Amaranth Color Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427598 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Amaranth Color Market Size

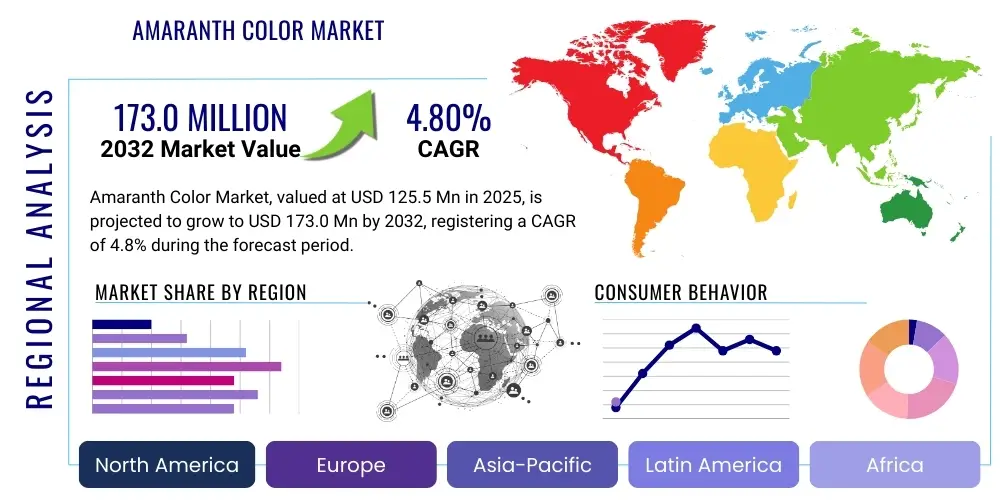

The Amaranth Color Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 125.5 Million in 2025 and is projected to reach USD 173.0 Million by the end of the forecast period in 2032. This growth trajectory is influenced by a confluence of factors including sustained demand from end-user industries such as food and beverage, pharmaceuticals, and cosmetics, alongside evolving regulatory landscapes and increasing consumer preference for visually appealing products. The valuation reflects the aggregate revenue generated from the sale of Amaranth color, encompassing its various grades and forms used across diverse applications globally.

Amaranth Color Market introduction

The Amaranth Color Market is defined by the production, distribution, and consumption of Amaranth, a synthetic azo dye chemically known as trisodium 2-hydroxy-1-(4-sulfonato-1-naphthylazo)naphthalene-3,6-disulfonate. This vibrant, deep red to reddish-purple pigment, also identified as E123 in the European Union and formerly as FD&C Red No. 2 in the United States, has historically found extensive application across various industries due to its excellent color intensity, stability, and cost-effectiveness. As a product, Amaranth is typically available in powder or granular form, offering high solubility in water, which makes it highly versatile for different formulations. Its primary applications span the food and beverage sector, where it is used to color confectionery, desserts, soft drinks, and processed foods, significantly enhancing visual appeal and consumer acceptance. Beyond edibles, Amaranth is also substantially utilized in the pharmaceutical industry for coating tablets and capsules, and in the cosmetic industry for lipsticks, blushes, and other personal care products, providing desirable aesthetic qualities.

The benefits of using Amaranth include its consistent color profile, broad applicability across diverse matrices, and relative affordability compared to many natural alternatives, which are often more expensive and can exhibit less stability under various processing conditions. Key driving factors for this market encompass the sustained global demand for visually appealing consumer products, the expansion of the processed food and beverage industry particularly in emerging economies, and the continuous growth of the pharmaceutical and cosmetic sectors. Regulatory frameworks, however, play a crucial role, influencing its permissible uses and market dynamics globally. Stringent health and safety regulations, varying by region, necessitate careful consideration by manufacturers and suppliers to ensure compliance and market access, shaping innovation towards safer production methods and exploring permissible applications within strict guidelines. The market navigates a complex balance between consumer demand for vibrant colors and the imperative for regulatory adherence and public health safety.

Amaranth Color Market Executive Summary

The Amaranth Color Market is experiencing dynamic shifts, driven primarily by evolving regulatory environments, sustained industrial demand, and advancements in manufacturing processes. Business trends indicate a focus on supply chain optimization, diversification of product offerings to meet specific regional regulations, and increased investment in research and development to explore new applications within permissible limits. Companies are also prioritizing cost-effective production methods to maintain competitiveness while adhering to stringent quality standards. Furthermore, strategic collaborations and mergers among key players are observed, aimed at expanding geographic reach and consolidating market share in a highly specialized yet globally relevant industry. The emphasis on product purity and consistency remains paramount, influencing sourcing strategies and production technologies across the value chain. Enterprises are also leveraging digital tools for market intelligence, enabling quicker adaptation to changing consumer preferences and regulatory updates, ensuring business continuity and growth.

Regionally, the market exhibits varied growth patterns. Asia Pacific, particularly countries like India and China, represents a significant growth hub due to burgeoning food processing, pharmaceutical, and cosmetic industries, coupled with a large consumer base and relatively less restrictive (though evolving) regulatory frameworks in some segments compared to Western markets. North America and Europe, while mature markets, demonstrate stable demand, driven by established industries and a strong focus on regulatory compliance, which often leads to demand for high-purity and certified grades of Amaranth. Latin America and the Middle East & Africa also show promising growth, fueled by economic development and increasing industrialization. Segment-wise, the food and beverage application continues to dominate the market share, followed closely by pharmaceuticals and cosmetics. Within these segments, trends include a growing preference for specific color shades, the development of specialized formulations for different product types, and a keen eye on ingredient traceability. The demand for industrial-grade Amaranth for non-food applications also contributes significantly, though often under different regulatory scrutiny. Overall, the market remains highly competitive, with innovation centered on compliance, efficiency, and meeting diverse global demands.

AI Impact Analysis on Amaranth Color Market

The integration of Artificial intelligence (AI) within the Amaranth Color Market is poised to drive significant advancements, primarily by optimizing various stages of the product lifecycle and enhancing market intelligence. Common user questions related to AIs impact often revolve around how AI can improve formulation precision, ensure regulatory compliance, predict market trends, and streamline supply chains. Users are particularly interested in AIs capability to analyze complex datasets regarding color stability, chemical interactions, and potential health implications, thereby accelerating research and development. Theres an expectation that AI will help in identifying optimal synthesis pathways for Amaranth, reducing production costs, and improving the purity of the dye. Furthermore, concerns about the ethical implications of AI in food and drug safety, alongside the need for robust data governance, frequently surface. The overarching theme is the pursuit of efficiency, safety, and innovation through intelligent automation and predictive analytics within this specialized chemical market.

- AI can optimize Amaranth synthesis processes, identifying ideal reaction conditions for enhanced yield and purity, leading to more efficient production.

- Predictive analytics powered by AI can forecast demand for Amaranth across different applications and regions, improving inventory management and reducing waste.

- AI algorithms can analyze vast datasets of scientific literature and regulatory documents, assisting manufacturers in ensuring compliance with evolving global food and drug safety standards for Amaranth.

- Quality control can be significantly enhanced through AI-driven image analysis and spectroscopy, detecting impurities or inconsistencies in Amaranth batches with greater accuracy and speed.

- AI-enabled research and development tools can accelerate the discovery of new, permissible applications or alternative colorants by simulating molecular interactions and predicting stability.

- Supply chain optimization through AI can monitor raw material availability, logistics, and distribution channels for Amaranth, improving resilience and reducing operational costs.

- Market trend analysis using AI helps in identifying emerging color preferences and consumer demands, guiding product innovation and marketing strategies for Amaranth-containing products.

DRO & Impact Forces Of Amaranth Color Market

The Amaranth Color Market is shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that dictate its growth trajectory and sustainability. One of the primary drivers is the persistent demand for visually appealing products across the food and beverage, pharmaceutical, and cosmetic industries. Consumers are often drawn to products with vibrant and consistent coloration, making Amaranth a preferred choice for achieving specific aesthetic effects economically. The growth of the processed food and convenience food sectors globally, especially in developing economies, further fuels this demand. Additionally, the cost-effectiveness and excellent coloring properties of Amaranth, including its heat and light stability in certain applications, make it a competitive option against more expensive natural alternatives or other synthetic dyes, providing a significant advantage in large-scale industrial use. The expanding pharmaceutical industry, requiring consistent color for tablet coatings and liquid formulations for brand recognition and differentiation, also contributes significantly to market demand. Lastly, technological advancements in dye synthesis and purification contribute to higher quality and consistent product availability, bolstering market confidence and expanding its application scope within permissible limits.

However, the market faces considerable restraints, primarily stemming from stringent and often varying regulatory frameworks concerning food additives and colorants across different regions. Historically, Amaranth has been subject to intense scrutiny and outright bans in some major markets, such as the United States for food use, due to concerns over potential health effects, even though it remains permitted in others, including the European Union under strict conditions (E123). This regulatory divergence creates significant market fragmentation and complexity for manufacturers operating globally, necessitating tailored production and distribution strategies. Public perception and consumer preference for "clean label" ingredients and natural colors also pose a restraint, pushing manufacturers to explore alternative colorants or reduce reliance on synthetic dyes where possible. Furthermore, the availability of a wide array of alternative synthetic and natural colorants, some with perceived better safety profiles or broader regulatory acceptance, intensifies market competition and limits Amaranths growth potential. Economic downturns and fluctuations in raw material prices, particularly petrochemical derivatives, can also impact production costs and overall market profitability, further challenging market stability.

Despite these challenges, opportunities within the Amaranth market exist for companies focused on innovation and strategic adaptation. One significant opportunity lies in the development of higher purity Amaranth grades that can meet the most stringent international regulatory standards, potentially unlocking new markets or expanding existing applications under strict controls. Research into synergistic uses with other ingredients to enhance color stability or reduce required concentrations could also create new value propositions. Moreover, strategic market entry into regions with less restrictive regulations or growing industrial sectors offers considerable potential for market expansion. The development of advanced encapsulation or stabilization technologies that protect Amaranth from degradation and improve its performance in complex food matrices could also differentiate products and command premium pricing. Furthermore, a focus on transparent labeling and clear communication about the permitted uses and safety profiles of Amaranth can help address consumer concerns and build trust in markets where it is approved. Companies that invest in sustainable production practices, ensuring minimal environmental impact, could also gain a competitive edge and appeal to environmentally conscious consumers and businesses, aligning with broader corporate social responsibility initiatives and enhancing brand reputation in a sensitive market.

Segmentation Analysis

The Amaranth Color Market is comprehensively segmented based on various attributes to provide a detailed understanding of its dynamics and opportunities. These segmentations typically include analyses by application, form, grade, and end-use industry, allowing for a granular view of demand patterns and market preferences. Understanding these segments is crucial for manufacturers, distributors, and stakeholders to tailor their strategies, product offerings, and marketing efforts effectively. The analysis helps in identifying high-growth areas, niche markets, and potential threats across the value chain. For instance, different end-use industries might prioritize varying grades of Amaranth depending on their specific regulatory requirements and product characteristics. Similarly, the form of Amaranth (liquid vs. powder) preferred can differ based on ease of integration into manufacturing processes and final product formulation. This multi-faceted segmentation provides a strategic lens through which the markets complexities and opportunities can be effectively navigated, fostering informed decision-making and sustainable growth for market participants.

- By Application: This segment categorizes Amaranth based on its use, including food and beverages (confectionery, soft drinks, dairy products, processed foods), pharmaceuticals (tablet coatings, syrups), and cosmetics (lipsticks, blushes, shampoos).

- By Form: Segmentation here differentiates between Amaranth available in powder form (most common, offering stability and ease of handling) and liquid form (often preferred for specific industrial applications due to ease of dispersion).

- By Grade: This segment distinguishes Amaranth by its purity and quality standards, such as food grade (meeting specific safety and purity criteria for edible products), pharmaceutical grade (adhering to stringent pharmacopoeial standards), and industrial grade (used in non-ingestible applications where regulatory requirements might be less strict).

- By End-Use Industry: This broad segmentation covers the primary sectors consuming Amaranth, including the Food & Beverage industry, Pharmaceutical industry, Cosmetic industry, and Textile industry (though less prominent for Amaranth, other dyes are common here), each having distinct requirements and consumption patterns.

- By Function: Analyzing Amaranth based on its functional properties, such as primary coloring agent, shade enhancer, or aesthetic additive, offers insights into its versatile roles across diverse product formulations.

Amaranth Color Market Value Chain Analysis

The Amaranth Color Market’s value chain encompasses a series of interconnected stages, beginning from the procurement of raw materials and extending through manufacturing, distribution, and ultimately, to the end-users. Upstream analysis focuses on the sourcing of key chemical precursors and intermediates, primarily derived from petrochemicals, which are essential for the synthesis of Amaranth. This stage involves chemical suppliers providing purified raw materials like naphthalene, sulfonic acid, and various coupling components. The quality and availability of these raw materials are critical, directly impacting the purity, yield, and cost of the final Amaranth product. Manufacturers in this segment often rely on specialized chemical companies, and fluctuations in petrochemical prices or supply chain disruptions can significantly affect the entire value chain. Strategic partnerships with raw material suppliers are crucial for ensuring stable and cost-effective production, highlighting the importance of robust procurement strategies and strong supplier relationships in maintaining competitive advantage and operational continuity within the market.

Midstream activities involve the chemical synthesis, purification, and formulation of Amaranth. Specialized chemical manufacturers employ various industrial processes to synthesize the dye, followed by rigorous purification steps to meet specific food, pharmaceutical, or cosmetic grade standards. This stage includes drying, milling, and blending to produce the desired powder or granular forms. Quality control is paramount here, with extensive testing for purity, heavy metals, and other contaminants to ensure compliance with stringent regulatory requirements. Downstream analysis then focuses on the distribution channels and end-use applications. Amaranth products are typically distributed through a combination of direct sales from manufacturers to large industrial clients and indirect channels involving wholesalers, distributors, and agents who supply to smaller businesses or specialized markets. The choice of distribution channel often depends on the geographic reach, market size, and specific needs of the end-user industries. Effective logistics and supply chain management are critical to ensure timely delivery and maintain product integrity across diverse global markets. The end-users, encompassing food and beverage companies, pharmaceutical firms, and cosmetic manufacturers, integrate Amaranth into their final products, showcasing the broad applicability of the colorant within their respective manufacturing processes. The efficiency and reliability of these distribution networks are vital for ensuring widespread market penetration and responsiveness to customer demand. The interaction between direct sales teams and indirect channel partners plays a significant role in navigating market complexities, offering technical support, and ensuring compliance with regional specific regulations, thereby cementing the products position in various consumer goods.

Amaranth Color Market Potential Customers

The potential customers for Amaranth Color are diverse, primarily spanning industries that require vibrant and stable colorants for product differentiation and consumer appeal. The largest segment of end-users are companies within the food and beverage industry. This includes manufacturers of confectionery items, soft drinks, bakery products, dairy products, desserts, and various processed foods that utilize Amaranth to enhance visual attractiveness, standardize product appearance, and stimulate consumer purchasing decisions. These buyers often seek high-purity, food-grade Amaranth that complies with regional food safety regulations. Their demand is driven by consumer preferences for aesthetically pleasing food products and the need for consistent branding across product lines. The efficacy of Amaranth in providing a specific reddish hue at a competitive cost makes it a valuable additive for these large-scale producers. The growth of this sector, particularly in emerging markets, continues to expand the customer base for Amaranth manufacturers.

Another significant segment of potential customers includes pharmaceutical companies. Amaranth is employed in the pharmaceutical sector primarily for coloring tablet coatings, capsules, and liquid formulations. This application serves functional purposes such as product identification (distinguishing different dosages or medications), brand recognition, and improving patient compliance through visually appealing medicines. Pharmaceutical buyers require pharmaceutical-grade Amaranth that meets rigorous pharmacopoeial standards for purity, stability, and safety, ensuring no adverse interactions with active pharmaceutical ingredients. The stringent quality control and regulatory requirements in the pharmaceutical industry make this a highly specialized customer segment. Furthermore, the cosmetic industry represents a substantial customer base, utilizing Amaranth in products like lipsticks, blushes, foundations, and various personal care items. Cosmetic manufacturers value Amaranth for its intense color, stability, and ability to create desired aesthetic effects in their formulations. These customers prioritize cosmetic-grade Amaranth that is safe for topical application and complies with cosmetic regulations. Beyond these core industries, a smaller but notable customer base exists in other sectors such as specialized printing inks or certain textile applications where specific color properties and cost-effectiveness are desired, provided regulatory approvals are in place for the respective use cases. Each of these customer segments presents unique demands regarding product specifications, regulatory compliance, and supply chain logistics, necessitating a tailored approach from Amaranth suppliers.

Amaranth Color Market Key Technology Landscape

The Amaranth Color Markets technological landscape is primarily characterized by advancements in chemical synthesis, purification processes, and formulation techniques aimed at enhancing product quality, consistency, and regulatory compliance. The core technology lies in the efficient and controlled production of Amaranth through azo coupling reactions. This involves the diazotization of an aromatic amine, followed by its coupling with a naphthol derivative. Key technological advancements in this area focus on optimizing reaction parameters such as temperature, pH, and reactant ratios to maximize yield and minimize by-product formation. Innovations in reactor design and process automation are also critical, enabling large-scale, cost-effective, and highly reproducible synthesis. Furthermore, the development of continuous flow synthesis methods, as opposed to traditional batch processes, represents a frontier for improving efficiency, reducing energy consumption, and enhancing safety in Amaranth production, driving down operational costs and increasing throughput capacity.

Post-synthesis purification technologies play a crucial role in meeting the stringent purity requirements for food, pharmaceutical, and cosmetic grades of Amaranth. These technologies include advanced filtration methods, crystallization techniques, membrane separation, and chromatographic purification. The goal is to effectively remove unreacted raw materials, undesirable by-products, heavy metals, and other impurities to ensure the final product adheres to strict international regulatory standards. Manufacturers are investing in more efficient and environmentally friendly purification techniques that minimize solvent use and waste generation. Beyond synthesis and purification, formulation technologies are also vital. This involves developing various forms of Amaranth, such as highly soluble powders, granular forms for dust-free handling, or pre-dispersed liquid concentrates, to suit diverse customer applications. Encapsulation technologies, though more common for natural colors, are also being explored to improve Amaranths stability against light, heat, and pH variations in specific applications. Analytical technologies, including High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Spectrophotometry, are indispensable for quality control at every stage, ensuring the identity, purity, and concentration of the Amaranth produced, thereby guaranteeing product integrity and regulatory adherence across the global supply chain.

Regional Highlights

- Asia Pacific: This region stands as a dominant and rapidly growing market for Amaranth color, primarily driven by the expanding food processing, pharmaceutical, and cosmetic industries in countries like China, India, and Southeast Asian nations. High population density, increasing disposable incomes, and evolving dietary preferences contribute to a strong demand for processed foods and beverages, in which Amaranth is widely used. While regulations are becoming more stringent, the sheer volume of production and consumption maintains Asia Pacifics leading position.

- Europe: The European market for Amaranth, while mature, maintains stable demand, particularly within the food and beverage industry where it is permitted under strict EU regulations (E123). Germany, France, and the UK are key consumers, driven by well-established food processing, confectionery, and pharmaceutical sectors. The regions emphasis on high-quality and safety standards influences product specifications and demand for high-purity Amaranth.

- North America: Despite Amaranth (FD&C Red No. 2) being banned for food use in the United States since 1976, the market in North America still exists for specific non-food applications (e.g., textiles, certain non-ingestible cosmetics or external pharmaceutical preparations where approved) and in Canada, where its use in food is permitted with restrictions. This creates a specialized demand for Amaranth, though significantly smaller for ingestible applications compared to regions where it is fully approved.

- Latin America: This region exhibits significant growth potential, fueled by expanding economies, urbanization, and the corresponding growth in processed food consumption and pharmaceutical manufacturing. Countries like Brazil, Mexico, and Argentina are emerging as important markets, with local regulations often aligning with international standards but sometimes offering more flexibility in dye usage.

- Middle East & Africa: The market in this region is developing, propelled by economic diversification, increasing foreign investment in the food and pharmaceutical sectors, and a growing consumer base. While currently smaller, the demand for Amaranth is expected to rise as industrialization progresses and consumer products become more varied and accessible across the region, particularly in Saudi Arabia, UAE, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amaranth Color Market.- Chr. Hansen Holding A/S

- Sensient Technologies Corporation

- DDW The Color House

- Kalsec Inc.

- Colorcon Inc.

- Ajinomoto Co., Inc.

- BASF SE

- Clariant AG

- Sun Chemical Corporation (DIC Corporation)

- Sigma-Aldrich (Merck KGaA)

- Foodchem International Corporation

- Aarkay Food Products Ltd.

- Matrix Pharma Chem

- Dynemic Products Ltd.

- Rohini Dyechem Pvt. Ltd.

Frequently Asked Questions

What is Amaranth Color?

Amaranth color is a synthetic azo dye, chemically known as E123 or FD&C Red No. 2, used as a red or reddish-purple colorant in various industrial applications, primarily in the food, pharmaceutical, and cosmetic sectors, where permitted by local regulations.

Is Amaranth Color safe for consumption?

The safety of Amaranth Color for consumption is subject to varying regulatory opinions globally. It is permitted for food use in many countries, including the European Union, under strict maximum use levels and specific conditions, based on scientific evaluations. However, it is banned for food use in other countries, such as the United States, due to historical concerns.

What are the primary applications of Amaranth Color?

Amaranth Color finds its primary applications in the food and beverage industry for coloring confectionery, soft drinks, and processed foods. It is also extensively used in pharmaceuticals for tablet coatings and liquid medications, and in cosmetics for lipsticks, blushes, and other personal care products.

How do regulations impact the Amaranth Color market?

Regulations profoundly impact the Amaranth Color market by dictating its permissible uses, maximum concentration levels, and labeling requirements across different regions. Strict regulatory divergence creates market fragmentation, requiring manufacturers to adapt product formulations and distribution strategies to comply with diverse global standards, thus significantly influencing market access and growth.

What are the key drivers of the Amaranth Color market?

Key drivers include the continuous demand for visually appealing consumer products in the food, pharmaceutical, and cosmetic industries, the expansion of processed food sectors globally, and the cost-effectiveness and stability of Amaranth compared to natural alternatives. Advancements in production technologies also contribute to consistent supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager