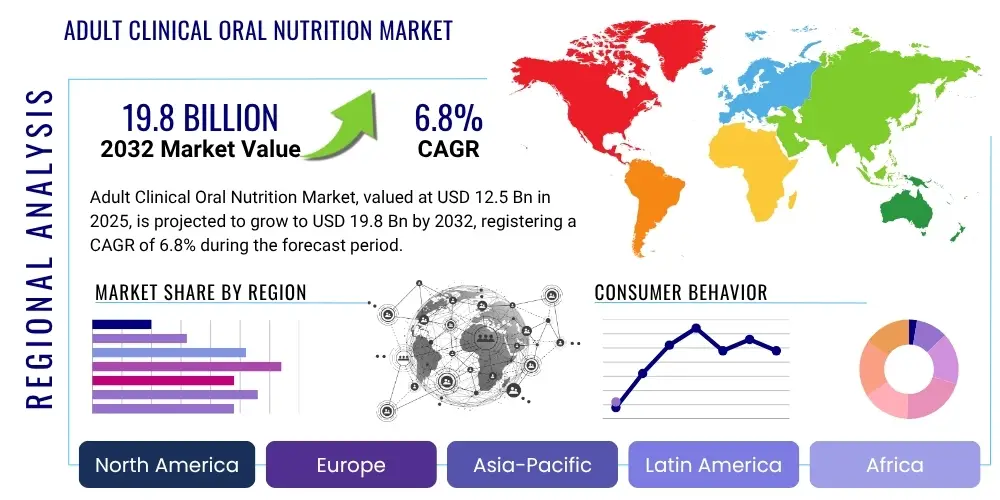

Adult Clinical Oral Nutrition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430100 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Adult Clinical Oral Nutrition Market Size

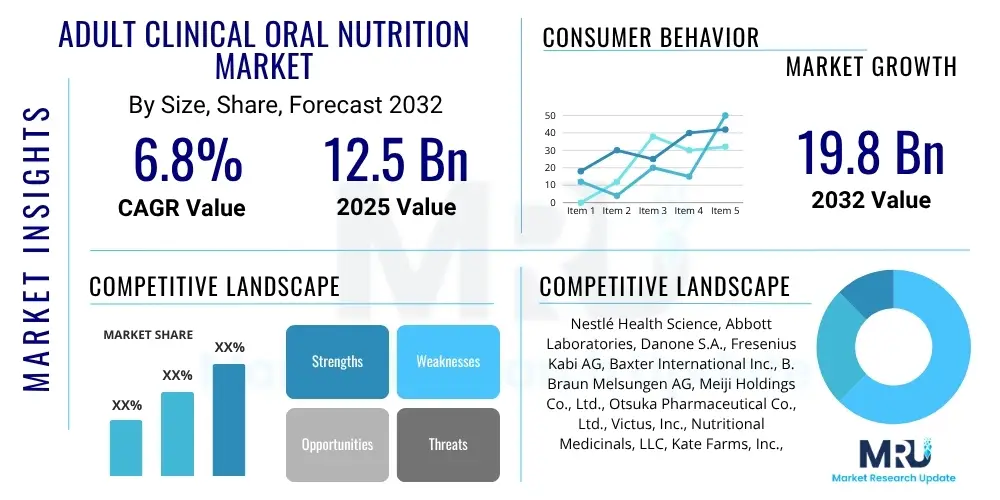

The Adult Clinical Oral Nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2032.

Adult Clinical Oral Nutrition Market introduction

The Adult Clinical Oral Nutrition Market encompasses a diverse range of specialized dietary formulations designed to provide essential nutrients to adults who are unable to meet their nutritional requirements through conventional food intake due to various medical conditions, chronic illnesses, or age-related factors. These products include complete nutritional supplements, protein-rich formulas, and disease-specific preparations tailored for conditions such as diabetes, renal insufficiency, cancer, and gastrointestinal disorders. They are administered orally, often as ready-to-drink liquids or powders mixed with beverages, and serve a critical role in preventing and treating malnutrition, supporting patient recovery, enhancing immune function, and managing chronic disease symptoms. The primary applications for these products span across hospitals, long-term care facilities, and increasingly, homecare settings, driven by an aging global population, the rising prevalence of chronic diseases, and a growing medical understanding of the profound impact of nutrition on health outcomes.

The benefits derived from adult clinical oral nutrition are substantial, ranging from improved clinical outcomes and reduced hospital stays to enhanced quality of life for patients managing chronic conditions. These products provide a convenient and effective method for delivering targeted nutrition, which is crucial for wound healing, maintaining muscle mass, and supporting organ function. Key driving factors propelling this market include demographic shifts, particularly the global increase in the geriatric population, which is inherently more susceptible to malnutrition and requires specialized dietary support due to physiological changes and polypharmacy. Furthermore, advancements in medical technology and an evolving understanding of personalized nutrition are fostering innovation, leading to more palatable, efficacious, and disease-specific formulations that address a wider spectrum of patient needs. The increasing awareness among healthcare professionals and the general public about the critical role of nutritional intervention in patient care further stimulates market expansion.

The market is also witnessing a shift towards preventative nutritional strategies and a greater emphasis on early intervention to mitigate the adverse effects of malnutrition. This proactive approach, coupled with the expanding reach of healthcare services in developing economies, is broadening the adoption of clinical oral nutrition products. Regulatory frameworks are evolving to ensure the safety and efficacy of these specialized formulas, instilling greater confidence among consumers and healthcare providers. As healthcare systems globally grapple with the economic burden of chronic diseases and an aging populace, clinical oral nutrition products are becoming indispensable tools in comprehensive patient management, offering both therapeutic and supportive roles in maintaining and improving health status.

Adult Clinical Oral Nutrition Market Executive Summary

The Adult Clinical Oral Nutrition Market is experiencing dynamic growth, propelled by several overarching business, regional, and segment-specific trends that collectively shape its trajectory and competitive landscape. Business trends are characterized by a significant focus on research and development to introduce innovative and disease-specific formulations, strategic partnerships and collaborations aimed at expanding product portfolios and market reach, and an increasing adoption of digital marketing and e-commerce platforms to improve accessibility for patients and caregivers. Companies are also investing in enhancing product palatability and convenience, recognizing their importance in improving patient compliance and overall therapeutic success. The emphasis on evidence-based nutrition is driving greater investment in clinical trials to substantiate product claims and gain physician trust, thereby solidifying market leadership.

Regionally, North America and Europe currently represent the largest and most mature markets, primarily due to their advanced healthcare infrastructures, high prevalence of chronic diseases, and strong governmental support for nutritional therapy. These regions benefit from established reimbursement policies and a high level of awareness among both healthcare professionals and the general population. However, the Asia Pacific region is emerging as the fastest-growing market, attributed to its rapidly expanding geriatric population, improving healthcare access, increasing disposable incomes, and a growing understanding of the importance of clinical nutrition in patient management. Latin America, the Middle East, and Africa are also demonstrating promising growth, driven by increasing healthcare expenditure and a gradual shift towards modern medical practices, though they face challenges related to infrastructure and affordability.

Segmentation trends reveal a strong and increasing demand for specialized nutritional formulas tailored to specific disease states, such as diabetic nutrition, renal nutrition, and oncology-specific supplements, reflecting the targeted nature of modern medical interventions. Standard complete nutrition products continue to form a foundational segment, addressing general malnutrition and recovery needs. Protein supplements are also experiencing robust growth, driven by an increased focus on sarcopenia prevention and muscle maintenance in the elderly and critically ill. Distribution channels are diversifying, with a notable surge in online sales supplementing traditional hospital and retail pharmacy channels, offering greater convenience and accessibility for homecare patients. The market is thus characterized by a continuous evolution towards more targeted, accessible, and scientifically validated nutritional solutions.

AI Impact Analysis on Adult Clinical Oral Nutrition Market

User inquiries regarding Artificial Intelligence’s influence on the Adult Clinical Oral Nutrition Market frequently center on its potential for personalized dietary recommendations, optimization of supply chains, and improved diagnostic capabilities for nutritional deficiencies. Common questions explore how AI could streamline patient assessment, enhance adherence to complex nutritional regimens, and accelerate the research and development of novel formulations with tailored nutrient profiles. Concerns often revolve around the ethical implications of using patient data, the accuracy and bias of AI algorithms in diverse populations, the need for human oversight, and the significant financial investment required for integrating AI technologies into existing healthcare and manufacturing infrastructures. There is a clear expectation that AI will bring unprecedented precision and efficiency, but also a cautious optimism regarding its practical and equitable implementation.

The integration of Artificial Intelligence (AI) is poised to revolutionize the Adult Clinical Oral Nutrition Market across multiple dimensions, offering unparalleled opportunities for precision, efficiency, and personalized care. AI algorithms can meticulously analyze vast datasets comprising patient medical histories, genetic predispositions, dietary habits, and real-time physiological responses to create highly individualized nutritional intervention plans. This capability moves beyond generic recommendations, enabling healthcare professionals to prescribe or suggest formulations that are optimally suited for a patient’s specific disease state, metabolic needs, and personal preferences, thereby significantly improving therapeutic outcomes and patient compliance. Furthermore, AI can play a crucial role in early detection of malnutrition risk by identifying subtle patterns in patient data that might otherwise be overlooked, facilitating proactive intervention and preventing severe complications.

Beyond direct patient care, AI’s impact extends to operational efficiencies and product innovation within the clinical oral nutrition industry. AI-powered predictive analytics can optimize manufacturing processes, supply chain management, and inventory forecasting, ensuring that the right products are available at the right time, minimizing waste, and enhancing logistical robustness. In research and development, AI can accelerate the discovery of novel ingredients, predict their efficacy and potential interactions, and streamline the formulation development process, leading to the creation of more advanced and targeted nutritional solutions. While the adoption of AI requires substantial investment in data infrastructure, cybersecurity measures, and regulatory compliance, its transformative potential for enhancing personalized nutrition, improving operational effectiveness, and driving product innovation makes it an indispensable technology for the future of adult clinical oral nutrition.

- Personalized nutrition plan development: AI analyzes patient data (medical history, genetics, diet) to create highly individualized nutritional regimens, optimizing efficacy and adherence.

- Optimized supply chain and inventory management: AI predicts demand, streamlines logistics, and reduces waste in manufacturing and distribution of clinical nutrition products.

- Improved early detection and diagnosis of malnutrition risks: AI identifies patterns in patient data for proactive intervention, preventing severe nutritional deficiencies.

- Enhanced research and development for new formulations: AI accelerates ingredient discovery, predicts efficacy, and streamlines formulation development processes.

- Predictive analytics for market demand and patient outcomes: AI forecasts future market needs and anticipates patient responses to specific nutritional therapies.

- Automated monitoring of patient nutritional intake and adherence: AI-driven tools track consumption and provide feedback, improving compliance with prescribed diets.

- Development of smart dispensers for controlled oral nutrition delivery: AI can be integrated into devices for precise, automated dosage and scheduling, particularly in homecare.

- Data-driven insights for targeted marketing and product development: AI helps manufacturers understand market gaps and consumer preferences, informing strategic decisions.

- Remote patient monitoring and telemedicine integration for nutritional counseling: AI facilitates virtual consultations and continuous monitoring, enhancing accessibility and support.

- Ethical considerations in data privacy and algorithmic bias in patient care: Addressing challenges related to secure data handling, fairness, and transparency in AI applications.

DRO & Impact Forces Of Adult Clinical Oral Nutrition Market

The Adult Clinical Oral Nutrition Market is significantly shaped by a complex interplay of drivers, restraints, and opportunities that collectively constitute its impact forces. The primary drivers include the escalating global prevalence of chronic diseases such as cancer, diabetes, and renal failure, which necessitate specialized nutritional support for patient management and recovery. Concurrently, the rapidly expanding geriatric population, inherently more vulnerable to malnutrition and age-related physiological decline, fuels a consistent demand for these products. Increasing awareness among healthcare professionals and the public about the critical role of nutritional therapy in improving patient outcomes and reducing healthcare costs further propels market growth. These factors underscore the essential nature of clinical oral nutrition in modern healthcare, reinforcing its market trajectory despite various headwinds.

However, the market also faces notable restraints that can impede its full growth potential. The high cost associated with manufacturing and distribution of specialized clinical nutrition products often translates to premium pricing, which can be a significant barrier for patients, especially in regions with limited insurance coverage or inadequate reimbursement policies. Palatability issues and patient compliance challenges, stemming from taste and texture preferences, can also affect the consistent use of these products, diminishing their intended therapeutic benefits. Furthermore, stringent regulatory approval processes for new formulations and health claims, coupled with a fragmented regulatory landscape across different countries, pose significant hurdles for manufacturers seeking to innovate and expand their market presence. Addressing these restraints requires a concerted effort from manufacturers, healthcare providers, and policymakers to ensure wider accessibility and acceptance.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The growing demand for personalized nutrition, driven by advancements in genomic and metabolomic research, presents a fertile ground for developing highly tailored oral nutrition solutions. The expansion of homecare and remote patient management settings also opens new avenues for product delivery and consumption, enhancing convenience and reducing the burden on institutional healthcare facilities. Technological advancements in food science, such as microencapsulation for improved taste masking and enhanced nutrient bioavailability, are enabling the development of more effective and patient-friendly products. Strategic collaborations between pharmaceutical companies, nutrition manufacturers, and technology providers are expected to unlock new synergies, leading to novel product offerings and more integrated nutritional care solutions that capitalize on these emerging opportunities.

Segmentation Analysis

The Adult Clinical Oral Nutrition Market is meticulously segmented across various dimensions to reflect the intricate nature of patient needs, product characteristics, and distribution modalities, providing a comprehensive framework for market understanding and strategic planning. This detailed breakdown allows stakeholders to identify specific growth areas, understand competitive dynamics within niches, and tailor product development and marketing strategies effectively. Key segmentation criteria include product type, which differentiates between standard and disease-specific formulas; application areas, categorizing usage across hospitals, homecare, and long-term care facilities; flavor preferences, addressing palatability; distribution channels, encompassing pharmacies and online platforms; age group, distinguishing adult and geriatric consumers; and the specific type of nutrient primarily targeted. Such a multi-faceted approach ensures that the market analysis captures the full breadth of the industry's complexity.

The segmentation by product type is particularly crucial, as it highlights the evolution from general nutritional support to highly specialized interventions designed for specific medical conditions. For instance, the demand for formulas for diabetic patients with controlled carbohydrate levels or renal patients with adjusted electrolyte and protein profiles continues to grow, indicating a shift towards precision nutrition. Similarly, the application segment underscores the increasing importance of homecare settings, where patients manage their nutritional needs independently, necessitating user-friendly and readily available products. Flavor segmentation, while seemingly minor, is vital for patient compliance, as unpleasant tastes can lead to non-adherence, thereby impacting therapeutic outcomes. Manufacturers are constantly innovating to offer a wider array of appealing flavors, including neutral options, to cater to diverse patient preferences and cultural tastes.

Further, the segmentation by distribution channel reflects the evolving landscape of healthcare delivery, with online pharmacies and direct-to-consumer models gaining prominence alongside traditional brick-and-mortar pharmacies and institutional sales. This shift provides greater accessibility and convenience, especially for patients requiring long-term nutritional support. The age group segmentation naturally distinguishes between the broad adult population and the growing geriatric segment, each with unique nutritional requirements and consumption patterns. Finally, the nutrient type classification helps in understanding the market for specific macronutrients like proteins, essential fats, and complex carbohydrates, as well as micronutrients such as vitamins and minerals, highlighting areas of particular therapeutic focus. This granular analysis is instrumental for companies aiming to penetrate specific market segments and for healthcare providers to make informed decisions regarding patient care.

- By Product Type

- Standard Formulas: Designed for general nutritional support, often used for overall recovery and maintenance.

- Disease-Specific Formulas: Tailored for specific medical conditions.

- Diabetic Formulas: Carbohydrate-controlled for blood glucose management.

- Renal Formulas: Electrolyte and protein modified for kidney disease patients.

- Hepatic Formulas: Formulated for liver health support.

- Pulmonary Formulas: Designed for respiratory compromised patients.

- Cancer Formulas: High-calorie, protein-rich to combat cachexia.

- Gastrointestinal Formulas: Easily digestible, often elemental or semi-elemental for GI disorders.

- Protein Supplements: High-protein solutions for muscle maintenance and recovery.

- Vitamin & Mineral Supplements: Targeted micronutrient support.

- Fiber Supplements: Aids digestive health and regularity.

- By Application

- Hospitals & Clinics: Institutional use for inpatient and outpatient care.

- Homecare Settings: For patients managing nutrition independently at home.

- Long-Term Care Facilities: Nursing homes, assisted living, for chronic nutritional support.

- Ambulatory Surgical Centers: For pre and post-surgical nutritional needs.

- By Flavor

- Vanilla: A widely accepted and classic flavor.

- Chocolate: Popular flavor, especially for younger adult patients.

- Strawberry: Fruity option, often preferred.

- Neutral: Unflavored options for mixing with other foods or drinks.

- Others: Including coffee, mixed berry, and savory options for variety.

- By Distribution Channel

- Hospital Pharmacies: In-hospital distribution for patients.

- Retail Pharmacies: Over-the-counter or prescription sales through drugstores.

- Online Pharmacies/E-commerce: Growing segment for convenience and home delivery.

- Direct Sales: Manufacturers selling directly to institutions or large volume consumers.

- By Age Group

- Geriatric: Specifically for individuals 65 years and older, addressing age-related issues.

- Adult (18-64 years): For the general adult population requiring clinical nutrition.

- By Type of Nutrient

- Proteins: Focus on various protein sources like whey, casein, soy, pea.

- Carbohydrates: Simple and complex carbohydrates for energy.

- Fats: Essential fatty acids, MCTs (Medium-Chain Triglycerides) for energy and absorption.

- Vitamins & Minerals: Comprehensive micronutrient blends.

Value Chain Analysis For Adult Clinical Oral Nutrition Market

The value chain for the Adult Clinical Oral Nutrition Market is an intricate network of activities that spans from the procurement of raw materials to the final consumption of products by patients, each stage adding value and influencing the market dynamics. Upstream activities are centered on the sourcing and acquisition of high-quality, often specialized, ingredients such such as various protein isolates (whey, casein, soy), complex carbohydrates, essential fatty acids (omega-3, omega-6), a wide spectrum of vitamins, and essential minerals. Manufacturers forge strong relationships with reliable suppliers globally to ensure consistent quality, safety, and traceability of these critical components, adhering to stringent purity and ethical sourcing standards. Research and development also plays a crucial upstream role, constantly innovating ingredient combinations and processing technologies to enhance nutrient bioavailability and product efficacy, laying the groundwork for market differentiation.

Midstream activities involve the sophisticated processes of manufacturing, formulation, and quality assurance. This stage includes precise blending of ingredients, sterile packaging, and rigorous quality control checks to ensure that each product meets specific nutritional profiles, safety standards, and regulatory requirements. Significant investments are made in advanced manufacturing technologies, such as aseptic processing and microencapsulation, which not only preserve nutrient integrity and extend shelf life but also improve the palatability of the final product, which is a critical factor for patient adherence. Effective quality management systems are paramount to maintain product consistency and meet diverse international certifications, building consumer and healthcare professional trust in the brand. The development of new product formats, such as compact and ready-to-drink solutions, also falls within this stage, aiming to improve user convenience.

Downstream, the focus shifts to distribution, marketing, and sales, encompassing how products reach the end-users. Distribution channels are multifaceted, including direct sales to large institutional buyers like hospitals and long-term care facilities, as well as indirect channels through retail pharmacies, specialty stores, and a rapidly expanding e-commerce presence. The effectiveness of this stage relies on efficient logistics, cold chain management where necessary, and robust inventory systems to ensure timely and widespread availability. Marketing efforts are often targeted at healthcare professionals—physicians, dietitians, and nurses—who serve as key influencers and prescribers, providing them with clinical evidence and educational support. Concurrently, consumer-facing marketing strategies, particularly in the homecare segment, emphasize ease of use, palatability, and specific health benefits to encourage direct purchasing. This holistic approach across the value chain ensures that adult clinical oral nutrition products effectively bridge the gap between production and patient needs.

Adult Clinical Oral Nutrition Market Potential Customers

The Adult Clinical Oral Nutrition Market serves a broad and continually expanding spectrum of potential customers, primarily comprised of individuals grappling with diverse medical conditions that compromise their ability to achieve adequate nutritional intake or absorption through conventional means. This core demographic includes a significant portion of the global geriatric population, who are particularly susceptible to age-related malnutrition, sarcopenia, dysphagia (swallowing difficulties), and chronic diseases that impact appetite and nutrient utilization. Beyond the elderly, critical care patients, individuals recovering from major surgeries or severe trauma, and those undergoing intensive medical treatments such as chemotherapy or radiation for cancer represent a substantial customer base, as these conditions often lead to hypermetabolic states or gastrointestinal distress necessitating specialized nutritional support.

Another crucial segment of potential customers includes patients managing chronic diseases such as diabetes, renal failure, hepatic disorders, and various gastrointestinal diseases like Crohn's or ulcerative colitis. These conditions frequently require specific dietary modifications that are difficult to achieve through regular food, making clinical oral nutrition products indispensable for disease management, preventing complications, and improving overall quality of life. For instance, diabetic patients may require carbohydrate-controlled formulas, while renal patients need carefully adjusted protein and electrolyte levels. Furthermore, individuals with neurological conditions that impair their ability to chew or swallow safely, or those with eating disorders who need structured nutritional repletion, also represent important end-users who rely on these specialized products for their daily sustenance and recovery.

The definition of potential customers also extends to the direct purchasers and facilitators of these products, which include a wide array of healthcare institutions and providers. Hospitals, specialized clinics, long-term care facilities (like nursing homes and assisted living centers), and rehabilitation centers are primary institutional buyers, integrating clinical oral nutrition into their patient care protocols. Increasingly, homecare agencies and individual caregivers also constitute a significant customer group, as a growing number of patients receive medical care and nutritional support in their own homes. Furthermore, healthcare professionals such as physicians, registered dietitians, and pharmacists act as key influencers and prescribers, guiding patients and caregivers in selecting the most appropriate and effective clinical oral nutrition products based on comprehensive patient assessments and therapeutic goals, making them indirect but vital customers in the market's ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2032 | USD 19.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Health Science, Abbott Laboratories, Danone S.A., Fresenius Kabi AG, Baxter International Inc., B. Braun Melsungen AG, Meiji Holdings Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Victus, Inc., Nutritional Medicinals, LLC, Kate Farms, Inc., Glanbia PLC, Hormel Foods Corporation, DSM Nutritional Products AG, Ajinomoto Co., Inc., Reckitt Benckiser Group plc, Takeda Pharmaceutical Company Limited, Lonza Group Ltd, Südzucker AG (BENEO), Kerry Group plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adult Clinical Oral Nutrition Market Key Technology Landscape

The Adult Clinical Oral Nutrition Market is significantly shaped by a dynamic and evolving technology landscape, where innovation in food science, biotechnology, and digital health converges to enhance product efficacy, palatability, and patient adherence. Core technologies include advanced formulation techniques such as microencapsulation, which is crucial for taste masking unpleasant ingredients, improving the stability of sensitive nutrients like vitamins and omega-3 fatty acids, and ensuring their targeted release within the digestive system. Similarly, sophisticated protein processing methods, including enzymatic hydrolysis and advanced filtration, are employed to produce highly digestible and bioavailable protein sources, critical for muscle synthesis and recovery in critically ill or elderly patients. These technologies are foundational to creating specialized formulas that meet the complex nutritional demands of various disease states without compromising patient acceptance.

Furthermore, significant advancements in understanding the human gut microbiome are driving the development of pre- and probiotic-fortified oral nutrition products, leveraging insights into how gut health impacts nutrient absorption, immune function, and overall well-being. This area of research is paving the way for next-generation products that not only provide essential nutrients but also actively promote a healthy gut ecosystem. Analytical technologies, such as high-performance liquid chromatography (HPLC), mass spectrometry (MS), and nuclear magnetic resonance (NMR), are indispensable for stringent quality control, ensuring the precise composition, purity, and safety of raw materials and finished products. These tools also accelerate research and development by enabling rapid screening of novel ingredients and detailed characterization of their nutritional properties and potential interactions, thereby shortening product development cycles and fostering continuous innovation.

Beyond ingredient and formulation science, digital technologies are increasingly being integrated into the clinical oral nutrition space. Artificial Intelligence (AI) and machine learning (ML) algorithms are being utilized for personalized nutrition recommendations, analyzing patient data to suggest optimal product choices and dosages. Smart packaging solutions, incorporating QR codes or NFC tags, can provide patients with detailed product information, usage instructions, and even track adherence, enhancing patient engagement and therapeutic outcomes. Remote patient monitoring systems, often linked with telehealth platforms, allow healthcare providers to track nutritional intake and progress, offering real-time adjustments to treatment plans. This technological synergy aims to create a more integrated, efficient, and patient-centric approach to adult clinical oral nutrition, improving accessibility, efficacy, and overall patient experience in diverse healthcare settings.

Regional Highlights

The global Adult Clinical Oral Nutrition Market exhibits distinct regional dynamics, influenced by varying healthcare infrastructures, demographic shifts, economic conditions, and cultural perceptions of nutrition. North America and Europe currently represent the most established markets, holding significant market shares due to their advanced healthcare systems, high prevalence of chronic diseases, and a substantial aging population. In these regions, there is a well-developed understanding and adoption of clinical nutrition among healthcare professionals, supported by robust research and development activities and established reimbursement policies. The continuous innovation in product offerings and the strong presence of major market players further solidify their leading positions, catering to diverse nutritional needs from post-surgical recovery to long-term disease management.

The Asia Pacific region is poised for the most rapid and substantial growth during the forecast period. This acceleration is driven by several key factors, including a rapidly expanding geriatric population in countries like Japan, China, and South Korea, which increases the demand for nutritional support to combat age-related conditions. Furthermore, improving economic conditions, rising healthcare expenditure, and increasing awareness about the importance of clinical nutrition are contributing to broader market penetration across the region. Countries such as India and China, with their vast populations and developing healthcare infrastructures, present immense untapped potential, attracting significant investments from global and regional players seeking to capitalize on the burgeoning demand for specialized nutritional products. Government initiatives aimed at improving public health and combating malnutrition also play a crucial role in stimulating market expansion in APAC.

Latin America, the Middle East, and Africa (MEA) represent emerging markets within the adult clinical oral nutrition landscape, characterized by varying stages of healthcare development and market maturity. Latin American countries, particularly Brazil and Mexico, are experiencing a growing prevalence of chronic diseases and an expanding middle class, leading to increased demand for specialized nutritional products. In the Middle East and Africa, rising healthcare spending, a growing incidence of lifestyle-related diseases, and improving access to modern medical treatments are fueling market growth. While these regions may face challenges such as limited reimbursement policies, infrastructural gaps, and lower public awareness compared to developed markets, they offer significant long-term opportunities due to their large populations, increasing urbanization, and ongoing healthcare reforms. Strategic investments in local manufacturing capabilities and tailored product solutions are crucial for successful market penetration in these diverse and dynamic regions.

- North America: Dominant market share attributed to high healthcare expenditure, well-established reimbursement systems, significant geriatric population, and advanced R&D.

- Europe: Mature market with robust healthcare infrastructure, high awareness of clinical nutrition, and a large aging demographic in countries like Germany, France, and the UK.

- Asia Pacific (APAC): Fastest-growing region driven by a rapidly expanding elderly population, increasing prevalence of chronic diseases, improving healthcare access, and rising disposable incomes, particularly in China, India, and Japan.

- Latin America: Emerging market characterized by improving healthcare infrastructure, rising health awareness, and growing demand for specialized nutrition, notably in Brazil and Mexico.

- Middle East & Africa (MEA): Developing market offering significant growth potential due to increasing healthcare spending, growing incidence of chronic illnesses, and advancements in medical tourism in countries like Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adult Clinical Oral Nutrition Market.- Nestlé Health Science

- Abbott Laboratories

- Danone S.A.

- Fresenius Kabi AG

- Baxter International Inc.

- B. Braun Melsungen AG

- Meiji Holdings Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Victus, Inc.

- Nutritional Medicinals, LLC

- Kate Farms, Inc.

- Glanbia PLC

- Hormel Foods Corporation

- DSM Nutritional Products AG

- Ajinomoto Co., Inc.

- Reckitt Benckiser Group plc

- Takeda Pharmaceutical Company Limited

- Lonza Group Ltd

- Südzucker AG (through BENEO)

- Kerry Group plc

Frequently Asked Questions

What is clinical oral nutrition and who primarily uses it?

Clinical oral nutrition involves specialized dietary supplements and formulas consumed orally to provide essential nutrients to adults who cannot meet their dietary needs through regular food due to medical conditions, chronic illnesses, or advanced age. Primary users include the elderly suffering from malnutrition, patients recovering from surgery or trauma, and individuals managing chronic diseases like cancer, diabetes, or renal failure, where specific nutritional interventions are critical for recovery and health maintenance.

How are adult clinical oral nutrition products distributed to consumers?

Adult clinical oral nutrition products are distributed through a variety of channels to ensure widespread accessibility. These include traditional avenues such as hospital pharmacies, which cater to inpatient and outpatient needs, and retail pharmacies, offering both over-the-counter and prescription options. Increasingly, online pharmacies and e-commerce platforms have become significant distribution channels, providing convenience and home delivery, particularly for patients requiring long-term nutritional support in homecare settings.

What are the key factors driving growth in the adult clinical oral nutrition market?

The market's growth is predominantly driven by several interconnected factors, including the escalating global geriatric population, which is more susceptible to malnutrition and chronic diseases. Furthermore, the rising prevalence of chronic illnesses such as cancer, diabetes, and gastrointestinal disorders significantly increases the demand for specialized nutritional interventions. Growing awareness among healthcare professionals and the public about the vital role of nutritional therapy in enhancing patient outcomes and reducing healthcare costs also acts as a major catalyst for market expansion.

What role does technology play in the Adult Clinical Oral Nutrition Market?

Technology plays a transformative role in the Adult Clinical Oral Nutrition Market by enhancing product efficacy, palatability, and delivery. Advanced formulation techniques like microencapsulation improve nutrient stability and taste masking. Biotechnology aids in creating highly bioavailable proteins. Digital technologies, including AI and machine learning, enable personalized nutrition plans, optimize supply chain management, and facilitate remote patient monitoring, leading to more tailored and efficient nutritional care.

What challenges does the Adult Clinical Oral Nutrition Market face?

The Adult Clinical Oral Nutrition Market encounters several challenges, notably the high cost associated with specialized products, which can limit accessibility, especially in regions with inadequate reimbursement policies. Palatability issues and patient compliance represent significant hurdles, as unpleasant tastes can lead to inconsistent usage. Additionally, navigating complex and varied regulatory approval processes across different countries poses a challenge for manufacturers seeking to innovate and expand their global market presence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager