Aerospace and Defense Fiber Optic Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429564 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aerospace and Defense Fiber Optic Cables Market Size

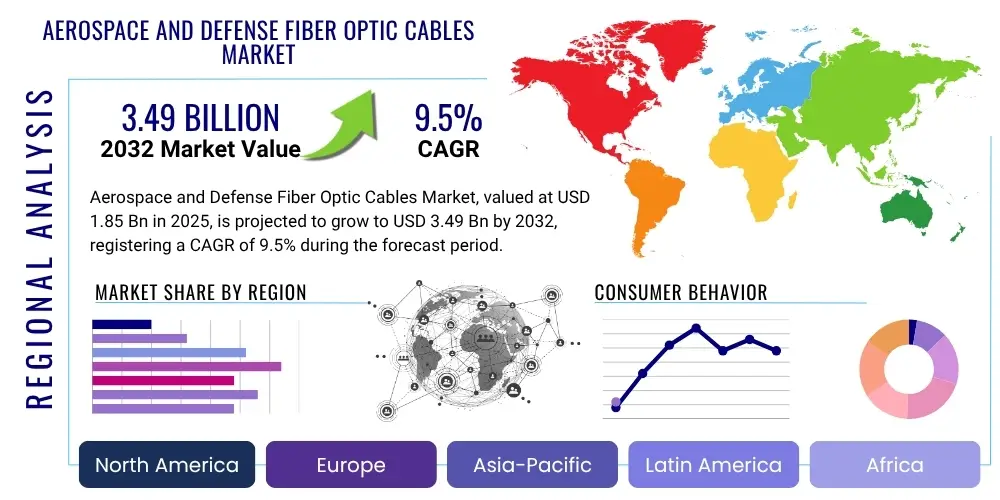

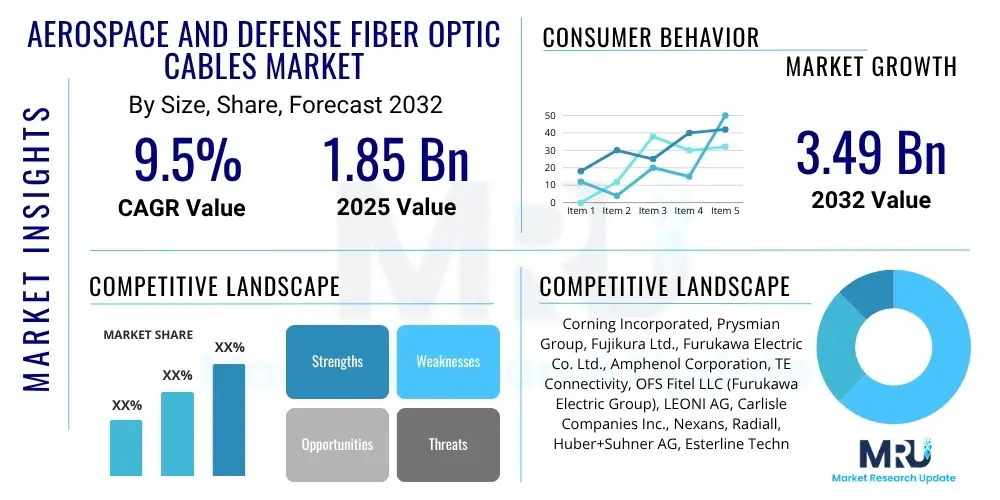

The Aerospace and Defense Fiber Optic Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at $1.85 Billion in 2025 and is projected to reach $3.49 Billion by the end of the forecast period in 2032.

Aerospace and Defense Fiber Optic Cables Market introduction

The Aerospace and Defense Fiber Optic Cables Market encompasses the specialized segment of optical fiber technology tailored for the rigorous demands of aviation, space, and military applications. These cables are designed to transmit data using light signals, offering significant advantages over traditional copper cables, including superior bandwidth, immunity to electromagnetic interference (EMI) and radio frequency interference (RFI), reduced size and weight, and enhanced security. Products in this market include single-mode, multi-mode, and specialty fibers engineered for extreme temperatures, radiation exposure, and mechanical stress. Major applications span critical aircraft systems like avionics, in-flight entertainment, and navigation, as well as defense communication networks, weapon systems, and space-grade satellite links. The primary benefits driving adoption include unparalleled data transmission speeds crucial for modern data-intensive platforms, significant weight reduction for fuel efficiency in aircraft, and robust performance in harsh operating environments, ensuring reliability and system integrity. Key driving factors accelerating market growth are the increasing sophistication of avionic systems requiring higher data rates, the global surge in defense spending focused on technologically advanced platforms, and the expanding demand for autonomous systems that rely on resilient high-speed data links.

Aerospace and Defense Fiber Optic Cables Market Executive Summary

The Aerospace and Defense Fiber Optic Cables Market is experiencing robust growth, driven by the continuous modernization of aerospace platforms and the escalating demand for high-bandwidth, secure, and lightweight communication solutions across defense sectors. Current business trends indicate a strong emphasis on research and development to produce more resilient, miniaturized, and higher-performance fiber optic cables capable of withstanding extreme environmental conditions encountered in space, high-altitude flight, and battlefield operations. Manufacturers are increasingly focusing on vertical integration and strategic partnerships to secure supply chains and offer integrated solutions, encompassing not just the cables but also connectors, transceivers, and complete optical harness assemblies. The market is also witnessing a shift towards customized solutions tailored to specific platform requirements, such as radiation-hardened fibers for space applications and bend-insensitive fibers for compact aircraft installations. Regional trends highlight North America and Europe as dominant markets due to substantial defense budgets and established aerospace industries, while the Asia Pacific region is rapidly emerging as a significant growth hub, fueled by increasing commercial aircraft deliveries and ambitious defense modernization programs, particularly in countries like China and India. Segmentation trends reveal a growing preference for specialty fibers, including polarization-maintaining and high-temperature varieties, essential for advanced sensing and navigation systems. Moreover, the military aircraft segment continues to be a primary consumer, alongside a burgeoning demand from the commercial space industry, underscoring the diverse application landscape for these critical components. Overall, the market remains highly dynamic, characterized by technological innovation, stringent quality requirements, and a persistent drive for enhanced operational efficiency and reliability in critical aerospace and defense systems.

AI Impact Analysis on Aerospace and Defense Fiber Optic Cables Market

The integration of Artificial Intelligence (AI) across aerospace and defense systems is fundamentally reshaping the requirements and capabilities expected from fiber optic cables. Common user questions revolve around how AI can enhance the performance and longevity of these cables, the data demands AI systems place on existing infrastructure, and the role of fiber optics in enabling AI-driven autonomous operations. Users are concerned with whether current fiber optic technologies are sufficient to handle the immense data throughput generated by AI algorithms in real-time, especially for applications like predictive maintenance, advanced sensor fusion, and autonomous flight control. There is also significant interest in how AI can be leveraged in the manufacturing and quality control processes of fiber optic cables themselves, potentially leading to more efficient production and higher reliability. Expectations are high for fiber optics to serve as the backbone for AI-enabled defense systems, providing the low-latency, high-bandwidth communication vital for decision-making in complex operational environments, while also addressing concerns about data security and integrity in an increasingly AI-dependent landscape. The key themes revolve around enablement, optimization, and security, with fiber optics positioned as an indispensable component for the successful deployment of AI in these critical sectors.

- AI-driven systems demand higher data bandwidth and lower latency, directly increasing the need for advanced fiber optic cables capable of ultra-fast data transmission.

- Predictive maintenance algorithms, powered by AI, can analyze data from embedded fiber optic sensors to foresee cable degradation, optimizing replacement schedules and extending system lifespan.

- Autonomous navigation and control systems, heavily reliant on AI, require robust, high-integrity fiber optic networks for real-time sensor data fusion and command transmission, enhancing operational safety and precision.

- AI applications in electronic warfare and cyber defense leverage fiber optic networks for secure, interference-free communication, protecting sensitive data from interception and manipulation.

- Manufacturing processes for fiber optic cables can be optimized using AI for quality control, defect detection, and process efficiency, leading to higher yield and improved product reliability.

- The development of smart platforms with integrated AI capabilities will drive demand for specialized fiber optic cables that can withstand extreme conditions while supporting complex, data-intensive AI operations.

- AI-powered sensor networks within aircraft and defense platforms will increasingly rely on fiber optics for distributing processed intelligence, enabling faster response times and enhanced situational awareness.

DRO & Impact Forces Of Aerospace and Defense Fiber Optic Cables Market

The Aerospace and Defense Fiber Optic Cables Market is significantly influenced by a dynamic interplay of driving forces that propel its expansion, alongside inherent restraints that temper growth, and emerging opportunities that define its future trajectory, all while being shaped by broader impact forces. Key drivers include the escalating demand for high-bandwidth data transmission within sophisticated avionic and defense systems, necessitating the superior performance of fiber optics over traditional copper wiring. The continuous trend towards miniaturization in electronic components and platforms further favors fiber optic cables due to their lightweight and compact nature, contributing to fuel efficiency and increased payload capacity in aircraft and spacecraft. Additionally, the growing adoption of "fly-by-light" and "drive-by-light" technologies, which replace mechanical or electrical controls with optical signals, significantly boosts demand. Restraints on market growth involve the considerable initial installation and maintenance costs associated with fiber optic systems, which can be higher than conventional alternatives. The technical complexities involved in designing, installing, and maintaining fiber optic networks in the extremely harsh aerospace and defense environments, including challenges related to vibration, temperature extremes, and radiation, also pose significant hurdles. Furthermore, stringent regulatory approvals and lengthy certification processes for aerospace-grade components can delay market entry and product deployment. Opportunities abound with the launch of new generation commercial and military aircraft programs, the development of advanced stealth platforms requiring enhanced data security and reduced electromagnetic signatures, and the expansion of global satellite internet constellations which rely heavily on sophisticated fiber optic components. The integration with next-generation sensor technologies, particularly for advanced surveillance and reconnaissance, also presents a lucrative avenue for growth. Broader impact forces, such as geopolitical tensions and conflicts, often trigger increased defense spending, directly fueling demand for advanced military technologies including fiber optic cables. Conversely, global economic downturns can lead to reduced defense budgets, impacting market investment. Technological advancements in competing communication methods or breakthrough innovations in fiber optic materials and manufacturing techniques also continuously reshape the competitive landscape, while supply chain disruptions for critical raw materials, like specialized glass and polymers, can significantly affect production and market stability.

Segmentation Analysis

The Aerospace and Defense Fiber Optic Cables Market is meticulously segmented to provide a granular understanding of its diverse components and evolving dynamics. This comprehensive segmentation allows for an in-depth analysis of market trends, technological preferences, and demand patterns across various product types, applications, platforms, end-users, cable configurations, and material compositions. Each segment addresses specific operational requirements and performance criteria essential for the highly demanding aerospace and defense environments, from the high-speed data needs of avionics to the radiation resistance demanded by space applications. Understanding these distinct segments is crucial for stakeholders to identify lucrative niches, tailor product development, and formulate effective market penetration strategies within this specialized industry. The market's complexity and the criticality of its applications necessitate such detailed categorization to accurately project future growth and identify areas of significant investment and innovation.

- By Type

- Single-Mode Fiber: Utilized for long-distance, high-bandwidth data transmission, ideal for satellite communication and inter-platform links.

- Multi-Mode Fiber: Employed for shorter distances and high-speed data within aircraft or vehicles, prevalent in local area networks and sensor systems.

- Plastic Optical Fiber (POF): Offers cost-effectiveness, flexibility, and ease of installation, suitable for specific cabin entertainment systems and less critical applications.

- Specialty Fibers: Engineered for extreme conditions or specific functions.

- Polarization-Maintaining Fiber: Critical for precision sensing applications, gyroscopes, and interferometers in navigation systems.

- High-Temperature Fiber: Designed to operate reliably in environments with elevated thermal profiles, such as engine compartments.

- Radiation-Hardened Fiber: Essential for space applications and nuclear-hardened defense systems where radiation exposure is a concern.

- By Application

- Avionics: Core systems including flight control, navigation, and display systems.

- In-Flight Entertainment (IFE): High-speed data networks for passenger amenities and connectivity.

- Navigation Systems: GPS, INS, and other guidance systems requiring precise signal integrity.

- Communication Systems: Internal and external communication links for voice and data.

- Weapon Systems: Data transfer for targeting, guidance, and control mechanisms.

- Sensing: Fiber optic sensors for temperature, pressure, strain, and other environmental monitoring.

- Data Transfer: General high-speed data backbones within platforms.

- By Platform

- Commercial Aircraft: Large airliners, regional jets, and business jets.

- Military Aircraft: Fighter jets, transport aircraft, bombers, and reconnaissance planes.

- Helicopters: Both military and commercial rotary-wing aircraft.

- Unmanned Aerial Vehicles (UAVs): Drones for surveillance, reconnaissance, and combat operations.

- Spacecraft: Satellites, space stations, and deep-space probes.

- Missiles: Guided munitions and ballistic missiles.

- Naval Vessels: Warships, submarines, and aircraft carriers.

- Ground Vehicles: Armored vehicles, tanks, and command centers.

- By End-User

- Original Equipment Manufacturers (OEMs): Aircraft and defense system manufacturers integrating new cables.

- Aftermarket (MRO): Maintenance, repair, and overhaul service providers for existing platforms.

- By Cable Type

- Loose Tube Cables: Suitable for outdoor applications, offering protection against moisture and environmental stresses.

- Tight Buffered Cables: Ideal for indoor or inter-equipment connections, providing robustness and ease of handling.

- Ribbon Cables: High fiber density in a compact form, used for space-saving installations.

- Armored Cables: Enhanced protection against mechanical damage, critical for rugged defense applications.

- By Material

- Glass Fiber: Dominant for high-performance applications due to superior optical properties.

- Plastic Fiber: Offers flexibility and lower cost for less demanding applications.

Value Chain Analysis For Aerospace and Defense Fiber Optic Cables Market

The value chain for the Aerospace and Defense Fiber Optic Cables Market begins with a comprehensive upstream analysis, primarily encompassing the sourcing of raw materials such as ultra-pure silica glass preforms, specialized polymers for cladding and jacketing, and advanced materials for connectors and optical components. These raw materials are processed by highly specialized suppliers who adhere to stringent quality and purity standards critical for optical fiber performance in extreme environments. Following material procurement, fiber manufacturers draw these preforms into optical fibers, often customizing them with coatings and buffers to meet specific aerospace and defense requirements like radiation hardening or high-temperature resistance. This stage involves significant R&D and precision manufacturing. The midstream segment then involves cable assembly and termination, where optical fibers are integrated into robust cable structures, often incorporating shielding, armor, and specialized connectors to form finished fiber optic cables and harness assemblies ready for integration into aerospace and defense platforms. The downstream analysis focuses on the distribution and end-use of these specialized cables. Distribution channels are typically a mix of direct and indirect approaches; direct sales and technical support are crucial for large OEMs and prime defense contractors who require highly customized solutions and extensive technical collaboration. Indirect channels involve a network of distributors and integrators who supply smaller manufacturers, MRO providers, and specific subsystem developers. End-users ultimately include major aircraft manufacturers, defense system integrators, government defense agencies, space organizations, and MRO service providers. The complex technical requirements, long product lifecycles, and high-stakes nature of aerospace and defense applications necessitate a tightly integrated and quality-controlled value chain, where reliability and performance are paramount at every stage.

Aerospace and Defense Fiber Optic Cables Market Potential Customers

The potential customers for Aerospace and Defense Fiber Optic Cables are a highly specialized and discerning group, primarily comprising original equipment manufacturers (OEMs) and government entities deeply involved in the design, production, and maintenance of critical aerospace and defense platforms. These end-users and buyers demand products that meet extremely rigorous specifications for performance, reliability, and longevity under harsh operating conditions, making quality and certification paramount. Key customers include global aircraft manufacturers such as Boeing, Airbus, Lockheed Martin, and Northrop Grumman, who integrate these cables into commercial airliners, military jets, and rotorcraft for avionics, in-flight entertainment, and communication systems. Defense contractors and system integrators represent another significant customer segment, requiring fiber optics for command and control systems, weapon platforms, surveillance equipment, and secure communication networks across land, sea, and air. Additionally, space agencies and commercial space companies, including NASA, ESA, SpaceX, and Blue Origin, are vital customers, procuring radiation-hardened and high-performance fibers for satellite, spacecraft, and launch vehicle applications. Maintenance, repair, and overhaul (MRO) providers also constitute a substantial part of the customer base, requiring replacement cables and upgrades for existing fleets. Furthermore, government defense departments and ministries across various nations are direct or indirect purchasers, funding programs and projects that necessitate cutting-edge fiber optic technology to maintain technological superiority and operational readiness. The demanding nature of these applications means that potential customers prioritize suppliers who can demonstrate proven track records, adhere to stringent industry standards like ARINC and MIL-SPEC, and offer robust technical support and customization capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.85 Billion |

| Market Forecast in 2032 | $3.49 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Prysmian Group, Fujikura Ltd., Furukawa Electric Co. Ltd., Amphenol Corporation, TE Connectivity, OFS Fitel LLC (Furukawa Electric Group), LEONI AG, Carlisle Companies Inc., Nexans, Radiall, Huber+Suhner AG, Esterline Technologies Corporation (now part of TransDigm Group), AFL (Fujikura Company), Timbercon Inc., Methode Electronics Inc., Rosenberger, Sumitomo Electric Industries Ltd., Stratos Optical Technologies (Emcore) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace and Defense Fiber Optic Cables Market Key Technology Landscape

The Aerospace and Defense Fiber Optic Cables market is characterized by a sophisticated technology landscape, continuously evolving to meet the increasingly stringent demands of high-performance platforms operating in extreme environments. At its core, the technology revolves around the precise manufacturing of optical fibers, which includes drawing high-purity silica glass into hair-thin strands, often incorporating dopants to control refractive index and optimize light transmission. Key fiber types include single-mode fibers, preferred for their ability to transmit data over long distances with minimal signal loss and high bandwidth, essential for intercontinental communications and long-range sensing. Multi-mode fibers are also critical for shorter links within aircraft or vehicles, offering cost-effectiveness and ease of connection for local networks. Beyond standard fibers, a significant portion of the technological landscape is dedicated to specialty fibers, such as polarization-maintaining fibers crucial for high-precision gyroscopes and sensors, high-temperature fibers for engine compartments, and radiation-hardened fibers designed to resist degradation from ionizing radiation in space and nuclear environments. These fibers often utilize advanced cladding materials, specialized coatings, and core compositions to enhance their resilience. The cable construction itself involves technologies like loose tube and tight buffered designs, along with the development of robust jacketing materials resistant to abrasion, chemicals, and extreme temperatures. Furthermore, the market heavily relies on advanced connector technologies, including expanded beam connectors and termini, which ensure reliable, low-loss connections that can withstand severe vibration, shock, and thermal cycling, while also facilitating easy field installation and maintenance. The ongoing integration of fiber optics with other high-speed data components, such as optical transceivers and active optical cables (AOCs), represents another important technological frontier, enabling seamless conversion between electrical and optical signals for complex networked systems. These technological advancements collectively aim to enhance system performance, reduce size and weight, and improve the overall reliability and maintainability of fiber optic solutions in the most demanding applications across aerospace and defense sectors.

Regional Highlights

- North America: Dominates the market due to significant defense budgets, a robust aerospace manufacturing industry, extensive research and development activities, and the presence of major prime contractors and technology innovators. The region’s focus on advanced military aircraft, satellite programs, and commercial aviation modernization drives high demand for sophisticated fiber optic solutions.

- Europe: Holds a substantial market share, propelled by well-established aerospace and defense companies, collaborative defense initiatives (e.g., Eurofighter Typhoon, FCAS), and investment in next-generation platforms. Countries like the UK, France, and Germany are key contributors, emphasizing technological advancements and stringent safety standards for both military and commercial applications.

- Asia Pacific (APAC): Emerging as the fastest-growing region, driven by increasing defense spending, rapid expansion of commercial aviation fleets, and significant investments in indigenous aerospace and defense manufacturing capabilities in countries such as China, India, and Japan. The region's growing demand for advanced communication and surveillance systems fuels the adoption of fiber optic cables.

- Latin America: Exhibits steady growth, primarily influenced by ongoing military modernization programs and limited commercial aviation expansion. Investment in surveillance and border security initiatives contributes to the demand for rugged and reliable fiber optic communication solutions.

- Middle East and Africa (MEA): Shows gradual market development, primarily driven by defense procurements from oil-rich nations and strategic investments in national security and infrastructure projects. The demand is often tied to imports of advanced military equipment and localized upgrades of existing platforms, necessitating robust communication technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace and Defense Fiber Optic Cables Market.- Corning Incorporated

- Prysmian Group

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Amphenol Corporation

- TE Connectivity

- OFS Fitel LLC (Furukawa Electric Group)

- LEONI AG

- Carlisle Companies Inc.

- Nexans

- Radiall

- Huber+Suhner AG

- Esterline Technologies Corporation (now part of TransDigm Group)

- AFL (Fujikura Company)

- Timbercon Inc.

- Methode Electronics Inc.

- Rosenberger

- Sumitomo Electric Industries Ltd.

- Stratos Optical Technologies (Emcore)

Frequently Asked Questions

What are the primary benefits of fiber optic cables in aerospace and defense compared to traditional copper wires?

Fiber optic cables offer superior bandwidth, immunity to electromagnetic interference (EMI) and radio frequency interference (RFI), significant weight reduction, enhanced data security, and superior resistance to harsh environmental conditions. These advantages are crucial for high-speed, reliable data transmission in modern aircraft, spacecraft, and military platforms.

Which factors are driving the growth of the Aerospace and Defense Fiber Optic Cables Market?

Key drivers include the increasing demand for high-bandwidth communication in advanced avionics and defense systems, the continuous miniaturization of components requiring lightweight solutions, the rising adoption of fly-by-light technology, escalating global defense spending, and the critical need for enhanced EMI/RFI immunity in sensitive electronic environments.

What are the main challenges faced by manufacturers in this specialized market?

Manufacturers face challenges such as high initial installation and maintenance costs, technical complexities in designing cables for extreme aerospace environments (e.g., radiation, temperature, vibration), stringent regulatory approvals and certification processes, and the limited manufacturing capabilities for highly specialized fiber types.

How is AI impacting the demand and development of fiber optic cables in aerospace and defense?

AI is significantly impacting the market by demanding higher data bandwidth and lower latency for autonomous systems and real-time processing, driving the need for more advanced fiber optic solutions. AI also influences predictive maintenance for cable longevity and is integrated into smart platforms, increasing the demand for resilient and high-performance fiber optic networks.

Which types of fiber optic cables are most prevalent in aerospace and defense applications?

Single-mode fibers are primarily used for long-distance, high-bandwidth applications, while multi-mode fibers are common for shorter links within platforms. Additionally, specialty fibers, including polarization-maintaining, high-temperature, and radiation-hardened fibers, are critically important for niche applications requiring extreme environmental resilience and precision sensing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager