Aluminum Foam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428555 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Aluminum Foam Market Size

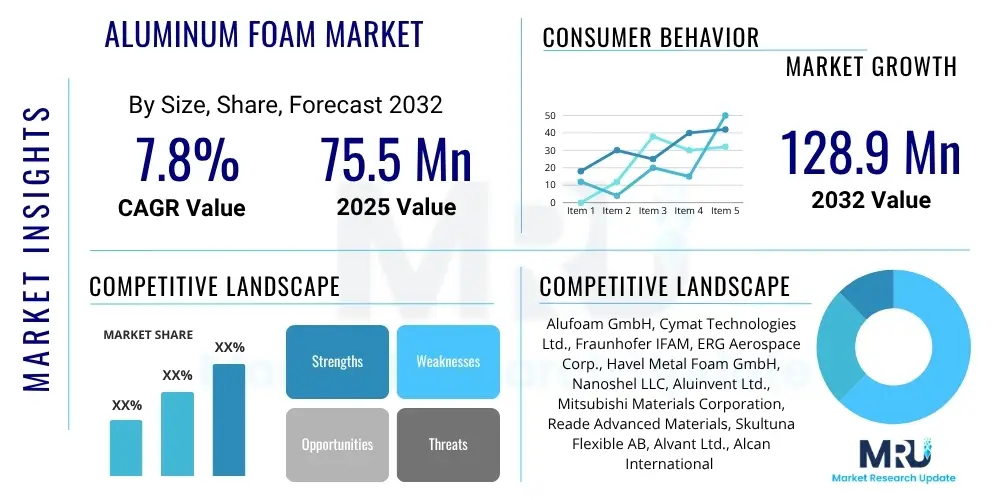

The Aluminum Foam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $75.5 Million in 2025 and is projected to reach $128.9 Million by the end of the forecast period in 2032.

Aluminum Foam Market introduction

The Aluminum Foam Market is experiencing significant growth driven by the increasing demand for advanced lightweight materials across various industries. Aluminum foam, a cellular metallic material, offers an exceptional combination of high specific strength, excellent energy absorption capabilities, and superior thermal and acoustic insulation properties. Its unique microstructure, characterized by a network of interconnected or isolated pores within an aluminum matrix, makes it a highly desirable material for a wide range of sophisticated applications where conventional materials fall short.

This innovative product is primarily categorized into closed-cell and open-cell structures, each offering distinct advantages for specific uses. Closed-cell aluminum foam is predominantly used in structural applications where high stiffness and impact resistance are crucial, such as in automotive crash boxes and blast mitigation panels. Open-cell aluminum foam, with its permeable structure, finds utility in functional applications like heat exchangers, filters, and sound absorbers, leveraging its high surface area and porous nature. The manufacturing processes for aluminum foam involve techniques such as melt foaming, powder metallurgy foaming, and gas injection, constantly evolving to enhance material properties and reduce production costs.

The benefits of aluminum foam extend to enhanced fuel efficiency in transportation, improved safety through superior energy dissipation, effective noise reduction in industrial settings, and fire resistance in construction. Key driving factors for the market's expansion include stringent environmental regulations promoting lightweighting for reduced emissions, increasing investments in research and development for novel material applications, and a growing emphasis on safety standards across automotive and aerospace sectors. The versatility and high performance of aluminum foam position it as a critical material for sustainable and advanced engineering solutions in the coming decade.

Aluminum Foam Market Executive Summary

The Aluminum Foam Market is poised for robust expansion, reflecting significant advancements in material science and increasing industrial adoption. Business trends indicate a strong focus on process optimization and cost reduction strategies, as manufacturers aim to overcome the historical challenges associated with high production expenses and limited scalability. Strategic collaborations between material producers and end-use industries, particularly in automotive and aerospace, are becoming more prevalent, fostering innovation and accelerating market penetration for new applications. The market is also witnessing a surge in patent filings related to novel foaming techniques and enhanced foam properties, signaling a vibrant research and development landscape that promises to introduce more efficient and versatile aluminum foam products.

Regionally, Asia Pacific is emerging as a dominant force, fueled by rapid industrialization, burgeoning automotive manufacturing, and extensive infrastructure development projects, especially in countries like China, India, and Japan. North America and Europe continue to be key markets, characterized by high adoption rates in aerospace, defense, and advanced manufacturing sectors, supported by significant R&D investments and stringent regulatory frameworks for safety and environmental performance. Latin America and the Middle East and Africa regions are expected to show steady growth as their industrial bases expand and awareness of advanced materials increases, particularly in construction and transportation.

Segment-wise, closed-cell aluminum foam is projected to maintain its lead due to its superior mechanical properties essential for structural components and energy absorption systems. However, open-cell aluminum foam is gaining traction for its functional applications in thermal management, filtration, and acoustic dampening, driven by demand from electronics, renewable energy, and industrial sectors. The market is also seeing trends towards customization and specialized foam solutions tailored to specific performance requirements, indicating a maturing market where diverse needs are addressed through innovative product development. Overall, the market's trajectory is upward, propelled by technological advancements, favorable regulatory environments, and diverse application opportunities.

AI Impact Analysis on Aluminum Foam Market

Common user questions regarding AI's impact on the Aluminum Foam Market frequently revolve around how artificial intelligence can optimize complex manufacturing processes, enhance material properties, ensure stringent quality control, and contribute to cost efficiencies. Users are keen to understand if AI can accelerate the discovery of new aluminum foam compositions, predict material performance under various stress conditions, and streamline the entire supply chain from raw material procurement to product delivery. There is also significant interest in AI's role in enabling sustainable production practices and reducing waste, aligning with broader industry goals for environmental responsibility.

AI is set to significantly influence the aluminum foam market by introducing unprecedented levels of precision and efficiency across the product lifecycle. In manufacturing, AI algorithms can analyze vast datasets from production lines to optimize foaming parameters, ensuring consistent pore size distribution, cell wall thickness, and overall structural integrity, thereby reducing defects and material waste. This optimization extends to predictive maintenance for manufacturing equipment, minimizing downtime and improving operational throughput. Furthermore, AI-driven simulations can rapidly prototype and test new foam designs, allowing engineers to virtually experiment with different alloys and foaming agents to achieve desired properties, dramatically cutting down on physical experimentation and accelerating innovation cycles.

- AI-driven optimization of foaming parameters for improved material consistency and reduced defects.

- Predictive analytics for equipment maintenance, minimizing downtime and enhancing production efficiency.

- Accelerated material discovery and design through AI-powered simulations and computational modeling.

- Enhanced quality control systems using computer vision and machine learning for real-time defect detection.

- Supply chain optimization, including demand forecasting and logistics management for raw materials and finished products.

- Enabling of sustainable manufacturing by optimizing energy consumption and minimizing material waste.

- Development of smart aluminum foam structures with embedded sensors for real-time performance monitoring.

DRO & Impact Forces Of Aluminum Foam Market

The Aluminum Foam Market is shaped by a confluence of driving forces, significant restraints, and emerging opportunities, all interacting to define its growth trajectory. Key drivers include the global push for lightweight materials to enhance fuel efficiency and reduce emissions, particularly in the automotive and aerospace industries. Growing awareness of safety and crashworthiness in vehicles further amplifies demand, as aluminum foam offers superior energy absorption. Additionally, advancements in manufacturing technologies are steadily improving the cost-effectiveness and scalability of aluminum foam production, making it more accessible for diverse applications. The inherent benefits of aluminum foam, such as high stiffness-to-weight ratio, excellent sound and thermal insulation, and fire resistance, continue to broaden its appeal across multiple sectors, positioning it as a preferred material for innovative engineering solutions.

Despite these strong drivers, the market faces notable restraints. High manufacturing costs, primarily due to specialized processing techniques and the need for high-purity aluminum, remain a significant barrier to widespread adoption. The limited production capacity and relatively small scale of existing manufacturing facilities also hinder market expansion, particularly for large-volume applications. Furthermore, the lack of standardized testing methods and material specifications for aluminum foams can create uncertainty among potential users, slowing down their integration into new product designs. Challenges in producing foams with perfectly uniform cell structures and consistent mechanical properties across large batches also pose technical hurdles that manufacturers are actively working to overcome, requiring continuous investment in research and development.

However, substantial opportunities exist for market growth. The burgeoning electric vehicle (EV) market presents a significant avenue for aluminum foam, where lightweighting is crucial for battery range and structural integrity. Innovations in architectural design and smart city infrastructure also open doors for aluminum foam in applications requiring superior insulation, aesthetics, and structural support. The ongoing development of additive manufacturing techniques, such as 3D printing of metal foams, promises to revolutionize production capabilities, enabling complex geometries and customized foam properties. Additionally, the increasing emphasis on circular economy principles and recyclability of materials aligns well with aluminum foam's inherent recyclability, offering a sustainable advantage that could drive future adoption. The market's future will be influenced by the ability of manufacturers to capitalize on these opportunities while effectively mitigating existing restraints, leveraging technological advancements to achieve cost-competitive and high-performance solutions.

Segmentation Analysis

The Aluminum Foam Market is comprehensively segmented across various dimensions, including type, application, and end-use industry, providing a granular view of its diverse utility and market dynamics. This segmentation helps in understanding the specific demands and growth drivers within different niches of the market, allowing for targeted product development and strategic market entry. The distinct characteristics and performance benefits offered by different aluminum foam variants cater to a wide array of industrial requirements, from robust structural components to highly efficient thermal management solutions, reflecting the material's versatility.

- By Type

- Closed-Cell Aluminum Foam

- Open-Cell Aluminum Foam

- By Application

- Energy Absorbers (e.g., crash boxes, blast protection)

- Heat Exchangers (e.g., heat sinks, compact heat exchangers)

- Sound Absorbers (e.g., acoustic panels, engine compartments)

- Structural Components (e.g., sandwich panels, lightweight beams)

- Filters (e.g., molten metal filters, catalytic converters)

- Others (e.g., aesthetic panels, buoyancy applications)

- By End-Use Industry

- Automotive (e.g., passenger vehicles, commercial vehicles)

- Aerospace and Defense (e.g., aircraft, spacecraft, military vehicles)

- Building and Construction (e.g., facades, insulation, sound barriers)

- Marine (e.g., boat hulls, offshore structures)

- Industrial (e.g., machinery, electronics, general manufacturing)

- Others (e.g., medical devices, consumer goods)

Value Chain Analysis For Aluminum Foam Market

The value chain for the Aluminum Foam Market commences with upstream activities involving the sourcing of primary raw materials and specialized equipment. This stage is dominated by suppliers of high-purity aluminum ingots, which form the primary matrix for the foam, along with foaming agents such as titanium hydride or calcium carbonate, and various binders and stabilizers. Key suppliers also include manufacturers of specialized melting furnaces, casting equipment, and foaming reactors essential for the production process. The quality and cost-effectiveness of these raw materials and equipment significantly influence the final product's performance and price point. Strong relationships with reliable suppliers are crucial to ensure a consistent supply of quality inputs, which in turn impacts the consistency and scalability of aluminum foam production.

Further down the value chain, the aluminum foam manufacturers transform these raw materials into finished foam products through various patented and proprietary processes, including melt foaming, powder metallurgy foaming, and casting impregnation. This manufacturing stage requires significant capital investment in machinery, extensive R&D, and skilled personnel to control the intricate foaming parameters and achieve desired cellular structures and mechanical properties. Manufacturers then engage in processing steps such as cutting, shaping, and joining the foam to meet specific application requirements. The distribution channel plays a critical role in connecting manufacturers with end-users, encompassing both direct sales and indirect routes. Direct sales are often preferred for large-volume orders from major automotive OEMs or aerospace prime contractors, facilitating closer collaboration and customization. This direct interaction allows for specific technical requirements to be precisely met and for proprietary information to be exchanged securely.

Indirect distribution involves partnerships with specialized distributors and material suppliers who cater to smaller-scale applications, niche markets, and diverse end-users across various industries. These distributors provide logistical support, local market expertise, and often value-added services such as further processing or integration of aluminum foam components into larger assemblies. The downstream segment of the value chain involves the integration of aluminum foam into final products by end-use industries such as automotive, aerospace, building and construction, and marine. The efficiency of the entire value chain, from raw material procurement to end-product integration, significantly impacts the overall cost, availability, and competitiveness of aluminum foam in the global market. Continuous innovation in production techniques and strategic collaborations across the value chain are essential for driving market growth and expanding the adoption of this advanced material.

Aluminum Foam Market Potential Customers

The potential customer base for the Aluminum Foam Market is broad and diverse, primarily encompassing industries that prioritize lightweighting, energy absorption, structural integrity, and advanced material performance. The automotive sector represents a significant end-user, with manufacturers increasingly integrating aluminum foam into vehicle designs for crash boxes, bumper beams, and floor panels to enhance passenger safety and improve fuel efficiency. The ongoing shift towards electric vehicles further amplifies this demand, as lightweight materials are crucial for extending battery range and managing thermal properties. Aerospace and defense industries are also key buyers, utilizing aluminum foam for lightweight structural components, blast protection panels, and sound insulation in aircraft, spacecraft, and military vehicles, where high performance under extreme conditions is paramount.

Beyond transportation, the building and construction sector is a growing consumer, employing aluminum foam for architectural facades, lightweight partition walls, and sound or thermal insulation panels in smart buildings and modern infrastructure projects. Its fire-resistant properties and aesthetic versatility make it an attractive option for contemporary designs. The marine industry also seeks aluminum foam for lightweight hull structures and buoyancy applications in boats and offshore platforms, where weight reduction directly translates to improved performance and reduced operational costs. Furthermore, the industrial sector, including electronics and general manufacturing, utilizes open-cell aluminum foam for heat sinks, filters, and catalytic converter substrates due to its high surface area and porous structure, enabling efficient thermal management and filtration.

Other emerging applications include the medical device industry, where lightweight and biocompatible materials are desired, and the renewable energy sector, particularly in components for wind turbines and solar panel structures. The end-users in these industries are typically large original equipment manufacturers (OEMs) who integrate the foam into their final products, or specialized fabricators and construction firms that utilize semi-finished aluminum foam sheets or custom components. The market's growth is inherently linked to these industries' continuous search for innovative materials that offer a competitive edge in performance, sustainability, and cost-effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $75.5 Million |

| Market Forecast in 2032 | $128.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alufoam GmbH, Cymat Technologies Ltd., Fraunhofer IFAM, ERG Aerospace Corp., Havel Metal Foam GmbH, Nanoshel LLC, Aluinvent Ltd., Mitsubishi Materials Corporation, Reade Advanced Materials, Skultuna Flexible AB, Alvant Ltd., Alcan International Network, Composites One, Goodfellow Corporation, ZwickRoell GmbH & Co. KG, Ultramet, American Elements, Sapa AS, Alusuisse, Forme Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Foam Market Key Technology Landscape

The Aluminum Foam Market is characterized by a dynamic and evolving technology landscape, primarily driven by the pursuit of enhanced material properties, cost-effective production methods, and expanded application potential. Traditional manufacturing techniques such as melt foaming, which involves injecting gas into molten aluminum, and powder metallurgy foaming, where aluminum powder is mixed with a foaming agent and heated, remain foundational. These methods are continually being refined to achieve greater control over cell size, distribution, and overall foam density, which are critical for dictating the material's mechanical and functional performance. Innovations in these established processes include the development of new foaming agents that are more efficient and environmentally benign, as well as improved mold designs and cooling strategies to minimize defects and enhance structural uniformity. The goal is to produce large-scale, high-quality aluminum foam panels with consistent properties, overcoming historical challenges related to inhomogeneity and high scrap rates.

A significant area of technological advancement lies in hybrid foaming techniques and the development of composite foams, where aluminum foam is combined with other materials or reinforced with fibers to create multi-functional structures. For instance, sandwich panels incorporating aluminum foam cores are gaining traction due to their exceptional stiffness-to-weight ratio and energy absorption capabilities, making them ideal for lightweighting in transportation and construction. Furthermore, the advent of additive manufacturing (3D printing) is opening entirely new possibilities for aluminum foam. Techniques such as selective laser melting (SLM) or electron beam melting (EBM) can be used to create intricate, customized cellular structures with precise control over pore geometry and connectivity, allowing for the fabrication of highly specialized components that are impossible to produce with conventional methods. This enables the rapid prototyping and production of complex heat exchangers, custom filters, and advanced energy absorbers tailored to specific performance requirements.

The technology landscape also encompasses advanced characterization and simulation tools. High-resolution imaging techniques, such as micro-computed tomography (micro-CT), are crucial for understanding the internal microstructure of aluminum foams, while sophisticated finite element analysis (FEA) and computational fluid dynamics (CFD) simulations are increasingly employed to predict mechanical behavior, thermal transfer efficiency, and acoustic absorption properties. These simulation tools, often augmented by artificial intelligence and machine learning algorithms, enable engineers to virtually design and test new foam structures, optimize processing parameters, and accelerate product development cycles. The integration of smart materials concepts, such as embedding sensors within aluminum foam structures for real-time monitoring of strain, temperature, or damage, represents another frontier in technological innovation, promising to create intelligent, responsive materials for future applications.

Regional Highlights

- North America: This region is a significant market for aluminum foam, driven by robust aerospace and defense industries, which demand lightweight and high-performance materials for aircraft and military vehicles. The automotive sector, particularly with its focus on advanced safety features and fuel efficiency in the US and Canada, also contributes substantially. Strong research and development infrastructure further supports innovation and adoption.

- Europe: Europe represents a mature market, with stringent environmental regulations pushing for lightweight materials in automotive manufacturing, particularly in Germany, France, and the UK. The region also sees substantial application in the construction sector for energy-efficient buildings and sound insulation, coupled with a strong emphasis on sustainable engineering practices.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily fueled by rapid industrialization, massive infrastructure development, and the booming automotive production in countries like China, India, Japan, and South Korea. Increasing demand for lightweight and high-strength materials in these expanding economies drives market penetration.

- Latin America: This region is an emerging market for aluminum foam, with growth primarily in the automotive industry in countries like Brazil and Mexico, as well as developing construction sectors. While smaller compared to other regions, increasing foreign investments and industrial expansion present significant future opportunities.

- Middle East and Africa (MEA): The MEA region exhibits nascent growth, with potential stemming from investments in infrastructure, construction, and the developing automotive sectors. Applications in offshore structures and energy-related projects also contribute to the gradual adoption of aluminum foam, especially for its thermal and lightweight properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Foam Market.- Alufoam GmbH

- Cymat Technologies Ltd.

- Fraunhofer IFAM

- ERG Aerospace Corp.

- Havel Metal Foam GmbH

- Nanoshel LLC

- Aluinvent Ltd.

- Mitsubishi Materials Corporation

- Reade Advanced Materials

- Skultuna Flexible AB

- Alvant Ltd.

- Alcan International Network

- Composites One

- Goodfellow Corporation

- ZwickRoell GmbH & Co. KG

- Ultramet

- American Elements

- Sapa AS

- Alusuisse

- Forme Industries

Frequently Asked Questions

What are the primary benefits of aluminum foam?

Aluminum foam offers significant advantages including exceptional lightweight properties, high energy absorption capabilities for crash safety, superior sound damping, and excellent thermal insulation, making it ideal for diverse advanced applications.

How is aluminum foam manufactured?

Common manufacturing methods for aluminum foam include melt foaming, where gas is injected into molten aluminum, and powder metallurgy foaming, involving heating a mixture of aluminum powder and a foaming agent.

What are the main applications of aluminum foam?

Key applications include automotive crash structures, lightweight aerospace components, building insulation, sound absorption panels, heat exchangers, and filters, driven by its unique mechanical and functional properties.

What are the major challenges facing the aluminum foam market?

Significant challenges include the relatively high manufacturing costs, limitations in large-scale production, a lack of standardized material specifications, and ensuring consistent quality across batches.

How is AI influencing the aluminum foam industry?

AI is transforming the industry by optimizing manufacturing processes for consistency, accelerating material design through simulations, enhancing real-time quality control, and improving supply chain efficiencies, leading to cost reduction and faster innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aluminum Foam Market Statistics 2025 Analysis By Application (Automotive, Aerospace, Construction, Other), By Type (Compressed Foam, Special Foam, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aluminum Foam Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Alloy Aluminum, Pure Aluminum), By Application (Transportation, Architecture, Aerospace, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager