Algorithmic Trading Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431203 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Algorithmic Trading Market Size

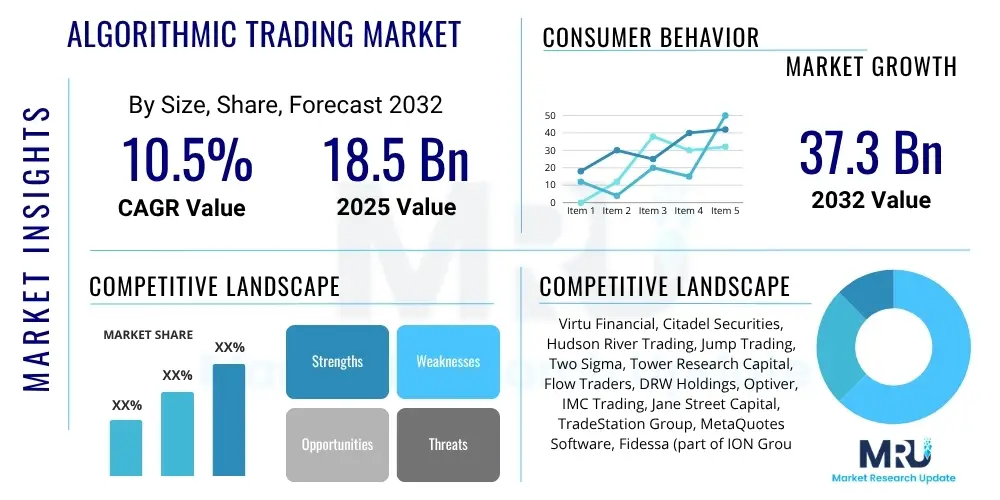

The Algorithmic Trading Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 37.3 Billion by the end of the forecast period in 2032.

Algorithmic Trading Market introduction

The Algorithmic Trading Market encompasses the use of advanced computer programs to execute trades in financial markets automatically, based on a predefined set of instructions and parameters. These programs are designed to analyze market data, identify trading opportunities, and execute orders at speeds and frequencies that are unattainable by human traders, thereby enhancing efficiency and reducing the impact of emotional biases. Major applications include high-frequency trading, statistical arbitrage, market making, and direct market access, serving a diverse clientele from large institutional investors and hedge funds to brokerage firms and increasingly sophisticated retail traders. The primary benefits derived from algorithmic trading include superior execution prices, minimized transaction costs through optimized order placement, and the ability to rigorously backtest strategies against historical market data before deployment. The market is significantly driven by the escalating demand for faster, more precise, and automated trade execution across global financial exchanges, coupled with continuous advancements in computing power, real-time data analytics, and the integration of artificial intelligence and machine learning technologies, which collectively empower more complex and adaptive trading strategies.

Algorithmic Trading Market Executive Summary

The Algorithmic Trading Market is poised for substantial expansion, characterized by dynamic business trends that favor advanced technological integration and strategic innovation. A prominent business trend is the increasing adoption of cloud-based algorithmic platforms, offering enhanced scalability, flexibility, and cost-efficiency for market participants of all sizes. Furthermore, there is a significant movement towards incorporating artificial intelligence and machine learning algorithms to augment predictive capabilities, optimize trade execution, and adapt swiftly to evolving market conditions. Regional trends indicate North America and Europe maintaining their leadership positions due to well-established financial infrastructures, high trading volumes, and a strong culture of technological adoption, while the Asia Pacific region is rapidly emerging as a high-growth market, driven by expanding economies, increasing investor sophistication, and governmental initiatives to modernize financial systems. Segment-wise, solutions tailored for institutional investors, particularly hedge funds and investment banks, continue to dominate, although the retail brokerage segment is experiencing accelerated growth as advanced tools become more accessible. Strategies like high-frequency trading and statistical arbitrage remain central, constantly refined by technological improvements and regulatory adaptations, underscoring a continuous pursuit of alpha generation and operational excellence.

AI Impact Analysis on Algorithmic Trading Market

Users frequently express interest in how artificial intelligence (AI) can significantly enhance the sophistication, efficiency, and profitability of algorithmic trading. Common user questions often revolve around AI's ability to provide superior predictive analytics, automate the discovery of nuanced market patterns, and adapt trading strategies dynamically to real-time shifts in market sentiment and conditions. There is considerable expectation for AI to improve risk management through advanced anomaly detection and to optimize order execution across fragmented markets. Concerns, however, are also prevalent, centering on the transparency and explainability of complex AI models, the potential for new systemic risks arising from interconnected AI-driven systems, and the evolving regulatory landscape required to govern increasingly autonomous trading agents. Despite these concerns, the overarching expectation is that AI will revolutionize algorithmic trading by pushing the boundaries of strategic development, market analysis, and decision-making capabilities.

- Enhanced predictive analytics and forecasting capabilities for market direction and volatility.

- Automated discovery and exploitation of complex, non-obvious trading patterns and arbitrage opportunities.

- Dynamic and adaptive adjustment of trading strategies in response to real-time market data and news events.

- Improved risk management frameworks through sophisticated anomaly detection and scenario analysis.

- Optimization of order execution, minimizing market impact and achieving better average prices.

- Development of self-learning algorithms that continuously refine strategies based on past performance.

- Significant reduction of human emotional biases and cognitive errors in trading decisions.

- Increased efficiency in backtesting and simulating complex strategies with larger datasets.

- Potential for creating new, highly individualized trading products and services.

- Facilitation of cross-asset and multi-market strategies with greater coordination.

- Streamlined compliance monitoring through AI-driven surveillance tools.

- Acceleration of market making activities with more intelligent quote generation.

- Advancements in natural language processing (NLP) for sentiment analysis from news and social media.

- Better management of liquidity through intelligent order routing.

- Development of synthetic data generation for robust model training.

- Identification of new data sources and their relevance to market movements.

- Creation of more resilient and robust trading systems.

DRO & Impact Forces Of Algorithmic Trading Market

The Algorithmic Trading Market is influenced by a powerful combination of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. Key drivers include the escalating demand for ultra-fast and highly efficient trade execution in increasingly volatile global financial markets, the proliferation and availability of vast datasets that fuel advanced analytics, and the continuous institutional adoption of sophisticated, data-driven trading strategies aimed at alpha generation and risk mitigation. However, the market faces significant restraints, such as the substantial upfront capital investment required for high-performance computing infrastructure and specialized software, the stringent and evolving regulatory frameworks designed to prevent market manipulation and ensure fairness, and the inherent technical complexity involved in developing, deploying, and maintaining intricate algorithmic systems. Concurrently, abundant opportunities are emerging from the rapid advancements in artificial intelligence and machine learning technologies, which enable more adaptive and predictive trading models. Further opportunities arise from the expansion into developing financial markets with improving infrastructure and liquidity, alongside the development of more user-friendly and accessible algorithmic trading platforms that cater to a broader spectrum of investors, thus creating a robust environment for innovation and market expansion.

Segmentation Analysis

The Algorithmic Trading Market is comprehensively segmented across several dimensions to reflect the diverse operational needs and strategic approaches of market participants. These segments delineate the market by the constituent components of the solutions, the deployment models chosen by firms, the specific trading strategies employed, and the distinct end-user categories leveraging these advanced technologies. Each segmentation offers unique insights into market dynamics, highlighting areas of particular growth, technological concentration, and strategic investment. The varied requirements across these segments underscore the need for adaptable and specialized algorithmic trading solutions that can cater to different scales of operations, risk appetites, and market objectives, driving ongoing innovation and customization within the industry.

- Component:

- Software: Includes trading platforms, execution management systems (EMS), order management systems (OMS), risk management software, and pre-trade analysis tools.

- Services: Comprises consulting, implementation, training, support, and managed services for algorithmic trading infrastructure and strategies.

- Deployment Type:

- On-Premise: Solutions deployed and managed within a firm's own data centers, offering maximum control and customization.

- Cloud-Based: Hosted solutions accessible via the internet, providing scalability, flexibility, and reduced infrastructure costs.

- Trading Strategy:

- High-Frequency Trading (HFT): Rapid execution of a large number of orders over very short timeframes to capitalize on small price discrepancies.

- Algorithmic Arbitrage: Exploiting price differences of the same asset across different markets or forms.

- Statistical Arbitrage: Identifying statistically significant price relationships between assets and trading on deviations.

- Low-Latency Trading: Strategies designed to achieve the fastest possible execution speeds, often involving co-location.

- Direct Market Access (DMA): Allowing institutional investors to place orders directly into the market without manual intervention from a broker.

- Market Making: Placing both buy and sell orders to profit from the bid-ask spread while providing liquidity.

- Volume Weighted Average Price (VWAP): Executing orders over a period to achieve an average price close to the VWAP of that period.

- Time Weighted Average Price (TWAP): Distributing large orders over a specific timeframe to minimize market impact.

- Others: Includes smart order routing, pairs trading, momentum trading, mean reversion, and event-driven strategies.

- End-User:

- Hedge Funds: Utilize complex algorithms for diverse strategies including quantitative, macro, and relative value.

- Investment Banks: Employ algorithmic trading for proprietary trading, market making, risk management, and client order execution.

- Retail Investors: Accessing algorithmic tools through advanced brokerage platforms for automated strategy execution.

- Brokerage Firms: Offering algorithmic execution services to institutional and high-net-worth clients.

- Asset Management Firms: Implementing algorithms for portfolio rebalancing, risk management, and large order execution.

- Proprietary Trading Firms: Exclusively trading their own capital with highly sophisticated and often high-frequency algorithms.

- Other Financial Institutions: Including pension funds, mutual funds, and endowments using algorithms for efficient portfolio management.

Value Chain Analysis For Algorithmic Trading Market

The value chain for the Algorithmic Trading Market is a multi-faceted ecosystem that starts with upstream providers and extends through execution and post-trade activities. Upstream participants are crucial, encompassing data vendors who supply real-time, historical, and alternative market data feeds, specialized software developers who create the core algorithmic trading platforms, execution management systems (EMS), and order management systems (OMS), and hardware manufacturers providing high-performance computing infrastructure, including low-latency servers and network equipment. Midstream, financial institutions such as hedge funds, investment banks, and proprietary trading firms integrate these technologies to develop and deploy their specific trading strategies, leveraging sophisticated analytics and risk management tools. Downstream activities are dominated by brokerage firms that provide connectivity to exchanges and settlement services, as well as compliance and regulatory technology (RegTech) providers ensuring adherence to market rules. Distribution channels for algorithmic trading solutions are primarily direct, involving direct sales from technology vendors to financial institutions, often accompanied by extensive customization and integration services. Indirect channels include financial exchanges offering co-location services and data aggregators that consolidate market information, enabling seamless access for algorithmic trading participants.

Algorithmic Trading Market Potential Customers

The potential customer base for Algorithmic Trading Market solutions is broad and diverse, primarily comprising financial institutions and sophisticated individual investors seeking competitive advantages through automation and speed. This group prominently includes large institutional investors who manage substantial assets and require efficient execution for vast portfolios, alongside dynamic hedge funds that rely on complex algorithms for alpha generation across various strategies. Proprietary trading firms, which trade their own capital, are also key consumers, often pushing the boundaries of high-frequency and low-latency trading. Investment banks utilize algorithmic systems for their market making, arbitrage desks, and to provide advanced execution services to their clients. Furthermore, brokerage firms are significant buyers, as they integrate these technologies to offer sophisticated trading platforms and services, catering to both institutional and high-net-worth individual clients. A growing segment includes technologically adept retail investors and family offices who increasingly seek access to automated strategies previously exclusive to institutional players, aiming to enhance their trading performance and risk management capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 37.3 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Virtu Financial, Citadel Securities, Hudson River Trading, Jump Trading, Two Sigma, Tower Research Capital, Flow Traders, DRW Holdings, Optiver, IMC Trading, Jane Street Capital, TradeStation Group, MetaQuotes Software, Fidessa (part of ION Group), AlgoTrader, QuantConnect, SAS Institute, Refinitiv (part of LSEG), Bloomberg LP, Kx Systems (part of FD Technologies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Algorithmic Trading Market Key Technology Landscape

The Algorithmic Trading Market is fundamentally shaped by a sophisticated and evolving technological landscape that enables high-speed, data-driven, and automated financial transactions. At its core, this landscape relies heavily on high-performance computing (HPC) infrastructure, including specialized processors, low-latency memory, and high-throughput storage solutions designed to process massive volumes of market data instantaneously. Ultra-low-latency networking is equally critical, utilizing fiber optics and co-location services to minimize the physical distance and transmission time between trading algorithms and exchange matching engines. Advanced software development platforms, often employing languages like C++ and Python, are used to create the complex trading algorithms, execution management systems (EMS), and order management systems (OMS) that form the backbone of these operations. The increasing integration of artificial intelligence (AI) and machine learning (ML) is a pivotal trend, enabling predictive modeling, pattern recognition, adaptive strategy optimization, and enhanced risk management. Cloud computing technologies are gaining traction for their scalability and flexibility, providing robust infrastructure for backtesting, simulation, and deployment of trading algorithms. Furthermore, specialized data analytics tools and big data platforms are essential for extracting actionable insights from market data, while emerging technologies like blockchain are beginning to explore applications in secure post-trade processing and settlement, promising further advancements in transparency and efficiency within the algorithmic trading ecosystem.

Regional Highlights

- North America: Dominates the global algorithmic trading market, driven by the presence of major financial hubs like New York and Chicago, extensive technological infrastructure, high trading volumes, and a proactive approach to financial innovation. The region benefits from a robust ecosystem of technology providers, large institutional investors, and a high adoption rate of sophisticated trading strategies, including high-frequency trading and AI-driven solutions.

- Europe: Represents a significant market share, with key financial centers such as London, Frankfurt, and Paris leading the adoption of algorithmic trading. The region is characterized by advanced regulatory frameworks, particularly MiFID II, which influences market structure and transparency, driving demand for compliant and efficient algorithmic solutions. Institutional trading, derivatives, and cross-border execution are prominent.

- Asia Pacific (APAC): Identified as the fastest-growing region, fueled by rapidly expanding economies, increasing disposable income, and the modernization of financial markets in countries like China, Japan, India, and Australia. Rising investor sophistication, coupled with government initiatives to promote financial technology, contributes to the rapid adoption of algorithmic trading platforms across exchanges in Tokyo, Shanghai, Hong Kong, and Mumbai.

- Latin America: An emerging market showing increasing interest in algorithmic trading solutions, particularly in Brazil, Mexico, and Chile. Growth is supported by improving financial infrastructure, increasing market liquidity, and a growing recognition among local financial institutions of the benefits of automated trading for efficiency and competitive advantage. Regulatory developments are also gradually paving the way for broader adoption.

- Middle East and Africa (MEA): A nascent but promising market, with regions like the UAE, Saudi Arabia, and South Africa investing heavily in financial technology and diversifying their economies. Modernization efforts in stock exchanges and the ambition to become regional financial hubs are fostering demand for advanced trading tools, including algorithmic solutions, albeit at an earlier stage of adoption compared to more established markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Algorithmic Trading Market.- Virtu Financial

- Citadel Securities

- Hudson River Trading

- Jump Trading

- Two Sigma

- Tower Research Capital

- Flow Traders

- DRW Holdings

- Optiver

- IMC Trading

- Jane Street Capital

- TradeStation Group

- MetaQuotes Software

- Fidessa (part of ION Group)

- AlgoTrader

- QuantConnect

- SAS Institute

- Refinitiv (part of LSEG)

- Bloomberg LP

- Kx Systems (part of FD Technologies)

Frequently Asked Questions

What is algorithmic trading and how does it work?

Algorithmic trading involves using sophisticated computer programs to execute trades automatically based on predefined instructions such as time, price, and volume, aiming to optimize execution speed, efficiency, and remove human emotional biases from trading decisions.

How is AI transforming the algorithmic trading market?

AI is transforming algorithmic trading by enabling superior predictive analytics, dynamic strategy adaptation to real-time market changes, advanced risk management through anomaly detection, and automated discovery of complex trading patterns, leading to more sophisticated and profitable strategies.

What are the primary benefits of adopting algorithmic trading solutions?

The primary benefits include significantly faster trade execution, improved pricing, reduction in transaction costs, enhanced ability to backtest and optimize strategies, and the elimination of psychological biases that can affect human trading performance.

Who are the typical end-users or customers in the Algorithmic Trading Market?

Typical end-users include hedge funds, investment banks, proprietary trading firms, brokerage firms, asset management firms, and increasingly, sophisticated retail investors and family offices seeking automated and efficient trading strategies.

What are the main challenges faced by the Algorithmic Trading Market?

Key challenges include the high initial investment required for infrastructure, stringent and evolving regulatory oversight concerning market fairness and manipulation, the technical complexity of developing and maintaining advanced systems, and the potential for flash crashes due to rapid, automated market movements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager