Agricultural Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427683 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Coatings Market Size

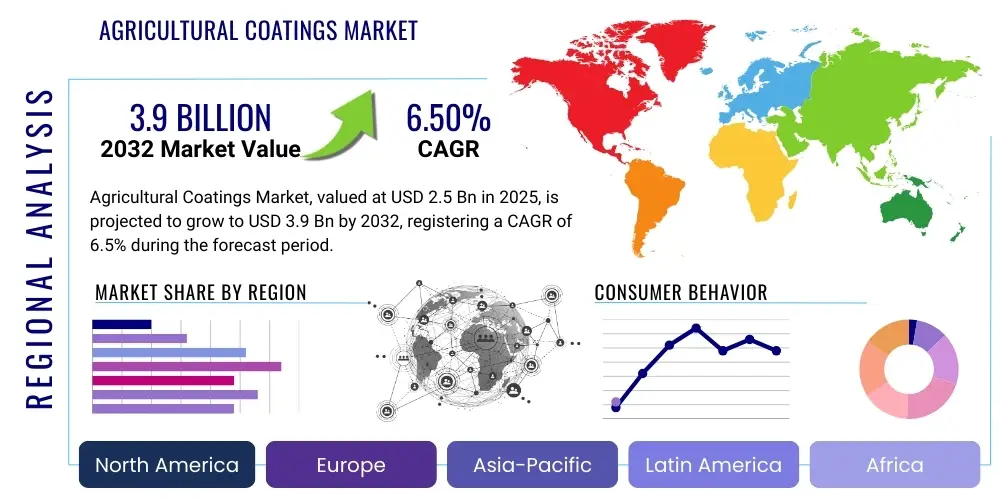

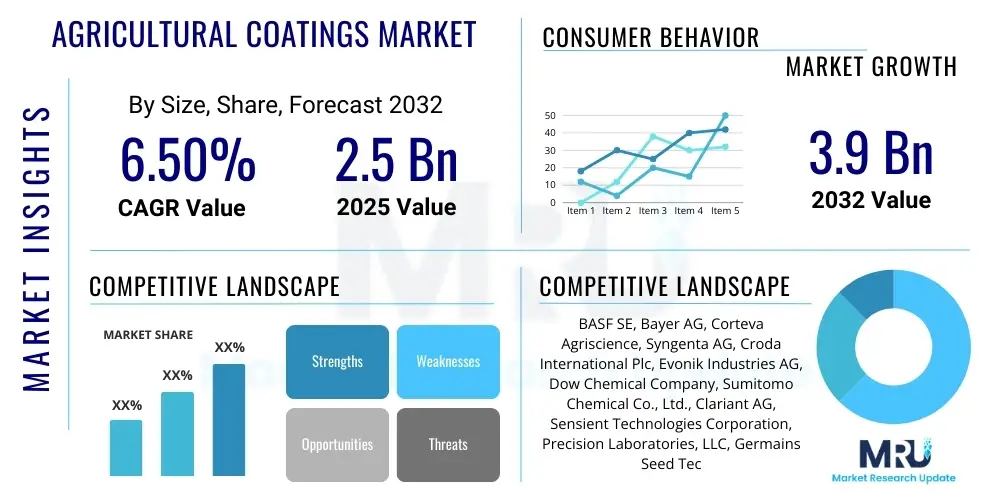

The Agricultural Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 2.5 billion in 2025 and is projected to reach USD 3.9 billion by the end of the forecast period in 2032. This growth is underpinned by an increasing global population, escalating demand for food production, and the imperative to enhance crop yield and quality through sustainable agricultural practices. The market’s expansion is further fueled by continuous innovation in coating technologies, including the development of advanced polymer-based solutions and bio-based alternatives designed for specific environmental conditions and crop requirements.

The market size reflects a growing recognition among agricultural stakeholders regarding the economic and environmental benefits offered by advanced coatings. These benefits range from improved nutrient use efficiency in fertilizers to enhanced seed germination and protection against biotic and abiotic stresses. Furthermore, the rising adoption of precision agriculture techniques and integrated pest management strategies in developed and developing economies significantly contributes to the market’s upward trajectory, as coatings play a crucial role in delivering targeted and controlled release of active ingredients, optimizing agricultural input usage.

Agricultural Coatings Market introduction

The Agricultural Coatings Market encompasses a diverse range of specialized materials applied to various agricultural inputs, including seeds, fertilizers, pesticides, and soil amendments, to improve their performance, efficacy, and environmental profile. These coatings serve multiple critical functions, such as enhancing seed germination rates, providing protection against pathogens and pests, regulating nutrient release from fertilizers, and encapsulating agrochemicals for controlled delivery. The primary objective is to optimize resource utilization, reduce waste, and ultimately boost crop productivity and quality while minimizing ecological impact. The evolution of these coatings is directly linked to the global imperative of achieving food security for a growing population under increasingly challenging environmental conditions.

Product descriptions within this market span a broad spectrum of chemical compositions and functionalities. They typically include polymer-based coatings, which offer durable protection and controlled release properties; wax-based coatings, providing moisture barriers and improved handling; and various additives such as microbial enhancements, growth regulators, and UV stabilizers. These materials are engineered to create a protective barrier, modify surface properties, or facilitate the timed release of active substances, ensuring that agricultural inputs perform optimally in diverse environments. The continuous research and development in this sector focus on creating more environmentally friendly, biodegradable, and highly effective coating solutions that align with modern sustainable farming practices.

Major applications for agricultural coatings are extensive, significantly impacting crop cultivation from planting to harvest. Seed coatings are vital for early-stage crop protection and establishment, improving germination and seedling vigor. Fertilizer coatings enable slow or controlled release of nutrients, reducing leaching and increasing uptake efficiency. Pesticide encapsulation through coatings minimizes off-target drift and extends the active life of agrochemicals, leading to more efficient pest and disease management. Beyond these, benefits such as improved handling and flowability of inputs, enhanced plant resilience against environmental stressors, and a reduction in overall chemical usage underscore the crucial role of agricultural coatings. The markets growth is driven by the global demand for sustainable food production, the increasing adoption of precision agriculture, and the need to address environmental concerns associated with conventional farming methods.

Agricultural Coatings Market Executive Summary

The Agricultural Coatings Market is experiencing robust growth driven by significant business trends that prioritize innovation, sustainability, and efficiency across the agricultural value chain. A primary trend involves the increasing investment in research and development towards bio-based and biodegradable coating formulations, responding to stringent environmental regulations and rising consumer demand for organic and sustainably produced food. Furthermore, strategic collaborations and mergers among key market players are accelerating product development and market penetration, fostering a competitive landscape focused on offering integrated solutions for crop enhancement. The market is also seeing a surge in demand for specialized coatings tailored for specific crop types and growing conditions, indicating a shift towards more precise and customized agricultural solutions.

Regional trends significantly shape the markets trajectory, with Asia-Pacific emerging as the largest and fastest-growing region due to its vast agricultural lands, increasing population, and government initiatives promoting modern farming techniques. North America and Europe, while mature, are characterized by high adoption rates of advanced coating technologies, stringent environmental policies, and a strong emphasis on precision agriculture, driving innovation in high-performance and eco-friendly products. Latin America is also showing considerable potential, fueled by the expansion of arable land and the growing need to improve crop yields for export markets. These regional dynamics highlight diverse market drivers, from the need for increased production capacity in developing economies to the demand for sustainable and high-tech solutions in developed regions.

Segmentation trends within the agricultural coatings market indicate distinct growth patterns and areas of intense focus. Seed coatings continue to dominate the market, primarily due to their direct impact on germination, seedling health, and early-stage crop protection, which are critical for maximizing yield potential. The fertilizer coatings segment is projected to witness substantial growth, propelled by the urgent need to enhance nutrient use efficiency, minimize environmental pollution from nutrient runoff, and reduce overall fertilizer consumption. Moreover, the demand for coatings in pesticide encapsulation and specialty applications, such as for agricultural films and irrigation systems, is steadily increasing as farmers seek comprehensive solutions to optimize resource management and improve crop resilience, further diversifying the markets revenue streams and application areas.

AI Impact Analysis on Agricultural Coatings Market

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in revolutionizing the Agricultural Coatings Market, focusing on how AI can optimize formulations, enhance application precision, and improve supply chain efficiencies. Common questions revolve around the use of AI for predictive analytics in tailoring coating properties to specific environmental conditions or crop needs, such as identifying optimal nutrient release rates or pest protection durations. There is also significant interest in AIs role in developing novel, smart coating materials that can respond to real-time environmental data, and concerns about the ethical implications of data privacy, the potential for job displacement, and the economic accessibility of such advanced technologies for smaller farming operations. Users generally anticipate that AI will lead to more sustainable, cost-effective, and highly efficient coating solutions, fundamentally changing how agricultural inputs are manufactured, applied, and managed across the value chain.

The integration of Artificial Intelligence is poised to significantly enhance the Agricultural Coatings Market by introducing unprecedented levels of precision, efficiency, and intelligence into product development and application. AI-driven platforms can analyze vast datasets, including climate patterns, soil conditions, crop specificities, and historical performance data, to predict optimal coating formulations for diverse agricultural contexts. This capability allows for the development of hyper-tailored solutions that maximize the efficacy of seeds, fertilizers, and pesticides, thereby reducing waste and environmental impact. Beyond formulation, AI will empower precision application technologies, enabling farmers to apply coated inputs with unprecedented accuracy based on real-time field data, leading to superior crop health and higher yields.

- Predictive analytics for optimal coating formulation, matching specific crop and environmental needs.

- Enhanced quality control and consistency in manufacturing processes through AI-powered monitoring.

- Optimization of supply chain and logistics for raw materials and finished coated products.

- Development of smart coatings with integrated sensors capable of real-time environmental monitoring.

- Automated decision-making for precision application strategies in the field, reducing input overuse.

- Accelerated research and development of novel bio-based and eco-friendly coating materials.

- Improved demand forecasting and inventory management, minimizing waste and ensuring timely supply.

DRO & Impact Forces Of Agricultural Coatings Market

The Agricultural Coatings Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces that shape its growth trajectory and competitive landscape. Key drivers include the escalating global demand for food, propelled by a rapidly expanding population, which necessitates increased crop yields from finite arable land. This demand, coupled with the growing adoption of precision agriculture techniques and the imperative for sustainable farming practices, significantly fuels the need for advanced coatings that optimize input efficiency and minimize environmental footprint. Additionally, technological advancements in material science, particularly in polymer and nano-coating technologies, are continuously opening new avenues for product development, offering solutions that enhance crop resilience against evolving environmental stressors and pest threats, thereby reinforcing market expansion.

Despite the strong growth drivers, the market faces several notable restraints. High upfront research and development costs associated with developing innovative coating formulations, especially bio-based and controlled-release technologies, can be prohibitive for some market players. Furthermore, stringent environmental regulations governing the use of certain chemicals and materials in agricultural applications, particularly in developed regions, pose challenges for product commercialization and require significant investment in compliance. Volatility in raw material prices, such as polymers, waxes, and specialized additives, can also impact production costs and profit margins, creating an unpredictable supply chain environment. Lastly, a lack of awareness or slow adoption of advanced coating technologies in some developing agricultural regions can limit market penetration and growth potential.

Opportunities for growth are abundant, particularly in the development and commercialization of bio-based and biodegradable coatings that align with global sustainability goals and consumer preferences for eco-friendly products. The integration of nanotechnology into agricultural coatings represents a significant growth avenue, enabling ultra-thin, highly effective layers for targeted delivery and enhanced protection. Emerging markets in Asia-Pacific, Latin America, and Africa offer immense untapped potential, driven by rapid agricultural modernization and increasing investment in farming technologies. Moreover, the convergence of agricultural coatings with smart farming and IoT platforms presents an opportunity for developing intelligent coatings that can sense environmental changes and release active ingredients adaptively, promising a future of highly optimized and responsive agricultural input management. These opportunities, when strategically pursued, have the potential to significantly mitigate the impact of existing restraints and propel the market forward.

Segmentation Analysis

The Agricultural Coatings Market is comprehensively segmented to provide granular insights into its diverse components and evolving dynamics, reflecting the various technologies, applications, and regional demands shaping the industry. These segmentations are crucial for understanding market behavior, identifying high-growth areas, and tailoring strategies to meet specific customer needs. The market is primarily analyzed by Type, encompassing different coating materials and formulations; by Application, detailing the specific agricultural inputs or areas where coatings are used; by Crop Type, focusing on the varied requirements of different agricultural produce; and by Function, highlighting the primary purpose or benefit of the coating.

Each segment offers a unique perspective on market trends and consumer preferences. For instance, the segmentation by Type reveals the dominance of polymer-based coatings due to their versatility and controlled-release capabilities, while also highlighting the rapid growth of bio-based alternatives. Application-based segmentation underscores the critical role of coatings in seed treatment and fertilizer efficiency, with increasing interest in advanced pesticide encapsulation. Understanding these intricate segments is vital for stakeholders to innovate, position their products effectively, and capitalize on the most promising avenues for growth within the complex landscape of modern agriculture.

- By Type: Polymer-based coatings, Wax-based coatings, Other coatings (e.g., mineral-based, bio-based).

- By Application: Seed coatings, Fertilizer coatings, Pesticide coatings, Other applications (e.g., agricultural films, soil amendments).

- By Crop Type: Grains and cereals, Oilseeds and pulses, Fruits and vegetables, Other crop types.

- By Function: Protection, Controlled release, Enhanced germination, Nutrient uptake improvement, Aesthetics.

Agricultural Coatings Market Value Chain Analysis

The value chain for the Agricultural Coatings Market is a complex and interconnected network of activities, commencing from the sourcing of raw materials to the final application by end-users in the agricultural sector. At the upstream end, the value chain is dominated by chemical manufacturers and specialized suppliers who provide foundational ingredients such as polymers (e.g., polyurethanes, polyacrylates), waxes (e.g., carnauba, paraffin), various pigments, surfactants, and a wide array of additives including microbial agents, growth regulators, and UV stabilizers. The quality and cost-effectiveness of these raw materials significantly impact the final products performance and market competitiveness, driving continuous research into more sustainable and advanced material science. These suppliers are critical for innovation, offering new chemistries that improve coating efficacy, durability, and environmental safety, thereby setting the foundational stage for product development.

Moving downstream, these raw materials are processed and formulated by agricultural coating manufacturers who specialize in developing and producing the finished coating solutions. These manufacturers often engage in extensive research and development to create proprietary formulations tailored for specific applications, such as seed treatment, fertilizer encapsulation, or pesticide delivery. After production, these coated products reach the end-users—primarily seed companies, fertilizer manufacturers, agrochemical producers, and large commercial farms—through various distribution channels. The distribution network can be bifurcated into direct and indirect channels. Direct sales typically involve large-scale transactions between coating manufacturers and major agricultural input companies or very large farming conglomerates, often accompanied by technical support and customized solutions. This direct engagement fosters strong relationships and allows for tailored product development and service.

Indirect distribution channels, on the other hand, involve a network of distributors, wholesalers, and agricultural retailers who make the coated products accessible to a broader base of farmers, including small and medium-sized enterprises. These intermediaries play a crucial role in market penetration, especially in regions with fragmented agricultural landscapes, by providing local access, technical advice, and logistical support. The efficiency of this downstream distribution is vital for timely delivery of seasonal agricultural inputs, ensuring that farmers can access the necessary coatings when they need them most. The entire value chain is characterized by a high degree of specialization and a growing emphasis on collaboration among different stakeholders to enhance product innovation, optimize supply chain logistics, and ultimately deliver maximum value to the end agricultural consumer, contributing to improved crop yields and sustainable farming practices.

Agricultural Coatings Market Potential Customers

The potential customers for the Agricultural Coatings Market represent a diverse ecosystem of entities within the agricultural sector, each driven by distinct needs to enhance productivity, efficiency, and sustainability. At the forefront are seed companies, which represent a significant customer segment. These companies integrate specialized coatings onto their seeds to improve germination rates, protect against early-stage pests and diseases, and enhance seedling vigor. By doing so, they provide farmers with higher-quality planting materials that promise better establishment and yield, making coated seeds a premium offering in the market. The coatings often include fungicides, insecticides, and even micronutrients, thereby delivering comprehensive protection and nutritional support from the outset of crop growth. This strategic integration is crucial for maintaining market competitiveness and meeting farmer expectations for robust and resilient crops.

Another major segment of potential customers includes fertilizer manufacturers. These companies utilize agricultural coatings to produce slow-release or controlled-release fertilizers, which significantly improve nutrient use efficiency and reduce environmental pollution from nutrient runoff and leaching. By encapsulating fertilizer granules with various polymer or wax-based coatings, manufacturers can regulate the dissolution rate of nutrients, ensuring that plants receive a steady supply over an extended period. This technology helps farmers optimize their fertilization programs, reduce application frequency, and minimize input waste, leading to more sustainable and cost-effective nutrient management practices. The demand from fertilizer producers is particularly strong as global regulations tighten on environmental impact and the push for efficient resource utilization intensifies.

Furthermore, agrochemical producers constitute a vital customer base, employing coatings for the encapsulation and targeted delivery of pesticides, herbicides, and other crop protection chemicals. This application helps to reduce volatility, minimize off-target drift, and extend the residual activity of active ingredients, thereby increasing the efficacy of pest and disease management while simultaneously reducing the overall volume of chemicals needed. Beyond these primary sectors, large-scale commercial farms and, increasingly, small to medium-sized individual farmers are direct or indirect consumers of these coated products. They seek solutions that offer improved crop performance, enhanced resilience to environmental stresses, and streamlined operational efficiency. The collective demand from these varied end-users underpins the continuous innovation and growth within the agricultural coatings industry, driving the development of increasingly sophisticated and beneficial coating technologies designed to meet the evolving demands of modern agriculture.

Agricultural Coatings Market Key Technology Landscape

The Agricultural Coatings Market is characterized by a dynamic and innovative technology landscape, constantly evolving to address the complex challenges of modern agriculture, including food security, environmental sustainability, and resource optimization. A cornerstone of this landscape is Controlled-Release Technology (CRT), which enables the precise and timed release of active ingredients, such as nutrients, pesticides, or growth regulators, from coated agricultural inputs. This technology prevents rapid leaching or degradation, ensuring that the active substances are available to plants over an extended period, thereby maximizing their efficacy, minimizing waste, and reducing the frequency of applications. CRT encompasses various mechanisms, including diffusion-controlled release, swelling-controlled release, and erosion-controlled release, each tailored to specific environmental conditions and agricultural requirements, significantly enhancing the efficiency of fertilizers and crop protection agents.

Microencapsulation and nanotechnology are also pivotal in shaping the technological advancements within the market. Microencapsulation involves enveloping tiny particles of an active ingredient within a protective shell, offering enhanced stability, reduced volatility, and improved handling. This technique is particularly valuable for protecting sensitive agrochemicals from degradation and for achieving targeted delivery. Nanotechnology takes this a step further, utilizing materials at the nanoscale to create ultra-thin, highly effective coatings with novel properties. Nano-coatings can provide superior protection against pathogens, enhance water retention, and even facilitate more efficient nutrient uptake by plants. The ability to manipulate materials at such a precise level opens doors for developing smart coatings that can respond to environmental cues, thereby offering unprecedented levels of control and performance in agricultural applications.

Beyond controlled release and advanced encapsulation, the technology landscape includes the development of sophisticated polymer science, particularly focusing on bio-based and biodegradable polymers to address environmental concerns associated with synthetic materials. These eco-friendly alternatives offer similar performance benefits while ensuring minimal ecological impact, aligning with global sustainability goals. Furthermore, the integration of sensors and responsive materials into coatings is giving rise to intelligent or smart coatings that can monitor soil conditions, detect early signs of stress, or even signal nutrient deficiencies, leading to highly adaptive and precise agricultural management. Innovations in precision application equipment, such as electrostatic sprayers and drone-based systems, are also integral, ensuring that these advanced coatings are applied accurately and efficiently, maximizing their intended benefits and reinforcing the overall technological sophistication of the agricultural coatings market.

Regional Highlights

- North America: This region is a leader in adopting advanced agricultural coating technologies, driven by a strong emphasis on precision agriculture, technological innovation, and sustainable farming practices. The market benefits from substantial R&D investments and a high demand for high-performance seed and fertilizer coatings.

- Europe: Characterized by stringent environmental regulations and a strong focus on organic and bio-based products, Europe is a key market for eco-friendly and biodegradable agricultural coatings. Innovation is driven by the need to comply with policies promoting reduced chemical use and enhanced environmental protection.

- Asia-Pacific: Emerging as the largest and fastest-growing market, Asia-Pacific is propelled by its vast agricultural land, increasing population, and the pressing need to enhance food security. Government initiatives promoting modern farming techniques and rising disposable incomes contribute to the rapid adoption of advanced coatings for improved crop yields.

- Latin America: This region presents significant growth potential due to the expansion of arable land, increasing agricultural exports, and a growing demand for high-yield crops. The adoption of advanced coatings is driven by the need to optimize resource utilization and enhance crop resilience against regional climatic challenges.

- Middle East & Africa: An emerging market, the Middle East & Africa region is witnessing increasing investments in agricultural infrastructure and technology to address food security concerns and diversify economies. Coatings play a crucial role in improving crop productivity in challenging environmental conditions, such as water scarcity and high temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Coatings Market.- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta AG (ADAMA Agricultural Solutions Ltd.)

- Croda International Plc

- Evonik Industries AG

- Dow Chemical Company

- Sumitomo Chemical Co., Ltd.

- Clariant AG

- Sensient Technologies Corporation

- Precision Laboratories, LLC

- Germains Seed Technology

- Incotec Group BV (part of Croda International Plc)

- Kao Corporation

- Chemtura Corporation (now part of Lanxess AG)

- Arkema S.A.

- Drexel Chemical Company

- Polymer Group, Inc.

Frequently Asked Questions

What are agricultural coatings and why are they important for modern farming?

Agricultural coatings are specialized materials applied to seeds, fertilizers, and other farm inputs to enhance their performance, protection, and efficiency. They are crucial for modern farming as they improve crop yield, reduce the need for excessive chemical use, and promote sustainable practices by enabling controlled release of nutrients and targeted protection against pests and diseases, thereby optimizing resource utilization and minimizing environmental impact for a growing global population.

What are the primary benefits of using agricultural coatings in crop production?

The primary benefits of agricultural coatings include enhanced seed germination and early seedling vigor, improved nutrient use efficiency from fertilizers, reduced leaching and volatilization of active ingredients, and extended protection against biotic and abiotic stresses. These benefits collectively lead to higher crop yields, better crop quality, reduced input costs over time, and a more environmentally friendly approach to agriculture, supporting global food security initiatives.

Which factors are primarily driving the growth of the agricultural coatings market?

The growth of the agricultural coatings market is primarily driven by the escalating global demand for food due to population growth, the imperative to increase crop yields from limited arable land, and the increasing adoption of precision agriculture techniques. Additionally, the growing focus on sustainable farming practices, the demand for high-value crops, and continuous technological advancements in coating materials and application methods are significant drivers contributing to market expansion worldwide.

What challenges does the agricultural coatings market currently face?

The agricultural coatings market faces several challenges, including high research and development costs for innovative and sustainable formulations, stringent environmental regulations governing chemical use and biodegradability, and volatility in raw material prices. Furthermore, a lack of awareness and slower adoption rates in some developing regions, alongside the need for specialized application equipment, can also pose significant barriers to market penetration and sustained growth.

How do agricultural coatings contribute to sustainable agriculture and environmental protection?

Agricultural coatings significantly contribute to sustainable agriculture by enabling precise and efficient use of inputs, reducing waste, and minimizing environmental pollution. They facilitate controlled release of nutrients, reducing runoff and groundwater contamination from fertilizers. For pesticides, coatings minimize off-target drift and extend efficacy, leading to less frequent applications and lower overall chemical usage, thus preserving soil health, water quality, and biodiversity in agricultural ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager