Aerospace & Defense Thermal Management Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429611 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aerospace & Defense Thermal Management Systems Market Size

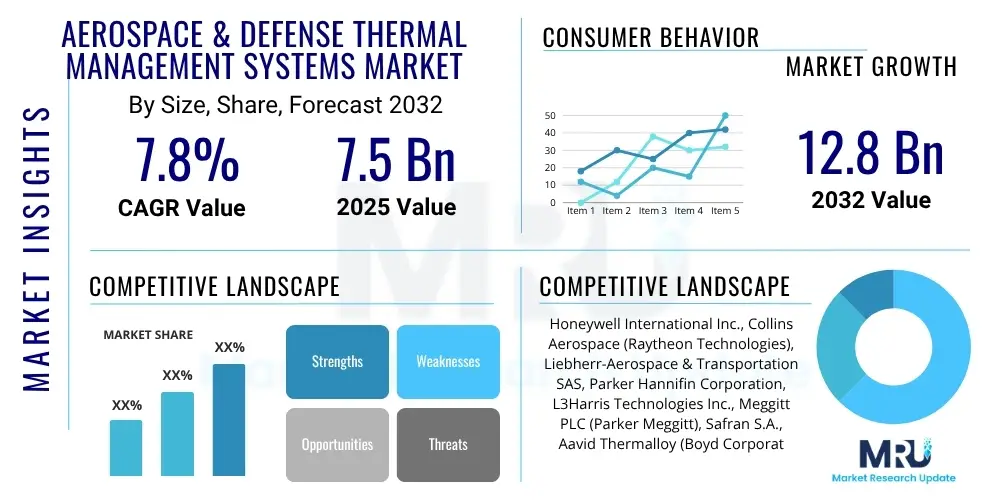

The Aerospace & Defense Thermal Management Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 7.5 Billion in 2025 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2032.

Aerospace & Defense Thermal Management Systems Market introduction

The Aerospace & Defense Thermal Management Systems Market encompasses a critical sector focused on controlling and dissipating heat generated by various components within aircraft, spacecraft, defense vehicles, and associated ground systems. As aerospace and defense platforms become increasingly sophisticated and compact, the density of electronic components, power systems, and propulsion units has escalated, leading to higher heat loads. Effective thermal management is paramount to ensure optimal performance, reliability, and longevity of these sensitive systems, preventing overheating that could lead to malfunctions, reduced operational lifespan, or even catastrophic failure. This market addresses the need for robust, efficient, and lightweight solutions capable of operating under extreme environmental conditions.

Products within this market range from conventional heat sinks, fans, and liquid cooling systems to advanced technologies such as phase-change materials, micro-channel heat exchangers, thermoelectric coolers, and pulsating heat pipes. These systems are integral across a myriad of applications, including avionics, radar systems, power electronics, laser systems, environmental control systems, and high-energy weapons. The primary benefits derived from these advanced thermal solutions include enhanced system performance, improved fuel efficiency through weight reduction, increased operational safety, and extended mission durations. Furthermore, the ability to miniaturize and integrate complex functionalities often hinges on the efficacy of thermal management, allowing for more compact and powerful next-generation platforms.

Key driving factors for the growth of this market include the continuous modernization of defense fleets globally, the escalating demand for high-performance commercial aircraft, the proliferation of advanced electronics and sophisticated sensor technologies in both manned and unmanned platforms, and the increasing focus on developing hypersonic vehicles and space exploration missions. The stringent regulatory requirements for operational safety and reliability within the aerospace and defense sectors further underscore the necessity for highly efficient and dependable thermal management solutions, compelling manufacturers to invest in continuous innovation.

Aerospace & Defense Thermal Management Systems Market Executive Summary

The Aerospace & Defense Thermal Management Systems Market is experiencing robust growth driven by technological advancements and strategic investments across the globe. Key business trends include a heightened focus on lightweight and compact thermal solutions, the integration of smart thermal management systems with predictive capabilities, and a push towards environmentally friendly refrigerants and cooling fluids. Companies are increasingly engaging in strategic partnerships and collaborations to pool expertise and resources for developing next-generation solutions, particularly for high-power applications and extreme operating environments. The market is also witnessing a shift towards additive manufacturing techniques for producing complex thermal components with optimized designs and reduced lead times, enhancing customization and performance.

Regionally, North America continues to dominate the market due to its robust defense spending, advanced aerospace manufacturing capabilities, and significant investments in research and development. Europe follows closely, driven by its strong commercial aviation sector and collaborative defense initiatives. The Asia Pacific region is projected to exhibit the highest growth rate, fueled by rapid expansion in its commercial aircraft fleet, increasing defense budgets, and the emergence of indigenous aerospace and defense industries in countries like China and India. Latin America, the Middle East, and Africa are also showing steady growth, supported by ongoing modernization programs and increasing demand for advanced military hardware.

Segment-wise, the market is broadly categorized by type, application, platform, and component. Liquid cooling systems are expected to maintain a significant share due to their high efficiency in managing substantial heat loads, especially in power electronics and high-performance computing units. Vapor compression cycles and air-based systems also hold substantial market positions. In terms of applications, avionics and radar systems represent major segments due to their critical need for precise temperature control. The growing adoption of unmanned aerial vehicles (UAVs) and advanced fighter jets is creating new avenues for specialized thermal management solutions, while the demand for reliable space systems further contributes to segment growth.

AI Impact Analysis on Aerospace & Defense Thermal Management Systems Market

User inquiries regarding AI's impact on Aerospace & Defense Thermal Management Systems frequently center on how artificial intelligence can enhance system efficiency, enable predictive maintenance, and optimize design processes. There is significant interest in AI's role in creating more adaptive and autonomous cooling solutions that can respond dynamically to changing operational conditions and heat loads. Concerns often involve the complexity of integrating AI algorithms with existing hardware, data security implications, and the reliability of AI-driven thermal management in mission-critical applications. Expectations are high for AI to revolutionize the lifecycle of thermal systems from conception to maintenance, promising unprecedented levels of performance and reliability.

- AI-driven optimization of thermal system design and simulation, leading to more efficient and compact solutions.

- Predictive maintenance capabilities for thermal components, reducing downtime and extending operational life.

- Real-time adaptive control of cooling systems based on sensor data and operational parameters, maximizing efficiency.

- Autonomous thermal management in UAVs and spacecraft, enabling longer missions and greater reliability.

- Fault detection and diagnostics for thermal anomalies, improving safety and system integrity.

- Enhanced thermal modeling and analysis through machine learning, predicting performance under diverse conditions.

- Integration with overall platform health management systems for comprehensive operational awareness.

DRO & Impact Forces Of Aerospace & Defense Thermal Management Systems Market

The Aerospace & Defense Thermal Management Systems Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its trajectory. A primary driver is the relentless pursuit of technological advancement in aerospace and defense platforms, leading to higher power densities and more compact electronic systems. The increasing integration of advanced avionics, sophisticated radar systems, high-energy weapons, and powerful computing units generates substantial heat, necessitating highly efficient and reliable thermal management solutions. Furthermore, the global rise in defense spending, coupled with ongoing military modernization programs and the growing demand for new generation commercial aircraft, significantly boosts market growth. The imperative for enhanced operational safety, extended mission endurance, and system longevity across all aerospace and defense applications also serves as a strong impetus for innovation in thermal management.

Despite these strong drivers, the market faces several restraints. The high cost associated with developing, manufacturing, and integrating advanced thermal management systems, particularly those utilizing exotic materials or complex designs, can be a significant barrier. Stringent regulatory requirements and qualification processes in the aerospace and defense sectors lead to lengthy development cycles and substantial R&D investments, which can slow market adoption. The challenge of integrating thermal solutions into existing platforms, especially with retrofit programs, can be complex and expensive due to space and weight limitations. Additionally, the availability of specialized materials and skilled labor for manufacturing and maintenance can pose operational challenges for market players.

Opportunities within this market are abundant, driven by several emerging trends. The increasing focus on unmanned systems, including UAVs and UCAVs, presents a fertile ground for developing lightweight and highly efficient thermal solutions tailored to their unique operational profiles. The burgeoning space exploration sector, with its demand for extreme temperature resilience and long-duration thermal stability, opens up new avenues for innovative technologies. Furthermore, the development of hypersonic vehicles, which generate immense heat due to aerodynamic friction, creates a critical need for revolutionary thermal management approaches. The growing emphasis on additive manufacturing for producing intricate thermal components offers opportunities for design optimization and cost reduction, while the integration of smart sensors and AI for predictive thermal management promises improved system reliability and efficiency. The shift towards sustainable aviation and defense also encourages the development of more environmentally friendly cooling solutions.

Segmentation Analysis

The Aerospace & Defense Thermal Management Systems market is intricately segmented to reflect the diverse technological approaches, applications, and end-user requirements across the industry. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product development, and strategize market entry. The market can be broadly categorized based on the type of cooling technology employed, the specific application within aerospace and defense platforms, the platform itself (e.g., aircraft, spacecraft), and the components that constitute these thermal systems. Each segment presents unique challenges and demands specialized solutions, driving continuous innovation and differentiation within the market landscape.

- By System Type:

- Air Cycle Systems

- Vapor Cycle Systems

- Liquid Cooling Systems

- Solid-State Cooling Systems (Thermoelectric Coolers)

- Phase Change Material (PCM) Based Systems

- Cryogenic Cooling Systems

- Pumped Two-Phase Systems

- Heat Pipes and Vapor Chambers

- By Platform:

- Commercial Aircraft

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets

- Military Aircraft

- Fighter Jets

- Transport Aircraft

- Helicopters

- Special Mission Aircraft

- Spacecraft

- Satellites

- Launch Vehicles

- Space Stations

- Rovers/Probes

- Unmanned Aerial Vehicles (UAVs)

- Military Drones

- Commercial Drones

- Land Vehicles (Military)

- Tanks

- Armored Personnel Carriers (APCs)

- Other Combat Vehicles

- Naval Vessels

- Submarines

- Warships

- Commercial Aircraft

- By Application:

- Avionics

- Radar Systems

- Power Electronics

- Environmental Control Systems (ECS)

- High-Energy Lasers

- Payloads

- Propulsion Systems

- Battery Thermal Management

- Targeting Systems

- Sensors and Optics

- By Component:

- Heat Exchangers

- Pumps and Valves

- Refrigerants/Coolants

- Thermal Interface Materials (TIMs)

- Cold Plates

- Fans and Blowers

- Compressors

- Condensers

- Evaporators

- Thermal Straps

- Temperature Sensors

- Controllers and Software

Value Chain Analysis For Aerospace & Defense Thermal Management Systems Market

The value chain for the Aerospace & Defense Thermal Management Systems Market begins with upstream activities involving raw material suppliers and component manufacturers. This phase is critical as it dictates the quality, performance, and cost of the final thermal management solutions. Suppliers provide specialized materials such as high-thermal-conductivity metals (e.g., aluminum, copper alloys), composites, ceramics, and advanced refrigerants or dielectric fluids. Component manufacturers then transform these raw materials into specific parts like micro-channel heat exchangers, cold plates, pumps, compressors, and thermal interface materials, often requiring precision engineering and adherence to stringent aerospace and defense standards. Research and development is also a significant upstream activity, driving innovation in materials science, thermal fluid dynamics, and system design.

Midstream activities involve the integration and assembly of these components into complete thermal management systems. System integrators and original equipment manufacturers (OEMs) are key players in this stage, designing, fabricating, and testing complex cooling solutions tailored to specific platform requirements. This often includes custom engineering for space-constrained environments, weight optimization, and performance validation under extreme operating conditions. Integration typically involves significant collaboration between thermal management system providers and prime contractors (e.g., Boeing, Lockheed Martin, Airbus) to ensure seamless compatibility with aircraft, spacecraft, or defense vehicle platforms. The rigorous testing and certification processes at this stage are vital for meeting aerospace and defense safety and reliability mandates.

The downstream segment primarily involves the distribution, installation, and post-sales support for these thermal management systems. Distribution channels can be direct, where system manufacturers supply directly to prime contractors or government defense agencies. Indirect channels might involve third-party distributors or MRO (Maintenance, Repair, and Overhaul) service providers who supply spare parts and replacement systems. Aftermarket services, including maintenance, upgrades, and technical support, represent a crucial part of the downstream value chain, ensuring the long-term operational efficiency and reliability of installed systems. The formal and complex nature of aerospace and defense procurement means direct sales relationships and long-term contracts are prevalent, fostering strong ties between suppliers and end-users.

Aerospace & Defense Thermal Management Systems Market Potential Customers

The primary potential customers for Aerospace & Defense Thermal Management Systems are the large Original Equipment Manufacturers (OEMs) within the aerospace and defense sectors. These include major aircraft manufacturers such as Boeing, Airbus, Lockheed Martin, and Northrop Grumman, who integrate these systems into their commercial airplanes, military jets, helicopters, and unmanned aerial vehicles. Similarly, space agencies and private space companies like NASA, ESA, SpaceX, and Blue Origin represent significant buyers, requiring advanced thermal solutions for satellites, launch vehicles, and deep-space probes. These OEMs and prime contractors are responsible for designing and assembling entire platforms, making thermal management a critical subsystem procured from specialized suppliers to meet stringent performance and reliability specifications.

Beyond the prime OEMs, various government defense departments and military branches globally are direct or indirect purchasers of these systems. As they procure and maintain fleets of advanced military aircraft, ground vehicles, and naval vessels, the demand for robust and efficient thermal management systems for new builds and upgrades is constant. This includes naval shipyards, air forces, armies, and special forces units that require equipment to operate reliably in diverse and often harsh environmental conditions. The increasing emphasis on military modernization and the adoption of high-tech weaponry further solidifies these government entities as crucial end-users, driving requirements for innovative thermal solutions.

Another significant customer segment includes MRO (Maintenance, Repair, and Overhaul) providers and aftermarket service companies. These entities are responsible for the upkeep, repair, and upgrade of existing aerospace and defense platforms. They often require replacement parts, system upgrades, and specialized thermal solutions for aging fleets or to enhance the performance of current systems. Additionally, research and development institutions, universities, and specialized engineering firms working on next-generation aerospace and defense technologies also constitute potential customers, albeit often for prototyping and testing purposes. The diverse ecosystem of defense contractors, component manufacturers, and integrators also creates a complex web of buyers and suppliers within the broader market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.5 Billion |

| Market Forecast in 2032 | USD 12.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Collins Aerospace (Raytheon Technologies), Liebherr-Aerospace & Transportation SAS, Parker Hannifin Corporation, L3Harris Technologies Inc., Meggitt PLC (Parker Meggitt), Safran S.A., Aavid Thermalloy (Boyd Corporation), Thermacore Inc., TTM Technologies Inc., Advanced Cooling Technologies Inc. (ACT), CTT (Concordia Technology LLC), Astronautics Corporation of America, Curtiss-Wright Corporation, Moog Inc., GKN Aerospace, TAT Technologies Ltd., Daikin Industries Ltd., Modine Manufacturing Company, VSS (Vapor Statement Solutions). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace & Defense Thermal Management Systems Market Key Technology Landscape

The Aerospace & Defense Thermal Management Systems Market is characterized by a dynamic technology landscape continually evolving to meet the escalating demands for higher performance and reliability in extreme operating conditions. Traditional air-based and vapor cycle systems are being complemented and, in some cases, replaced by more efficient liquid cooling solutions, particularly for high-power electronics and advanced avionics. These liquid cooling systems often utilize specialized dielectric fluids or two-phase cooling loops, which offer superior heat transfer coefficients and enable more compact designs. The development of advanced cold plates and micro-channel heat exchangers is central to these liquid-based approaches, allowing for precise temperature control even in highly constrained spaces. Innovations in materials science are also pivotal, with lighter and stronger composite materials being integrated into system structures to reduce overall platform weight.

Emerging technologies are playing a critical role in shaping the future of thermal management in this sector. Phase change materials (PCMs) are gaining traction for passive thermal management, providing transient heat absorption capabilities crucial for applications with intermittent high heat loads. Thermoelectric coolers (TECs) offer precise temperature control without moving parts, making them ideal for sensitive sensors and optics. Advancements in heat pipe and vapor chamber technologies are leading to more efficient and reliable passive heat transfer devices, capable of operating effectively in zero-gravity environments or where active cooling is impractical. Furthermore, cryogenic cooling systems are becoming indispensable for infrared sensors, high-resolution cameras, and quantum computing components in both space and advanced defense applications, demanding highly specialized and ultra-low temperature solutions.

Digitalization and smart integration are also transforming the technology landscape. The incorporation of advanced sensors, intelligent controllers, and predictive analytics, often leveraging artificial intelligence and machine learning, allows for real-time monitoring and adaptive thermal management. These smart systems can anticipate heat spikes, optimize cooling loads, and perform predictive maintenance, significantly enhancing system reliability and operational efficiency. Additive manufacturing (3D printing) is revolutionizing the design and fabrication of complex thermal components, enabling the creation of intricate internal geometries for improved heat transfer and weight reduction. These technological convergences are not only pushing the boundaries of what is possible in thermal management but also creating opportunities for more integrated, autonomous, and resilient aerospace and defense platforms.

Regional Highlights

- North America: Dominates the market due to significant defense spending, a robust commercial aviation industry, and extensive research and development in advanced aerospace technologies. The presence of major OEMs and a strong innovation ecosystem drive market growth.

- Europe: A mature market driven by a strong commercial aircraft manufacturing base (e.g., Airbus) and collaborative defense initiatives (e.g., Eurofighter). Emphasis on sustainable aviation and modernization programs fuels demand for efficient thermal solutions.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate due to rapid expansion of commercial aircraft fleets, increasing defense budgets, and the emergence of indigenous aerospace and defense industries in countries like China, India, and Japan.

- Latin America: Experiences steady growth primarily driven by military modernization efforts and fleet upgrades. Investments in regional air travel also contribute to demand.

- Middle East and Africa (MEA): Growing market influenced by significant defense expenditures from oil-rich nations and increasing regional security concerns, leading to procurement of advanced military platforms requiring sophisticated thermal management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace & Defense Thermal Management Systems Market.- Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- Liebherr-Aerospace & Transportation SAS

- Parker Hannifin Corporation

- L3Harris Technologies Inc.

- Meggitt PLC (Parker Meggitt)

- Safran S.A.

- Aavid Thermalloy (Boyd Corporation)

- Thermacore Inc.

- TTM Technologies Inc.

- Advanced Cooling Technologies Inc. (ACT)

- CTT (Concordia Technology LLC)

- Astronautics Corporation of America

- Curtiss-Wright Corporation

- Moog Inc.

- GKN Aerospace

- TAT Technologies Ltd.

- Daikin Industries Ltd.

- Modine Manufacturing Company

- VSS (Vapor Statement Solutions)

Frequently Asked Questions

What are the primary drivers for the Aerospace & Defense Thermal Management Systems Market?

The market is primarily driven by the increasing power density of electronic components in modern platforms, the continuous modernization of defense fleets, growing demand for new commercial aircraft, and the critical need for enhanced operational safety and reliability.

How does AI impact thermal management systems in aerospace and defense?

AI significantly impacts by enabling real-time adaptive control, predictive maintenance, optimizing design processes, and improving overall system efficiency and reliability through intelligent monitoring and analysis of thermal data.

Which cooling technologies are most prevalent in this market?

Liquid cooling systems, vapor cycle systems, and air cycle systems are most prevalent, with advanced solutions like phase change materials, thermoelectric coolers, and heat pipes gaining traction for specific high-performance applications.

What challenges does the market face?

Key challenges include the high cost of development and integration, stringent regulatory requirements, the complexity of integrating advanced systems into existing platforms, and the need for specialized materials and skilled labor.

Which region holds the largest market share and why?

North America holds the largest market share due to its significant defense spending, robust commercial aviation sector, strong R&D investments, and the presence of numerous leading aerospace and defense OEMs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager