Aerial Work Platform Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429978 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aerial Work Platform Rental Market Size

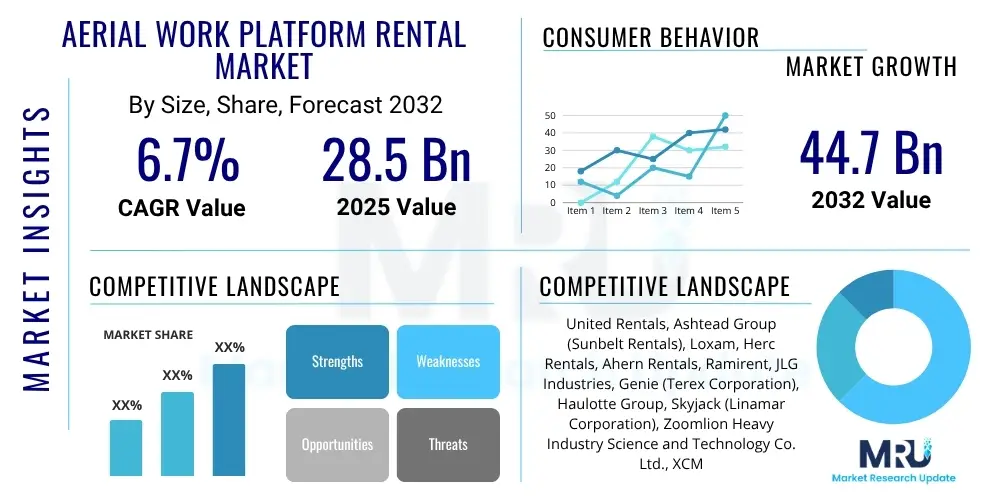

The Aerial Work Platform Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 28.5 billion in 2025 and is projected to reach USD 44.7 billion by the end of the forecast period in 2032.

Aerial Work Platform Rental Market introduction

The Aerial Work Platform (AWP) rental market encompasses the provision of various types of mobile elevated work platforms to businesses and individuals on a temporary basis. These platforms, designed to lift personnel and equipment to elevated positions, include scissor lifts, boom lifts, vertical mast lifts, and telehandlers. The primary objective of AWP rentals is to offer a cost-effective and flexible solution for tasks requiring height access across diverse industries, circumventing the significant capital expenditure associated with purchasing and maintaining such specialized equipment.

AWPs are crucial across numerous sectors due to their inherent safety features and operational versatility. Major applications span construction, where they facilitate tasks like steel erection, facade installation, and roofing; industrial maintenance, including plant shutdowns, equipment servicing, and infrastructure repairs; and utilities, supporting line work and maintenance of overhead infrastructure. Furthermore, they are extensively utilized in events and entertainment for stage setup, lighting installation, and venue decoration, showcasing their adaptability beyond traditional industrial uses.

The benefits of renting AWPs are multifaceted, offering enhanced operational flexibility, reduced maintenance burdens, and access to a diverse fleet of specialized equipment without long-term commitments. Driving factors for market expansion include accelerated urbanization, increasing investments in infrastructure development globally, and the implementation of stringent safety regulations that mandate certified equipment for working at height. The convenience of rental services, which often include delivery, maintenance, and operator training, further propels market demand, allowing businesses to focus on their core operations.

Aerial Work Platform Rental Market Executive Summary

The Aerial Work Platform Rental Market is experiencing robust growth driven by sustained activity in construction and infrastructure development, alongside increasing industrial maintenance requirements. A key business trend is the ongoing digitalization of rental operations, with companies leveraging telematics and advanced fleet management software to optimize utilization, enhance maintenance schedules, and improve customer service. There is also a significant push towards sustainability, leading to increased adoption of electric and hybrid AWPs, especially in urban environments and for indoor applications where emission and noise reduction are paramount. Rental providers are focusing on expanding their fleets with a wider range of specialized and environmentally friendly equipment to meet evolving client demands and regulatory pressures.

Regionally, the market exhibits varied growth trajectories. North America and Europe represent mature markets characterized by high penetration rates and a focus on technological upgrades, safety compliance, and efficient fleet management. These regions are witnessing a gradual shift towards more sophisticated equipment and integrated rental solutions. In contrast, the Asia Pacific region, particularly emerging economies like India and China, is projected to be the fastest-growing market. This growth is fueled by rapid urbanization, substantial government investments in infrastructure projects, and increasing awareness of workplace safety standards that necessitate the use of modern access equipment. Latin America and the Middle East and Africa are also poised for growth, albeit at a slower pace, driven by large-scale construction and industrial projects.

Segmentation trends indicate a rising demand for specific types of AWPs that offer enhanced maneuverability and efficiency for particular applications. Boom lifts and scissor lifts continue to dominate the market due to their versatility and widespread use across construction and industrial sectors. The market is also seeing increased uptake of electric and hybrid models across all AWP types, reflecting a broader industry trend towards greener operations and adherence to stricter environmental regulations. End-user segments such as construction and industrial sectors remain the primary revenue contributors, though growth in specialized applications like utilities, facility management, and large-scale events is also notable, leading to diversification in rental fleet composition and service offerings.

AI Impact Analysis on Aerial Work Platform Rental Market

Users frequently inquire about the transformative potential of Artificial intelligence in the Aerial Work Platform Rental Market, often focusing on how AI can enhance operational efficiency, improve safety, and optimize fleet management. Key themes emerging from these questions revolve around predictive maintenance capabilities that can reduce downtime and extend equipment lifespan, the role of AI in real-time diagnostics and remote troubleshooting, and its application in optimizing logistics and scheduling for rental fleets. Concerns also touch upon the initial investment required for AI integration, potential workforce displacement, and the need for robust data security. Users anticipate that AI will fundamentally change how AWPs are utilized, maintained, and rented, fostering a more intelligent and responsive rental ecosystem.

- Enhanced Predictive Maintenance: AI algorithms analyze telematics data to forecast equipment failures, enabling proactive servicing and reducing unexpected downtime, thereby improving fleet availability and customer satisfaction.

- Optimized Fleet Management: AI-driven systems process vast amounts of data on usage patterns, location, and demand to optimize equipment allocation, delivery routes, and scheduling, leading to higher utilization rates and lower operational costs.

- Improved Operator Safety: AI can monitor operator behavior, detect potential hazards, and provide real-time alerts or even intervene in critical situations, significantly reducing accident risks on job sites.

- Autonomous and Semi-Autonomous Operations: While full autonomy is still emerging, AI is enabling features like automated leveling, obstacle avoidance, and precise positioning, increasing efficiency and precision in specific tasks.

- Personalized Rental Experiences: AI can analyze customer preferences and past rental history to offer tailored recommendations, dynamic pricing, and streamlined booking processes, enhancing the overall customer journey.

- Advanced Training and Simulation: AI-powered virtual reality (VR) and augmented reality (AR) platforms can provide realistic training simulations for AWP operators, improving skill acquisition and safety awareness.

DRO & Impact Forces Of Aerial Work Platform Rental Market

The Aerial Work Platform Rental Market is primarily propelled by significant drivers such as global infrastructure development, increasing urbanization, and a growing emphasis on workplace safety standards across various industries. Investments in residential, commercial, and industrial construction projects consistently fuel the demand for AWPs. The inherent benefits of rental, including reduced capital expenditure for end-users and the flexibility to access diverse equipment types for specific project needs, also act as strong market drivers. Additionally, the adoption of advanced technologies like telematics and IoT in AWP fleets enhances efficiency and safety, further stimulating market growth.

Despite these drivers, the market faces several restraints. The high initial capital investment required for purchasing and maintaining AWP fleets poses a significant barrier for new entrants and can limit fleet expansion for existing players. Economic downturns and geopolitical uncertainties can directly impact construction and industrial activity, leading to reduced demand for rental equipment. Furthermore, a shortage of skilled operators and maintenance personnel presents operational challenges, affecting equipment uptime and service quality. Regulatory complexities and varying safety standards across different regions can also add to operational overheads and compliance costs for rental companies.

Opportunities for growth in the AWP rental market are substantial, particularly in emerging economies where infrastructure spending is on an upward trajectory and awareness of modern construction practices is increasing. Technological advancements, including the development of electric, hybrid, and more energy-efficient AWPs, open new avenues for market penetration, especially in environmentally sensitive projects and urban areas. The expansion into niche applications such as logistics, warehousing, and film production also represents untapped potential. The industry's impact forces, encompassing strong competitive intensity among numerous regional and global players, exert pressure on pricing and service differentiation, while buyer power is moderate due to the availability of multiple rental options. Supplier power for AWP manufacturers is considerable given the specialized nature of the equipment, and the threat of substitutes is low due to the essential role AWPs play in safe elevated access. The threat of new entrants is moderate, balanced by the high capital requirements against the fragmented nature of some regional markets.

Segmentation Analysis

The Aerial Work Platform Rental Market is comprehensively segmented to provide granular insights into demand patterns and growth opportunities. These segmentations are critical for understanding market dynamics across different equipment types, power sources, end-user applications, and geographic regions. Analyzing these distinct segments helps rental companies tailor their fleets and service offerings to specific client needs, optimize their operational strategies, and identify emerging market trends. The diverse range of AWPs available, coupled with the varied requirements of end-user industries, necessitates this detailed breakdown to capture the full scope of market activity and potential.

- Type

- Boom Lifts

- Articulating Boom Lifts

- Telescopic Boom Lifts

- Scissor Lifts

- Electric Scissor Lifts

- Rough Terrain Scissor Lifts

- Vertical Mast Lifts

- Telehandlers

- Personal Portable Lifts

- Others (e.g., Atrium Lifts, Trailer Mounted Boom Lifts)

- Boom Lifts

- Power Source

- Electric

- Diesel

- Hybrid

- Gasoline/LPG

- End-User

- Construction

- Industrial

- Utilities

- Events & Entertainment

- Facility Management

- Agriculture

- Government & Municipalities

- Others

- Application

- New Construction

- Maintenance & Repair

- Installation

- Inspection

- Demolition

- Warehousing & Logistics

- Film & Media Production

Value Chain Analysis For Aerial Work Platform Rental Market

The value chain for the Aerial Work Platform Rental Market begins with upstream activities involving the manufacturing and supply of raw materials and components. This segment includes steel and aluminum producers, hydraulic system manufacturers, engine and battery suppliers, and electronic control system developers. These upstream partners are crucial for providing the foundational elements that ensure the quality, reliability, and technological sophistication of the AWPs. Relationships with these suppliers are often strategic, focusing on cost-efficiency, material quality, and innovation, which directly impact the performance and cost structure of the final rental equipment.

Moving downstream, the value chain encompasses the AWP manufacturers, who assemble these components into various types of aerial work platforms. These manufacturers then engage with rental companies, either directly or through a network of distributors and dealers. Rental companies form the core of the market, acquiring a diverse fleet of AWPs and providing them to end-users. Their activities involve fleet management, maintenance, logistics, customer service, and ensuring compliance with safety regulations. The rental companies add significant value by offering accessibility, flexibility, and specialized support to their clientele, transforming the capital-intensive equipment into an operational expense for their customers.

The distribution channels in the AWP rental market are primarily direct and indirect. Direct channels involve large rental corporations procuring equipment directly from manufacturers, often through long-term contracts and bulk purchases. Indirect channels, on the other hand, involve smaller rental companies or regional players acquiring equipment through authorized dealers or distributors who act as intermediaries between manufacturers and end-users. After the rental transaction, downstream activities extend to the end-users who operate the AWPs, and eventually to maintenance and service providers, often internal departments of rental companies or third-party contractors, who ensure the equipment remains operational, safe, and compliant with industry standards. This integrated approach ensures continuous equipment availability and optimal performance throughout its lifecycle.

Aerial Work Platform Rental Market Potential Customers

The potential customers for the Aerial Work Platform Rental Market are diverse, spanning a broad spectrum of industries that require temporary access to elevated work areas. The primary end-users include construction companies, ranging from large general contractors involved in monumental infrastructure projects to smaller residential builders. These firms rely heavily on AWPs for tasks such as facade installation, structural steel work, roofing, interior finishing, and demolition, appreciating the flexibility and cost-efficiency of renting over purchasing expensive equipment for project-specific durations.

Beyond construction, industrial facilities represent another significant customer segment. This includes manufacturing plants, petrochemical complexes, power generation stations, and warehouses. These entities utilize AWPs for routine maintenance, equipment repair, facility upgrades, and inventory management at height. The need for precise positioning, varying lift capacities, and adherence to stringent safety protocols makes AWPs indispensable for maintaining operational continuity and safety in these environments. The flexibility of rental also allows these industries to adapt to fluctuating maintenance schedules and project requirements without long-term asset commitments.

Furthermore, the market serves a variety of other sectors, including utility companies for power line maintenance, telecommunications infrastructure work, and street light servicing. Event management firms frequently rent AWPs for setting up stages, lighting, and decorations for concerts, festivals, and exhibitions. Government agencies, including municipalities, utilize AWPs for public infrastructure maintenance, park landscaping, and traffic management. Facility management companies, airports, and even agricultural operations for tasks like orchard pruning and barn maintenance also constitute important customer bases, highlighting the widespread utility and diverse application potential of rented aerial work platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2032 | USD 44.7 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | United Rentals, Ashtead Group (Sunbelt Rentals), Loxam, Herc Rentals, Ahern Rentals, Ramirent, JLG Industries, Genie (Terex Corporation), Haulotte Group, Skyjack (Linamar Corporation), Zoomlion Heavy Industry Science and Technology Co. Ltd., XCMG Group, LiuGong Machinery Co. Ltd., Aichi Corporation, Snorkel, Manitou Group, MEC Aerial Work Platforms, Niftylift Ltd., Tadano Ltd., Ruthmann Holdings GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerial Work Platform Rental Market Key Technology Landscape

The Aerial Work Platform Rental Market is increasingly defined by the integration of advanced technologies aimed at enhancing safety, operational efficiency, and equipment utilization. Telematics systems are foundational, providing real-time data on equipment location, engine hours, fuel consumption, and operational status. This data is critical for optimizing maintenance schedules, preventing theft, and improving logistical planning. Rental companies leverage telematics to monitor fleet performance remotely, enabling proactive diagnostics and minimizing downtime, which is a key differentiator in a competitive market. Furthermore, geo-fencing capabilities and remote access controls add layers of security and operational compliance.

The adoption of Internet of Things (IoT) sensors and Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing predictive maintenance. These technologies analyze vast datasets from telematics to identify patterns and predict potential equipment failures before they occur. This shift from reactive to proactive maintenance significantly reduces repair costs, extends the lifespan of AWPs, and ensures higher fleet availability for customers. AI also plays a role in optimizing rental pricing, demand forecasting, and customer relationship management, providing a more personalized and efficient service experience.

In terms of equipment design, there is a notable trend towards electric and hybrid powertrains, driven by environmental regulations and a demand for quieter, zero-emission operation, particularly for indoor or urban projects. Advanced safety features, such as enhanced stability control systems, anti-entrapment devices, and operator assistance technologies, are becoming standard. Digital fleet management platforms, often cloud-based, are centralizing data from various sources, offering comprehensive dashboards for rental businesses to manage assets, streamline booking processes, and improve overall operational intelligence. Robotics and automation, while still nascent, are also beginning to influence aspects like automated battery charging and remote-controlled operations, signaling a future where AWPs become even more intelligent and autonomous.

Regional Highlights

- North America: This region is a mature and dominant market for AWP rentals, characterized by high adoption rates, sophisticated rental fleets, and a strong emphasis on safety regulations. Growth is sustained by robust construction activity, infrastructure upgrades, and industrial maintenance. The market also benefits from the early adoption of advanced technologies like telematics and predictive maintenance. Key countries include the United States and Canada, where large national rental companies operate extensive networks.

- Europe: The European AWP rental market is driven by stringent safety and environmental regulations, leading to a strong demand for modern, eco-friendly equipment, particularly electric and hybrid models. Infrastructure development, renovation projects, and events contribute significantly to market growth. Western European countries like Germany, the UK, and France are major contributors, while Eastern Europe shows increasing potential with developing economies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure projects, and industrialization in emerging economies such as China, India, and Southeast Asian nations. Increased awareness of workplace safety and a growing shift from equipment ownership to rental models are key drivers. The region is also a hub for AWP manufacturing, impacting local supply dynamics.

- Latin America: The AWP rental market in Latin America is developing, with growth influenced by investments in construction, mining, and energy sectors. Economic stability and governmental focus on infrastructure improvements are critical for market expansion. Brazil and Mexico are leading the market, with increasing adoption of rental solutions to manage operational costs and improve project efficiency.

- Middle East and Africa (MEA): The MEA region is experiencing growth driven by mega-projects in construction, hospitality, and energy sectors, particularly in the UAE, Saudi Arabia, and Qatar. Diversification away from oil economies and increased foreign investments are stimulating demand for advanced construction equipment, including AWPs. Rental penetration is increasing as companies seek flexible and efficient equipment solutions for large-scale developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerial Work Platform Rental Market.- United Rentals, Inc.

- Ashtead Group Plc (Sunbelt Rentals)

- Loxam S.A.S.

- Herc Rentals Inc.

- Ahern Rentals Inc.

- Ramirent Plc (part of Loxam)

- JLG Industries, Inc. (an Oshkosh Corporation Company)

- Genie (a Terex Corporation brand)

- Haulotte Group S.A.

- Skyjack Inc. (a Linamar Corporation company)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- XCMG Group

- LiuGong Machinery Co., Ltd.

- Aichi Corporation

- Snorkel Inc.

- Manitou Group

- MEC Aerial Work Platforms

- Niftylift Ltd.

- Tadano Ltd.

- Ruthmann Holdings GmbH

Frequently Asked Questions

Analyze common user questions about the Aerial Work Platform Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Aerial Work Platform Rental Market?

The primary drivers include increased global infrastructure spending, rapid urbanization, stringent workplace safety regulations mandating certified equipment, and the economic benefits of renting (reduced capital expenditure, maintenance flexibility) over purchasing AWPs for businesses.

How is technology impacting the Aerial Work Platform Rental Market?

Technology is significantly impacting the market through the integration of telematics for fleet tracking and optimization, AI and IoT for predictive maintenance, and the development of electric and hybrid AWPs for environmental compliance and enhanced efficiency. These innovations improve safety, reduce operational costs, and streamline rental processes.

Which regions are exhibiting the strongest growth in the AWP rental sector?

The Asia Pacific region, particularly countries like China and India, is showing the strongest growth due to massive infrastructure projects, rapid industrialization, and increasing awareness of workplace safety. North America and Europe remain robust markets driven by technology adoption and sustained construction activity.

What are the main challenges faced by the Aerial Work Platform Rental Market?

Key challenges include the high initial capital investment required for fleet acquisition, potential economic downturns affecting construction activity, a shortage of skilled operators and maintenance technicians, and the complexities of navigating diverse regional regulatory landscapes.

What types of Aerial Work Platforms are most commonly rented?

Scissor lifts and boom lifts (both articulating and telescopic) are the most commonly rented types of Aerial Work Platforms. Scissor lifts are preferred for tasks requiring vertical movement in confined spaces, while boom lifts offer greater reach and versatility for various elevated tasks across construction and industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager