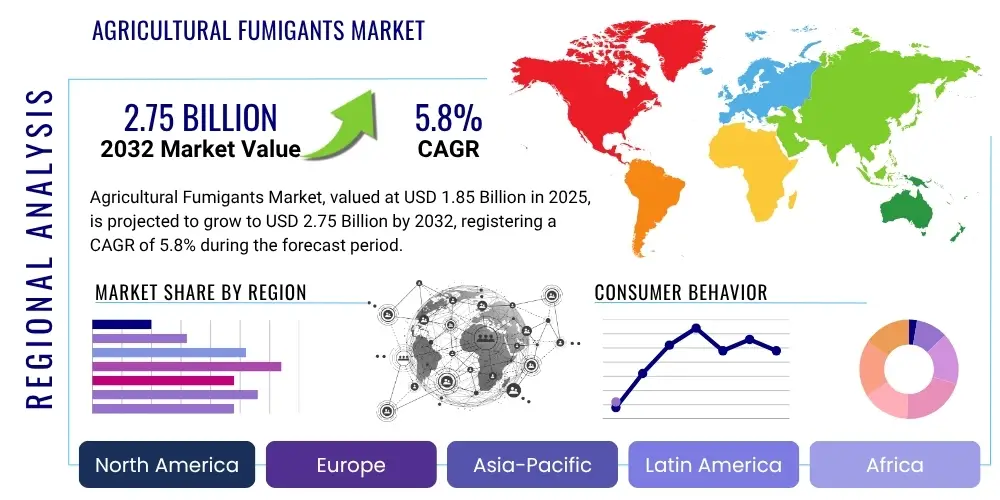

Agricultural Fumigants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429232 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Fumigants Market Size

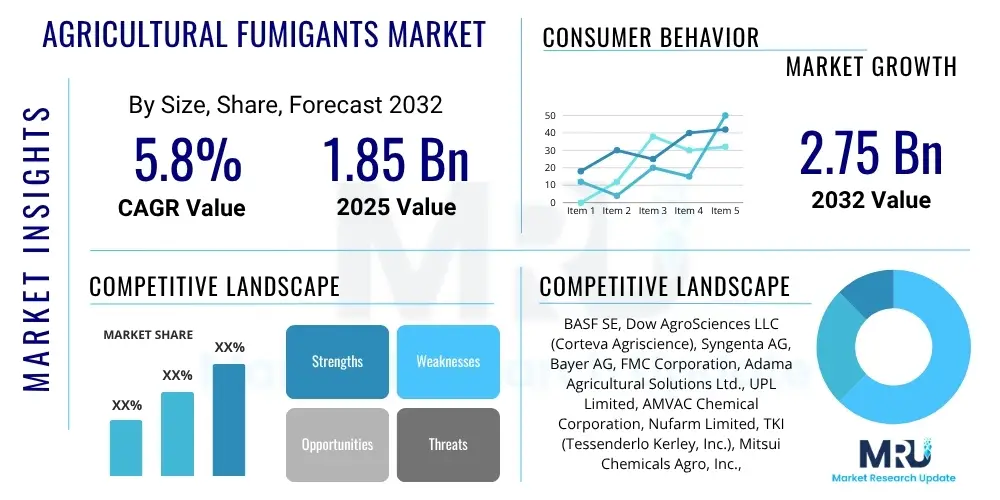

The Agricultural Fumigants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2032. This growth trajectory is underpinned by increasing global food demand, which necessitates enhanced crop protection measures to maximize yields and minimize post-harvest losses. The persistent threat from soil-borne pathogens, nematodes, weeds, and insect pests drives the continuous adoption of fumigants across diverse agricultural landscapes, ensuring sustained market expansion.

The market's expansion is further influenced by evolving agricultural practices that prioritize high-value crops and efficient land utilization. As agricultural intensity rises, the imperative to maintain soil health and eradicate harmful organisms becomes critical, thereby sustaining the demand for effective fumigation solutions. Moreover, technological advancements in fumigant formulations, application techniques, and monitoring systems are contributing to safer and more targeted usage, fostering market acceptance despite stringent environmental regulations. The global shift towards controlled-environment agriculture, such as greenhouses, also presents significant opportunities for specialized fumigant applications.

Agricultural Fumigants Market introduction

The Agricultural Fumigants Market encompasses the global production, distribution, and utilization of chemical compounds designed to control a broad spectrum of pests in soil, stored commodities, and enclosed spaces. These potent agents, typically applied as gases or substances that readily vaporize, penetrate porous materials and soil profiles to eliminate nematodes, fungi, insects, weeds, and other harmful organisms. The primary objective is to enhance crop productivity, safeguard stored produce from spoilage, and maintain the phytosanitary integrity of agricultural products during transit and storage, thereby playing a critical role in global food security.

Major applications of agricultural fumigants include pre-plant soil treatment for high-value crops like fruits, vegetables, and ornamentals, where they sterilize the soil to create a favorable environment for seedling growth and reduce disease pressure. They are also extensively used for space fumigation in warehouses, silos, and shipping containers to protect grains, oilseeds, dried fruits, and other stored commodities from insect infestations and microbial contamination. The benefits derived from their use are significant, ranging from substantial yield increases and improved crop quality to extended shelf life of perishable goods and compliance with international phytosanitary standards, which are crucial for facilitating global trade.

The market is primarily driven by the escalating global population and the corresponding increase in food demand, which puts immense pressure on agricultural systems to produce more efficiently. The rising incidence of pest resistance to conventional pesticides and the spread of invasive species also compel growers to adopt potent solutions like fumigants. Furthermore, advancements in precision agriculture, coupled with increasing awareness among farmers about the economic benefits of effective pest control, are key factors propelling market growth. Regulatory frameworks, while often restrictive, also push for the development of safer and more targeted fumigant products, encouraging innovation.

Agricultural Fumigants Market Executive Summary

The Agricultural Fumigants Market is experiencing dynamic shifts driven by a confluence of evolving business trends, distinct regional market dynamics, and specialized segment-specific demands. Business trends highlight a growing emphasis on product innovation, with manufacturers investing in the development of safer, more environmentally friendly, and target-specific fumigant formulations to navigate stricter regulatory landscapes. Strategic partnerships, mergers, and acquisitions are also prevalent, aimed at expanding geographic reach, diversifying product portfolios, and consolidating market share. Additionally, there is a rising adoption of integrated pest management (IPM) strategies that incorporate fumigants as a critical component, alongside biological and cultural controls, to ensure sustainable agricultural practices.

From a regional perspective, Asia Pacific continues to be the largest and fastest-growing market due to its vast agricultural lands, high population density necessitating intensive farming, and increasing adoption of modern farming techniques. North America and Europe, while mature, are characterized by stringent regulations that spur demand for advanced, low-residue fumigants and a focus on high-value crop production. Latin America and the Middle East & Africa regions are also witnessing significant growth, driven by expanding agricultural exports and the need to protect crops from diverse pest pressures in varying climatic conditions. Each region presents unique challenges and opportunities based on local crop patterns, pest prevalence, and regulatory environments, influencing market strategies.

Segmentation trends reveal that specific fumigant types, such as phosphine and sulfuryl fluoride, are gaining traction due to their efficacy and broader regulatory acceptance compared to older compounds like methyl bromide, which faces phase-out restrictions. Applications in soil fumigation for high-value crops and space fumigation for stored commodities remain dominant, reflecting their critical role in preventing significant economic losses. The demand for fumigants in greenhouse and nursery operations is also steadily increasing, driven by the expansion of protected cultivation. These trends collectively shape a market characterized by continuous adaptation to environmental concerns, technological progress, and the fundamental need for effective pest management in agriculture.

AI Impact Analysis on Agricultural Fumigants Market

Common user questions regarding AI's impact on the agricultural fumigants market often revolve around its potential to enhance precision, efficiency, and safety, while also considering its role in reducing overall chemical reliance. Users are keen to understand how AI-driven analytics can optimize fumigant application timing and dosage, forecast pest outbreaks more accurately, and monitor environmental conditions to minimize off-target effects. There is also interest in AI's capacity to streamline supply chains and automate data collection for regulatory compliance, alongside concerns about the initial investment costs and the need for specialized skills to implement AI technologies effectively in agricultural settings. The overarching expectation is that AI will transform fumigation into a more sustainable, data-driven, and less labor-intensive practice.

The integration of Artificial intelligence (AI) and machine learning (ML) within the agricultural fumigants market is poised to bring about transformative changes, moving the industry towards greater precision, efficiency, and sustainability. AI algorithms can analyze vast datasets, including weather patterns, soil conditions, pest population dynamics, and historical efficacy rates, to predict pest outbreaks with higher accuracy. This predictive capability enables farmers to apply fumigants proactively and precisely where and when they are most needed, significantly reducing overall chemical usage and associated environmental impact. Such data-driven decisions optimize resource allocation, leading to cost savings for growers and enhanced environmental stewardship for the industry.

Moreover, AI can revolutionize the application process itself. Drones equipped with AI-powered vision systems can conduct real-time mapping of fields, identifying specific areas of pest infestation or disease pressure, and guiding automated fumigant applicators for targeted treatment. This level of precision minimizes overspray and ensures that the active ingredients are delivered directly to the problem areas, maximizing efficacy while reducing chemical drift. In post-harvest applications, AI can monitor storage conditions in silos and warehouses, detecting early signs of infestation or spoilage, and recommending immediate, localized fumigation protocols, thereby preserving commodity quality and reducing post-harvest losses more effectively than traditional methods.

- AI-driven predictive analytics for precise pest outbreak forecasting.

- Optimization of fumigant dosage and application timing through data analysis.

- Automation of fumigant application via AI-equipped drones and robotics.

- Real-time environmental monitoring to minimize off-target chemical effects.

- Enhanced supply chain management and inventory optimization for fumigant products.

- Streamlined data collection and reporting for improved regulatory compliance.

- Development of AI-powered decision support systems for growers.

- Integration with sensor networks for continuous monitoring of soil and commodity health.

DRO & Impact Forces Of Agricultural Fumigants Market

The Agricultural Fumigants Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaped by various impact forces. Key drivers include the ever-increasing global food demand, which necessitates maximum yield protection from pests and diseases across all stages of crop growth and storage. The growing incidence of pest resistance to conventional pesticides further elevates the reliance on potent fumigants. Moreover, the expansion of high-value crop cultivation, requiring intensive pest management, and the increasing need to meet stringent international phytosanitary standards for agricultural exports significantly boost market demand. These factors collectively create a strong pull for fumigant solutions to ensure food security and economic stability in the agricultural sector.

However, the market also faces considerable restraints, primarily stemming from strict environmental regulations and health concerns associated with the use of highly toxic fumigant chemicals. Regulatory bodies worldwide are progressively limiting the use of certain fumigants, such as methyl bromide, due to their ozone-depleting potential and toxicity, pushing manufacturers towards developing safer alternatives. Public perception and consumer demand for "residue-free" produce also add pressure, impacting product acceptance. Furthermore, the high cost of certain fumigants, coupled with the need for specialized application equipment and trained personnel, can deter adoption, particularly among small and medium-scale farmers, creating a barrier to market penetration.

Despite these challenges, significant opportunities exist within the market. The development and commercialization of new, less toxic, and more environmentally benign fumigant formulations, along with advanced application technologies that enhance precision and reduce off-target exposure, present lucrative growth avenues. The rising adoption of controlled environment agriculture (CEA), such as hydroponics and greenhouses, offers a niche market for specialized fumigation solutions. Moreover, the integration of fumigants into broader Integrated Pest Management (IPM) strategies, combining chemical, biological, and cultural controls, positions them as a sustainable tool for pest management. Investment in research and development to address regulatory concerns and enhance product safety will be crucial for capitalizing on these opportunities.

Segmentation Analysis

The Agricultural Fumigants Market is comprehensively segmented based on various critical parameters, including type, application, crop type, form, and end-use, providing a granular understanding of market dynamics and consumer preferences. This detailed segmentation allows stakeholders to analyze specific market niches, identify growth areas, and tailor product development and marketing strategies to cater to diverse agricultural needs globally. Each segment reflects unique demand patterns influenced by regional agricultural practices, regulatory landscapes, and the prevalent pest challenges faced by growers and storage operators. Understanding these segments is vital for effective market penetration and competitive positioning.

The type segmentation highlights the shift from older, environmentally controversial chemicals to newer, more accepted alternatives. Application segmentation differentiates between soil, space, and commodity treatments, each addressing distinct pest control requirements across different stages of agricultural production and post-harvest management. Crop type segmentation underscores the varying pest vulnerabilities and economic significance of different crops, influencing fumigant choice. Furthermore, form and end-use segmentations clarify how fumigants are supplied and by whom they are ultimately consumed, from large-scale commercial farms to warehousing and logistics operations. These distinct segments underscore the versatility and specialized nature of fumigant products in modern agriculture.

- By Type

- Methyl Bromide

- Chloropicrin

- Phosphine

- Dazomet

- Metam Sodium

- Sulfuryl Fluoride

- Others (e.g., Telone, 1,3-Dichloropropene)

- By Application

- Soil Fumigation

- Space Fumigation (e.g., warehouses, silos, mills)

- Commodity Fumigation (e.g., grains, fruits, vegetables, nuts, timber)

- By Crop Type

- Grains & Cereals (e.g., wheat, rice, corn)

- Fruits & Vegetables (e.g., strawberries, tomatoes, peppers)

- Oilseeds & Pulses (e.g., soybeans, peanuts)

- Ornamentals & Turf

- Others (e.g., tobacco, coffee)

- By Form

- Liquid

- Solid

- Gaseous

- By End-use

- Agriculture (on-field)

- Warehouses & Storage Facilities

- Greenhouses & Nurseries

- Wood & Timber Preservation

- Shipping & Logistics

- Pest Control Services

Value Chain Analysis For Agricultural Fumigants Market

The value chain for the Agricultural Fumigants Market begins with upstream activities, primarily involving the sourcing and synthesis of active chemical ingredients. This stage is dominated by large chemical manufacturers and specialized producers who ensure the quality, purity, and availability of raw materials essential for fumigant production. These raw materials often include basic petrochemicals, phosphorus compounds, and halogenated hydrocarbons, which undergo complex chemical processes to yield the final fumigant compounds. Research and development efforts at this stage are critical for discovering new molecules, optimizing synthesis routes, and ensuring compliance with evolving environmental and safety standards, directly influencing product innovation and cost structures.

Midstream activities encompass the formulation, packaging, and distribution of the finished fumigant products. Manufacturers convert the active ingredients into various forms (liquid, solid, gaseous) and package them for safe handling, storage, and application. This stage also involves regulatory approvals, quality control, and branding. Distribution channels are diverse, ranging from direct sales to large agricultural cooperatives and commercial fumigation service providers, to indirect sales through a network of distributors, wholesalers, and agricultural retailers. The effectiveness of the distribution network is paramount for ensuring timely product availability, particularly in remote agricultural regions, and for providing technical support and guidance on proper product usage.

Downstream activities involve the ultimate application and consumption of agricultural fumigants by end-users. These end-users include individual farmers, large-scale agribusinesses, grain storage facilities, pest control operators, and companies involved in international trade requiring phytosanitary treatments. The efficiency and safety of fumigant application are crucial, often necessitating specialized equipment and highly trained personnel. Post-application monitoring for efficacy and residue levels, along with waste management, are also integral to this stage. The entire value chain is characterized by a strong emphasis on regulatory compliance, product stewardship, and sustainability, as the industry navigates the delicate balance between effective pest control and environmental protection, influencing pricing, market access, and competitive strategies.

Agricultural Fumigants Market Potential Customers

The potential customers for the Agricultural Fumigants Market represent a diverse array of entities across the agricultural and related sectors, all united by the common need to protect crops, commodities, and infrastructure from pest infestations. These end-users are primarily focused on maximizing yield, preserving quality, preventing economic losses, and complying with stringent health and safety standards. Their purchasing decisions are often influenced by the specific pest challenge they face, the crop or commodity being protected, the scale of their operations, and their adherence to local and international regulations regarding pesticide use and food safety. Identifying these customer segments precisely allows for targeted product development and marketing efforts.

Key segments of potential customers include individual farmers and large-scale agricultural enterprises engaged in the cultivation of high-value crops such as strawberries, tomatoes, peppers, and ornamental plants, where soil-borne pathogens and nematodes can cause significant economic damage. These growers rely on fumigants for pre-plant soil sterilization to ensure healthy crop establishment and optimal yields. Another substantial customer base comprises operators of grain storage facilities, silos, warehouses, and milling operations who require space and commodity fumigation to protect vast quantities of stored grains, oilseeds, and other processed agricultural products from insect infestation and mold growth, thereby maintaining product quality and preventing spoilage during prolonged storage.

Furthermore, commercial pest control service providers constitute a significant customer group, as they offer specialized fumigation services to a wide range of clients, including food processing plants, shipping companies, and horticultural businesses. Exporters and importers of agricultural commodities, especially those dealing with perishable goods like fruits, vegetables, and timber, are also critical customers, as they must comply with strict phytosanitary requirements to prevent the spread of pests across international borders. These requirements often mandate specific fumigation treatments before shipment. The wood and timber industry also utilizes fumigants to prevent infestations in logs, lumber, and manufactured wood products, demonstrating the broad application spectrum of these critical agricultural inputs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow AgroSciences LLC (Corteva Agriscience), Syngenta AG, Bayer AG, FMC Corporation, Adama Agricultural Solutions Ltd., UPL Limited, AMVAC Chemical Corporation, Nufarm Limited, TKI (Tessenderlo Kerley, Inc.), Mitsui Chemicals Agro, Inc., Arkema S.A., Lonza Group AG, Eastman Chemical Company, Solvay S.A., Redox Pty Ltd., Detia Degesch GmbH, Marrone Bio Innovations (Bioceres Crop Solutions Corp.), Isagro S.p.A., JL Specialty Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Fumigants Market Key Technology Landscape

The technological landscape of the Agricultural Fumigants Market is characterized by continuous innovation aimed at enhancing efficacy, improving safety, and minimizing environmental impact. A significant trend involves the development of advanced formulations that offer lower volatility, reduced environmental persistence, and more targeted action. This includes microencapsulation techniques and slow-release formulations that ensure a prolonged and controlled release of the active ingredient, thereby optimizing pest control while reducing the total amount of fumigant required. Such innovations are crucial for navigating stringent regulatory frameworks and addressing public concerns regarding chemical residues.

Furthermore, precision application technologies are revolutionizing how fumigants are deployed. This encompasses the use of GPS-guided equipment for highly localized soil fumigation, ensuring that chemicals are applied only where needed, reducing wastage and off-target drift. Drones equipped with remote sensing capabilities are emerging as a key technology for surveying fields and delivering targeted spot treatments. In enclosed environments, automated monitoring systems, including gas sensors and environmental controls, ensure optimal fumigant concentrations are maintained for effective pest eradication while minimizing human exposure. These technologies collectively contribute to a more efficient, safer, and environmentally responsible approach to fumigation.

Beyond application, advancements in post-application monitoring and residue detection technologies are also integral. Rapid analytical methods, including handheld devices and advanced laboratory techniques, allow for quick and accurate assessment of fumigant concentrations and residue levels in treated commodities and soil. This ensures compliance with maximum residue limits (MRLs) and certifies product safety for consumption and trade. The integration of data analytics and cloud-based platforms also plays a role, enabling growers and service providers to track application data, monitor efficacy, and optimize future treatments, thereby fostering a data-driven approach to fumigation management and contributing to overall agricultural sustainability.

Regional Highlights

The global Agricultural Fumigants Market exhibits distinct regional characteristics, driven by varying agricultural practices, pest pressures, regulatory environments, and economic factors. Asia Pacific currently dominates the market and is projected to experience the fastest growth, primarily due to its vast arable land, a large and growing population requiring increased food production, and the significant cultivation of high-value crops like fruits and vegetables. Countries such as China, India, and Southeast Asian nations are investing heavily in modern agricultural techniques to boost yields, leading to a robust demand for effective pest control solutions, including fumigants, to combat diverse pest and disease challenges prevalent in tropical and subtropical climates.

North America and Europe represent mature markets characterized by stringent regulatory landscapes that compel the adoption of advanced, environmentally friendly fumigant formulations and precision application technologies. In North America, the extensive cultivation of horticultural crops, coupled with sophisticated post-harvest storage infrastructure, sustains the demand for fumigants to protect both field crops and stored commodities. Europe, despite stricter controls on certain fumigants, continues to utilize these products, particularly in greenhouse cultivation and for protecting high-value agricultural exports, focusing on solutions that comply with strict MRLs and environmental protection standards. The emphasis in these regions is increasingly on integrated pest management approaches where fumigants play a targeted, complementary role.

Latin America and the Middle East & Africa (MEA) regions are witnessing considerable growth, driven by expanding agricultural frontiers, increasing exports of cash crops, and the need to address specific regional pest outbreaks. Countries like Brazil, Argentina, and Mexico in Latin America, and South Africa and Egypt in MEA, are significant agricultural producers where fumigants are essential for managing soil-borne diseases and protecting export-oriented produce. The adoption of modern farming practices and the expansion of irrigated agriculture in these regions contribute significantly to the rising demand. However, market growth in these areas can sometimes be constrained by economic factors, infrastructure limitations, and varying levels of regulatory enforcement.

- Asia Pacific: Largest market, highest growth rate, driven by population growth, intensive agriculture, high-value crop expansion in China, India, and Southeast Asian countries.

- North America: Mature market, strong demand for soil and post-harvest fumigation for high-value crops, focus on precision application and advanced formulations due to regulations in the US and Canada.

- Europe: Characterized by stringent regulations, demand for environmentally safer fumigants, significant use in greenhouse cultivation and for export-oriented commodities in countries like Spain, Italy, and the Netherlands.

- Latin America: Emerging market, growing agricultural exports, increasing adoption of modern farming practices in Brazil, Argentina, and Mexico driving demand for effective pest control.

- Middle East & Africa: Growing agricultural sector, increasing food security concerns, demand for fumigants in protecting field crops and stored grains in countries like South Africa and Egypt.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Fumigants Market.- BASF SE

- Dow AgroSciences LLC (Corteva Agriscience)

- Syngenta AG

- Bayer AG

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- UPL Limited

- AMVAC Chemical Corporation

- Nufarm Limited

- TKI (Tessenderlo Kerley, Inc.)

- Mitsui Chemicals Agro, Inc.

- Arkema S.A.

- Lonza Group AG

- Eastman Chemical Company

- Solvay S.A.

- Redox Pty Ltd.

- Detia Degesch GmbH

- Marrone Bio Innovations (Bioceres Crop Solutions Corp.)

- Isagro S.p.A.

- JL Specialty Chemical

Frequently Asked Questions

Analyze common user questions about the Agricultural Fumigants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are agricultural fumigants primarily used for?

Agricultural fumigants are primarily used to control a wide range of pests, including nematodes, fungi, insects, and weeds, in soil, stored commodities, and enclosed agricultural spaces to protect crop yields and post-harvest quality.

Which factors are driving the growth of the agricultural fumigants market?

Key drivers include rising global food demand, increasing pest resistance to conventional pesticides, expansion of high-value crop cultivation, and stringent phytosanitary standards for agricultural exports.

What are the main challenges faced by the agricultural fumigants market?

The market faces challenges from strict environmental regulations, health concerns associated with chemical use, high product costs, and the need for specialized application equipment and trained personnel.

How is AI impacting the agricultural fumigants industry?

AI is enhancing the industry by enabling precise pest outbreak forecasting, optimizing fumigant dosage and application timing, facilitating automated delivery via drones, and improving real-time environmental monitoring for safer use.

Which regions are key players in the agricultural fumigants market?

Asia Pacific is the largest and fastest-growing market, with significant contributions from North America, Europe, Latin America, and the Middle East & Africa due to diverse agricultural needs and practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager