Aerial Survey Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430556 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aerial Survey Services Market Size

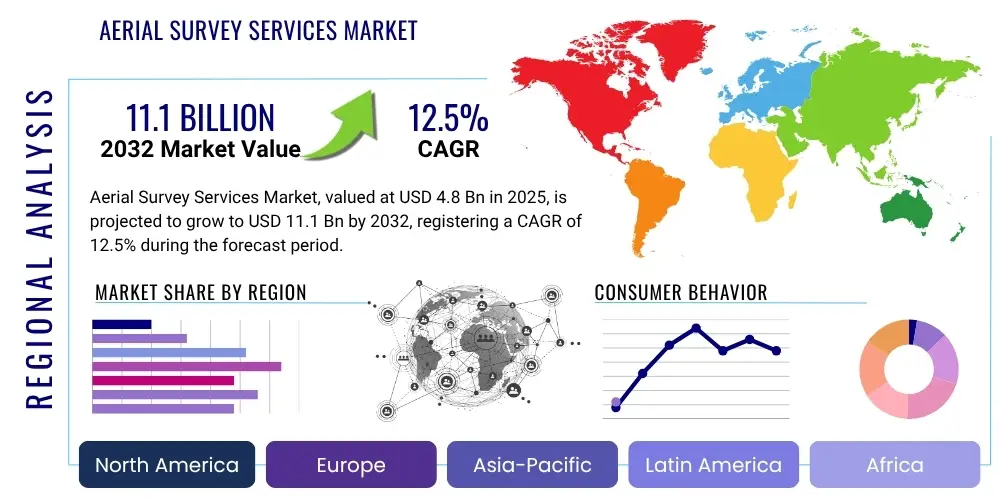

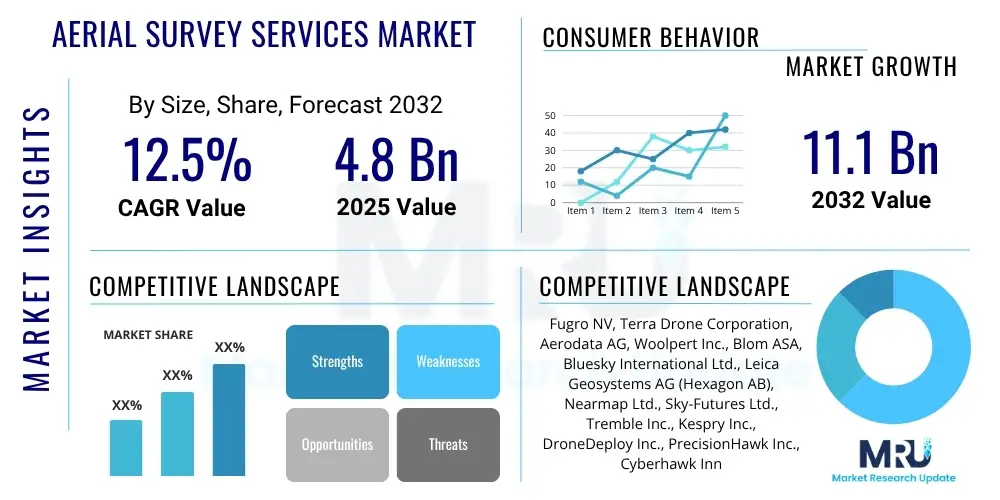

The Aerial Survey Services Market is projected to grow at a Compound Annualized Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2032.

Aerial Survey Services Market introduction

The Aerial Survey Services Market encompasses the provision of professional services involving the collection, processing, and analysis of geospatial data from an aerial perspective. These services leverage various platforms such as drones, manned aircraft, and satellites equipped with advanced sensors like LiDAR, photogrammetric cameras, hyperspectral imagers, and radar. The core product is high-accuracy spatial data, including detailed maps, 3D models, digital elevation models, and orthophotos, which are crucial for informed decision-making across numerous sectors. The comprehensive nature of aerial data collection offers significant benefits, including enhanced safety by minimizing human exposure to hazardous terrains, unparalleled data accuracy and resolution, and remarkable efficiency in covering large or inaccessible areas compared to traditional ground-based methods. This leads to substantial cost savings and accelerated project timelines for clients.

Major applications for aerial survey services span a wide array of industries, demonstrating their versatility and critical utility. These include detailed mapping and cartography for urban planning and resource management, precise land surveying for construction and infrastructure development projects such as roads, railways, and utilities, and volumetric calculations for mining operations. Furthermore, the agricultural sector utilizes these services for precision farming, crop health monitoring, and yield optimization, while environmental agencies rely on them for ecological assessments, disaster management, and monitoring changes in land use. The market is primarily driven by escalating demand for accurate geospatial data across these diverse applications, coupled with continuous technological advancements in drone capabilities, sensor technology, and data processing algorithms, all contributing to more efficient and cost-effective data acquisition solutions.

Aerial Survey Services Market Executive Summary

The Aerial Survey Services Market is experiencing robust expansion, characterized by significant business trends that underscore a shift towards advanced data acquisition and analytical methodologies. The increasing adoption of Unmanned Aerial Vehicles (UAVs) or drones is a primary driver, revolutionizing operational efficiency and accessibility while reducing costs. This trend is further amplified by the integration of sophisticated sensor technologies, artificial intelligence for data processing, and cloud-based platforms for data management, enabling service providers to offer highly precise and actionable insights. Companies are focusing on expanding their service portfolios to include advanced analytics, 3D modeling, and real-time data streaming, catering to the evolving demands of various end-user industries and fostering a competitive environment focused on innovation and data quality. Strategic partnerships and mergers are also prevalent as firms seek to consolidate market share and enhance technological capabilities.

Regionally, North America and Europe continue to be dominant markets, attributed to their early adoption of advanced technologies, established infrastructure projects, and robust regulatory frameworks supporting aerial operations. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by rapid urbanization, significant infrastructure development initiatives, and increasing investment in smart city projects across countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa are also witnessing substantial growth, driven by investments in mining, oil and gas exploration, and agricultural modernization. Each region presents unique opportunities and challenges, with varying regulatory landscapes and technological maturity levels influencing market penetration and growth trajectories.

From a segment perspective, the market is observing notable shifts. The drone-based services segment is projected to exhibit the highest growth, largely due to their flexibility, cost-effectiveness, and ability to operate in challenging environments. LiDAR and photogrammetry remain cornerstone technologies, continuously improving in resolution and accuracy, thereby expanding their application scope. The construction and infrastructure sector consistently holds a significant market share, driven by the need for precise planning, monitoring, and progress tracking of large-scale projects. Concurrently, the agriculture sector is rapidly adopting aerial survey for precision farming, while environmental monitoring and disaster management applications are gaining traction, indicating diversification of service demand. This comprehensive evolution across business, regional, and segment trends collectively paints a picture of a dynamic and expanding market with considerable future potential.

AI Impact Analysis on Aerial Survey Services Market

Users frequently inquire about how Artificial Intelligence (AI) is transforming aerial survey services, focusing on its ability to enhance efficiency, accuracy, and automation. There is a strong expectation that AI will streamline the entire workflow, from automated flight planning and data acquisition to advanced processing and interpretation. Common concerns revolve around the ethical implications of AI in data analysis, data privacy, and the potential for job displacement as AI takes over repetitive tasks. However, the predominant sentiment is one of optimism, anticipating AI's role in unlocking deeper insights from vast datasets, enabling predictive analytics, and ultimately delivering more valuable and cost-effective solutions to clients across various industries, pushing the boundaries of what is achievable with geospatial data.

- Automated Data Processing: AI algorithms significantly accelerate the processing of large volumes of aerial imagery and LiDAR data, reducing manual effort and processing time.

- Enhanced Data Accuracy: Machine learning models can detect anomalies and patterns more effectively, leading to improved accuracy in classifications, feature extraction, and change detection.

- Predictive Analytics: AI enables the development of predictive models for various applications, such as anticipating crop yields, identifying potential infrastructure failures, or forecasting environmental changes.

- Autonomous Operation: AI-powered drones can perform more intelligent flight paths, obstacle avoidance, and even automated data capture based on real-time analysis, increasing operational efficiency and safety.

- Feature Extraction and Object Recognition: AI excels at automatically identifying and classifying objects like buildings, roads, vegetation, or specific crop types from aerial imagery, saving immense manual effort.

- Quality Control and Anomaly Detection: AI can identify errors or inconsistencies in collected data, ensuring higher quality outputs and reducing the need for repeat surveys.

- Improved 3D Modeling: AI algorithms contribute to more precise and detailed 3D reconstructions from photogrammetric data, offering enhanced visualization and analysis capabilities.

- Reduced Human Intervention: AI automates repetitive and time-consuming tasks, allowing human experts to focus on complex problem-solving and higher-level analysis.

DRO & Impact Forces Of Aerial Survey Services Market

The Aerial Survey Services Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, shaping its growth trajectory and competitive landscape. Key drivers include rapid technological advancements in UAVs, sensor payloads (e.g., LiDAR, multispectral, thermal), and AI-powered data processing software, which together enhance the efficiency, accuracy, and cost-effectiveness of data collection. The escalating global demand for highly precise geospatial data across diverse sectors like urban planning, construction, mining, agriculture, and environmental monitoring further fuels market expansion. Additionally, massive infrastructure development projects worldwide, coupled with the increasing adoption of smart city initiatives and digital twin concepts, create a continuous and growing need for comprehensive aerial data, solidifying its position as a critical enabling technology.

However, several restraints pose challenges to the market's unbridled growth. High initial capital investment required for acquiring advanced drones, sophisticated sensors, and specialized software platforms can be a significant barrier for new entrants and smaller service providers. Furthermore, the complex and evolving regulatory landscape surrounding drone operations, particularly concerning airspace restrictions, privacy concerns, and licensing requirements, creates operational hurdles and limits scalability in certain regions. The shortage of skilled professionals proficient in operating advanced aerial platforms, processing complex geospatial data, and interpreting analytical outputs also constrains market growth, as specialized expertise is crucial for delivering high-quality services. Data security and privacy issues, especially when dealing with sensitive infrastructural or personal data, represent another considerable concern for both providers and clients.

Despite these challenges, the market is replete with substantial opportunities. The emergence of new application areas, such as precision agriculture, disaster management, renewable energy project planning, and archaeological surveys, broadens the market's revenue streams. Integration with other nascent technologies like the Internet of Things (IoT), big data analytics, and cloud computing promises to unlock new capabilities, facilitating real-time data access, enhanced data integration, and more sophisticated analytical insights. Expansion into untapped emerging economies, particularly in Asia Pacific and Latin America, which are experiencing rapid industrialization and infrastructure growth, offers significant market penetration opportunities. Moreover, the continuous innovation in autonomous systems and improved battery technology for drones are expected to further reduce operational costs and expand flight durations, making aerial survey services even more attractive and accessible for a wider range of applications and clients.

Segmentation Analysis

The Aerial Survey Services Market is comprehensively segmented based on various factors including the platform used for data acquisition, the type of technology employed, the specific applications, and the end-use industries served. This segmentation provides a granular view of market dynamics, allowing for a detailed analysis of growth opportunities and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to tailor their offerings, identify niche markets, and strategize for optimal market penetration. The evolving technological landscape continues to influence these segments, with significant growth seen in drone-based solutions and advanced sensor technologies.

- By Platform

- Drones UAVs

- Manned Aircraft

- Satellites

- By Type

- Photogrammetry

- LiDAR

- Hyperspectral Imaging

- Radar

- Thermal Imaging

- By Application

- Mapping and Cartography

- Construction and Infrastructure

- Mining and Quarrying

- Agriculture and Forestry

- Environmental Monitoring and Conservation

- Oil and Gas

- Defense and Public Safety

- Disaster Management

- By End-Use Industry

- Government and Public Sector

- Energy and Utilities

- Real Estate and Land Development

- Insurance

- Telecommunications

- Transportation

Value Chain Analysis For Aerial Survey Services Market

The value chain for the Aerial Survey Services Market begins with upstream activities focused on the manufacturing and supply of critical components and systems. This includes the development and production of aerial platforms such as drones, manned aircraft, and satellite systems, alongside highly specialized sensors like LiDAR scanners, high-resolution cameras (RGB, multispectral, hyperspectral, thermal), and radar units. Software developers also play a crucial upstream role by providing advanced flight planning tools, sensor control systems, and initial data acquisition software. Key players in this stage are often technology innovators and hardware manufacturers who supply the foundational tools necessary for data collection.

Moving downstream, the value chain encompasses the core service provision: data acquisition, processing, and analysis. Service providers deploy the aerial platforms to capture raw geospatial data. This raw data then undergoes rigorous processing, involving photogrammetric reconstruction, LiDAR point cloud classification, data fusion, and geo-referencing, often using sophisticated AI/ML-powered software. The final stage of downstream activities involves generating actionable insights, reports, 3D models, and interactive maps that are tailored to the specific needs of the end-user. This stage often includes advanced analytics, predictive modeling, and integration with Geographic Information Systems (GIS) for comprehensive client solutions.

Distribution channels for aerial survey services are typically both direct and indirect. Direct channels involve service providers engaging directly with end-clients, offering customized solutions based on their project requirements. This often involves establishing long-term relationships with government agencies, large construction firms, or mining corporations. Indirect channels include partnerships with engineering firms, consultancy services, and software vendors who integrate aerial survey data into broader project scopes. Some providers also leverage platform-based models, offering data-as-a-service or utilizing online marketplaces to reach a wider client base. The choice of distribution channel often depends on the scale of the project, the specialization of the service, and the geographic reach desired by the provider.

Aerial Survey Services Market Potential Customers

The potential customer base for Aerial Survey Services is diverse and expansive, encompassing a wide range of industries and government entities that require precise, large-scale geospatial data for operational efficiency, planning, and monitoring. Government agencies are significant buyers, utilizing these services for urban planning, land management, infrastructure development (roads, railways, utilities), environmental protection, disaster response, and national defense. Their need for accurate cadastral maps, digital elevation models, and change detection analyses drives consistent demand. Local municipalities leverage these services for property assessment, zoning enforcement, and public works project management, highlighting the broad public sector reliance on aerial data.

In the private sector, the construction and infrastructure industry represents a major customer segment. Companies involved in building new structures, developing real estate, or maintaining existing infrastructure rely on aerial surveys for site planning, progress monitoring, volumetric calculations, and as-built documentation. Mining and quarrying operations utilize these services for resource estimation, pit optimization, and safety monitoring. Furthermore, the energy and utilities sector (oil and gas, power transmission, renewable energy) employs aerial surveys for pipeline inspection, power line monitoring, site assessment for new installations, and asset management across vast geographies. These industries benefit from the ability to quickly and safely collect data over extensive and often hazardous areas, leading to improved project outcomes and reduced operational risks.

Beyond these primary users, other significant customer segments include precision agriculture, where farmers and agricultural enterprises use aerial data for crop health analysis, yield prediction, and optimized resource application. Environmental organizations and researchers are increasingly using these services for ecological surveys, deforestation monitoring, and climate change impact assessments. Insurance companies employ aerial surveys for damage assessment after natural disasters, while telecommunication firms utilize them for tower inspections and network planning. The diverse applications underscore the critical value of aerial survey services as a fundamental tool for data-driven decision-making across an ever-expanding array of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 11.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fugro NV, Terra Drone Corporation, Aerodata AG, Woolpert Inc., Blom ASA, Bluesky International Ltd., Leica Geosystems AG (Hexagon AB), Nearmap Ltd., Sky-Futures Ltd., Tremble Inc., Kespry Inc., DroneDeploy Inc., PrecisionHawk Inc., Cyberhawk Innovations Ltd., Phoenix LiDAR Systems, Quantum-Systems GmbH, senseFly SA (AgEagle Aerial Systems), ESRI (Environmental Systems Research Institute), Geodigital International, Aibotix GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerial Survey Services Market Key Technology Landscape

The technological landscape of the Aerial Survey Services Market is characterized by rapid innovation and integration of advanced systems that continually enhance data acquisition, processing, and analytical capabilities. Unmanned Aerial Vehicles (UAVs) or drones are at the forefront, offering unparalleled flexibility, cost-effectiveness, and the ability to access difficult terrains. These platforms are equipped with diverse sensor payloads, including high-resolution RGB cameras for photogrammetry, sophisticated LiDAR (Light Detection and Ranging) scanners for highly accurate 3D point cloud generation, multispectral and hyperspectral sensors for detailed agricultural and environmental analysis, and thermal cameras for heat signature detection and inspection. The continuous miniaturization and improvement in sensor performance are key drivers of this segment's growth, enabling more detailed and varied data collection.

Complementing the hardware, advanced software solutions form a critical component of the technology landscape. This includes specialized flight planning and control software that optimizes drone operations, ensuring efficient coverage and data consistency. Post-processing software, often incorporating Artificial Intelligence (AI) and Machine Learning (ML) algorithms, plays a vital role in transforming raw sensor data into actionable insights. These AI/ML capabilities enable automated feature extraction, object recognition, change detection, and 3D modeling, significantly reducing manual processing time and enhancing data accuracy. Cloud computing platforms are increasingly utilized for data storage, processing, and collaborative analysis, facilitating scalability and accessibility for global projects.

Furthermore, the integration of Global Positioning System (GPS) and Global Navigation Satellite System (GNSS) technologies provides highly accurate geo-referencing, crucial for precision mapping and surveying. Geographic Information Systems (GIS) serve as foundational platforms for integrating, analyzing, and visualizing the vast amounts of geospatial data generated. Innovations in battery technology, beyond visual line of sight (BVLOS) capabilities, and anti-collision systems are further enhancing the operational range and safety of aerial platforms. The synergy between these diverse technologies creates a robust ecosystem that supports the intricate requirements of modern aerial survey services, pushing the boundaries of what is possible in remote sensing and spatial data intelligence.

Regional Highlights

- North America: A leading market driven by early adoption of advanced drone technology, significant investment in infrastructure development, and a strong presence of key market players and innovation hubs. Regulatory advancements are gradually supporting broader commercial applications.

- Europe: Characterized by increasing demand from smart city initiatives, precision agriculture, and environmental monitoring projects. Strict but evolving regulations are shaping the market, with Germany, France, and the UK being major contributors to growth and technological advancements.

- Asia Pacific: Fastest-growing region owing to rapid urbanization, massive infrastructure projects (e.g., China's Belt and Road Initiative, India's smart cities), and increasing adoption of modern surveying techniques in agriculture and mining sectors. Favorable government policies and lower operational costs also contribute to its expansion.

- Latin America: Experiencing growth primarily due to extensive mining activities, oil and gas exploration, and agricultural modernization. Countries like Brazil and Mexico are emerging as key markets, leveraging aerial surveys for resource management and infrastructure planning despite varying regulatory challenges.

- Middle East and Africa (MEA): Growth driven by significant investments in large-scale construction projects, urban development, and expansion in the oil and gas sector. Countries like UAE, Saudi Arabia, and South Africa are adopting aerial survey services for land management and monitoring critical infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerial Survey Services Market.- Fugro NV

- Terra Drone Corporation

- Aerodata AG

- Woolpert Inc.

- Blom ASA

- Bluesky International Ltd.

- Leica Geosystems AG (Hexagon AB)

- Nearmap Ltd.

- Sky-Futures Ltd.

- Trimble Inc.

- Kespry Inc.

- DroneDeploy Inc.

- PrecisionHawk Inc.

- Cyberhawk Innovations Ltd.

- Phoenix LiDAR Systems

- Quantum-Systems GmbH

- senseFly SA (AgEagle Aerial Systems)

- ESRI (Environmental Systems Research Institute)

- Geodigital International

- Aibotix GmbH

Frequently Asked Questions

What are aerial survey services?

Aerial survey services involve collecting geospatial data from an airborne platform, such as drones, manned aircraft, or satellites, using specialized sensors like cameras, LiDAR, or radar to create maps, 3D models, and detailed analyses for various applications.

What industries primarily benefit from aerial surveys?

Key industries benefiting include construction and infrastructure, mining, agriculture, urban planning, environmental monitoring, oil and gas, and defense, all requiring precise geospatial data for planning, monitoring, and management.

How does AI impact aerial survey services?

AI significantly enhances aerial survey services by automating data processing, improving accuracy in feature extraction, enabling predictive analytics, and allowing for more efficient and intelligent autonomous drone operations, thereby streamlining workflows and providing deeper insights.

What are the main technologies used in aerial surveying?

The main technologies include Unmanned Aerial Vehicles (UAVs) or drones, advanced sensors (LiDAR, photogrammetric cameras, multispectral imagers), GPS/GNSS for precise positioning, and specialized software for data processing, 3D modeling, and Geographic Information Systems (GIS).

What are the primary challenges facing the Aerial Survey Services Market?

Key challenges include high initial investment costs for equipment, complex and evolving regulatory frameworks for drone operations, concerns regarding data privacy and security, and a persistent shortage of skilled professionals capable of operating advanced systems and interpreting complex geospatial data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager