Air Insulated Power Distribution Component Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428217 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Air Insulated Power Distribution Component Market Size

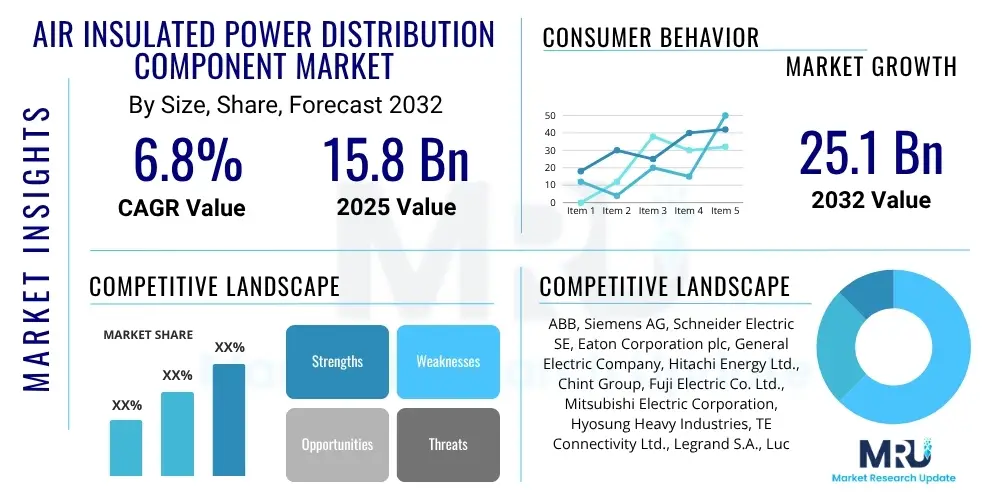

The Air Insulated Power Distribution Component Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 25.1 Billion by the end of the forecast period in 2032.

Air Insulated Power Distribution Component Market introduction

The Air Insulated Power Distribution Component Market encompasses a wide array of electrical equipment essential for the reliable and efficient transmission and distribution of electrical power. These components, which include switchgear, circuit breakers, disconnectors, and busbars, rely on atmospheric air as the primary insulating medium between live parts and ground, and between phases. This method of insulation is favored for its cost-effectiveness, environmental friendliness due to the absence of greenhouse gases like SF6, and ease of maintenance. The robustness and proven reliability of air-insulated solutions make them a cornerstone of modern electrical grids, from generation stations to end-user consumption points, ensuring safety and operational continuity across diverse applications.

Major applications of air-insulated power distribution components span across the entire energy ecosystem. Utilities represent the largest segment, utilizing these components in substations for voltage transformation, transmission line protection, and distribution network management. Industrial sectors, including manufacturing plants, mining operations, and oil & gas facilities, depend on these components for motor control, process automation, and ensuring a stable power supply for heavy machinery. Commercial establishments like data centers, hospitals, and large office complexes also heavily integrate air-insulated systems to manage their intricate electrical loads and maintain uninterrupted operations. The versatility and scalability of these components allow for their deployment in varied environments, from urban centers to remote industrial sites.

The market benefits significantly from several inherent advantages of air insulation technology. Firstly, its environmental profile is superior, as it avoids the use of potent greenhouse gases, aligning with global sustainability initiatives and stricter environmental regulations. Secondly, air-insulated components are generally less complex to manufacture and maintain compared to their gas-insulated counterparts, leading to lower total cost of ownership over their operational lifespan. Driving factors for market growth include the global push for grid modernization, which necessitates replacing aging infrastructure with more reliable and efficient systems. Furthermore, rapid industrialization and urbanization in emerging economies are fueling demand for new power infrastructure, while the integration of renewable energy sources into existing grids requires robust and flexible distribution components to manage intermittent power flows effectively. These intertwined factors collectively underpin the sustained expansion of the air-insulated power distribution component market.

Air Insulated Power Distribution Component Market Executive Summary

The Air Insulated Power Distribution Component Market is experiencing robust growth driven by several pervasive business trends. The increasing emphasis on grid modernization and digitalization across both developed and developing nations is a primary catalyst, as utilities seek to enhance reliability, efficiency, and smart grid capabilities. This trend involves upgrading existing infrastructure, which often includes replacing older, less efficient air-insulated components with advanced, digitally integrated versions capable of remote monitoring and control. Furthermore, the global shift towards renewable energy sources like solar and wind power necessitates sophisticated power distribution solutions to manage fluctuating inputs and integrate them seamlessly into the grid, thereby creating substantial demand for flexible and resilient air-insulated switchgear and circuit breakers. Manufacturers are responding by developing more compact, modular, and intelligent air-insulated solutions that offer enhanced performance and reduced footprint.

Regional trends significantly influence the market’s trajectory. Asia Pacific, particularly countries like China and India, stands out as a dominant growth region due propelled by rapid industrialization, burgeoning urbanization, and extensive infrastructure development projects. These nations are heavily investing in expanding their power generation, transmission, and distribution capacities, driving a substantial demand for foundational components like air-insulated systems. North America and Europe, while more mature markets, are focusing on upgrading aging infrastructure, integrating smart grid technologies, and enhancing grid resilience against extreme weather events. The stringent regulatory frameworks in these regions, coupled with a strong emphasis on reducing carbon footprints, are also fostering the adoption of environmentally friendly air-insulated alternatives. Latin America, the Middle East, and Africa are also witnessing considerable investments in power infrastructure, driven by economic growth and electrification initiatives, contributing to steady market expansion.

Segment-wise, the market is exhibiting dynamic shifts. The medium voltage (MV) segment continues to hold a significant share, primarily due to its widespread application in industrial facilities, commercial buildings, and utility distribution networks. Within product types, air circuit breakers and air-insulated switchgear remain foundational, but there is an increasing demand for specialized solutions such as vacuum circuit breakers within air-insulated enclosures, offering enhanced performance and reduced maintenance. The push for modular and compact designs is also driving innovation, allowing for easier installation and reduced space requirements, particularly in urban areas or retrofitting projects. The utilities segment consistently dominates the application landscape, but the rapid growth in industrial automation, data centers, and renewable energy installations is creating new lucrative opportunities for air-insulated power distribution components designed to meet their specific demands for high reliability and efficiency. These trends collectively paint a picture of a dynamic market adapting to evolving energy landscapes and technological advancements.

AI Impact Analysis on Air Insulated Power Distribution Component Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the air-insulated power distribution component market, focusing on aspects like predictive maintenance, operational efficiency, and grid reliability. Key themes emerging from these inquiries revolve around AI's ability to analyze vast amounts of operational data from smart sensors embedded in switchgear and circuit breakers, enabling early detection of potential failures and optimizing maintenance schedules. There is a strong expectation that AI will enhance grid resilience by rapidly identifying and isolating faults, minimize downtime, and contribute to a more autonomous and efficient energy management system. Concerns often include data security, the initial investment required for AI integration, and the need for skilled personnel to manage and interpret AI-driven insights. Overall, users anticipate that AI will transition power distribution from reactive to proactive, ensuring a more stable and sustainable electricity supply while optimizing asset utilization and lifecycle management.

- AI-driven predictive maintenance significantly reduces equipment downtime by analyzing real-time operational data from air-insulated components to predict potential failures before they occur.

- Enhanced operational efficiency through AI-optimized load balancing and demand forecasting, leading to reduced energy losses and improved grid performance.

- Real-time fault detection and isolation, leveraging AI algorithms to quickly pinpoint issues within air-insulated networks, thereby minimizing outage durations and enhancing system resilience.

- Automated monitoring and control of air-insulated switchgear and circuit breakers, allowing for remote operations and quicker response to changing grid conditions.

- Improved asset management and lifecycle optimization by using AI to assess component health, remaining useful life, and prioritizing replacements or upgrades based on actual condition rather than fixed schedules.

- Advanced cybersecurity for intelligent air-insulated systems, as AI can detect anomalous patterns indicative of cyber threats, enhancing the security posture of critical infrastructure.

- Support for seamless integration of distributed renewable energy sources into the grid by managing their intermittent nature through AI-powered predictive analytics and dynamic control of air-insulated components.

- Optimization of energy trading and market operations by providing more accurate forecasts of supply and demand, influencing the dispatch of power through air-insulated distribution networks.

DRO & Impact Forces Of Air Insulated Power Distribution Component Market

The Air Insulated Power Distribution Component Market is significantly shaped by a confluence of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating pace of global infrastructure development and grid modernization initiatives. As economies expand, particularly in developing regions, there is an inherent need to build new power networks and upgrade existing, often aging, electricity infrastructure. This push for modernization includes enhancing grid resilience, integrating smart technologies, and improving overall energy efficiency, all of which directly fuel demand for reliable air-insulated components. Furthermore, the global imperative to transition towards renewable energy sources necessitates robust and adaptable distribution components capable of handling the variable nature of solar and wind power, further bolstering market growth. Industrialization and urbanization continue to be foundational drivers, increasing power consumption and requiring extensive distribution networks equipped with secure and efficient components.

However, the market also faces considerable restraints that temper its growth. The high initial capital expenditure associated with installing new power distribution infrastructure, including air-insulated components, can be a significant barrier, particularly for regions with limited investment capabilities. Intense competition from Gas Insulated Switchgear (GIS) in certain high-voltage and space-constrained applications presents another challenge; while air-insulated systems are cost-effective, GIS offers a compact footprint and sealed-for-life characteristics that are attractive for specific deployments. Fluctuations in raw material prices, such as copper, aluminum, and steel, which are integral to manufacturing these components, can impact production costs and market pricing. Additionally, complex and evolving regulatory landscapes, particularly concerning safety standards and environmental mandates, can slow down project approvals and increase compliance costs for manufacturers.

Despite these challenges, numerous opportunities are poised to propel the market forward. The increasing global focus on smart grid development offers a substantial avenue for growth, as air-insulated components are being integrated with advanced sensors, communication modules, and digital controls, enabling greater intelligence and automation. Emerging economies in Asia Pacific, Latin America, and Africa present vast untapped potential, driven by ongoing electrification projects and economic expansion. The burgeoning demand for reliable power in critical infrastructure like data centers, healthcare facilities, and transportation networks creates a niche for high-performance air-insulated solutions. Moreover, the growing emphasis on environmentally friendly technologies, coupled with increasing awareness of the potent greenhouse effects of SF6 gas, positions air-insulated components as a preferred sustainable alternative. These opportunities collectively highlight a resilient market that is adapting to technological advancements and global energy transitions.

Segmentation Analysis

The Air Insulated Power Distribution Component Market is comprehensively segmented to provide a detailed understanding of its varied applications, product types, and operational requirements. This granular analysis allows stakeholders to identify key growth areas, competitive landscapes, and specific market demands across different industries and geographical regions. The segmentation helps in understanding the distinct characteristics and adoption rates of air-insulated technologies, enabling targeted strategies for product development and market penetration. It reflects the diverse operational environments from urban utility grids to specialized industrial facilities, each requiring specific configurations and voltage levels of power distribution components.

- By Voltage Level

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- By Product Type

- Circuit Breakers

- Vacuum Circuit Breakers

- Air Circuit Breakers

- SF6 Free Solutions (Air-Insulated)

- Switchgear

- Primary Switchgear

- Secondary Switchgear

- Compact Switchgear

- Modular Switchgear

- Disconnectors/Isolators

- Busbars

- Current Transformers

- Potential Transformers

- Relays

- Control & Protection Systems

- Circuit Breakers

- By Application

- Utilities

- Transmission

- Distribution

- Substations

- Industrial

- Manufacturing

- Mining

- Oil & Gas

- Data Centers

- Process Industries

- Commercial

- Buildings

- Hospitals

- Malls & Retail

- Education Campuses

- Residential

- Infrastructure

- Railways

- Airports

- Ports

- Renewable Energy

- Solar Farms

- Wind Farms

- Hydroelectric Plants

- Utilities

- By End-User

- Electricity Generation Companies

- Transmission & Distribution System Operators (TSOs & DSOs)

- Independent Power Producers (IPPs)

- Industrial End-Users

- Commercial End-Users

- Government & Public Sector

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Air Insulated Power Distribution Component Market

The value chain for the Air Insulated Power Distribution Component Market is a complex network involving multiple stages, from raw material extraction to end-user deployment and post-sales services. The upstream segment of the value chain primarily involves the sourcing and processing of essential raw materials. This includes suppliers of various metals such as copper, aluminum, and steel, which are critical for conductors, enclosures, and structural components. Insulation materials like ceramics, epoxy resins, and various plastics are also procured from specialized manufacturers. These raw material providers form the foundational layer, dictating the quality and cost of inputs for component manufacturers. Additionally, specialized electronic component suppliers provide relays, sensors, and control boards crucial for modern intelligent air-insulated systems, highlighting the interdependency of several industries.

Further along the value chain, component manufacturers convert these raw materials into finished air-insulated power distribution products such as switchgear, circuit breakers, disconnectors, and transformers. These manufacturers engage in design, engineering, assembly, and rigorous testing to ensure product reliability and compliance with international standards. Following manufacturing, the distribution channel plays a pivotal role in delivering these components to end-users. This involves a mix of direct and indirect channels. Direct sales often occur for large-scale projects, where manufacturers sell directly to major utility companies, large industrial enterprises, or Engineering, Procurement, and Construction (EPC) contractors. This approach allows for customized solutions and direct technical support, fostering strong client relationships.

Indirect channels involve a network of authorized distributors, wholesalers, and system integrators who procure components from manufacturers and then supply them to smaller utilities, industrial clients, commercial establishments, and residential developers. These intermediaries often provide additional value-added services such as local warehousing, logistics, technical consultation, and after-sales support, bridging the gap between manufacturers and diverse customer bases. The downstream segment encompasses the installation, commissioning, maintenance, and upgrade services provided by specialized contractors, service providers, and sometimes the manufacturers themselves. These services are crucial for ensuring the long-term performance and reliability of the air-insulated components throughout their operational life cycle. The entire value chain is driven by technological advancements, regulatory compliance, and the constant demand for efficient and sustainable power distribution solutions.

Air Insulated Power Distribution Component Market Potential Customers

The potential customers for Air Insulated Power Distribution Components are diverse and span across various sectors that rely heavily on robust and reliable electrical infrastructure for their operations. Utilities, including both public and private sector electricity generation, transmission, and distribution companies, represent the largest and most critical customer segment. These entities require air-insulated switchgear, circuit breakers, and other components for their substations, grid extensions, and modernization projects. Their primary objectives are to ensure continuous and stable power supply, manage complex network operations, and enhance grid resilience against faults and outages. The substantial investments made by utilities in infrastructure upgrades, integration of renewable energy sources, and smart grid initiatives make them continuous and high-volume purchasers of these essential components.

Beyond utilities, the industrial sector forms another significant customer base. Manufacturing plants, particularly those in heavy industries such as metals, cement, automotive, and chemicals, require highly reliable power distribution systems to ensure uninterrupted production processes. Mining operations, oil & gas extraction and refining facilities, and large-scale data centers also fall into this category, demanding robust and safe air-insulated components that can withstand harsh operating conditions and provide secure power for critical equipment. These industrial end-users prioritize operational efficiency, safety, and minimized downtime, making the proven reliability of air-insulated systems a key purchasing factor. Their demand is driven by expansion projects, technological upgrades, and the need to replace aging electrical infrastructure.

The commercial and residential sectors also contribute significantly to the demand. Commercial buildings like shopping malls, office complexes, hospitals, educational institutions, and airports utilize air-insulated power distribution components for their internal electrical networks to ensure safety, energy efficiency, and reliable power for essential services. The growing urbanization and development of smart cities are further boosting this demand, as new infrastructure requires modern and efficient power management systems. While individual residential consumption might not drive large-scale component purchases, residential developments, townships, and housing projects collectively represent a substantial market through their demand for low and medium voltage air-insulated distribution boards and protective devices. The emphasis on safety, space efficiency, and long-term cost-effectiveness drives adoption across these varied customer segments, making the market highly diversified.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 25.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens AG, Schneider Electric SE, Eaton Corporation plc, General Electric Company, Hitachi Energy Ltd., Chint Group, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Hyosung Heavy Industries, TE Connectivity Ltd., Legrand S.A., Lucy Electric Ltd., Powell Industries Inc., Toshiba Corporation, Larsen & Toubro Limited, CG Power and Industrial Solutions Limited, Bharat Heavy Electricals Limited (BHEL), Emerson Electric Co., WEG S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Insulated Power Distribution Component Market Key Technology Landscape

The Air Insulated Power Distribution Component Market is continually evolving, driven by significant advancements in technology aimed at enhancing performance, reliability, and environmental sustainability. A prominent trend is the increasing integration of digitalization and smart grid technologies. This involves embedding air-insulated switchgear and circuit breakers with advanced sensors, IoT devices, and communication modules that enable real-time monitoring of operational parameters such as current, voltage, temperature, and partial discharges. These smart capabilities facilitate remote control, predictive maintenance, and sophisticated fault diagnosis, moving away from traditional time-based maintenance schedules to condition-based strategies, thereby extending asset life and minimizing unscheduled downtime. The emphasis on data analytics and connectivity is transforming traditional components into intelligent assets capable of contributing to a more responsive and efficient grid.

Another crucial technological development focuses on improving the inherent safety and operational efficiency of air-insulated systems. Innovations in arc-resistant designs are paramount, enhancing personnel safety by containing the effects of internal arc faults. Modular and compact designs are also gaining traction, particularly for urban substations and industrial applications where space is a premium. These designs allow for easier installation, scalability, and reduced footprint, making retrofitting projects more feasible. Furthermore, advancements in materials science are leading to the development of higher-performance insulators and conductor materials, which can withstand greater electrical stresses and extreme environmental conditions, thereby boosting the overall reliability and longevity of air-insulated components without compromising their cost-effectiveness.

The push towards greater sustainability and environmental responsibility is also a significant driver of technological innovation. While air insulation is inherently environmentally friendly compared to SF6-based systems, continuous research is focused on further reducing the carbon footprint of manufacturing processes and ensuring the use of recyclable materials. The development of SF6-free solutions, even within air-insulated categories, is expanding as manufacturers seek to offer alternatives that meet the most stringent environmental mandates while maintaining competitive performance. These technological advancements collectively aim to address the challenges of an aging grid infrastructure, increasing energy demands, and the integration of diverse renewable energy sources, ensuring that air-insulated power distribution components remain a vital and future-proof segment of the global energy landscape.

Regional Highlights

- North America: This region is characterized by significant investments in upgrading aging electrical infrastructure and modernizing grids to enhance reliability and integrate renewable energy sources. The strong focus on smart grid initiatives and the robust industrial sector drive consistent demand for air-insulated power distribution components. Regulatory emphasis on environmental sustainability also favors air-insulated solutions over SF6 alternatives.

- Europe: Europe is a mature market witnessing substantial adoption of air-insulated components, fueled by strict environmental regulations, the ongoing transition to a low-carbon economy, and extensive renewable energy integration targets. Countries are actively replacing older infrastructure and implementing digitalized grid solutions, creating a steady demand for modern, efficient, and environmentally friendly air-insulated switchgear and circuit breakers.

- Asia Pacific (APAC): APAC represents the fastest-growing market, propelled by rapid industrialization, urbanization, and large-scale infrastructure development projects across countries like China, India, and Southeast Asian nations. The burgeoning demand for electricity, coupled with significant investments in new power generation and distribution capacities, makes this region a crucial hub for the air-insulated power distribution component market. Economic expansion and electrification initiatives are key drivers.

- Latin America: The market in Latin America is experiencing steady growth driven by increasing electrification efforts, industrial expansion, and investments in infrastructure development, particularly in countries like Brazil, Mexico, and Chile. The region's rich natural resources and growing energy demand necessitate robust power distribution networks, creating opportunities for air-insulated solutions.

- Middle East and Africa (MEA): This region is characterized by substantial investments in power infrastructure expansion, driven by rapid population growth, urbanization, and economic diversification efforts, especially in the GCC countries. The development of new cities, industrial zones, and oil & gas facilities fuels the demand for reliable power distribution components. Electrification initiatives in various African countries also contribute to market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Insulated Power Distribution Component Market.- ABB

- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- General Electric Company

- Hitachi Energy Ltd.

- Chint Group

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- TE Connectivity Ltd.

- Legrand S.A.

- Lucy Electric Ltd.

- Powell Industries Inc.

- Toshiba Corporation

- Larsen & Toubro Limited

- CG Power and Industrial Solutions Limited

- Bharat Heavy Electricals Limited (BHEL)

- Emerson Electric Co.

- WEG S.A.

Frequently Asked Questions

Analyze common user questions about the Air Insulated Power Distribution Component market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are air-insulated power distribution components?

Air-insulated power distribution components are electrical devices such as switchgear, circuit breakers, and disconnectors that use atmospheric air as the primary insulating medium. They are essential for managing and protecting electrical power in grids, industries, and commercial buildings.

Why is the market for these components growing?

The market is growing due to global grid modernization efforts, rapid industrialization and urbanization in emerging economies, increasing integration of renewable energy sources, and a rising demand for reliable, cost-effective, and environmentally friendly power distribution solutions.

What are the key advantages of air-insulated systems?

Key advantages include environmental friendliness (no greenhouse gases like SF6), lower initial and maintenance costs, proven reliability, ease of maintenance, and adaptability for various voltage levels and applications, making them a sustainable choice for power infrastructure.

How does AI impact air-insulated power distribution?

AI significantly impacts the market by enabling predictive maintenance, real-time fault detection, enhanced operational efficiency through optimized load balancing, and smarter asset management. It transforms traditional components into intelligent, interconnected systems for a more resilient grid.

What are the main applications of air-insulated power distribution components?

These components are widely applied in utilities (transmission, distribution, substations), industrial facilities (manufacturing, mining, data centers), commercial buildings (hospitals, offices), and infrastructure projects (railways, airports), as well as in renewable energy installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager