Aircraft Arresting System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430635 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Aircraft Arresting System Market Size

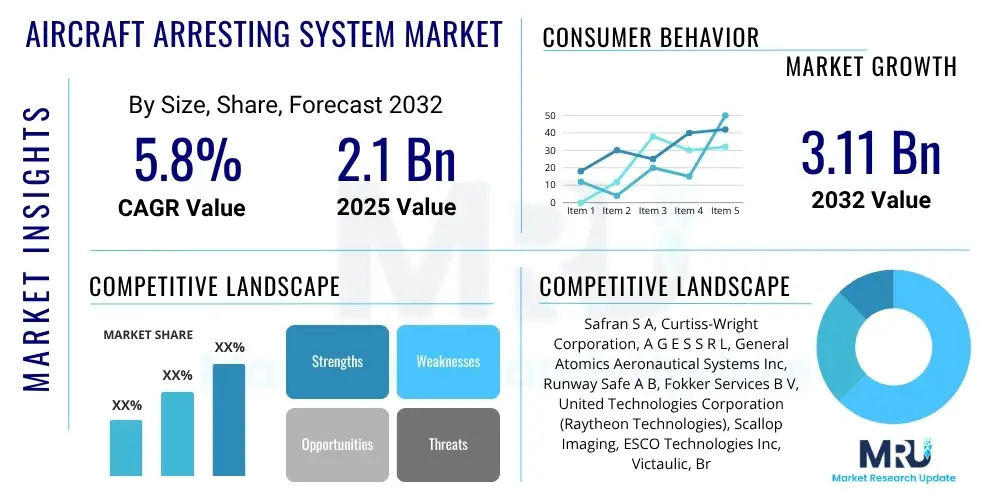

The Aircraft Arresting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $2.1 Billion in 2025 and is projected to reach $3.11 Billion by the end of the forecast period in 2032.

Aircraft Arresting System Market introduction

The Aircraft Arresting System market encompasses the design, manufacture, and deployment of specialized equipment used to safely decelerate and stop aircraft during emergency landings, aborted takeoffs, or routine operations on short runways, particularly on aircraft carriers. These systems are critical safety components that prevent aircraft overruns and potential catastrophic accidents, safeguarding both personnel and expensive assets. The primary products include various types of arresting gear such as cable-based systems, net barriers, and expeditionary rotary hydraulic systems, each designed for specific operational requirements and aircraft types. Major applications span across military airfields, naval aviation platforms, and increasingly, civilian airports for contingency situations involving distressed aircraft. The core benefits derived from these systems are enhanced operational safety, prevention of aircraft damage, and maintaining high levels of operational readiness for both fixed-wing and rotary-wing aircraft in challenging environments.

The functionality of an aircraft arresting system is to absorb the kinetic energy of a moving aircraft within a short distance, ensuring a controlled stop. This is achieved through mechanisms that engage the aircraft's landing gear or airframe and transfer the braking force to an energy-absorbing unit, such as hydraulic cylinders, friction brakes, or net-based decelerators. The market is driven significantly by ongoing military modernization programs globally, particularly in naval aviation where arresting gear is indispensable for carrier-based operations, and by the increasing emphasis on aviation safety standards across all flight operations. Geopolitical tensions and the need for rapid deployment capabilities further stimulate demand for portable and robust arresting solutions. The continuous evolution of aircraft design and performance characteristics necessitates corresponding advancements in arresting system technology to ensure compatibility and effectiveness.

Aircraft Arresting System Market Executive Summary

The Aircraft Arresting System market is currently experiencing robust growth, primarily fueled by global defense spending increases, particularly in naval aviation and the modernization of military airbases. Business trends indicate a strong focus on developing more versatile, lightweight, and rapidly deployable systems, alongside advancements in sensor integration and automated control for improved operational efficiency and safety. Strategic partnerships and collaborations between defense contractors and technology providers are becoming more prevalent to develop next-generation solutions that can accommodate future aircraft designs and operational demands. Furthermore, there is a growing emphasis on lifecycle support services, including maintenance, repair, and overhaul (MRO), which contributes significantly to market revenue.

Regionally, North America continues to dominate the market due to substantial defense budgets and the presence of key industry players, with the United States Navy and Air Force being major consumers. The Asia Pacific region is emerging as a significant growth hub, driven by the expansion and modernization of air forces in countries like China, India, and Japan, alongside increasing investments in domestic aircraft carrier programs. Europe is also seeing steady growth, spurred by NATO modernization efforts and the upgrading of existing air infrastructure. Segment trends highlight a consistent demand for hydraulic-based systems, especially for high-performance military jets, while net barrier systems are gaining traction for expeditionary and emergency airfield applications. The focus on developing advanced friction-based systems for land-based operations also represents a key area of innovation. The market is characterized by a limited number of highly specialized manufacturers, leading to an oligopolistic competitive landscape.

AI Impact Analysis on Aircraft Arresting System Market

Users are increasingly curious about how Artificial Intelligence can enhance the reliability, efficiency, and safety of aircraft arresting systems, moving beyond traditional mechanical operations. Common questions revolve around AI's capability to predict system failures, optimize deployment speeds for varying aircraft types, and integrate with broader airfield management systems for real-time decision-making. There is a strong expectation that AI could significantly reduce human error, streamline maintenance protocols, and contribute to more adaptive and responsive arresting operations, especially in critical or rapidly evolving scenarios. The key themes include predictive maintenance, intelligent system calibration, enhanced situational awareness, and the potential for autonomous or semi-autonomous system operation, aiming for unprecedented levels of safety and operational readiness.

- Predictive Maintenance: AI algorithms analyze sensor data from arresting gear to forecast potential failures, enabling proactive maintenance and reducing downtime.

- Optimized Deployment and Response: AI can process real-time aircraft parameters (speed, weight, approach angle) to automatically adjust arresting system settings for optimal engagement, minimizing wear and tear and maximizing stopping effectiveness.

- Enhanced Situational Awareness: Integration with airfield management systems allows AI to provide real-time data on runway conditions, aircraft status, and arresting gear readiness, offering critical insights to ground crew and air traffic control.

- Autonomous Operation Support: AI can assist in the semi-autonomous deployment and retraction of systems, particularly in remote or high-risk environments, reducing the need for direct human intervention.

- Training and Simulation: AI-powered simulations can create realistic scenarios for training ground personnel on arresting gear operations, including emergency procedures, thereby improving proficiency and reaction times.

DRO & Impact Forces Of Aircraft Arresting System Market

The Aircraft Arresting System market is propelled by a confluence of critical drivers, notably the sustained global military modernization programs which prioritize enhancing aviation safety and operational readiness. Geopolitical instability in various regions necessitates robust defense capabilities, leading to increased procurement of advanced arresting systems for both fixed and expeditionary airfields. The rising number of aircraft operations, particularly in military contexts, naturally increases the demand for reliable safety infrastructure. Furthermore, stringent aviation safety regulations and the continuous evolution of aircraft performance, requiring more sophisticated stopping mechanisms, serve as significant market accelerators. These factors collectively underscore the indispensable role of arresting systems in modern aviation infrastructure, driving innovation and investment within the sector.

Despite strong drivers, the market faces notable restraints including the exceptionally high capital investment required for the acquisition, installation, and certification of advanced arresting systems. The complexity of these systems necessitates specialized maintenance and highly skilled personnel, adding to operational costs. Long procurement cycles, often extending several years due to rigorous testing and government approval processes, can also impede market growth. Opportunities in the market are abundant, particularly in the development of lightweight, modular, and rapidly deployable systems suitable for forward operating bases and disaster relief scenarios. The integration of advanced sensor technology, automation, and AI offers avenues for improving system efficiency, predictive maintenance, and overall operational safety. Emerging economies investing in domestic defense capabilities and naval expansion programs also present significant growth prospects for manufacturers.

Impact forces on the market include a highly competitive landscape characterized by a limited number of global players who possess specialized expertise and long-standing relationships with defense organizations. Technological advancements, such as the adoption of advanced composite materials and sophisticated hydraulic control systems, continuously reshape product offerings and competitive advantages. The regulatory environment, governed by international aviation safety standards and military specifications, plays a crucial role in product development and market entry. Economic downturns or shifts in defense budgets can exert considerable influence on demand, making the market susceptible to macroeconomic fluctuations. Supply chain disruptions, particularly for specialized components, can also impact production schedules and market stability.

Segmentation Analysis

The Aircraft Arresting System market is extensively segmented to cater to diverse operational requirements and aircraft platforms across the globe. This segmentation allows for a granular understanding of market dynamics, identifying specific demand patterns and technological preferences within different user groups. Key segmentation categories include the Type of Arresting System, the Application or End-Use, and the Platform on which these systems are deployed. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, defense spending priorities, and evolving aviation safety standards. This detailed breakdown aids manufacturers in tailoring their product offerings and strategic approaches to specific market niches.

- Type

- Rotary Hydraulic Arresting Systems

- Net Barrier Arresting Systems

- Friction-based Arresting Systems

- Portable and Expeditionary Arresting Systems

- Cable-based Arresting Systems (E.g., C-13 and E-28 systems)

- Application

- Military Airfields

- Naval Airbases (Aircraft Carriers, Shore-based)

- Civilian Airports (Emergency Use)

- Forward Operating Bases

- Test and Training Facilities

- Platform

- Land-based Systems

- Carrier-based Systems

- Expeditionary/Tactical Systems

Value Chain Analysis For Aircraft Arresting System Market

The value chain for the Aircraft Arresting System market begins with a highly specialized upstream segment encompassing the sourcing of advanced raw materials and the manufacturing of precision components. This includes suppliers of high-strength alloys, specialized polymers, hydraulic components, cables, nets, and sophisticated electronic control units. These components often require rigorous testing and adherence to aerospace-grade specifications, making the supplier base relatively concentrated and specialized. The quality and reliability of these upstream inputs directly influence the performance and safety of the final arresting system. Manufacturers of core components such as hydraulic cylinders, braking mechanisms, and energy absorption units form a crucial part of this initial stage, often involving long-term supply agreements with system integrators.

Moving downstream, the value chain progresses to the design, assembly, integration, and testing of complete aircraft arresting systems. This stage is dominated by a few key defense contractors and specialized aerospace manufacturers who possess the engineering expertise and manufacturing capabilities to produce complex, certified systems. These integrators collaborate closely with end-users, primarily military forces, to ensure systems meet specific operational requirements and compatibility with various aircraft types. The distribution channel is predominantly direct, characterized by government tenders, long-term contracts with defense ministries, and direct sales to naval or air force procurement agencies. Given the strategic nature and high cost of these systems, indirect channels through distributors are less common, although prime defense contractors may act as intermediaries for sub-systems within larger defense projects. After-sales support, including installation, commissioning, training, and long-term maintenance, repair, and overhaul (MRO) services, forms a critical part of the downstream value chain, ensuring system longevity and operational effectiveness. These services often involve dedicated support teams and global logistical networks to provide rapid response and technical assistance.

Aircraft Arresting System Market Potential Customers

The primary potential customers for Aircraft Arresting Systems are governmental defense organizations and naval forces globally. Military air forces require arresting systems for their land-based airfields to ensure safety during training exercises, emergency landings, and to support the operations of high-performance fighter jets. These systems are crucial for maintaining pilots' proficiency and safeguarding valuable aircraft assets. Naval aviation, particularly for aircraft carriers, represents another significant customer segment, where arresting gear is absolutely indispensable for the launch and recovery of fixed-wing aircraft in compact and dynamic maritime environments. Countries with active aircraft carrier programs or those planning to expand their naval aviation capabilities are key buyers in this segment.

Beyond core military applications, there is a growing, albeit smaller, segment of civilian airports considering or installing emergency arresting systems. While rare, these systems can provide a critical safety net for commercial aircraft experiencing braking failures or other emergencies during landing, preventing runway overruns and potential disasters. Furthermore, test and training facilities for aerospace manufacturers and defense agencies often require arresting systems to safely conduct flight tests for new aircraft designs or to simulate emergency conditions. Homeland security and border patrol agencies that operate various aircraft types in austere or unconventional landing zones also represent niche but potential customers for expeditionary or portable arresting solutions, prioritizing rapid deployment and adaptability to diverse operational landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.1 Billion |

| Market Forecast in 2032 | $3.11 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S A, Curtiss-Wright Corporation, A G E S S R L, General Atomics Aeronautical Systems Inc, Runway Safe A B, Fokker Services B V, United Technologies Corporation (Raytheon Technologies), Scallop Imaging, ESCO Technologies Inc, Victaulic, Bridon-Bekaert Ropes Group, QinetiQ Group plc, Rheinmetall AG, Teledyne Technologies Inc, Textron Inc, L3Harris Technologies Inc, Lockheed Martin Corporation, The Boeing Company, General Dynamics Corporation, BAE Systems plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Arresting System Market Key Technology Landscape

The technology landscape for the Aircraft Arresting System market is characterized by continuous innovation aimed at enhancing efficiency, reliability, and adaptability. Advanced hydraulic systems remain a cornerstone, with developments focusing on greater energy absorption capacity, faster reset times, and more precise control mechanisms. These systems are crucial for handling a wide range of aircraft weights and approach speeds safely. Alongside hydraulics, the utilization of lightweight yet highly durable composite materials in structural components is gaining traction. These materials contribute to reduced system weight, making expeditionary and portable systems more viable for rapid deployment in diverse operational environments, while also enhancing corrosion resistance and overall system longevity.

Furthermore, sensor integration and digital control systems are becoming increasingly sophisticated. Modern arresting systems incorporate an array of sensors to monitor aircraft speed, weight, hook engagement, and system performance in real time. This data is fed into advanced control algorithms that can automatically adjust parameters for optimal energy absorption, minimize aircraft stress, and provide critical diagnostic information. The adoption of smart systems capable of self-diagnosis and predictive maintenance is also emerging, leveraging data analytics to anticipate failures and schedule maintenance proactively. Research and development efforts are also concentrated on improving the durability and lifespan of arresting cables and nets, exploring novel materials and weaving techniques to withstand extreme forces and harsh environmental conditions, thereby extending operational readiness and reducing lifecycle costs.

Regional Highlights

- North America: This region is a dominant force in the Aircraft Arresting System market, primarily driven by the substantial defense budget of the United States. The presence of leading aerospace and defense contractors, coupled with extensive modernization programs for military airfields and ongoing advancements in naval aviation (e.g., aircraft carriers), ensures continuous demand. The U.S. Navy and Air Force are major consumers, consistently investing in next-generation arresting technologies and maintaining vast fleets of aircraft requiring robust safety infrastructure.

- Europe: The European market demonstrates steady growth, propelled by the modernization efforts of various NATO member states and other European air forces. Countries like the United Kingdom, France, and Germany are investing in upgrading their military infrastructure and capabilities, which includes enhancing airfield safety with modern arresting systems. Collaboration within the European defense industry and a focus on advanced technology integration also contribute to the region's market expansion.

- Asia Pacific (APAC): The APAC region is poised for significant growth, emerging as a critical market for Aircraft Arresting Systems. This growth is fueled by increasing defense expenditures in countries such as China, India, and Japan, which are rapidly expanding and modernizing their air forces and naval capabilities, including the development and acquisition of aircraft carriers. Geopolitical tensions and the strategic importance of air superiority in the region also necessitate robust investment in advanced aviation safety systems.

- Latin America: The market in Latin America is comparatively smaller but shows potential for gradual growth. Investments are primarily driven by the need to upgrade existing military airfields and enhance safety for older aircraft fleets. Economic stability and governmental priorities regarding defense spending will largely dictate the pace of market development in this region.

- Middle East and Africa (MEA): The MEA region is experiencing increasing demand for Aircraft Arresting Systems, mainly due to ongoing geopolitical instability, regional conflicts, and the consequent need for enhanced defense capabilities. Countries in the Middle East, in particular, are investing heavily in modernizing their air forces and building advanced military infrastructure, creating a consistent market for sophisticated arresting technologies and associated services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Arresting System Market.- Safran S A

- Curtiss-Wright Corporation

- A G E S S R L

- General Atomics Aeronautical Systems Inc

- Runway Safe A B

- Fokker Services B V

- United Technologies Corporation (Raytheon Technologies)

- Scallop Imaging

- ESCO Technologies Inc

- Victaulic

- Bridon-Bekaert Ropes Group

- QinetiQ Group plc

- Rheinmetall AG

- Teledyne Technologies Inc

- Textron Inc

- L3Harris Technologies Inc

- Lockheed Martin Corporation

- The Boeing Company

- General Dynamics Corporation

- BAE Systems plc

Frequently Asked Questions

What is an aircraft arresting system and why is it important?

An aircraft arresting system is specialized equipment designed to safely decelerate and stop aircraft during emergency landings, aborted takeoffs, or routine operations on short runways, especially on aircraft carriers. It is crucial for preventing overruns, safeguarding aircraft, and ensuring pilot safety, thereby maintaining operational readiness and preventing catastrophic accidents.

How do aircraft arresting systems typically work?

Most systems engage an aircraft's landing gear (via a tailhook or by capturing the fuselage with a net) and transfer the aircraft's kinetic energy to a robust energy-absorbing mechanism. These mechanisms can include hydraulic pistons, friction brakes, or stretched nets, which safely bring the aircraft to a halt over a short distance.

Who are the primary users of aircraft arresting systems?

The primary users are military forces, particularly air forces and naval aviation units (for aircraft carriers and shore-based operations). Some civilian airports also install these systems for emergency use, providing a critical safety measure for commercial aircraft experiencing braking system failures.

What factors are driving the growth of the Aircraft Arresting System market?

Key drivers include ongoing global military modernization programs, increased defense spending by nations, the expansion of naval aviation capabilities (e.g., new aircraft carriers), stringent aviation safety regulations, and the continuous need to upgrade existing airfield infrastructure to support modern aircraft.

How is Artificial Intelligence impacting aircraft arresting systems?

AI is beginning to impact these systems by enabling predictive maintenance, optimizing system deployment based on real-time aircraft data, enhancing situational awareness for ground crews, and potentially supporting semi-autonomous operations, all aimed at improving reliability, safety, and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager