Aircraft Fire Protection Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430322 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Aircraft Fire Protection Systems Market Size

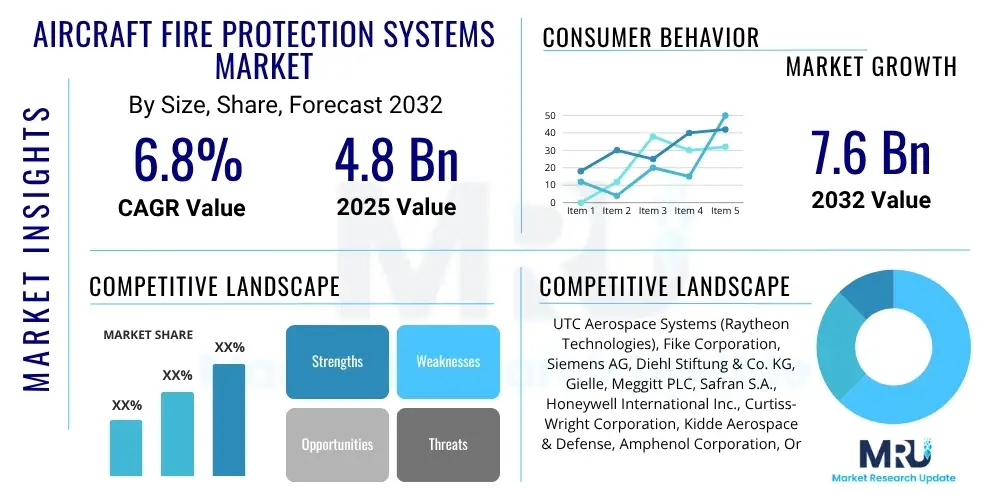

The Aircraft Fire Protection Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2032.

Aircraft Fire Protection Systems Market introduction

The Aircraft Fire Protection Systems Market encompasses the design, manufacturing, integration, and maintenance of specialized equipment and technologies engineered to detect, contain, and extinguish fires onboard various types of aircraft. These critical systems are essential for ensuring the safety of passengers, crew, and high-value aerospace assets, operating under stringent regulatory frameworks to prevent catastrophic incidents. Products typically include sophisticated detection systems, fire suppression agents, and associated control mechanisms that activate automatically or manually upon fire detection, providing immediate response capabilities.

Major applications for these systems span across commercial airliners, regional jets, cargo aircraft, business jets, and military aircraft, each requiring tailored solutions based on their operational profiles and design specifications. The primary benefits include enhanced operational safety, compliance with international aviation regulations from bodies such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), and the preservation of expensive aircraft components and structures from fire damage. These systems are indispensable for minimizing risks and ensuring flight integrity.

The market is significantly driven by a continuous increase in global air traffic, the modernization of existing aircraft fleets with advanced safety features, and the relentless pursuit of improved safety standards by aviation authorities worldwide. Technological advancements in sensor capabilities, fire extinguishing agents, and intelligent control systems are continuously shaping the market, offering more effective, environmentally friendly, and lighter-weight solutions. The overarching goal is to minimize response times, maximize suppression effectiveness, and reduce the overall weight and maintenance requirements of these vital safety components.

Aircraft Fire Protection Systems Market Executive Summary

The Aircraft Fire Protection Systems Market is experiencing robust growth fueled by escalating air travel demand, increasingly stringent safety mandates, and ongoing fleet expansions and modernizations across global aviation sectors. Key business trends indicate a strategic pivot towards more integrated and lightweight fire protection solutions, emphasizing digital connectivity, real-time monitoring, and predictive maintenance capabilities. Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Overhaul (MRO) providers are pivotal players, focusing on continuous product innovation, forming strategic partnerships, and extending comprehensive service offerings to meet the dynamic requirements of both commercial airlines and the defense sector. The market is also witnessing consolidation efforts as leading companies seek to enhance their technological portfolios, expand geographical reach, and optimize supply chain efficiencies.

Regionally, North America and Europe currently maintain leading positions within the market, primarily attributable to the substantial presence of major aircraft manufacturers, well-established aviation infrastructure, and the enforcement of rigorous and comprehensive safety regulations. However, the Asia Pacific region is projected to exhibit the highest growth rates over the forecast period, propelled by burgeoning air passenger traffic, significant governmental and private investments in new aircraft procurement, and the rapid expansion of regional aviation sectors, particularly in burgeoning economies like China and India. Latin America and the Middle East are also demonstrating promising growth trajectories, driven by necessary fleet upgrades, increased demand for air cargo services, and developing tourism industries that rely heavily on air travel. These diverse regional dynamics highlight varied opportunities and competitive landscapes that market participants must navigate.

Segmentation trends indicate a strong and consistent demand for advanced fire detection systems, including sophisticated smoke, heat, and flame detectors, owing to their pivotal role in early incident identification and rapid response. Halon-alternative suppression systems, such as those utilizing clean agents like HFCs or advanced inert gas systems, are rapidly gaining traction amidst growing environmental concerns and evolving regulatory pressures to phase out ozone-depleting substances. The commercial aircraft segment continues to dominate the market by volume and value due to the sheer size of commercial fleets and passenger safety requirements, while the military aircraft segment offers significant opportunities for high-performance and highly customized solutions, reflecting distinct technological requirements, operational conditions, and procurement cycles across these critical aerospace domains. The emphasis on developing lighter, more efficient, and smarter systems is a consistent and overarching theme across all major market segments.

AI Impact Analysis on Aircraft Fire Protection Systems Market

Common user questions regarding AI's impact on the Aircraft Fire Protection Systems Market frequently center on how artificial intelligence can significantly enhance detection accuracy, substantially minimize the occurrence of false alarms, enable sophisticated predictive maintenance for critical components, and facilitate more autonomous or semi-autonomous response capabilities. Users are particularly interested in AI's advanced ability to process and interpret complex sensor data from multiple sources in real-time to identify fire threats faster and with greater reliability than traditional systems, thereby reducing the need for direct human intervention and considerably improving overall safety outcomes. There is also significant curiosity about how AI could integrate seamlessly into existing fire protection infrastructures for smarter, centralized monitoring and more efficient resource allocation during emergencies, leading to more proactive rather than reactive fire management strategies onboard aircraft and throughout their operational lifecycle.

- Enhanced fire detection accuracy and speed through AI-powered image recognition, sensor fusion, and anomaly detection, significantly reducing false positives.

- Predictive maintenance for fire protection components, utilizing AI to analyze operational data, identify potential failures before they occur, and improve system reliability and reduce unscheduled aircraft downtime.

- Optimized fire suppression agent deployment, with AI determining the most effective quantity, type, and method of agent release based on real-time fire characteristics and compartment conditions.

- Development of autonomous or semi-autonomous response systems, allowing for quicker initial containment and mitigation of fire incidents before direct human crew intervention is possible or optimal.

- Real-time threat assessment and adaptive response strategies that can adjust based on dynamic environmental factors, flight parameters, and evolving fire scenarios, ensuring optimal safety measures.

- Seamless integration with broader aircraft health monitoring (AHM) systems, providing a comprehensive and holistic view of aircraft safety and operational health, leveraging interconnected data for deeper insights.

DRO & Impact Forces Of Aircraft Fire Protection Systems Market

The Aircraft Fire Protection Systems Market is propelled by several significant drivers, most notably the escalating global air passenger traffic and the consequent robust demand for new aircraft across commercial, cargo, and military sectors, all of which inherently require sophisticated and reliable fire safety installations. Stringent and continuously evolving aviation safety regulations, meticulously enforced by authoritative bodies such as the FAA, EASA, and ICAO, mandate the implementation of advanced fire protection technologies, thereby compelling manufacturers to innovate and adhere to the highest safety standards. Furthermore, the imperative for airlines and military operators to modernize aging fleets with more efficient, environmentally compliant, and safer systems, coupled with a pervasive heightened focus on passenger and crew safety, significantly contributes to the continuous expansion and technological advancement within this market segment. These factors collectively create a robust and sustained demand environment for advanced fire protection solutions.

However, the market also confronts considerable restraints that can impede its growth and development. The intrinsically high initial cost associated with the extensive research, development, rigorous certification processes, and complex installation of advanced fire protection systems poses a significant financial barrier, particularly for smaller operators or in highly price-sensitive segments of the aviation industry. The exceedingly complex and often lengthy certification procedures required for novel technologies or even minor modifications can substantially delay market entry, escalate development costs, and create bottlenecks in product commercialization. Additionally, the persistent engineering challenge of integrating new, often heavier, systems into existing or new aircraft designs without compromising critical factors such as fuel efficiency, payload capacity, or overall aircraft performance presents an ongoing hurdle, necessitating the relentless pursuit of lightweight, compact, and highly efficient solutions that maximize safety without adverse operational impacts. These multifaceted restraints demand a delicate and intricate balance between achieving superior safety, managing development and acquisition costs, and optimizing operational performance.

Opportunities within this market are substantial and diverse, particularly in the accelerating development of environmentally friendly fire suppression agents designed as effective replacements for traditional Halon systems, a trend significantly driven by stricter global environmental regulations and sustainability initiatives. Emerging aviation markets in the Asia Pacific region, as well as the Middle East and Africa, characterized by rapid aviation infrastructure development, substantial investments in new airport capacities, and continuously growing commercial fleets, offer significant untapped potential for market penetration and expansion. Furthermore, the increasing industry-wide focus on predictive maintenance strategies and the sophisticated integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) technologies promise to substantially enhance system reliability, minimize operational downtime, and reduce through-life maintenance costs, thereby opening entirely new avenues for pioneering product and service innovation. These opportunities are further bolstered by the continuous and substantial demand for retrofit solutions for the extensive global fleet of in-service aircraft, ensuring that older aircraft can also benefit from the latest safety advancements.

The impact forces within the Aircraft Fire Protection Systems market are shaped by several dynamics, including the strong bargaining power of major aircraft Original Equipment Manufacturers (OEMs) and large commercial airlines, who often dictate specific technical requirements, performance specifications, and pricing terms due to their significant purchasing volumes and influence over industry standards. The bargaining power of suppliers is moderate, influenced by the highly specialized nature of certain components and proprietary technologies, but somewhat mitigated by a reasonably competitive supplier base and the availability of multiple qualified vendors. The threat of new entrants into this market is relatively low due to the immense capital investment required for research and development, the profound technological expertise necessary, and the extraordinarily stringent regulatory and certification barriers that are characteristic of the aerospace safety sector. The threat of substitutes is also low, as there are currently no viable or approved alternatives to dedicated and specialized fire protection systems for ensuring fundamental aircraft safety. Consequently, industry rivalry among established players is high, with several prominent companies competing intensely on product innovation, system reliability, cost-effectiveness, and the provision of comprehensive aftermarket service quality, leading to continuous technological advancements and competitive pricing strategies across the market.

Segmentation Analysis

The Aircraft Fire Protection Systems market is comprehensively segmented to provide a detailed and granular understanding of its diverse components, functionalities, and applications across the global aviation industry. This meticulous segmentation allows for precise market analysis, enabling the identification of key trends, distinct growth drivers, and specific challenges inherent across various product types, aircraft categories, and end-user applications. Understanding these multifaceted distinctions is absolutely crucial for all stakeholders, including manufacturers, airlines, and regulatory bodies, to effectively tailor their strategies, optimize their product development roadmaps, and meticulously address specific market demands and regulatory requirements with targeted solutions. The inherent complexity of this market necessitates such a granular breakdown to accurately capture the nuances of technological adoption rates, varying operational contexts, and the stringent regulatory compliance frameworks that govern different segments.

The primary segments within this market include various system types, which precisely reflect the different functionalities and technologies required for comprehensive fire safety onboard an aircraft, encompassing detection, suppression, and control. Furthermore, the market is distinctly differentiated by the specific aircraft platforms for which these systems are designed, explicitly acknowledging the unique structural, operational, and regulatory requirements of commercial aircraft, military aircraft, and general aviation aircraft. End-user categories highlight the direct consumers and beneficiaries of these sophisticated systems, ranging from large-scale airline operators and national defense departments to private jet owners and aircraft leasing companies. Each of these segments operates under distinct economic forces, adheres to specific regulatory mandates, and often exhibits unique technological preferences, all of which significantly shape their respective growth trajectories, competitive landscapes, and overall contributions to the total market share. This detailed segmentation offers a roadmap for understanding the intricate dynamics of the global aircraft fire protection industry.

- By System Type

- Fire Detection Systems (Smoke Detectors, Heat Detectors, Flame Detectors, Carbon Monoxide Detectors, Multi-Sensor Detectors)

- Fire Suppression Systems (Halon-based Systems, Halon-alternative Systems (e.g., Novec 1230, FM-200), Inert Gas Systems, Water Mist Systems, Dry Chemical Systems)

- Fire Extinguishers (Portable Extinguishers, Fixed Extinguishers)

- Control and Indicating Equipment (Control Panels, Annunciators, Warning Systems, Digital Interfaces)

- By Aircraft Type

- Commercial Aircraft (Narrow-body Aircraft, Wide-body Aircraft, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Attack Helicopters, Reconnaissance Aircraft)

- General Aviation Aircraft (Business Jets, Private Aircraft, Light Aircraft, Helicopters)

- Cargo Aircraft (Dedicated Freighters, Converted Freighters)

- By Application

- Engines and Auxiliary Power Units (APU)

- Cargo Compartments (Class C, Class D, Class E Cargo Holds)

- Lavatories and Galleys

- Wheel Wells and Landing Gear Bays

- Electronic Equipment Bays and Avionics Compartments

- Passenger Cabins and Cockpits

- Fuel Tanks and Hydraulic Compartments

- By End User

- Original Equipment Manufacturers (OEM) (Aircraft Manufacturers)

- Aftermarket (Maintenance, Repair, and Overhaul (MRO) Providers, Airlines & Operators, Aircraft Leasing Companies)

Value Chain Analysis For Aircraft Fire Protection Systems Market

The value chain for the Aircraft Fire Protection Systems Market commences with robust upstream activities, primarily involving the meticulous sourcing and processing of highly specialized raw materials such as fire-resistant alloys, advanced composite polymers, precise electronic components for sensors, and specific chemical compounds required for effective suppression agents. Key upstream players include specialized chemical manufacturers, high-tech sensor technology providers, and precision engineering firms that meticulously supply critical components like sophisticated detectors, custom-designed nozzles, robust pressure vessels, and advanced control units. These foundational suppliers play an absolutely vital role in ensuring the stringent quality, unwavering reliability, and strict regulatory compliance of these fundamental elements, which directly and profoundly impacts the overall performance, safety integrity, and ultimate certification of the final integrated fire protection systems.

Midstream activities primarily encompass the intricate design, advanced manufacturing, precise assembly, and rigorous testing of the integrated fire protection systems by highly specialized aerospace safety suppliers. This crucial stage involves substantial and continuous research and development (R&D) investment to develop cutting-edge solutions that are not only lightweight and energy-efficient but also exceptionally reliable and capable of meeting the exceedingly stringent aviation safety and performance standards established globally. The meticulous manufacturing processes ensure that all components are integrated seamlessly and function flawlessly under extreme operational conditions. Downstream activities involve the highly specialized distribution, precision installation, and comprehensive aftermarket support services essential for the long-term operational integrity of these systems. The primary distribution channels are characterized by direct sales to major aircraft OEMs for seamless integration into new aircraft during the initial manufacturing phase. Additionally, systems are distributed through a network of certified MRO providers and specialized aerospace distributors for aftermarket sales, essential retrofits, and crucial maintenance services provided to airlines and various other aircraft operators.

Both direct and indirect distribution channels are intrinsically vital to the market's efficiency and reach. Direct channels foster close and collaborative partnerships with prominent aircraft manufacturers, ensuring precise integration and customized solutions for new aircraft build programs and prototypes. Conversely, indirect channels leverage extensive global networks of MRO providers and parts distributors to reach a broader base of aircraft operators worldwide, catering to their diverse needs for routine maintenance, timely repairs, essential upgrades, and component replacements throughout the aircraft's operational lifespan. The aftermarket segment, diligently handled by MRO providers and specialized parts distributors, is absolutely essential for consistently servicing existing fleets, conducting routine mandatory inspections, providing readily available spare parts, and performing critical upgrades to ensure continued regulatory compliance and enhanced safety. This intricate and interconnected value chain network is meticulously designed to ensure that state-of-the-art fire protection systems are consistently designed, manufactured, maintained, and updated, thereby upholding the highest aviation safety standards from the initial design phase through the entire operational lifecycle of every aircraft.

Aircraft Fire Protection Systems Market Potential Customers

The primary potential customers for Aircraft Fire Protection Systems are exceptionally diverse, encompassing a broad and critical spectrum of stakeholders within the extensive global aviation ecosystem. Commercial airlines, including major flag carriers, rapidly expanding low-cost carriers, and essential regional airlines, collectively constitute a monumental portion of the market due to their large and continuously expanding fleets, driven relentlessly by increasing global passenger traffic and cargo demands. These sophisticated operators consistently require highly reliable, technologically advanced, and fully compliant fire protection systems for both their ongoing new aircraft acquisitions and the critical, continuous maintenance and essential upgrade cycles of their vast existing aircraft fleets, invariably prioritizing paramount safety, robust operational efficiency, and stringent regulatory adherence.

Military and defense organizations across the globe represent another profoundly critical and distinct customer segment within this market. These entities demand exceptionally specialized and robust fire protection systems tailored for an extensive array of military aircraft, including high-performance fighter jets, heavy-lift transport aircraft, versatile attack helicopters, and specialized reconnaissance platforms. Their unique operational requirements often involve extreme environmental conditions, demanding mission-specific performance parameters, intricate stealth capabilities for tactical advantage, and strict adherence to specific national and international defense standards, frequently leading to the development and procurement of highly bespoke, technologically advanced, and immensely durable fire protection solutions that meet rigorous military specifications. The general aviation sector, encompassing affluent business jet operators, discerning private aircraft owners, and diverse light aircraft fleets, also constitutes a significant customer group, albeit with varying scales of operation, diverse customization needs, and distinct purchasing motivations, ranging from personal safety to corporate asset protection.

Furthermore, major aircraft Original Equipment Manufacturers (OEMs) such as Boeing, Airbus, Embraer, Bombardier, and Comac are integral customers, as they directly procure and integrate these advanced fire protection systems into every newly manufactured aircraft during the initial assembly process, ensuring full compliance from the outset. Maintenance, Repair, and Overhaul (MRO) service providers are pivotal aftermarket customers, consistently purchasing replacement components, upgrade kits, and complete systems for routine inspections, essential repairs, and critical upgrades of a vast range of in-service aircraft across all aviation segments. Additionally, dedicated cargo airlines, leveraging their large fleets of specialized freighter aircraft, represent a rapidly growing segment, particularly as global air cargo volumes continue their significant expansion, necessitating robust and highly effective fire suppression and detection capabilities specifically designed for voluminous cargo holds to safeguard valuable goods and ensure flight safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 7.6 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UTC Aerospace Systems (Raytheon Technologies), Fike Corporation, Siemens AG, Diehl Stiftung & Co. KG, Gielle, Meggitt PLC, Safran S.A., Honeywell International Inc., Curtiss-Wright Corporation, Kidde Aerospace & Defense, Amphenol Corporation, Orbit Aerospace Inc., Spectrex Inc., Minimax GmbH, Amerex Corporation, Novec (3M Company), Chemguard (Tyco Fire Protection Products), Janus Fire Systems, Autronica Fire and Security AS, Tyco Fire Protection Products (Johnson Controls). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Fire Protection Systems Market Key Technology Landscape

The technology landscape for the Aircraft Fire Protection Systems Market is characterized by relentless and continuous innovation aimed squarely at significantly enhancing detection speed, maximizing suppression efficiency, and bolstering overall system reliability, all while simultaneously striving to minimize system weight and reduce environmental impact. Advanced fire detection technologies are prominently featuring multi-sensor detectors that intelligently combine sophisticated smoke, heat, and flame detection capabilities. This integration serves to dramatically reduce false alarms and provide vastly more accurate and rapid fire identification across diverse and challenging aircraft compartments. Infrared (IR) and Ultraviolet (UV) flame detectors, alongside highly sophisticated smoke detection systems often utilizing advanced aspiration technology, are increasingly being widely adopted for their superior rapid response capabilities and their refined ability to accurately discern genuine fire threats from complex ambient conditions within the aircraft environment.

In the crucial domain of fire suppression, the market is undergoing a rapid and decisive transition towards the widespread adoption of environmentally friendly Halon alternatives. These innovative alternatives include advanced clean agents such as Novec 1230 fluid, FM-200 (HFC-227ea), and various highly efficient inert gas systems, all of which offer robust and effective fire extinguishing properties coupled with significantly lower environmental footprints and reduced toxicity compared to traditional agents. Extensive research and development efforts are also keenly focused on the application of specialized water mist systems for particular aircraft applications, presenting a non-toxic, cost-effective, and highly efficient alternative where suitable. Furthermore, sophisticated intelligent control units, meticulously equipped with advanced algorithms and real-time processing capabilities, are rapidly becoming a standard feature. These units are capable of seamlessly integrating data from multiple disparate sensors, making rapid and critical decisions, and initiating precise suppression actions either autonomously or with minimal human input, thereby significantly improving overall response times and effectiveness during a critical incident.

Emerging technologies that are poised to reshape the market include the extensive integration of Internet of Things (IoT) sensors for continuous, real-time monitoring and advanced predictive maintenance of fire protection components. This allows for proactive servicing, significantly increases system uptime, and reduces unscheduled maintenance events. Artificial intelligence (AI) and machine learning (ML) algorithms are being rigorously explored and implemented for enhanced data analysis, sophisticated pattern recognition in fire incident data, and for dynamically optimizing suppression strategies based on evolving scenarios. The paramount focus remains firmly fixed on developing even lighter, more compact, and energy-efficient systems that can seamlessly integrate with the increasingly complex avionics and digital architectures of modern aircraft. These advancements are critical to providing robust performance under the most extreme operating conditions, ensuring unwavering compliance with the absolute highest levels of aviation safety standards, and contributing to the overall longevity and reliability of aircraft fleets globally.

Regional Highlights

- North America: This region holds a dominant market share, primarily attributed to the significant presence of major aircraft manufacturers such as Boeing, the enforcement of exceptionally strict FAA regulations, and substantial government defense spending on advanced military aircraft. North America also stands as a leading hub for intensive Research and Development (R&D) and continuous technological advancements in aerospace safety and fire protection solutions.

- Europe: Europe represents another leading market, strongly driven by the presence of major aerospace players like Airbus and the robust regulatory frameworks established by the European Union Aviation Safety Agency (EASA). There is a pronounced emphasis in this region on developing and adopting sustainable and environmentally friendly fire suppression solutions, alongside ongoing and extensive aircraft fleet modernization programs across commercial and military sectors.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is propelled by burgeoning air passenger traffic, substantial governmental and private sector investments in new aircraft procurement, and the rapid expansion of regional aviation infrastructure. Countries like China and India are at the forefront of this growth, experiencing increasing demand for both commercial and general aviation aircraft and associated safety systems.

- Latin America: This region is an emerging market, driven by essential fleet renewal initiatives, the rapid expansion of its tourism sectors, and increasing demand for efficient air cargo services. Significant investments in improving airport infrastructure and enhancing regional air connectivity are also crucial contributing factors to market growth within Latin America.

- Middle East & Africa (MEA): The MEA region demonstrates significant growth potential, fueled by ambitious large-scale airline expansions, the strategic development of new international aviation hubs, and increasing defense expenditures focused on modernizing military aircraft fleets. The region's crucial geopolitical and geographical location also strongly supports the robust growth in air cargo aviation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Fire Protection Systems Market.- UTC Aerospace Systems (a Raytheon Technologies company)

- Fike Corporation

- Siemens AG

- Diehl Stiftung & Co. KG

- Gielle

- Meggitt PLC

- Safran S.A.

- Honeywell International Inc.

- Curtiss-Wright Corporation

- Kidde Aerospace & Defense

- Amphenol Corporation

- Orbit Aerospace Inc.

- Spectrex Inc.

- Minimax GmbH

- Amerex Corporation

- Novec (3M Company)

- Chemguard (part of Tyco Fire Protection Products)

- Janus Fire Systems

- Autronica Fire and Security AS

- Tyco Fire Protection Products (a Johnson Controls company)

Frequently Asked Questions

What are the primary drivers for the Aircraft Fire Protection Systems Market growth?

The market is primarily driven by escalating global air passenger traffic, the continuous modernization and expansion of existing aircraft fleets, and increasingly stringent aviation safety regulations mandated by authorities worldwide. These factors collectively create a robust demand for advanced and reliable fire protection technologies in all types of aircraft.

How is AI impacting aircraft fire protection systems?

AI is significantly transforming aircraft fire protection by enhancing detection accuracy through advanced sensor fusion and image processing, minimizing false alarms, enabling sophisticated predictive maintenance for system components, and facilitating more intelligent, rapid, and potentially autonomous response mechanisms during fire incidents. This leads to improved overall aircraft safety and operational reliability, reducing human error.

What types of aircraft commonly utilize these fire protection systems?

Aircraft fire protection systems are essential safety installations across all major aircraft types, including commercial airliners (e.g., narrow-body, wide-body, regional jets), military aircraft (e.g., fighter jets, transport aircraft, helicopters), general aviation aircraft (e.g., business jets, private planes, light aircraft), and dedicated cargo aircraft. Each category has specific requirements for tailored system designs to ensure maximum safety.

What are the key technological trends in fire suppression agents?

A pivotal technological trend is the industry-wide shift towards environmentally friendly Halon alternatives, such as Novec 1230 fluid, FM-200, and various inert gas systems. Research and development are also focused on advanced water mist systems and other clean agents that offer highly effective fire extinguishing properties with reduced environmental impact and lower toxicity, aligning with global sustainability initiatives and regulatory compliance goals.

Which regions are leading in the Aircraft Fire Protection Systems Market, and what is the growth outlook?

North America and Europe currently hold significant market shares due to well-established aerospace manufacturing bases and strict regulatory environments. However, the Asia Pacific region is projected to exhibit the highest growth over the forecast period, driven by rapid air traffic expansion, substantial investments in new aircraft procurement, and considerable infrastructure development across its aviation sector, making it a key focus for market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager