Agricultural Drone Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430753 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Agricultural Drone Market Size

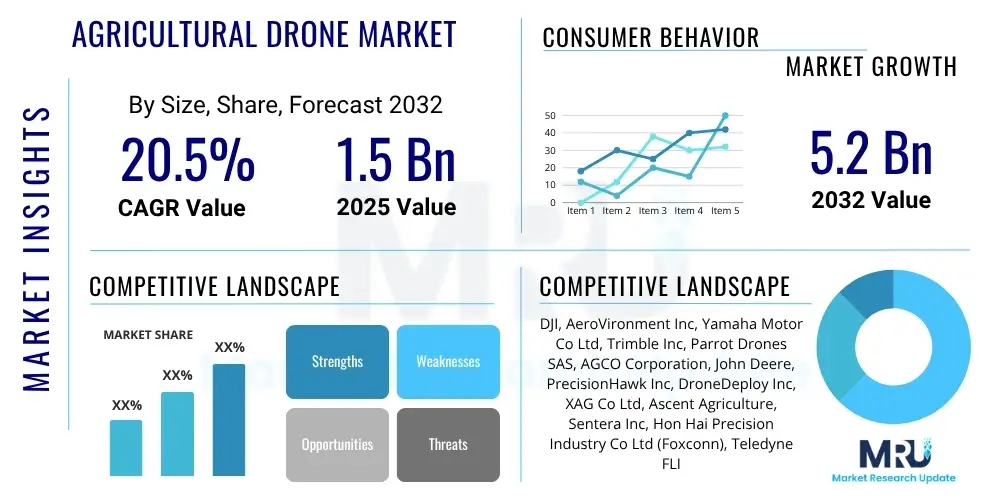

The Agricultural Drone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2032. The market is estimated at USD 1.5 Billion in 2025 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2032.

Agricultural Drone Market introduction

The agricultural drone market encompasses the production, distribution, and utilization of unmanned aerial vehicles (UAVs) specifically designed for agricultural applications. These sophisticated devices, often equipped with advanced sensors, cameras, and GPS technology, are revolutionizing traditional farming practices by enabling precision agriculture techniques. They address critical challenges faced by the agricultural sector, such as optimizing resource allocation, increasing crop yields, and mitigating environmental impact.

Product descriptions typically highlight drones capable of autonomous flight, programmed missions, and real-time data collection. Major applications span across crop monitoring, where they provide detailed insights into plant health and growth; precision spraying of pesticides and fertilizers, ensuring targeted application and reducing waste; and detailed field mapping for soil analysis and irrigation management. These applications collectively enhance efficiency, reduce manual labor requirements, and improve overall farm productivity.

The benefits of agricultural drones are multi-faceted, including significant cost savings through optimized resource use, enhanced decision-making capabilities derived from accurate data, improved crop health leading to higher yields, and reduced environmental footprint due to targeted chemical application. Driving factors for market growth include the increasing demand for food globally, the rising adoption of precision farming techniques, scarcity of agricultural labor, and advancements in drone technology, including improved battery life, payload capacity, and autonomous capabilities.

Agricultural Drone Market Executive Summary

The agricultural drone market is poised for substantial expansion, driven by the escalating global demand for sustainable and efficient farming practices. Business trends indicate a strong focus on developing integrated solutions that combine advanced drone hardware with sophisticated data analytics software, moving beyond mere data collection to actionable insights. Strategic partnerships between drone manufacturers, agricultural technology providers, and farming enterprises are becoming increasingly common, fostering innovation and wider market penetration. Moreover, the emergence of drone-as-a-service (DaaS) models is lowering the entry barrier for smaller farms, accelerating adoption rates.

Regional trends reveal North America and Europe as early adopters, primarily due to well-established agricultural infrastructure, robust technological advancements, and supportive government policies promoting smart farming. The Asia Pacific region, however, is emerging as a significant growth hub, propelled by large agricultural land areas, government subsidies for modern farming techniques, and a burgeoning need for efficiency amidst rising population pressures. Latin America and the Middle East & Africa are also showing promising growth, albeit at an earlier stage, driven by the need to optimize resource management in diverse climatic conditions.

Segmentation trends highlight the increasing sophistication of drone applications. While hardware sales remain robust, the software and services segments are experiencing rapid growth as farmers seek comprehensive solutions for data processing, analysis, and interpretation. Within applications, crop monitoring and precision spraying continue to dominate, but new uses in irrigation management, livestock monitoring, and soil analysis are gaining traction. The market is also seeing differentiation by drone type, with rotary-wing drones favored for versatility and fixed-wing for extensive coverage, while hybrid models offer a blend of both benefits.

AI Impact Analysis on Agricultural Drone Market

Users frequently inquire about how Artificial Intelligence (AI) can elevate the capabilities of agricultural drones, seeking to understand the transition from basic automation to intelligent, predictive farming. Key themes revolve around enhanced data processing, autonomous decision-making, and the potential for greater precision in various farming operations. Concerns often include the complexity of AI integration, data security, and the necessity for robust, user-friendly AI algorithms. Users expect AI to not only analyze vast amounts of drone-captured data but also to offer prescriptive recommendations for optimal farm management, ultimately leading to significant improvements in yield, resource efficiency, and sustainability.

- Enhanced data analytics for crop health assessment and disease detection.

- Autonomous flight planning and navigation, reducing human intervention.

- Predictive analytics for irrigation scheduling and fertilizer application.

- Real-time anomaly detection in fields for immediate intervention.

- Optimized route planning for precision spraying and reduced chemical usage.

- Automated weed detection and selective spraying.

- Livestock monitoring and health tracking through image recognition.

- Integration with IoT sensors for comprehensive farm data insights.

- Improved yield forecasting accuracy based on historical and real-time data.

DRO & Impact Forces Of Agricultural Drone Market

The agricultural drone market is significantly influenced by a confluence of drivers, restraints, and opportunities, shaping its growth trajectory and competitive landscape. Key drivers include the global imperative for enhanced food security, the increasing adoption of precision agriculture techniques to optimize resource utilization, and the pressing issue of labor shortages in the agricultural sector, particularly in developed economies. These factors collectively push farmers towards embracing technological solutions that offer greater efficiency and automation. Furthermore, government initiatives and subsidies in many regions are actively promoting the integration of advanced technologies like drones into farming practices, providing financial incentives for adoption.

Conversely, the market faces several notable restraints. The high initial capital investment required for purchasing advanced agricultural drones and associated software can be prohibitive for small and medium-sized farms, limiting widespread adoption. Complex and evolving regulatory frameworks, including airspace restrictions and operational guidelines for UAVs, pose significant challenges, requiring continuous adaptation from manufacturers and users. Additionally, the lack of skilled personnel capable of operating and maintaining sophisticated drone technology, as well as interpreting the vast amounts of data generated, represents a bottleneck for market expansion. Battery life limitations and payload restrictions also affect operational efficiency and the scale of operations.

Despite these challenges, substantial opportunities exist for market growth. The continuous advancement in artificial intelligence, machine learning, and sensor technologies promises to make drones more intelligent, autonomous, and capable. Emerging economies, with their large agricultural bases and increasing focus on modernization, present untapped markets for agricultural drone solutions. The development of drone-as-a-service models and rental options can help overcome the high initial cost barrier, making the technology accessible to a broader range of farmers. Moreover, the integration of agricultural drones with other smart farming technologies, such as IoT and big data platforms, offers avenues for creating comprehensive, ecosystem-level solutions, further enhancing their value proposition and driving future innovation.

Segmentation Analysis

The agricultural drone market is extensively segmented based on various factors including type, component, application, and farm size, allowing for a detailed understanding of its diverse landscape and specialized solutions. This granular segmentation helps stakeholders identify specific growth areas, target customer groups, and develop tailored products and services. Each segment addresses distinct needs and operational requirements within the agricultural ecosystem, reflecting the varied nature of farming operations globally.

Segmentation by type distinguishes between fixed-wing, rotary-wing, and hybrid drones, each offering unique operational characteristics suitable for different farming scales and tasks. Component segmentation separates the market into hardware (drones, sensors, cameras), software (flight management, data analytics, mapping), and services (maintenance, data processing, pilot services). Application segmentation covers the primary uses such as crop monitoring, precision spraying, field mapping, irrigation management, and livestock management, reflecting the diverse utility of drone technology in agriculture.

Finally, segmentation by farm size categorizes the market based on the scale of agricultural operations, differentiating between small, medium, and large farms. This distinction is crucial because the technological requirements, investment capacities, and operational complexities vary significantly across different farm sizes. Understanding these segments provides critical insights for manufacturers and service providers to effectively penetrate the market and cater to the specific demands of each agricultural sub-sector.

- By Type:

- Fixed-Wing Drones

- Rotary-Wing Drones (Multirotor)

- Hybrid Drones

- By Component:

- Hardware

- Drone Platforms

- Sensors & Cameras

- GPS/Navigation Systems

- Batteries

- Software

- Flight Management Software

- Data Analysis Software

- Mapping Software

- AI/ML Algorithms

- Services

- Drone Maintenance & Repair

- Data Processing & Analysis

- Consulting & Training

- By Application:

- Crop Monitoring

- Precision Spraying & Variable Rate Application

- Field Mapping & Surveying

- Irrigation Management

- Livestock Monitoring

- Soil Analysis & Field Scouting

- Planting & Seeding

- By Farm Size:

- Small Farms (Less than 100 acres)

- Medium Farms (100-1000 acres)

- Large Farms (More than 1000 acres)

Value Chain Analysis For Agricultural Drone Market

The value chain for the agricultural drone market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user application, highlighting the intricate interdependencies among various stakeholders. The upstream segment primarily involves the manufacturers of critical components such as airframes, propulsion systems, high-performance batteries, advanced sensors (multispectral, thermal, LiDAR), GPS modules, and sophisticated microcontrollers. These component suppliers form the foundational layer, providing the necessary building blocks for drone assembly. Innovation in these upstream technologies directly impacts the capabilities and cost-effectiveness of the final agricultural drone products.

The midstream segment focuses on the assembly, integration, and development of agricultural drones and their accompanying software. This includes drone manufacturers who integrate components into functional UAVs, as well as software developers creating flight management systems, data analytics platforms, and AI-powered algorithms for agricultural applications. These entities are responsible for transforming raw components into intelligent, operational tools designed for farming. Downstream activities involve distribution, sales, and service provision, connecting the finished products to the end-users. This includes direct sales channels from manufacturers, authorized dealers, and increasingly, drone-as-a-service (DaaS) providers who offer rental or contractual drone operations.

Distribution channels are critical in reaching the diverse agricultural customer base. Direct sales often cater to larger farms or specialized agricultural enterprises, allowing for customized solutions and direct technical support. Indirect channels, through agricultural equipment distributors, retailers, and online platforms, help penetrate smaller markets and provide broader access. Both direct and indirect models also encompass post-sales support, maintenance, and training, which are crucial for ensuring optimal drone performance and user satisfaction, thereby completing the value delivery cycle and sustaining market growth.

Agricultural Drone Market Potential Customers

The potential customer base for agricultural drones is diverse, encompassing a wide spectrum of agricultural operations from smallholder farmers to large-scale agribusinesses, each seeking to leverage drone technology for improved efficiency and profitability. End-users of these advanced systems primarily include individual farmers and farm managers who are increasingly facing challenges such as labor scarcity, rising input costs, and the need for more sustainable farming practices. These customers are driven by the desire to enhance crop yields, optimize resource allocation, and make data-driven decisions for better farm management, thereby offering a direct economic advantage.

Beyond individual farming entities, agricultural cooperatives represent a significant segment of potential customers. These organizations pool resources and expertise, enabling smaller farms to collectively invest in and benefit from high-value technologies like agricultural drones, which might be cost-prohibitive for them individually. Cooperatives can purchase drone fleets or subscribe to drone services, distributing the benefits and costs among their members, thus democratizing access to precision agriculture. Additionally, agricultural research institutions and universities constitute another key customer group, utilizing drones for scientific studies, experimental farming, and developing new methodologies for crop management and environmental monitoring.

Government agencies involved in agricultural development, land management, and environmental conservation also represent crucial potential buyers. They deploy drones for large-scale land surveys, disaster assessment in agricultural areas, monitoring compliance with environmental regulations, and supporting rural development projects. Agribusiness corporations, particularly those involved in large-scale commercial farming, food processing, or agricultural inputs (e.g., seed and fertilizer companies), are prominent adopters, integrating drones into their operations for maximizing productivity across extensive landholdings and ensuring quality control throughout the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2032 | USD 5.2 Billion |

| Growth Rate | CAGR 20.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, AeroVironment Inc, Yamaha Motor Co Ltd, Trimble Inc, Parrot Drones SAS, AGCO Corporation, John Deere, PrecisionHawk Inc, DroneDeploy Inc, XAG Co Ltd, Ascent Agriculture, Sentera Inc, Hon Hai Precision Industry Co Ltd (Foxconn), Teledyne FLIR LLC, Invenio Imaging Inc, Quantum Systems GmbH, Skydio Inc, 3DR Inc, Draganfly Inc, Wingtra AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Drone Market Key Technology Landscape

The agricultural drone market is underpinned by a rapidly evolving technological landscape, where innovations in various fields converge to enhance drone capabilities and applications in farming. At the core of these advancements are sophisticated navigation and positioning systems, primarily relying on highly accurate Global Positioning System (GPS) and Real-Time Kinematic (RTK) or Post-Processed Kinematic (PPK) technology. These systems enable centimeter-level precision for tasks like spraying and mapping, ensuring optimal resource utilization and avoiding crop damage. Improved battery technologies, offering longer flight times and faster charging cycles, are also critical for expanding operational ranges and efficiency.

Sensor technology constitutes another pivotal aspect of the agricultural drone landscape. Multispectral and hyperspectral cameras are widely used to capture data across various light spectra, providing detailed insights into crop health, nutrient deficiencies, and pest infestations invisible to the naked eye. LiDAR (Light Detection and Ranging) sensors are employed for creating highly accurate 3D maps of terrain and crop canopy, essential for precise volume calculations and drainage planning. Thermal sensors detect temperature variations, aiding in irrigation management and identifying stressed plants. These diverse sensors collect the raw data that forms the basis for informed agricultural decisions.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming drone-collected data into actionable intelligence. AI powers image recognition for automated disease and pest detection, crop counting, and yield estimation. ML models analyze historical and real-time data to provide predictive insights for optimal planting, fertilizing, and harvesting schedules. Advanced flight control systems incorporate AI for autonomous navigation, obstacle avoidance, and dynamic mission planning, reducing the need for constant human supervision. The ongoing development in these technological domains ensures that agricultural drones continue to offer increasingly sophisticated, efficient, and intelligent solutions for modern farming.

Regional Highlights

The global agricultural drone market exhibits distinct growth patterns and adoption rates across various geographical regions, shaped by a combination of economic factors, technological readiness, regulatory environments, and agricultural practices. Understanding these regional dynamics is crucial for stakeholders to identify key growth markets and tailor their strategies accordingly. Each region presents a unique set of drivers and challenges that influence the uptake of agricultural drone technology, reflecting the diverse landscape of global agriculture.

North America and Europe have been at the forefront of agricultural drone adoption, driven by high labor costs, the widespread embrace of precision agriculture, and significant investment in agricultural technology research and development. These regions benefit from supportive government policies that encourage smart farming, well-established infrastructure, and a strong market presence of key technology providers. The emphasis on sustainable farming practices and environmental conservation further propels the demand for precise, drone-based solutions in these mature markets.

The Asia Pacific (APAC) region is rapidly emerging as a dominant force in the agricultural drone market, characterized by its vast agricultural land, large farming populations, and increasing government support for agricultural modernization. Countries like China, India, and Japan are investing heavily in drone technology to enhance food security, improve farm productivity, and address rural labor migration. Latin America and the Middle East & Africa (MEA) represent nascent yet promising markets, driven by the need to optimize water usage in arid regions, manage extensive farmlands, and improve crop yields amidst growing food demand, although regulatory complexities and economic constraints can present adoption hurdles in certain areas.

- North America: Leading market due to high adoption of precision agriculture, significant R&D investment, and favorable government policies. Key countries include the United States and Canada.

- Europe: Strong growth driven by advanced farming practices, environmental regulations pushing for sustainable solutions, and government subsidies for agritech. Germany, France, and the UK are prominent.

- Asia Pacific (APAC): Fastest-growing market due to large agricultural sectors, government initiatives for modernizing farming, and increasing demand for food security. China, India, Japan, and Australia are key contributors.

- Latin America: Emerging market with increasing adoption to optimize large-scale commodity farming and address diverse climatic challenges. Brazil, Argentina, and Mexico show significant potential.

- Middle East and Africa (MEA): Growing interest driven by the need for water management in arid regions and enhancing food production, albeit with varying levels of infrastructure and regulatory support. South Africa and Saudi Arabia are notable markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Drone Market.- DJI

- AeroVironment Inc

- Yamaha Motor Co Ltd

- Trimble Inc

- Parrot Drones SAS

- AGCO Corporation

- John Deere

- PrecisionHawk Inc

- DroneDeploy Inc

- XAG Co Ltd

- Ascent Agriculture

- Sentera Inc

- Hon Hai Precision Industry Co Ltd (Foxconn)

- Teledyne FLIR LLC

- Invenio Imaging Inc

- Quantum Systems GmbH

- Skydio Inc

- 3DR Inc

- Draganfly Inc

- Wingtra AG

Frequently Asked Questions

What are the primary applications of agricultural drones?

Agricultural drones are primarily used for crop monitoring, precision spraying of fertilizers and pesticides, detailed field mapping, irrigation management, and livestock monitoring, enhancing efficiency and productivity in farming operations.

How do agricultural drones improve farm profitability?

Agricultural drones improve profitability by optimizing resource use, reducing labor costs, increasing crop yields through timely interventions, and enabling data-driven decisions that minimize waste and maximize output.

What types of drones are commonly used in agriculture?

Common types include rotary-wing drones (multirotor) for versatility and precise spot treatments, fixed-wing drones for extensive area coverage, and hybrid drones that combine the benefits of both for diverse agricultural tasks.

What is the role of AI in agricultural drone technology?

AI enhances agricultural drones by enabling advanced data analysis for crop health assessment, autonomous flight, predictive analytics for resource management, and real-time anomaly detection, leading to smarter farming practices.

Are there regulatory challenges for using agricultural drones?

Yes, regulatory challenges include varying airspace restrictions, licensing requirements for drone operation, weight limits, and privacy concerns, which can impact widespread adoption and operational flexibility for farmers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager