Agricultural Secondary Nutrients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428317 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Agricultural Secondary Nutrients Market Size

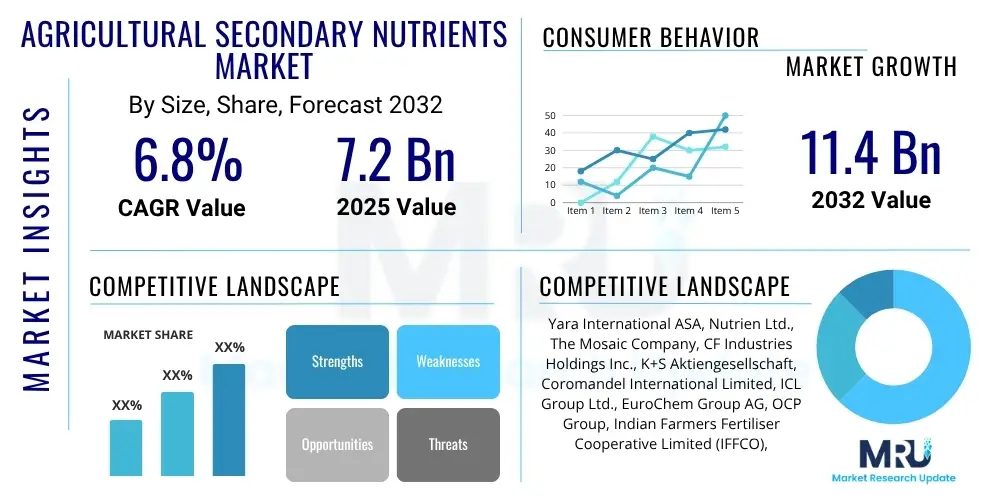

The Agricultural Secondary Nutrients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 7.2 Billion in 2025 and is projected to reach USD 11.4 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by the increasing global demand for food, declining soil fertility in many agricultural regions, and a heightened awareness among farmers regarding the critical role of these essential elements in optimizing crop yield and quality. The imperative to maximize agricultural output from limited arable land necessitates the efficient utilization of all necessary plant nutrients, positioning secondary nutrients as vital components in modern farming practices.

Agricultural Secondary Nutrients Market introduction

The Agricultural Secondary Nutrients Market encompasses the production, distribution, and application of vital plant nutrients such as Calcium (Ca), Magnesium (Mg), and Sulfur (S), which are required by crops in relatively large quantities compared to micronutrients, though less than primary nutrients like Nitrogen, Phosphorus, and Potassium. These nutrients play indispensable roles in plant physiological processes. Calcium is crucial for cell wall structure, cell division, and enzyme activity, directly impacting fruit quality, disease resistance, and overall plant vigor. Magnesium is the central atom in the chlorophyll molecule, essential for photosynthesis, and also activates numerous enzymes involved in energy transfer and protein synthesis. Sulfur is a fundamental component of amino acids, proteins, and vitamins, vital for enzyme activation, chlorophyll formation, and the development of flavors and odors in many crops, particularly cruciferous vegetables.

Products within this market are available in various forms, including sulfates (e.g., calcium sulfate or gypsum, magnesium sulfate, ammonium sulfate), oxides, nitrates, and chelated forms, each offering distinct advantages in terms of solubility, application method, and nutrient availability to plants. Major applications span a wide spectrum of agricultural segments, including field crops such such as corn, wheat, rice, and soybeans, horticultural crops including fruits, vegetables, and flowers, as well as oilseeds, pulses, and plantation crops. The benefits derived from the judicious application of secondary nutrients are manifold, extending beyond mere yield enhancement to encompass improved crop quality, better nutritional content, increased shelf life of produce, and enhanced plant resilience against environmental stresses and diseases. These factors collectively underscore their importance in achieving sustainable and productive agriculture.

Driving factors propelling the expansion of this market include the global surge in population, which necessitates greater food production from dwindling land resources. Intensive farming practices, while boosting immediate yields, often deplete soil reserves of secondary nutrients, creating a continuous demand for their replenishment. Furthermore, the increasing adoption of high-yielding crop varieties and genetically modified organisms, which often have higher nutrient demands, exacerbates this need. Growing awareness among the agricultural community regarding the specific functions and deficiency symptoms of calcium, magnesium, and sulfur, coupled with advancements in soil testing and plant diagnostic tools, empowers farmers to make informed decisions about nutrient management. Regulatory support for balanced fertilization and sustainable agricultural practices in various regions also contributes significantly to market growth.

Agricultural Secondary Secondary Nutrients Market Executive Summary

The Agricultural Secondary Nutrients Market is experiencing robust expansion, propelled by converging global trends in agriculture and environmental stewardship. Business trends indicate a strong shift towards product innovation, with manufacturers focusing on developing more efficient and environmentally friendly formulations, such as slow-release and coated fertilizers, bio-fortified products, and chelated nutrient solutions that enhance uptake efficiency and minimize leaching. Furthermore, strategic collaborations and acquisitions are becoming prevalent, as companies seek to expand their product portfolios, strengthen their distribution networks, and leverage technological advancements. The emphasis on sustainable agriculture and precision farming practices is also reshaping market dynamics, driving demand for tailored nutrient solutions that reduce waste and optimize resource utilization. This has fostered an environment where integrated nutrient management is gaining significant traction, moving beyond the traditional NPK focus to include secondary and micronutrients as integral components for holistic plant health.

Regional trends highlight dynamic growth across different geographies. Asia-Pacific stands out as the largest and fastest-growing market, primarily due to its vast agricultural land, rapidly increasing population, and government initiatives promoting agricultural productivity and modernization in countries like China, India, and Southeast Asian nations. The growing awareness among farmers about nutrient deficiencies and the shift from subsistence farming to commercial agriculture are key accelerators in this region. North America and Europe, while mature markets, exhibit stable growth driven by the adoption of advanced agricultural technologies, precision farming techniques, and stringent environmental regulations that necessitate efficient nutrient management. Latin America and the Middle East & Africa are emerging as significant markets, characterized by expanding agricultural frontiers, increasing investment in modern farming, and efforts to enhance food security, creating considerable opportunities for market participants.

Segmentation trends reveal significant insights into market demand. By nutrient type, sulfur is experiencing particularly high demand, driven by its critical role in oilseed crops and its widespread deficiency in many soils globally. Calcium and magnesium also demonstrate steady growth, particularly in regions with acidic soils or where specific crops with high demands for these elements are cultivated. The liquid and granular forms of secondary nutrients continue to dominate due to ease of application and effective soil distribution, although water-soluble powders and foliar sprays are gaining popularity for targeted applications and rapid nutrient uptake. Crop-type segmentation indicates strong demand from staple crops such as grains and cereals, alongside expanding requirements from the high-value fruits and vegetables sector, where quality and appearance are paramount. The overarching trend points towards customized, crop-specific, and application-specific nutrient solutions, moving away from a one-size-fits-all approach to maximize agricultural efficiency and environmental sustainability.

AI Impact Analysis on Agricultural Secondary Nutrients Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the Agricultural Secondary Nutrients Market by transforming how nutrient deficiencies are detected, how applications are managed, and how supply chains operate. Common user questions revolve around AI's ability to provide hyper-localized and precise nutrient recommendations, predict soil health changes, and automate application processes to enhance efficiency and reduce environmental impact. Farmers and agribusinesses are keen to understand how AI-powered analytics can help them make data-driven decisions regarding the timing, dosage, and specific type of secondary nutrients required, moving beyond traditional soil testing to real-time, predictive insights. There is also significant interest in AI's potential to optimize the entire value chain, from raw material sourcing and manufacturing to distribution, ensuring nutrient availability and minimizing waste.

Users frequently inquire about the feasibility and cost-effectiveness of deploying AI-driven systems, such as drone-based sensing for nutrient stress detection or AI algorithms that integrate weather data, crop growth models, and historical yields to generate dynamic fertilization schedules. Concerns also include the accuracy and reliability of AI predictions in diverse agricultural environments, the security of sensitive farm data, and the need for user-friendly interfaces that enable widespread adoption by farmers of varying technological literacy. The expectation is that AI will not only improve the efficacy of secondary nutrient application but also contribute significantly to sustainable farming practices by preventing over-application, reducing nutrient runoff, and ultimately enhancing the economic viability of agricultural operations. This shift represents a move towards 'smart' nutrient management, where every input is optimized for maximum benefit.

- Precision Nutrient Management: AI algorithms analyze vast datasets including soil maps, satellite imagery, weather patterns, and historical yield data to provide highly precise, zone-specific recommendations for secondary nutrient application, reducing waste and increasing efficacy.

- Predictive Analytics for Soil Health: AI models forecast nutrient deficiencies and excesses based on soil type, crop rotation, and environmental factors, enabling proactive management rather than reactive treatments.

- Automated Application Systems: Integration of AI with drones, autonomous tractors, and smart irrigation systems facilitates automated, variable-rate application of secondary nutrients, optimizing distribution and labor costs.

- Supply Chain Optimization: AI enhances logistics, inventory management, and demand forecasting for secondary nutrient manufacturers and distributors, ensuring timely delivery and reducing stockouts or overstocking.

- Disease and Stress Detection: AI-powered image recognition and sensing technologies can identify early signs of nutrient stress in crops, allowing for timely and targeted interventions with specific secondary nutrient formulations.

- Enhanced Crop Monitoring: AI-driven analytics of crop performance data provides insights into nutrient uptake efficiency, helping farmers adjust their fertilization strategies in real-time.

- Decision Support Systems: AI platforms aggregate complex agricultural data to offer actionable insights to farmers, simplifying decision-making regarding nutrient input, timing, and product selection.

DRO & Impact Forces Of Agricultural Secondary Nutrients Market

The Agricultural Secondary Nutrients Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, alongside significant Impact Forces that collectively shape its trajectory. The primary drivers include the burgeoning global population, which exerts immense pressure on agricultural systems to produce more food from finite resources, inherently increasing the demand for all essential plant nutrients, including calcium, magnesium, and sulfur. Concurrent with this, widespread soil nutrient depletion, often a consequence of intensive farming practices and erosion, necessitates consistent replenishment of secondary nutrients to maintain productivity. The growing adoption of high-yielding crop varieties and genetically modified crops, which typically have higher nutrient requirements, further amplifies this demand. Moreover, the increasing awareness among farmers about the specific physiological roles of secondary nutrients in enhancing crop quality, improving disease resistance, and boosting yields is a significant catalyst for market growth. Precision agriculture and integrated nutrient management strategies, which advocate for balanced fertilization, are also driving the targeted application of these essential elements.

Despite these strong drivers, the market faces several restraints. One significant barrier is the relatively high cost of some advanced secondary nutrient formulations, particularly chelated forms, which can deter adoption, especially among small-scale farmers in developing regions. A lack of comprehensive awareness and understanding among certain farmer segments regarding the specific benefits and correct application methods of secondary nutrients, often compounded by limited access to soil testing facilities, can hinder market penetration. Regulatory challenges and varying standards across different countries concerning fertilizer composition, labeling, and environmental impact can create complexities for manufacturers and distributors. Furthermore, the environmental concerns associated with the over-application or improper management of fertilizers, leading to nutrient runoff and water pollution, necessitate stricter controls and the development of more efficient application technologies, adding to operational costs and potentially slowing market expansion.

Opportunities within the market are abundant, particularly in the realm of sustainable and innovative solutions. The development and promotion of bio-based and organic secondary nutrient formulations offer a promising avenue, catering to the growing demand for organic produce and environmentally friendly farming practices. Integrating secondary nutrient products with smart farming technologies, such as IoT sensors, drones, and AI-powered analytics, presents an opportunity to deliver highly precise and efficient nutrient management solutions, optimizing resource use and minimizing environmental footprint. The expansion of agricultural land in developing economies, coupled with increased investments in modern farming techniques, opens new markets and growth prospects for secondary nutrient suppliers. Furthermore, research and development into novel nutrient delivery systems, such as nano-fertilizers and customized release technologies, could significantly improve nutrient uptake efficiency and extend the market's reach and impact. Impact forces such as climate change, which can alter soil conditions and nutrient availability, government policies supporting sustainable agriculture and balanced fertilization, and fluctuations in raw material prices all exert significant influence on market dynamics, requiring adaptability and strategic planning from industry participants. Outbreaks of pest and disease can also indirectly drive demand for secondary nutrients, as healthy plants with adequate nutrient status are generally more resilient.

Segmentation Analysis

The Agricultural Secondary Nutrients Market is comprehensively segmented to provide granular insights into its diverse dynamics, addressing variations in product forms, application methods, crop specific requirements, and regional consumption patterns. This segmentation is crucial for stakeholders to identify niche markets, tailor product development, and formulate targeted marketing strategies. The market can be broadly categorized by the type of nutrient, distinguishing between Calcium, Magnesium, and Sulfur, each with unique physiological roles and demand drivers. Further distinctions are made based on the physical form of these nutrients, encompassing granular, liquid, and powder formulations, catering to different application preferences and efficiencies. The crop type segmentation delineates demand across major agricultural sectors, including grains, oilseeds, fruits, and vegetables, recognizing their varied nutritional needs. Lastly, application methods such as soil application, foliar spray, and fertigation provide insights into preferred delivery mechanisms, reflecting technological advancements and farming practices.

- By Nutrient Type:

- Calcium

- Magnesium

- Sulfur

- By Form:

- Granular

- Liquid

- Powder

- Other (e.g., pelleted, prilled)

- By Crop Type:

- Grains & Cereals (e.g., Wheat, Rice, Corn, Barley)

- Oilseeds & Pulses (e.g., Soybean, Rapeseed, Sunflower, Chickpea)

- Fruits & Vegetables (e.g., Tomatoes, Potatoes, Citrus, Apples, Grapes)

- Other Crops (e.g., Sugarcane, Cotton, Forage Crops, Plantation Crops)

- By Application Method:

- Soil Application

- Foliar Application

- Fertigation

- Other (e.g., Seed Treatment)

Value Chain Analysis For Agricultural Secondary Nutrients Market

The value chain for the Agricultural Secondary Nutrients Market is a complex network of interconnected stages, beginning with the sourcing of raw materials and culminating in the application of nutrients on farms. The upstream analysis focuses on the extraction and initial processing of raw materials. Calcium is predominantly sourced from limestone, gypsum, and dolomitic lime. Magnesium is derived from various minerals like dolomite, magnesite, and serpentine, as well as from seawater and brines. Sulfur originates largely as a by-product of oil and gas refining, metallurgical processes, or is mined from elemental sulfur deposits. These raw materials undergo initial processing, purification, and sometimes chemical conversion to create suitable forms for fertilizer production. Key players in this stage include mining companies, chemical producers, and industrial by-product suppliers, whose operational efficiency and cost structures significantly influence the final product pricing and availability downstream.

Moving downstream, the value chain involves the manufacturing, formulation, and distribution of secondary nutrient products. Manufacturers acquire these processed raw materials and employ various technologies to formulate them into fertilizers in granular, liquid, or powdered forms, often incorporating chelating agents or slow-release technologies to enhance efficacy and reduce environmental impact. This stage includes blending different nutrients to create balanced formulations and ensuring quality control. Following manufacturing, products move through sophisticated distribution channels. These channels can be direct, where large agricultural cooperatives or industrial farms purchase directly from manufacturers, often through long-term contracts. Alternatively, indirect channels are more common for smaller farms, involving a network of wholesalers, regional distributors, and local agricultural retailers or dealers. These intermediaries play a crucial role in inventory management, localized marketing, providing technical support, and ensuring product availability across diverse geographical regions. The efficiency and reach of this distribution network are paramount for market penetration and timely delivery to end-users.

The final stages of the value chain involve the marketing, sales, and end-use application by farmers and growers. Agricultural input companies market their products through various channels, including field demonstrations, farmer education programs, agricultural trade shows, and digital platforms, aiming to raise awareness about the benefits and proper application of secondary nutrients. Technical support and agronomic advice provided by sales teams and agronomists are vital in guiding farmers on soil testing, deficiency diagnosis, and appropriate product selection. End-users, primarily commercial farms, small-holder farmers, and horticultural enterprises, then apply these nutrients using various methods such as broadcast spreading, foliar sprays, or through irrigation systems (fertigation). The effectiveness of the entire value chain hinges on seamless coordination between all participants, from raw material suppliers ensuring consistent quality and supply, to distributors maintaining efficient logistics, and ultimately to farmers adopting best practices for nutrient application to achieve optimal crop health and yield. Innovations in digital platforms and e-commerce are increasingly streamlining direct and indirect distribution channels, offering more efficient connections between manufacturers and end-users, especially for specialized products and advisory services.

Agricultural Secondary Nutrients Market Potential Customers

The potential customers for the Agricultural Secondary Nutrients Market are diverse and span the entire spectrum of agricultural operations, from large-scale commercial farming enterprises to individual small-holder farmers and specialized horticultural businesses. Commercial farms, particularly those engaged in intensive cultivation of staple crops such as grains, cereals, oilseeds, and pulses, represent a significant customer base. These operations often possess the capital and technological infrastructure to invest in advanced nutrient management programs, recognizing the direct correlation between balanced nutrition and maximized yield and profitability. Their demand is driven by the need for consistent, high-quality production to meet market demands, often utilizing large volumes of fertilizers tailored to specific crop requirements and extensive acreage. The increasing adoption of precision farming techniques within this segment further boosts demand for sophisticated and highly efficient secondary nutrient products.

Small-holder farmers, especially in emerging economies, constitute another critical segment of potential customers. While individual purchases may be smaller, their collective demand is substantial. As these farmers transition from traditional practices to more commercial and scientifically informed agriculture, their awareness of and need for secondary nutrients grow. Government initiatives, agricultural cooperatives, and non-governmental organizations often play a pivotal role in educating and empowering these farmers, facilitating access to soil testing services, appropriate nutrient products, and financial support. These farmers seek cost-effective and easy-to-apply solutions that can visibly improve crop health and yield, thereby enhancing their livelihoods and food security. The expansion of agricultural extension services and micro-financing options in these regions is crucial for unlocking this customer segment's full potential.

Beyond traditional field agriculture, the horticulture sector, including fruit and vegetable growers, floriculturists, and greenhouse operators, represents a high-value customer segment. For these growers, crop quality, appearance, and shelf-life are paramount, making the precise application of secondary nutrients indispensable. For example, calcium is vital for preventing blossom-end rot in tomatoes and ensuring fruit firmness, while magnesium and sulfur contribute to vibrant foliage and intense flavors. Nurseries and landscape professionals also constitute a market segment, requiring specific nutrient formulations for healthy plant establishment and vigorous growth. Research institutions and agricultural universities also serve as indirect customers, utilizing these products for experimental purposes, developing new crop varieties, and formulating advanced nutrient management strategies. The emphasis for these diverse customer groups is on tailored solutions that address specific plant needs, soil conditions, and desired outcomes, underscoring the market’s responsiveness to specialized demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2032 | USD 11.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yara International ASA, Nutrien Ltd., The Mosaic Company, CF Industries Holdings Inc., K+S Aktiengesellschaft, Coromandel International Limited, ICL Group Ltd., EuroChem Group AG, OCP Group, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Gujarat State Fertilizers & Chemicals Limited (GSFC), Zuari Agro Chemicals Ltd., Deepak Fertilizers and Petrochemicals Corporation Ltd., ADAMA Agricultural Solutions Ltd., Haifa Chemicals Ltd., SQM S.A., Compass Minerals International Inc., Sinofert Holdings Limited, Koch Industries Inc., Helm AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Secondary Nutrients Market Key Technology Landscape

The Agricultural Secondary Nutrients Market is continually evolving, driven by innovations in technology aimed at enhancing nutrient efficiency, reducing environmental impact, and optimizing agricultural productivity. One prominent technological advancement involves the development of advanced fertilizer formulations. This includes slow-release and controlled-release fertilizers, which are designed to gradually release nutrients over an extended period, minimizing losses due to leaching or volatilization and ensuring a sustained supply of calcium, magnesium, and sulfur to plants. These formulations often involve coating technologies or specific chemical structures that regulate nutrient dissolution. Similarly, the advent of nano-fertilizers, where nutrients are delivered in nanoscale particles, offers improved absorption rates and targeted delivery, allowing for lower application rates while achieving higher efficacy, thereby contributing to both economic and environmental sustainability. Chelating agents are another crucial technology, used to bind secondary nutrients (especially magnesium and calcium) in a protective organic complex, preventing them from reacting with soil particles and becoming unavailable to plants, thus enhancing their mobility and uptake efficiency in various soil conditions.

Precision agriculture technologies are fundamentally transforming how secondary nutrients are managed and applied. This landscape includes the integration of advanced soil testing technologies, such as portable nutrient sensors and rapid diagnostic kits, which provide real-time data on soil composition and nutrient levels, enabling highly localized and immediate adjustments to fertilization programs. Geographic Information Systems (GIS) and Global Positioning Systems (GPS) are employed to create detailed farm maps, allowing for variable-rate application of secondary nutrients. This means applying the exact amount of nutrient needed in specific areas of a field, based on real-time data and historical performance, rather than blanket application. Drone and satellite imagery play a vital role in this, providing high-resolution data on crop health and stress indicators, which can then be correlated with secondary nutrient deficiencies, guiding targeted interventions. These technologies minimize waste, optimize resource use, and significantly improve the efficiency of nutrient delivery, translating into higher yields and reduced environmental footprint.

Beyond application, digital agriculture platforms and data analytics are emerging as critical technologies. These platforms integrate data from various sources—soil sensors, weather stations, crop imagery, yield monitors—and apply sophisticated algorithms, including AI and machine learning, to provide comprehensive decision support for farmers. This allows for predictive modeling of nutrient requirements, optimal timing of application, and identification of specific secondary nutrient product types best suited for particular crops and soil conditions. Furthermore, advancements in biotechnology and plant genomics are contributing to the development of crop varieties with enhanced nutrient use efficiency (NUE), meaning they can absorb and utilize secondary nutrients more effectively from the soil, potentially reducing overall fertilizer requirements. The continuous innovation in these interconnected technological domains is driving the Agricultural Secondary Nutrients Market towards more intelligent, sustainable, and productive farming systems, directly addressing challenges related to food security, environmental conservation, and economic viability for farmers worldwide.

Regional Highlights

- North America: This region is characterized by advanced agricultural practices, high adoption rates of precision farming, and significant R&D investment. The market for secondary nutrients is driven by the need to replenish soil fertility after intensive cultivation of staple crops like corn and soybeans. Stringent environmental regulations also push for efficient and targeted nutrient management, favoring advanced formulations and application technologies. Canada and the United States are key contributors.

- Europe: The European market is mature, with a strong emphasis on sustainable agriculture, organic farming, and environmental protection. Demand for secondary nutrients is influenced by policies promoting balanced fertilization and reducing nutrient pollution. Countries like Germany, France, and the UK focus on optimized nutrient use efficiency, often utilizing sophisticated soil diagnostics and tailor-made nutrient programs. Sulfur demand is particularly high for oilseed rape and protein crops.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market globally, fueled by its vast agricultural land, burgeoning population, and increasing food demand. Countries like China, India, and Southeast Asian nations are witnessing a significant shift towards modern farming techniques and increased awareness among farmers about secondary nutrient benefits. Government support for agricultural development and the expansion of high-value crops are key drivers.

- Latin America: This region presents considerable growth potential due to expanding agricultural frontiers, particularly for soybean, sugarcane, and corn cultivation in Brazil and Argentina. Soil degradation and nutrient deficiencies, especially sulfur and magnesium, are prevalent challenges, driving demand for replenishment. Increased investment in modern agricultural infrastructure and technologies is also boosting market growth.

- Middle East and Africa (MEA): The MEA market is an emerging region, driven by efforts to enhance food security and diversify agricultural production. Countries in this region are increasingly adopting modern farming practices and investing in irrigation and land development projects. Challenges include water scarcity and diverse soil conditions, which necessitate efficient and targeted nutrient application, creating opportunities for specialized secondary nutrient products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Secondary Nutrients Market.- Yara International ASA

- Nutrien Ltd.

- The Mosaic Company

- CF Industries Holdings Inc.

- K+S Aktiengesellschaft

- Coromandel International Limited

- ICL Group Ltd.

- EuroChem Group AG

- OCP Group

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Zuari Agro Chemicals Ltd.

- Deepak Fertilizers and Petrochemicals Corporation Ltd.

- ADAMA Agricultural Solutions Ltd.

- Haifa Chemicals Ltd.

- SQM S.A.

- Compass Minerals International Inc.

- Sinofert Holdings Limited

- Koch Industries Inc.

- Helm AG

- Bayer AG

- FMC Corporation

- Syngenta AG

- BASF SE

- Corteva Agriscience

Frequently Asked Questions

What are agricultural secondary nutrients?

Agricultural secondary nutrients are essential plant nutrients like Calcium (Ca), Magnesium (Mg), and Sulfur (S) that crops require in larger quantities than micronutrients but less than primary nutrients (N, P, K). They are crucial for various physiological processes, including cell structure, photosynthesis, enzyme activity, and protein synthesis, directly impacting crop yield, quality, and overall plant health.

Why are secondary nutrients becoming increasingly important in modern agriculture?

Secondary nutrients are gaining importance due to intensive farming practices depleting soil reserves, increased demand from high-yielding crop varieties, and a greater understanding of their vital roles in plant metabolism. Their proper application enhances crop quality, improves disease resistance, and boosts overall agricultural productivity, which is critical for meeting global food demand.

How does AI impact the application of agricultural secondary nutrients?

AI significantly impacts secondary nutrient application by enabling precision nutrient management through data analysis from soil sensors, satellite imagery, and weather patterns. AI-powered systems provide hyper-localized recommendations, optimize application timing and dosage, predict deficiencies, and automate variable-rate application, leading to enhanced efficiency, reduced waste, and improved environmental sustainability.

What are the main types of secondary nutrient products available in the market?

The market offers secondary nutrient products primarily in three forms: granular, liquid, and powder. These can be specific nutrient sources like calcium sulfate (gypsum), magnesium sulfate, or ammonium sulfate, and are also available in advanced formulations such as slow-release, controlled-release, and chelated forms to improve nutrient availability and uptake efficiency.

Which regions are driving the growth of the agricultural secondary nutrients market?

The Asia Pacific region is the primary driver of market growth, attributed to its large agricultural land base, high population density, and rapid adoption of modern farming techniques in countries like China and India. North America and Europe also contribute with stable growth driven by precision agriculture, while Latin America and MEA are emerging markets with significant potential due to expanding agricultural sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager