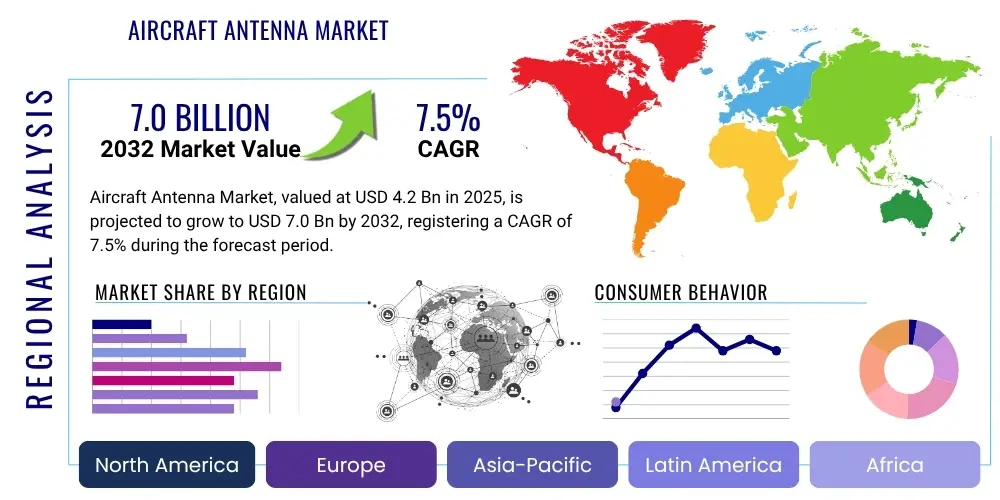

Aircraft Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431258 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aircraft Antenna Market Size

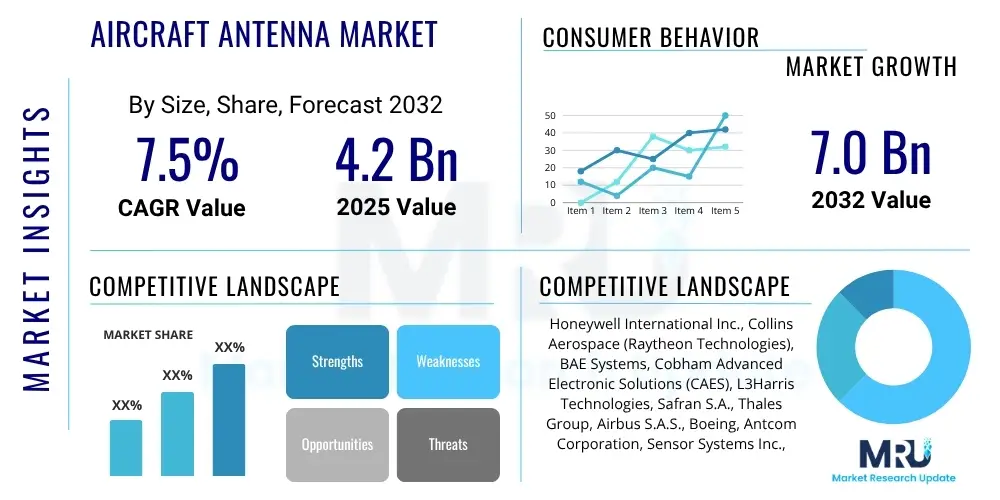

The Aircraft Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at $4.2 Billion in 2025 and is projected to reach $7.0 Billion by the end of the forecast period in 2032.

Aircraft Antenna Market introduction

Aircraft antennas are integral components of any airborne platform, serving as critical interfaces for communication, navigation, and surveillance systems. These specialized devices are designed to withstand extreme environmental conditions while facilitating the transmission and reception of electromagnetic waves, enabling essential functions from ground control interactions to in-flight entertainment. The performance and reliability of aircraft antennas directly impact flight safety, operational efficiency, and the overall passenger experience. Modern aircraft require a diverse array of antenna types, each optimized for specific frequency bands and operational purposes, ranging from traditional blade antennas to advanced phased array systems.

The core function of an aircraft antenna is to provide seamless connectivity and situational awareness for the crew and ground operations. Major applications include voice communication (VHF/UHF), data transmission, GPS navigation, weather radar, air traffic control transponder services, and satellite communications (SATCOM) for broadband internet and global reach. The benefits derived from these sophisticated systems are manifold, encompassing enhanced flight safety through precise navigation and collision avoidance, improved operational efficiency by streamlining communication flows, and enriched passenger experience through reliable in-flight connectivity. The continuous evolution of avionics demands ever more capable and compact antenna solutions.

Driving factors for the aircraft antenna market include the burgeoning demand for air travel globally, leading to increased aircraft production and fleet modernization initiatives. Furthermore, the imperative for higher bandwidth and ubiquitous connectivity, both for operational data and passenger services, is spurring innovation in antenna design. The expansion of the Unmanned Aerial Vehicle (UAV) market, encompassing both military and commercial applications, also presents a significant growth avenue, as these platforms rely heavily on advanced antenna systems for command, control, and data link capabilities. The ongoing digital transformation within the aviation sector necessitates more robust, versatile, and high-performance antenna solutions to support next-generation aircraft systems.

Aircraft Antenna Market Executive Summary

The Aircraft Antenna Market is experiencing robust growth driven by the modernization of global aircraft fleets, increasing demand for high-speed in-flight connectivity, and the expansion of unmanned aerial vehicle (UAV) operations. Business trends indicate a focus on miniaturization, multi-band capabilities, and the integration of advanced digital technologies to support enhanced communication and navigation systems. Regional trends highlight North America and Europe as established markets due to a strong presence of aerospace OEMs and defense spending, while the Asia Pacific region is emerging as a significant growth hub, propelled by rapidly expanding commercial aviation sectors and defense modernization programs. Segment trends showcase strong growth in satellite communication (SATCOM) antennas driven by the demand for global broadband connectivity, along with increasing adoption of phased array antennas for enhanced performance and adaptability, reflecting the industry's shift towards more integrated and software-defined avionics architectures.

AI Impact Analysis on Aircraft Antenna Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize aircraft antenna performance, reliability, and design. Key questions revolve around AI's ability to optimize antenna arrays for dynamic environments, enhance signal processing for superior data throughput, predict maintenance needs to reduce downtime, and bolster cybersecurity for critical communication links. The overarching theme is the expectation that AI will lead to more intelligent, adaptive, and autonomous antenna systems. Concerns often include the complexity of integrating AI into highly regulated aerospace systems, the need for robust AI algorithms that can guarantee performance and safety, and the potential for new vulnerabilities if AI systems are compromised. Users anticipate significant advancements in antenna capabilities, particularly in areas requiring real-time adaptation and complex data analysis, but also emphasize the importance of rigorous testing and certification for AI-driven solutions in aviation.

- AI enables real-time adaptive beamforming, optimizing signal direction and strength dynamically for improved communication quality and range, especially in challenging environments.

- Predictive maintenance analytics, powered by AI, can monitor antenna health, anticipate potential failures, and schedule proactive repairs, thereby enhancing reliability and reducing operational costs.

- AI algorithms facilitate advanced signal processing, improving noise reduction, interference cancellation, and data throughput for high-bandwidth applications like in-flight entertainment and operational data links.

- AI contributes to the design and optimization of antenna geometries, utilizing machine learning to explore complex design spaces for superior performance characteristics and miniaturization.

- Enhanced security protocols through AI-driven anomaly detection can identify and mitigate cyber threats targeting aircraft communication systems and antenna controls.

- AI supports cognitive radio functionalities, allowing antennas to intelligently sense and adapt to available spectrum, improving spectrum efficiency and resilience against jamming.

DRO & Impact Forces Of Aircraft Antenna Market

The Aircraft Antenna Market is significantly influenced by a confluence of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the escalating global demand for air travel, which necessitates the production of new aircraft and the modernization of existing fleets, all requiring advanced communication and navigation capabilities. Furthermore, the persistent push for higher data rates and seamless connectivity, both for operational efficiency and passenger services, fuels innovation in antenna technology. The burgeoning market for Unmanned Aerial Vehicles (UAVs) across defense, commercial, and civilian sectors also acts as a powerful driver, as these platforms are entirely dependent on robust and compact antenna systems for their command, control, and payload data transmission.

Conversely, the market faces notable restraints. The aerospace industry's stringent regulatory and certification processes for new components, including antennas, impose considerable time and cost burdens on manufacturers, potentially delaying market entry for innovative solutions. The high cost associated with research and development for cutting-edge antenna technologies, coupled with specialized manufacturing processes and materials, contributes to higher product costs, which can impact adoption rates. Moreover, the complexities involved in integrating diverse antenna systems into increasingly crowded aircraft structures, while maintaining aerodynamic efficiency and electromagnetic compatibility, present significant engineering challenges that restrain rapid deployment.

Opportunities within the market are abundant, particularly with the advent of 5G technology, promising ultra-low latency and high-bandwidth capabilities that will revolutionize in-flight connectivity and air-to-ground communication. The development of advanced antenna materials, such as metamaterials and reconfigurable antennas, offers pathways to improved performance, reduced size, and lower weight. The expansion of satellite internet services for aviation, leveraging constellations of Low Earth Orbit (LEO) satellites, creates substantial demand for advanced SATCOM antennas capable of tracking multiple satellites simultaneously. Additionally, emerging segments like Urban Air Mobility (UAM) and continued global defense modernization programs present new frontiers for specialized antenna solutions, while the integration of IoT within aviation expands the scope for sensor and communication antenna applications. These opportunities, combined with the inherent impact forces of continuous technological innovation and evolving regulatory landscapes, shape a dynamic and forward-looking market.

Segmentation Analysis

The aircraft antenna market is broadly segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for precise analysis of market trends, technological preferences, and end-user demands across various aircraft types and operational needs. The market can be categorized by antenna type, the specific application it serves, the end-user utilizing the aircraft, and the operational frequency band. Each segment reflects unique technological requirements, market dynamics, and competitive landscapes, driving specialized innovation and product development to meet the stringent demands of the aviation sector.

- By Type:

- Blade Antennas

- Dipole Antennas

- Horn Antennas

- Patch Antennas

- Phased Array Antennas

- S-band Antennas

- X-band Antennas

- Ku-band Antennas

- Ka-band Antennas

- L-band Antennas

- VHF/UHF Antennas

- GPS Antennas

- Satellite Communication (SATCOM) Antennas

- Transponder Antennas

- Weather Radar Antennas

- By Application:

- Communication

- Air-to-Air Communication

- Air-to-Ground Communication

- Satellite Communication

- Navigation

- GPS/GNSS

- VOR/ILS

- Surveillance

- ATC Transponder

- TCAS

- Weather Radar

- Electronic Warfare (EW)

- Communication

- By End-User:

- Commercial Aircraft

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Military Aircraft

- Fighter Aircraft

- Transport Aircraft

- Helicopters

- UAVs (Military)

- Business Jets

- General Aviation

- UAVs (Commercial/Civil)

- Commercial Aircraft

- By Frequency:

- Low Frequency (LF)

- High Frequency (HF)

- Very High Frequency (VHF)

- Ultra High Frequency (UHF)

- L-band

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

- V-band

- W-band

Value Chain Analysis For Aircraft Antenna Market

The value chain for the Aircraft Antenna Market begins with upstream activities encompassing the sourcing of specialized raw materials and the manufacturing of intricate electronic components. This stage involves suppliers of high-grade metals, ceramics, composites, and semiconductors that are crucial for antenna fabrication, ensuring durability, lightweight properties, and optimal electrical performance under extreme aerospace conditions. Key component manufacturers provide filters, amplifiers, transceivers, and digital signal processors that are integrated into the final antenna systems. The specialized nature of these materials and components often requires proprietary technologies and stringent quality control, driving a focus on partnerships and long-term supply agreements within this segment.

Moving downstream, the value chain progresses through the original equipment manufacturers (OEMs) of aircraft antennas, who design, assemble, and test the complete antenna systems. These OEMs often engage in extensive research and development to innovate new antenna types, improve existing designs, and comply with evolving aviation standards. Following manufacturing, the distribution channel plays a pivotal role, primarily involving direct sales to major aircraft manufacturers (e.g., Boeing, Airbus) for new aircraft installations, and to Maintenance, Repair, and Overhaul (MRO) providers or direct to airlines for aftermarket upgrades and replacements. Indirect channels may include specialized aerospace distributors who manage logistics and provide technical support across various regions.

The final stages involve the integration of antennas into aircraft platforms and their subsequent operational use. Aircraft OEMs incorporate these antennas during the initial aircraft assembly, while MROs and airlines handle installation during scheduled maintenance or for specific upgrade projects. The entire value chain is characterized by a strong emphasis on quality assurance, regulatory compliance, and post-sales support, reflecting the critical safety and operational requirements of the aviation industry. Direct engagement with aircraft manufacturers ensures seamless integration and customization, whereas the aftermarket distribution networks provide essential services for the global operational fleet. This complex interdependency across upstream and downstream partners ensures the continuous functionality and evolution of aircraft antenna technology.

Aircraft Antenna Market Potential Customers

The primary potential customers for aircraft antennas are diverse, ranging from major global aircraft manufacturers to various aviation operators and defense organizations. Aircraft OEMs such as Boeing, Airbus, Embraer, and Bombardier represent a significant customer base, procuring antennas for integration into new commercial, regional, and business jet platforms. These manufacturers require a wide array of antennas for communication, navigation, and surveillance systems to be installed during the aircraft's initial assembly. Their procurement decisions are heavily influenced by performance specifications, reliability, weight, aerodynamic impact, and compliance with rigorous aviation certification standards.

Beyond initial manufacturing, the aftermarket segment constitutes another substantial customer base. This includes commercial airlines globally, which require antennas for fleet modernization, upgrades, replacements due to wear and tear, or to adapt to new regulatory mandates or technological advancements. Maintenance, Repair, and Overhaul (MRO) service providers also act as crucial intermediaries, purchasing antennas for the airlines and aircraft operators they serve. Similarly, business jet operators and general aviation enthusiasts purchase antennas for their respective fleets, often prioritizing compact size, ease of installation, and cost-effectiveness tailored to smaller aircraft.

Furthermore, military forces and defense contractors worldwide are pivotal customers, driving demand for highly specialized, ruggedized, and often clandestine antenna systems for military aircraft, helicopters, and UAVs. These customers prioritize anti-jamming capabilities, secure communications, electronic warfare applications, and stealth characteristics. The growing market for Unmanned Aerial Vehicles (UAVs), both military and commercial, also represents a rapidly expanding customer segment, seeking lightweight, efficient, and reliable antennas for command and control, telemetry, and payload data transmission. Each customer segment presents unique demands and purchasing criteria, necessitating a tailored approach from antenna manufacturers to address specific operational and technical requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.2 Billion |

| Market Forecast in 2032 | $7.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Collins Aerospace (Raytheon Technologies), BAE Systems, Cobham Advanced Electronic Solutions (CAES), L3Harris Technologies, Safran S.A., Thales Group, Airbus S.A.S., Boeing, Antcom Corporation, Sensor Systems Inc., Astronics Corporation, Carlisle Interconnect Technologies, TE Connectivity, Meggitt PLC, RST Engineering, Rohde & Schwarz, General Dynamics Corporation, Leonardo S.p.A., Data Device Corporation (DDC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Antenna Market Key Technology Landscape

The aircraft antenna market is characterized by a rapidly evolving technological landscape, driven by the continuous demand for enhanced performance, miniaturization, and multi-functional capabilities. One of the most significant advancements is the proliferation of phased array antennas, which offer electronic beam steering, allowing for rapid and precise signal direction without physical movement. This technology is crucial for high-speed satellite communications, advanced radar systems, and electronic warfare applications, providing superior adaptability and resilience compared to traditional fixed-beam antennas. The integration of such arrays also enables multi-functionality from a single aperture, reducing the number of antennas required on an aircraft and thereby minimizing drag and weight.

Another pivotal technological trend is the development of Software Defined Radio (SDR) and Software Defined Antennas (SDA). These technologies allow for dynamic reconfiguration of antenna characteristics and radio functionalities through software, offering unprecedented flexibility in supporting multiple frequency bands, modulation schemes, and communication protocols. This software-centric approach facilitates rapid upgrades and adaptability to new standards or operational requirements without extensive hardware modifications, significantly extending the lifespan and utility of antenna systems. Miniaturization techniques, including the use of advanced materials like metamaterials and novel fabrication processes, are also paramount, enabling the design of smaller, lighter, and more aerodynamically efficient antennas, which is critical for UAVs and space-constrained aircraft platforms.

Furthermore, the market is seeing significant innovation in multi-band and ultra-wideband antennas, designed to cover a broad spectrum of frequencies for various applications from VHF to Ka-band within a single unit. This reduces complexity and installation costs. Anti-jamming and anti-spoofing technologies, particularly for navigation and critical communication systems, are also becoming standard requirements, leveraging advanced signal processing and adaptive algorithms to maintain integrity in hostile electromagnetic environments. The impending rollout of 5G networks is driving the development of new air-to-ground communication antenna solutions, while the expansion of Low Earth Orbit (LEO) satellite constellations is accelerating the need for high-gain, low-profile, and electronically steered SATCOM antennas capable of maintaining continuous connectivity with fast-moving satellites. These technological advancements collectively underpin the market's trajectory towards more intelligent, integrated, and versatile antenna systems.

Regional Highlights

- North America: Dominant market share attributed to the presence of major aerospace and defense contractors, significant R&D investments, and robust defense spending, leading to advanced avionics development and fleet upgrades.

- Europe: Strong market driven by leading aircraft manufacturers like Airbus and major defense initiatives, coupled with a focus on sustainable aviation and modernization of air traffic management systems.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapidly expanding commercial aviation fleets, increasing passenger traffic, growing defense budgets, and rising demand for enhanced connectivity in emerging economies like China and India.

- Latin America: Moderate growth driven by ongoing fleet modernization programs, particularly in commercial aviation, and increasing regional air travel, creating demand for efficient communication and navigation solutions.

- Middle East and Africa (MEA): Emerging market with significant investments in new aircraft purchases by well-funded airlines and defense modernization efforts, particularly in the Gulf Cooperation Council (GCC) countries, contributing to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Antenna Market.- Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- BAE Systems

- Cobham Advanced Electronic Solutions (CAES)

- L3Harris Technologies

- Safran S.A.

- Thales Group

- Airbus S.A.S.

- Boeing

- Antcom Corporation

- Sensor Systems Inc.

- Astronics Corporation

- Carlisle Interconnect Technologies

- TE Connectivity

- Meggitt PLC

- RST Engineering

- Rohde & Schwarz

- General Dynamics Corporation

- Leonardo S.p.A.

- Data Device Corporation (DDC)

Frequently Asked Questions

What are the primary functions of aircraft antennas?

Aircraft antennas serve critical functions including communication (air-to-air, air-to-ground, satellite), navigation (GPS, VOR/ILS), and surveillance (ATC transponders, weather radar, TCAS), ensuring flight safety, operational efficiency, and passenger connectivity.

How is 5G technology impacting aircraft antenna design?

5G technology is driving the development of new, high-bandwidth, low-latency antennas capable of supporting enhanced in-flight connectivity, real-time data exchange, and improved air-to-ground communication, necessitating advanced phased array and multi-band designs.

What challenges do aircraft antenna manufacturers face?

Manufacturers face challenges such as stringent regulatory certification processes, high R&D costs, the need for miniaturization and lightweight designs, complex integration into aircraft structures, and ensuring electromagnetic compatibility in crowded avionics environments.

What role do phased array antennas play in modern aircraft?

Phased array antennas are crucial for modern aircraft due to their ability to electronically steer beams, providing rapid, agile, and simultaneous communication links for satellite services, radar, and electronic warfare, enhancing performance and reducing physical components.

How does regulatory compliance affect the aircraft antenna market?

Regulatory compliance significantly impacts the market by requiring rigorous testing, adherence to international aviation standards (e.g., FAA, EASA), and extensive certification processes, which influence design, manufacturing, market entry, and operational costs for antenna solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager