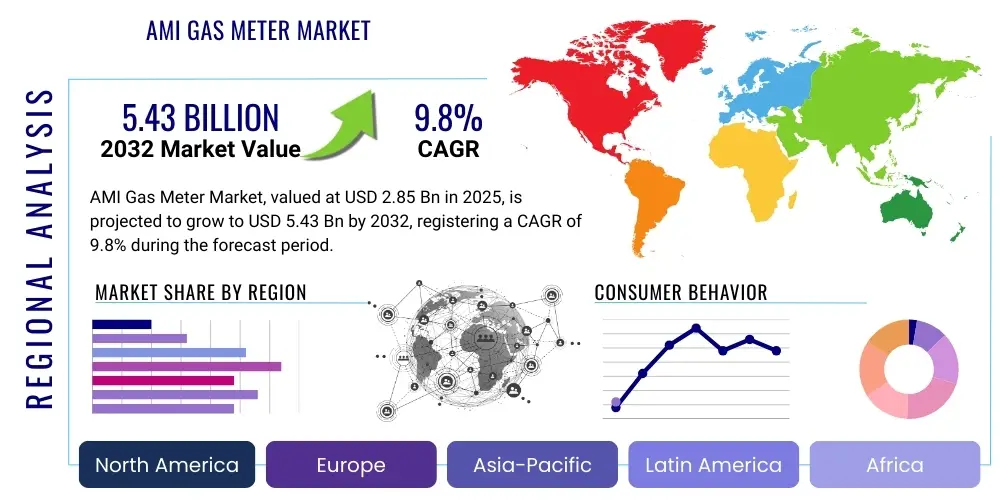

AMI Gas Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427513 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

AMI Gas Meter Market Size

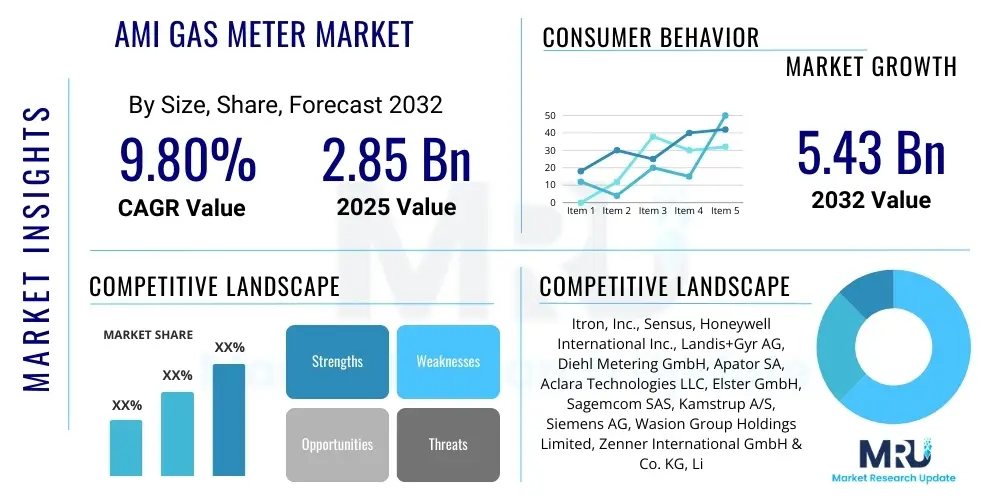

The AMI Gas Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at USD 2.85 billion in 2025 and is projected to reach USD 5.43 billion by the end of the forecast period in 2032.

AMI Gas Meter Market introduction

The Advanced Metering Infrastructure (AMI) Gas Meter market encompasses the development, deployment, and management of smart gas meters that enable two-way communication between the utility and the meter. These sophisticated devices go beyond traditional meters by providing real-time or near real-time data on gas consumption, facilitating remote meter reading, and offering advanced functionalities such as leak detection, remote shut-off capabilities, and demand-side management. The core purpose of AMI gas meters is to enhance operational efficiency for gas utilities, improve billing accuracy for consumers, and contribute significantly to energy conservation efforts by providing granular consumption data.

Product descriptions typically highlight features like integrated communication modules (utilizing technologies such as cellular, radio frequency (RF) mesh, or low-power wide-area networks (LPWAN)), long battery life, robust security protocols, and compliance with stringent industry standards. Major applications span across residential, commercial, and industrial sectors, each benefiting from tailored functionalities. For residential users, AMI meters offer transparent billing and insights into usage patterns; for commercial and industrial entities, they support energy management strategies and load optimization.

The benefits derived from AMI gas meter deployment are multifaceted, including substantial reductions in operational costs due to automated meter reading, enhanced safety through rapid leak detection and remote valve control, and improved customer service via more accurate and frequent billing. Driving factors for market growth include increasing global emphasis on energy efficiency and conservation, supportive regulatory mandates promoting smart grid infrastructure, the ongoing digital transformation within the utility sector, and the overarching need to modernize aging gas distribution networks. These elements collectively foster an environment conducive to widespread AMI gas meter adoption.

AMI Gas Meter Market Executive Summary

The AMI Gas Meter market is undergoing significant transformation driven by evolving business trends, distinct regional dynamics, and advancements across various segments. From a business perspective, the market is characterized by a strong push towards digitalization, integration of Internet of Things (IoT) technologies, and a growing emphasis on data analytics to derive actionable insights from meter data. Utilities are increasingly viewing AMI not just as a meter reading solution but as a foundational component for broader smart city initiatives and enhanced grid intelligence. The imperative for sustainable energy practices and reduced carbon footprints also fuels investment in these advanced metering solutions, fostering collaborations between technology providers and utility companies to develop more sophisticated and interconnected ecosystems.

Regional trends indicate North America and Europe as frontrunners in AMI gas meter adoption, primarily due to well-established regulatory frameworks, significant investments in infrastructure modernization, and high consumer awareness regarding energy efficiency. Governments in these regions have implemented mandates and incentive programs to accelerate smart meter rollouts, pushing utilities towards comprehensive AMI deployments. The Asia-Pacific region, particularly countries like China, India, and Japan, is emerging as a high-growth market, propelled by rapid urbanization, substantial investments in new energy infrastructure, and increasing demand for reliable and efficient utility services. Latin America and the Middle East & Africa are also showing promising growth, albeit from a lower base, as their respective governments prioritize resource management and develop smart city initiatives.

Segmentation trends highlight a continued dominance of the residential sector in terms of volume, driven by large-scale deployments, while the commercial and industrial segments are witnessing growth in value due to their higher data demands and specialized application requirements. Communication technologies are a pivotal segment, with Low-Power Wide-Area Networks (LPWAN) such as LoRaWAN and NB-IoT gaining substantial traction due to their cost-effectiveness, extended range, and low power consumption, offering viable alternatives to traditional cellular and RF mesh solutions. Furthermore, the market is seeing a convergence of hardware, software, and services, with an increasing demand for end-to-end solutions that include meter installation, data management platforms, and advanced analytics, suggesting a holistic approach to AMI implementation across the industry.

AI Impact Analysis on AMI Gas Meter Market

Artificial Intelligence (AI) is rapidly transforming the AMI Gas Meter market, addressing key user concerns and expectations by revolutionizing data processing, predictive analytics, and operational efficiency. Users frequently inquire about AIs ability to enhance leak detection, optimize network management, improve demand forecasting, and bolster cybersecurity. AI algorithms, particularly machine learning models, are capable of analyzing vast datasets collected from AMI gas meters to identify subtle anomalies indicative of potential leaks, predict equipment failures before they occur, and forecast consumption patterns with remarkable accuracy. This shift from reactive to proactive utility management significantly enhances safety, reduces operational costs, and improves service reliability.

The integration of AI also promises to streamline customer service operations and personalize consumer engagement. By processing meter data alongside external factors like weather patterns and demographic information, AI can provide personalized energy usage insights, recommend efficiency measures, and even detect unusual consumption patterns that might suggest tampering or appliance malfunctions. Furthermore, AI-driven solutions are crucial for managing the immense volume of data generated by millions of smart meters, transforming raw data into actionable intelligence that supports strategic decision-making and fosters innovation within the utility sector. The ability of AI to adapt and learn from new data ensures continuous improvement in system performance and predictive capabilities, offering a future-proof approach to gas utility management.

- Enhanced predictive maintenance and fault detection through pattern recognition in meter data, minimizing outages and operational disruptions.

- Optimized gas network management and distribution efficiency by predicting demand fluctuations and enabling dynamic pressure adjustments.

- Improved leak detection capabilities by identifying anomalous flow patterns and pressure drops more accurately than traditional methods.

- Advanced demand forecasting for better resource allocation, procurement strategies, and balancing supply and demand.

- Heightened cybersecurity posture through AI-driven anomaly detection to identify and mitigate potential cyber threats to the AMI network.

- Personalized customer insights and energy efficiency recommendations, fostering greater consumer engagement and conservation.

- Automated anomaly detection for billing discrepancies or potential meter tampering, ensuring revenue protection.

- Real-time data analysis for proactive decision-making, optimizing field service operations and emergency response.

DRO & Impact Forces Of AMI Gas Meter Market

The AMI Gas Meter market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers propelling market growth include the escalating global demand for energy efficiency and conservation, bolstered by supportive government regulations and mandates for smart grid modernization. Utilities are increasingly motivated to adopt AMI solutions to achieve significant operational cost reductions through automated meter reading, minimized manual interventions, and enhanced asset management. Additionally, the inherent benefits of improved billing accuracy, heightened safety features like remote shut-off and leak detection, and the desire for more granular consumption data for demand-side management are crucial factors stimulating market expansion. The digital transformation agenda across the energy sector, coupled with advancements in communication technologies, further accelerates adoption.

However, the market also faces considerable restraints that temper its growth trajectory. The most prominent challenge is the substantial upfront capital investment required for comprehensive AMI system deployment, which can be prohibitive for some utilities, particularly smaller ones or those in developing regions. Cybersecurity concerns are another critical restraint, as the interconnected nature of AMI networks makes them potential targets for cyberattacks, necessitating robust security protocols and ongoing vigilance. Interoperability issues with existing legacy infrastructure, the complexity of data management and integration, and regulatory hurdles pertaining to data privacy and security also pose significant challenges. Furthermore, a shortage of skilled personnel for installation and maintenance, coupled with a lack of standardization in some areas, can slow down adoption rates.

Despite these challenges, numerous opportunities exist for market players to capitalize on. The growing integration with renewable energy sources and the increasing emphasis on demand response programs create new avenues for AMI gas meters to contribute to overall energy system stability and optimization. The development of advanced analytics and Artificial Intelligence (AI) for predictive maintenance, fraud detection, and enhanced customer services presents substantial value-addition opportunities. Furthermore, the expansion into emerging economies with nascent but rapidly developing utility infrastructures offers fertile ground for new deployments. Continuous innovation in communication technologies, such as the evolution of LPWAN and 5G, promises more cost-effective and reliable data transmission, further enhancing the appeal and capabilities of AMI gas meter systems, ultimately reshaping the competitive landscape through various impact forces.

Segmentation Analysis

The AMI Gas Meter market is segmented across various dimensions, providing a granular view of its structure, growth dynamics, and key contributing factors. Understanding these segments is crucial for stakeholders to identify specific growth opportunities, tailor product development, and strategize market entry. The primary segmentation typically considers criteria such as the type of meter technology, the components that constitute the AMI system, the end-user application areas, and the communication technologies employed. Each segment exhibits distinct characteristics in terms of market share, growth rate, and technological maturity, reflecting diverse needs and adoption patterns across the global utility landscape. The interplay between these segments often dictates the overall market direction, influencing investment priorities and competitive strategies.

For instance, while the residential sector consistently accounts for the largest volume due to the sheer number of households, the commercial and industrial sectors often lead in terms of value growth, driven by higher consumption rates and the demand for more sophisticated data management and energy optimization tools. Similarly, within communication technologies, while traditional RF mesh has a strong installed base, newer LPWAN technologies are gaining significant traction due to their cost-effectiveness and suitability for extensive deployments. The segmentation analysis thus helps in pinpointing the most lucrative areas for market development and technological innovation, enabling companies to focus their resources on segments with the highest potential returns and most pressing utility needs, ensuring a targeted approach to market penetration and expansion.

- By Type: Diaphragm Meters, Rotary Meters, Turbine Meters.

- By Component: Smart Gas Meters (Hardware), Communication Modules, Software & Services (Data Management, Analytics, Cloud Platforms).

- By Application: Residential, Commercial, Industrial.

- By Communication Technology: Cellular (2G/3G/4G/5G), Radio Frequency (RF) Mesh, Low-Power Wide-Area Network (LPWAN) (e.g., LoRaWAN, NB-IoT, Sigfox), Power Line Communication (PLC).

AMI Gas Meter Market Value Chain Analysis

The AMI Gas Meter markets value chain encompasses a series of interconnected activities, from the sourcing of raw materials to the delivery and post-installation support of smart metering solutions. Upstream activities involve the procurement of critical components and raw materials such as sensors, microcontrollers, communication chips, casing materials, and battery technologies. Manufacturers of these specialized components form a vital part of the value chain, supplying to meter manufacturers who assemble the complete smart gas meters. This stage demands precision engineering, adherence to international standards, and robust supply chain management to ensure quality and cost-effectiveness. The efficiency of upstream operations directly impacts the final products performance and cost structure, making strong supplier relationships crucial for market players.

Midstream activities primarily focus on the manufacturing, assembly, and integration of the AMI gas meters and their associated communication modules. This includes the production of the physical meter, embedding communication technologies, rigorous testing for accuracy and durability, and ensuring compliance with regulatory requirements. Downstream activities then involve the distribution, installation, and ongoing maintenance of these systems. Distribution channels typically include direct sales to large utility companies, partnerships with system integrators who provide end-to-end solutions, and sales through authorized distributors and contractors. Installation services are often provided by utility field teams or specialized third-party contractors, requiring skilled labor and adherence to safety protocols.

The value chain extends further into software and services, which are critical for the functionality of AMI systems. This includes the development and deployment of Meter Data Management (MDM) systems, data analytics platforms, cybersecurity solutions, and cloud-based services for data storage and processing. Post-installation support, including maintenance, troubleshooting, and software updates, also forms a significant part of the downstream value chain. Both direct and indirect distribution channels play a role; direct sales facilitate large-scale deployments and long-term partnerships with major utilities, while indirect channels through integrators and distributors help reach a broader customer base and offer specialized regional support. The entire value chain emphasizes collaboration, technological innovation, and service excellence to deliver comprehensive and effective AMI solutions to end-users.

AMI Gas Meter Market Potential Customers

The primary potential customers for AMI Gas Meter solutions are entities responsible for the distribution, management, and billing of natural gas, along with large-scale consumers seeking advanced energy management. At the forefront are gas utility companies and energy providers, which form the largest segment of end-users. These organizations are driven by the need to modernize their infrastructure, improve operational efficiency, reduce non-revenue gas, enhance customer service, and comply with evolving regulatory mandates for smart grid adoption and energy conservation. They seek comprehensive AMI solutions that offer remote meter reading, advanced leak detection, outage management capabilities, and robust data analytics to optimize their entire gas distribution network and customer interactions.

Beyond traditional utilities, municipalities and local government bodies represent another significant customer segment. These entities are increasingly focused on developing smart city initiatives, where intelligent utility infrastructure, including AMI gas meters, plays a foundational role in achieving urban sustainability goals, improving public safety, and fostering efficient resource management. Such customers often look for integrated solutions that can communicate with other smart city components, providing holistic data for urban planning and service delivery. The drive towards interconnected smart environments positions municipalities as key decision-makers and adopters of advanced metering technologies.

Furthermore, large industrial complexes, commercial establishments, and even large-scale residential housing developers constitute a growing customer base. Industrial and commercial entities are motivated by the desire to meticulously monitor and manage their energy consumption, optimize their operational costs, and meet their own sustainability targets. AMI gas meters provide them with the granular data necessary for effective energy management, load balancing, and identifying areas for efficiency improvements. Residential housing developers, especially those involved in constructing smart homes or communities, incorporate AMI meters as part of their modern infrastructure offerings, attracting environmentally conscious buyers and ensuring future-proof utility services for their residents. These diverse end-user requirements necessitate flexible and scalable AMI solutions.

AMI Gas Meter Market Key Technology Landscape

The AMI Gas Meter market is characterized by a dynamic and evolving technology landscape, where continuous innovation in communication protocols, data processing, and hardware design is paramount. Central to the functionality of AMI systems are the communication technologies that enable two-way data exchange between the meters and the utilitys central systems. Low-Power Wide-Area Networks (LPWAN) such as LoRaWAN, NB-IoT (Narrowband-IoT), and Sigfox have emerged as leading contenders, offering cost-effective, long-range, and energy-efficient connectivity suitable for large-scale deployments. These technologies address the critical need for meters to operate on battery power for extended periods while reliably transmitting data from often remote or hard-to-reach locations. Alongside LPWAN, cellular technologies (2G, 3G, 4G, and increasingly 5G for enhanced capacity and lower latency) and established Radio Frequency (RF) Mesh networks continue to play significant roles, each offering distinct advantages based on deployment density, terrain, and data requirements.

Beyond communication, the technological landscape includes sophisticated metering hardware that integrates advanced sensors for highly accurate gas measurement, robust microcontrollers for data processing, and tamper detection mechanisms to ensure integrity. The evolution towards smart meters includes features like integrated shut-off valves for remote service control and enhanced security modules to protect against cyber threats. On the software front, Meter Data Management (MDM) systems are foundational, acting as central repositories for collecting, validating, and processing vast amounts of meter data. These systems are increasingly leveraging cloud computing platforms for scalability, cost-efficiency, and flexibility in data storage and access. The shift to cloud-native architectures allows utilities to process larger volumes of data more efficiently and integrate seamlessly with other enterprise applications.

A crucial and rapidly expanding area within the AMI gas meter technology landscape is the application of advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) algorithms. These technologies enable utilities to move beyond simple data collection to deriving actionable insights from their meter data. AI/ML models are employed for predictive maintenance of gas network infrastructure, sophisticated leak detection through pattern recognition, accurate demand forecasting, and personalized customer engagement strategies. Furthermore, robust cybersecurity solutions, including encryption, authentication protocols, and intrusion detection systems, are integral to protecting the integrity and privacy of the AMI network and the sensitive data it handles. This comprehensive technological ecosystem drives the intelligence and efficiency of modern gas distribution networks, ensuring reliable and secure operations.

Regional Highlights

- North America: This region stands as a dominant force in the AMI Gas Meter market, characterized by extensive infrastructure modernization initiatives and significant investments in smart grid technologies. Driven by regulatory mandates, utility programs aimed at operational efficiency, and a strong focus on energy conservation, countries like the United States and Canada are witnessing widespread AMI deployments. High adoption rates are supported by advanced technological capabilities and robust competitive landscapes among market players.

- Europe: Europe represents another mature market, propelled by ambitious energy efficiency targets set by the European Union and national governments. Directives promoting smart meter rollouts have accelerated adoption, particularly in countries such as the UK, France, Germany, and Italy. The region emphasizes standardized interoperability, data privacy, and the integration of smart gas metering into broader smart energy ecosystems, showcasing a strong commitment to sustainable utility management.

- Asia-Pacific: Emerging as the fastest-growing region, Asia-Pacific is fueled by rapid urbanization, industrialization, and substantial investments in new utility infrastructure, especially in developing economies like China, India, and Southeast Asian nations. Governments in this region are initiating smart grid projects to address growing energy demand, reduce losses, and improve service reliability. Japan and South Korea also contribute significantly with their advanced technological capabilities and smart city initiatives.

- Latin America: This region is an emerging market for AMI Gas Meters, with increasing awareness and initial investments in smart infrastructure. Countries like Brazil, Mexico, and Argentina are gradually adopting these technologies to combat non-revenue gas, enhance billing accuracy, and improve operational efficiency. Economic growth and a drive for modernization are key factors, though high upfront costs and regulatory complexities can pose challenges.

- Middle East & Africa: The market in the Middle East & Africa is experiencing growth, primarily driven by smart city initiatives in the Gulf Cooperation Council (GCC) countries and a growing emphasis on resource management and energy diversification across the region. Countries like UAE and Saudi Arabia are investing in advanced utility infrastructure, including AMI gas meters, to support their sustainable development visions and improve service delivery, albeit with varying paces of adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AMI Gas Meter Market.- Itron, Inc.

- Sensus (Xylem Inc.)

- Honeywell International Inc.

- Landis+Gyr AG

- Diehl Metering GmbH

- Apator SA

- Aclara Technologies LLC (Hubbell Inc.)

- Elster GmbH (Honeywell International Inc.)

- Sagemcom SAS

- Kamstrup A/S

- Siemens AG

- Wasion Group Holdings Limited

- Zenner International GmbH & Co. KG

- Linyang Energy Co., Ltd.

- EDMI Limited

Frequently Asked Questions

What are the primary benefits of AMI gas meters for utilities?

AMI gas meters offer utilities significant advantages including automated meter reading, reducing operational costs and manual labor. They enhance billing accuracy, improve customer service, and provide critical data for leak detection and proactive network management, leading to improved safety and operational efficiency.

How do AMI gas meters contribute to energy efficiency?

AMI gas meters contribute to energy efficiency by providing granular, real-time consumption data to both utilities and consumers. This data empowers utilities to optimize network performance and allows consumers to monitor their usage patterns, identify inefficiencies, and make informed decisions to reduce consumption.

What communication technologies are commonly used in AMI gas meters?

Common communication technologies for AMI gas meters include Low-Power Wide-Area Networks (LPWAN) such as LoRaWAN and NB-IoT, cellular technologies (2G/3G/4G/5G), and Radio Frequency (RF) Mesh networks. Each offers distinct benefits regarding range, power consumption, data rates, and cost-effectiveness for various deployment scenarios.

What are the main challenges in deploying AMI gas meter systems?

Key challenges in AMI gas meter deployment include high initial investment costs, ensuring robust cybersecurity, addressing interoperability issues with legacy infrastructure, managing large volumes of data, and navigating complex regulatory environments concerning data privacy and standardization.

How does AI enhance the functionality of AMI gas meters?

AI significantly enhances AMI gas meter functionality by enabling advanced predictive analytics for maintenance, improving the accuracy of leak detection, optimizing gas network operations through demand forecasting, and bolstering cybersecurity measures. It transforms raw data into actionable insights for proactive utility management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager