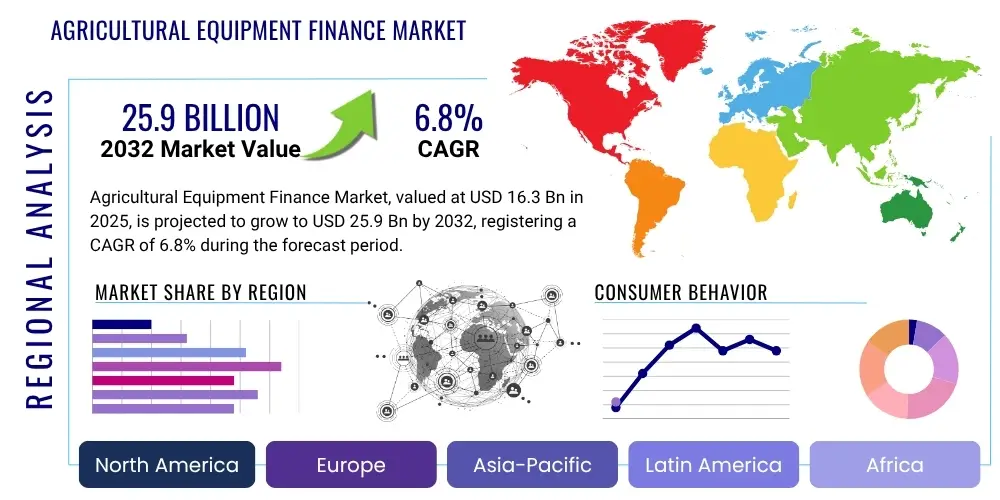

Agricultural Equipment Finance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430189 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Equipment Finance Market Size

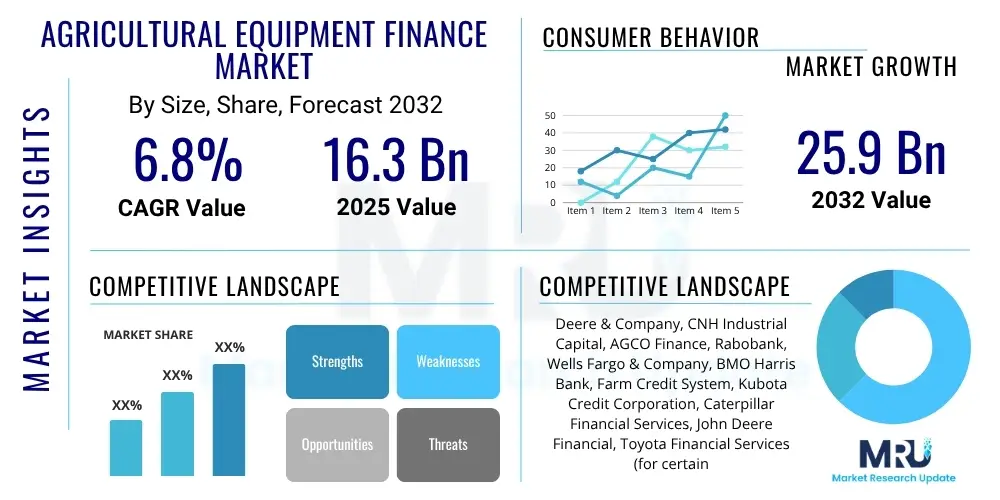

The Agricultural Equipment Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 16.3 billion in 2025 and is projected to reach USD 25.9 billion by the end of the forecast period in 2032.

Agricultural Equipment Finance Market introduction

The Agricultural Equipment Finance market provides crucial financial solutions for farmers and agricultural businesses to acquire essential machinery and technology. This market encompasses a range of financing products designed to support the capital-intensive nature of modern farming, enabling the purchase, lease, or upgrade of equipment such as tractors, harvesters, irrigation systems, and specialized precision agriculture tools. These financial instruments are vital for maintaining productivity, optimizing operational efficiency, and adopting technological advancements across the agricultural sector. The accessibility of tailored financial products ensures that agricultural stakeholders can invest in the necessary infrastructure without significant upfront capital burdens, thereby sustaining growth and competitiveness.

The primary offerings within this market include term loans, equipment leases, and lines of credit, each structured to meet diverse operational and financial requirements of agricultural enterprises. Term loans typically cover the full purchase price of new or used equipment, amortized over several years, while leases offer flexibility and potential tax advantages by allowing farmers to use equipment for a fixed period without ownership. Lines of credit provide revolving access to funds for various seasonal needs or smaller equipment purchases. Major applications span crop farming, livestock management, horticulture, and forestry, impacting every stage from land preparation and planting to harvesting and post-harvest processing. The overarching benefit is the enhancement of agricultural output and sustainability through modernized practices.

Key driving factors for the agricultural equipment finance market include the escalating global demand for food, which necessitates increased mechanization and efficiency in farming. Technological advancements in agricultural machinery, particularly in precision agriculture and automation, create a continuous need for investment in modern equipment. Additionally, government initiatives and subsidies aimed at promoting agricultural development, improving food security, and supporting farmer livelihoods often include provisions that facilitate access to financing for equipment purchases. The desire among farmers to reduce labor costs, improve yield quality, and adopt environmentally sustainable practices further fuels the demand for specialized equipment, making finance solutions indispensable for market expansion.

Agricultural Equipment Finance Market Executive Summary

The Agricultural Equipment Finance Market is experiencing robust growth driven by the ongoing modernization of farming practices, global food demand, and technological advancements in machinery. Business trends indicate a strong move towards digital lending platforms, offering expedited application processes and enhanced user experiences for farmers seeking financing. There is an increasing focus on sustainable farming practices, leading to a greater demand for specialized equipment that supports eco-friendly agriculture, and consequently, a rise in financing options for such technologies. Furthermore, the market is characterized by intense competition among diverse lenders, including traditional banks, captive finance companies, and independent financial institutions, each vying to offer competitive rates and flexible terms tailored to the unique cyclical nature of agricultural income. Strategic partnerships between equipment manufacturers and financial institutions are becoming more common, streamlining the acquisition process for end-users.

Regionally, the market exhibits varied dynamics. North America and Europe represent mature markets with significant adoption of advanced agricultural technologies and established financial infrastructures, driving demand for financing sophisticated, high-value equipment. These regions are also seeing a shift towards precision agriculture equipment, which requires specialized financing solutions. The Asia Pacific region is poised for substantial growth, primarily due to large agricultural populations, increasing mechanization efforts in countries like India and China, and supportive government policies aimed at boosting agricultural productivity. Latin America also presents considerable opportunities, with expanding agricultural land and a growing need for modern machinery to enhance efficiency and meet export demands. The Middle East and Africa, while smaller in market share, are emerging with investments in large-scale farming projects and infrastructure development, gradually increasing the need for equipment finance.

In terms of segments, the market is witnessing significant trends across equipment types, financing products, and end-users. The demand for financing high-horsepower tractors, advanced harvesting machinery, and sophisticated irrigation systems remains consistently high due to their direct impact on farm output and efficiency. Leasing, as a financing type, is gaining traction among farmers due to its flexibility, lower upfront costs, and tax benefits, allowing for easier upgrades to newer technology. Loans for used equipment are also seeing increased popularity, particularly among small and medium-sized farms looking for cost-effective solutions. Large commercial farms continue to be the primary drivers of demand for high-value equipment finance, while smaller farms are increasingly accessing microfinance and specialized government-backed schemes to acquire essential machinery, ensuring broad-based market growth across different farm sizes.

AI Impact Analysis on Agricultural Equipment Finance Market

User inquiries concerning AI's impact on the Agricultural Equipment Finance Market primarily center on how artificial intelligence will transform loan application processes, enhance risk assessment, detect fraud, enable personalized financial product offerings, improve operational efficiency for lenders, and influence farmer decision-making regarding equipment investments. There is significant interest in how AI can streamline paperwork, reduce processing times, and provide more accurate credit evaluations, especially for agricultural businesses with unique financial cycles and risks. Concerns often revolve around data privacy, the potential for algorithmic bias in lending decisions, and the need for robust cybersecurity measures to protect sensitive financial and operational data. Users also express expectations for AI to deliver predictive analytics for equipment maintenance, optimize fleet management, and offer proactive financial advice tailored to individual farm needs and market conditions.

- Enhanced Credit Scoring: AI algorithms analyze diverse data sets, including weather patterns, crop yields, commodity prices, and historical payment behavior, for more accurate and dynamic risk assessment in agricultural lending.

- Automated Loan Processing: AI-powered platforms can automate repetitive tasks such as document verification, data entry, and initial eligibility checks, significantly speeding up the loan application and approval process.

- Personalized Financial Products: AI enables lenders to offer highly customized financing solutions, including flexible repayment schedules and interest rates, based on individual farm profiles, operational cycles, and predicted cash flows.

- Predictive Maintenance for Equipment: Integration of AI with IoT data from agricultural machinery allows for predictive maintenance financing, reducing unexpected breakdowns and offering tailored insurance products based on equipment health.

- Fraud Detection and Prevention: AI systems can identify anomalous patterns and suspicious activities in financial transactions and loan applications, enhancing security and reducing fraudulent claims within the finance ecosystem.

- Optimized Portfolio Management: AI tools provide lenders with insights into their loan portfolios, helping to identify potential risks, optimize capital allocation, and forecast market trends more effectively.

- Improved Customer Experience: Chatbots and AI assistants can offer 24/7 support, answer common questions, and guide applicants through the financing process, improving accessibility and satisfaction for farmers.

- Data-Driven Decision Making: AI provides farmers with advanced analytics on equipment utilization, operational costs, and potential returns on investment, aiding in more informed purchasing and financing decisions.

DRO & Impact Forces Of Agricultural Equipment Finance Market

The Agricultural Equipment Finance Market is profoundly shaped by a confluence of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating global demand for food, which compels farmers to boost productivity through modernization and mechanization. This necessitates significant investment in advanced agricultural machinery, directly fueling the need for financing solutions. Furthermore, rapid technological advancements in equipment, such as precision agriculture technologies, autonomous tractors, and smart irrigation systems, continuously create a demand for new and upgraded machinery, making finance indispensable for adoption. Government support through subsidies, grants, and favorable lending policies also acts as a significant driver, reducing the financial burden on farmers and encouraging equipment acquisition. The increasing focus on sustainable agriculture also drives demand for financing specialized, eco-friendly equipment, aligning with broader environmental goals.

Conversely, several restraints impede market growth. The inherent volatility of agricultural income, influenced by unpredictable weather conditions, fluctuating commodity prices, and disease outbreaks, introduces significant risk for both farmers and lenders, potentially increasing loan defaults or making finance less accessible. High upfront costs associated with modern agricultural machinery, particularly specialized or large-scale equipment, can be prohibitive for many farmers, especially small and medium-sized operations, even with financing options. Moreover, the cyclical nature of agricultural production and economic downturns can lead to cautious lending practices and reduced farmer investment. Stringent regulatory frameworks and complex documentation requirements for securing agricultural loans in some regions also pose barriers, adding to administrative burdens for borrowers and lenders alike.

Opportunities within this market are substantial and evolving. Emerging markets, particularly in Asia Pacific and Latin America, present vast untapped potential for agricultural mechanization and, consequently, equipment finance, as these regions strive to enhance food security and agricultural output. The growing demand for financing used agricultural equipment offers a more affordable entry point for smaller farms and new farmers, expanding the customer base. Digitalization of financial services, including online loan applications, mobile banking, and AI-powered credit assessments, offers a significant opportunity to streamline processes, improve accessibility, and reduce operational costs for lenders. Additionally, the development of innovative financial products tailored to specific agricultural sectors or seasonal cash flow patterns can cater to niche needs and broaden market reach. The increasing adoption of sustainable and smart farming technologies opens new avenues for specialized green finance solutions.

External impact forces significantly influence the market landscape. Economic stability or instability directly affects farmers' purchasing power and lenders' willingness to extend credit. Global economic slowdowns or recessions can restrict capital flow and dampen investment in agricultural assets. Climate change poses a growing threat, leading to extreme weather events that can impact crop yields and agricultural profitability, thereby affecting repayment capacities and increasing perceived risk for lenders. Changes in government agricultural policies, trade agreements, and environmental regulations can alter market dynamics, influencing demand for certain equipment types and the availability of financial support. Fluctuations in interest rates by central banks impact the cost of borrowing for both farmers and financial institutions, directly affecting the attractiveness and affordability of agricultural equipment finance. Geopolitical tensions and supply chain disruptions can also influence equipment availability and pricing, further impacting financing needs.

Segmentation Analysis

The Agricultural Equipment Finance market is broadly segmented across several key dimensions, reflecting the diverse needs of the agricultural sector and the various approaches taken by financial providers. These segments include equipment type, financing type, end-user, and lender type, each offering unique insights into market dynamics and growth opportunities. Understanding these distinct segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and risk assessments effectively. The segmentation provides a granular view of demand patterns, allowing for more targeted financial solutions that cater to the specific operational and economic realities of different farming activities and business models. This structured approach helps in identifying underserved niches and anticipating shifts in farmer preferences and technological adoption across the agricultural landscape.

- By Equipment Type

- Tractors

- Harvesters (Combine Harvesters, Forage Harvesters)

- Irrigation Systems (Center Pivots, Drip Irrigation)

- Planting and Fertilizing Equipment (Planters, Seeders, Spreaders)

- Spraying Equipment (Self-Propelled Sprayers, Trailed Sprayers)

- Tillage Equipment (Ploughs, Harrows, Cultivators)

- Hay and Forage Equipment (Mowers, Balers, Rakes)

- Loaders and Attachments

- Dairy Equipment

- Other Agricultural Equipment (e.g., grain handling, livestock feeding, specialty crop equipment)

- By Financing Type

- Loans (Term Loans, Secured Loans)

- Leases (Operating Leases, Finance Leases)

- Lines of Credit

- Hire Purchase

- By End-User

- Large Farms (Commercial Farms)

- Small and Medium-Sized Farms

- Agricultural Contractors

- Agricultural Cooperatives

- Forestry Operations

- Dairy Farms

- By Lender Type

- Banks (Commercial Banks, Agricultural Banks)

- Captive Finance Companies (Manufacturer-backed finance)

- Independent Finance Companies

- Credit Unions

- Government-backed Lenders

Value Chain Analysis For Agricultural Equipment Finance Market

The value chain for the Agricultural Equipment Finance Market is a complex ecosystem involving various interconnected stages, from equipment manufacturing to end-user acquisition and subsequent financing. The upstream analysis primarily focuses on the production and distribution of agricultural machinery. This involves raw material suppliers providing components to equipment manufacturers, who design, build, and assemble the diverse range of machinery. These manufacturers then rely on a robust network of dealerships and distributors to reach the end-users. The efficiency and cost-effectiveness at this stage directly impact the final price of the equipment, which in turn influences the scale and terms of financing required by farmers. Strong relationships and reliable supply chains between manufacturers and their dealer networks are critical for consistent equipment availability and competitive pricing, forming the foundation of the financing market.

Downstream analysis in the value chain centers on the end-users—farmers, agricultural cooperatives, and other agricultural businesses—who are the ultimate consumers of both the equipment and the financing services. After acquiring equipment, these entities utilize the machinery for various agricultural operations, from cultivation and planting to harvesting and processing. The performance and reliability of the equipment directly impact their productivity and profitability, which are crucial for timely loan repayments and successful lease agreements. The efficiency of equipment usage, coupled with market prices for agricultural produce, determines the financial viability of their operations. The downstream segment also includes services like equipment maintenance and repair, which can be bundled into financing packages or managed separately, further influencing the overall cost of ownership and the financial commitments of the end-user. The success of the financing market is intrinsically linked to the economic health and operational efficiency of these downstream agricultural enterprises.

Distribution channels play a pivotal role in connecting equipment manufacturers with end-users and facilitating financing. The primary channels include authorized dealerships, which often serve as a one-stop shop for equipment sales, maintenance, and finance application assistance. These dealerships frequently have direct or indirect partnerships with financial institutions, offering captive finance solutions or facilitating third-party lending. Online platforms and e-commerce portals are emerging as increasingly important direct and indirect distribution channels, particularly for used equipment or smaller implements, allowing for broader reach and potentially more competitive pricing. Direct financing options involve manufacturers' captive finance divisions offering loans or leases directly to customers, providing a seamless purchasing experience. Indirect financing involves independent banks, credit unions, and specialized agricultural lenders providing funds, often through partnerships with dealerships, enabling a wider array of financial products and competitive rates. Both direct and indirect channels are essential for ensuring comprehensive market coverage and offering diverse choices to agricultural customers.

Agricultural Equipment Finance Market Potential Customers

The primary potential customers for the Agricultural Equipment Finance Market are diverse, encompassing a wide spectrum of agricultural stakeholders who require capital for machinery acquisition. This includes individual farmers, ranging from small-scale family operations to large-scale commercial agricultural enterprises. Small and medium-sized farms often seek financing for essential upgrades to improve efficiency or replace aging equipment, while large commercial farms typically require substantial funding for high-value, technologically advanced machinery to maintain competitive advantage and maximize output. These customers are motivated by the need to increase productivity, reduce labor costs, adopt sustainable farming practices, and comply with evolving agricultural standards. Their financial needs are often seasonal, necessitating flexible repayment terms that align with harvest cycles and commodity price fluctuations, making tailored finance solutions particularly attractive.

Beyond individual farm owners, agricultural contractors represent a significant customer segment. These entities provide specialized machinery and services to multiple farms, requiring a robust fleet of diverse equipment. Financing is critical for them to acquire, maintain, and upgrade their machinery to meet the demands of various clients and services, such as custom harvesting, planting, or spraying. Agricultural cooperatives, which pool resources to benefit their members, also frequently engage in equipment finance to purchase shared machinery or facilitate financing for individual members. These cooperatives leverage their collective bargaining power and stability to secure favorable financing terms. The focus for these customers is on operational efficiency and the ability to offer comprehensive services, which directly depends on access to modern, reliable equipment.

Furthermore, new entrants into the agricultural sector, including young farmers and those transitioning into agriculture, constitute a growing segment of potential customers. These individuals often require significant upfront capital to establish their operations, making equipment finance an essential tool for market entry. Food processing companies that integrate backward into farming operations also represent potential buyers, seeking financing for equipment used in large-scale cultivation and harvesting to ensure a consistent supply of raw materials. Government agricultural initiatives and research institutions may also require financing for specialized equipment used in pilot projects, agricultural research, or demonstration farms. Each of these customer groups presents unique risk profiles and financial requirements, necessitating a broad portfolio of financing products and services from lenders to effectively cater to the diverse needs of the agricultural equipment finance market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 16.3 billion |

| Market Forecast in 2032 | USD 25.9 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial Capital, AGCO Finance, Rabobank, Wells Fargo & Company, BMO Harris Bank, Farm Credit System, Kubota Credit Corporation, Caterpillar Financial Services, John Deere Financial, Toyota Financial Services (for certain equipment), Scotiabank, Bank of America, JP Morgan Chase & Co., DLL Group, Hitachi Capital Corporation, PNC Bank, Santander Bank, CIT Group (part of First Citizens Bank), Mitsubishi HC Capital Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Equipment Finance Market Key Technology Landscape

The Agricultural Equipment Finance market is increasingly leveraging advanced technologies to enhance efficiency, reduce risk, and improve customer experience. One of the most significant technological shifts is the adoption of digital lending platforms. These platforms utilize cloud-based infrastructure and mobile applications to streamline the entire loan application and approval process, from initial inquiry to disbursement. Features like online application forms, digital document submission, and electronic signatures significantly reduce paperwork and processing times, making financing more accessible and faster for farmers, especially those in remote areas. These platforms often integrate with existing financial systems, allowing for seamless data exchange and improved operational workflows for lenders, thus accelerating the market's reach and responsiveness.

Another crucial technological development is the integration of Artificial Intelligence (AI) and Machine Learning (ML) for sophisticated risk assessment and personalized offerings. AI algorithms analyze vast amounts of data, including historical financial records, credit scores, weather patterns, crop yields, commodity price forecasts, and even telematics data from equipment, to provide more accurate and dynamic credit evaluations. This allows lenders to tailor financing products with variable interest rates and flexible repayment schedules that align with the cyclical and often unpredictable nature of agricultural income. Furthermore, AI-powered chatbots and virtual assistants enhance customer service, providing 24/7 support and answering common questions, thereby improving the overall borrower experience and increasing efficiency for finance providers by automating routine inquiries.

The Internet of Things (IoT) and telematics play a transformative role by enabling real-time asset tracking and predictive analytics for agricultural equipment. IoT sensors embedded in machinery collect data on usage, performance, and maintenance needs, which can be invaluable for both farmers and lenders. For farmers, this data helps optimize equipment utilization and anticipate maintenance, reducing downtime. For finance companies, telematics data offers insights into the collateral's condition and operational patterns, enabling more accurate valuation, better risk management, and the potential for usage-based financing models. Blockchain technology is also emerging as a tool to enhance transparency and security in transactions, providing an immutable ledger for contract management and asset ownership records, which can reduce fraud and streamline the legal aspects of equipment finance. These technological advancements collectively contribute to a more dynamic, efficient, and secure agricultural equipment finance ecosystem.

Regional Highlights

- North America: This region represents a mature and technologically advanced agricultural equipment finance market. The United States and Canada are characterized by large-scale commercial farming operations that extensively utilize high-value, sophisticated machinery, including precision agriculture technologies. Demand for financing is driven by the continuous need for equipment upgrades, favorable government policies, and the presence of major equipment manufacturers and well-established financial institutions. The market here is robust, with a strong emphasis on digital lending solutions and tailored financial products.

- Europe: The European agricultural equipment finance market is driven by a strong focus on sustainable farming practices, stringent environmental regulations, and the adoption of advanced, energy-efficient machinery. Countries like Germany, France, and the UK are key players, with a blend of small to large-scale farms. The market benefits from strong banking sectors and a growing preference for leasing options due to favorable tax treatments and the desire for technological flexibility. Support for green agriculture also encourages financing for specialized sustainable equipment.

- Asia Pacific (APAC): The APAC region is projected to be one of the fastest-growing markets for agricultural equipment finance. This growth is primarily fueled by increasing mechanization in developing economies such as India, China, and Southeast Asian nations. Rising populations, urbanization, and the need for enhanced food security are compelling farmers to adopt modern farming techniques and machinery. Government initiatives promoting agricultural productivity and farmer subsidies significantly boost the demand for financing, often for smaller, more affordable equipment, but also increasingly for mid-range and high-tech solutions.

- Latin America: Latin America showcases significant potential for market expansion, particularly in agricultural powerhouses like Brazil and Argentina. The region's vast agricultural lands, growing export demands for commodities, and efforts to modernize farming infrastructure drive the need for equipment finance. Government support for agricultural development and the increasing adoption of large-scale farming practices contribute to a steady demand for heavy machinery and corresponding financing options. Local and international financial institutions are expanding their presence to cater to this growing demand.

- Middle East and Africa (MEA): While currently a smaller share of the global market, the MEA region is emerging with considerable growth opportunities, particularly as countries focus on improving food security and developing their agricultural sectors. Investments in large-scale agricultural projects, along with initiatives to introduce modern farming techniques, are increasing the demand for equipment and, consequently, financing. Challenges such as limited access to credit and political instability exist, but there is a growing recognition of the need for robust agricultural infrastructure, supported by international development funds and local government backing for equipment acquisition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Equipment Finance Market.- Deere & Company

- CNH Industrial Capital

- AGCO Finance

- Rabobank

- Wells Fargo & Company

- BMO Harris Bank

- Farm Credit System

- Kubota Credit Corporation

- Caterpillar Financial Services

- John Deere Financial

- Toyota Financial Services

- Scotiabank

- Bank of America

- JP Morgan Chase & Co.

- DLL Group

- Hitachi Capital Corporation

- PNC Bank

- Santander Bank

- CIT Group (part of First Citizens Bank)

- Mitsubishi HC Capital Inc.

Frequently Asked Questions

What is agricultural equipment finance?

Agricultural equipment finance refers to specialized financial products and services, such as loans, leases, and lines of credit, provided to farmers and agricultural businesses to acquire machinery and technology essential for farming operations.

How does financing impact farm productivity?

Financing significantly boosts farm productivity by enabling farmers to invest in modern, efficient equipment. This leads to increased operational speed, reduced labor costs, improved crop yields, and the adoption of advanced farming techniques, ultimately enhancing output and profitability.

What are the common types of agricultural equipment financing?

The most common types include term loans for equipment purchases, operating leases and finance leases for flexible usage without ownership, and lines of credit for revolving capital needs or smaller equipment acquisitions.

How do interest rates affect equipment finance decisions?

Interest rates directly impact the total cost of borrowing for agricultural equipment. Lower interest rates make financing more affordable and stimulate investment in new machinery, while higher rates can deter purchases and increase financial burden on farmers.

What role does technology play in modern agricultural finance?

Technology, including digital lending platforms, AI-powered risk assessment, IoT for asset tracking, and blockchain for secure transactions, streamlines processes, enhances accuracy, reduces fraud, and enables personalized financial solutions, making finance more efficient and accessible for farmers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager