Active Optical Cable and Extender Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430597 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Active Optical Cable and Extender Market Size

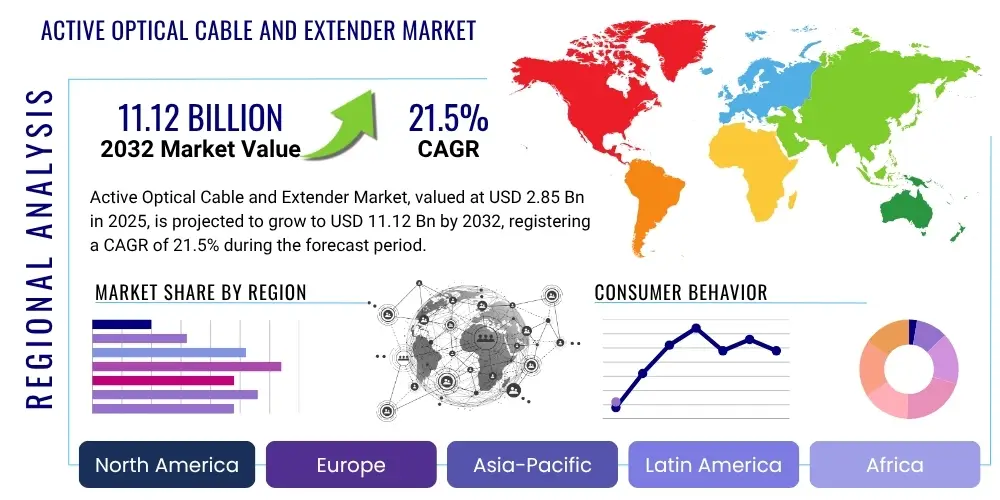

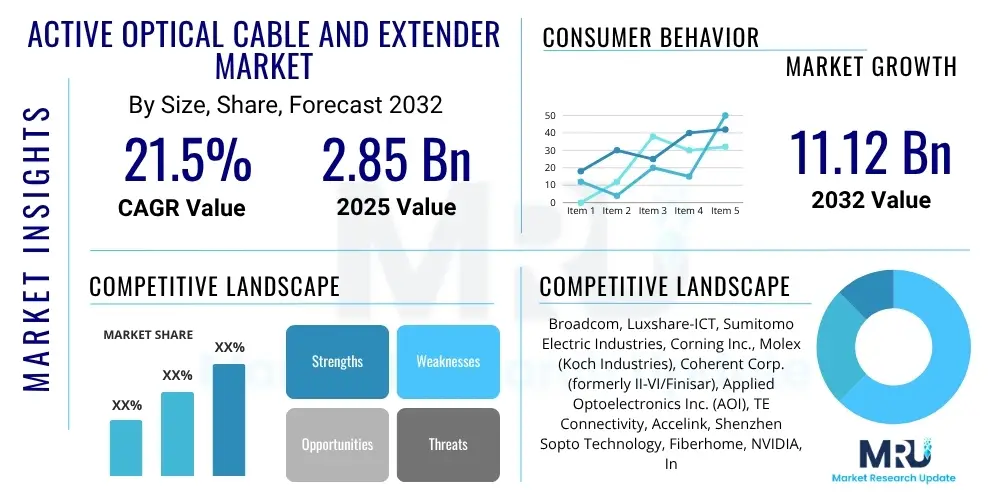

The Active Optical Cable and Extender Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2025 and 2032. The market is estimated at $2.85 billion in 2025 and is projected to reach $11.12 billion by the end of the forecast period in 2032.

Active Optical Cable and Extender Market introduction

The Active Optical Cable and Extender market encompasses high-performance cabling solutions designed to transmit data over longer distances and at higher bandwidths than traditional copper cables, while overcoming electromagnetic interference. Active Optical Cables (AOCs) integrate optical fiber with electrical-to-optical conversion components directly within the cable connectors, enabling seamless data transmission. Extenders, often used in conjunction with AOCs, facilitate signal extension for various interfaces, ensuring integrity over considerable lengths. These technologies are crucial for modern digital infrastructure where speed, reliability, and distance are paramount, addressing the limitations inherent in purely electrical solutions.

Major applications for AOCs and extenders span across a multitude of industries, including data centers, consumer electronics, professional audio-visual (Pro-AV) installations, industrial automation, and telecommunications networks. In data centers, they connect servers, storage, and networking equipment, facilitating high-speed data transfer critical for cloud computing and big data analytics. For consumer electronics, AOCs enhance experiences in gaming, virtual reality, and home theater systems by supporting ultra-high-definition video and fast data transfer for USB and HDMI connections. Their benefits include superior bandwidth, reduced latency, immunity to electromagnetic interference (EMI), lighter weight, and smaller diameter compared to copper alternatives, which simplifies cable management and improves airflow in dense environments.

The market's growth is primarily driven by the escalating demand for higher data rates, the proliferation of cloud computing and hyperscale data centers, the global rollout of 5G networks, and the increasing adoption of advanced artificial intelligence and machine learning technologies. As digital content becomes more complex and data volumes explode, the infrastructure supporting these advancements requires increasingly robust and efficient connectivity solutions. AOCs and extenders are strategically positioned to meet these evolving demands, offering future-proof connectivity that can scale with technological progress, ensuring uninterrupted high-speed communication across diverse applications.

Active Optical Cable and Extender Market Executive Summary

The Active Optical Cable and Extender market is experiencing robust expansion, propelled by significant business trends such as the escalating demand for data center capacity, the imperative for high-speed connectivity in consumer electronics, and the ongoing digital transformation across various industries. Enterprises are increasingly investing in cloud infrastructure and deploying advanced networking solutions, driving the adoption of AOCs that offer superior performance and reliability over longer distances. Innovation in higher data rates and smaller form factors continues to be a key business trend, pushing manufacturers to develop solutions capable of supporting emerging standards and applications, while also addressing supply chain resilience and cost optimization strategies.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as a dominant region, fueled by rapid urbanization, substantial investments in data center infrastructure, aggressive 5G network deployments, and a thriving consumer electronics manufacturing base, particularly in countries like China, Japan, and India. North America remains a significant innovation hub, with early adoption of advanced technologies, a high concentration of hyperscale data centers, and strong R&D spending in AI and cloud computing. Europe is also a key player, driven by robust industrial automation, telecommunications upgrades, and smart city initiatives, emphasizing energy efficiency and sustainable practices in its infrastructure development.

Segmentation trends highlight pronounced growth in the data center segment, attributed to the continuous expansion of hyperscale and enterprise facilities, alongside the increasing need for 400Gbps and 800Gbps interconnections. The consumer electronics segment is witnessing substantial uptake, particularly with the proliferation of 8K televisions, virtual reality devices, and high-performance gaming systems that demand high-bandwidth HDMI and USB AOCs. The professional audio-visual market is also a burgeoning area, with AOC extenders enabling uncompressed, high-resolution video transmission over extended distances for large venues, broadcasting, and conferencing solutions. This broad application spectrum underscores the versatility and critical importance of AOC technology in diverse ecosystems.

AI Impact Analysis on Active Optical Cable and Extender Market

The advent and rapid integration of Artificial Intelligence (AI) across various sectors have ignited a critical examination among users regarding its implications for the Active Optical Cable and Extender market. Common user questions revolve around how AI's insatiable demand for processing power and data transfer will impact bandwidth requirements, whether current AOC technologies are adequately equipped to handle future AI workloads, and the potential for new form factors or specialized AOCs to emerge. Users are particularly concerned about the implications for data center architectures, the need for ultra-low latency, and the power efficiency of connectivity solutions in AI-intensive environments. The prevailing expectation is that AI will be a significant catalyst for innovation and growth within the AOC market, driving demand for even higher speeds and more robust, energy-efficient solutions.

- Increased demand for ultra-high-bandwidth AOCs to support AI clusters and GPU interconnections.

- Necessity for ultra-low latency AOCs to ensure efficient real-time data processing in AI applications.

- Development of specialized AOCs for high-density AI server racks and accelerated computing platforms.

- Pressure to reduce power consumption of optical transceivers and cables for AI data centers.

- Innovation in optical fiber technology and advanced modulation schemes to cope with AI-driven data explosion.

- Shift towards more compact and high-port-density AOC solutions for AI infrastructure.

- Increased adoption of AOCs in edge computing scenarios to support distributed AI inference.

- Greater emphasis on reliability and fault tolerance in AOC design for critical AI operations.

DRO & Impact Forces Of Active Optical Cable and Extender Market

The Active Optical Cable and Extender market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces. Key drivers include the exponential growth in data traffic, primarily fueled by the expansion of hyperscale and enterprise data centers, the pervasive adoption of cloud computing services, and the global rollout of 5G wireless networks which necessitate robust backhaul and fronthaul solutions. The increasing demand for high-resolution content, such as 4K and 8K video in consumer electronics and professional AV, alongside the proliferation of IoT devices and advanced AI/ML applications, further underscores the need for high-bandwidth, long-distance, and EMI-resistant connectivity that AOCs provide. These technological shifts create an inherent demand that propels market expansion.

However, the market also faces considerable restraints. The relatively higher cost of AOCs compared to traditional copper cables, particularly for shorter distances, can act as a barrier to widespread adoption, especially for cost-sensitive applications or smaller deployments. Interoperability issues between different vendors' products and the technical complexities associated with integrating optical components into electrical systems pose additional challenges. Furthermore, while AOCs offer extended reach over copper, their maximum transmission distances are still limited compared to passive fiber optic solutions, requiring specialized extenders or repeaters for extremely long runs, which adds to system complexity and cost. These factors necessitate continuous innovation to drive down costs and enhance compatibility.

Opportunities for growth are abundant within this evolving landscape. Emerging markets, particularly in Asia Pacific and Latin America, present significant potential as they ramp up digital infrastructure investments and increase adoption of advanced connectivity solutions. The advent of advanced manufacturing processes, smart factories, and the growing demand for high-speed, reliable connectivity in automotive infotainment systems and medical imaging equipment offer new avenues for application. Furthermore, the continuous development and standardization of new interfaces like USB4, HDMI 2.1, DisplayPort 2.0, and evolving Ethernet standards (e.g., 800GbE) create fresh demand for AOCs capable of supporting these next-generation protocols. The impact forces, including rapid technological advancements in optical components, intense competitive landscapes driving innovation, evolving regulatory environments, and fluctuating global economic conditions, constantly reshape the market, demanding agility and strategic foresight from market players.

Segmentation Analysis

The Active Optical Cable and Extender market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics and growth drivers. These segments offer granular insights into product types, diverse applications, supported data rates, different end-user categories, and varying cable lengths, each reflecting unique demand patterns and technological requirements. This multi-faceted segmentation allows market participants to identify lucrative niches, understand competitive landscapes, and tailor product development and marketing strategies to specific market needs. The intricate interplay between these segments defines the overall trajectory and expansion opportunities within the AOC and extender ecosystem.

- By Type

- HDMI Active Optical Cables and Extenders

- USB Active Optical Cables and Extenders (USB 3.0, USB 3.1, USB 3.2, USB4)

- DisplayPort Active Optical Cables and Extenders

- Ethernet Active Optical Cables and Extenders (10G, 25G, 40G, 100G, 200G, 400G, 800G)

- SAS Active Optical Cables

- SFP/QSFP Active Optical Cables (SFP+, QSFP+, QSFP28, QSFP-DD)

- InfiniBand Active Optical Cables

- Thunderbolt Active Optical Cables

- DVI Active Optical Cables and Extenders

- VGA Active Optical Cables and Extenders

- Others (e.g., SDI, Custom Interfaces)

- By Application

- Data Centers (Hyperscale, Enterprise)

- Consumer Electronics (Gaming, Virtual Reality/Augmented Reality, Home Theater, PCs)

- Professional Audio-Visual (Digital Signage, Broadcasting, Conferencing, Live Events)

- Industrial Automation

- Telecommunications (5G Backhaul, FTTx Infrastructure)

- Medical Imaging

- Defense & Aerospace

- Automotive Infotainment

- Others (e.g., Smart Cities, Surveillance)

- By Data Rate

- 10 Gbps

- 25 Gbps

- 40 Gbps

- 50 Gbps

- 100 Gbps

- 200 Gbps

- 400 Gbps

- 800 Gbps and Beyond

- By End-User

- Enterprise

- Hyperscale Data Centers

- Small & Medium Businesses (SMBs)

- Residential

- Commercial

- Government & Public Sector

- By Length

- Up to 10 Meters

- 10 Meters to 30 Meters

- 30 Meters to 100 Meters

- Over 100 Meters

Value Chain Analysis For Active Optical Cable and Extender Market

The value chain for the Active Optical Cable and Extender market is a multi-stage process, commencing with upstream activities involving the sourcing and manufacturing of critical components. This stage includes suppliers of raw materials such as optical fiber preforms, plastics, metals, and semiconductor materials. Key component manufacturers specialize in producing crucial elements like Vertical Cavity Surface Emitting Lasers (VCSELs), photodiodes, optical engines, signal conditioning ASICs (Application-Specific Integrated Circuits), and specialized connectors. These components are then integrated by AOC manufacturers who design, assemble, and test the final cable products, ensuring high performance and reliability. The efficiency and innovation at this upstream level significantly dictate the performance and cost-effectiveness of the end product, influencing the competitive landscape.

Moving downstream, the distribution channel plays a vital role in bringing AOCs and extenders to end-users. This involves a network of system integrators who incorporate these cables into larger networking or AV solutions, distributors who manage inventory and logistics for various resellers, and Value-Added Resellers (VARs) who provide tailored solutions and support. The distribution can be direct, particularly for large enterprise or hyperscale data center clients who engage directly with manufacturers for bulk orders and custom solutions. Conversely, indirect channels are prevalent for smaller businesses, consumer electronics, and professional AV markets, where products are sold through online retailers, specialty electronics stores, and a wide array of authorized dealers. This dual-channel approach ensures market penetration across different customer segments.

The effectiveness of this value chain relies heavily on robust logistics, strategic partnerships, and a deep understanding of market demands at each stage. Strong relationships between component suppliers, manufacturers, and channel partners are crucial for ensuring a steady supply, managing costs, and accelerating time-to-market for new technologies. Furthermore, post-sale support and technical assistance provided through these channels contribute to customer satisfaction and loyalty. The evolving technological landscape, characterized by rapid advancements in data rates and form factors, constantly reshapes this value chain, demanding continuous adaptation and optimization from all participants to maintain competitiveness and deliver cutting-edge connectivity solutions efficiently.

Active Optical Cable and Extender Market Potential Customers

The Active Optical Cable and Extender market serves a diverse range of potential customers and end-users, each with distinct connectivity requirements driven by their operational needs for high-speed, reliable data transmission. At the forefront are data center operators, encompassing both hyperscale facilities managed by tech giants and enterprise data centers supporting corporate IT infrastructure. These entities are consistently seeking to upgrade their network backbones and interconnections to accommodate ever-increasing data volumes, AI workloads, and cloud service demands, making them primary consumers of high-bandwidth AOCs. The relentless pursuit of faster processing and storage solutions directly translates into a continuous demand for advanced optical connectivity.

Beyond the realm of data centers, the consumer electronics sector represents a substantial and growing customer base. This includes manufacturers of high-end televisions (8K, 4K), gaming consoles, virtual reality and augmented reality (VR/AR) headsets, and premium home theater systems, all of whom require AOCs for HDMI, USB, and DisplayPort interfaces to deliver uncompressed, high-resolution audio and video over longer distances without signal degradation. End-users in these segments, such as avid gamers, home cinema enthusiasts, and VR/AR developers, directly benefit from the enhanced performance and flexibility offered by these cables, contributing to their widespread adoption. The push for immersive experiences fuels this particular demand.

Other significant segments include professional AV integrators and broadcasters, who deploy AOC extenders for digital signage, large-venue displays, and live event production, ensuring flawless video and audio transmission over substantial lengths. Industrial automation firms are increasingly utilizing AOCs in smart factories and robotics for reliable, EMI-immune data links. Telecommunication providers leverage AOCs in 5G network infrastructure and Fiber-to-the-x (FTTx) deployments, while the medical imaging industry relies on them for high-fidelity data transfer in advanced diagnostic equipment. Government and defense sectors also represent critical customers, requiring secure, high-bandwidth communication links for mission-critical applications. This broad customer base underscores the essential role of AOCs and extenders in powering modern digital ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.85 billion |

| Market Forecast in 2032 | $11.12 billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom, Luxshare-ICT, Sumitomo Electric Industries, Corning Inc., Molex (Koch Industries), Coherent Corp. (formerly II-VI/Finisar), Applied Optoelectronics Inc. (AOI), TE Connectivity, Accelink, Shenzhen Sopto Technology, Fiberhome, NVIDIA, Intel, Cisco, IBM, Hewlett Packard Enterprise (HPE), CommScope, OFS Fitel (Furukawa Electric), Fujitsu Optical Components, LEONI AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Optical Cable and Extender Market Key Technology Landscape

The Active Optical Cable and Extender market is characterized by a rapidly evolving technological landscape, driven by the continuous demand for higher bandwidth, longer reach, and improved power efficiency. A core technology underpinning many AOCs is the use of Vertical Cavity Surface Emitting Lasers (VCSELs) for short-reach optical communication, offering cost-effectiveness and good performance for multi-mode fiber applications within data centers. However, for longer distances and higher data rates, single-mode fiber coupled with advanced optical engines and silicon photonics technology is gaining prominence. Silicon photonics integrates optical components and electronic circuitry onto a single silicon chip, enabling high-density integration, lower power consumption, and improved scalability for next-generation AOCs, particularly those supporting 400Gbps and 800Gbps Ethernet standards. This integration reduces manufacturing complexity and enhances overall performance.

Further advancements in the technological landscape include sophisticated signal integrity management techniques and advanced modulation schemes, such as Pulse Amplitude Modulation 4 (PAM4), which doubles the data rate per unit bandwidth compared to Non-Return-to-Zero (NRZ) signaling. This allows for higher data transmission rates over existing fiber infrastructure. Miniaturization of optical components and connectors is another critical trend, enabling AOCs to fit into increasingly compact devices and high-density port configurations, which is vital for consumer electronics and dense data center racks. Power efficiency is a major focus, with manufacturers striving to reduce the energy consumption of integrated transceivers to align with green data center initiatives and extend battery life in portable devices. The adoption of new packaging technologies that allow for co-packaging optics closer to the host processor is also on the horizon, promising further reductions in power and latency for AI and high-performance computing applications.

Hybrid copper-fiber designs are also emerging as a niche technology, particularly for USB and power delivery applications, combining the benefits of optical data transmission with electrical power delivery. This allows for simpler cable management in scenarios where devices require both high-speed data and power from the host. Furthermore, the development of robust and flexible fiber materials and connector designs is enhancing the durability and ease of installation of AOCs, making them suitable for a broader range of harsh industrial environments and frequent use scenarios. These technological innovations collectively position AOCs and extenders as a cornerstone of modern high-speed connectivity, capable of adapting to the demanding requirements of future digital infrastructure.

Regional Highlights

- North America: This region is a leading market for Active Optical Cables and Extenders, characterized by early adoption of advanced technologies, a high concentration of hyperscale data centers, and substantial investments in cloud computing, AI, and 5G infrastructure. Countries like the United States and Canada are innovation hubs, driving demand for high-speed, low-latency connectivity solutions across enterprise, consumer electronics, and defense sectors.

- Europe: The European market is robust, driven by extensive telecommunications infrastructure upgrades, significant investments in industrial automation (Industry 4.0), and the growing deployment of smart city initiatives. Countries such as Germany, the UK, France, and the Nordics are key contributors, focusing on energy-efficient data centers and sustainable connectivity solutions to support their digital economies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic expansion, massive investments in data center construction (especially in China, India, Japan, and Southeast Asian countries), aggressive 5G network rollouts, and a thriving consumer electronics manufacturing base. The increasing penetration of internet services and rising disposable incomes also boost demand for high-bandwidth home entertainment systems.

- Latin America: This region represents an emerging market with significant growth potential, driven by increasing internet penetration, expanding data center footprint, and ongoing digital transformation efforts across various industries. Countries like Brazil, Mexico, and Argentina are gradually adopting advanced connectivity solutions to modernize their infrastructure and support cloud services.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, primarily due to government-led digital transformation initiatives, smart city projects (e.g., in UAE and Saudi Arabia), and increasing investments in telecommunications infrastructure. The demand for reliable and high-speed connectivity is rising in sectors such as oil and gas, healthcare, and education.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Optical Cable and Extender Market.- Broadcom

- Luxshare-ICT

- Sumitomo Electric Industries

- Corning Inc.

- Molex (Koch Industries)

- Coherent Corp. (formerly II-VI/Finisar)

- Applied Optoelectronics Inc. (AOI)

- TE Connectivity

- Accelink

- Shenzhen Sopto Technology

- Fiberhome

- NVIDIA

- Intel

- Cisco

- IBM

- Hewlett Packard Enterprise (HPE)

- CommScope

- OFS Fitel (Furukawa Electric)

- Fujitsu Optical Components

- LEONI AG

Frequently Asked Questions

What is an Active Optical Cable (AOC) and how does it differ from traditional copper cables?

An Active Optical Cable (AOC) is a type of optical fiber cable terminated with electrical connectors, designed for high-speed data transmission over longer distances. Unlike traditional copper cables that transmit electrical signals, AOCs convert electrical signals into optical signals at one end, transmit them over fiber optic strands, and then convert them back to electrical signals at the other end. This process enables higher bandwidth, immunity to electromagnetic interference (EMI), and allows for thinner, lighter cables over extended lengths.

Why are Active Optical Cables preferred over copper for high-speed data centers?

AOCs are preferred in high-speed data centers due to their superior performance characteristics. They support significantly higher data rates (e.g., 100Gbps, 400Gbps, 800Gbps) over longer distances than copper cables, which suffer from signal degradation and attenuation at such speeds and lengths. AOCs also provide immunity to EMI, crucial in dense server environments, and their lighter, thinner form factor improves airflow and simplifies cable management within racks, contributing to better cooling efficiency.

What are the primary applications of Active Optical Cable and Extender technology?

The primary applications include data centers (connecting servers, switches, and storage in hyperscale and enterprise environments), consumer electronics (for high-resolution video like 8K HDMI, high-speed USB for VR/gaming), professional audio-visual (for digital signage, broadcasting, and conferencing), industrial automation, and telecommunications (for 5G infrastructure and FTTx deployments). They are essential wherever high bandwidth, long reach, and EMI resistance are critical.

How is the global rollout of 5G networks impacting the demand for AOCs?

The global rollout of 5G networks is a significant driver for AOC demand. 5G requires robust, high-bandwidth connectivity for its backhaul and fronthaul infrastructure to support massive data traffic and ultra-low latency applications. AOCs are ideally suited to meet these demands, providing reliable, high-speed optical links between base stations, centralized units, and core networks, facilitating the efficient transmission of vast amounts of data generated by 5G-enabled devices and services.

What technological advancements are shaping the future of Active Optical Cables?

Key technological advancements include the adoption of silicon photonics for increased integration and reduced power consumption, advanced modulation schemes like PAM4 for higher data rates over existing fiber, miniaturization of components for compact designs, and innovations in optical engine technology. There's also a growing focus on power efficiency, hybrid copper-fiber designs for power delivery, and co-packaged optics to bring optical transceivers closer to processing units, particularly for AI and high-performance computing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager