Aircraft Component MRO Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430804 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aircraft Component MRO Market Size

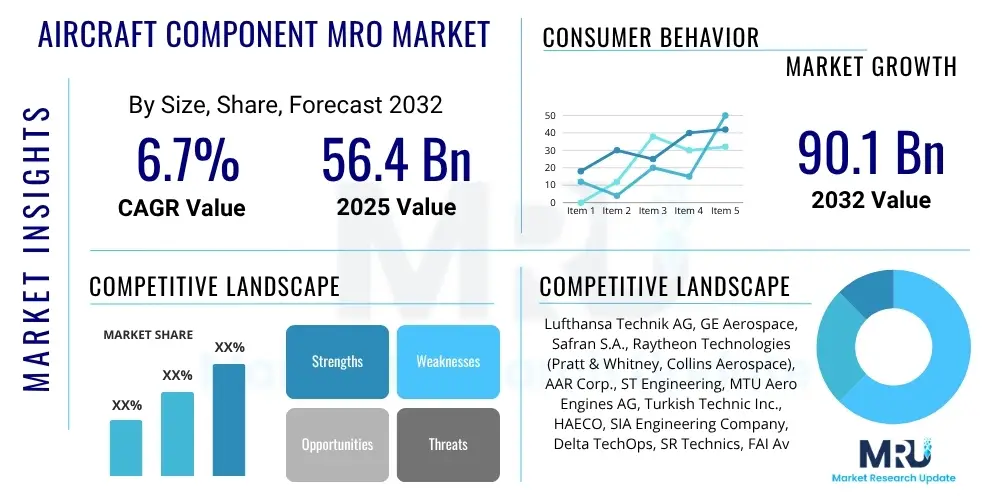

The Aircraft Component MRO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at USD 56.4 billion in 2025 and is projected to reach USD 90.1 billion by the end of the forecast period in 2032.

Aircraft Component MRO Market introduction

The Aircraft Component MRO (Maintenance, Repair, and Overhaul) market encompasses all services dedicated to ensuring the airworthiness, reliability, and optimal performance of various aircraft components throughout their lifecycle. This critical sector of the aviation industry provides comprehensive support for a wide array of parts, including engines, airframes, landing gear, avionics, and interiors, which are essential for the safe and efficient operation of both commercial and military aircraft. The market's primary objective is to extend the operational life of aircraft components, minimize downtime, and ensure compliance with stringent aviation regulations set by bodies like the FAA and EASA.

The core services provided within this market include routine inspections, scheduled maintenance, complex repairs, component replacements, and comprehensive overhauls. These services leverage specialized expertise, advanced tooling, and robust logistical networks to maintain the integrity and functionality of aircraft systems. The increasing complexity of modern aircraft, coupled with the rising demand for air travel and defense capabilities globally, continues to drive the necessity for sophisticated MRO solutions, making it an indispensable element of the aerospace ecosystem.

Key applications span across commercial aviation, including passenger and cargo airlines, as well as military and general aviation sectors. The market is propelled by benefits such as enhanced aircraft safety, improved operational efficiency, reduced long-term operating costs, and adherence to global regulatory standards. Major driving factors include the continuous growth in air passenger traffic, an expanding global aircraft fleet, the aging of existing aircraft necessitating more frequent maintenance, and ongoing technological advancements in MRO processes and materials science.

Aircraft Component MRO Market Executive Summary

The Aircraft Component MRO market is experiencing dynamic shifts, characterized by significant business trends focused on digitalization, sustainability, and supply chain resilience. Regionally, the market exhibits robust growth in the Asia Pacific due to fleet expansion and rising passenger volumes, while established markets in North America and Europe emphasize technological integration and operational efficiency. Segment-wise, engine MRO continues to dominate, driven by its complexity and critical role, alongside steady growth in airframe and avionics maintenance as airlines seek to maximize asset utilization and operational safety across diverse aircraft types.

Key business trends underscore a move towards predictive maintenance methodologies, leveraging advanced analytics and IoT to anticipate component failures and optimize maintenance schedules, thereby minimizing unscheduled downtime and improving operational economics for airlines. Furthermore, there is a growing emphasis on sustainable MRO practices, including waste reduction, efficient energy consumption, and the adoption of eco-friendly materials, driven by increasing environmental regulations and corporate social responsibility initiatives within the aviation industry. Supply chain optimization, particularly in the wake of recent global disruptions, is also a critical area of focus, with companies investing in localized sourcing and robust inventory management systems to ensure component availability.

From a regional perspective, the Asia Pacific region is forecast to be a primary growth engine, propelled by expanding low-cost carrier fleets and increasing air travel demand, leading to new MRO facility developments and capacity expansions. North America and Europe, while mature, are characterized by high technological adoption, specialized MRO capabilities, and a strong focus on regulatory compliance and advanced engineering services. Emerging markets in Latin America, the Middle East, and Africa are also showing potential, driven by fleet modernization and the establishment of local MRO hubs. These regional dynamics contribute to a diverse and competitive market landscape, necessitating tailored strategies for market entry and expansion.

AI Impact Analysis on Aircraft Component MRO Market

Users are keen to understand how artificial intelligence will fundamentally transform aircraft component MRO, with common questions revolving around its ability to enhance predictive maintenance capabilities, streamline operational efficiency, reduce costs, and improve safety. There is significant interest in how AI can process vast amounts of data from sensors and operational systems to foresee component failures, optimize inspection intervals, and personalize maintenance schedules, thus moving beyond traditional time-based or flight-cycle-based approaches. Concerns also include the integration challenges, the need for skilled personnel to manage AI systems, and the potential impact on existing job roles within the MRO sector, alongside expectations for significant improvements in component reliability and overall aircraft uptime.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data, flight records, and maintenance history to forecast component degradation and potential failures, enabling proactive repairs.

- Optimized Maintenance Scheduling: AI tools can recommend ideal maintenance windows, minimizing aircraft downtime and maximizing operational efficiency by considering fleet schedules, parts availability, and technician workload.

- Improved Fault Detection and Diagnostics: AI systems can quickly identify anomalies and pinpoint root causes of malfunctions, reducing diagnostic time and improving repair accuracy.

- Automated Inspection Processes: AI-powered computer vision can analyze drone or robotic inspection imagery for surface defects, wear, and tear, increasing inspection speed and consistency.

- Intelligent Inventory Management: AI predicts demand for spare parts, optimizing stock levels, reducing carrying costs, and ensuring timely availability of critical components.

- Augmented Reality (AR) Assisted Maintenance: AI integrated with AR platforms provides technicians with real-time instructions, component information, and virtual overlays, enhancing repair precision and training.

- Workforce Augmentation and Training: AI tools can assist technicians with complex tasks and provide personalized training modules, upskilling the workforce for next-generation MRO.

- Data-Driven Decision Making: AI aggregates and interprets complex datasets, offering deeper insights into operational performance, component longevity, and maintenance effectiveness.

- Cost Reduction: Through optimized maintenance cycles, reduced unscheduled repairs, and efficient resource allocation, AI significantly contributes to lowering overall MRO expenditures.

- Enhanced Safety and Compliance: By ensuring components are maintained precisely when needed, AI contributes to higher safety standards and better adherence to regulatory requirements.

DRO & Impact Forces Of Aircraft Component MRO Market

The Aircraft Component MRO market is shaped by a confluence of driving forces such as the relentless growth in global air traffic and the concomitant expansion of commercial and military aircraft fleets, which inherently demand more maintenance. Restraints, including the significant capital investment required for MRO facilities and advanced technologies, coupled with persistent skilled labor shortages and the complexities of global supply chains, temper this growth. Opportunities arise from the adoption of digitalization and predictive maintenance technologies, allowing for greater efficiency and proactive fault resolution, creating an environment where innovative solutions can mitigate existing challenges and propel market expansion despite underlying impact forces.

Driving factors are primarily centered around the increase in air travel, leading to a larger active fleet and consequently a higher demand for component maintenance. The aging global aircraft fleet also plays a crucial role, as older aircraft typically require more frequent and extensive MRO services to remain airworthy. Additionally, increasingly stringent aviation safety regulations mandated by international and national authorities necessitate rigorous maintenance checks and component overhauls, further solidifying the market's foundation. Technological advancements in aircraft design and materials also create a continuous need for specialized MRO services capable of handling complex composite structures and advanced avionics systems.

However, the market faces significant restraints. The substantial upfront capital expenditure required to establish and upgrade MRO facilities, invest in specialized tools, and acquire certifications can be a barrier to entry and expansion. A critical challenge is the global shortage of skilled MRO technicians, engineers, and mechanics, which impacts service delivery timelines and labor costs. Furthermore, the inherent complexities of the global aviation supply chain, including geopolitical instability, trade restrictions, and raw material price fluctuations, can lead to disruptions in parts availability and increased operational costs for MRO providers. These intertwined factors create a dynamic environment where MRO providers must constantly innovate to remain competitive and efficient.

Segmentation Analysis

The Aircraft Component MRO market is comprehensively segmented to provide a granular understanding of its diverse landscape, reflecting variations in component types, aircraft categories, and the specific nature of MRO services delivered. This segmentation allows for targeted strategic planning and resource allocation by MRO providers, OEMs, and airlines, enabling a clearer view of market demand, service requirements, and technological trends across different aviation sectors. The primary segmentation dimensions include the type of aircraft component being serviced, the aircraft platform (commercial, military, general aviation), and the MRO service offering itself, which ranges from line maintenance to heavy checks and component repairs.

Understanding these segments is crucial for identifying areas of growth and specific market needs. For instance, engine MRO represents a significant portion of the market due to the complexity and high value of aircraft engines, requiring highly specialized skills and equipment. Similarly, the distinction between narrow-body and wide-body aircraft maintenance highlights differences in scale, component size, and operational demands. The varying requirements of military versus commercial aviation also create distinct market segments, with military MRO often involving longer maintenance cycles, secure supply chains, and specialized defense-related component expertise.

Further granularity in segmentation helps address niche requirements, such as the increasing demand for MRO services for regional jets and business jets, each with unique maintenance profiles. The types of MRO services themselves, from airframe heavy maintenance (C-checks, D-checks) to component repair and overhaul, and even modifications, form critical sub-segments that cater to different lifecycle stages and operational needs of aircraft. This multi-layered segmentation provides a robust framework for analyzing market trends, competitive positioning, and future investment opportunities within the aircraft component MRO industry.

- By Component Type:

- Engine

- Airframe

- Landing Gear

- Avionics

- Interiors

- Hydraulics & Pneumatics

- Electrical Components

- Safety Equipment

- Other Components

- By Aircraft Type:

- Commercial Aircraft

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Military Aircraft

- Fighters

- Transport Aircraft

- Helicopters

- Special Mission Aircraft

- General Aviation Aircraft

- Business Jets

- Piston Aircraft

- Turboprop Aircraft

- Commercial Aircraft

- By MRO Type:

- Line Maintenance

- Base Maintenance (Heavy Maintenance)

- Component Maintenance

- Engine Maintenance

- Modification & Upgrades

- By End-User:

- Airlines

- MRO Providers (Third-Party)

- OEMs

- Aircraft Lessors

- Government & Military

- Private Operators

Value Chain Analysis For Aircraft Component MRO Market

The Aircraft Component MRO market's value chain is a complex ecosystem beginning with upstream activities involving raw material suppliers and component manufacturers, flowing through core MRO service providers, and concluding with downstream end-users such as airlines and military operators. Upstream elements include specialized material suppliers and Original Equipment Manufacturers (OEMs) who design and produce aircraft components, setting the initial quality and performance standards. The MRO providers then undertake maintenance, repair, and overhaul activities, acting as a crucial intermediary. Downstream, distribution channels, both direct and indirect, ensure components and services reach the final customers efficiently, highlighting a collaborative network essential for operational continuity and safety in aviation.

Upstream in the value chain, component manufacturers play a pivotal role, not only in producing the parts but often in providing initial maintenance manuals, technical specifications, and training to MRO organizations. These OEMs frequently engage in long-term support agreements with airlines and MRO providers, ensuring the availability of genuine spare parts and technical expertise. Raw material suppliers, from advanced composites to specialized alloys, underpin the entire manufacturing process, emphasizing the importance of a robust and resilient supply base for sustained MRO operations, especially given the strict quality and certification requirements in aviation.

Downstream, the MRO services are delivered through a combination of direct and indirect channels. Direct channels often involve in-house MRO capabilities maintained by major airlines or military organizations, providing dedicated support for their own fleets. OEMs also offer direct MRO services, leveraging their proprietary knowledge and access to specialized tools and parts. Indirect channels are dominated by third-party MRO providers, ranging from large global independent MROs to smaller specialized workshops, who cater to a wide customer base including airlines, lessors, and general aviation operators. The efficiency of these distribution channels, supported by sophisticated logistics and inventory management systems, is critical for minimizing aircraft downtime and maximizing operational readiness for the end-users.

Aircraft Component MRO Market Potential Customers

The primary potential customers and end-users of aircraft component MRO services are diverse, spanning the entire spectrum of the aviation industry, from large commercial airlines to government entities and individual aircraft owners. Commercial airlines, including major flag carriers, low-cost carriers, and cargo operators, represent the largest segment, consistently requiring extensive MRO for their vast fleets to ensure passenger safety, operational reliability, and regulatory compliance. Beyond commercial operations, military and defense organizations are significant consumers, demanding specialized and often classified MRO services for their varied array of combat, transport, and surveillance aircraft, crucial for national security and defense readiness.

Aircraft lessors also emerge as substantial customers, as they are responsible for maintaining the airworthiness of their assets before leasing them to operators and during lease transitions, often outsourcing these intricate MRO tasks to specialized providers. The growing segment of general aviation, encompassing private jet operators, business aviation fleets, and charter companies, further contributes to the demand for MRO, particularly for highly customized and expedited services. Additionally, smaller regional airlines and specialized operators, such as those involved in aerial work, agricultural aviation, or emergency services, rely heavily on external MRO expertise to keep their specialized fleets operational and compliant with unique mission profiles.

Original Equipment Manufacturers (OEMs) themselves can also be considered potential customers for MRO services, especially in niche areas or for outsourced tasks where specialized third-party MRO providers possess particular capabilities or geographical reach. Ultimately, any entity owning, operating, or managing an aircraft is a potential buyer of aircraft component MRO services, underscoring the broad and fundamental nature of this market within the global aerospace industry, driven by the universal need for aircraft safety, performance, and regulatory adherence throughout an aircraft's operational life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 56.4 billion |

| Market Forecast in 2032 | USD 90.1 billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lufthansa Technik AG, GE Aerospace, Safran S.A., Raytheon Technologies (Pratt & Whitney, Collins Aerospace), AAR Corp., ST Engineering, MTU Aero Engines AG, Turkish Technic Inc., HAECO, SIA Engineering Company, Delta TechOps, SR Technics, FAI Aviation Group, Embraer S.A., Evektor, Airbus SAS, Boeing Global Services, Dassault Aviation, Bombardier Inc., Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Component MRO Market Key Technology Landscape

The Aircraft Component MRO market is rapidly evolving through the integration of advanced technologies designed to enhance efficiency, accuracy, and predictability in maintenance operations. A significant technological shift is observed in the widespread adoption of predictive analytics and the Internet of Things (IoT), where sensors on aircraft components continuously transmit operational data. This data is then analyzed using machine learning algorithms to forecast potential failures, optimize maintenance schedules, and move away from traditional time-based maintenance towards condition-based maintenance. This not only reduces unscheduled downtime but also extends the useful life of components and significantly lowers operating costs for airlines.

Furthermore, additive manufacturing, commonly known as 3D printing, is transforming the spare parts supply chain by enabling on-demand production of complex or hard-to-find components. This technology reduces lead times, cuts inventory costs, and provides greater flexibility in part replacement, especially for older aircraft models where original parts may be scarce. Robotics and automation are also being increasingly deployed for repetitive and hazardous tasks, such as aircraft washing, inspection, and component handling, improving safety for technicians and ensuring consistent quality in maintenance procedures. These advancements collectively streamline MRO operations, making them more responsive and cost-effective.

Augmented Reality (AR) and Virtual Reality (VR) technologies are proving invaluable for technician training and on-site maintenance support, providing immersive experiences and real-time guidance for complex repair tasks. Technicians can use AR headsets to overlay digital instructions onto physical components, improving accuracy and reducing errors. Blockchain technology is also gaining traction for enhancing supply chain transparency and traceability of aircraft parts, ensuring authenticity and compliance. These technologies are collectively driving a digital transformation within the MRO sector, promising a future of smarter, more efficient, and highly reliable aircraft maintenance processes that directly contribute to enhanced aviation safety and operational readiness.

Regional Highlights

- North America: A mature market characterized by early adoption of advanced MRO technologies, a strong presence of major OEMs and MRO providers, and stringent regulatory frameworks. Significant investment in digitalization and predictive analytics, driven by a large existing fleet and a focus on operational efficiency for both commercial and military aviation.

- Europe: An established market with a high concentration of sophisticated MRO capabilities, particularly for engine and airframe heavy maintenance. Strong emphasis on regulatory compliance, sustainability, and the development of MRO hubs by leading airlines and independent providers. Innovation in automation and specialized component repair is a key trend.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid expansion of commercial airline fleets, increasing passenger traffic, and the emergence of new low-cost carriers. Significant investment in new MRO facilities and capacity expansion, driven by countries like China, India, and Southeast Asian nations. Focus on cost-effective solutions and localized MRO services.

- Latin America: An emerging market experiencing fleet modernization and increased demand for MRO services. Growth is driven by expanding domestic and regional air travel, leading to partnerships between local MRO providers and international players to enhance capabilities and infrastructure.

- Middle East and Africa (MEA): A strategically important region with growing demand for MRO services, particularly in the Middle East due to the expansion of major flag carriers and their large, modern fleets. Africa shows potential for growth with increasing air connectivity and fleet renewal programs, though infrastructure development remains a key challenge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Component MRO Market.- Lufthansa Technik AG

- GE Aerospace

- Safran S.A.

- Raytheon Technologies

- AAR Corp.

- ST Engineering

- MTU Aero Engines AG

- Turkish Technic Inc.

- HAECO

- SIA Engineering Company

- Delta TechOps

- SR Technics

- FAI Aviation Group

- Embraer S.A.

- Airbus SAS

- Boeing Global Services

- Bombardier Inc.

- Honeywell International Inc.

- StandardAero

- Magnetic MRO (part of Extant Aerospace)

Frequently Asked Questions

What are the primary drivers for the growth of the Aircraft Component MRO market?

The primary drivers include the consistent growth in global air passenger traffic, the expansion and aging of the worldwide aircraft fleet, increasingly stringent aviation safety regulations, and continuous technological advancements in MRO processes.

How is artificial intelligence impacting the Aircraft Component MRO sector?

AI is significantly impacting MRO by enabling enhanced predictive maintenance, optimizing maintenance scheduling, improving fault detection and diagnostics, and automating inspection processes, leading to greater efficiency and cost savings.

Which region holds the largest share in the Aircraft Component MRO market?

North America and Europe currently represent significant shares due to their mature aviation industries and advanced MRO capabilities, but the Asia Pacific region is projected for the fastest growth due to extensive fleet expansion.

What are the key challenges faced by the Aircraft Component MRO market?

Key challenges include high capital investment requirements, a persistent shortage of skilled MRO technicians, complexities and vulnerabilities within the global supply chain, and increasing pressure to reduce MRO costs while maintaining safety standards.

What technological trends are shaping the future of Aircraft Component MRO?

Future MRO is being shaped by trends like the widespread adoption of predictive analytics, IoT, additive manufacturing (3D printing), robotics, augmented reality (AR) for technician assistance, and blockchain for supply chain transparency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager