Airline Route Profitability Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430146 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Airline Route Profitability Software Market Size

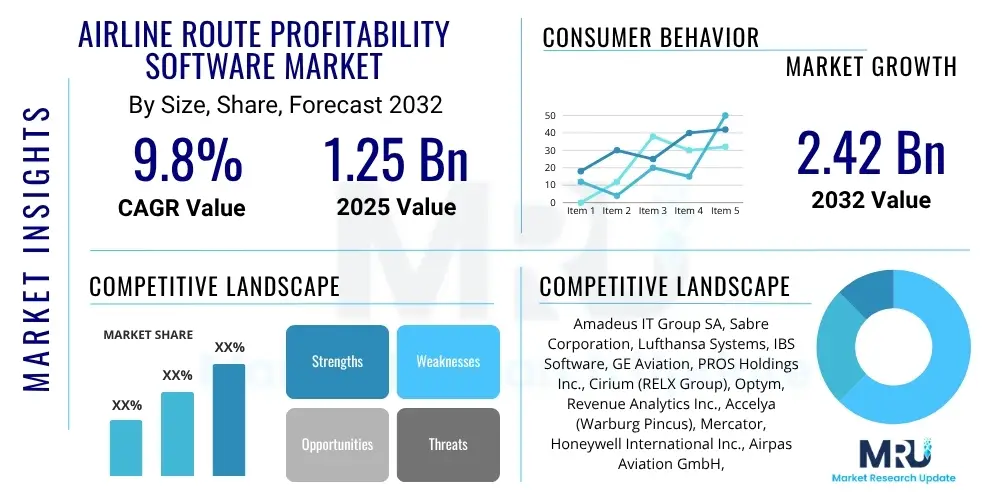

The Airline Route Profitability Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at $1.25 Billion in 2025 and is projected to reach $2.42 Billion by the end of the forecast period in 2032.

Airline Route Profitability Software Market introduction

The Airline Route Profitability Software Market encompasses specialized digital tools and platforms designed to help airlines analyze, optimize, and manage their flight routes for maximum financial return. These software solutions integrate various data points such as passenger demand, fuel costs, operational expenses, competitor pricing, and historical performance to provide actionable insights for strategic decision-making. The core product offering involves robust analytics engines, forecasting modules, and scenario planning capabilities that empower airlines to identify lucrative routes, discontinue unprofitable ones, and adjust capacities to meet fluctuating market conditions. Major applications span network planning, revenue management, fleet assignment, and schedule optimization, all aimed at enhancing operational efficiency and boosting profitability. The primary benefits include improved financial performance, enhanced competitive advantage, better resource allocation, and reduced operational risks. Key driving factors for this market's growth include the increasing complexity of global air travel networks, the imperative for airlines to maximize efficiency in a highly competitive and volatile industry, advancements in data analytics, and the continuous push towards cost reduction and revenue maximization.

The product description highlights a sophisticated suite of analytical tools providing airlines with a holistic view of their network performance. This software goes beyond simple data aggregation, utilizing advanced algorithms to simulate various operational scenarios and predict their financial outcomes. By integrating data from ticketing systems, operational databases, fuel suppliers, and maintenance logs, these platforms offer a comprehensive operational and financial landscape. The objective is to transform raw data into strategic intelligence, enabling airline executives to make informed decisions swiftly and accurately, thereby ensuring optimal utilization of assets and human resources.

Major applications of Airline Route Profitability Software are diverse and critical to an airline's operational success. These solutions are pivotal in designing new routes, evaluating the viability of existing ones, and optimizing flight schedules to align with passenger demand and operational constraints. They also play a significant role in fleet assignment, ensuring that the right aircraft type is deployed on the most suitable route to maximize seat utilization and cargo capacity. Furthermore, the software supports dynamic pricing strategies and revenue management by identifying optimal fare structures and seat allocations across different booking classes. The benefits derived from employing such advanced systems are substantial, leading to measurable improvements in profitability, operational efficiency, and overall market competitiveness, especially in an industry characterized by tight margins and high operational costs.

- Market Intro: Specialized software for optimizing airline flight routes and maximizing financial returns.

- Product Description: Digital tools integrating diverse data for analytics, forecasting, and scenario planning.

- Major Applications: Network planning, revenue management, fleet assignment, schedule optimization.

- Benefits: Improved financial performance, enhanced competitive advantage, better resource allocation, reduced operational risks.

- Driving Factors: Increasing network complexity, industry competition, data analytics advancements, cost reduction and revenue maximization imperatives.

Airline Route Profitability Software Market Executive Summary

The Airline Route Profitability Software Market is experiencing robust growth, driven by airlines' persistent need to enhance operational efficiency and financial performance in an increasingly complex and competitive global aviation landscape. Key business trends include the rising adoption of cloud-based solutions for greater scalability and accessibility, the integration of artificial intelligence and machine learning for predictive analytics, and a growing emphasis on real-time data processing for agile decision-making. Regional trends show strong adoption in North America and Europe due to mature aviation markets and technological readiness, while Asia Pacific exhibits significant growth potential driven by expanding air travel and new airline entrants. Segmentation trends indicate a preference for integrated suites offering comprehensive functionalities over standalone modules, with a notable shift towards subscription-based software-as-a-service (SaaS) models. This evolution reflects a broader industry movement towards flexible, scalable, and data-driven operational intelligence.

From a business trends perspective, the market is characterized by intense innovation, with vendors constantly enhancing their offerings to meet evolving airline demands. There is a clear shift towards modular yet integrated solutions that can seamlessly connect with existing airline IT infrastructure. Cybersecurity and data privacy are becoming paramount considerations for airlines adopting these platforms, leading to increased investment in secure software architecture. Furthermore, the market is witnessing strategic partnerships between software providers and aviation consulting firms, aiming to offer bundled solutions that combine technology with expert advisory services, thus providing a more holistic approach to route optimization and profitability enhancement.

Regional dynamics play a crucial role in shaping market demand. North America and Europe, with their well-established airlines and high passenger volumes, represent the largest segments, emphasizing sophisticated analytics for optimizing densely populated routes and managing slot constraints. Asia Pacific is emerging as a high-growth region, fueled by rapid expansion of low-cost carriers, increasing disposable incomes, and a burgeoning middle class driving air travel demand. Latin America and the Middle East and Africa regions are also showing steady growth as their aviation infrastructure develops and airlines seek advanced tools to compete effectively and expand their networks. Each region presents unique challenges and opportunities, influencing feature requirements and deployment strategies for route profitability software.

- Business Trends: Cloud adoption, AI/ML integration, real-time data processing, strategic partnerships, focus on cybersecurity.

- Regional Trends: Strong adoption in North America and Europe, high growth in Asia Pacific, steady growth in Latin America and MEA.

- Segments Trends: Preference for integrated suites, shift to SaaS models, demand for comprehensive functionalities.

AI Impact Analysis on Airline Route Profitability Software Market

Common user questions regarding AI's impact on Airline Route Profitability Software revolve around its ability to enhance predictive accuracy, automate complex decision-making, and uncover hidden revenue opportunities. Users are keenly interested in how AI can move beyond traditional statistical models to account for unforeseen variables and dynamic market shifts, providing more resilient and adaptive route strategies. Concerns often include the transparency and explainability of AI recommendations, the data quality requirements for effective AI deployment, and the potential for job displacement or skill gaps within airline operations teams. Expectations are high for AI to deliver unprecedented levels of optimization, leading to significant cost savings and substantial revenue growth by refining everything from fuel burn predictions to optimal fare class allocations and proactive response to demand fluctuations.

The integration of Artificial Intelligence (AI) into Airline Route Profitability Software is revolutionizing the capabilities of these platforms, pushing them beyond conventional statistical analysis into predictive and prescriptive intelligence. AI algorithms, particularly machine learning models, can process vast datasets from diverse sources—historical flight data, weather patterns, geopolitical events, social media sentiment, and economic indicators—to identify intricate patterns and correlations that human analysts might miss. This enables more accurate demand forecasting, dynamic pricing adjustments, and intelligent risk assessment for route planning. For instance, AI can predict the impact of minor schedule changes on connecting flights and overall passenger satisfaction, or model the financial implications of opening a new route given fluctuating fuel prices and competitor activities with greater precision.

Moreover, AI is transforming the efficiency and speed of decision-making. With AI-powered tools, airlines can automate routine optimization tasks, freeing up analysts to focus on higher-level strategic initiatives. Generative AI could even propose novel route combinations or schedule adjustments based on complex, multi-objective optimization criteria, such as maximizing profit while minimizing environmental impact or crew fatigue. The ability of AI to learn and adapt from continuous data streams ensures that route profitability models remain current and relevant in a rapidly changing operational environment. This continuous learning capability positions AI as a critical component for airlines seeking a sustainable competitive advantage through superior operational and commercial decision-making.

- Enhanced Predictive Accuracy: AI improves forecasting of passenger demand, fuel costs, and operational disruptions.

- Dynamic Pricing and Revenue Management: AI optimizes fare structures and seat allocations in real-time based on market dynamics.

- Automated Scenario Planning: AI models various route configurations and operational changes to identify optimal strategies.

- Risk Assessment and Mitigation: AI identifies potential operational risks and recommends proactive measures.

- Operational Efficiency: AI streamlines crew scheduling, fleet assignment, and maintenance planning.

- Personalized Offerings: AI can analyze passenger preferences to tailor route-specific services and offerings.

- Fraud Detection: AI algorithms can identify anomalies in booking patterns that may indicate fraudulent activity.

DRO & Impact Forces Of Airline Route Profitability Software Market

The Airline Route Profitability Software Market is shaped by a confluence of Drivers, Restraints, and Opportunities, which collectively constitute the impact forces determining its growth trajectory. Key drivers include the ever-increasing fuel costs, which compel airlines to optimize routes for efficiency, the growing global air passenger traffic necessitating smarter network planning, and the intense competition among carriers pushing for every possible margin improvement. Restraints often involve the high initial investment required for sophisticated software, the complexity of integrating these solutions with legacy IT systems, and the challenge of data siloization within large airline organizations. Opportunities lie in the advent of advanced analytics, cloud computing, and AI/ML technologies that promise greater optimization capabilities, along with the potential for personalized service offerings and dynamic market responsiveness. These impact forces necessitate continuous innovation and strategic adaptation from software vendors and airlines alike.

A primary driver for the market is the sustained pressure on airline operating margins. Fuel is a significant variable cost, and even minor improvements in route efficiency can translate into substantial savings. Furthermore, the global expansion of air travel, particularly in emerging economies, creates demand for more sophisticated tools to manage increasingly complex networks. Airlines are also under constant pressure from competitors, including low-cost carriers, which necessitates precise route planning and revenue management to remain competitive. The need for real-time visibility into operational performance and the ability to rapidly adapt to market shifts further fuels the adoption of these software solutions. Regulatory changes, such as those related to environmental impact, also indirectly drive demand for software that can optimize routes to minimize carbon footprints.

However, the market faces notable restraints. The initial capital expenditure for acquiring and implementing advanced route profitability software can be significant, posing a barrier for smaller airlines or those with limited IT budgets. The integration of new software with an airline's existing, often disparate, legacy systems can be a complex, time-consuming, and resource-intensive process, fraught with technical challenges. Additionally, the fragmented nature of data across different departments within an airline (e.g., operations, finance, marketing) can hinder the creation of a unified data source necessary for effective software utilization. Staff training and change management are also considerable hurdles, as adoption requires a shift in analytical approaches and operational workflows. Addressing these restraints effectively is critical for widespread market penetration.

- Drivers: High fuel costs, increasing air passenger traffic, intense airline competition, need for operational efficiency, advancements in data analytics.

- Restraints: High initial investment, complex integration with legacy systems, data siloization, skilled personnel requirement, cybersecurity concerns.

- Opportunity: Emergence of AI/ML for predictive analytics, cloud-based deployments (SaaS), real-time data processing, personalized offerings, market expansion in emerging regions.

- Impact Forces: Technological advancements, economic volatility, regulatory changes, competitive landscape, data privacy regulations.

Segmentation Analysis

The Airline Route Profitability Software Market is broadly segmented based on deployment model, application type, enterprise size, and component. This segmentation provides a granular view of the market, allowing stakeholders to understand specific demand patterns and technology preferences across different airline operational contexts. The deployment model distinguishes between on-premise and cloud-based solutions, reflecting evolving IT infrastructure strategies. Application type segmentations delve into specific functional areas such as network planning, revenue management, and fleet assignment. Enterprise size considers the varying needs of large airlines versus smaller regional carriers. Component-wise, the market is typically divided into software and services, highlighting the importance of ongoing support and customization in complex software deployments. Each segment addresses distinct requirements and challenges faced by various types of airline operators globally.

Analyzing the market by deployment model reveals a significant shift towards cloud-based solutions. While on-premise deployments have historically been favored by larger airlines due to perceived control and security, the benefits of cloud computing—such as scalability, reduced infrastructure costs, easier updates, and remote accessibility—are driving rapid adoption of Software-as-a-Service (SaaS) models. This transition is particularly appealing to smaller and medium-sized airlines seeking to leverage advanced analytics without substantial upfront capital expenditure. Cloud-based solutions also facilitate faster integration with other cloud platforms, creating a more interconnected and agile IT ecosystem for airlines.

Further segmentation by application type highlights the diverse functional areas where route profitability software delivers value. Network planning and optimization remains a cornerstone, focusing on strategic route development and schedule efficiency. Revenue management applications are crucial for dynamic pricing and maximizing passenger yield. Fleet assignment solutions ensure optimal aircraft utilization, while crew management integration helps reduce operational costs. The demand for integrated suites that cover multiple applications is growing, as airlines seek holistic platforms for comprehensive operational oversight. Enterprise size also dictates software choice, with larger airlines often requiring highly customized, extensive suites, whereas smaller carriers might opt for more standardized, cost-effective solutions tailored to their regional operations.

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS)

- By Application Type:

- Network Planning and Optimization

- Revenue Management

- Fleet Assignment and Utilization

- Schedule Optimization

- Fuel Management

- Crew Management Integration

- By Enterprise Size:

- Large Airlines

- Small and Medium-Sized Airlines

- By Component:

- Software

- Services (Consulting, Implementation, Support)

Value Chain Analysis For Airline Route Profitability Software Market

The value chain for the Airline Route Profitability Software Market begins with upstream activities involving core technology development and data acquisition, extending through the software development and deployment phases, and concluding with downstream activities centered around end-user application, support, and distribution. Upstream analysis focuses on the providers of fundamental technologies like big data analytics platforms, AI/ML frameworks, and cloud infrastructure services, alongside data aggregators that supply market intelligence, fuel price forecasts, and passenger demand data. Downstream analysis considers how airlines implement, integrate, and utilize the software for strategic decision-making and operational improvements. Distribution channels are crucial, encompassing direct sales from vendors, partnerships with aviation consultants, and indirect channels via system integrators or value-added resellers. Both direct and indirect models are vital for market penetration and customer reach.

Upstream in the value chain, the creation of robust route profitability software is heavily dependent on cutting-edge technological components and comprehensive data inputs. This includes research and development into advanced algorithms for optimization and forecasting, leveraging capabilities from cloud service providers (AWS, Azure, Google Cloud) for scalable infrastructure, and utilizing sophisticated database management systems. Additionally, access to diverse and high-quality data is paramount. This encompasses internal airline data (historical flight data, maintenance logs, booking records), external market data (competitor schedules, fare data, economic indicators), and operational data (weather forecasts, air traffic control information, fuel prices). Partnerships with data providers and cybersecurity firms are also critical to ensure data integrity and security.

The midstream segment involves the core software development, customization, and implementation processes. Software developers engineer the functionalities, user interfaces, and integration capabilities of the profitability platforms. This stage also includes rigorous testing and quality assurance to ensure reliability and performance. Downstream activities focus on the delivery, adoption, and ongoing support for the airline clients. This involves deployment, training airline personnel, and providing continuous maintenance and updates. Distribution channels are multifaceted; many major vendors opt for a direct sales force to handle complex enterprise deals, offering bespoke solutions and direct implementation support. Indirect channels, through aviation consultants or specialized IT service providers, often cater to a broader client base, providing integration expertise and localized support, ensuring wider market penetration and tailored client solutions.

- Upstream Analysis: Core technology development (big data, AI/ML, cloud infrastructure), data acquisition (market intelligence, fuel prices, demand data).

- Downstream Analysis: Airline implementation, integration, utilization, support, and strategic decision-making.

- Distribution Channels:

- Direct: Vendor's own sales teams and professional services.

- Indirect: Aviation consultants, system integrators, value-added resellers.

- Intermediaries: Technology partners, data providers, cybersecurity firms, implementation specialists.

Airline Route Profitability Software Market Potential Customers

The primary potential customers for Airline Route Profitability Software are commercial airlines, ranging from large flag carriers with extensive global networks to regional airlines and emerging low-cost carriers. Each segment of the airline industry has distinct needs and motivations for adopting these solutions. Large network airlines often seek highly sophisticated, customizable platforms that can integrate with complex legacy systems and handle a vast array of interconnected routes and diverse fleet types. Regional airlines focus on optimizing feeder routes and managing smaller, more specialized networks. Low-cost carriers, driven by an acute focus on cost efficiency and rapid expansion, are keen on solutions that provide quick ROI and scalable analytics for their point-to-point models. Beyond traditional airlines, charter flight operators and cargo airlines also represent a growing customer base, driven by the need to optimize their unique operational models for profitability.

Major flag carriers and legacy airlines represent a significant customer segment, characterized by their intricate global networks, diverse fleet portfolios, and established operational procedures. For these airlines, route profitability software is crucial for managing slot allocations at congested airports, optimizing intercontinental routes, and balancing passenger and cargo revenues. They often require advanced features such as alliance management optimization, complex codeshare analysis, and seamless integration with existing enterprise resource planning (ERP) and revenue management systems. The investment in such software is a strategic imperative to maintain their competitive edge and ensure sustainable profitability across their expansive operations.

Conversely, low-cost carriers (LCCs) and regional airlines represent a rapidly expanding customer base with different, yet equally critical, requirements. LCCs prioritize solutions that enable rapid route expansion, efficient turnaround times, and aggressive cost control through optimized fuel consumption and minimized operational overhead. Their business model, often centered on point-to-point routes, benefits immensely from software that can quickly evaluate the profitability of new city pairs and adjust schedules dynamically. Regional airlines, operating smaller fleets and serving specific geographical areas, need tools that can optimize their local networks, ensure connectivity with larger hubs, and maximize the utilization of their more limited resources. The scalability and cost-effectiveness of cloud-based SaaS solutions are particularly appealing to these smaller operators, allowing them access to advanced analytical capabilities without prohibitive upfront costs.

- Commercial Airlines: Large Flag Carriers, Network Airlines, Regional Airlines, Low-Cost Carriers (LCCs).

- Charter Flight Operators: Companies providing non-scheduled air transport services.

- Cargo Airlines: Operators focused exclusively on air freight logistics and optimization.

- Airline Alliances: Groups of airlines collaborating to optimize shared networks and resources.

- Aviation Consulting Firms: Utilize these tools for advisory services to airlines.

- Airport Authorities: Potentially use aggregated data for infrastructure planning and slot management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.25 Billion |

| Market Forecast in 2032 | $2.42 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amadeus IT Group SA, Sabre Corporation, Lufthansa Systems, IBS Software, GE Aviation, PROS Holdings Inc., Cirium (RELX Group), Optym, Revenue Analytics Inc., Accelya (Warburg Pincus), Mercator, Honeywell International Inc., Airpas Aviation GmbH, SITA, Flyr Labs, AIMS Group, Laminaar Aviation Infotech, Infare, Aviaso, FL Technics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airline Route Profitability Software Market Key Technology Landscape

The Airline Route Profitability Software market is underpinned by a sophisticated technological landscape that includes advanced data analytics, artificial intelligence (AI) and machine learning (ML), cloud computing, and robust integration capabilities. These technologies collectively enable the software to process vast quantities of heterogeneous data, perform complex simulations, and deliver highly accurate predictive and prescriptive insights. Data analytics forms the core, utilizing statistical modeling, optimization algorithms, and business intelligence tools to transform raw operational and market data into actionable intelligence. AI and ML algorithms further enhance this by enabling dynamic forecasting, pattern recognition in passenger behavior, and the autonomous identification of optimal route configurations and pricing strategies. Cloud computing provides the necessary scalability, flexibility, and cost-efficiency for deploying these data-intensive applications, while robust APIs and integration frameworks ensure seamless interoperability with airline legacy systems and third-party data sources.

At the heart of these solutions is sophisticated data analytics. This involves not only descriptive analytics to understand past performance but also predictive analytics to forecast future demand, fuel prices, and operational costs, and prescriptive analytics to recommend optimal actions. Techniques such as regression analysis, time series forecasting, and simulation modeling are routinely employed. Business intelligence dashboards and visualization tools are crucial for presenting complex data in an easily digestible format, empowering airline management to quickly grasp key trends and make informed decisions. The ability to integrate and synthesize data from disparate sources—ranging from reservation systems and flight operations to maintenance records and external economic indicators—is a fundamental technological requirement, ensuring a holistic view of the airline's network and its financial implications.

The accelerating adoption of AI and machine learning is profoundly impacting the market, moving software capabilities beyond deterministic optimization. AI-powered modules can identify subtle correlations, detect anomalies, and adapt models in real-time to unforeseen market events, offering a competitive edge. For example, neural networks can be used for highly accurate demand forecasting, while reinforcement learning can optimize dynamic pricing strategies across thousands of routes and fare classes. Cloud computing architecture, often leveraging serverless functions and containerization, provides the elastic infrastructure required to handle the computational demands of AI/ML, enabling airlines to scale resources up or down as needed. Furthermore, the development of open APIs and microservices architectures facilitates easier integration with diverse airline operational systems, fostering a more connected and efficient aviation ecosystem, thereby continuously driving innovation and efficiency across the entire value chain.

- Advanced Data Analytics: Statistical modeling, optimization algorithms, business intelligence tools, predictive and prescriptive analytics.

- Artificial Intelligence (AI) and Machine Learning (ML): Dynamic forecasting, pattern recognition, autonomous optimization, natural language processing (for unstructured data analysis).

- Cloud Computing: SaaS deployment, scalability, flexibility, reduced infrastructure costs, remote accessibility.

- Big Data Technologies: Distributed storage and processing (e.g., Hadoop, Spark) for handling massive datasets.

- Integration Capabilities: Robust APIs, microservices architecture, middleware for seamless data exchange with legacy systems.

- Simulation and Scenario Planning: Tools for modeling various operational and market conditions.

- Cybersecurity Frameworks: Data encryption, access controls, threat detection for data integrity and privacy.

Regional Highlights

- North America: This region consistently holds a significant share in the Airline Route Profitability Software Market due to the presence of technologically advanced airlines, high air passenger traffic, and a mature aviation infrastructure. Major airlines in the US and Canada are early adopters of advanced analytical solutions to manage extensive domestic and international networks. The region benefits from a robust ecosystem of software providers and a strong emphasis on operational efficiency and competitive advantage. The demand is driven by the need to optimize routes in highly competitive markets, manage slot constraints at major hubs, and integrate complex data sources for superior decision-making. Continuous investment in digital transformation initiatives further fuels market growth.

- Europe: The European market is another prominent region for Airline Route Profitability Software, characterized by its dense network of intra-European flights, numerous national flag carriers, and a strong presence of low-cost airlines. Regulatory frameworks and environmental concerns also play a role, driving demand for fuel-efficient route optimization. The region's market is spurred by the intense competition among carriers, the need for efficient resource allocation across diverse routes, and the integration requirements across multiple countries and air traffic control zones. Countries like the UK, Germany, and France are key contributors, demonstrating a high adoption rate of sophisticated software for network planning and revenue management.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Airline Route Profitability Software Market. This growth is primarily attributed to the rapid expansion of air travel, the establishment of new airlines, and increasing disposable incomes fueling passenger demand in countries like China, India, and Southeast Asian nations. The region presents significant opportunities for software vendors as airlines seek to build efficient networks from scratch or modernize existing operations to cope with exponential growth. The complexity of operating across diverse geographical and regulatory landscapes also drives the adoption of advanced planning and optimization tools. Investments in aviation infrastructure and digital transformation are critical growth drivers here.

- Latin America: The Latin American market for Airline Route Profitability Software is experiencing steady growth, driven by increasing air travel demand, economic development, and efforts by regional airlines to enhance their competitiveness. Airlines in this region are focusing on optimizing their domestic and international routes, managing fluctuating fuel prices, and improving overall operational efficiency to serve a growing middle class. Countries like Brazil and Mexico are leading the adoption, as their aviation markets mature and airlines seek technological solutions to overcome operational challenges and expand their reach.

- Middle East and Africa (MEA): The MEA region is witnessing growing adoption, particularly in the Middle East, driven by major global hub airlines that manage vast international networks and strive for world-class operational excellence. These airlines invest heavily in advanced technologies to optimize long-haul routes, manage extensive fleets, and maximize profitability in a highly competitive global market. In Africa, the market is emerging, with new airlines and expanding regional carriers seeking cost-effective solutions to improve their network planning and revenue generation capabilities amid infrastructural and economic development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airline Route Profitability Software Market.- Amadeus IT Group SA

- Sabre Corporation

- Lufthansa Systems

- IBS Software

- GE Aviation

- PROS Holdings Inc.

- Cirium (RELX Group)

- Optym

- Revenue Analytics Inc.

- Accelya (Warburg Pincus)

- Mercator

- Honeywell International Inc.

- Airpas Aviation GmbH

- SITA

- Flyr Labs

- AIMS Group

- Laminaar Aviation Infotech

- Infare

- Aviaso

- FL Technics

Frequently Asked Questions

What is Airline Route Profitability Software?

Airline Route Profitability Software is a specialized digital solution that helps airlines analyze, plan, and optimize their flight routes to maximize revenue and operational efficiency. It integrates various data points like costs, demand, and competition to provide insights for strategic decision-making in network planning, revenue management, and fleet assignment.

How does this software improve airline operations?

The software improves operations by enabling data-driven decisions for route selection, schedule optimization, and fleet utilization. It helps reduce fuel costs, enhance passenger yield through dynamic pricing, and allocate resources more effectively, leading to overall improved financial performance and competitive positioning.

What are the key technological trends influencing the market?

Key technological trends include the increasing adoption of cloud-based Software-as-a-Service (SaaS) models for scalability, the integration of Artificial Intelligence and Machine Learning for advanced predictive analytics, and the emphasis on real-time data processing for agile decision-making and continuous optimization.

Which regions are leading the adoption of this software?

North America and Europe are currently leading in the adoption of Airline Route Profitability Software due to mature aviation markets and technological readiness. However, Asia Pacific is projected to be the fastest-growing region, driven by expanding air travel and new airline entrants.

What challenges do airlines face in implementing these solutions?

Airlines often face challenges such as high initial investment costs, complexity in integrating new software with existing legacy IT systems, internal data siloization across departments, and the need for specialized personnel training to effectively utilize the advanced features of these platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager