Aerospace & Defense Ducting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428137 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Aerospace & Defense Ducting Market Size

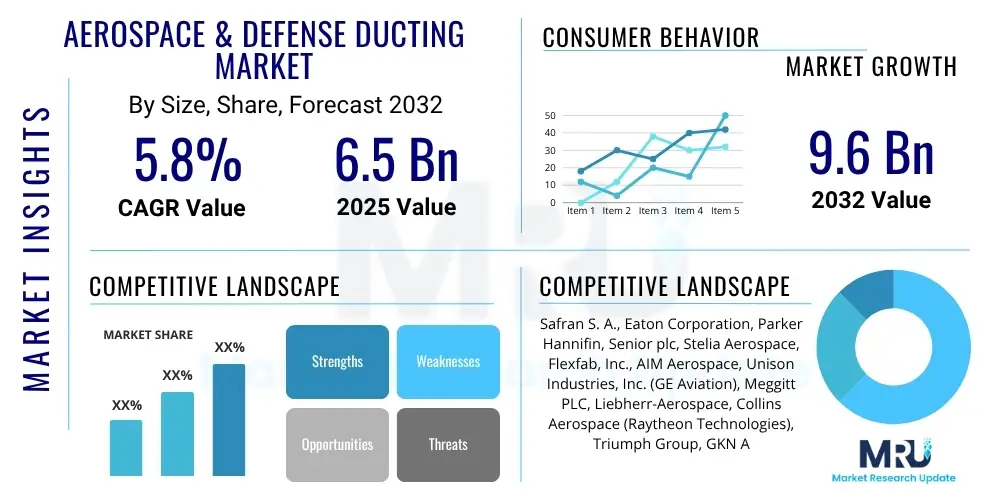

The Aerospace & Defense Ducting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 6.5 Billion in 2025 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2032.

Aerospace & Defense Ducting Market introduction

The Aerospace & Defense (A&D) ducting market encompasses a wide array of specialized conduits and systems designed to manage the flow of air, fluids, and gases within aircraft, spacecraft, and defense vehicles. These essential components are critical for various functions, including environmental control systems (ECS), engine bleed air, cabin pressurization, avionics cooling, and anti-icing systems. The integrity and performance of ducting directly impact the safety, efficiency, and operational lifespan of aerospace platforms, necessitating materials and designs capable of withstanding extreme temperatures, pressures, vibrations, and corrosive environments.

The products within this market range from rigid metal ducts, often made from titanium or stainless steel alloys, to flexible and semi-rigid ducts constructed from advanced composites, high-performance polymers, or specialized fabrics. Product descriptions emphasize their lightweight properties, durability, thermal resistance, and ability to conform to complex geometries within confined spaces. Each ducting solution is engineered to meet stringent aerospace standards for reliability and performance, contributing significantly to overall system integration and functionality across diverse applications.

Major applications for A&D ducting include commercial aircraft, military jets, helicopters, business jets, and various space vehicles, as well as ground-based defense systems. The market is driven by several factors, including the increasing global demand for new aircraft, modernization of existing fleets, rising defense expenditures, and continuous advancements in material science and manufacturing technologies. The benefits derived from high-performance ducting include enhanced operational efficiency, reduced fuel consumption through lightweight designs, improved passenger comfort and safety, and extended component life in challenging operational conditions.

Aerospace & Defense Ducting Market Executive Summary

The Aerospace & Defense Ducting Market is experiencing robust growth, propelled by the sustained expansion of commercial aviation and escalating global defense spending. Business trends indicate a strong focus on advanced materials, particularly lightweight composites and high-temperature alloys, aimed at improving fuel efficiency and reducing overall aircraft weight. Furthermore, there is a clear shift towards integrated modular designs and the adoption of additive manufacturing techniques to optimize production processes and enable complex geometries that were previously unattainable. Supply chain resilience and sustainability initiatives are also emerging as critical considerations for market participants, driving investment in localized production capabilities and eco-friendly manufacturing practices.

Regionally, North America and Europe continue to dominate the market due to the presence of major aircraft OEMs and defense contractors, coupled with significant research and development investments. However, the Asia Pacific region is rapidly gaining traction, fueled by increasing passenger traffic, military modernization programs in countries like China and India, and the establishment of new aerospace manufacturing hubs. Latin America, the Middle East, and Africa represent emerging markets with growing potential, driven by fleet expansion and defense procurement, albeit at a slower pace compared to more established regions. These regional dynamics highlight a diversified growth landscape with varying drivers and opportunities.

Segmentation trends reveal a growing preference for flexible and semi-rigid ducting solutions, particularly those made from advanced composite materials, owing to their superior performance-to-weight ratio and ease of installation. Applications related to engine bleed air and environmental control systems (ECS) remain dominant, driven by the need for precise temperature and pressure management in critical aircraft systems. The increasing demand for next-generation aircraft and the retrofit market for older fleets are also creating distinct opportunities across these segments, emphasizing durability, performance, and compliance with evolving regulatory standards. This comprehensive overview underscores a dynamic market environment characterized by technological innovation and strategic regional expansion.

AI Impact Analysis on Aerospace & Defense Ducting Market

The integration of Artificial intelligence (AI) is set to revolutionize various facets of the Aerospace & Defense Ducting Market, fundamentally transforming design, manufacturing, and maintenance processes. Common user questions often revolve around how AI can optimize the complex geometries of ducting systems, predict component failures, and streamline supply chains. Users are keenly interested in AI's potential to accelerate the development cycle of advanced ducting solutions, particularly for lightweight and high-performance materials, and to enhance the precision and efficiency of manufacturing processes, including additive manufacturing. There are also significant expectations regarding AI's role in improving the overall reliability and safety of aerospace platforms by enabling predictive maintenance for ducting systems.

Key themes emerging from these inquiries include the potential for AI-driven generative design to create novel, optimized ducting structures that surpass traditional human-designed counterparts in terms of weight, strength, and airflow efficiency. Furthermore, concerns about data security and the ethical implications of AI in critical aerospace applications are also prevalent, underscoring the need for robust validation and verification frameworks. The market anticipates that AI will facilitate a more data-centric approach to problem-solving, moving from reactive maintenance to proactive interventions, thereby reducing operational costs and downtime for aircraft and defense systems.

The expectations surrounding AI's influence in this domain include a significant reduction in design iteration cycles, enhanced material selection based on performance criteria, and improved quality control through automated inspection systems. AI-powered analytics are expected to offer deeper insights into the operational performance of ducting, identifying potential failure points before they manifest. This proactive capability is crucial for maintaining the stringent safety and reliability standards required in the aerospace and defense sectors, ultimately leading to more robust and efficient ducting solutions throughout their lifecycle.

- AI-driven generative design optimizes ducting geometry for minimal weight and maximum airflow efficiency.

- Predictive maintenance algorithms use sensor data to forecast ducting component wear and potential failures.

- AI enhances quality control and inspection processes during manufacturing, identifying defects with higher accuracy.

- Supply chain optimization through AI improves logistics, inventory management, and material procurement for ducting components.

- AI enables personalized design and manufacturing for highly specialized and complex ducting requirements in advanced aircraft.

- Simulation and modeling capabilities are significantly improved by AI, accelerating testing and validation phases.

DRO & Impact Forces Of Aerospace & Defense Ducting Market

The Aerospace & Defense Ducting Market is shaped by a confluence of influential factors, categorized as Drivers, Restraints, Opportunities, and broader Impact Forces. A primary driver is the accelerating demand for new commercial aircraft globally, fueled by increasing air travel and fleet modernization programs, which directly translates into higher demand for ducting systems. Concurrently, rising defense budgets and ongoing military modernization initiatives across various nations contribute significantly to market growth, especially for high-performance and specialized ducting in military aircraft and ground vehicles. Advancements in material science, particularly the development of lightweight and high-temperature resistant composites, further drive innovation and adoption.

However, the market also faces notable restraints. The aerospace and defense industries are subject to exceptionally stringent regulatory and certification processes, which can be time-consuming and costly, thereby extending product development cycles. High research and development expenditures required for new material formulations and advanced manufacturing techniques pose a significant barrier, particularly for smaller market players. Moreover, volatility in raw material prices, such as titanium and specialized polymers, along with potential supply chain disruptions, can impact production costs and market stability.

Opportunities within this market are abundant, notably in the adoption of additive manufacturing (3D printing) for complex ducting geometries, allowing for rapid prototyping and customized solutions. The growing emphasis on fuel efficiency and emission reduction is spurring demand for ultra-lightweight and aerodynamically optimized ducting. Furthermore, the robust market for Maintenance, Repair, and Overhaul (MRO) provides a continuous revenue stream for ducting suppliers as existing fleets undergo regular servicing and upgrades. The broader impact forces include intense competitive rivalry among established players and new entrants, the bargaining power of major aircraft OEMs as buyers, and the influence of raw material suppliers on pricing and availability. The threat of substitutes, though limited due to stringent specifications, drives continuous innovation in materials and design, while the potential for new market entrants encourages competitive pricing and technological differentiation.

Segmentation Analysis

The Aerospace & Defense Ducting Market is segmented across various critical parameters, providing a comprehensive view of its intricate structure and diverse offerings. This segmentation enables a deeper understanding of market dynamics, specific demand patterns, and technological preferences within different applications and end-user categories. The primary segmentation criteria typically include type of ducting, material composition, specific application areas within aircraft or defense platforms, and the end-user industry, allowing for granular analysis of market trends and growth opportunities across the value chain. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory requirements, and operational demands.

- By Type

- Rigid Ducts: Known for structural integrity and use in high-pressure/temperature zones.

- Semi-Rigid Ducts: Offer a balance of flexibility and strength, common in various aircraft sections.

- Flexible Ducts: Highly adaptable, used for routing in confined spaces and vibration absorption.

- By Material

- Metals and Alloys:

- Stainless Steel: High strength, corrosion resistance, high-temperature capability.

- Titanium & Alloys: Exceptional strength-to-weight ratio, corrosion resistance, high-temperature performance.

- Aluminum & Alloys: Lightweight, good thermal conductivity, corrosion resistance.

- Composites:

- Carbon Fiber Composites: Ultra-lightweight, high strength, customizable properties.

- Glass Fiber Composites: Good strength, corrosion resistance, cost-effective.

- Hybrid Composites: Combining multiple fibers for optimized properties.

- High-Performance Polymers:

- PEEK (Polyether Ether Ketone): High temperature, chemical resistance, lightweight.

- Other Advanced Polymers: Used for specific applications requiring flexibility and particular chemical resistance.

- Metals and Alloys:

- By Application

- Environmental Control Systems (ECS): Cabin air distribution, temperature and humidity control.

- Engine Bleed Air Systems: Hot air for anti-icing, pressurization, and power.

- Avionics Cooling: Managing heat generated by electronic components.

- Fuel Systems: Fuel transfer and venting.

- Hydraulic Systems: Fluid transfer in high-pressure hydraulic circuits.

- Anti-Icing Systems: Preventing ice formation on critical surfaces.

- Waste & Water Systems: Managing potable water and waste.

- Other Applications: Specialized uses in various sub-systems.

- By End-User

- Commercial Aviation:

- Commercial Aircraft (Passenger & Cargo): New builds and MRO.

- Business Jets: Specialized requirements for luxury and performance.

- Military Aviation:

- Fighter Aircraft: High-performance, extreme conditions.

- Transport Aircraft: Cargo and troop movement.

- Helicopters: Unique vibration and space constraints.

- Space: Launch vehicles, satellites, spacecraft.

- Defense Ground Systems: Tanks, armored vehicles, command centers.

- Commercial Aviation:

Value Chain Analysis For Aerospace & Defense Ducting Market

The value chain for the Aerospace & Defense Ducting Market is complex and highly specialized, commencing with upstream raw material suppliers and extending through various manufacturing and distribution stages to reach the final end-users. The upstream segment involves suppliers of critical raw materials, including specialized metal alloys (such as titanium, stainless steel, and aluminum), high-performance polymers (like PEEK and other thermoplastics), and advanced composite fibers and resins (carbon fiber, glass fiber). These suppliers play a crucial role in providing materials that meet the stringent aerospace specifications for strength, weight, temperature resistance, and durability. Their capabilities in research and development directly influence the performance characteristics of the final ducting products, often requiring long-term partnerships and qualification processes.

Further along the chain, ducting component manufacturers engage in precision engineering, fabrication, and assembly. This involves processes such as welding, bending, forming, and increasingly, additive manufacturing to create highly complex and optimized ducting systems. These manufacturers often specialize in particular types of ducts (e.g., rigid, flexible) or materials (e.g., metal, composite). They integrate components from various sub-suppliers, including connectors, clamps, and insulation materials, to deliver complete ducting assemblies to major aerospace OEMs (Original Equipment Manufacturers) or Tier 1 suppliers. Strict quality control, adherence to certifications, and efficient production methods are paramount at this stage to meet the demanding requirements of the aerospace industry.

The downstream segment primarily consists of major aircraft manufacturers (e.g., Boeing, Airbus, Lockheed Martin), military contractors, and space agencies, who integrate these ducting systems into their final platforms. Distribution channels are predominantly direct, with ducting manufacturers working closely with OEMs throughout the design, development, and production phases. However, for Maintenance, Repair, and Overhaul (MRO) operations, indirect distribution through specialized aerospace parts distributors is also common, providing replacement parts and servicing solutions. This direct and indirect model ensures comprehensive market coverage, catering to both initial equipment installation and subsequent aftermarket support needs, highlighting the importance of robust logistics and customer support throughout the product lifecycle.

Aerospace & Defense Ducting Market Potential Customers

The primary potential customers and end-users of Aerospace & Defense ducting products are diversified across the commercial, military, and space sectors, reflecting the critical nature of these components in various airborne and ground-based platforms. Major commercial aircraft manufacturers, such as Boeing, Airbus, Embraer, and Bombardier, represent a significant customer base, as they require extensive ducting systems for their new aircraft programs and fleet upgrades. These OEMs demand highly engineered solutions that contribute to fuel efficiency, passenger comfort, and overall operational reliability, driving the need for innovative and lightweight ducting materials and designs.

In the military domain, prominent defense contractors and national defense forces are key purchasers. Companies like Lockheed Martin, BAE Systems, Northrop Grumman, and Dassault Aviation, alongside various government defense departments, procure specialized ducting for fighter jets, military transport aircraft, helicopters, and advanced ground defense systems. For these customers, performance under extreme conditions, survivability, and compliance with stringent military specifications are paramount, often necessitating custom-engineered solutions tailored to specific mission profiles and environmental challenges.

Beyond new aircraft manufacturing, the robust Maintenance, Repair, and Overhaul (MRO) sector also constitutes a substantial segment of potential customers. Airlines, independent MRO providers, and military MRO depots continually require replacement ducting components for scheduled maintenance, repairs, and fleet modernization. Furthermore, emerging players in the space industry, including satellite manufacturers and developers of launch vehicles, represent a growing customer segment for high-performance ducting, where extreme temperature variations and vacuum environments pose unique engineering challenges. This diverse customer landscape underscores the broad applicability and essential role of advanced ducting solutions across the entire Aerospace & Defense ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.5 Billion |

| Market Forecast in 2032 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S. A., Eaton Corporation, Parker Hannifin, Senior plc, Stelia Aerospace, Flexfab, Inc., AIM Aerospace, Unison Industries, Inc. (GE Aviation), Meggitt PLC, Liebherr-Aerospace, Collins Aerospace (Raytheon Technologies), Triumph Group, GKN Aerospace, Ducommun Inc., F. W. Gartner GmbH, AeroControlex, Esterline Technologies Corporation (TransDigm Group), TE Connectivity, Saint-Gobain S. A., Trelleborg AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace & Defense Ducting Market Key Technology Landscape

The Aerospace & Defense Ducting Market is characterized by a rapidly evolving technological landscape, driven by the incessant demand for enhanced performance, weight reduction, and increased operational efficiency in modern aircraft and defense platforms. One of the most significant technological advancements is the widespread adoption of advanced material science, particularly in the development and application of high-performance composites such as carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs). These materials offer superior strength-to-weight ratios, corrosion resistance, and thermal stability compared to traditional metal alloys, leading to significant fuel savings and reduced maintenance requirements. The ongoing research into hybrid composites and smart materials with integrated functionalities is also pushing the boundaries of ducting design.

Another transformative technology impacting the market is additive manufacturing, commonly known as 3D printing. This technology allows for the creation of highly complex and optimized ducting geometries that are impossible to achieve with conventional manufacturing methods. Additive manufacturing facilitates rapid prototyping, reduces lead times, minimizes material waste, and enables the production of consolidated parts with internal features, thereby reducing assembly complexities and overall component count. The ability to print intricate internal structures for improved airflow or integrated cooling channels presents a significant advantage for next-generation aerospace systems, driving innovation in custom ducting solutions.

Furthermore, the market is leveraging advanced simulation and modeling tools, including Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA), to optimize ducting designs for aerodynamic efficiency, thermal management, and structural integrity. These digital tools enable engineers to predict performance under various operational conditions, identify potential stress points, and validate designs virtually before physical prototyping, significantly accelerating the development cycle and reducing R&D costs. Automation in manufacturing processes, coupled with sophisticated sensor integration for real-time health monitoring of ducting systems, is also becoming increasingly prevalent, promising enhanced reliability, predictive maintenance capabilities, and extended component lifespans for critical aerospace and defense applications.

Regional Highlights

The Aerospace & Defense Ducting Market exhibits distinct regional dynamics influenced by varying levels of aerospace manufacturing, defense spending, and technological advancements. Each region contributes uniquely to the overall market landscape, driven by local economic conditions, strategic imperatives, and the presence of key industry players. Understanding these regional highlights is crucial for market participants seeking to identify growth opportunities and formulate effective market entry strategies.

- North America:

North America holds a dominant position in the global Aerospace & Defense Ducting Market, primarily due to the presence of major aircraft OEMs like Boeing and defense contractors such as Lockheed Martin and Northrop Grumman. The region benefits from substantial defense budgets, continuous investment in military modernization programs, and a highly advanced commercial aviation sector. Strong R&D capabilities and a robust supply chain ecosystem further solidify its market leadership. The demand for lightweight, high-performance ducting is consistently high, driven by new aircraft programs and the upgrading of existing fleets. The United States, in particular, remains at the forefront of aerospace innovation.

- Dominant market share due to major OEMs and defense primes.

- Significant defense spending and continuous military modernization.

- High investment in R&D and advanced manufacturing technologies.

- Robust commercial aviation growth and fleet expansion.

- Focus on advanced materials like composites and additive manufacturing.

- Europe:

Europe represents another significant market for aerospace & defense ducting, propelled by leading aircraft manufacturers like Airbus and major defense companies such as BAE Systems and Dassault Aviation. The region is characterized by a strong emphasis on aerospace engineering excellence, environmental regulations driving demand for fuel-efficient and lightweight solutions, and collaborative defense projects among EU member states. Countries like France, Germany, and the UK are key contributors to market growth, with a focus on advanced materials and sustainable manufacturing practices. The aftermarket segment for MRO services also plays a crucial role in the European market.

- Presence of major aircraft manufacturers and defense integrators.

- Stringent environmental regulations driving demand for lightweight solutions.

- Collaborative defense programs and R&D initiatives.

- Strong MRO sector supporting existing fleets.

- Focus on innovation in material science and sustainable production.

- Asia Pacific (APAC):

The Asia Pacific region is projected to be the fastest-growing market for Aerospace & Defense Ducting, primarily fueled by the rapid expansion of its commercial aviation sector, increasing air passenger traffic, and significant investments in military modernization. Countries like China, India, Japan, and South Korea are leading this growth, with substantial orders for new aircraft and the development of indigenous aerospace capabilities. The demand for new aircraft, coupled with the establishment of new MRO facilities, creates immense opportunities for ducting suppliers. While domestic manufacturing capabilities are increasing, there remains a strong reliance on imported advanced components and technologies.

- Highest growth rate driven by expanding commercial aviation.

- Significant military modernization programs in key countries.

- Increasing air passenger traffic and new aircraft deliveries.

- Growing domestic aerospace manufacturing capabilities.

- Emerging MRO market potential.

- Latin America:

The Latin American Aerospace & Defense Ducting Market is characterized by steady, albeit slower, growth compared to other regions. This growth is primarily driven by the modernization of aging commercial fleets, increasing regional air travel, and gradual improvements in defense spending. Brazil, with its established aerospace industry (Embraer), and other countries like Mexico and Argentina, are key contributors. The market typically relies on imports for high-tech components and MRO services, presenting opportunities for international suppliers. Economic stability and political factors significantly influence market dynamics in this region.

- Fleet modernization of commercial aircraft driving demand.

- Growing regional air travel and tourism.

- Increasing defense procurement and upgrades.

- Reliance on imports for advanced aerospace components.

- Brazil, Mexico, and Argentina as key markets.

- Middle East and Africa (MEA):

The Middle East and Africa region presents a promising yet nascent market for Aerospace & Defense Ducting. The Middle East, in particular, is witnessing substantial investment in commercial aviation infrastructure and fleet expansion, driven by major airlines and strategic geographical positioning. Countries like UAE and Saudi Arabia are investing heavily in new aircraft and defense capabilities. In Africa, the market is primarily driven by expanding domestic and regional air travel, along with increasing defense spending for national security. The demand often focuses on durable, reliable, and cost-effective solutions, with MRO services becoming increasingly important as aircraft fleets expand.

- Significant investment in commercial aviation infrastructure in the Middle East.

- Major fleet expansion by regional airlines.

- Increasing defense spending and strategic procurements.

- Growing demand for MRO services across the region.

- Emphasis on durable and reliable ducting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace & Defense Ducting Market.- Safran S. A.

- Eaton Corporation

- Parker Hannifin

- Senior plc

- Stelia Aerospace

- Flexfab, Inc.

- AIM Aerospace

- Unison Industries, Inc. (GE Aviation)

- Meggitt PLC

- Liebherr-Aerospace

- Collins Aerospace (Raytheon Technologies)

- Triumph Group

- GKN Aerospace

- Ducommun Inc.

- F. W. Gartner GmbH

- AeroControlex

- Esterline Technologies Corporation (TransDigm Group)

- TE Connectivity

- Saint-Gobain S. A.

- Trelleborg AB

Frequently Asked Questions

Analyze common user questions about the Aerospace & Defense Ducting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Aerospace & Defense Ducting Market?

The Aerospace & Defense Ducting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032, reaching an estimated value of USD 9.6 Billion by 2032 from USD 6.5 Billion in 2025.

What key factors are driving the growth of this market?

Key growth drivers include increasing global demand for new commercial aircraft, rising defense expenditures and military modernization programs, continuous advancements in lightweight and high-temperature resistant materials, and a growing emphasis on fuel efficiency across the aerospace sector.

How is AI impacting the Aerospace & Defense Ducting Market?

AI is significantly impacting the market by enabling generative design for optimized ducting geometries, facilitating predictive maintenance to forecast component failures, improving quality control in manufacturing, and streamlining supply chain operations for enhanced efficiency and reliability.

Which materials are predominantly used in aerospace & defense ducting?

Predominant materials include advanced metal alloys such as stainless steel, titanium, and aluminum, alongside high-performance composites like carbon fiber and glass fiber reinforced polymers, and specialized high-performance polymers such as PEEK, chosen for their strength, weight, and thermal resistance.

What are the primary applications for aerospace & defense ducting?

Primary applications include environmental control systems (ECS), engine bleed air systems, avionics cooling, fuel systems, hydraulic systems, and anti-icing systems, all critical for maintaining operational safety and performance in aircraft, spacecraft, and defense vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager