Alcohol Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429874 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Alcohol Packaging Market Size

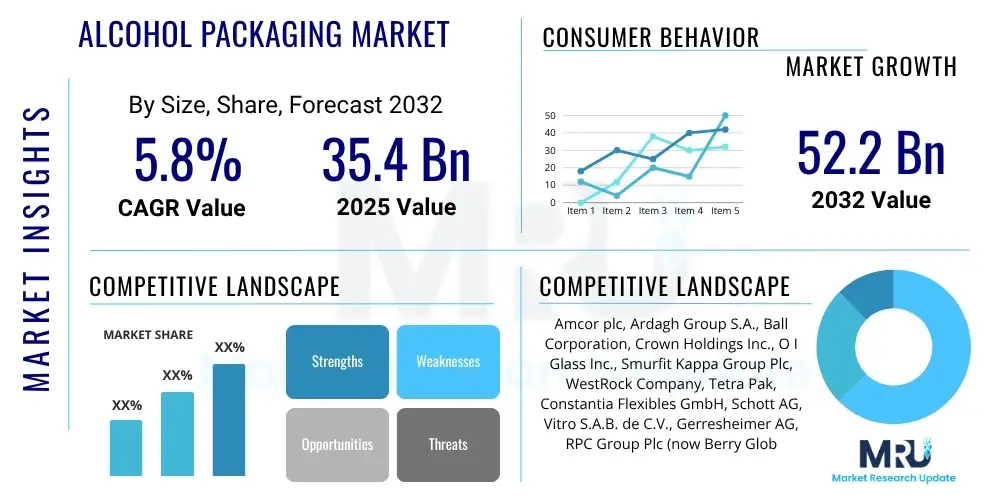

The Alcohol Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 35.4 billion in 2025 and is projected to reach USD 52.2 billion by the end of the forecast period in 2032.

Alcohol Packaging Market introduction

The Alcohol Packaging Market encompasses a diverse range of materials and formats designed to contain, protect, and present alcoholic beverages such as beer, wine, spirits, and ready-to-drink (RTD) cocktails. This packaging plays a critical role beyond mere containment, serving as a primary marketing tool that communicates brand identity, ensures product integrity, and facilitates consumer engagement. Key product descriptions include bottles (glass, plastic), cans (aluminum, steel), bag-in-box solutions, pouches, and specialty closures, each tailored to specific beverage types and consumption occasions.

Major applications for alcohol packaging span the entire spectrum of alcoholic beverage production, from large-scale breweries and distilleries to boutique wineries and craft beverage makers. Packaging benefits include extended shelf life, protection against physical damage and environmental factors, ease of transport and storage, and enhanced consumer convenience. The market is significantly driven by factors such as increasing global alcohol consumption, a rising demand for premium and craft beverages, the expansion of e-commerce channels, and evolving consumer preferences for sustainable and aesthetically appealing packaging solutions.

Alcohol Packaging Market Executive Summary

The alcohol packaging market is experiencing robust growth driven by evolving consumer lifestyles, globalization of alcohol brands, and a strong emphasis on product differentiation. Business trends indicate a pivot towards sustainable packaging solutions, including lightweighting, increased use of recycled content, and innovative biodegradable materials, as companies strive to meet environmental regulations and consumer expectations. Digital printing and smart packaging technologies are also gaining traction, offering enhanced brand storytelling and anti-counterfeiting measures, thereby contributing to market dynamism.

Regional trends highlight the Asia Pacific as a significant growth hub, fueled by increasing disposable incomes and a growing young adult population with rising alcohol consumption rates, particularly in emerging economies. North America and Europe, while mature, demonstrate strong demand for premium and craft beverage packaging, alongside pioneering sustainability initiatives and technological advancements. Latin America and the Middle East and Africa are emerging as markets with considerable untapped potential, driven by urbanization and changing consumption patterns.

Segment trends reveal glass bottles maintaining their dominance for premium spirits and wines due to their aesthetic appeal and perceived quality, while aluminum cans are rapidly expanding their footprint across beer, RTDs, and even wine, owing to their convenience, recyclability, and lighter weight. Plastic packaging, particularly PET, continues to be relevant for cost-effectiveness and transport efficiency, especially in larger format containers. The overarching theme across all segments is the continuous innovation in materials and design to align with sustainability goals and shifting consumer preferences for convenience and unique brand experiences.

AI Impact Analysis on Alcohol Packaging Market

User questions regarding AI's impact on the alcohol packaging market often revolve around efficiency gains, supply chain optimization, personalization, and sustainability. Consumers and industry stakeholders are keen to understand how AI can streamline production processes, reduce waste, enhance package design, and create more interactive and engaging consumer experiences. There is a general expectation that AI will lead to more intelligent, responsive, and environmentally friendly packaging solutions, while also addressing concerns about data privacy and the ethical implications of advanced automation in a traditionally tactile industry.

- AI driven demand forecasting optimizes raw material procurement and production schedules, minimizing waste and inventory costs.

- Predictive maintenance for packaging machinery reduces downtime, improves operational efficiency, and extends equipment lifespan.

- AI powered quality control systems identify defects in packaging at high speeds, ensuring consistent product quality and reducing recalls.

- Generative design tools assist in creating innovative and functional packaging designs, tailored to specific product requirements and consumer aesthetics.

- Personalized packaging experiences are enabled through AI, allowing for mass customization based on consumer preferences and marketing campaigns.

- Supply chain visibility and traceability are enhanced using AI algorithms, optimizing logistics and ensuring authenticity of products.

- Sustainability efforts are boosted by AI analyzing material usage, waste generation, and lifecycle impacts to recommend eco-friendlier solutions.

DRO & Impact Forces Of Alcohol Packaging Market

The Alcohol Packaging Market is significantly influenced by a confluence of drivers, restraints, and opportunities, collectively shaping its trajectory. Key drivers include the consistent growth in global alcohol consumption, especially premium and craft beverages, which demand high-quality and aesthetically pleasing packaging. The rapid expansion of e-commerce platforms has also necessitated packaging innovations that ensure product safety during transit while maintaining brand integrity. Furthermore, increasing consumer awareness and preference for sustainable products are pushing manufacturers to adopt eco-friendly packaging solutions, thereby driving innovation in materials and designs.

However, the market faces several restraints that could impede its growth. Stringent regulatory frameworks pertaining to alcohol advertising, labeling, and recycling across various regions can increase compliance costs and limit design flexibility. Fluctuations in raw material prices, particularly for glass, aluminum, and plastic resins, along with potential supply chain disruptions, pose significant challenges to manufacturers. Additionally, the high initial investment required for advanced packaging machinery and sustainable technologies can be a barrier for smaller players, fostering consolidation within the market.

Despite these restraints, numerous opportunities are emerging. The development of smart packaging technologies, such as NFC and QR codes, offers new avenues for consumer engagement, anti-counterfeiting, and supply chain transparency. Innovations in lightweighting materials and designs contribute to reduced transportation costs and environmental impact. The growing trend of customization and personalization in packaging provides brands with a powerful tool to differentiate themselves in a competitive market. Moreover, the increasing demand for ready-to-drink (RTD) cocktails and single-serve alcoholic beverages is opening up new market niches for convenient and versatile packaging formats, driving further market expansion.

Segmentation Analysis

The Alcohol Packaging Market is comprehensively segmented by material type, packaging type, application, and end-use, reflecting the diverse requirements and preferences across the alcoholic beverage industry. This granular segmentation provides a detailed understanding of market dynamics, enabling stakeholders to identify growth opportunities and tailor their strategies effectively. Each segment contributes uniquely to the overall market landscape, driven by factors such as material cost, aesthetic appeal, functional properties, and environmental considerations.

- By Material

- Glass

- Plastic (PET, HDPE, others)

- Metal (Aluminum, Steel)

- Paperboard/Cartons

- Flexible Packaging (Pouches, Bag-in-box)

- By Packaging Type

- Bottles

- Cans

- Kegs

- Pouches

- Bag-in-Box

- Other Specialty Packaging

- By Application

- Beer

- Wine

- Spirits (Whiskey, Vodka, Gin, Rum, etc.)

- Ready-to-Drink (RTD) Cocktails

- Other Alcoholic Beverages

- By End-Use

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Retail Stores, Supermarkets, Online Sales)

Value Chain Analysis For Alcohol Packaging Market

The value chain for the alcohol packaging market is a complex network involving several stages, starting from raw material suppliers and extending to the end consumers. Upstream analysis focuses on the procurement of primary materials such as silica sand for glass, bauxite for aluminum, and crude oil derivatives for plastics. Key players in this segment include major glass manufacturers, aluminum sheet producers, and plastic resin suppliers, whose operational efficiency and pricing strategies significantly influence the cost structure of packaging. The quality and sustainability credentials of these raw materials are increasingly critical, driving innovation towards recycled and bio-based alternatives.

Midstream activities involve the conversion of these raw materials into finished packaging products like bottles, cans, and cartons by packaging manufacturers. This stage requires significant capital investment in machinery, advanced manufacturing processes, and quality control. Technological advancements in molding, printing, and closure systems are paramount here. Downstream analysis encompasses the integration of packaging into the alcoholic beverage production process, where bottlers, breweries, wineries, and distilleries fill and seal their products. This segment also includes distributors who handle logistics and transport of packaged alcohol to various sales channels.

The distribution channel for alcohol packaging can be segmented into direct and indirect routes. Direct channels involve packaging manufacturers supplying directly to large alcoholic beverage producers, often through long-term contracts. Indirect channels utilize distributors or brokers who serve smaller beverage companies or manage specialized packaging requirements. The efficiency of these channels is crucial for ensuring timely delivery and cost-effectiveness. The final stage involves retailers and online platforms making the packaged alcohol available to the end-consumer, completing the value chain. Brand owners increasingly collaborate across the value chain to optimize sustainability, design, and supply chain resilience.

Alcohol Packaging Market Potential Customers

The primary potential customers and end-users of alcohol packaging are the diverse entities involved in the production, distribution, and sale of alcoholic beverages. This encompasses a broad spectrum from multinational corporations to independent craft producers, each with unique packaging needs and demands. Understanding these customer segments is crucial for packaging suppliers to tailor their offerings effectively and capture market share. The evolving landscape of beverage consumption, including premiumization and the rise of ready-to-drink options, continuously shapes the requirements of these end-users.

Major breweries, wineries, and distilleries constitute a significant portion of the customer base, requiring high volumes of standardized and often customized packaging. These large-scale producers prioritize cost-efficiency, supply chain reliability, and packaging performance in high-speed filling lines. Craft beverage producers, including microbreweries, artisanal distilleries, and boutique wineries, represent another rapidly growing customer segment. They often seek unique, aesthetically appealing, and smaller-batch packaging solutions that reflect their brand identity and cater to niche markets. This segment values design flexibility, sustainability, and innovative materials.

Beyond direct producers, co-packers and third-party logistics providers also act as crucial intermediaries and customers, as they manage packaging and distribution for multiple beverage brands. Furthermore, specialized distributors focused on the alcohol sector require packaging that facilitates efficient handling and storage. Ultimately, the preferences of the final consumer, driven by factors such as convenience, sustainability, and visual appeal, ripple back through the value chain, influencing the packaging choices made by all these potential customers. Retailers and online platforms, while not direct buyers of packaging, significantly influence demand through their display and logistical requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 35.4 billion |

| Market Forecast in 2032 | USD 52.2 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Ardagh Group S.A., Ball Corporation, Crown Holdings Inc., O I Glass Inc., Smurfit Kappa Group Plc, WestRock Company, Tetra Pak, Constantia Flexibles GmbH, Schott AG, Vitro S.A.B. de C.V., Gerresheimer AG, RPC Group Plc (now Berry Global Inc.), Silgan Holdings Inc., Berlin Packaging LLC, Bormioli Rocco S.p.A., Verallia S.A., Arol S.p.A., Vetropack Holding AG, Graphic Packaging International LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alcohol Packaging Market Key Technology Landscape

The alcohol packaging market is continuously evolving with significant advancements in technology aimed at enhancing product protection, consumer engagement, and sustainability. Lightweighting technologies, for instance, are crucial across glass and metal packaging, reducing material usage, manufacturing costs, and transportation emissions. Innovations in glass manufacturing allow for thinner yet stronger bottles, while advanced aluminum alloys contribute to lighter cans. Similarly, in plastics, multi-layer co-extrusion and barrier technologies improve shelf life and reduce material consumption, aligning with environmental goals and operational efficiencies.

Smart packaging technologies represent a transformative trend, integrating features like QR codes, NFC tags, and augmented reality (AR) experiences. These technologies facilitate enhanced brand interaction, provide product traceability, combat counterfeiting, and offer personalized content to consumers. Digital printing is another vital technology, enabling high-quality, flexible, and cost-effective customization and personalization of packaging, particularly beneficial for craft beverages and limited-edition runs. This allows brands to respond quickly to market trends and deliver unique visual identities without the high setup costs associated with traditional printing methods.

Furthermore, sustainable material innovations are at the forefront of the technological landscape. This includes the development of advanced recycled content (PCR plastics, cullet for glass, recycled aluminum), bio-based plastics derived from renewable resources, and compostable or biodegradable packaging solutions. Active and intelligent packaging systems that incorporate oxygen scavengers, moisture absorbers, or temperature indicators are also gaining traction, particularly for sensitive alcoholic beverages, extending product freshness and ensuring quality. Automation and robotics in packaging lines are also streamlining operations, improving efficiency, and ensuring precision in filling, sealing, and labeling processes.

Regional Highlights

- North America: A mature market characterized by strong demand for craft beers, premium spirits, and RTDs. Innovation in sustainable packaging, smart labels, and convenient formats is prominent. The region also sees significant investment in advanced manufacturing and recycling infrastructure, driven by consumer environmental awareness and brand differentiation strategies.

- Europe: A highly regulated yet innovative market with a long-standing tradition in wine and spirits production. Key trends include a strong push for circular economy principles, widespread adoption of recycled content, and a focus on minimalist and premium packaging designs that reflect heritage and quality. Craft beverage growth is also a driving force.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, urbanization, and a burgeoning young adult population. Markets like China and India are witnessing a surge in alcohol consumption, driving demand for both economic and premium packaging solutions. The region is also becoming a hub for packaging manufacturing and technological adoption.

- Latin America: An emerging market experiencing consistent growth in alcohol consumption and a developing taste for international and premium brands. Packaging demand is driven by local production expansion and the need for cost-effective, yet secure, packaging solutions. Increasing focus on PET bottles for spirits and beers due to cost and transport benefits.

- Middle East and Africa (MEA): A market with varied growth rates, influenced by diverse cultural norms and regulatory environments. Growth is primarily observed in regions with increasing tourism and expatriate populations, leading to demand for a wider variety of packaged alcohol. Emphasis on robust and secure packaging for challenging supply chain conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alcohol Packaging Market.- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- Crown Holdings Inc.

- O I Glass Inc.

- Smurfit Kappa Group Plc

- WestRock Company

- Tetra Pak

- Constantia Flexibles GmbH

- Schott AG

- Vitro S.A.B. de C.V.

- Gerresheimer AG

- Berry Global Inc. (formerly RPC Group Plc)

- Silgan Holdings Inc.

- Berlin Packaging LLC

- Bormioli Rocco S.p.A.

- Verallia S.A.

- Arol S.p.A.

- Vetropack Holding AG

- Graphic Packaging International LLC

Frequently Asked Questions

What are the primary factors driving the growth of the Alcohol Packaging Market?

The market's growth is primarily driven by increasing global alcohol consumption, a rising preference for premium and craft beverages, the expansion of e-commerce, and evolving consumer demand for sustainable and convenient packaging solutions.

How is sustainability impacting alcohol packaging trends?

Sustainability is a major driver, leading to increased adoption of recycled content, lightweighting initiatives, exploration of bio-based and biodegradable materials, and a focus on circular economy practices across all packaging types.

Which packaging materials are most prominent in the Alcohol Packaging Market?

Glass and metal (aluminum cans) are the most prominent materials, valued for their barrier properties, recyclability, and premium perception. Plastic (PET) and flexible packaging also hold significant shares for specific applications and convenience.

What role do smart packaging technologies play in the industry?

Smart packaging, including QR codes and NFC tags, enhances consumer engagement, provides traceability for anti-counterfeiting, and offers personalized content, creating a more interactive and secure brand experience.

What are the key challenges faced by alcohol packaging manufacturers?

Challenges include navigating stringent regulatory environments, managing fluctuating raw material costs, ensuring supply chain resilience, and making significant investments in sustainable technologies and advanced machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager