokki Co., Ltd., Ziegler-Instruments GmbH, Apex Acoustics, Metravib SAS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acoustic Camera Market Key Technology Landscape

The technological landscape underpinning the Acoustic Camera Market is a rapidly evolving domain, characterized by continuous innovation across multiple interconnected disciplines, all aimed at enhancing the precision, sensitivity, and user-friendliness of these advanced diagnostic instruments. At its foundational core, the technology is heavily reliant on cutting-edge microphone array designs, predominantly utilizing Micro-Electro-Mechanical Systems (MEMS) microphones. These miniature, high-performance sensors offer superior signal-to-noise ratios, excellent frequency response, and exceptional durability, making them ideal for integration into dense arrays. These arrays can comprise anywhere from a few dozen to several hundred microphones, strategically arranged in various geometries (e.g., spiral, uniform circular, planar) to optimize spatial resolution, maximize sensitivity across a broad frequency range, and effectively minimize spatial aliasing. Significant advancements in MEMS technology have been instrumental in enabling the development of smaller, lighter, more portable, and increasingly robust acoustic cameras capable of operating effectively in challenging industrial environments, thereby pushing the boundaries of traditional acoustic measurement capabilities.

Beyond the physical hardware, sophisticated digital signal processing (DSP) algorithms constitute the intellectual engine of acoustic cameras, transforming raw acoustic data into actionable visual insights. Beamforming is the seminal technique, allowing the system to electronically 'steer' its focus towards specific directions, thereby localizing sound sources with remarkable precision while simultaneously suppressing extraneous background noise. Modern acoustic camera systems incorporate a suite of advanced algorithms for real-time data acquisition, adaptive noise reduction, transient event detection, and high-resolution spectral analysis. These computational enhancements enable immediate visual feedback, presenting complex acoustic phenomena as intuitive, color-coded overlays on optical images. The burgeoning demand for 3D acoustic imaging capabilities is driving the development of even more complex volumetric algorithms that can process sound data across three dimensions, providing depth perception and a more holistic understanding of the acoustic environment, which is crucial for intricate diagnostic tasks in large industrial spaces or complex machinery.

Furthermore, the transformative integration of artificial intelligence (AI) and machine learning (ML) is rapidly reshaping the technological paradigm of acoustic cameras. AI algorithms are being strategically deployed to automate the recognition and classification of specific sound patterns associated with a myriad of anomalies, such as impending machinery faults, elusive gas leaks, or critical electrical discharges. This automation significantly reduces human analysis time, improves diagnostic accuracy, and standardizes the interpretation of complex acoustic signatures. Machine learning models empower acoustic cameras to 'learn' and adapt to new acoustic environments, identify novel fault signatures over extended periods, and predict potential failures with increasing reliability, thereby evolving into highly intelligent predictive tools. Concurrent advancements in connectivity technologies, including high-speed wireless data transfer (e.g., 5G), seamless integration with industrial IoT (Internet of Things) platforms, and robust cloud-based data storage and analytics solutions, are becoming standard features. These connectivity enhancements facilitate remote monitoring, enable collaborative data sharing, and ensure the effortless integration of acoustic cameras into broader smart factory ecosystems, supporting overarching strategies for comprehensive data analysis, operational optimization, and proactive asset management.

Regional Highlights

- North America: This region stands as a dominant force in the Acoustic Camera Market, characterized by early and widespread adoption of advanced industrial technologies, a deeply entrenched culture of stringent regulatory compliance concerning noise control, and a formidable presence across pivotal sectors such as automotive manufacturing, aerospace & defense, and power generation. The United States and Canada are the primary market contributors, distinguished by robust research and development (R&D) initiatives and substantial ongoing investments in comprehensive predictive maintenance and quality assurance solutions. The region's innovative spirit and a high degree of technological readiness ensure sustained demand for high-precision acoustic cameras, particularly those integrated with AI capabilities for enhanced diagnostic accuracy and automation.

- Europe: Europe represents a highly mature and technologically advanced market for acoustic cameras, boasting consistently high adoption rates, especially within economic powerhouses like Germany, the United Kingdom, and France. This robust market is significantly driven by a combination of stringent environmental noise regulations, a world-leading industrial manufacturing base (notably in automotive, industrial machinery, and consumer electronics), and an unwavering focus on industrial automation, worker safety standards, and energy efficiency. European companies are at the forefront of innovation in sophisticated sensor technology, advanced signal processing algorithms, and seamless software integration, positioning the region as a leader in both product development and application expertise for acoustic camera solutions.

- Asia Pacific (APAC): The Asia Pacific region is unequivocally identified as the fastest-growing market segment for acoustic cameras globally. This explosive growth is underpinned by unparalleled rapid industrialization, massive foreign direct investment flowing into the manufacturing and infrastructure sectors, and a burgeoning awareness among industries regarding the profound benefits of proactive maintenance, enhanced operational safety, and optimized energy efficiency. Key economic players such as China, Japan, South Korea, and India are spearheading this growth, driven by their rapidly expanding electronics, automotive, energy, and heavy industries. Aggressive governmental support for smart factory initiatives, coupled with the widespread adoption of Industry 4.0 principles, acts as a powerful catalyst propelling market expansion and technological adoption across the region.

- Latin America: This region currently represents an emerging market for acoustic cameras, exhibiting gradual but steady growth. Key investments in critical sectors such as infrastructure development, mining, and oil & gas are the primary drivers of adoption. Countries like Brazil and Mexico are at the forefront of this regional expansion, predominantly utilizing acoustic camera technology for industrial safety audits, comprehensive equipment condition monitoring, and efficiency improvements. While economic volatility and varying levels of industrial modernization can influence the pace of market growth, the increasing emphasis on operational efficiency and preventative maintenance is steadily fostering a more receptive environment for advanced diagnostic tools in the region.

- Middle East & Africa (MEA): The Middle East & Africa region constitutes a nascent but highly promising market with significant long-term growth potential. Demand is largely concentrated within the lucrative oil & gas, petrochemical, and large-scale construction industries, fueled by ambitious mega-projects and a rapidly increasing emphasis on robust operational safety protocols and asset integrity management. Countries within the Gulf Cooperation Council (GCC) are leading the charge in adopting acoustic cameras, albeit from a relatively lower base compared to other global regions. The region's strategic investments in industrial diversification and the modernization of its infrastructure are expected to incrementally drive the demand for advanced acoustic monitoring solutions, making it an area to watch for future market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acoustic Camera Market.- Polytec GmbH

- Norsonic AS

- Brüel & Kjær (HBK)

- Siemens AG

- National Instruments (NI)

- GFAI Tech GmbH

- Sorama B.V.

- OptiNav, Inc.

- Seven Bel GmbH

- Sinus Messtechnik GmbH

- Roga-Instruments GmbH

- CAE Systems GmbH

- AVL List GmbH

- HEAD acoustics GmbH

- Hottinger Brüel & Kjær (HBK)

- Teledyne FLIR LLC

- Ono Sokki Co., Ltd.

- Ziegler-Instruments GmbH

- Apex Acoustics

- Metravib SAS

Frequently Asked Questions

What is an acoustic camera and how does it function in practical applications?

An acoustic camera is an advanced diagnostic instrument designed to visually map sound sources in real-time. It comprises an array of highly sensitive microphones that capture sound waves, which are then processed by sophisticated digital signal processing (DSP) algorithms, primarily beamforming. This technology pinpoints the exact origin and intensity of sounds, translating them into a color-coded visual overlay on an optical image or video. In practical applications, this enables immediate identification of noise sources, such as machinery faults, air leaks, or electrical discharges, making complex acoustic environments easily understandable and facilitating rapid troubleshooting and precise maintenance interventions across various industrial settings.

What are the key benefits of deploying acoustic cameras in industrial settings?

Deploying acoustic cameras in industrial settings offers a multitude of significant benefits, profoundly enhancing operational efficiency and safety. These advantages include dramatically accelerated troubleshooting processes due to instant visual identification of sound anomalies, which significantly reduces downtime and associated costs. Acoustic cameras are non-invasive and can safely operate in hazardous or hard-to-reach environments, minimizing human exposure to risks. They also facilitate proactive and predictive maintenance by detecting early signs of equipment wear or failure, thus preventing costly breakdowns. Furthermore, their ability to pinpoint energy losses from leaks contributes to improved energy efficiency, and their precision aids in complying with stringent environmental noise regulations, ultimately fostering a safer, more efficient, and more compliant operational environment.

How is Artificial Intelligence (AI) enhancing the capabilities of acoustic cameras?

Artificial Intelligence (AI) is significantly enhancing acoustic camera capabilities by introducing advanced automation, superior diagnostic accuracy, and deeper analytical insights. AI algorithms, particularly machine learning, enable acoustic cameras to automatically recognize and classify specific sound patterns associated with various industrial faults, such as different types of leaks or distinct machinery malfunctions, often with greater speed and precision than human analysis. This reduces the need for extensive human expertise in interpretation, making the technology more accessible. AI also improves noise filtering, allowing the cameras to isolate target sounds from complex background noise, and bolsters predictive maintenance by identifying subtle trends that forecast potential equipment failures, thereby transforming acoustic cameras into more intelligent, autonomous, and powerful diagnostic tools.

What are the primary factors driving the growth of the global Acoustic Camera Market?

The global Acoustic Camera Market is experiencing robust growth driven by several powerful and interconnected factors. A principal driver is the escalating industrial demand for predictive maintenance solutions aimed at minimizing unplanned downtime and optimizing asset performance. Simultaneously, increasingly stringent governmental regulations worldwide concerning industrial noise pollution and workplace safety compel industries to adopt advanced monitoring and diagnostic technologies. Furthermore, continuous technological advancements in microphone array design, digital signal processing algorithms, and integrated software platforms significantly enhance the precision, versatility, and user-friendliness of acoustic cameras. The overarching trend towards Industry 4.0 and the imperative for smart manufacturing also serve as major catalysts, creating a strong market pull for real-time acoustic intelligence and data-driven decision-making in complex operational environments.

Which industries are the primary end-users of acoustic camera technology?

Acoustic camera technology finds its primary end-users across a diverse range of industries critical for global economic activity. The automotive sector utilizes them extensively for Noise, Vibration, and Harshness (NVH) testing and quality control. The aerospace & defense industry employs them for engine diagnostics and structural integrity checks. The power & energy sector relies on them for leak detection in power plants and electrical discharge identification in substations. Electronics & manufacturing uses them for quality assurance and machinery monitoring. Additionally, the oil & gas industry benefits from leak detection in pipelines, while environmental agencies and smart city initiatives leverage them for noise mapping and regulatory compliance. This widespread adoption underscores the technology's versatile utility in enhancing efficiency, safety, and quality across multiple industrial verticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager