Aircraft Weapons Carriage and Release System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430149 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Aircraft Weapons Carriage and Release System Market Size

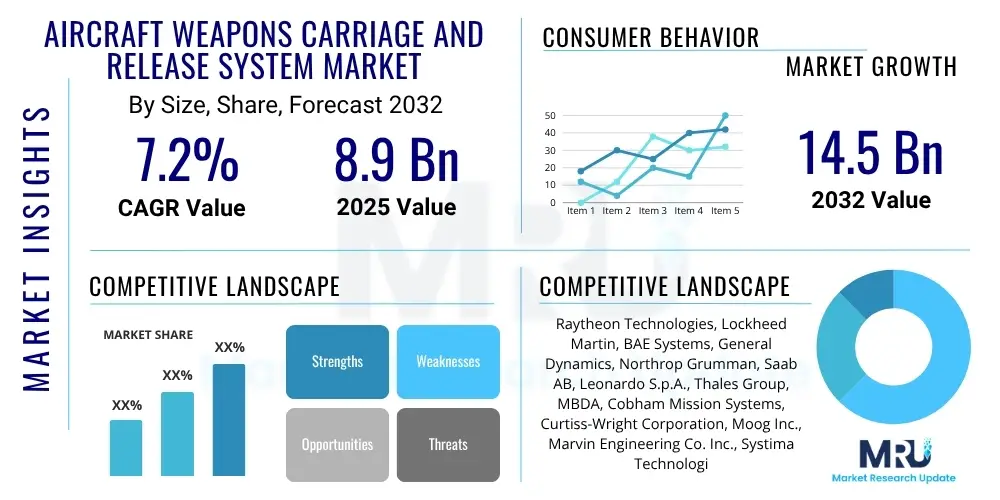

The Aircraft Weapons Carriage and Release System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 8.9 Billion in 2025 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2032.

Aircraft Weapons Carriage and Release System Market introduction

The Aircraft Weapons Carriage and Release System (AWC&RS) market encompasses the sophisticated hardware and software solutions critical for safely and effectively transporting, launching, and releasing munitions from various aerial platforms. These systems are integral to modern military operations, enabling combat aircraft to perform their mission-critical roles by integrating a diverse array of weaponry, from bombs and missiles to precision-guided munitions. The product description includes components such as pylons, ejector release units (ERUs), bomb racks, missile launchers, and associated control and interface systems, all designed to meet stringent aerospace and defense standards for structural integrity, aerodynamic performance, and operational reliability.

Major applications for AWC&RS span across fixed-wing aircraft like fighter jets, bombers, and attack aircraft, as well as rotary-wing platforms such as attack helicopters, and increasingly, unmanned aerial vehicles (UAVs). These systems are essential for air-to-air combat, air-to-ground strike missions, intelligence, surveillance, and reconnaissance (ISR) operations, and even for carrying auxiliary fuel tanks or sensor pods to extend mission endurance and capabilities. The primary benefits derived from advanced AWC&RS include enhanced mission flexibility, improved weapon precision and targeting, increased payload capacity, and critically, heightened operational safety for both personnel and equipment.

Driving factors propelling the AWC&RS market growth include escalating geopolitical tensions worldwide, leading to increased defense spending and military modernization efforts across numerous nations. The continuous demand for advanced weapon integration capabilities, the development of next-generation aircraft and smart munitions, and the emphasis on network-centric warfare further contribute to market expansion. Moreover, technological advancements in materials science, digital control systems, and modular open systems architectures (MOSA) are enabling the development of more versatile, lighter, and more capable carriage and release solutions, catering to the evolving requirements of modern air forces globally.

Aircraft Weapons Carriage and Release System Market Executive Summary

The Aircraft Weapons Carriage and Release System market is experiencing dynamic shifts driven by global defense modernization initiatives and an emphasis on interoperability and advanced weapon integration. Business trends indicate a strong focus on research and development to create more adaptable and universal carriage systems, capable of integrating diverse weapon types across multiple platforms. This includes a push towards smart pylons and networked release mechanisms that enhance target engagement and operational efficiency. The industry is also seeing consolidation among key players to leverage economies of scale and expand technological expertise, alongside a growing interest in modular and open-architecture solutions that simplify upgrades and maintenance.

Regional trends highlight North America and Europe as established leaders in terms of market size and technological innovation, owing to significant defense budgets and robust aerospace and defense industries. However, the Asia Pacific (APAC) region is emerging as a critical growth hub, propelled by increasing defense expenditures from countries like China, India, and Japan, which are actively modernizing their air forces and investing in advanced indigenous capabilities. Latin America, the Middle East, and Africa are also contributing to market growth through procurement of new aircraft and upgrades to existing fleets, often driven by regional security concerns and counter-terrorism efforts.

Segment trends underscore a notable shift towards systems compatible with unmanned aerial vehicles (UAVs), reflecting the growing role of drones in modern warfare. The demand for advanced ejector release units (ERUs) and universal bomb racks (UBRs) that can accommodate a wide range of precision-guided munitions is paramount. Furthermore, there is an increasing emphasis on carriage systems that support stealth aircraft requirements, focusing on internal bay integration and reduced radar cross-section. The integration of advanced sensors and communication systems within carriage platforms to enable smarter weapon deployment and real-time mission updates represents another key segment trend, enhancing the overall combat effectiveness and adaptability of modern air platforms.

AI Impact Analysis on Aircraft Weapons Carriage and Release System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Aircraft Weapons Carriage and Release Systems (AWC&RS) frequently revolve around enhancing precision, optimizing mission parameters, and improving autonomous functionalities. Common questions explore how AI can contribute to predictive maintenance of these complex systems, improve weapon selection and targeting in dynamic combat environments, and support autonomous weapon release decisions in future unmanned platforms. There is also significant interest in AI's role in reducing operator workload, minimizing collateral damage through smarter weapon deployment, and addressing the ethical implications of AI-driven combat systems. Users are keen to understand the technological advancements and implementation challenges associated with integrating AI into such safety-critical defense hardware.

- Enhanced precision targeting and weapon selection through AI-driven algorithms.

- Predictive maintenance and fault detection for carriage and release mechanisms.

- Optimized weapon loadouts and mission planning based on real-time data.

- Increased autonomy in weapon deployment for unmanned aerial vehicles (UAVs).

- Improved decision support for pilots in high-stress combat scenarios.

- Integration with sensor fusion for advanced situational awareness.

- Streamlined post-mission analysis and system diagnostics.

- Development of adaptive and self-correcting release sequences.

- Potential for reduced human error and improved safety protocols.

- Challenges in cybersecurity and ensuring ethical AI deployment.

DRO & Impact Forces Of Aircraft Weapons Carriage and Release System Market

The Aircraft Weapons Carriage and Release System market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the ongoing modernization of global air forces, spurred by escalating geopolitical tensions and regional conflicts that necessitate advanced strike capabilities and robust defense postures. The continuous technological advancements in weapon systems, demanding more sophisticated and adaptable carriage solutions for next-generation munitions and platforms, further fuel market expansion. Additionally, increasing defense budgets across major economies, coupled with a growing emphasis on precision strike capabilities and multi-role aircraft versatility, significantly contribute to the demand for advanced AWC&RS. The proliferation of unmanned aerial vehicles (UAVs) and the integration of smart weapons also act as strong impetuses.

Conversely, several restraints impede the market's growth trajectory. High research and development costs associated with designing, testing, and certifying these highly complex and safety-critical systems represent a significant barrier. Stringent regulatory frameworks and lengthy certification processes imposed by defense authorities contribute to extended development cycles and increased operational expenses. Furthermore, global economic uncertainties and fluctuations in defense spending can lead to project delays or cancellations, directly impacting market revenue. The specialized nature of the technology often results in a limited customer base, making market expansion challenging, while the long lifespan of existing aircraft and their carriage systems can delay new procurements.

Opportunities within the AWC&RS market are primarily found in the development of modular and open-architecture systems that facilitate easier integration of new weapons and sensors, thereby extending platform lifecycle and reducing upgrade costs. The expanding market for unmanned combat aerial vehicles (UCAVs) and smaller, tactical drones presents a fertile ground for developing miniaturized and highly integrated carriage and release solutions. Emerging economies in Asia Pacific and the Middle East, with their burgeoning defense investments and efforts towards indigenous defense manufacturing, offer significant untapped market potential. The increasing focus on network-centric warfare and multi-domain operations also creates demand for intelligent carriage systems capable of advanced communication and data exchange.

The impact forces influencing the market dynamics include the bargaining power of buyers, primarily national defense ministries, which exert considerable pressure on pricing and contract terms due to their large-scale procurements. The bargaining power of suppliers, particularly specialized component manufacturers, can be high due to the unique technical expertise and proprietary technologies involved. The threat of new entrants is relatively low due to the substantial capital investment, technological complexity, and stringent regulatory barriers. However, the threat of substitutes, while limited for core functionality, can come from alternative weapon delivery methods or integrated platform designs. Competitive rivalry among established aerospace and defense contractors remains intense, driving continuous innovation and efficiency improvements in a highly specialized and strategic sector.

Segmentation Analysis

The Aircraft Weapons Carriage and Release System market is segmented across various critical dimensions, enabling a granular analysis of market dynamics, demand patterns, and technological preferences. These segmentations typically categorize the market based on the type of carriage and release mechanism, the specific aircraft platform, the intended application, and the operational platform type. Such a detailed breakdown provides crucial insights for manufacturers, defense contractors, and policymakers to strategically allocate resources, identify niche opportunities, and develop tailored solutions that meet the diverse and evolving requirements of global air forces.

- By Type

- Pylons

- Bomb Racks

- Missile Launchers

- Ejector Release Units (ERUs)

- Adapters

- Universal Carriage Systems

- By Aircraft Type

- Fixed-Wing Aircraft

- Fighter Jets

- Bombers

- Attack Aircraft

- Transport Aircraft

- Reconnaissance Aircraft

- Rotary-Wing Aircraft

- Attack Helicopters

- Utility Helicopters

- Unmanned Aerial Vehicles (UAVs)

- Combat Drones (UCAVs)

- Surveillance Drones

- Fixed-Wing Aircraft

- By Application

- Combat

- Training

- Transport (for non-weapon payloads)

- By Platform

- Manned Aircraft

- Unmanned Aircraft

- By Technology

- Mechanical Release Systems

- Pneumatic Release Systems

- Hydraulic Release Systems

- Electro-mechanical Release Systems

- Smart/Intelligent Release Systems

- By Material

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Composite Materials

Value Chain Analysis For Aircraft Weapons Carriage and Release System Market

The value chain for the Aircraft Weapons Carriage and Release System market is intricate, involving a series of specialized activities from raw material procurement to final deployment and aftermarket support. The upstream segment of the value chain primarily involves suppliers of high-grade raw materials such as aluminum, titanium, steel alloys, and advanced composite materials, essential for manufacturing robust and lightweight components. This also includes specialized manufacturers of electronic components, sensors, actuators, and precision mechanical parts that form the core of modern carriage and release mechanisms. These suppliers often operate under stringent quality controls and possess niche expertise, making their contribution critical to the system's overall performance and safety.

Further along the chain, defense contractors and original equipment manufacturers (OEMs) of aircraft develop, integrate, and assemble these components into complete AWC&RS units. This stage involves extensive research and development, engineering design, rigorous testing, and certification processes to ensure compliance with military specifications and airworthiness standards. The distribution channel predominantly involves direct sales and long-term contracts between these prime contractors and national defense ministries, air forces, or other government agencies. Due to the highly sensitive and strategic nature of the products, indirect channels through commercial distributors are less common for the main systems but may be utilized for certain maintenance parts or training equipment.

Downstream activities encompass the installation of AWC&RS onto aircraft platforms, operational deployment by military end-users, and subsequent maintenance, repair, and overhaul (MRO) services. MRO is a significant part of the value chain, ensuring the continued operational readiness and safety of these critical systems throughout their lifecycle. Direct distribution involves direct procurement by defense organizations, while indirect distribution, though limited, might include specialized defense technology integrators or system upgrade contractors working on behalf of the end-users. The close collaboration between manufacturers, integrators, and end-users throughout the entire product lifecycle is paramount, driven by the unique requirements for performance, reliability, and security in the defense sector.

Aircraft Weapons Carriage and Release System Market Potential Customers

The primary potential customers and end-users for Aircraft Weapons Carriage and Release Systems are national defense ministries and their respective air forces, navies, and armies globally. These governmental entities are the ultimate buyers, procuring these systems as part of their broader defense acquisition programs for new aircraft or as upgrades for existing fleets. The demand stems directly from their strategic defense requirements, including air superiority, ground attack, reconnaissance, and maritime patrol capabilities, all of which necessitate reliable and advanced weapon deployment mechanisms. The substantial investments in military aviation across numerous countries, particularly those modernizing their armed forces or facing evolving security threats, underscore the consistent demand from this core customer base.

Beyond national defense organizations, major aerospace and defense prime contractors also serve as key customers. These companies, such as Lockheed Martin, Boeing, Airbus, and Saab, integrate AWC&RS into their aircraft platforms before delivering them to governmental clients. They either develop these systems in-house or procure them from specialized subsystem manufacturers to fulfill their aircraft manufacturing contracts. Therefore, AWC&RS suppliers often target these large system integrators as crucial partners and direct customers in the product development and sales cycle. Additionally, some government-owned or privately-operated defense research and development agencies, focused on developing future combat aircraft or weapon systems, may also be potential customers for specialized AWC&RS prototypes or advanced components for testing and evaluation purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 8.9 Billion |

| Market Forecast in 2032 | USD 14.5 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raytheon Technologies, Lockheed Martin, BAE Systems, General Dynamics, Northrop Grumman, Saab AB, Leonardo S.p.A., Thales Group, MBDA, Cobham Mission Systems, Curtiss-Wright Corporation, Moog Inc., Marvin Engineering Co. Inc., Systima Technologies, RUAG International, Circor International, Harris Corporation (L3Harris Technologies), Parker Hannifin, Aerojet Rocketdyne, Textron Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Weapons Carriage and Release System Market Key Technology Landscape

The Aircraft Weapons Carriage and Release System market is at the forefront of defense technological innovation, continuously integrating advanced solutions to enhance operational effectiveness and safety. A significant technological trend is the adoption of modular open systems architecture (MOSA), which allows for flexible integration of diverse weapon types and future upgrades with reduced cost and time. This approach moves away from proprietary, closed systems towards standardized interfaces, promoting interoperability and adaptability. Furthermore, the development of smart pylons and intelligent release units, incorporating advanced sensors and embedded processing capabilities, enables real-time weapon status monitoring, precise targeting data exchange, and automated diagnostics, significantly improving mission success rates and predictive maintenance.

Materials science plays a crucial role, with an increasing use of advanced composites and lightweight alloys (e.g., carbon fiber composites, titanium alloys) to reduce system weight, improve aerodynamic performance, and enhance stealth characteristics, particularly for next-generation combat aircraft. Miniaturization of electronic components and hydraulic/pneumatic systems is another key aspect, allowing for more compact designs that maximize internal weapon bay capacity or reduce external drag. The integration of advanced data buses and network-centric capabilities ensures seamless communication between the aircraft's mission computer, weapon systems, and ground control, facilitating rapid decision-making and synchronized weapon deployment in complex multi-domain operations. This connectivity is vital for precision-guided munitions and networked munitions.

Further technological advancements include the incorporation of sophisticated electromechanical actuation systems, which offer greater precision, reliability, and reduced maintenance compared to traditional hydraulic or pneumatic systems, while also enabling finer control over weapon release sequences. Autonomous capabilities, particularly for unmanned combat aerial vehicles (UCAVs), are driving the development of highly intelligent carriage and release systems that can execute complex weapon deployment procedures with minimal human intervention, relying on AI-driven decision-making and advanced sensor fusion. Cybersecurity measures are also paramount, as these networked and intelligent systems must be protected from sophisticated cyber threats to ensure operational integrity and prevent unauthorized access or manipulation. These collective technological advancements are shaping the future of weapon integration and deployment from aerial platforms.

Regional Highlights

- North America: This region dominates the Aircraft Weapons Carriage and Release System market, driven by the substantial defense budgets of the United States and Canada. The presence of major aerospace and defense prime contractors, coupled with extensive research and development capabilities, fuels continuous innovation in advanced weapon integration technologies, particularly for stealth aircraft and precision-guided munitions. Modernization programs and strong governmental backing for defense industries ensure sustained market growth and technological leadership in this region.

- Europe: A significant market for AWC&RS, characterized by countries like the UK, France, Germany, and Italy investing heavily in their air forces' modernization. Collaborative defense programs, such as the Future Combat Air System (FCAS) and Tempest, are driving demand for next-generation carriage and release solutions, emphasizing modularity, interoperability, and advanced material usage. Geopolitical shifts and a focus on maintaining regional security contribute to consistent defense spending.

- Asia Pacific (APAC): Emerging as the fastest-growing market due to escalating defense expenditures from nations such as China, India, Japan, and South Korea. Rapid military modernization, rising geopolitical tensions, and increased procurement of advanced combat aircraft are propelling demand. Many countries in this region are also focusing on developing indigenous defense capabilities, creating opportunities for local manufacturers and technology transfer agreements.

- Latin America: This region exhibits gradual growth, primarily driven by the need to upgrade aging military aircraft fleets and address internal security challenges. While defense budgets are generally lower compared to other regions, selective procurement of advanced weaponry and corresponding carriage systems from international suppliers is observed as nations seek to enhance their air defense and strike capabilities.

- Middle East and Africa (MEA): Geopolitical instability and ongoing conflicts significantly drive defense spending in the Middle East, leading to substantial imports of advanced military aircraft and associated weapon carriage systems. Countries like Saudi Arabia, UAE, and Israel are key buyers. Africa's market is smaller but growing, driven by counter-terrorism efforts and regional security concerns, leading to limited but strategic acquisitions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Weapons Carriage and Release System Market.- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- BAE Systems Plc

- Northrop Grumman Corporation

- Saab AB

- Leonardo S.p.A.

- Thales Group

- MBDA Missile Systems

- Cobham Mission Systems (Eaton Corporation)

- Curtiss-Wright Corporation

- Moog Inc.

- Marvin Engineering Co. Inc.

- Systima Technologies, Inc. (An Applied Composites Company)

- RUAG International

- Circor International, Inc.

- L3Harris Technologies, Inc.

- Parker Hannifin Corporation

- Aerojet Rocketdyne Holdings, Inc.

- Textron Inc.

- General Dynamics Corporation

Frequently Asked Questions

What is an Aircraft Weapons Carriage and Release System?

An Aircraft Weapons Carriage and Release System (AWC&RS) is a critical aerospace component enabling military aircraft to safely and reliably carry, launch, and deploy various munitions, such as bombs, missiles, and external fuel tanks, during combat or training missions. It includes pylons, racks, launchers, and sophisticated control mechanisms.

What factors are driving the growth of the AWC&RS market?

Market growth is primarily driven by increasing global defense spending, escalating geopolitical tensions, ongoing modernization of military aircraft fleets, advancements in smart weapon technologies, and the rising adoption of unmanned aerial vehicles (UAVs) in military operations worldwide.

How is AI impacting the Aircraft Weapons Carriage and Release System market?

AI is impacting AWC&RS by enabling enhanced precision targeting, optimizing weapon selection and mission planning, facilitating predictive maintenance, and advancing autonomous weapon deployment capabilities for future platforms, leading to improved operational efficiency and safety.

Which regions are key contributors to the AWC&RS market?

North America and Europe are major contributors due to significant defense budgets and robust aerospace industries. The Asia Pacific region is emerging as a rapidly growing market, driven by military modernization and increased defense investments in countries like China and India.

What are the primary challenges faced by the AWC&RS market?

The market faces challenges such as high research and development costs, stringent regulatory and certification requirements, lengthy development cycles, and the significant capital investment required. Budget constraints and economic uncertainties can also impact market growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager