Aluminum Cladding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429469 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Aluminum Cladding Market Size

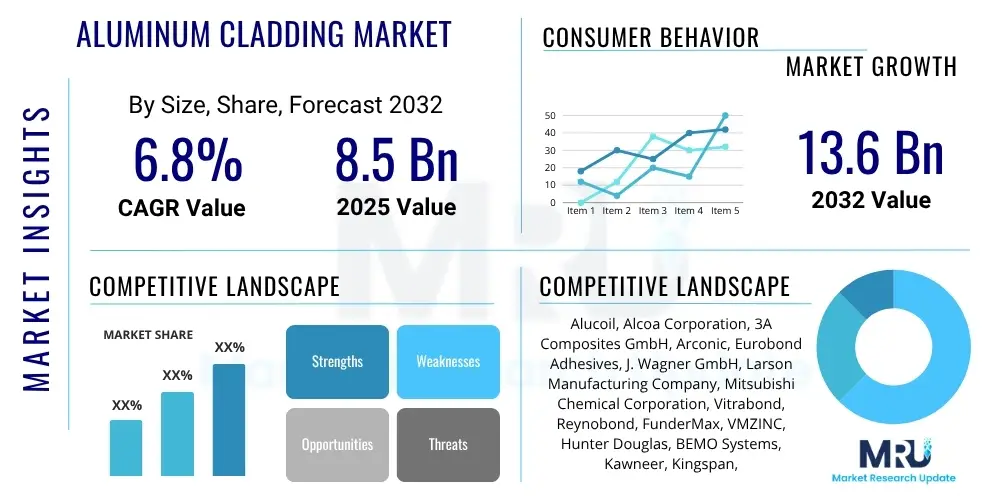

The Aluminum Cladding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 13.6 Billion by the end of the forecast period in 2032.

Aluminum Cladding Market introduction

The Aluminum Cladding Market encompasses the manufacturing, distribution, and installation of external building facades made from aluminum. This product involves attaching lightweight aluminum panels or sheets to the exterior of buildings, offering a protective and aesthetic layer. Aluminum cladding is widely appreciated for its exceptional durability, corrosion resistance, and malleability, making it a versatile material in modern architectural designs.

Major applications of aluminum cladding span across commercial, residential, and industrial sectors, including high-rise buildings, educational institutions, healthcare facilities, and private homes. Its benefits are manifold, ranging from enhanced structural integrity and weather protection to significant energy efficiency improvements through better insulation properties. The market is primarily driven by rapid urbanization, increasing demand for sustainable building materials, and a growing emphasis on aesthetically appealing and low-maintenance facades.

Aluminum Cladding Market Executive Summary

The Aluminum Cladding Market is poised for substantial growth, driven by an expanding global construction industry and a rising preference for lightweight, durable, and aesthetically versatile building materials. Business trends indicate a strong focus on product innovation, including advanced coating technologies and customizable panel designs, catering to diverse architectural requirements and sustainability mandates. Manufacturers are increasingly adopting automated production processes to enhance efficiency and meet the escalating demand for bespoke solutions.

Regional trends highlight Asia Pacific as a dominant market, fueled by robust infrastructural development and rapid urbanization, particularly in emerging economies. North America and Europe demonstrate mature markets, emphasizing renovation projects, stringent energy efficiency regulations, and the adoption of advanced green building standards. The Middle East and Africa, alongside Latin America, are emerging as significant growth hubs due to ongoing investments in commercial and residential construction projects.

Segment trends reveal a growing demand for aluminum composite panels (ACPs) due to their cost-effectiveness and design flexibility, while solid aluminum panels are favored for their superior fire resistance and long-term durability in high-profile projects. The commercial sector continues to be the largest end-user, with a noticeable surge in residential applications driven by modern architectural preferences. The focus on sustainable and recyclable materials is further influencing product development and market dynamics across all segments.

AI Impact Analysis on Aluminum Cladding Market

Users frequently inquire about how artificial intelligence will transform the aluminum cladding industry, focusing on enhanced design capabilities, optimized manufacturing processes, improved material efficiency, and predictive maintenance. Key themes revolve around the potential for AI to drive greater customization, reduce production waste, shorten lead times, and deliver more resilient and sustainable building solutions. There is considerable expectation that AI will facilitate intelligent design, streamline supply chain logistics, and improve on-site installation accuracy, addressing current industry challenges such as labor shortages and material waste. Stakeholders are particularly interested in AI's role in creating smart buildings through integrated cladding systems and optimizing energy performance.

- AI enhances architectural design through generative design, exploring optimal panel configurations and material usage.

- Predictive maintenance for cladding systems, identifying potential issues before they become critical.

- Optimized manufacturing processes reduce waste and improve efficiency through AI-driven robotics and quality control.

- Supply chain management benefits from AI for demand forecasting, inventory optimization, and logistics planning.

- AI-powered simulation tools predict the performance of cladding systems under various environmental conditions.

- Automated quality inspection of manufactured panels ensures consistency and adherence to standards.

- Personalized cladding solutions designed with AI algorithms meet specific client aesthetic and functional needs.

- AI assists in project management, improving scheduling, resource allocation, and on-site coordination for installation.

- Enhanced material traceability and sustainability monitoring using AI to track lifecycle impacts.

- Intelligent energy management in buildings through AI-integrated smart cladding systems.

DRO & Impact Forces Of Aluminum Cladding Market

The Aluminum Cladding Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory. Key drivers include the global boom in construction and infrastructure development, particularly in urban centers, alongside the increasing demand for aesthetically pleasing, durable, and low-maintenance building facades. The inherent benefits of aluminum, such as its lightweight nature, excellent corrosion resistance, fire resistance properties, and recyclability, align well with modern architectural and environmental standards, further propelling market expansion.

Conversely, several restraints impede the market's full potential. The high initial cost of aluminum cladding compared to traditional materials can deter budget-sensitive projects. Installation complexity, requiring specialized skills and equipment, also contributes to higher labor costs. Furthermore, volatile raw material prices for aluminum, influenced by global commodity markets and geopolitical factors, introduce an element of uncertainty for manufacturers and can impact pricing strategies. Intense competition from alternative cladding materials like fiber cement, wood, and uPVC also poses a challenge, necessitating continuous innovation in product differentiation.

Despite these challenges, substantial opportunities exist, driven by a growing emphasis on green building initiatives and energy-efficient construction, where aluminum cladding can play a crucial role in improving thermal performance. The increasing trend of facade renovation projects for aging buildings, especially in developed economies, presents a lucrative market. Technological advancements in surface finishes, panel designs, and intelligent cladding systems also open new avenues for market penetration and value addition. The impact forces, viewed through Porter's Five Forces analysis, indicate moderate bargaining power of buyers due to numerous suppliers, moderate bargaining power of suppliers influenced by aluminum commodity prices, a low to moderate threat of new entrants due to high capital investment and expertise required, a moderate threat of substitutes from other cladding materials, and high industry rivalry among established players.

Segmentation Analysis

The Aluminum Cladding Market is extensively segmented to categorize products and applications, providing a clearer understanding of market dynamics and consumer preferences. These segmentations are critical for market participants to identify niche opportunities and develop targeted strategies. The market is primarily bifurcated based on the type of aluminum product used, the surface finish applied, the specific application areas in construction, and the end-use sector.

- Type

- Solid Aluminum Panels

- Aluminum Composite Panels (ACPs)

- Aluminum Honeycomb Panels

- Surface Finish

- PVDF (Polyvinylidene Fluoride) Coated

- Polyester Coated

- Anodized

- Powder Coated

- Natural (Mill Finish)

- Application

- Exterior Wall Cladding

- Interior Wall Cladding

- Roof Cladding

- Ceiling Cladding

- Column Covers

- End-Use

- Commercial Buildings (Offices, Retail, Hospitality)

- Residential Buildings (Multi-family, Single-family)

- Industrial Buildings

- Institutional Buildings (Healthcare, Education)

Value Chain Analysis For Aluminum Cladding Market

The value chain for the Aluminum Cladding Market begins with upstream activities involving the sourcing and processing of raw materials. This stage is dominated by bauxite mining and the primary production of aluminum ingots and sheets, which are then supplied to manufacturers. Key players at this stage include global aluminum producers responsible for smelting and casting, ensuring the consistent supply of high-grade aluminum alloys suitable for cladding applications. The quality and cost of these raw materials significantly influence the final product’s characteristics and market price.

Midstream activities involve the manufacturing and fabrication of aluminum cladding products. This includes processes such as extrusion, rolling, panel fabrication (for composite or solid panels), and various surface treatments like PVDF coating, anodizing, and powder coating. Manufacturers at this stage transform raw aluminum into finished or semi-finished cladding components, requiring significant capital investment in machinery, technology, and skilled labor. Quality control and adherence to architectural specifications are paramount to ensure product performance and aesthetic appeal.

Downstream activities focus on the distribution, installation, and end-use of aluminum cladding. Distribution channels are varied, encompassing direct sales to large construction projects, sales through a network of distributors and wholesalers to smaller contractors and retailers, and increasingly, specialized facade companies that offer integrated design, supply, and installation services. Direct channels are common for bespoke, large-scale commercial projects, offering close collaboration between manufacturers and architects. Indirect channels leverage established distribution networks to reach a broader customer base, particularly in the residential and small commercial sectors. Installers, typically specialized contractors, play a critical role in the final quality and performance of the cladding system, ensuring proper fastening, sealing, and alignment. This entire value chain is characterized by a need for specialized expertise, coordination, and adherence to evolving building codes and environmental standards.

Aluminum Cladding Market Potential Customers

The primary potential customers and end-users of aluminum cladding products are diverse, reflecting the material's broad applicability across various construction and architectural domains. A significant segment comprises construction companies and general contractors involved in both new build and renovation projects. These entities procure cladding for their projects, seeking materials that offer a balance of aesthetic appeal, durability, and compliance with building regulations. Their purchasing decisions are often influenced by project budgets, timelines, and specific design requirements.

Architects and architectural firms also act as crucial indirect customers, specifying aluminum cladding in their designs. While they do not directly purchase the material, their recommendations heavily influence the choice of cladding products by developers and contractors. Real estate developers, ranging from residential to large-scale commercial developers, are key direct buyers as they drive the construction of new buildings and are keenly interested in materials that enhance property value, reduce maintenance costs, and contribute to modern, attractive facades. Building owners, particularly for commercial properties, also represent a significant customer base for renovation and maintenance projects, focusing on long-term performance, energy efficiency, and aesthetic upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2032 | USD 13.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alucoil, Alcoa Corporation, 3A Composites GmbH, Arconic, Eurobond Adhesives, J. Wagner GmbH, Larson Manufacturing Company, Mitsubishi Chemical Corporation, Vitrabond, Reynobond, FunderMax, VMZINC, Hunter Douglas, BEMO Systems, Kawneer, Kingspan, SIKA AG, Saint-Gobain, Nucor, Steelway Fencing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Cladding Market Key Technology Landscape

The Aluminum Cladding Market is continuously evolving with the integration of advanced manufacturing processes and innovative material science. Key technological advancements include the widespread adoption of Computer Numerical Control (CNC) machining for precise cutting, routing, and bending of aluminum panels, enabling highly complex and custom designs with minimal material waste. Robotic fabrication is also gaining traction, particularly in large-scale production facilities, to enhance efficiency, consistency, and worker safety. These technologies allow for rapid prototyping and mass customization, meeting the diverse demands of modern architecture.

In terms of materials and finishes, advancements in surface treatment technologies are paramount. Polyvinylidene Fluoride (PVDF) coatings continue to be popular for their superior weatherability, color retention, and chemical resistance, with ongoing research focused on enhancing their environmental profile and expanding color palettes. Anodizing processes have also seen improvements, offering more durable and aesthetically varied finishes. Furthermore, the development of fire-retardant cores for aluminum composite panels (ACPs) is a critical technological trend, addressing safety concerns and regulatory demands in high-rise construction. Research into sustainable coatings and recycled aluminum content is also a significant area of focus, aligning with global green building initiatives.

Beyond manufacturing, the integration of Building Information Modeling (BIM) software is transforming the design and installation phases of aluminum cladding projects. BIM facilitates collaborative design, clash detection, and accurate quantity take-offs, streamlining the entire construction workflow. Smart cladding systems, incorporating sensors for monitoring temperature, light, and structural integrity, are emerging, contributing to intelligent building management and enhanced energy performance. These technological shifts are not only improving product quality and performance but also driving greater efficiency, sustainability, and innovation across the aluminum cladding industry.

Regional Highlights

- Asia Pacific: This region stands as the dominant market for aluminum cladding, driven by massive urbanization, burgeoning construction industries, and significant infrastructure development projects, especially in countries like China, India, and Southeast Asian nations. The demand for modern, durable, and aesthetically appealing facades in both commercial and residential sectors is fueling growth.

- North America: Characterized by a mature construction market, North America shows strong demand for aluminum cladding, particularly in renovation and remodeling projects. The emphasis on energy-efficient buildings, sustainable materials, and robust building codes drives the adoption of high-performance aluminum cladding systems.

- Europe: The European market for aluminum cladding is driven by stringent environmental regulations, a focus on green building certifications, and a strong preference for high-quality, durable facade materials. Renovation of aging infrastructure and architectural innovation are key growth factors, with countries like Germany, France, and the UK leading the adoption.

- Latin America: This region is an emerging market with increasing investments in commercial and residential construction, spurred by economic growth and urbanization. Countries like Brazil and Mexico are witnessing a rising adoption of aluminum cladding as architects and developers seek modern, cost-effective, and resilient building solutions.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits significant growth potential due to extensive investment in large-scale commercial and residential projects, including iconic skyscrapers and smart cities. The need for materials that can withstand harsh climatic conditions, coupled with a focus on contemporary aesthetics, drives demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Cladding Market.- Alucoil

- Alcoa Corporation

- 3A Composites GmbH

- Arconic

- Eurobond Adhesives

- J. Wagner GmbH

- Larson Manufacturing Company

- Mitsubishi Chemical Corporation

- Vitrabond

- Reynobond

- FunderMax

- VMZINC

- Hunter Douglas

- BEMO Systems

- Kawneer

- Kingspan

- SIKA AG

- Saint-Gobain

- Nucor

- Steelway Fencing

Frequently Asked Questions

What is aluminum cladding?

Aluminum cladding is a building facade material consisting of aluminum panels or sheets attached to the exterior of a structure, offering protection, insulation, and aesthetic appeal. It is known for its lightweight nature, durability, and corrosion resistance.

What are the primary benefits of using aluminum cladding?

The key benefits include excellent durability, superior corrosion resistance, fire resistance, energy efficiency through insulation, low maintenance requirements, and significant aesthetic versatility for modern architectural designs.

Is aluminum cladding a sustainable building material?

Yes, aluminum cladding is highly sustainable. Aluminum is 100% recyclable, and its production often involves recycled content. It also contributes to building energy efficiency by enhancing insulation, reducing the building's overall carbon footprint.

What are the main types of aluminum cladding available?

The main types include Solid Aluminum Panels, Aluminum Composite Panels (ACPs) which have a core sandwiched between aluminum layers, and Aluminum Honeycomb Panels known for their exceptional strength-to-weight ratio.

Which industries primarily use aluminum cladding?

Aluminum cladding is predominantly used in the commercial, residential, industrial, and institutional sectors. It is extensively applied in high-rise buildings, corporate offices, retail spaces, educational institutions, healthcare facilities, and modern homes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager