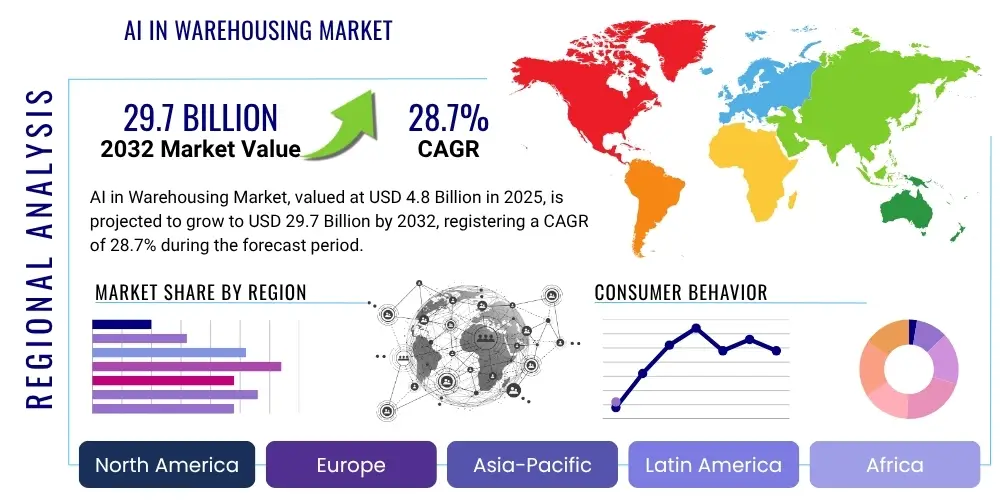

AI in Warehousing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428799 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

AI in Warehousing Market Size

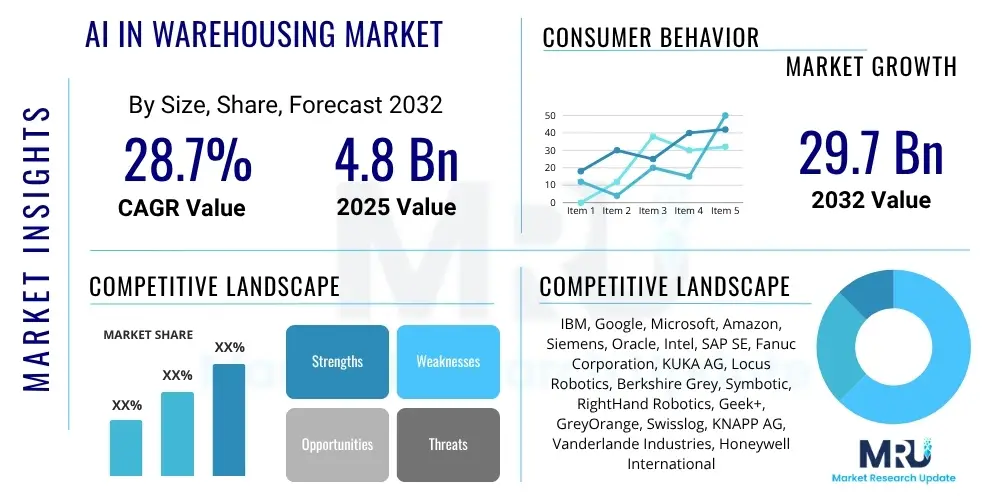

The AI in Warehousing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.7% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 29.7 Billion by the end of the forecast period in 2032.

AI in Warehousing Market introduction

The AI in Warehousing Market is undergoing a transformative shift, driven by the imperative to optimize operational efficiency and responsiveness in modern supply chains. This market encompasses the application of artificial intelligence technologies and solutions within warehouse and distribution center environments to automate, streamline, and enhance various logistical processes. These solutions leverage advanced algorithms, machine learning, computer vision, and robotics to deliver unprecedented levels of precision and speed, thereby redefining traditional warehousing paradigms.

The product portfolio within this market includes a diverse range of AI-powered systems such as autonomous mobile robots (AMRs) for material handling, intelligent vision systems for quality control and inventory tracking, predictive analytics platforms for demand forecasting and route optimization, and AI-driven warehouse management systems (WMS). Major applications span across inventory management, order fulfillment, labor optimization, predictive maintenance of equipment, and enhanced security. The inherent benefits of adopting AI in warehousing are substantial, leading to significant reductions in operational costs, improvements in inventory accuracy, accelerated order processing times, and enhanced worker safety through the automation of repetitive and hazardous tasks. Key driving factors propelling market expansion include the exponential growth of e-commerce, persistent labor shortages in the logistics sector, the increasing complexity of supply chains, and the pervasive demand for greater efficiency and resilience in warehouse operations globally.

AI in Warehousing Market Executive Summary

The AI in Warehousing Market is witnessing robust expansion, characterized by a fundamental shift towards automation and data-driven decision-making across global logistics and supply chain operations. Business trends indicate a strong emphasis on integrating AI with existing infrastructure, leading to hybrid automation models that leverage both human and robotic capabilities. There is a growing inclination towards scalable and flexible AI solutions that can adapt to fluctuating demand and evolving operational complexities. Furthermore, the market is seeing increased collaboration between AI technology providers and established logistics players, fostering innovation and wider adoption of sophisticated AI applications, particularly in areas like predictive inventory management and optimized picking paths. The competitive landscape is dynamic, with both large tech conglomerates and specialized AI startups vying for market share through continuous product development and strategic partnerships.

Regional trends highlight North America and Europe as early adopters and dominant players due to advanced technological infrastructure, high labor costs, and a mature logistics industry. However, the Asia Pacific region is rapidly emerging as a significant growth engine, fueled by the explosive growth of e-commerce, expanding manufacturing bases, and increasing investments in automation from countries like China, India, and Japan. Latin America, the Middle East, and Africa are showing nascent but accelerating growth, driven by economic diversification efforts and infrastructural development aimed at modernizing supply chains. Segment trends reveal that the software component, including AI-driven analytics and WMS, holds a substantial share, while the hardware segment, particularly robotics and automated guided vehicles (AGVs), is experiencing rapid growth due to advancements in machine vision and sensor technologies. Services, encompassing integration, maintenance, and consulting, are also gaining traction as businesses seek expert assistance in deploying and optimizing complex AI systems.

AI Impact Analysis on AI in Warehousing Market

The integration of AI into warehousing operations addresses critical user concerns regarding efficiency, cost, and labor challenges, while simultaneously raising questions about job displacement and data security. Users frequently inquire about how AI can genuinely reduce operational expenditures, improve inventory accuracy, and accelerate order fulfillment to meet the escalating demands of e-commerce. They seek clarity on the tangible benefits of AI-driven automation, such as its ability to optimize routes for picking robots, predict equipment failures, and manage seasonal fluctuations in demand. Concerns also revolve around the complexity of integrating advanced AI systems with legacy infrastructure, the initial investment required, and the availability of a skilled workforce to manage these sophisticated technologies. Furthermore, there are prevalent discussions about the ethical implications of AI, particularly concerning data privacy, algorithmic bias, and the future of human employment within automated warehouses, leading users to look for solutions that foster human-robot collaboration rather than outright replacement.

- Enhanced operational efficiency through automated tasks.

- Significant reduction in labor costs and human error.

- Improved inventory accuracy and traceability.

- Accelerated order fulfillment and shipping processes.

- Optimized space utilization within warehouses.

- Predictive maintenance leading to reduced downtime for equipment.

- Real-time data analytics for informed decision-making.

- Increased worker safety by automating hazardous activities.

- Better demand forecasting and supply chain resilience.

- New opportunities for highly skilled human roles in AI management.

DRO & Impact Forces Of AI in Warehousing Market

The AI in Warehousing Market is shaped by a complex interplay of driving forces, inherent restraints, and emerging opportunities, all of which are influenced by broader industry impact forces. Key drivers include the relentless expansion of the global e-commerce sector, which necessitates faster and more accurate fulfillment capabilities to meet customer expectations for rapid delivery. The pervasive shortage of manual labor in logistics, coupled with rising labor costs, compels businesses to seek automation solutions that AI readily provides. Furthermore, advancements in AI, machine learning, and robotics technologies have made these solutions more accessible and effective, driving their adoption across various warehouse functions. The increasing pressure to reduce operational costs and enhance overall supply chain resilience in the face of disruptions also acts as a significant catalyst for AI integration.

However, several restraints impede the market's full potential. The high initial capital investment required for deploying AI-powered systems, including hardware, software, and infrastructure upgrades, can be a significant barrier for small and medium-sized enterprises. The complexity of integrating AI solutions with existing legacy warehouse management systems and operational processes poses substantial technical and logistical challenges. Data security and privacy concerns, particularly when handling vast amounts of operational data, also represent a critical restraint. Moreover, the scarcity of skilled personnel capable of deploying, maintaining, and optimizing these advanced AI systems can hinder effective implementation. Despite these challenges, ample opportunities exist for market growth, such as the development of more customizable and flexible AI solutions tailored to specific industry needs, the expansion into predictive maintenance services for warehouse equipment, and the cultivation of human-robot collaborative environments that maximize efficiency while retaining human oversight and problem-solving capabilities. These forces collectively define the competitive landscape and strategic direction for players within the AI in Warehousing Market.

Segmentation Analysis

The AI in Warehousing Market is comprehensively segmented to provide a detailed understanding of its diverse components, technological applications, operational uses, and end-user industries. This segmentation allows for precise market analysis, identifying key growth areas and niche opportunities within the broader AI integration in logistics. Each segment reflects distinct market dynamics, adoption rates, and technological maturity, offering insights into where investment and innovation are most concentrated. Understanding these segments is crucial for stakeholders to tailor strategies, develop targeted products, and optimize their market positioning in this rapidly evolving landscape.

- By Component

- Hardware (Robots, Sensors, Cameras, Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS))

- Software (Warehouse Management Systems (WMS), Predictive Analytics, Machine Learning Platforms, Computer Vision Software, Natural Language Processing (NLP) Software)

- Services (Integration Services, Consulting Services, Maintenance and Support Services, Training Services)

- By Technology

- Machine Learning (ML)

- Computer Vision

- Natural Language Processing (NLP)

- Robotics

- Predictive Analytics

- Deep Learning

- Reinforcement Learning

- By Application

- Inventory Management

- Order Fulfillment (Picking, Packing, Shipping)

- Workforce Optimization

- Predictive Maintenance

- Quality Control

- Warehouse Automation

- Demand Forecasting

- Logistics and Route Optimization

- By End-user Industry

- Retail and E-commerce

- Manufacturing

- Automotive

- Food and Beverage

- Healthcare and Pharmaceuticals

- Logistics and 3PL (Third-Party Logistics)

- Consumer Goods

Value Chain Analysis For AI in Warehousing Market

The value chain for the AI in Warehousing Market encompasses a series of interconnected activities that collectively deliver AI-powered solutions to end-users, extending from raw material suppliers to post-deployment services. The upstream segment of the value chain involves the foundational suppliers of critical components such as advanced sensors, AI chips, robotic components, and specialized software development kits. Key players here include semiconductor manufacturers, vision system providers, and core AI algorithm developers. These entities are crucial for providing the technological building blocks upon which complete AI solutions are constructed. Downstream activities focus on the integration, deployment, and operationalization of these complex systems within warehouse environments. This includes software integration specialists who adapt AI platforms to existing WMS, robotics integrators who deploy and configure automated systems, and data analytics providers who ensure effective data utilization for predictive insights.

Distribution channels for AI in warehousing solutions are multifaceted, ranging from direct sales models to complex indirect networks. Large enterprises often engage in direct procurement from major AI solution providers or system integrators, benefiting from bespoke solutions and dedicated support. Indirect channels involve partnerships with third-party logistics (3PL) providers, value-added resellers (VARs), and regional distributors who offer localized expertise, implementation services, and ongoing support to a broader range of businesses, particularly small and medium-sized enterprises (SMEs). This layered approach ensures market penetration and accessibility across different scales of operations. The interaction between direct and indirect channels is dynamic, with many solution providers leveraging both approaches to maximize their market reach and cater to diverse customer segments, emphasizing a collaborative ecosystem where technology providers, integrators, and end-users co-create value through enhanced operational intelligence and efficiency.

AI in Warehousing Market Potential Customers

The potential customers for AI in Warehousing solutions are diverse, spanning across various industries that operate extensive supply chain and logistics networks, seeking to enhance efficiency, reduce costs, and improve responsiveness. At the forefront are e-commerce giants and online retailers, for whom rapid and accurate order fulfillment is a direct competitive advantage and a necessity to meet escalating consumer demands. These companies invest heavily in AI-driven automation to manage vast inventories, optimize picking paths, and ensure swift dispatch, often operating large-scale fulfillment centers that benefit immensely from advanced robotics and predictive analytics.

Additionally, third-party logistics (3PL) providers represent a significant customer segment. As outsourcing partners for warehousing and distribution, 3PLs constantly seek innovative technologies to offer superior services, attract more clients, and maintain a competitive edge. AI solutions enable them to manage multiple client inventories efficiently, optimize shared warehouse spaces, and provide sophisticated data-driven insights to their customers. Manufacturing industries, including automotive, electronics, and consumer goods, are also prime candidates, as they rely on efficient inbound and outbound logistics for raw materials, work-in-progress, and finished goods, leveraging AI for inventory synchronization and production line feeding. Healthcare and pharmaceutical distributors, with their stringent regulatory requirements and critical need for precise inventory tracking and temperature control, find AI indispensable for maintaining product integrity and ensuring compliance. Food and beverage companies, facing challenges of perishable goods and rapid stock rotation, also benefit from AI for demand forecasting and inventory optimization, minimizing waste and improving freshness. These end-users are driven by the common goals of operational excellence, cost reduction, and superior customer service in increasingly complex and competitive markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 29.7 Billion |

| Growth Rate | 28.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Google, Microsoft, Amazon, Siemens, Oracle, Intel, SAP SE, Fanuc Corporation, KUKA AG, Locus Robotics, Berkshire Grey, Symbotic, RightHand Robotics, Geek+, GreyOrange, Swisslog, KNAPP AG, Vanderlande Industries, Honeywell International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AI in Warehousing Market Key Technology Landscape

The AI in Warehousing Market is underpinned by a dynamic and rapidly evolving technology landscape, leveraging several cutting-edge innovations to transform traditional warehouse operations into intelligent, automated, and highly efficient systems. Central to this landscape are advanced machine learning algorithms, which enable systems to learn from vast datasets, predict demand fluctuations, optimize picking routes, and identify anomalies with remarkable accuracy. These algorithms are the backbone of predictive analytics platforms, allowing warehouses to move from reactive to proactive strategies in inventory management, maintenance, and resource allocation. Computer vision technology, driven by deep learning networks, is another pivotal component, facilitating automated quality control, damage detection, item identification, and precise navigation for autonomous robots. This technology enhances accuracy and speed in tasks that traditionally relied on human visual inspection.

Robotics, encompassing autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and robotic arms, forms the physical manifestation of AI in warehousing. These robots are equipped with AI to navigate complex environments, collaborate with human workers, and perform tasks such as picking, packing, sorting, and material handling. Natural Language Processing (NLP) is increasingly being integrated into warehouse management systems and voice-picking solutions, enabling more intuitive human-machine interaction and streamlining communication processes. Furthermore, the extensive deployment of Internet of Things (IoT) sensors provides real-time data from various points within the warehouse, feeding critical information to AI systems for continuous optimization. Cloud computing and edge computing infrastructures are essential for processing and storing the massive volumes of data generated by these AI systems, allowing for both centralized analysis and rapid, localized decision-making. These integrated technologies collectively drive the market towards fully autonomous and intelligent warehouse environments, addressing the complex demands of modern supply chains.

Regional Highlights

- North America: This region is a leading market for AI in warehousing, driven by early adoption of advanced technologies, the presence of major tech companies and innovative startups, and high labor costs necessitating automation. The robust e-commerce sector and significant investments in supply chain modernization further fuel market growth, particularly in the United States and Canada.

- Europe: Europe exhibits strong growth, characterized by high levels of automation in manufacturing and logistics, stringent regulations promoting worker safety, and a focus on sustainability. Countries like Germany, the UK, and the Netherlands are at the forefront, with substantial investments in smart warehouses and a growing emphasis on human-robot collaboration.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by the booming e-commerce market, rapid industrialization, and significant government initiatives supporting smart logistics in countries like China, India, Japan, and South Korea. The region benefits from a large manufacturing base and increasing disposable incomes, driving demand for efficient warehousing solutions.

- Latin America: This emerging market is experiencing gradual adoption, primarily driven by increasing foreign investments, infrastructure development, and the expansion of organized retail and e-commerce. Brazil and Mexico are key markets, focusing on improving logistics efficiency to compete globally.

- Middle East and Africa (MEA): The MEA region is witnessing nascent but accelerating growth, fueled by economic diversification efforts, significant investments in logistics hubs and mega-projects, particularly in the GCC countries, and a growing emphasis on technological adoption to modernize supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AI in Warehousing Market.- IBM

- Microsoft

- Amazon

- Siemens

- Oracle

- Intel

- SAP SE

- Fanuc Corporation

- KUKA AG

- Locus Robotics

- Berkshire Grey

- Symbotic

- RightHand Robotics

- Geek+

- GreyOrange

- Swisslog

- KNAPP AG

- Vanderlande Industries

- Honeywell International

Frequently Asked Questions

What are the primary benefits of implementing AI in warehousing?

The primary benefits include significant improvements in operational efficiency, reduced labor costs, enhanced inventory accuracy, accelerated order fulfillment, optimized space utilization, and increased worker safety through automation of repetitive and hazardous tasks.

How does AI address labor shortages in the warehousing sector?

AI addresses labor shortages by automating tasks like picking, packing, and sorting using robots and smart systems, reducing reliance on manual labor, and freeing up human workers for more complex, strategic roles.

What are the main challenges for AI adoption in warehouses?

Key challenges include high initial investment costs, the complexity of integrating new AI systems with existing legacy infrastructure, concerns around data security and privacy, and the need for a skilled workforce to manage and maintain AI technologies.

Which industries are the largest end-users of AI in warehousing?

The largest end-user industries are retail and e-commerce due to high demand for rapid fulfillment, followed by manufacturing, automotive, food and beverage, and third-party logistics (3PL) providers.

What role do autonomous mobile robots (AMRs) play in AI warehousing?

AMRs play a crucial role by autonomously navigating warehouses to transport goods, assist in picking and sorting, and perform inventory counts, thereby increasing throughput, reducing manual effort, and improving operational flexibility and scalability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager