Airbag System Initiators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431265 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Airbag System Initiators Market Size

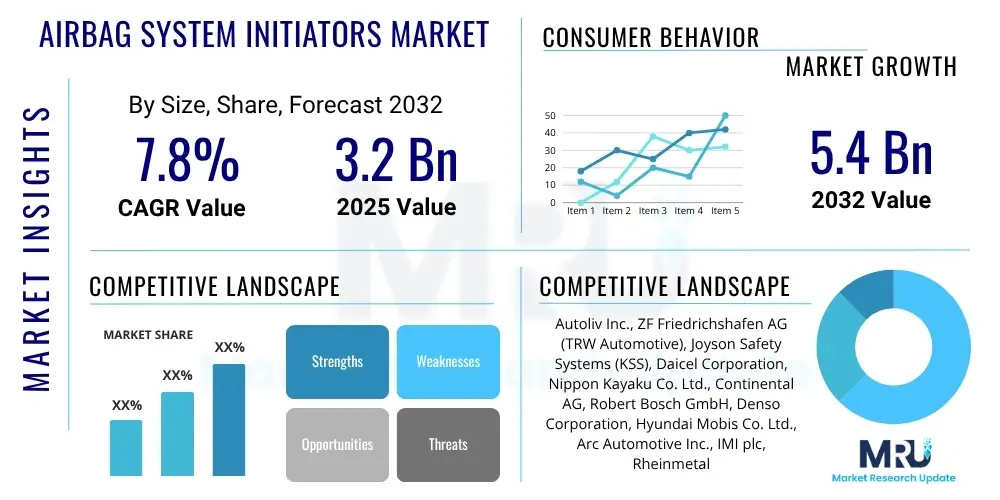

The Airbag System Initiators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 3.2 Billion in 2025 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2032.

Airbag System Initiators Market introduction

The Airbag System Initiators Market represents a critical segment within the automotive safety industry, providing the foundational technology for passive safety systems that protect vehicle occupants during a collision. Airbag system initiators are electrically actuated pyrotechnic devices designed to rapidly ignite a solid propellant, generating gas to inflate an airbag cushion within milliseconds of an impact. These components are paramount to modern vehicle safety, fulfilling increasingly stringent global regulations and consumer expectations for occupant protection. Their precise and reliable operation is non-negotiable, directly contributing to the effectiveness of the entire airbag system, which has been instrumental in significantly reducing fatalities and severe injuries in vehicular accidents across the globe.

The product description for airbag system initiators primarily centers on their function as a micro gas generator or a squib, engineered to produce a controlled explosion that facilitates instantaneous airbag deployment. These initiators are characterized by their compact size, robust construction, and extreme reliability, as they must perform flawlessly in a critical, singular event. They are integrated into various airbag modules, including frontal airbags, side-impact airbags, curtain airbags, and knee airbags, as well as seatbelt pretensioners. The sophisticated design often incorporates advanced electronic control mechanisms to ensure precise timing and sensitivity, preventing inadvertent deployment while guaranteeing activation in genuine crash scenarios. The inherent safety benefits of these devices are widely recognized, as they offer a vital layer of protection that works in conjunction with seatbelts to mitigate the impact forces on occupants, distributing loads more evenly and preventing contact with hard interior surfaces.

Major applications for airbag system initiators span the entire automotive sector, from passenger cars and light commercial vehicles to heavy-duty trucks and specialized transport. The pervasive implementation of airbags as a standard safety feature across virtually all new vehicles underscores the widespread demand for these initiators. The driving factors behind market growth are multifaceted, including the continuous evolution of global automotive safety standards, such as those mandated by regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) in the US, Euro NCAP in Europe, and similar organizations worldwide. Furthermore, a rising consumer awareness regarding vehicle safety, coupled with increasing disposable incomes in emerging economies, fuels the demand for vehicles equipped with comprehensive safety features. Technological advancements aimed at improving initiator reliability, miniaturization, and integration with complex vehicle electronics also serve as significant market drivers, pushing innovation and expanding the market's trajectory.

Airbag System Initiators Market Executive Summary

The Airbag System Initiators Market is currently experiencing robust growth, driven by an interplay of evolving business trends, distinct regional dynamics, and innovative segmental advancements. Business trends reveal a pronounced focus on supplier consolidation, with major Tier 1 automotive suppliers acquiring smaller specialized firms to achieve economies of scale and integrate advanced capabilities. There is also an increasing emphasis on developing more compact, lightweight, and environmentally friendly initiator solutions to meet evolving automotive design requirements and sustainability goals. Furthermore, the market is witnessing a surge in research and development activities aimed at enhancing the precision and reliability of initiator deployment, alongside efforts to reduce manufacturing costs through process optimization and automation. The integration of advanced diagnostics and predictive maintenance features into initiator systems is also a key business trend, ensuring proactive safety management throughout a vehicle's lifecycle.

Regionally, the market exhibits diverse growth trajectories. Asia Pacific is poised for significant expansion, fueled by burgeoning automotive production, rising consumer safety awareness, and the gradual adoption of more stringent safety regulations in countries like China, India, and Southeast Asian nations. This region represents both a major manufacturing hub and a rapidly expanding consumer market. North America and Europe, while mature markets, continue to demonstrate steady growth, primarily driven by the continuous update of safety standards, the integration of advanced driver-assistance systems (ADAS), and a consistent demand for premium vehicle segments that often feature more comprehensive airbag configurations. Latin America and the Middle East & Africa are emerging as promising markets, characterized by increasing vehicle parc and growing regulatory pressures to enhance vehicle safety, albeit with a slower adoption rate compared to developed regions, often influenced by economic volatility and infrastructural development.

Segment trends within the airbag system initiators market highlight a continued dominance of pyrotechnic initiators due to their proven reliability and cost-effectiveness. However, there is an observable shift towards micro gas generators and more sophisticated electrical initiators capable of precise, multi-stage deployment, especially in luxury and advanced vehicle models. The demand for initiators for side airbags and curtain airbags is experiencing accelerated growth, reflecting the increased focus on lateral impact protection. Moreover, the integration of initiators into seatbelt pretensioner systems is becoming standard, further augmenting occupant restraint efficacy. As vehicle electrification and autonomous driving technologies advance, segments related to smart, adaptive airbag systems that can tailor deployment based on crash severity, occupant position, and vehicle dynamics are expected to witness substantial innovation and market penetration.

AI Impact Analysis on Airbag System Initiators Market

Common user questions regarding AI's impact on the Airbag System Initiators Market often revolve around how artificial intelligence can enhance safety, improve deployment accuracy, and integrate with advanced vehicle systems. Users are keen to understand if AI can reduce false positives or negatives, leading to more reliable airbag activation, and whether it can contribute to more adaptive and personalized occupant protection. There are also expectations that AI will play a role in predicting crash severity and optimizing deployment strategies in complex scenarios, such as multi-impact collisions or situations involving autonomous vehicles. Concerns frequently touch upon the reliability and trustworthiness of AI algorithms in safety-critical applications, the potential for new types of system failures, and the ethical implications of AI-driven decision-making in life-saving systems. Overall, the themes center on AI's potential to revolutionize the precision, adaptability, and overall intelligence of airbag systems, transitioning them from reactive devices to more proactive and context-aware safety solutions.

- Enhanced sensor fusion for accident prediction: AI algorithms can analyze data from multiple vehicle sensors (radar, lidar, cameras, accelerometers) to more accurately predict the imminence and severity of a collision, optimizing the timing and force of initiator activation for airbag deployment.

- Adaptive deployment strategies based on occupant position and size: AI-powered systems can use interior cameras and pressure sensors to determine occupant classification (child vs. adult), seating position, and posture, allowing for intelligent adjustment of initiator firing sequences and airbag inflation characteristics.

- Reduced false deployments through intelligent algorithms: By processing vast amounts of driving data and environmental conditions, AI can differentiate between genuine collision events and non-critical impacts (e.g., potholes, minor bumps), significantly minimizing the risk of unnecessary or erroneous airbag deployment.

- Integration with advanced driver-assistance systems (ADAS): AI facilitates seamless communication and coordination between ADAS features (like automatic emergency braking) and the passive safety systems, enabling pre-crash preparedness actions that can optimize airbag performance before impact.

- Predictive maintenance for initiator systems: AI can monitor the operational health of airbag initiators and related components, identifying potential malfunctions or degradation over time, thereby enabling proactive maintenance or replacement to ensure consistent reliability throughout the vehicle's lifespan.

- Development of personalized occupant protection: Future AI systems could tailor airbag deployment not just to general occupant characteristics but to individual biometric data or dynamic movements immediately preceding an impact, offering a highly personalized safety response.

- Simulation and testing optimization: AI and machine learning are increasingly used in virtual crash testing and simulation environments, accelerating the design and validation process for new initiator technologies and airbag system architectures, reducing physical prototyping costs and time.

DRO & Impact Forces Of Airbag System Initiators Market

The Airbag System Initiators Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, shaped by powerful impact forces inherent to the automotive safety sector. A primary driver is the global escalation of stringent automotive safety regulations, with governments and regulatory bodies continuously updating and expanding mandates for passive safety features in new vehicles. This includes requirements for more airbags per vehicle, advanced occupant protection systems, and enhanced crash test protocols that necessitate highly responsive and reliable initiators. Concurrently, the increasing global vehicle production, particularly in emerging markets, contributes significantly to market expansion. Consumer demand for safer vehicles, often influenced by safety ratings and public awareness campaigns, further fuels the integration of comprehensive airbag systems. Lastly, continuous technological advancements in automotive electronics, sensor technology, and pyrotechnic materials enable the development of more precise, compact, and efficient initiators, enhancing performance and driving innovation.

Despite these growth drivers, several restraints pose challenges to the market. High research and development costs associated with developing new initiator technologies and ensuring their impeccable reliability are substantial, requiring significant investment from manufacturers. The market is also subject to incredibly stringent testing and validation requirements, often spanning years and incurring considerable expenses to meet global safety standards and prevent potentially catastrophic recalls. Past incidents of major airbag recalls have created a cautious environment, leading to increased scrutiny and compliance burdens for manufacturers. Supply chain disruptions, exacerbated by geopolitical events or global pandemics, can severely impact production and delivery schedules. Furthermore, cost sensitivity, particularly in highly competitive and price-conscious automotive markets, especially in developing economies, can limit the adoption of more advanced or expensive initiator technologies, putting pressure on profit margins for component suppliers.

Opportunities within the Airbag System Initiators Market are abundant and largely converge on the future of automotive mobility. The ongoing development of advanced occupant protection systems, including pedestrian protection airbags, external airbags, and multi-stage or adaptive airbag deployments, presents significant avenues for innovation and market penetration. The advent of autonomous vehicles is a transformative opportunity, as these vehicles will require re-imagined interior configurations and dynamic occupant positions, necessitating novel airbag designs and initiator placements to ensure safety in diverse crash scenarios, including those without a traditional driver. Market penetration in emerging economies, driven by rising disposable incomes and increasing vehicle ownership, offers a vast untapped potential for increased sales of airbag-equipped vehicles. Furthermore, advancements in lightweight materials and smart airbag systems that leverage AI and sensor data for highly personalized and optimized deployment represent long-term growth prospects, pushing the boundaries of what passive safety systems can achieve. The drive towards electrification also opens doors for initiators that are compatible with new vehicle architectures and power systems, potentially influencing design and material choices.

Segmentation Analysis

The Airbag System Initiators Market is extensively segmented to reflect the diverse product offerings, vehicle applications, and end-user requirements prevalent in the global automotive safety industry. Understanding these segments is crucial for market participants to identify growth niches, tailor product development strategies, and optimize distribution channels. The primary segmentation dimensions include the type of initiator technology employed, the specific vehicle type in which they are integrated, the particular application or location of the airbag within the vehicle, and the sales channel through which these components reach the automotive ecosystem. Each segment is influenced by technological advancements, regulatory mandates, and specific market demands, leading to varied growth patterns and competitive landscapes across the globe. This detailed segmentation allows for a granular analysis of market dynamics, enabling stakeholders to navigate the complexities and capitalize on emerging trends.

- By Type

- Pyrotechnic Initiators: Dominate the market due to proven reliability and cost-effectiveness, using a chemical charge to generate gas.

- Micro Gas Generators: Smaller, more precise, often used in pretensioners and side airbags, offering controlled gas generation.

- Others: Includes experimental or niche technologies like electric initiators and alternative propellants.

- By Vehicle Type

- Passenger Cars: The largest segment, encompassing sedans, hatchbacks, SUVs, and minivans, driven by high production volumes and safety standards.

- Commercial Vehicles: Includes light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and buses, with growing adoption of safety features.

- By Application

- Frontal Airbags: Driver and passenger airbags, traditionally the most common application.

- Side Airbags: Include torso and head protection, offering lateral impact safety.

- Curtain Airbags: Deploy from the roofline to cover side windows, protecting occupants from side impacts and rollovers.

- Knee Airbags: Designed to protect the lower extremities from impact with the dashboard.

- Seatbelt Pretensioners: Components that tighten the seatbelt instantly during a crash, working in conjunction with airbags.

- Others: Includes niche applications like pedestrian airbags, external airbags, and center airbags.

- By Sales Channel

- OEM (Original Equipment Manufacturer): The primary channel, where initiators are supplied directly to automotive manufacturers for integration into new vehicles.

- Aftermarket: A smaller segment comprising replacement parts for repairs or modifications, though less common for safety-critical initiators.

- By Regional Market

- North America: Stable market with high safety standards and technological adoption.

- Europe: Stringent regulations, innovation-driven market, focus on advanced safety.

- Asia Pacific (APAC): Rapid growth due to increasing vehicle production and rising safety awareness.

- Latin America: Emerging market with growing safety regulations and vehicle sales.

- Middle East & Africa (MEA): Developing market with potential for future growth as automotive industry matures.

Value Chain Analysis For Airbag System Initiators Market

The value chain for the Airbag System Initiators Market is characterized by a multi-tiered structure, beginning with the upstream supply of raw materials and complex components, flowing through manufacturing and assembly, and culminating in delivery to automotive original equipment manufacturers (OEMs). The upstream segment involves a diverse range of suppliers providing specialized chemicals for propellant formulations, high-strength metals for casings and electrodes, and advanced plastics for various housing and sealing components. These suppliers operate under strict quality controls and often engage in long-term contracts with initiator manufacturers. Key activities at this stage include sourcing, refining, and preparing materials that meet precise specifications for purity, thermal stability, and mechanical strength, which are critical for the safety and reliability of the final initiator product. Research and development in material science, focusing on miniaturization and enhanced performance, are also vital upstream activities that drive innovation across the value chain.

Moving downstream, the value chain progresses through the manufacturing of the initiators themselves, often by specialized Tier 2 or Tier 1 suppliers who possess extensive expertise in pyrotechnic devices and precision engineering. These manufacturers assemble the various components, including the bridge wire, igniter charge, and output charge, within a robust casing. Following manufacturing, the initiators are then typically supplied to Tier 1 airbag module manufacturers, who integrate them with airbag cushions, inflators, and electronic control units (ECUs) to form complete airbag modules. These modules are then supplied directly to automotive OEMs for installation into vehicles on the assembly line. The downstream segment is highly critical as it involves stringent testing and validation processes at each stage to ensure the flawless operation of the entire airbag system. Packaging, logistics, and supply chain management are also key downstream activities, ensuring timely and secure delivery of these sensitive components.

Distribution channels in the Airbag System Initiators Market are predominantly direct from Tier 1 suppliers to automotive OEMs, particularly for initial equipment installations in new vehicles. This direct channel facilitates close collaboration between suppliers and manufacturers, allowing for custom specifications, design integration, and stringent quality assurance throughout the vehicle development cycle. Indirect distribution, though less prominent for new vehicle production, exists in the aftermarket segment, where a limited number of replacement initiators or complete airbag modules might be distributed through authorized service centers, specialized automotive parts distributors, or certified repair shops. However, due to the safety-critical nature of these components and the complexity of installation, aftermarket sales of individual initiators are highly regulated and often discouraged in favor of complete module replacements handled by trained professionals. The distribution network emphasizes reliability, security, and traceability, given the hazardous nature of pyrotechnic devices and the paramount importance of their functionality.

Airbag System Initiators Market Potential Customers

The primary and most significant potential customers for Airbag System Initiators are the automotive Original Equipment Manufacturers (OEMs). These global automobile manufacturers, ranging from mass-market producers to luxury brands, integrate these critical components into every new vehicle they produce. Their demand is driven by evolving safety regulations, consumer expectations for enhanced vehicle safety features, and the continuous innovation in vehicle design, which often necessitates new types and placements of airbags. OEMs directly procure initiators or complete airbag modules from Tier 1 suppliers who specialize in automotive safety systems. The relationship between OEMs and their suppliers is characterized by long-term contracts, rigorous qualification processes, and collaborative product development to ensure seamless integration and adherence to the highest safety and quality standards.

Beyond the direct OEM market, Tier 1 suppliers specializing in airbag modules and complete occupant safety systems also serve as key customers. These companies, such as Autoliv, ZF Friedrichshafen (TRW), and Joyson Safety Systems, purchase initiators from specialized manufacturers and integrate them into their proprietary airbag module designs. They then supply these complete modules to various automotive OEMs. This tiered customer structure signifies the complexity of the automotive supply chain. Additionally, to a much lesser extent, aftermarket repair and replacement service providers, including authorized dealerships and independent garages, represent a peripheral customer segment. However, due to the highly regulated and safety-critical nature of airbag components, the replacement of individual initiators is rare, with most repairs involving the replacement of entire airbag modules or sophisticated re-calibration by certified technicians, thereby limiting the direct aftermarket sales of standalone initiators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 5.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autoliv Inc., ZF Friedrichshafen AG (TRW Automotive), Joyson Safety Systems (KSS), Daicel Corporation, Nippon Kayaku Co. Ltd., Continental AG, Robert Bosch GmbH, Denso Corporation, Hyundai Mobis Co. Ltd., Arc Automotive Inc., IMI plc, Rheinmetall AG, Safran S.A., MSD Ignition, Littelfuse, Inc., Melexis, STMicroelectronics, Infineon Technologies AG, Key Safety Systems (now part of Joyson Safety Systems), Takata Corporation (now part of Joyson Safety Systems) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airbag System Initiators Market Key Technology Landscape

The Airbag System Initiators Market is driven by a sophisticated and continuously evolving technology landscape, essential for meeting the ever-increasing demands for occupant safety and vehicle integration. At the core are highly specialized pyrotechnic materials and advanced propellant formulations, carefully engineered to produce a precise, rapid, and reproducible gas generation curve upon ignition. This requires extensive knowledge of material science, chemical engineering, and combustion dynamics to ensure optimal performance across a wide range of operating temperatures and environmental conditions. Concurrently, the miniaturization of these pyrotechnic devices is a key technological trend, enabling their integration into increasingly compact and complex vehicle architectures, such as steering wheels, dashboards, seats, and roofliners, without compromising performance or safety. This miniaturization is crucial for supporting multi-airbag systems that protect occupants from various angles and impact types, while also reducing overall weight.

Beyond the pyrotechnic core, advancements in micro-electromechanical systems (MEMS) sensors play a pivotal role in the overall airbag system, indirectly influencing initiator technology. These highly sensitive accelerometers and pressure sensors detect impact events with extreme precision, triggering the electronic control unit (ECU) which then sends the electrical signal to the initiator. The reliability and responsiveness of these sensors are paramount, preventing false deployments while ensuring activation in genuine collision scenarios. Furthermore, the development of robust and precise electrical ignition systems, including the bridge wire and associated circuitry, is fundamental. These systems must deliver the exact amount of energy required to initiate the pyrotechnic charge within microseconds, reliably and repeatedly, throughout the vehicle's lifespan, often under harsh automotive operating conditions.

The broader technology landscape also encompasses advanced electronic control units (ECUs) that integrate complex algorithms for crash sensing, occupant classification, and deployment decision-making. These ECUs are becoming increasingly sophisticated, leveraging data from multiple sensors to determine the optimal timing and intensity of initiator firing. Diagnostic capabilities are another critical technological aspect, allowing the vehicle's onboard systems to continuously monitor the health and readiness of each initiator and the entire airbag system, alerting the driver to any potential malfunctions. Looking ahead, the integration of smart materials and AI-driven control systems is set to revolutionize initiator technology, enabling adaptive and predictive airbag deployments that can tailor protection based on real-time crash parameters, occupant characteristics, and even pre-impact vehicle dynamics. This holistic technological advancement ensures that airbag system initiators remain at the forefront of automotive passive safety.

Regional Highlights

- North America: The North American market for airbag system initiators is characterized by its maturity, robust regulatory framework, and consistent demand for advanced safety features. Countries like the United States and Canada have some of the most stringent automotive safety standards globally, driving continuous innovation and widespread adoption of multi-airbag systems across all vehicle segments. The region exhibits a high penetration rate of sophisticated vehicle models equipped with frontal, side, curtain, and knee airbags, often featuring adaptive deployment capabilities. A strong presence of major automotive OEMs and Tier 1 suppliers fuels consistent R&D investments, focusing on enhancing initiator reliability, miniaturization, and integration with evolving vehicle architectures, including electric vehicles and future autonomous platforms. Consumer awareness regarding vehicle safety is also exceptionally high, reinforcing market stability and demand for premium safety solutions.

- Europe: Europe stands as a pivotal hub for innovation and stringent safety standards within the airbag system initiators market. Regulatory bodies like Euro NCAP continuously push for higher safety ratings, which directly translates to a demand for advanced and more numerous airbag systems in vehicles. Countries such as Germany, France, and Italy, with their strong automotive manufacturing bases, are at the forefront of adopting and developing next-generation initiator technologies. There is a significant emphasis on pedestrian protection systems, external airbags, and intelligent adaptive airbag systems that can optimize deployment based on crash severity and occupant characteristics. The European market is also a leader in sustainable manufacturing practices, influencing the development of initiators with reduced environmental impact and higher recyclability. The shift towards electric and hybrid vehicles also shapes the design and integration requirements for initiators, ensuring compatibility with new vehicle layouts and power systems.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for airbag system initiators, driven by the burgeoning automotive industry, particularly in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and a growing middle class are contributing to a surge in vehicle production and sales across these nations. While historically some markets in APAC had less stringent safety regulations, there is a clear trend towards adopting international safety standards and implementing local mandates for essential safety features, including airbags. This regulatory evolution, coupled with rising consumer safety awareness, is propelling the demand for comprehensive airbag systems. The region also serves as a major manufacturing hub for automotive components, making it a critical area for both supply and demand within the global market. Investment in localized R&D and manufacturing facilities is increasing to cater to the specific needs and cost sensitivities of the diverse markets within APAC.

- Latin America: The Latin American market for airbag system initiators is experiencing gradual yet consistent growth, primarily influenced by increasing automotive production and the progressive implementation of stricter safety regulations. Countries like Brazil, Mexico, and Argentina are leading the adoption of advanced safety features, driven by initiatives from regional safety organizations and international automotive safety standards. While traditionally focused on basic frontal airbag systems, there is a growing trend towards integrating side and curtain airbags in new vehicle models to meet evolving safety benchmarks. Economic fluctuations and infrastructure challenges can sometimes impact market growth, but the underlying demand for safer vehicles continues to expand. The market is also influenced by the import of vehicles and technologies from North America and Europe, which often come equipped with advanced passive safety systems, thereby setting new benchmarks for local production.

- Middle East and Africa (MEA): The Middle East and Africa region represents an emerging market for airbag system initiators, with significant growth potential tied to ongoing infrastructure development, increasing vehicle ownership, and nascent but growing automotive manufacturing capabilities. The adoption of airbag systems is expanding, especially in countries with higher per capita income and more developed automotive markets, such as Saudi Arabia, UAE, and South Africa. While regulatory frameworks are still evolving in many parts of the region, there is a clear trend towards aligning with international safety standards, especially as global automotive brands expand their presence. The demand is largely influenced by the import of vehicles from Europe, Asia, and North America, which are equipped with modern safety features. Local initiatives to enhance road safety and consumer awareness campaigns are also contributing to the gradual increase in demand for vehicles with comprehensive airbag systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airbag System Initiators Market.- Autoliv Inc.

- ZF Friedrichshafen AG (TRW Automotive)

- Joyson Safety Systems (KSS)

- Daicel Corporation

- Nippon Kayaku Co. Ltd.

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Hyundai Mobis Co. Ltd.

- Arc Automotive Inc.

- IMI plc

- Rheinmetall AG

- Safran S.A.

- MSD Ignition

- Littelfuse, Inc.

- Melexis

- STMicroelectronics

- Infineon Technologies AG

- Key Safety Systems (now part of Joyson Safety Systems)

- Takata Corporation (now part of Joyson Safety Systems)

Frequently Asked Questions

What are airbag system initiators?

Airbag system initiators are precision-engineered pyrotechnic devices designed to rapidly generate gas to inflate an airbag cushion upon receiving an electrical signal during a vehicle collision. They are critical components of passive safety systems, ensuring instantaneous deployment for occupant protection.

How do safety regulations impact the Airbag System Initiators Market?

Safety regulations are a primary driver for the market, as increasingly stringent global mandates for vehicle safety, such as those from NHTSA and Euro NCAP, necessitate the inclusion of more airbags per vehicle and advanced deployment capabilities, directly boosting demand for sophisticated initiators.

What role does technology play in initiator development?

Technology is crucial, with advancements in pyrotechnic materials, miniaturization, MEMS sensors, and electronic control units enabling more precise, reliable, and adaptive initiator performance. Future developments focus on AI integration for smart, predictive, and personalized airbag deployments.

Which regions are key for Airbag System Initiators Market growth?

Asia Pacific is a significant growth region due to booming automotive production and evolving safety standards. North America and Europe remain key mature markets, driven by consistent demand for advanced safety features and continuous regulatory updates.

What challenges does the Airbag System Initiators Market face?

The market faces challenges including high research and development costs, stringent testing requirements, the risk of recalls, potential supply chain disruptions, and intense cost sensitivity, particularly in emerging markets, all of which demand robust quality control and efficient manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager