Americas Petcoke Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429421 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Americas Petcoke Market Size

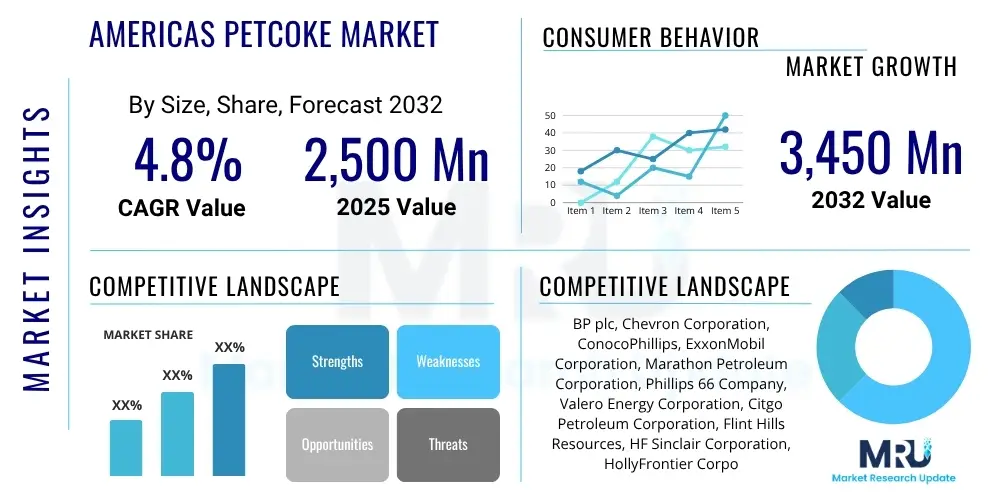

The Americas Petcoke Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at $2,500 million in 2025 and is projected to reach $3,450 million by the end of the forecast period in 2032.

Americas Petcoke Market introduction

The Americas Petcoke Market encompasses the intricate web of production, distribution, and consumption of petroleum coke, a vital carbon-rich solid byproduct generated during the crude oil refining process. This market plays an indispensable role in powering numerous heavy industries across North, Central, and South America, serving as both a critical fuel source and an essential raw material. Derived from the heaviest residues of crude oil distillation, petcoke's inherent characteristics, including its high carbon content and energy density, are fundamentally influenced by the specific crude feedstock and the diverse coking technologies employed by refineries. The market dynamic is complex, reflecting global energy prices, regional industrial growth, and evolving environmental policies, making it a subject of continuous analysis for stakeholders seeking sustainable and efficient energy solutions.

Petroleum coke is primarily categorized into two distinct types: fuel grade and anode grade. Fuel grade petcoke, representing the vast majority of the market volume, is characterized by its high calorific value, low ash content, and relatively high sulfur levels, making it a highly efficient and cost-effective energy source for various industrial applications. It is widely adopted in sectors requiring intense heat generation, such as cement manufacturing, thermal power generation, and industrial boilers, where it often serves as a cheaper alternative to coal. Conversely, anode grade petcoke demands exceptionally low levels of sulfur and heavy metals, undergoing an additional calcination process to achieve the purity, porosity, and structural integrity required for the production of carbon anodes. These anodes are indispensable components in the electrolytic reduction of alumina to produce aluminum, a process crucial for lightweighting in automotive, aerospace, and packaging industries. The quality differential between these grades dictates their market value and specific end-use sectors, creating distinct demand patterns within the overall petcoke landscape.

The major applications driving the Americas Petcoke Market are diverse and critical to regional economies. Cement manufacturers in particular rely heavily on fuel grade petcoke as a primary energy input for their kilns, valuing its consistent burning properties and economic advantages over conventional fuels like coal. Similarly, power generation facilities, especially those equipped with circulating fluidized bed combustion technology, leverage petcoke for electricity production, contributing significantly to the energy matrix of several nations. The burgeoning aluminum industry across North and South America is a cornerstone for anode grade petcoke demand, with smelters continually seeking high-quality, low-sulfur options to ensure efficient and pure aluminum output for their high-value products. The inherent benefits of petcoke, including its relatively low cost compared to alternatives and its consistent availability as a refinery byproduct, underscore its strategic importance. Furthermore, key driving factors for the market's projected growth include sustained economic expansion across the Americas, significant investments in infrastructure development, escalating energy consumption across industrial and commercial sectors, and the robust growth of petcoke-intensive industries such as construction and automotive, all contributing to a steady, albeit regulated, upward trajectory for demand.

Americas Petcoke Market Executive Summary

The Americas Petcoke Market is poised for steady growth through the forecast period, primarily propelled by robust demand from pivotal industrial sectors such as cement, aluminum, and thermal power generation. Business trends indicate a persistent emphasis on optimizing refinery operations to maximize petcoke output while simultaneously navigating an increasingly complex landscape of environmental regulations concerning industrial emissions. The market observes a delicate yet critical balance between fuel grade petcoke, which experiences demand fluctuations closely tied to global energy prices and the availability of alternative fuels like coal, and anode grade petcoke, which benefits significantly from the consistent expansion of aluminum production, particularly for burgeoning automotive, construction, and packaging industries. Price volatility, often directly correlated with global crude oil prices and specific regional supply-demand imbalances, remains a defining characteristic influencing procurement and investment strategies within this market.

Regional trends reveal highly distinct market landscapes and operational priorities across the Americas. North America, characterized by its technologically advanced refining capabilities, established industrial infrastructure, and stringent environmental policies, serves as a major producer and consumer of petcoke. Demand here is predominantly driven by sophisticated cement kilns, modern thermal power plants, and a significant concentration of aluminum smelters. The region is actively investing in technologies for cleaner petcoke utilization and compliance. Conversely, Latin America presents a dynamic and rapidly expanding market, fueled by accelerating industrialization, burgeoning energy requirements, and substantial infrastructure development projects. This growth leads to increased consumption of fuel grade petcoke in countries such as Brazil and Mexico, which are prominent players in both production and consumption, significantly shaping the sub-regional market dynamics through their economic expansion and trade activities.

Segment trends underscore the increasing strategic importance of calcined petcoke, particularly the anode grade variant, due to the sustained global expansion of the aluminum industry and the rising demand for lightweight metals. While fuel grade petcoke continues to dominate in terms of sheer volume, the premium pricing and specialized quality requirements for anode grade varieties contribute disproportionately to overall market value and profitability. Moreover, the market is witnessing a pronounced shift towards cleaner production methods and more efficient utilization technologies, as industries strive to meet ever-tightening environmental standards and enhance their corporate sustainability profiles. Strategic investments in advanced desulfurization technologies, fluidized bed combustion systems, and petcoke gasification processes are becoming more prevalent, aimed at mitigating the environmental footprint of petcoke and unlocking new, higher-value applications, thereby influencing the future trajectory of petcoke consumption across a broad spectrum of industrial end-users.

AI Impact Analysis on Americas Petcoke Market

User inquiries regarding the impact of Artificial Intelligence on the Americas Petcoke Market frequently delve into how these advanced technologies can revolutionize operational efficiency, optimize complex supply chain networks, enhance precision in demand forecasting, and provide critical support in navigating increasingly stringent environmental monitoring requirements. A prevalent theme among these questions centers on AI's potential to streamline the entire petcoke lifecycle, from its initial production within refineries to its final consumption by end-users. Stakeholders are keen to understand how AI can lead to more efficient and sustainable petcoke production processes, enabling better management of its storage, inventory, and transportation logistics across vast geographic areas. Moreover, there is a strong interest in how AI can provide more accurate and dynamic predictions of market prices and demand shifts, allowing businesses to adapt proactively to volatile market conditions and make informed strategic decisions.

Concerns about AI integration often highlight the substantial initial capital investment required for implementing sophisticated AI infrastructure and the critical need for specialized talent and expertise to effectively manage and interpret AI-generated insights. Companies are cautious about the complexity of integrating AI solutions with legacy operational systems and the potential for data privacy and security challenges. Despite these initial hurdles, expectations for AI are considerably high across the market. There is a strong anticipation that AI will serve as a transformative tool, significantly driving down operational costs by optimizing resource allocation and reducing waste. Furthermore, AI is expected to markedly improve product quality consistency, which is particularly crucial for the high-purity demands of anode grade petcoke used in aluminum smelting. Perhaps most significantly, AI is foreseen as a powerful ally in meeting regulatory compliance by enabling real-time, granular monitoring of emissions and predictive maintenance schedules for critical coking units, thereby mitigating environmental risks and enhancing overall operational sustainability. The ability of AI to analyze vast datasets and identify subtle patterns is expected to provide unprecedented levels of operational control and foresight, shaping a more responsive and efficient petcoke market.

- AI-driven predictive analytics optimizes refinery coking unit performance, significantly reducing unscheduled downtime and improving overall production yield and efficiency of petcoke.

- Advanced AI algorithms enhance the precision of demand forecasting for both fuel and anode grade petcoke, enabling producers and traders to align supply more accurately with market needs and minimize inventory holding costs.

- AI-powered logistics and supply chain management systems optimize transportation routes and schedules, leading to substantial reductions in freight costs and more timely deliveries to end-users across the Americas.

- Real-time environmental monitoring systems, integrated with AI, provide continuous oversight of emissions from petcoke combustion, ensuring immediate detection of anomalies and facilitating proactive compliance with regulatory standards.

- Machine learning models are employed to analyze petcoke characteristics, enabling the optimization of blending strategies to meet specific customer requirements or environmental specifications, thereby maximizing product value.

- Automated quality control systems leveraging computer vision and AI ensure stringent adherence to petcoke specifications, particularly for critical parameters like sulfur content and volatile matter in anode grade petcoke.

- AI-driven market intelligence platforms offer deep insights into price trends, competitor activities, and emerging market opportunities, empowering strategic decision-making and enhancing competitive positioning.

- Predictive maintenance for petcoke handling equipment and calcination plants, using AI, prevents costly breakdowns and extends asset lifespans, improving operational reliability and safety.

- AI can model the impact of varying crude oil inputs on petcoke quality and quantity, assisting refineries in optimizing feedstock selection and coking processes for improved byproduct management.

- Energy management systems enhanced by AI can optimize petcoke consumption in industrial processes, leading to reduced energy costs and lower carbon intensity.

DRO & Impact Forces Of Americas Petcoke Market

The Americas Petcoke Market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its growth trajectory and strategic landscape. Key drivers include the robust and sustained demand from foundational heavy industries such as cement manufacturing and aluminum production, both of which rely extensively on petcoke as a cost-effective and high-energy source or a critical raw material. Rapid industrialization, coupled with accelerated urbanization across developing economies within Latin America, further fuels the demand for construction materials, directly bolstering cement production and subsequently petcoke consumption. The inherent advantage of petcoke, characterized by its relatively lower cost compared to other fossil fuels like steam coal and its superior calorific value, makes it an economically attractive option for power generation, especially in regions with abundant refinery output and pressing energy needs, thereby driving consistent market demand.

However, the market faces substantial and complex restraints, primarily stemming from an increasingly stringent global and regional environmental regulatory framework. These regulations are specifically aimed at controlling sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter emissions, which are common byproducts of petcoke combustion. The utilization of high-sulfur fuel grade petcoke poses significant compliance challenges for industries, necessitating substantial capital investment in advanced desulfurization technologies, such as flue gas desulfurization (FGD) systems, and other emission control equipment. Furthermore, inherent fluctuations in global crude oil prices directly impact both the production cost and overall availability of petcoke, leading to significant price volatility that can profoundly affect end-user industries' procurement strategies and long-term planning. The accelerating global transition towards cleaner energy sources and the continuous development of alternative, lower-carbon fuels also present a formidable long-term competitive pressure on the traditional petcoke market, urging industries to explore more sustainable alternatives.

Despite these considerable challenges, significant opportunities abound within the Americas Petcoke Market, promising avenues for strategic growth and innovation. A prime example is the steadily growing demand for high-quality anode grade petcoke, which is driven by the expansion of the global aluminum industry, particularly bolstered by the rising adoption of electric vehicles (EVs) and the increasing demand for lightweight materials in various sectors. Advancements in petcoke gasification technologies offer a promising pathway for cleaner energy generation and the creation of value-added chemical products from petcoke, thereby mitigating prevalent environmental concerns and enhancing its utility. Moreover, strategic investments in advanced desulfurization and other sophisticated emission control technologies can effectively unlock new markets and broaden existing applications for petcoke, enabling compliance with evolving environmental standards. The overarching impact forces of sustained economic growth, an evolving regulatory landscape, and continuous technological advancements will collectively dictate the market's future direction, compelling stakeholders towards adopting more sustainable, efficient, and technologically advanced utilization practices.

Segmentation Analysis

The Americas Petcoke Market is extensively segmented to provide a granular and comprehensive understanding of its diverse components, aiding stakeholders in strategic decision-making, market positioning, and investment planning. These segmentations are primarily based on critical factors such as the product type, which delineates between distinct qualities of petcoke, its varied applications across different industrial sectors, and the form in which it is processed and utilized in various operations. Understanding these distinct segments is absolutely crucial for accurately analyzing market dynamics, identifying specific growth pockets, assessing the competitive landscape with greater precision, and tailoring product offerings to meet specific industry demands. The inherent differentiation in quality specifications, chemical composition, and required processing steps fundamentally dictates the suitability of petcoke for particular industrial needs, thereby significantly influencing its market value and dynamic demand patterns across the vast and varied regional markets of the Americas.

- By Type

- Fuel Grade Petcoke: Characterized by higher sulfur content and used primarily for energy generation in industries like cement and power.

- Anode Grade Petcoke: Distinguished by very low sulfur and metal impurities, essential for manufacturing carbon anodes in aluminum smelting.

- By Application

- Cement: Utilized as a cost-effective fuel source for cement kilns, leveraging its high calorific value.

- Power Plants: Employed for electricity generation, often blended with coal, in thermal power stations.

- Aluminum: Exclusive consumer of anode grade petcoke for producing electrolytic anodes.

- Steel: Used as a carbon additive in steel manufacturing processes and as a fuel.

- Others: Includes applications in industries such as chemicals, fertilizers, industrial boilers, and as a raw material for specific carbon products.

- By Form

- Green Petcoke: Raw petroleum coke directly from the coker unit, containing volatile matter.

- Calcined Petcoke: Green petcoke that has undergone thermal treatment to remove volatile matter, enhancing its purity and density for anode production.

Value Chain Analysis For Americas Petcoke Market

The value chain for the Americas Petcoke Market initiates fundamentally with the upstream processing of crude oil, where petroleum coke is generated as an inevitable byproduct in oil refineries, specifically through delayed coking units or other coking technologies. This initial stage involves the intricate conversion of heavy crude oil residues into more valuable lighter fractions and a solid residue, petcoke. The quality, volume, and type of petcoke produced at this stage are largely dependent on the specific crude oil feedstock characteristics, such as API gravity and sulfur content, as well as the advanced refining technology employed. Key players in this upstream segment are primarily major integrated oil refining companies with significant coking capacity strategically located across both North and South America. The operational efficiency of crude processing directly impacts the subsequent volume and critical characteristics of the green petcoke produced, thereby establishing the fundamental foundation for the entire downstream value chain.

The midstream segment of the petcoke value chain encompasses the crucial activities of handling, storage, and sophisticated transportation of petcoke from the refineries to various processing facilities or direct end-users. This segment relies heavily on robust logistics infrastructure, including extensive networks of rail, truck fleets, and marine shipping, all of which are absolutely critical for the cost-effective and timely distribution of petcoke across the vast geographic expanse of the Americas. A highly significant part of this midstream stage involves specialized calcination plants, where raw green petcoke undergoes a rigorous thermal treatment process to transform it into calcined petcoke. This calcination process meticulously removes volatile matter and significantly enhances its carbon content, density, and electrical conductivity, making it perfectly suitable for high-value applications such as anode production in the aluminum industry. Specialist trading companies often play an indispensable role in this segment, adeptly connecting petcoke producers with a diverse array of consumers and expertly managing the complex logistical challenges involved in bulk commodity trading.

Downstream analysis meticulously focuses on the various end-use industries, which collectively represent the major and diverse consumers of petcoke across the Americas. This critical segment includes vital sectors such as cement manufacturers, large-scale thermal power generation companies, specialized aluminum smelters, and various steel producers, among others. The distribution channel is frequently direct for large-scale industrial buyers who procure petcoke in massive bulk quantities directly from major refineries or leading commodity traders, ensuring consistent supply for their continuous operations. Indirect channels typically involve regional distributors or smaller, specialized traders who supply petcoke to smaller industrial units or for specific niche applications that require tailored quantities or qualities. The sustained demand from these economically significant downstream sectors acts as the primary driving force for the entire petcoke market, with price sensitivity and stringent quality requirements varying significantly among different end-users, consequently influencing the intricate dynamics and overall profitability across the entire value chain.

Americas Petcoke Market Potential Customers

The primary potential customers and end-users of petroleum coke in the Americas are largely concentrated within heavy industrial sectors that necessitate substantial volumes of cost-effective energy or highly specialized carbon materials for their core operations. These industries are intrinsically dependent on the unique properties of petcoke for maintaining their operational efficiency, achieving specific product qualities, and managing production costs effectively. The diverse range of applications for petcoke, spanning from a fundamental fuel source to a critical raw material in advanced manufacturing, attracts a wide array of buyers across distinct economic segments. Their procurement decisions are typically influenced by a multifaceted array of factors including petcoke's calorific value, its precise sulfur and ash content, prevailing market pricing, the consistency and reliability of supply, and crucially, increasingly stringent environmental compliance considerations that dictate permissible usage patterns and required emission control technologies.

Cement manufacturers constitute an exceptionally significant segment of petcoke buyers throughout the Americas, extensively utilizing it as an economical and highly efficient alternative fuel for their energy-intensive rotary kilns. They value its consistent burning properties, high energy density, and often lower cost compared to traditional fuels like coal. Similarly, large-scale power generation plants represent another major customer base, particularly in regions where petcoke can be efficiently combusted in modern circulating fluidized bed boilers or judiciously blended with coal. This provides a remarkably cost-effective fuel source for electricity production, thereby contributing substantially to the overall energy matrix of several nations. The robust aluminum smelting industry is another critically important segment, specifically for high-quality anode grade petcoke. This specialized petcoke is meticulously calcined and then processed to produce carbon anodes, which are absolutely essential for the electrolytic reduction process of alumina, forming a core and irreplaceable component of their complex production value chain.

Beyond these foundational primary consumers, the steel industry also procures petcoke for various crucial capacities, including its use as a valuable carbon additive to enhance steel properties or as an supplementary fuel source within blast furnaces or electric arc furnaces. Chemical manufacturers may similarly procure specific grades of petcoke for specialized processes, though typically to a lesser extent than the aforementioned primary sectors. Other industrial boilers across a broad spectrum of manufacturing sectors that require a high-energy, low-cost fuel source also represent significant potential customers, contributing to the overall demand landscape. The sustained growth, technological advancements, and operational health of these industrial giants directly correlate with the demand for petcoke, firmly establishing them as the cornerstone of the Americas Petcoke Market's customer base and the fundamental drivers of future market trends and innovations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2,500 million |

| Market Forecast in 2032 | $3,450 million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BP plc, Chevron Corporation, ConocoPhillips, ExxonMobil Corporation, Marathon Petroleum Corporation, Phillips 66 Company, Valero Energy Corporation, Citgo Petroleum Corporation, Flint Hills Resources, HF Sinclair Corporation, HollyFrontier Corporation, PBF Energy Inc., Shell plc, Koch Industries Inc., Oxbow Corporation, Rain Carbon Inc., Vitol Inc., Trafigura Group Pte. Ltd., Glencore plc, Cemex S.A.B. de C.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Americas Petcoke Market Key Technology Landscape

The technological landscape surrounding the Americas Petcoke Market is primarily defined by the sophisticated methods employed for petcoke production, its subsequent meticulous processing, and its diverse utilization across various heavy industries. At the core of petcoke production reside advanced coking technologies within oil refineries, predominantly delayed coking, which skillfully converts heavy residual oil fractions into more valuable lighter products and the solid byproduct, petcoke. Other less common but technologically significant processes include fluid coking and flexicoking, which are often designed for higher conversion rates of difficult feedstocks and greater flexibility in terms of input crude oil. These production technologies are absolutely critical as they directly influence the quantity, physical characteristics, and chemical quality of the green petcoke produced, thereby impacting its ultimate suitability for different downstream applications and its prevailing market value.

Beyond the initial production phase, significant technological advancements are keenly focused on petcoke processing and effective environmental mitigation strategies. Calcination technology is of paramount importance for transforming green petcoke into calcined petcoke, a refined product that is indispensable for anode production in the aluminum industry. This intricate process involves subjecting green petcoke to extremely high temperatures in rotary kilns or shaft calciners to meticulously remove volatile matter, significantly improve its electrical conductivity, enhance bulk density, and refine its crystalline structure. Innovations in calcination aim for superior energy efficiency, reduced operational costs, and minimized atmospheric emissions. Furthermore, advanced desulfurization technologies, such as highly efficient flue gas desulfurization (FGD) systems and sorbent injection technologies, are vital for end-users, particularly large thermal power plants and cement kilns, to comply with increasingly stringent environmental regulations regarding sulfur dioxide emissions when combusting high-sulfur fuel grade petcoke, thereby ensuring continued market access and operational licenses.

The broader technological landscape also encompasses cutting-edge advancements in petcoke gasification, a transformative process where petcoke can be efficiently converted into synthesis gas (syngas). Syngas is a highly valuable chemical feedstock that can be used to produce a range of chemicals, hydrogen, or as a cleaner fuel for power generation. This technology offers a promising pathway for more sustainable energy production and the creation of value-added products from petcoke, directly addressing persistent environmental concerns associated with its direct combustion and offering a higher-value utilization route. Additionally, continuous technological improvements in material handling, sophisticated storage solutions, and precise blending techniques for different petcoke grades are constantly evolving, optimizing logistics chains, minimizing material degradation, and ensuring consistent quality and specific compositions for discerning end-users. The increasing integration of digital technologies, including advanced sensors, real-time data analytics, and Artificial Intelligence, is also beginning to play a transformative role in optimizing refinery coking operations, enhancing petcoke quality control, and improving overall market efficiency and responsiveness.

Regional Highlights

- North America: This region, particularly comprising the United States and Canada, stands as a dominant force in the global petcoke market, acting as both a major producer and a significant consumer due to its extensive crude oil refining capacity and a well-established heavy industrial base. The U.S. Gulf Coast is a prominent hub for petcoke production, benefiting from abundant crude oil supplies. Demand is consistently strong from cement manufacturers, large thermal power generation utilities, and especially a robust aluminum smelting sector that critically relies on high-quality anode grade petcoke. Environmental regulations are exceptionally stringent, actively driving continuous investment in cleaner utilization technologies and influencing strict product specifications for petcoke entering the market.

- Latin America: Countries such as Brazil, Mexico, and Argentina represent key and rapidly expanding markets within Latin America, characterized by burgeoning industrialization, steadily increasing energy demand, and significant investments in infrastructure development. Brazil, with its substantial refining sector and robust cement and aluminum industries, is a major regional player in both petcoke production and consumption. Mexico's ongoing industrial growth and its strong economic and trade ties with the U.S. also contribute significantly to its petcoke consumption footprint. The region primarily utilizes fuel grade petcoke for essential power generation and cement production, often navigating the delicate balance between economic viability and the emergence of stricter environmental considerations and sustainability mandates.

- United States: As the largest economy and a major refining center in the Americas, the U.S. holds a pivotal position in the petcoke market. It produces substantial quantities of both fuel grade and anode grade petcoke, with significant domestic consumption observed across cement manufacturing, thermal power plants, and the critical aluminum sector. Innovations in advanced environmental controls, such as carbon capture and desulfurization technologies, coupled with the development of more efficient combustion technologies, are absolutely crucial for ensuring sustained market activity and long-term viability in the face of evolving regulations.

- Canada: Canada possesses considerable oil sands refining capacity, which inherently yields petcoke as a significant byproduct, contributing to its domestic supply. The petcoke market dynamics here are primarily driven by strong domestic industrial demand, particularly from its established aluminum smelting industry, which necessitates consistent access to high-quality anode grade petcoke. Canada's close geographical proximity to the U.S. also facilitates robust cross-border trade and enhances supply chain integration, allowing for flexible market responses to regional demand shifts.

- Brazil: As a leading industrial power and the largest economy in South America, Brazil features a substantial and growing refining industry that generates significant volumes of petcoke. The country's expanding infrastructure, a booming construction sector (driving cement production), and a strong aluminum production base collectively contribute to its high domestic consumption of both fuel grade and anode grade petcoke. Brazil's economic growth patterns and industrial development heavily influence its petcoke market dynamics, making it a critical focus point for market analysis in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Americas Petcoke Market.- BP plc

- Chevron Corporation

- ConocoPhillips

- ExxonMobil Corporation

- Marathon Petroleum Corporation

- Phillips 66 Company

- Valero Energy Corporation

- Citgo Petroleum Corporation

- Flint Hills Resources

- HF Sinclair Corporation

- HollyFrontier Corporation

- PBF Energy Inc.

- Shell plc

- Koch Industries Inc.

- Oxbow Corporation

- Rain Carbon Inc.

- Vitol Inc.

- Trafigura Group Pte. Ltd.

- Glencore plc

- Cemex S.A.B. de C.V.

Frequently Asked Questions

What is the primary application of fuel grade petcoke in the Americas?

Fuel grade petcoke is predominantly used as a cost-effective energy source in heavy industries. Its primary applications are for cement manufacturing and electricity generation in thermal power plants across the Americas, owing to its high calorific value and consistent burning properties.

How do environmental regulations impact the Americas Petcoke Market?

Environmental regulations significantly restrain the market by imposing strict limits on sulfur dioxide and particulate matter emissions from petcoke combustion. This necessitates substantial investments in desulfurization technologies and cleaner combustion methods for industrial users, influencing market adoption and operational costs.

What drives the demand for anode grade petcoke specifically?

The demand for anode grade petcoke is primarily driven by the robust and expanding aluminum smelting industry. It serves as a critical raw material for producing high-purity carbon anodes, which are essential for the electrolytic reduction process of alumina to produce aluminum metal.

Which geographical regions are key producers and consumers of petcoke within the Americas?

North America, particularly the United States, is a major producer and consumer due to its extensive refining capacity and industrial base. Latin American countries like Brazil and Mexico also represent significant markets, driven by their industrialization and growing energy needs for construction and manufacturing sectors.

What role does crude oil price volatility play in the petcoke market dynamics?

Crude oil price volatility directly influences petcoke production costs and overall supply dynamics, as petcoke is an inherent byproduct of the oil refining process. These fluctuations lead to price instability in the petcoke market, significantly impacting procurement strategies and profitability for end-user industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager