Aircraft Paint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429877 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aircraft Paint Market Size

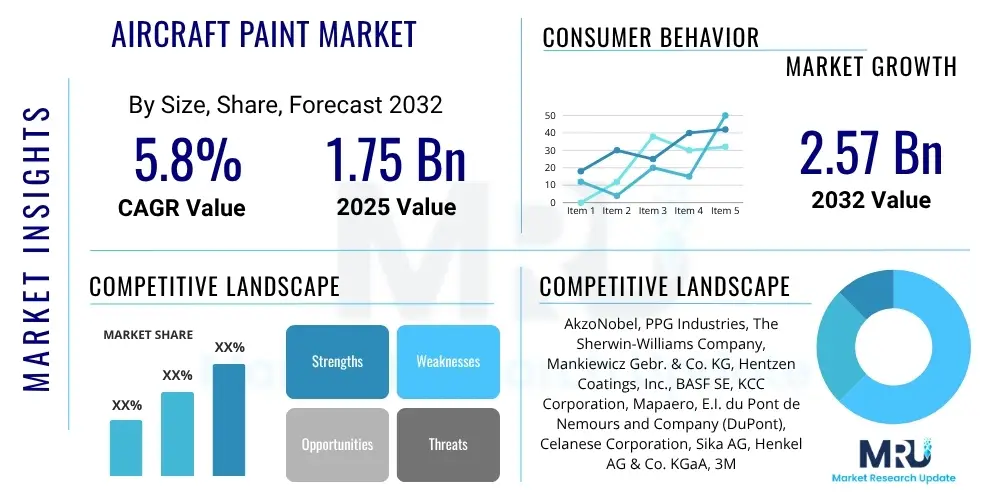

The Aircraft Paint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.75 Billion in 2025 and is projected to reach USD 2.57 Billion by the end of the forecast period in 2032.

Aircraft Paint Market introduction

The Aircraft Paint Market encompasses a specialized segment within the broader coatings industry, focusing on high-performance formulations designed for aerospace applications. These paints are critical for both the aesthetic appeal and structural integrity of aircraft, offering protection against harsh environmental conditions, corrosion, UV radiation, and mechanical wear. The market's products range from primers that enhance adhesion and corrosion resistance, to basecoats providing color, and clearcoats offering gloss and further protection. Specialized coatings also include those for interior applications, anti-static purposes, and even stealth properties for military aircraft, making them indispensable components in aircraft manufacturing and maintenance.

Major applications for aircraft paints span across commercial aviation, military aircraft, and general aviation sectors. In commercial aviation, these coatings are vital for branding, fuel efficiency through aerodynamic smoothness, and ensuring passenger comfort and safety within the cabin. For military applications, paints offer camouflaging, radar absorption, and extreme durability to withstand combat conditions. General aviation, including private jets and smaller planes, also relies on these paints for aesthetic personalization and robust protection. The benefits derived from these advanced coatings are multifaceted, including extended aircraft lifespan, reduced maintenance costs, enhanced safety through improved visibility, and compliance with stringent aviation regulations regarding performance and environmental impact.

The market is primarily driven by several key factors. The continuous growth in global air passenger traffic necessitates an expansion of commercial aircraft fleets, leading to increased demand for new aircraft and, consequently, new paint applications. Moreover, the extensive maintenance, repair, and overhaul (MRO) activities required for existing fleets, typically involving periodic repainting, contribute significantly to market expansion. Technological advancements in paint formulations, aimed at improving durability, reducing weight, and minimizing environmental impact through low VOC (Volatile Organic Compound) emissions, further stimulate market growth. The military sector's ongoing modernization programs and the demand for advanced stealth and protective coatings also act as strong market drivers.

Aircraft Paint Market Executive Summary

The Aircraft Paint Market is experiencing dynamic shifts, influenced by global business trends towards sustainability, enhanced performance, and digital integration. Key business trends include a significant push for eco-friendly coating solutions, such as waterborne and high-solid paints, driven by stricter environmental regulations worldwide. There is also a continuous focus on research and development to create lighter, more durable, and fuel-efficient coatings that contribute to operational cost savings for airlines. Furthermore, the market is seeing increased consolidation among major players, as companies seek to expand their product portfolios and geographical reach, leveraging economies of scale and specialized expertise to maintain competitive advantages within a highly regulated industry.

Regionally, the market exhibits varied growth trajectories and demand patterns. The Asia Pacific region is anticipated to demonstrate the highest growth, propelled by the booming aviation industry, rising disposable incomes, and increasing air travel demand, leading to substantial investments in new aircraft and MRO facilities. North America and Europe, while mature markets, continue to hold significant shares due to their large existing aircraft fleets, robust MRO infrastructure, and ongoing technological advancements in coating applications. Latin America and the Middle East & Africa also present emerging opportunities, driven by fleet expansion and upgrades, though at a comparatively slower pace, often influenced by economic stability and geopolitical factors affecting air travel and defense spending.

Segmentation trends reveal a clear inclination towards advanced coating types and applications. The demand for polyurethane-based coatings remains strong due to their superior durability, chemical resistance, and aesthetic finish. However, there is a growing interest in epoxy-based primers for their excellent corrosion protection. Application-wise, exterior coatings dominate the market due to larger surface areas and higher exposure to environmental stress, but interior coatings are also gaining traction with a focus on enhanced aesthetics, hygiene, and fire retardancy. The commercial aircraft end-use segment is the largest revenue contributor, consistently driven by new aircraft deliveries and routine MRO cycles, while the military aircraft segment offers high-value opportunities for specialized and high-performance coatings, reflecting continuous defense spending and modernization efforts.

AI Impact Analysis on Aircraft Paint Market

User inquiries regarding AI's impact on the Aircraft Paint Market predominantly center on how artificial intelligence can optimize existing processes, enhance product quality, and contribute to sustainability efforts. Common questions explore the potential for AI-driven robotic paint application systems to improve precision and reduce waste, the use of machine learning in quality control for defect detection, and the role of predictive analytics in managing coating maintenance cycles. There's also significant interest in AI's capacity to optimize paint formulations for specific performance criteria, such as weight reduction or enhanced durability, and to streamline supply chain logistics for raw materials, reflecting an overall expectation that AI will bring efficiency, intelligence, and advanced capabilities to a traditionally labor-intensive and precision-critical sector.

- AI-powered robotic painting systems for enhanced precision and uniformity, reducing material waste and application time.

- Machine learning algorithms for advanced quality inspection, identifying microscopic defects and ensuring consistent coating thickness.

- Predictive maintenance for aircraft coatings, utilizing AI to analyze sensor data and environmental factors to forecast coating degradation and optimal repaint schedules.

- AI-driven optimization of paint formulations, enabling faster development of new coatings with desired properties like lightweighting or improved corrosion resistance.

- Enhanced supply chain management through AI, predicting demand for raw materials and finished products, leading to optimized inventory and reduced lead times.

- Automated compliance checks and data analysis for environmental regulations, ensuring paint products meet stringent industry standards with minimal manual effort.

- Simulation and digital twinning of paint application processes, allowing for virtual testing and optimization before physical implementation, saving costs and time.

DRO & Impact Forces Of Aircraft Paint Market

The Aircraft Paint Market is shaped by a confluence of driving forces, inherent restraints, promising opportunities, and overarching impact factors. Key drivers include the robust growth in global air passenger traffic, leading to an increased demand for new commercial aircraft and a corresponding need for initial paint applications. Additionally, the extensive maintenance, repair, and overhaul (MRO) activities for existing fleets, which routinely involve repainting, provide a consistent demand stream. The continuous push for lightweight and fuel-efficient aircraft also propels innovation in coatings that offer enhanced aerodynamic properties and reduced weight. Furthermore, stringent regulatory frameworks from aviation authorities worldwide, mandating high-performance, durable, and environmentally compliant coatings, compel manufacturers to invest in advanced formulations.

Despite these drivers, the market faces several significant restraints. The high research and development costs associated with developing new, advanced coating formulations that meet rigorous aerospace standards can be a barrier to entry and innovation for smaller players. The volatility in raw material prices, such as specialty resins, pigments, and solvents, can impact production costs and profit margins. Moreover, the long product qualification cycles required for new aircraft paints, coupled with strict regulatory approvals, extend the time-to-market. A persistent challenge is also the shortage of skilled labor proficient in complex aircraft painting techniques, which can hinder efficient operations and quality control across MRO facilities globally, necessitating greater investment in training or automation.

Opportunities within the market largely revolve around sustainability and technological advancements. The growing demand for eco-friendly and low-VOC (Volatile Organic Compound) coatings presents a significant opportunity for manufacturers to innovate and gain a competitive edge. The development of 'smart coatings' with self-healing properties, anti-icing capabilities, or embedded sensors for structural health monitoring could revolutionize aircraft maintenance. Emerging markets, particularly in Asia Pacific and Latin America, offer untapped growth potential as their aviation sectors expand rapidly. The adoption of additive manufacturing processes in aircraft components could also open new avenues for specialized coatings designed for unique material surfaces and complex geometries, fostering market diversification and new product development.

Segmentation Analysis

The Aircraft Paint Market is comprehensively segmented based on various critical attributes, including the type of resin used, the specific application area, the end-user industry, and the distinct aircraft type. This multi-dimensional segmentation allows for a granular understanding of market dynamics, enabling stakeholders to identify precise demand patterns, technological preferences, and regional consumption trends. Each segment provides unique insights into the competitive landscape, regulatory influences, and the specific performance requirements that drive product development and market penetration. Analyzing these segments helps in strategizing for product innovation, market entry, and optimizing distribution channels to cater to diverse customer needs across the aerospace industry.

- By Resin Type

- Epoxy-based Coatings: Known for excellent adhesion, corrosion resistance, and durability, primarily used in primers.

- Polyurethane-based Coatings: Valued for superior gloss retention, chemical resistance, and flexibility, commonly used as topcoats.

- Acrylic-based Coatings: Offer good weatherability and color stability, often used in specific decorative or protective layers.

- Other Resin Types: Includes specialized formulations like fluoropolymer-based and siloxane-based coatings for unique performance requirements.

- By Application

- Exterior Coatings: Covers primers, intermediate coats, and topcoats applied to the external surfaces of aircraft for protection against weather, corrosion, and UV radiation, as well as for aesthetic appeal and branding.

- Interior Coatings: Used for cabin walls, floors, seats, and other internal components, focusing on fire retardancy, hygiene, aesthetics, and passenger comfort.

- By End-Use Industry

- Commercial Aviation: Includes passenger aircraft, cargo planes, and regional jets. This segment is driven by new aircraft deliveries and MRO activities for large fleets.

- Military Aviation: Encompasses fighter jets, transport aircraft, helicopters, and UAVs for defense. Demand here is for high-performance, stealth, and camouflage coatings.

- General Aviation: Consists of private jets, turboprops, piston-engine aircraft, and smaller helicopters. Focuses on aesthetics, durability, and customization.

- By Aircraft Type

- Commercial Aircraft: Narrow-body, Wide-body, Regional Jets.

- Military Aircraft: Fighters, Bombers, Transport Aircraft, Helicopters, UAVs.

- General Aviation Aircraft: Business Jets, Piston Aircraft, Turboprop Aircraft, Helicopters.

- By Sales Channel

- OEM (Original Equipment Manufacturer): Sales directly to aircraft manufacturers for new aircraft production.

- MRO (Maintenance, Repair, and Overhaul): Sales to MRO facilities and airlines for aircraft repainting and maintenance.

Value Chain Analysis For Aircraft Paint Market

The value chain for the Aircraft Paint Market begins with the upstream suppliers of critical raw materials, which form the foundational components of advanced aerospace coatings. These include specialized chemical manufacturers providing high-performance resins such as epoxy, polyurethane, and acrylic, essential pigments for color and UV stability, various additives for properties like corrosion inhibition, flow control, and fire retardancy, and solvents, including water-based options, for viscosity adjustment and application. The quality and availability of these raw materials directly impact the final paint product's performance, cost, and environmental profile. Significant research and development efforts are often shared between raw material suppliers and paint manufacturers to innovate and meet stringent aerospace specifications, especially concerning lightweighting and environmental compliance.

Moving downstream, the value chain encompasses the aircraft paint manufacturers themselves, who process these raw materials into finished coating systems, including primers, basecoats, and clearcoats. These manufacturers invest heavily in R&D to develop formulations that comply with international aviation standards (e.g., aerospace material specifications, environmental regulations), offer superior durability, corrosion protection, aerodynamic efficiency, and aesthetic appeal. After manufacturing, these paint systems are distributed through various channels to reach the end-users. Direct distribution typically involves sales teams engaging directly with large Original Equipment Manufacturers (OEMs) like Boeing and Airbus, who procure substantial volumes for new aircraft production. This direct relationship allows for customized product development and technical support throughout the manufacturing process.

Indirect distribution plays a crucial role in reaching Maintenance, Repair, and Overhaul (MRO) facilities, airlines, and smaller general aviation clients. This often involves a network of specialized distributors who maintain inventories of aerospace-approved paints and provide logistical support and technical advice to their diverse client base. These distributors are critical in ensuring timely delivery and offering localized support, especially for smaller-scale repair and repainting jobs. The ultimate end-users, including commercial airlines, military forces, and private aircraft owners, then apply these paints, often through their in-house MRO departments or third-party service providers. The entire value chain is characterized by strict quality control, extensive certification processes, and a strong emphasis on long-term performance and safety, reflecting the high-stakes nature of the aerospace industry.

Aircraft Paint Market Potential Customers

The primary potential customers for the Aircraft Paint Market are broadly categorized into three major segments, each with distinct needs and procurement processes. Firstly, Original Equipment Manufacturers (OEMs) of aircraft, such as Boeing, Airbus, Embraer, and Bombardier, constitute a significant customer base. These manufacturers require large volumes of specific paint systems for the initial coating of new aircraft during the assembly phase. Their purchasing decisions are driven by strict performance specifications, regulatory compliance, supply chain reliability, and the ability of paint suppliers to integrate seamlessly into their production lines, often involving long-term supply agreements and specialized customization for new aircraft models. The paints used here are integral to the aircraft's structural integrity, aesthetic branding, and aerodynamic efficiency from day one.

Secondly, Maintenance, Repair, and Overhaul (MRO) facilities, including independent MRO providers, airline MRO departments, and defense contractors, represent another substantial segment of potential customers. These entities are responsible for the ongoing maintenance, repair, and periodic repainting of existing aircraft fleets. Their demand for aircraft paints is driven by routine maintenance schedules, damage repair, and fleet upgrades or rebranding initiatives. MRO customers prioritize products that offer quick application times, excellent durability under various operating conditions, and ease of rework, minimizing aircraft downtime. They often procure a wider variety of paint products to match existing liveries and ensure compliance with various repair specifications, making cost-effectiveness and localized availability key purchasing criteria.

Lastly, direct end-users such as commercial airlines, military forces, and owners of private and general aviation aircraft also serve as potential customers. Commercial airlines either operate their own MRO facilities or contract external providers, but their specifications often influence paint procurement. Military forces require specialized coatings for camouflage, stealth, and extreme environmental protection for their defense fleets. Private and general aviation aircraft owners, along with specialized finishing shops catering to them, seek high-quality paints for aesthetics, customization, and long-term durability for their often high-value assets. Across all customer types, factors such as environmental compliance, total cost of ownership, and comprehensive technical support from paint manufacturers are crucial considerations in their buying decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 2.57 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel, PPG Industries, The Sherwin-Williams Company, Mankiewicz Gebr. & Co. KG, Hentzen Coatings, Inc., BASF SE, KCC Corporation, Mapaero, E.I. du Pont de Nemours and Company (DuPont), Celanese Corporation, Sika AG, Henkel AG & Co. KGaA, 3M Company, W. R. Grace & Co., Lord Corporation, Solvay S.A., Dow Inc., Axalta Coating Systems, Ltd., Permagard, Aerospace Coatings International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Paint Market Key Technology Landscape

The Aircraft Paint Market is characterized by a dynamic technology landscape, continuously evolving to meet the aerospace industry's demands for enhanced performance, environmental compliance, and operational efficiency. A significant technological trend involves the shift towards eco-friendly formulations, including water-based and high-solids coatings. These technologies aim to drastically reduce Volatile Organic Compound (VOC) emissions, aligning with stringent environmental regulations and sustainability goals set by aviation authorities and airlines globally. Water-based paints offer benefits in terms of worker safety and environmental impact, while high-solids coatings provide a thicker protective layer with fewer coats, reducing both material usage and application time, directly contributing to lower maintenance costs and faster aircraft turnaround times.

Another crucial technological advancement is the development of advanced anti-corrosion systems, often incorporating chrome-free primers. These innovations are crucial for extending the lifespan of aircraft components, particularly aluminum and composite structures, by providing superior protection against galvanic corrosion and other forms of degradation without using hexavalent chromium, a known carcinogen. Furthermore, the integration of robotic paint application systems is gaining traction. These automated systems offer unparalleled precision, consistency, and speed in applying coatings, minimizing human error, optimizing material usage, and ensuring uniform thickness across complex aircraft geometries. Robotics also enhance worker safety by reducing exposure to paint fumes and chemicals, leading to a more efficient and safer production process for OEMs and MROs alike.

Beyond application and environmental aspects, there is ongoing research and development in functional and smart coatings. This includes self-healing coatings that can automatically repair minor scratches and cracks, thus reducing the need for manual touch-ups and prolonging paint durability. Additionally, aerodynamic coatings designed to minimize drag and improve fuel efficiency are becoming more sophisticated, incorporating nano-additives and surface modifications to create ultra-smooth surfaces. Anti-icing coatings, which prevent ice buildup on critical surfaces, are also under active development to enhance flight safety and reduce reliance on energy-intensive de-icing procedures. These technological innovations collectively underscore the industry's commitment to advancing aircraft performance, safety, and environmental stewardship, driving the market towards more intelligent and sustainable coating solutions.

Regional Highlights

- North America: This region holds a significant share of the aircraft paint market, driven by a mature aviation industry, a large number of existing aircraft fleets, and a robust MRO infrastructure. The presence of major aircraft manufacturers and defense contractors, coupled with ongoing technological advancements and strict regulatory frameworks, ensures sustained demand for high-performance coatings. The focus here is also on adopting environmentally compliant and efficient coating solutions to meet stringent EPA regulations.

- Europe: Similar to North America, Europe is a well-established market with a strong aerospace manufacturing base and extensive MRO activities. Countries like France, Germany, and the UK are key contributors, benefiting from major aircraft programs and a focus on advanced materials and sustainable coating technologies. Regulatory pressures from agencies like EASA drive innovation towards low-VOC and chrome-free formulations, influencing market trends.

- Asia Pacific (APAC): Expected to be the fastest-growing market, APAC is fueled by rapid expansion of air passenger traffic, significant investments in new aircraft procurement, and the development of new airports and MRO facilities, particularly in countries like China, India, and Southeast Asian nations. The region's increasing demand for both commercial and military aircraft presents substantial opportunities for paint manufacturers, often focusing on balancing cost-effectiveness with performance.

- Latin America: This region is an emerging market for aircraft paint, characterized by fleet modernization efforts and increasing air travel demand, particularly in Brazil and Mexico. While smaller than other regions, it offers growth potential as airlines expand their operations and existing fleets undergo necessary maintenance and repainting. Economic stability and governmental policies affecting aviation infrastructure play a crucial role in market development.

- Middle East and Africa (MEA): The MEA region is experiencing growth driven by strategic geographical location making it a hub for international air travel, substantial investments in airport infrastructure, and the expansion of major airlines like Emirates and Qatar Airways. Significant military spending in some MEA countries also contributes to the demand for specialized aircraft coatings. The market here is influenced by the procurement of new, state-of-the-art aircraft and the establishment of MRO capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Paint Market.- AkzoNobel

- PPG Industries

- The Sherwin-Williams Company

- Mankiewicz Gebr. & Co. KG

- Hentzen Coatings, Inc.

- BASF SE

- KCC Corporation

- Mapaero

- E.I. du Pont de Nemours and Company (DuPont)

- Celanese Corporation

- Sika AG

- Henkel AG & Co. KGaA

- 3M Company

- W. R. Grace & Co.

- Lord Corporation

- Solvay S.A.

- Dow Inc.

- Axalta Coating Systems, Ltd.

- Permagard

- Aerospace Coatings International

Frequently Asked Questions

What are the primary factors driving the growth of the Aircraft Paint Market?

The market is primarily driven by global growth in air passenger traffic, leading to increased demand for new commercial aircraft, coupled with the extensive maintenance, repair, and overhaul (MRO) activities required for existing fleets. Additionally, technological advancements for lighter, more durable, and eco-friendly coatings, alongside stringent regulatory requirements, significantly propel market expansion.

How do environmental regulations impact the Aircraft Paint Market?

Environmental regulations significantly influence the market by driving the demand for low Volatile Organic Compound (VOC) and chrome-free paint formulations. These regulations compel manufacturers to invest in R&D for more sustainable and environmentally compliant products, fostering innovation in water-based and high-solids coatings to reduce harmful emissions and ensure worker safety.

What role does AI play in the future of aircraft painting?

AI is poised to revolutionize aircraft painting by enabling highly precise robotic application systems, enhancing quality control through machine learning for defect detection, and optimizing paint formulations for superior performance. It also supports predictive maintenance for coatings and streamlines supply chain management, leading to greater efficiency, reduced waste, and improved overall quality in the aerospace sector.

Which region is expected to show the fastest growth in the Aircraft Paint Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth in the Aircraft Paint Market. This accelerated growth is attributed to the burgeoning aviation industry, increasing air travel demand, substantial investments in new aircraft procurement, and the rapid development of MRO facilities across countries like China and India.

What types of coatings are most commonly used in aircraft painting?

Epoxy-based coatings are widely used as primers due to their excellent adhesion and corrosion resistance, while polyurethane-based coatings are favored for topcoats because of their superior durability, chemical resistance, and high gloss retention. Acrylic-based coatings are also utilized for specific applications requiring good weatherability and color stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager