Aircraft Seating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427954 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Aircraft Seating Market Size

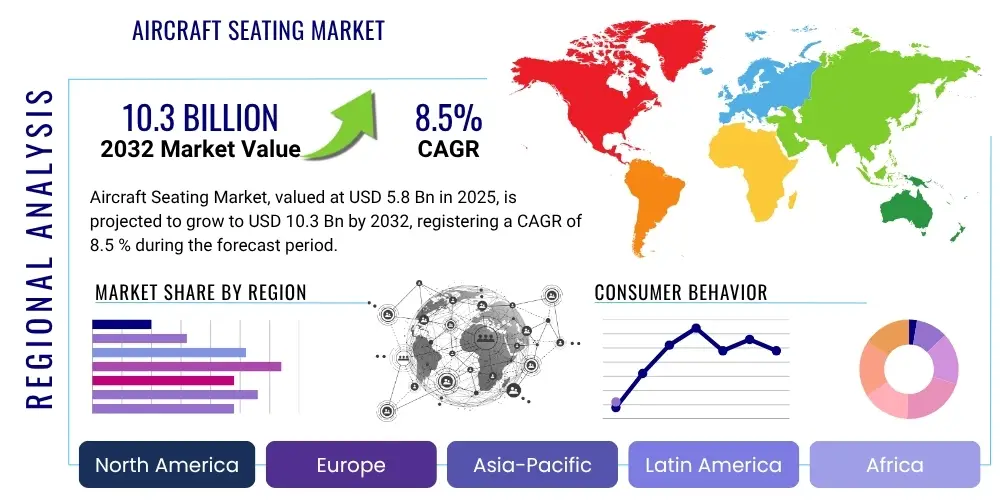

The Aircraft Seating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 5.8 billion in 2025 and is projected to reach USD 10.3 billion by the end of the forecast period in 2032.

Aircraft Seating Market introduction

The Aircraft Seating Market encompasses the design, manufacturing, and supply of seating solutions for various aircraft types, including commercial airlines, business jets, and military aircraft. This specialized sector is critical to the aviation industry, directly impacting passenger comfort, safety, operational efficiency, and airline branding. Aircraft seats are complex products, integrating ergonomic design, advanced materials, and sophisticated engineering to meet stringent regulatory standards while optimizing space and weight.

Product descriptions for aircraft seating vary significantly across classes and aircraft types. Economy class seats prioritize density and durability, often featuring lightweight composite structures and robust upholstery, while premium economy offers increased pitch and recline. Business and first-class seats, however, are sophisticated ecosystems offering lie-flat capabilities, integrated entertainment systems, privacy partitions, and premium finishes. The material choices range from aluminum alloys and steel for frames to advanced composites like carbon fiber for weight reduction, complemented by fire-resistant fabrics, leather, and foam for cushioning.

Major applications of aircraft seating span new aircraft deliveries (OEM market) and aftermarket installations or refurbishments (MRO market). The benefits derived include enhanced passenger experience, crucial for airline loyalty; improved safety performance through rigorous certification; and optimized cabin layouts that maximize revenue potential for airlines. Driving factors such as robust growth in global air passenger traffic, fleet expansion and modernization programs by airlines, the increasing demand for premium cabins, and continuous technological advancements in materials and design are propelling market expansion.

Aircraft Seating Market Executive Summary

The Aircraft Seating Market is currently characterized by dynamic business trends driven by intense competition among manufacturers to innovate and differentiate their offerings. Key trends include the widespread adoption of lightweight materials, such as advanced composites and aluminum alloys, to reduce fuel consumption and operating costs. There is also a significant emphasis on customization and personalization, with airlines seeking unique seating configurations and branding elements to enhance their passenger experience and competitive edge. The integration of smart seating features, including embedded sensors for predictive maintenance, advanced in-flight entertainment (IFE) systems, and connectivity options, is further transforming the market landscape.

Regionally, the market exhibits diverse growth patterns. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by expanding middle-class populations, increased air travel demand, and substantial investments in new aircraft by local carriers. North America and Europe, while mature, remain crucial markets, leading in technological innovation, premium cabin demand, and aftermarket services. Latin America and the Middle East & Africa (MEA) are also experiencing steady growth, driven by fleet expansion and the establishment of new low-cost carriers (LCCs) and full-service airlines seeking cost-effective and comfortable seating solutions.

Segmentation trends highlight robust demand across all classes, although with varying growth rates. The economy class segment continues to dominate in terms of volume due to the proliferation of LCCs and the expansion of global air travel. However, the premium economy, business, and first-class segments are witnessing faster growth in value, driven by airlines' strategies to offer enhanced passenger comfort and luxury, thus commanding higher fares. The aftermarket segment, including refurbishment and retrofitting, is also gaining traction as airlines extend the lifespan of their existing fleets and upgrade cabins to meet contemporary passenger expectations and competitive standards.

AI Impact Analysis on Aircraft Seating Market

Common user questions regarding AI's impact on the Aircraft Seating Market often revolve around how artificial intelligence can enhance design efficiency, manufacturing precision, maintenance protocols, and the overall passenger experience. Users are keen to understand if AI can predict material fatigue, optimize cabin layouts for diverse passenger demographics, or personalize seating features dynamically. There's also interest in AI's role in streamlining supply chains and ensuring compliance with stringent safety regulations. The prevailing themes include the expectation of AI driving innovation towards lighter, safer, more comfortable, and highly customizable seating solutions, while also raising concerns about data privacy and the complexity of integrating advanced AI systems into existing aircraft infrastructure.

- AI-driven generative design for optimal seat structures, minimizing weight while maximizing strength and ergonomics.

- Predictive maintenance analytics for seat components, identifying potential failures before they occur, reducing downtime and maintenance costs.

- Personalized cabin experiences through AI, adjusting seat comfort, lighting, and entertainment based on individual passenger preferences and biometric data.

- Enhanced manufacturing processes via AI-powered robotics and quality control systems, ensuring precision and reducing defects.

- Supply chain optimization using AI algorithms to forecast demand, manage inventory, and improve logistics for raw materials and finished seats.

- Data analytics for passenger feedback and usage patterns, informing future seat design iterations and material selection for improved durability and comfort.

- Simulation and testing optimization with AI, accelerating certification processes by predicting performance under various stress conditions.

DRO & Impact Forces Of Aircraft Seating Market

The Aircraft Seating Market is significantly influenced by a confluence of drivers, restraints, and opportunities. Key drivers include the consistent growth in global air passenger traffic, leading to increased demand for new aircraft and subsequent seating requirements. Fleet expansion and modernization initiatives by airlines, particularly in emerging economies, further fuel market growth. The rising preference for premium economy and business class travel, driven by both leisure and corporate travelers seeking enhanced comfort, necessitates the production of more sophisticated and value-added seating solutions. Additionally, the proliferation of low-cost carriers (LCCs) worldwide, focusing on maximizing seat density while maintaining basic comfort, continues to drive demand for economical and durable seating.

However, several restraints challenge market expansion. Stringent regulatory requirements and lengthy certification processes imposed by aviation authorities (such as FAA and EASA) significantly increase development costs and time-to-market for new seating products. The high capital expenditure required for research and development of advanced materials and manufacturing technologies acts as a barrier to entry for new players. Furthermore, the volatility of raw material prices, particularly for metals, composites, and specialized fabrics, can impact manufacturing costs and profit margins. Supply chain disruptions, often exacerbated by geopolitical tensions or global events, also pose significant operational challenges.

Opportunities within the market largely stem from technological advancements and evolving passenger expectations. The continuous innovation in lightweight and sustainable materials, such as advanced composites and bio-based textiles, presents avenues for reducing aircraft weight and environmental footprint. The integration of smart technologies, including sensors for predictive maintenance, wireless charging, and advanced in-flight entertainment (IFE) systems, offers significant differentiation potential. The growing demand for highly customizable and modular seating solutions, allowing airlines greater flexibility in cabin configurations and branding, represents a lucrative niche. Furthermore, the expanding aftermarket segment, driven by seat refurbishment and retrofitting programs, provides consistent revenue streams for manufacturers and MRO providers, enabling the upgrade of existing fleets to meet contemporary standards without the cost of new aircraft acquisition.

Segmentation Analysis

The Aircraft Seating Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation allows for targeted market analysis, highlighting growth areas and strategic opportunities across different aircraft types, seating classes, material compositions, and end-user applications. Understanding these distinct segments is crucial for manufacturers, airlines, and investors to develop tailored strategies and allocate resources effectively in a highly competitive and specialized industry.

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets

- Business Jets

- Military Aircraft

- By Seating Class:

- Economy Class

- Premium Economy Class

- Business Class

- First Class

- By Component:

- Seat Frames

- Cushions & Covers

- Actuators & Mechanism

- Armrests & Tray Tables

- Others (e.g., Seatbelts, Life Vest Pouch)

- By End-User:

- OEM (Original Equipment Manufacturer)

- Aftermarket (MRO - Maintenance, Repair, and Overhaul)

- By Material:

- Aluminum Alloys

- Composite Materials

- Steel Alloys

- Others (e.g., Fabrics, Leather, Foam)

- By Technology:

- Conventional Seating

- Smart Seating (e.g., integrated sensors, connectivity)

- By Sales Channel:

- Direct Sales

- Distributors/Suppliers

Value Chain Analysis For Aircraft Seating Market

The value chain for the Aircraft Seating Market is intricate, involving various stages from raw material sourcing to final installation and aftermarket services. The upstream segment involves the procurement of highly specialized raw materials, including aerospace-grade aluminum and steel alloys, advanced composite materials like carbon fiber and fiberglass, fire-resistant fabrics, premium leather, and various foam types. Suppliers in this segment are critical for providing components that meet stringent aerospace quality and safety standards, often requiring long-term partnerships due to the specialized nature of these materials and components such as actuators, electronics for IFE, and complex mechanical parts.

The core of the value chain lies in the design, engineering, and manufacturing phases. Seat manufacturers engage in extensive R&D to innovate ergonomic designs, lightweight structures, and integrate advanced features. This involves sophisticated computer-aided design (CAD) and simulation software, followed by rigorous prototyping and testing to comply with aviation regulations (e.g., 16g crash certification). The manufacturing process itself combines precision machining, composite fabrication, upholstery, and final assembly, often customized to airline specifications. Distribution channels for aircraft seats are primarily direct. Manufacturers typically sell directly to Original Equipment Manufacturers (OEMs) like Boeing, Airbus, and Embraer for new aircraft installations, or directly to airlines for aftermarket retrofitting and cabin refurbishments.

Downstream analysis focuses on the end-users and post-sale services. Once seats are delivered to OEMs, they are integrated into new aircraft during the assembly phase. For the aftermarket, seats are supplied to airlines or Maintenance, Repair, and Overhaul (MRO) facilities for installation, repair, or upgrades on existing fleets. This segment includes services like maintenance, repairs, spare parts supply, and refurbishment programs. Direct sales ensure tight control over product quality and customization, fostering strong customer relationships. Indirect channels might involve specialized distributors for smaller MRO operations or specific components, though direct engagement remains dominant for complete seat assemblies.

Aircraft Seating Market Potential Customers

The primary potential customers and end-users of aircraft seating products are broadly categorized within the aviation sector, encompassing entities responsible for the operation and maintenance of aircraft. Commercial airlines, spanning both full-service carriers and low-cost carriers (LCCs) globally, represent the largest segment of buyers. These airlines continually invest in new aircraft, necessitating initial seat installations (OEM market), and also frequently undertake cabin refurbishment programs for their existing fleets (aftermarket), driven by competition, passenger comfort demands, and regulatory compliance. Their purchasing decisions are heavily influenced by factors such as weight reduction, durability, passenger comfort, aesthetic appeal, and total cost of ownership.

Beyond commercial airlines, business jet operators and private aircraft owners constitute another significant customer base, albeit for highly customized and luxurious seating solutions. This segment demands bespoke designs, premium materials, and advanced features that prioritize comfort, privacy, and exclusivity. Government and military agencies also procure aircraft seating for their transport, VIP, and specialized mission aircraft, where robustness, specific ergonomic requirements, and specialized functionalities are paramount. Additionally, Maintenance, Repair, and Overhaul (MRO) facilities and aircraft leasing companies frequently purchase seats for replacement, repair, or upgrade purposes, playing a crucial role in the aftermarket segment by catering to the needs of various aircraft operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 10.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S.A., RECARO Aircraft Seating GmbH & Co. KG, Collins Aerospace (Raytheon Technologies Corp.), Acro Aircraft Seating, Geven S.p.A., HAECO Cabin Solutions, EASA (Expliseat), STELIA Aerospace (Airbus Atlantic), Mirus Aircraft Seating Ltd., ZIM Aircraft Seating GmbH, Thompson Aero Seating, Aviointeriors S.p.A., Adient Aerospace LLC, TSI Seats, TEAGUE, Iacobucci HF Aerospace, Brose Fahrzeugteile GmbH & Co. KG, Aircraft Interior Products, JAMCO Corporation, BE Aerospace Inc. (now part of Collins Aerospace) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Seating Market Key Technology Landscape

The Aircraft Seating Market is continuously evolving due to significant advancements in material science, manufacturing processes, and smart technologies. A crucial aspect of this technological landscape is the relentless pursuit of lightweighting. Manufacturers are increasingly utilizing advanced composite materials such as carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP) in seat frames and structural components. These materials offer superior strength-to-weight ratios compared to traditional aluminum or steel, directly contributing to fuel efficiency and reduced operational costs for airlines. Additionally, innovative metallic alloys and hybrid material combinations are being explored to achieve the optimal balance between weight, durability, and cost.

Beyond materials, advanced manufacturing techniques play a pivotal role. Additive manufacturing, or 3D printing, is gaining traction for producing complex seat components with intricate geometries that are difficult or impossible to achieve with traditional methods. This technology enables rapid prototyping, mass customization, and the creation of parts with optimized internal structures for further weight reduction. Furthermore, smart seating technologies are becoming more prevalent. This includes the integration of sensors for monitoring seat occupancy, wear and tear for predictive maintenance, and environmental conditions. Connectivity features such as USB charging ports, wireless charging, and advanced in-flight entertainment (IFE) systems are now standard expectations, driving demand for robust and seamlessly integrated electronic architectures within seat designs. Ergonomic design principles, supported by sophisticated simulation software, are also critical to ensure maximum passenger comfort within confined spaces, adapting to diverse body types and long flight durations.

Regional Highlights

- North America: A mature market characterized by strong demand for premium cabin configurations and significant investment in aircraft modernization by major carriers. It leads in technological innovation, particularly in smart seating and advanced materials, driven by a robust aerospace manufacturing base and high disposable incomes supporting premium travel.

- Europe: A highly competitive market with a focus on passenger comfort, design aesthetics, and environmental sustainability. European airlines frequently undertake cabin refurbishments, stimulating demand for innovative and lightweight seating solutions, while strict regulatory frameworks influence design and material choices.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid economic growth, expanding middle-class populations, and a surge in air passenger traffic. Significant investments in new aircraft by both full-service and low-cost carriers, particularly in China, India, and Southeast Asian nations, are driving substantial market expansion for both OEM and aftermarket segments.

- Latin America: Experiencing steady growth fueled by increasing air travel penetration, expansion of regional airlines, and fleet upgrades. The market is sensitive to cost-effectiveness, favoring durable and efficient economy class seating, alongside a growing demand for premium services on international routes.

- Middle East and Africa (MEA): Marked by substantial investments from prominent international airlines in luxury and premium travel experiences, particularly in the Middle East. These carriers are key drivers for the first and business class seating segments, demanding highly customized, technologically advanced, and opulent seating solutions. Africa's market growth is more centered on expanding regional connectivity and establishing new LCCs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Seating Market.- Safran S.A.

- RECARO Aircraft Seating GmbH & Co. KG

- Collins Aerospace (Raytheon Technologies Corp.)

- Acro Aircraft Seating

- Geven S.p.A.

- HAECO Cabin Solutions

- EASA (Expliseat)

- STELIA Aerospace (Airbus Atlantic)

- Mirus Aircraft Seating Ltd.

- ZIM Aircraft Seating GmbH

- Thompson Aero Seating

- Aviointeriors S.p.A.

- Adient Aerospace LLC

- TSI Seats

- TEAGUE

- Iacobucci HF Aerospace

- Brose Fahrzeugteile GmbH & Co. KG

- Aircraft Interior Products

- JAMCO Corporation

- BE Aerospace Inc. (now part of Collins Aerospace)

Frequently Asked Questions

Analyze common user questions about the Aircraft Seating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Aircraft Seating Market?

The primary drivers include the consistent growth in global air passenger traffic, extensive fleet expansion and modernization programs by airlines, the increasing demand for premium cabins, and the proliferation of low-cost carriers which require durable and cost-effective seating solutions. Continuous innovation in materials and design also fuels market expansion.

How do lightweight materials impact the aircraft seating industry?

Lightweight materials such as advanced composites and specialized aluminum alloys significantly impact the industry by enabling the production of lighter seats. This directly contributes to reduced aircraft fuel consumption, lower operational costs for airlines, and increased payload capacity, while maintaining stringent safety and durability standards.

What is the role of customization in aircraft seating?

Customization plays a crucial role by allowing airlines to differentiate their brand and enhance the passenger experience. It involves tailored designs, unique upholstery, specific color schemes, and integration of bespoke features like advanced IFE systems or unique privacy solutions, reflecting an airline's distinct service offerings and strategic positioning.

What are the main challenges faced by aircraft seat manufacturers?

Key challenges include navigating stringent regulatory requirements and lengthy certification processes, managing high research and development costs for advanced technologies, mitigating the volatility of raw material prices, and ensuring robust supply chain resilience. Meeting diverse airline demands while optimizing weight and cost also presents ongoing difficulties.

How is artificial intelligence (AI) expected to transform aircraft seating?

AI is poised to transform aircraft seating through generative design for structural optimization, predictive maintenance of seat components, and highly personalized passenger experiences. It can also enhance manufacturing precision, optimize supply chain logistics, and accelerate certification processes, leading to safer, more efficient, and more comfortable seating solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager