Aerospace Accumulator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430717 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aerospace Accumulator Market Size

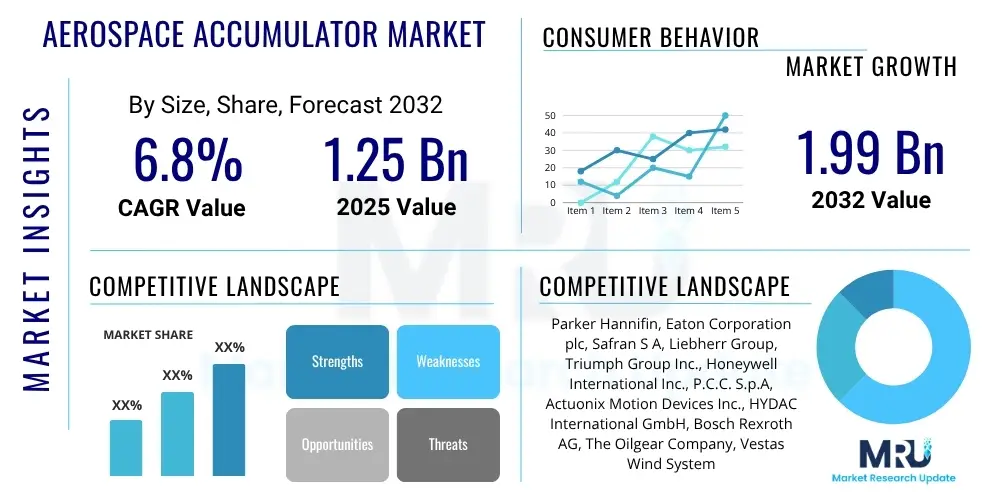

The Aerospace Accumulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.25 Billion in 2025 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2032.

Aerospace Accumulator Market introduction

The Aerospace Accumulator Market encompasses the design, manufacturing, and distribution of critical hydraulic and pneumatic components used across various aerospace platforms. These devices are essential for storing hydraulic energy under pressure, dampening hydraulic system shocks, compensating for thermal expansion or leakage, and providing emergency power in the event of primary system failure. Their robust design and reliable performance are paramount to ensuring the safety and operational efficiency of modern aircraft and spacecraft, spanning commercial, military, and emerging urban air mobility applications.

Aerospace accumulators primarily function by holding an incompressible hydraulic fluid under pressure, separated from a compressible gas (usually nitrogen) by a physical barrier such as a bladder, piston, or diaphragm. This allows them to absorb pulsations, smooth out pressure fluctuations, and deliver instantaneous power boosts when demand exceeds pump capacity. Their applications are extensive, ranging from landing gear retraction and extension systems, brake systems, and flight control surfaces in commercial airliners, to missile launch systems and satellite attitude control in defense and space sectors.

The benefits derived from aerospace accumulators are multifaceted, including enhanced system responsiveness, prolonged component lifespan by reducing stress on pumps and valves, and a critical layer of redundancy for safety-critical functions. The market is propelled by a confluence of factors such as the increasing global demand for new aircraft, the modernization and upgrading of existing fleets, and stringent safety regulations that mandate reliable hydraulic system performance. Furthermore, advancements in materials science and manufacturing techniques are driving the development of lighter, more efficient, and durable accumulator solutions to meet evolving aerospace requirements, including the burgeoning market for advanced air mobility vehicles and space exploration missions.

Aerospace Accumulator Market Executive Summary

The Aerospace Accumulator Market is experiencing robust growth, driven primarily by the sustained expansion of commercial aviation and increasing global defense expenditures. Business trends highlight a strong focus on technological innovation, with manufacturers investing in lightweight materials, intelligent monitoring systems, and modular designs to improve efficiency and reduce maintenance costs. Consolidation through strategic mergers and acquisitions is also shaping the competitive landscape, as companies seek to expand their product portfolios and geographical reach. The emphasis on fuel efficiency and enhanced safety features in next-generation aircraft platforms further stimulates demand for advanced accumulator solutions capable of high performance under extreme conditions.

Regional trends indicate that North America and Europe continue to be dominant markets, owing to the presence of major aircraft OEMs and a mature aerospace maintenance, repair, and overhaul (MRO) infrastructure. However, the Asia Pacific region is rapidly emerging as a significant growth hub, propelled by an escalating number of aircraft orders, expanding air travel networks, and increasing defense budgets across countries like China and India. Latin America and the Middle East and Africa regions are also demonstrating steady growth, driven by fleet modernization initiatives and new airline establishments, although at a comparatively slower pace. These regional dynamics are fostering localized manufacturing and service capabilities to address specific market needs and regulatory frameworks.

Segment trends within the market reveal that piston accumulators currently hold a substantial share due to their robustness and suitability for high-pressure applications, while bladder accumulators are gaining traction for their superior sealing properties and responsiveness. The commercial aircraft segment remains the largest application area, but military aircraft and emerging platforms such as Urban Air Mobility (UAM) and Unmanned Aerial Vehicles (UAVs) are poised for significant expansion, demanding specialized accumulator designs. The aftermarket segment, driven by scheduled maintenance and replacement cycles, also contributes substantially to market revenue, emphasizing the long operational lifespan of aerospace platforms. Overall, the market is characterized by continuous innovation to meet the rigorous demands of the aerospace industry, with a strong outlook for sustained expansion.

AI Impact Analysis on Aerospace Accumulator Market

The integration of Artificial Intelligence (AI) into the Aerospace Accumulator Market is poised to revolutionize several aspects, from design and manufacturing to operational maintenance and predictive diagnostics. Users frequently inquire about how AI can enhance the reliability and efficiency of these critical components, reduce downtime, and improve safety. Key themes emerging from these questions include AI's role in predictive maintenance to anticipate failures, optimizing accumulator design for specific operational parameters, streamlining manufacturing processes through automation, and enabling more intelligent system integration within complex aircraft hydraulic networks. There is a strong expectation that AI will lead to more proactive maintenance strategies, reducing unscheduled repairs and extending the lifespan of accumulators, while simultaneously contributing to the overall safety and cost-effectiveness of aerospace operations.

- AI enables predictive maintenance by analyzing sensor data for early anomaly detection and failure prediction, optimizing maintenance schedules.

- Generative design algorithms powered by AI can optimize accumulator structure, materials, and internal geometry for enhanced performance, weight reduction, and durability.

- AI-driven quality control systems improve manufacturing precision by identifying defects in real-time, ensuring adherence to stringent aerospace standards.

- Autonomous health monitoring systems utilize AI to continuously assess accumulator performance and communicate status to flight or ground crews, boosting operational safety.

- AI can optimize inventory management and supply chain logistics for accumulator components, improving efficiency and reducing lead times for critical parts.

- Integration of AI in hydraulic system diagnostics allows for more precise troubleshooting and root cause analysis of accumulator-related issues, minimizing downtime.

- Simulation and modeling capabilities are enhanced by AI, allowing for more accurate predictions of accumulator behavior under various extreme aerospace conditions.

DRO & Impact Forces Of Aerospace Accumulator Market

The Aerospace Accumulator Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. Key drivers include the escalating global demand for both commercial and military aircraft, which directly translates into a higher need for hydraulic system components, including accumulators. The continuous push for enhanced flight safety and operational efficiency mandates the incorporation of reliable and high-performance accumulators capable of handling extreme conditions and providing critical emergency power. Additionally, the modernization of aging aircraft fleets, coupled with the emergence of new aerospace applications such as Urban Air Mobility (UAM) and advanced Unmanned Aerial Vehicles (UAVs), creates substantial demand for advanced and specialized accumulator solutions. Stringent regulatory frameworks and certification requirements further compel manufacturers to continuously innovate and ensure the highest standards of product quality and reliability.

However, several restraints temper the market's growth trajectory. The inherently high manufacturing costs associated with aerospace-grade components, driven by specialized materials, complex engineering, and rigorous testing, can limit market accessibility for some players and potentially increase end-user costs. The extended product lifecycle of aircraft, often spanning decades, means that replacement cycles for accumulators are infrequent, leading to a demand primarily focused on new aircraft deliveries and scheduled MRO activities. Furthermore, the aerospace industry's reliance on legacy hydraulic systems can sometimes slow the adoption of newer, more technologically advanced accumulator designs, as integration requires extensive re-certification and testing. Supply chain complexities and potential disruptions for specialized materials and components also pose significant challenges, impacting production timelines and costs.

Despite these challenges, numerous opportunities exist for market expansion and innovation. The development of lighter and more compact accumulators through advanced materials and design techniques presents a significant opportunity to contribute to overall aircraft weight reduction and fuel efficiency, a critical objective for airlines. The integration of smart sensing technologies and connectivity for real-time performance monitoring and predictive maintenance opens new avenues for value-added services and operational insights. Moreover, the burgeoning MRO market, driven by the expanding global fleet, offers consistent demand for replacement and upgrade accumulators. Emerging aerospace sectors, including electric propulsion aircraft, space tourism, and advanced defense systems, are creating entirely new application niches for innovative accumulator technologies, pushing the boundaries of current designs and material capabilities. These opportunities underscore a future where accumulators are not just passive components but intelligent, integral parts of sophisticated aerospace systems.

Segmentation Analysis

The Aerospace Accumulator Market is comprehensively segmented to provide a granular understanding of its diverse components and applications. This segmentation allows for precise market analysis, identifying key growth areas and specific demand patterns across various product types, operational parameters, and end-use sectors. Understanding these segments is crucial for manufacturers to tailor their product offerings, for suppliers to target specific market niches, and for investors to identify high-potential growth avenues within the complex aerospace ecosystem. Each segment reflects unique technical requirements, regulatory compliance, and market dynamics that shape its contribution to the overall market landscape, highlighting the specialized nature of aerospace components.

- By Type

- Piston Accumulators

- Bladder Accumulators

- Diaphragm Accumulators

- By Application

- Commercial Aircraft

- Military Aircraft

- Helicopters

- UAVs (Unmanned Aerial Vehicles)

- Spacecraft

- By Pressure

- Low Pressure

- Medium Pressure

- High Pressure

- By End-Use

- OEM (Original Equipment Manufacturer)

- Aftermarket (MRO)

Value Chain Analysis For Aerospace Accumulator Market

The value chain for the Aerospace Accumulator Market is intricate and highly specialized, beginning with the upstream sourcing of advanced raw materials. This segment involves suppliers of high-grade metals such as stainless steel and aluminum alloys, as well as specialized elastomers and composites essential for accumulator bodies, pistons, bladders, and seals. These materials must meet stringent aerospace specifications for durability, weight, and resistance to extreme temperatures and pressures. Component manufacturers then transform these raw materials into precision-engineered parts like high-tolerance cylinders, sealing mechanisms, and gas valves, which are then assembled by accumulator manufacturers. The quality and reliability of these upstream components are paramount, directly impacting the final product's performance and certification.

Further along the value chain, accumulator manufacturers design, assemble, and rigorously test the final products, ensuring compliance with demanding aerospace standards and certifications. These manufacturers often engage in significant research and development to innovate new designs, integrate smart technologies, and enhance efficiency. The downstream segment of the value chain involves the distribution and integration of these accumulators into complete aerospace systems. Major customers include aircraft OEMs such as Boeing, Airbus, Lockheed Martin, and Bombardier, who integrate these accumulators into their hydraulic systems during aircraft production. Additionally, defense contractors, helicopter manufacturers, and emerging UAM and spacecraft developers represent significant downstream buyers.

Distribution channels for aerospace accumulators are predominantly direct for large-volume OEM sales, where manufacturers work closely with aircraft integrators from the design phase to installation. For the aftermarket segment, which includes maintenance, repair, and overhaul (MRO) providers and airlines, distribution often involves a mix of direct sales and a network of authorized distributors. These distributors ensure the availability of spare parts and replacement units globally, supporting the operational needs of existing fleets. The direct channel facilitates close technical collaboration and customized solutions, while the indirect channel ensures efficient supply chain management for routine maintenance and repair. This dual distribution approach underscores the industry's need for both bespoke solutions and readily available standard parts, emphasizing strong relationships throughout the entire value chain to maintain quality, safety, and operational continuity in the aerospace sector.

Aerospace Accumulator Market Potential Customers

The potential customers for the Aerospace Accumulator Market are diverse, spanning the entire spectrum of the aerospace and defense industries. Primarily, major commercial aircraft manufacturers such as Boeing, Airbus, Embraer, and Bombardier represent a significant customer base. These Original Equipment Manufacturers (OEMs) integrate accumulators into the hydraulic systems of new aircraft during the assembly phase, requiring high-volume supply and close technical collaboration for customized solutions that meet specific aircraft design and performance criteria. The ongoing global demand for new passenger and cargo aircraft directly fuels this segment, driven by increasing air travel and air freight volumes worldwide. The stringent regulatory environment in commercial aviation ensures a continuous demand for certified, high-quality components.

Beyond commercial aviation, military aircraft manufacturers like Lockheed Martin, Northrop Grumman, Dassault Aviation, and BAE Systems are crucial end-users. Accumulators in military platforms are vital for flight controls, weapon systems, and landing gear, often requiring designs that can withstand even more extreme environmental conditions and operational stresses. The defense sector's consistent investment in modernizing existing fleets and developing next-generation combat aircraft, transport planes, and surveillance platforms sustains a steady demand for specialized and ruggedized aerospace accumulators. Similarly, helicopter manufacturers such as Sikorsky, Bell, and Leonardo, along with manufacturers of Unmanned Aerial Vehicles (UAVs) and space systems developers, also constitute important customer segments, each with unique technical specifications for accumulator integration.

The aftermarket segment, encompassing Maintenance, Repair, and Overhaul (MRO) providers, airlines, and independent repair stations, forms another substantial customer base. These entities require accumulators for routine maintenance, scheduled replacements, and unscheduled repairs of existing aircraft fleets. Given the long operational life of aircraft, the MRO market provides a consistent and predictable demand stream, ensuring the continued airworthiness and safety of in-service aircraft. As global aircraft fleets expand and age, the importance of the aftermarket for replacement parts, including accumulators, continues to grow. Additionally, emerging aerospace players in urban air mobility (UAM), electric vertical take-off and landing (eVTOL) aircraft, and commercial space ventures are becoming new potential customers, driving innovation and demand for smaller, lighter, and more efficient accumulator designs tailored for these futuristic platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Eaton Corporation plc, Safran S A, Liebherr Group, Triumph Group Inc., Honeywell International Inc., P.C.C. S.p.A, Actuonix Motion Devices Inc., HYDAC International GmbH, Bosch Rexroth AG, The Oilgear Company, Vestas Wind Systems A/S (Hydraulics Division), Avic Systems Co Ltd, Kawasaki Heavy Industries Ltd., Weber Hydraulik GmbH, Freudenberg Sealing Technologies, Teledyne Controls, Collins Aerospace (Raytheon Technologies), Crane Aerospace & Electronics, Parker Aerospace |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Accumulator Market Key Technology Landscape

The Aerospace Accumulator Market is continuously evolving with significant technological advancements aimed at improving performance, reducing weight, and enhancing reliability. A critical area of focus is the development and adoption of lightweight materials, including advanced aluminum alloys, titanium, and composite materials. These materials significantly reduce the overall weight of accumulators, contributing to better aircraft fuel efficiency and increased payload capacity, which are paramount concerns for both commercial airlines and military operators. Innovations in manufacturing processes, such as additive manufacturing (3D printing), are also being explored to create complex internal geometries that optimize performance while further reducing weight and material waste, offering unprecedented design flexibility.

Another pivotal technological trend is the integration of smart sensors and intelligent monitoring systems directly into accumulators. These advanced sensors enable real-time data collection on critical parameters such as pressure, temperature, fluid levels, and vibration. This data is then utilized for condition monitoring and predictive maintenance, allowing operators to anticipate potential failures before they occur, optimize maintenance schedules, and reduce unscheduled downtime. The incorporation of digital design and simulation tools, including advanced CAD/CAE software, plays a crucial role in validating accumulator designs under various simulated flight conditions, accelerating the development cycle and ensuring compliance with stringent certification requirements.

Furthermore, advancements in sealing technologies and high-pressure containment solutions are vital for enhancing accumulator longevity and safety. Innovations in elastomer compounds and seal designs are improving resistance to hydraulic fluids, extreme temperatures, and dynamic stresses, thereby extending service intervals and reducing maintenance burden. The trend towards integrating accumulators more seamlessly into overall hydraulic fluid management systems, sometimes alongside electric actuation, also marks a significant technological shift. This integration aims to create more efficient, responsive, and robust hydraulic architectures within aircraft, addressing the evolving demands for precision control, redundancy, and enhanced system diagnostics. These technological strides collectively underpin the aerospace industry's relentless pursuit of safer, more efficient, and environmentally sustainable flight operations.

Regional Highlights

- North America: This region holds a significant share of the Aerospace Accumulator Market, driven by the strong presence of major aircraft OEMs like Boeing and defense contractors such as Lockheed Martin and Northrop Grumman. High defense spending, a mature commercial aviation sector, and robust MRO activities contribute to sustained demand for both new and replacement accumulators.

- Europe: Europe is another key market, home to major aerospace players like Airbus, Safran, and Liebherr. The region benefits from substantial investment in aerospace research and development, stringent safety regulations, and a well-established MRO network, fueling demand for advanced and highly reliable accumulator solutions across commercial and military applications.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market due to rapid expansion in commercial air travel, significant new aircraft orders from airlines in China, India, and Southeast Asia, and increasing defense modernization programs. The burgeoning middle class and expanding air connectivity are primary drivers, leading to substantial investment in aerospace infrastructure and manufacturing capabilities.

- Latin America: This region presents an emerging market with steady growth, primarily driven by increasing passenger traffic, fleet modernization efforts by regional airlines, and growing investments in regional aircraft manufacturing. Economic development and enhanced connectivity initiatives are expected to bolster demand for aerospace components, including accumulators.

- Middle East and Africa (MEA): The MEA region is experiencing growth propelled by strong commercial aviation expansion, particularly in the Middle East, with major airlines investing heavily in fleet expansion and modernization. Furthermore, increasing defense budgets and regional security concerns contribute to demand for military aircraft components, creating opportunities for accumulator suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Accumulator Market.- Parker Hannifin

- Eaton Corporation plc

- Safran S A

- Liebherr Group

- Triumph Group Inc.

- Honeywell International Inc.

- P.C.C. S.p.A

- Actuonix Motion Devices Inc.

- HYDAC International GmbH

- Bosch Rexroth AG

- The Oilgear Company

- Vestas Wind Systems A/S (Hydraulics Division)

- Avic Systems Co Ltd

- Kawasaki Heavy Industries Ltd.

- Weber Hydraulik GmbH

- Freudenberg Sealing Technologies

- Teledyne Controls

- Collins Aerospace (Raytheon Technologies)

- Crane Aerospace & Electronics

- Parker Aerospace

Frequently Asked Questions

What is an aerospace accumulator and what is its primary function?

An aerospace accumulator is a critical hydraulic or pneumatic component that stores pressurized fluid energy, dampens shocks, compensates for fluid leakage, and provides emergency power in aircraft and spacecraft hydraulic systems.

Why are accumulators essential for aerospace hydraulic systems?

Accumulators are essential for enhancing system responsiveness, maintaining constant pressure, protecting pumps from pulsations, and providing crucial redundancy for safety-critical functions like landing gear operation and flight controls.

What are the main types of aerospace accumulators?

The primary types include piston accumulators, known for their robustness in high-pressure applications; bladder accumulators, favored for good sealing and responsiveness; and diaphragm accumulators, suitable for smaller volumes and lighter weight needs.

How is AI impacting the Aerospace Accumulator Market?

AI is transforming the market by enabling predictive maintenance, optimizing accumulator design for efficiency and weight reduction, enhancing manufacturing quality control, and improving system integration for more intelligent hydraulic operations.

What are the key growth drivers for the Aerospace Accumulator Market?

Major drivers include the increasing global demand for new commercial and military aircraft, stringent safety regulations, ongoing fleet modernization, and the emergence of new aerospace platforms such as Urban Air Mobility (UAM) vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager