Aerospace and Defense Propulsion System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430315 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aerospace and Defense Propulsion System Market Size

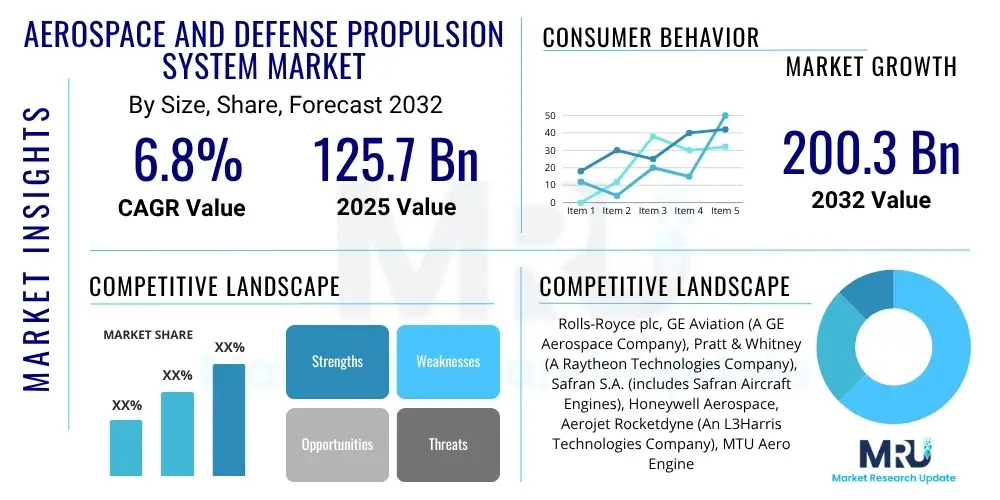

The Aerospace and Defense Propulsion System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $125.7 billion in 2025 and is projected to reach $200.3 billion by the end of the forecast period in 2032.

Aerospace and Defense Propulsion System Market introduction

The Aerospace and Defense Propulsion System market represents a critical and technologically intensive segment within the broader aerospace and defense industry. It encompasses the entire lifecycle of engines and sophisticated thrust-generating mechanisms essential for powered flight and space travel. This includes the intricate processes of research, conceptual design, engineering development, precision manufacturing, rigorous testing, and continuous maintenance of systems ranging from small piston engines for general aviation to colossal rocket engines for heavy-lift launch vehicles. These propulsion units are the core enablers of mobility, speed, and operational capability across air, space, and missile applications, fundamentally underpinning global transportation, security, and scientific exploration endeavors.

The product portfolio within this market is exceptionally diverse, featuring various propulsion technologies tailored for specific performance requirements and operational environments. This includes highly efficient turbofan engines powering modern commercial airliners, robust turboprop engines for regional and military transport aircraft, agile turboshaft engines for helicopters, and powerful rocket engines utilizing liquid, solid, or hybrid propellants for space launch vehicles and strategic missiles. Additionally, advanced concepts like ramjet and scramjet engines are under development for hypersonic flight, while emerging technologies such as electric, hybrid-electric, and hydrogen propulsion systems are gaining traction for their potential to revolutionize sustainable aviation and urban air mobility platforms. The continuous innovation in these product categories is driven by a relentless pursuit of enhanced performance, increased efficiency, and reduced environmental impact.

The major applications for these advanced propulsion systems are extensive and critical to national interests and global commerce. Commercial aviation relies on them for passenger and cargo transport, demanding systems that are reliable, fuel-efficient, and environmentally compliant. In the defense sector, propulsion systems are integral to fighter jets, bombers, transport aircraft, and precision-guided munitions, where performance attributes like thrust-to-weight ratio, stealth, and operational range are paramount for national security. Furthermore, space exploration and satellite deployment missions are entirely dependent on highly specialized rocket engines capable of generating immense thrust to overcome Earth's gravity and navigate the vacuum of space. The inherent benefits include superior speed, extended range, enhanced operational safety through redundancy and advanced monitoring, significant fuel economy improvements over legacy systems, and increasingly, reduced noise and emissions, which are crucial for meeting evolving environmental regulations and societal expectations.

Aerospace and Defense Propulsion System Market Executive Summary

The Aerospace and Defense Propulsion System market is currently undergoing a period of profound transformation, characterized by several pivotal business trends that are reshaping its competitive landscape and future trajectory. Strategic mergers, acquisitions, and joint ventures are increasingly common as key industry players seek to consolidate their technological expertise, expand market reach, and enhance their competitive edge, particularly in niche segments such as advanced materials and next-generation propulsion solutions. Extensive investments in research and development remain a cornerstone of growth, with a strong focus on sustainable aviation fuels (SAFs), electrification, and hydrogen-powered propulsion systems, reflecting the industry's commitment to decarbonization and meeting stringent environmental targets. Furthermore, the global geopolitical climate, marked by rising tensions and renewed defense spending by numerous nations, is significantly bolstering demand for advanced military propulsion systems, driving innovation in high-performance and stealth-capable engines.

From a regional perspective, North America continues to exert substantial influence over the global market, underpinned by its colossal defense budget, the entrenched presence of aerospace giants like GE Aviation and Pratt & Whitney, and a vibrant ecosystem of innovation and R&D. This region consistently leads in developing cutting-edge propulsion technologies for both military and commercial applications. The Asia Pacific (APAC) region stands out as the fastest-growing market, propelled by an unprecedented surge in commercial air travel, ambitious defense modernization programs across countries like China, India, and Japan, and increasing national investments in indigenous aerospace and space capabilities. Europe, while a mature market, exhibits steady growth driven by a concerted focus on environmental sustainability, leading to collaborative European initiatives in electric and hybrid propulsion, alongside significant contributions to global defense programs.

Segment-wise, traditional turbofan engines continue to dominate the commercial aviation sector due to their proven efficiency and reliability for long-haul flights, yet the market is witnessing a rapid diversification. There is an accelerated pace of innovation in nascent segments such as electric and hybrid-electric propulsion systems, particularly for urban air mobility (UAM) and regional aircraft, promising substantial reductions in operational costs and environmental impact. Hydrogen propulsion, whether through direct combustion or fuel cell technology, is emerging as a long-term, carbon-neutral solution for larger aircraft, attracting significant R&D funding. Concurrently, the defense segment is heavily investing in advanced military propulsion, including hypersonic technologies like ramjets and scramjets, alongside highly efficient and survivable engines for next-generation fighter aircraft and missile systems, underscoring a broad spectrum of technological advancements across all propulsion categories.

AI Impact Analysis on Aerospace and Defense Propulsion System Market

User queries regarding the influence of Artificial Intelligence on the Aerospace and Defense Propulsion System market predominantly highlight its potential to fundamentally transform operational paradigms, maintenance protocols, design methodologies, and the overall reliability of propulsion units. A significant portion of user interest centers on AI's capability to deliver predictive maintenance analytics, where machine learning algorithms analyze vast datasets from engine sensors to foresee component failures before they occur. This proactive approach aims to minimize unscheduled downtime, optimize maintenance schedules, and reduce costly repairs, thereby extending the operational life of critical assets. Users are also keen to understand how AI can optimize engine performance in real-time, adapting parameters during flight to maximize fuel efficiency, reduce emissions, and enhance overall thrust output under varying environmental conditions.

Another crucial theme in user questions revolves around AI's role in accelerating the design and testing phases of new propulsion systems. Generative design algorithms, powered by AI, can rapidly explore millions of design iterations, identifying optimal geometries and material combinations that might be impossible for human engineers to conceive. This significantly shortens development cycles and leads to more efficient and robust engine components. Furthermore, AI-driven simulations offer highly accurate predictions of engine behavior under extreme conditions, reducing the need for costly physical prototypes and extensive flight testing. The integration of AI in autonomous capabilities is also a key concern, particularly how it can enhance the decision-making processes of unmanned aerial vehicles (UAVs) and advanced spacecraft, enabling them to respond dynamically to complex scenarios with minimal human intervention.

Beyond performance and design, users also express interest in the broader implications of AI, including its contribution to supply chain optimization, manufacturing quality control, and cybersecurity within the propulsion system domain. AI algorithms can analyze supply chain data to identify potential bottlenecks, optimize inventory levels, and enhance logistics, ensuring a steady flow of critical parts. In manufacturing, AI-powered vision systems can detect microscopic defects, ensuring higher quality control standards. Crucially, the ethical considerations and security implications of deploying AI in critical defense systems, particularly regarding autonomous weapon systems and the protection of sensitive operational data, are consistently highlighted as areas requiring careful consideration and robust safeguards. The overarching expectation is that AI will drive unprecedented levels of efficiency, reliability, and innovation across the entire propulsion system lifecycle.

- Enhanced predictive maintenance and fault diagnostics, significantly reducing operational disruptions and maintenance costs by anticipating component wear and failure modes through real-time data analysis.

- Real-time engine performance optimization during flight, adapting fuel-air mixtures, thrust vectoring, and other parameters to maximize fuel efficiency and reduce emissions across diverse flight envelopes.

- Accelerated design and simulation processes for new propulsion architectures using AI-driven generative design, topological optimization, and advanced computational fluid dynamics (CFD) for faster prototyping and validation.

- Improved autonomous control systems for UAVs, satellites, and future autonomous aircraft, enabling more complex mission profiles, dynamic route adjustments, and enhanced decision-making capabilities.

- Advanced data analytics for supply chain management, optimizing procurement, logistics, and inventory forecasting for critical components, thereby mitigating risks of disruption.

- Strengthened cybersecurity measures for propulsion system software and control units, using AI to detect and prevent sophisticated cyber threats and anomalies in operational data.

- Development of self-learning systems for adaptive flight and mission profiles, allowing propulsion systems to adjust to unforeseen conditions like damage or environmental changes.

- Optimization of manufacturing processes through AI-powered robotics and quality inspection systems, ensuring higher precision, reduced waste, and improved component reliability.

- Integration of digital twins with AI for comprehensive lifecycle management, allowing for continuous monitoring, performance forecasting, and personalized maintenance recommendations for each individual engine.

DRO & Impact Forces Of Aerospace and Defense Propulsion System Market

The Aerospace and Defense Propulsion System market is intensely influenced by a combination of powerful drivers, significant restraints, compelling opportunities, and a complex interplay of competitive forces. The primary drivers underpinning market expansion include the sustained growth in global air passenger and cargo traffic, which necessitates continuous fleet modernization and expansion by commercial airlines, directly increasing demand for new, more efficient turbofan and turboprop engines. Simultaneously, the pervasive geopolitical instability and an evolving threat landscape worldwide are compelling governments to significantly increase defense budgets. This surge in defense spending directly fuels procurement cycles for advanced military aircraft, strategic missiles, and sophisticated unmanned aerial vehicles (UAVs), all requiring state-of-the-art propulsion systems tailored for performance and survivability. Furthermore, the ambitious and accelerating pace of global space exploration, championed by both established national space agencies and burgeoning private enterprises, is creating unprecedented demand for high-performance, reusable, and cost-effective rocket engines for launch vehicles and in-space propulsion.

However, the market also contends with formidable restraints that temper its growth trajectory. Foremost among these are the extraordinarily high costs associated with research, development, testing, and certification (RDTC) of new propulsion technologies. Developing an advanced jet engine or rocket engine requires billions of dollars in investment and many years of development, making it a highly capital-intensive endeavor with significant financial risk. Stringent and ever-evolving environmental regulations, particularly concerning aircraft emissions and noise pollution, impose additional burdens on manufacturers, requiring substantial investment in cleaner technologies and sustainable aviation fuels, which can increase development time and cost. Furthermore, the inherent complexities and global nature of the supply chain for specialized materials and components make it highly vulnerable to disruptions, as demonstrated by recent global events. Such vulnerabilities can lead to production delays, increased costs, and challenges in meeting delivery schedules. The extended lifespan of existing aircraft fleets can also act as a restraint, as airlines may defer new purchases in favor of maintenance and upgrades, thereby impacting the demand for new propulsion units.

Despite these challenges, the market is rife with transformative opportunities. The most significant of these lies in the accelerating development of sustainable aviation solutions, including electric, hybrid-electric, and hydrogen propulsion systems. These technologies promise not only to address environmental concerns but also to unlock new market segments like urban air mobility (UAM) and regional electric flights. The quest for hypersonic flight capabilities, especially for military and strategic applications, presents a lucrative niche for advancements in ramjet and scramjet technologies. Additive manufacturing, or 3D printing, offers revolutionary potential for producing complex, lightweight, and durable engine components with unprecedented design freedom and reduced manufacturing lead times. The shift towards greater digitization, including the adoption of digital twins and advanced simulations, offers significant opportunities for optimizing design, manufacturing, and maintenance processes. The impact forces at play include the substantial bargaining power of major aircraft OEMs (buyers), who demand highly customized, reliable, and cost-effective solutions. The specialized nature of raw materials and components gives suppliers considerable bargaining power. High barriers to entry, driven by immense capital requirements, technological expertise, and rigorous certification processes, limit the threat of new entrants, while the lack of viable substitutes for advanced propulsion systems in most applications ensures a stable core market. Intense competitive rivalry among a few established global players, however, continually drives innovation and efficiency improvements.

Segmentation Analysis

The Aerospace and Defense Propulsion System market is rigorously segmented to provide a granular and comprehensive understanding of its constituent parts and their interdependencies. This segmentation framework allows market analysts and industry stakeholders to dissect the market along various critical dimensions, including the fundamental type of propulsion technology employed, the specific end-use application or sector it serves, the individual components that make up these complex systems, and the platforms on which these systems are integrated. Such detailed categorization is indispensable for identifying key growth drivers within sub-segments, pinpointing emerging technological trends, assessing competitive dynamics, and formulating targeted business strategies that resonate with distinct market demands and regulatory environments across the globe.

Analyzing the market through these segments offers invaluable insights into where innovation is most concentrated, which sectors are experiencing the most rapid expansion, and what specific technological challenges and opportunities exist. For instance, understanding the differentiation between turbofan and rocket engines highlights vastly different design philosophies, manufacturing complexities, and customer bases. Similarly, distinguishing between commercial aviation and military applications reveals divergent priorities, such as fuel efficiency versus combat performance and stealth. This structured approach ensures that the market's vast complexity is broken down into manageable, analyzable parts, enabling a clearer vision for product development, market entry, and strategic partnerships. The continuous evolution of propulsion technology further necessitates a flexible segmentation strategy that can accommodate new types, applications, and components as they emerge and mature within the aerospace and defense landscape.

- By Type

- Turbofan Engines: Dominant in commercial airliners and large military transport, known for high bypass ratio efficiency and reduced noise.

- Turboprop Engines: Preferred for regional aircraft and military cargo planes, offering efficiency at lower speeds and altitudes.

- Turboshaft Engines: Primarily used in helicopters, providing power to rotor systems for lift and thrust.

- Piston Engines: Common in general aviation and smaller UAVs, typically for lower power requirements and cost-effectiveness.

- Rocket Engines:

- Liquid Propellant Rocket Engines: Offer high thrust, throttleability, and restart capability, used in major launch vehicles.

- Solid Propellant Rocket Motors: Simpler design, highly reliable, excellent for rapid deployment in missiles and as boosters.

- Hybrid Rocket Engines: Combine liquid oxidizer and solid fuel, offering safer handling, throttlability, and environmental benefits.

- Ramjet/Scramjet Engines: Experimental or highly specialized for supersonic and hypersonic flight, respectively, operating efficiently at extreme speeds.

- Electric & Hybrid-Electric Propulsion: Emerging for urban air mobility, regional aircraft, and UAVs, focusing on efficiency, reduced emissions, and quieter operation.

- Hydrogen Propulsion: Future-oriented technology for carbon-neutral aviation, utilizing hydrogen either through direct combustion or fuel cells.

- By End-Use

- Commercial Aviation: Propulsion for passenger and cargo aircraft fleets globally.

- Military Aviation: Engines for fighter jets, bombers, transport, and reconnaissance aircraft crucial for national defense.

- Space Exploration: Rocket engines for launch vehicles, spacecraft maneuvering, and deep space probes for scientific and commercial missions.

- Missiles & UAVs: Smaller, high-performance engines for guided munitions, strategic missiles, and unmanned aerial vehicles across various applications.

- By Component

- Fan: Moves air through or around the engine, crucial for initial thrust generation and engine bypass.

- Compressor: Increases air pressure before combustion, typically multi-stage axial or centrifugal.

- Combustor: Where fuel is mixed with compressed air and ignited, requiring high temperature resistance.

- Turbine: Extracts energy from hot gases to drive the compressor and fan, and often the gearbox for propellers.

- Nozzle: Accelerates exhaust gases to generate final thrust, critical for engine performance.

- Gearbox: Transmits and reduces power from the engine to the propeller or rotor system in turboprop and turboshaft engines.

- Propeller: Converts rotational power into thrust for turboprop and piston engines.

- Engine Control Systems (FADEC): Full Authority Digital Engine Control, managing engine performance digitally for optimal efficiency and safety.

- Fuel Systems: Delivers fuel to the combustor efficiently and safely, including pumps, filters, and lines.

- Ignition Systems: Initiates the combustion process, critical for engine start and relight.

- Auxiliary Power Units (APU): Provides non-propulsive power for aircraft systems on the ground or in flight.

- By Platform

- Fixed-Wing Aircraft: Includes commercial airliners, fighter jets, bombers, and cargo planes.

- Rotary-Wing Aircraft: Encompasses helicopters and tiltrotors for various military and civilian roles.

- Space Launch Vehicles: Rockets designed for orbital and suborbital missions, deploying satellites and spacecraft.

- Satellites: Utilizes thrusters for orbital maneuvering, station-keeping, and deorbiting.

- Unmanned Aerial Vehicles (UAVs): Drones for surveillance, combat, reconnaissance, and commercial delivery.

- Missiles: Propulsion for guided and unguided munitions across different ranges and purposes.

- Urban Air Mobility (UAM) Vehicles: Emerging platforms like eVTOLs, requiring electric or hybrid-electric propulsion.

Value Chain Analysis For Aerospace and Defense Propulsion System Market

The value chain of the Aerospace and Defense Propulsion System market is characterized by a multi-layered structure involving highly specialized entities, from the initial raw material extraction to the final end-user operation and subsequent support services. The upstream segment of this value chain is dominated by highly specialized raw material suppliers and component manufacturers. These include companies providing advanced superalloys, high-strength composites, sophisticated ceramics, and complex electronic control units, all engineered to withstand extreme temperatures, pressures, and stresses inherent in propulsion systems. These suppliers operate under stringent quality controls and regulatory compliance, developing materials that are often proprietary and critical to the performance and safety of the final product. Their ability to innovate in materials science directly impacts the efficiency, durability, and weight of modern engines, making them indispensable partners in the development process.

Moving downstream, these specialized materials and components are delivered to propulsion system Original Equipment Manufacturers (OEMs), such as GE Aviation, Rolls-Royce, and Pratt & Whitney. These OEMs are at the heart of the value chain, undertaking the complex tasks of design, engineering, assembly, integration, and extensive testing of complete engine systems. This stage involves significant intellectual property, massive capital investment in manufacturing facilities, and a workforce of highly skilled engineers and technicians. Following the manufacturing process, the finished propulsion systems are then typically supplied directly to aircraft, spacecraft, or missile manufacturers (also OEMs), who integrate these engines into their respective platforms. This direct distribution model is prevalent due to the bespoke nature of these products, the high unit cost, and the need for close technical collaboration throughout the integration and certification phases. Post-delivery, the value chain extends into the critical realm of maintenance, repair, and overhaul (MRO) services, often provided by the engine OEMs themselves or by certified third-party providers, ensuring the long-term operational integrity and safety of the propulsion systems.

The distribution channels in this market are predominantly direct, characterized by long-term strategic partnerships and contractual agreements between propulsion system manufacturers and major aircraft/spacecraft OEMs, as well as governmental defense agencies. These direct relationships are vital for complex product customization, ensuring regulatory compliance, and providing comprehensive post-sales support, including spare parts, technical assistance, and training. Indirect channels are less common but exist for specific aftermarket components or smaller, less critical systems, often through a network of authorized distributors. The dynamic interplay between direct and indirect distribution strategies influences market access and aftermarket revenue streams. Overall, the value chain is highly interdependent, with strong emphasis on technological prowess, quality assurance, and robust supply chain management to deliver high-performance, reliable, and safe propulsion solutions that meet the exacting standards of the aerospace and defense sectors globally. The continuous flow of innovation and stringent regulatory oversight at each stage ensures market resilience and fosters sustained technological advancement.

Aerospace and Defense Propulsion System Market Potential Customers

The potential customer base for Aerospace and Defense Propulsion Systems is diverse and comprises entities with unique operational requirements, purchasing capacities, and strategic objectives. Primarily, commercial airlines constitute a significant segment of the market, driven by the perennial need to expand and modernize their fleets with more fuel-efficient, quieter, and environmentally compliant aircraft. These airlines invest heavily in advanced turbofan and turboprop engines to optimize operational costs, enhance passenger comfort, meet stringent emission standards, and remain competitive in a rapidly growing global air travel market. Their purchasing decisions are often influenced by long-term contracts, total cost of ownership, and the availability of extensive MRO support from engine manufacturers, highlighting a strong preference for reliability and comprehensive service packages.

Another monumental customer segment encompasses national defense forces and military organizations worldwide. Governments, facing evolving geopolitical landscapes and security threats, are consistently investing in state-of-the-art military aircraft, helicopters, surveillance platforms, and missile systems. This demand fuels the procurement of high-performance propulsion systems designed for extreme operational conditions, stealth capabilities, superior thrust-to-weight ratios, and survivability in contested environments. Defense contracts are typically characterized by highly specialized requirements, classified technologies, and long procurement cycles, often involving extensive collaboration between military agencies and defense contractors. The strategic importance of these systems makes defense spending a powerful, though sometimes volatile, driver of market demand.

Furthermore, the rapidly expanding space sector presents a burgeoning customer base, including governmental space agencies (like NASA, ESA, ISRO) and a growing number of private space companies (such as SpaceX, Blue Origin, Rocket Lab). These entities are primary buyers of rocket engines for launch vehicles used to deploy satellites, ferry astronauts, and conduct deep space exploration missions. The focus here is on high thrust, reusability, reliability, and cost-effectiveness for space launch, alongside precision for in-orbit maneuvering and station-keeping thrusters for satellites. The proliferation of unmanned aerial vehicles (UAVs) and drones, utilized across military, commercial, and civilian applications, also creates demand for a range of smaller, yet highly efficient and reliable, propulsion units. General aviation, encompassing private and corporate aircraft, and helicopter operators, also contribute to the customer base, seeking reliable piston, turboprop, and turboshaft engines for varied missions, emphasizing durability and economical operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $125.7 Billion |

| Market Forecast in 2032 | $200.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rolls-Royce plc, GE Aviation (A GE Aerospace Company), Pratt & Whitney (A Raytheon Technologies Company), Safran S.A. (includes Safran Aircraft Engines), Honeywell Aerospace, Aerojet Rocketdyne (An L3Harris Technologies Company), MTU Aero Engines AG, IHI Corporation, Williams International, NPO Energomash, Kuznetsov, Hindustan Aeronautics Limited (HAL), Mitsubishi Heavy Industries (MHI), Collins Aerospace (A Raytheon Technologies Company), BorgWarner Inc. (Remy PowerDrive Systems), CFM International (Joint venture of GE Aviation and Safran Aircraft Engines), International Aero Engines (IAE), Engine Alliance (Joint venture of GE Aviation and Pratt & Whitney), Rocket Lab, Blue Origin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace and Defense Propulsion System Market Key Technology Landscape

The Aerospace and Defense Propulsion System market is defined by a relentless pursuit of technological excellence, driving innovation across multiple fronts to enhance performance, efficiency, safety, and environmental sustainability. A cornerstone of this evolution is the advancement in Additive Manufacturing (AM), or 3D printing. This technology is revolutionizing the production of complex engine components by allowing for intricate geometries previously unattainable with traditional manufacturing methods. AM facilitates the creation of lighter, stronger, and more thermally efficient parts, significantly reducing material waste, lead times, and the overall cost of production. Its ability to integrate multiple components into a single printed part also simplifies assembly and improves structural integrity, making it indispensable for next-generation engine designs.

Parallel to manufacturing innovations, the development and integration of Advanced Materials are crucial. The adoption of lightweight composites, such as carbon fiber reinforced polymers, and high-temperature-resistant materials like Ceramic Matrix Composites (CMCs) and advanced superalloys, is pivotal. These materials enable engines to operate at higher temperatures and pressures, directly contributing to improved fuel efficiency and increased thrust-to-weight ratios, while simultaneously extending component lifespan and reducing maintenance requirements. Digital technologies, including the pervasive use of Digital Twins and sophisticated Simulation and Modeling tools, are also transforming the entire product lifecycle. Digital twins create virtual, real-time replicas of physical engines, enabling continuous monitoring, predictive maintenance, and optimization of operational parameters without physical intervention. This not only minimizes costly physical testing but also accelerates design iterations and certification processes, ensuring faster market deployment of new technologies.

Furthermore, the drive towards decarbonization is profoundly shaping the technology landscape, spurring massive investments in alternative propulsion solutions. Electric and Hybrid-Electric Propulsion systems are emerging as viable options for smaller aircraft, regional flights, and urban air mobility vehicles, promising reduced noise pollution and zero localized emissions. Hydrogen Propulsion, either through direct combustion in modified gas turbines or via hydrogen fuel cells driving electric motors, is being vigorously explored as a long-term, carbon-neutral solution for larger commercial aircraft. Additionally, advancements in Full Authority Digital Engine Control (FADEC) systems continue to enhance engine management precision, optimize performance across diverse flight conditions, and provide crucial diagnostic capabilities. In the defense sector, the focus on Hypersonic Propulsion, utilizing ramjet and scramjet technologies, is paramount for developing next-generation high-speed strategic platforms. These collective technological advancements underscore a dynamic and innovative market poised for significant transformative growth.

Regional Highlights

- North America: This region holds a commanding position in the Aerospace and Defense Propulsion System market, driven by substantial defense expenditures from the United States and Canada, coupled with a robust commercial aviation sector. The presence of global aerospace giants and leading R&D institutions ensures continuous innovation in engine technologies. North America is a primary hub for advanced turbofan, turboshaft, and rocket engine development, strongly supported by government defense contracts and major airline fleet upgrades.

- Europe: Europe represents a mature and highly competitive market, distinguished by significant investments in sustainable aviation initiatives. Countries like the UK, France, and Germany are home to key propulsion system manufacturers, with a strong emphasis on collaborative projects aimed at developing electric, hybrid-electric, and hydrogen propulsion systems. The region also maintains a substantial military aerospace industry, contributing to demand for advanced fighter and transport aircraft engines, alongside a vibrant commercial aerospace segment focusing on next-generation efficiency.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is experiencing unparalleled expansion due to burgeoning commercial air travel demand, particularly in China, India, and Southeast Asian nations. Concurrently, increasing defense budgets and military modernization programs across the region are driving demand for advanced military aircraft and missile propulsion systems. Many countries in APAC are also investing heavily in developing indigenous aerospace manufacturing capabilities and space exploration programs, leading to significant market opportunities.

- Latin America: This emerging market shows steady growth, fueled by increasing air passenger traffic and the modernization of existing aircraft fleets. While not a primary manufacturing hub, Latin American countries are significant importers of propulsion systems for commercial and regional aircraft, as well as for modest defense modernization efforts. Opportunities exist in maintenance, repair, and overhaul (MRO) services as the region's fleet size expands.

- Middle East and Africa (MEA): The MEA region is characterized by substantial investments in expanding commercial airline operations, leveraging its strategic geographic location as a global transit hub. This drives demand for modern, fuel-efficient turbofan engines. Furthermore, significant defense spending by oil-rich nations in the Middle East contributes to the procurement of advanced military aircraft and associated propulsion systems, often sourced from international suppliers. African nations are also gradually investing in fleet upgrades, particularly for regional connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace and Defense Propulsion System Market.- Rolls-Royce plc

- GE Aviation (A GE Aerospace Company)

- Pratt & Whitney (A Raytheon Technologies Company)

- Safran S.A. (includes Safran Aircraft Engines and Safran Helicopter Engines)

- Honeywell Aerospace

- Aerojet Rocketdyne (An L3Harris Technologies Company)

- MTU Aero Engines AG

- IHI Corporation

- Williams International

- NPO Energomash

- Kuznetsov

- Hindustan Aeronautics Limited (HAL)

- Mitsubishi Heavy Industries (MHI)

- Collins Aerospace (A Raytheon Technologies Company)

- BorgWarner Inc. (Remy PowerDrive Systems)

- CFM International (Joint venture of GE Aviation and Safran Aircraft Engines)

- International Aero Engines (IAE)

- Engine Alliance (Joint venture of GE Aviation and Pratt & Whitney)

- Rocket Lab

- Blue Origin

Frequently Asked Questions

What is the projected growth rate for the Aerospace and Defense Propulsion System Market, and what are its market size estimations?

The Aerospace and Defense Propulsion System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $125.7 billion in 2025 and is expected to reach $200.3 billion by the end of 2032.

What are the primary factors driving the expansion of the Aerospace and Defense Propulsion System Market?

Key market drivers include the consistent growth in global air passenger and cargo traffic, escalating defense expenditures amidst global geopolitical tensions, the ambitious acceleration of space exploration initiatives, and continuous technological advancements aimed at improving propulsion system efficiency, power, and environmental performance.

How is Artificial Intelligence (AI) influencing the Aerospace and Defense Propulsion System Market?

AI is significantly transforming the market through enhanced predictive maintenance, real-time optimization of engine operational parameters for fuel efficiency, accelerated design and simulation of new propulsion architectures, improved autonomous control for various aerospace platforms, and advanced supply chain management.

What are the main segments and key technologies defining the Aerospace and Defense Propulsion System Market?

The market is segmented by Type (e.g., Turbofan, Rocket, Electric), End-Use (Commercial Aviation, Military Aviation, Space Exploration), Component (e.g., Fan, Turbine, FADEC), and Platform (Fixed-Wing, Space Launch Vehicles). Key technologies include additive manufacturing, advanced materials (CMCs, superalloys), digital twins, electric/hybrid propulsion, and hydrogen-based systems.

Which geographical regions are critical for the growth and innovation within the Aerospace and Defense Propulsion System Market?

North America currently leads the market due to significant defense spending and major industry players. Asia Pacific is the fastest-growing region, driven by expanding air travel and defense modernization. Europe emphasizes sustainable aviation and collaborative projects, while Latin America and MEA are important emerging markets for fleet upgrades and defense procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager